Features of filling out form No. T-10a

When filling out a sample work assignment for a business trip, adhere to generally accepted requirements:

- indicate the full name of the company at the top;

- indicate the document number;

- include the date it was compiled;

- FULL NAME. employee;

- personnel number of the person being sent on a business trip;

- OKPO code in accordance with the data in the notification from Rosstat.

In the sample form for filling out a business trip assignment, in the tabular section, enter:

- name of the structural unit in which the employee is registered;

- the position of the specialist;

- country, city, town or organization (the place to which the employee is sent);

- start date and end date of the business trip: the first day is the day of departure, the last day is the date of return;

- duration or duration of the trip: how many days in calendar terms did the employee spend away from his place of permanent work, how many days did the business trip last excluding travel;

- payer organization, here indicate the company that finances the entire trip of the specialist;

- basis, they submit a document on the basis of which a goal or official task is formulated, for example, it could be a letter, an official memo, and so on;

- in the “Task content” column include a description of the main task that the employee must perform during a business trip.

The completed business trip assignment form is signed by the head of the organization and structural unit, as well as the employee who is sent on the trip. Immediately after his return, the employee writes a short report on the completion of the assigned task, and the manager must fill out the conclusion, date it and sign it.

Completed travel assignment form

at the beginning of the article.

It is convenient to formulate the purpose of the trip if the organization’s employees are sent on business trips quite often. This will not only make it easier to maintain personnel documentation, but will also allow you to monitor after a few months whether the goal was formed correctly, what the results of the trip were, and what issues the organization managed to resolve.

What is guaranteed to the employee

Guarantees for an employee do not depend on the purpose of the business trip; there can be many examples. But with any of them, the employer bears some obligations to the employee. An employee who is sent on a business trip is provided with the following guarantees:

- preservation of position, workplace, average daily wage;

- payment for days off spent on a business trip at double the rate;

- reimbursement of expenses that may arise during a business trip in Russia and abroad, including obtaining a foreign passport, obtaining a visa, customs duties and other fees.

All these guarantees are prescribed in labor legislation and are subject to mandatory compliance by the employer.

Sample trip report

First, a short explanation of the structure. If you are writing a report in any form (and this practice is now widespread), then mentally divide the form into three parts: the beginning, the main section and the ending.

Beginning – information about the document itself (number, place, date of preparation).

The main block is the report itself, which includes:

- its period (start and end date);

- basis (here you must indicate the document on the basis of which you were sent on a business trip - this could be an invitation from another organization, an order from the director, etc.);

- purpose of the business trip (indicate the actual tasks that management has set for you);

- trip results: the more detailed, the better. If, as a result of the business trip, any agreements were concluded, certificates were received, etc. documents, you need to indicate their number and date.

If necessary, you can attach additional papers to the form, documenting their presence in the report as a separate item. At the end, the document must be signed and dated to the current date.

>Instructions: compiling a business trip report

How to formulate the purpose of an employee’s trip

When sending an employee on a business trip, it is necessary to formulate its purpose. A business trip is the purpose of the trip. The abolition of the mandatory registration of not only travel certificates, but also official assignments, as well as the generation of reports for employees returning from business trips, is regulated by:

- new edition of the Regulations on the specifics of sending on business trips (approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749).

- Decree of the President of the Russian Federation dated December 12, 2014 No. 765 (approved by Decree of the President of the Russian Federation dated July 18, 2005 No. 813).

Taking this into account, today a travel certificate, as well as an official assignment for a business trip, are not considered mandatory primary documents. Previously, without them, organizations could not accept and record all expenses incurred by an employee as expenses when calculating income taxes. Now the employer has the right to formulate the purpose of the trip orally.

Despite such innovations, a business trip assignment is still issued if it is necessary to clearly formulate the purpose of the trip, delineate obligations, and establish a list and scope of work during the employee’s work away from the main organization. The tasks will also help during reporting, when you need to justify writing off expenses incurred in accounting.

After the cancellation of travel certificates and assignments, the main documents in this area became the regulations and orders on sending an employee on a business trip. The purpose and duration of the trip are reflected in the order, and the actual duration of the trip is recorded using travel documents.

Order to send an employee on a business trip with expert comments

View sample

Official assignment for a business trip: is it mandatory or not to fill out?

Despite the fact that the mandatory registration of official assignments for business trips has been cancelled, many organizations still continue to document the purpose of the trip in writing. HR officers are guided by a sample job assignment for sending on a business trip.

This approach allows not only to optimize document flow in general, but also to systematize documents and arrange them in a unified format. It is rational to prescribe the procedure for processing and general maintenance of documents in the company’s internal local regulations.

What cannot be considered a business trip

Not every employee trip can be considered a business trip. Registration of a business trip is illegal in the following situations:

- lack of official registration of an employee in the organization, no concluded employment contract, no entry in the work book;

- the employee’s employment contract specifies the traveling nature of the work;

- the employee is a freelance worker who does not have a specific permanent place of work.

Mandatory advance report

In addition to reporting on the results of the business trip, the employee will also have to report on the expenses incurred. Let us remind you that when sending specialists, the employer is obliged to pay an advance on travel expenses.

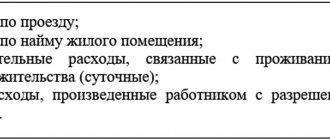

This advance is paid for:

- Payment for travel to the place where the work assignment is performed.

- Renting accommodation for accommodation on a business trip. For example, paying for a hotel room or renting a room or apartment in the private sector.

- Resort fee, if the employee is sent to the territory of the Russian Federation, for a stay there you will have to pay a resort fee.

- Per diem expenses that compensate for the inconvenience associated with an employee living outside of their primary place of residence.

- Other expenses as agreed with the manager. For example, purchasing teaching aids, paying for certificates, and other services.

Please note that when submitting an advance report to the accounting department, you will also have to submit supporting documents: checks, receipts, tickets, invoices and other documents.

01/08/2019 Unified form No. T-10 “Travel certificate” and No. T-10a “Office assignment for sending on a business trip and a report on its implementation” were approved by Resolution of the State Statistics Committee of the Russian Federation dated 01/05/2004 No. 1 “On approval of unified forms of primary accounting documentation for labor accounting and payment." They are unified forms of primary accounting documentation for recording labor and its payment (for personnel accounting). Instructions / recommendations for filling out the form (Extract from the Post. Goskomstat of the Russian Federation dated January 5, 2004 No. 1): Travel certificate (form No. T-10) It is a document certifying the time spent on a business trip (time of arrival at the destination(s) and time of departure from it(es)). At each destination, notes are made on the time of arrival and departure, which are certified by the signature of the responsible official and seal. Issued in one copy by an employee of the personnel service on the basis of an order (instruction) to be sent on a business trip (Form N T-9). After returning from a business trip to the organization, the employee (accountable person) draws up an advance report (Form N AO-1) with documents attached, confirming the expenses incurred. The official assignment for sending on a business trip and the report on its implementation (form No. T-10a) is used to formalize and record the official assignment for sending on a business trip, as well as the report on its implementation. The official assignment is signed by the head of the structural unit in which a posted worker is working. It is approved by the head of the organization or a person authorized by him and submitted to the personnel service for issuing an order (instruction) on sending on a business trip (Form N T-9 or N T-9a). An employee who has arrived from a business trip draws up a short report on the work performed for travel period, which is agreed upon with the head of the structural unit and submitted to the accounting department along with a travel certificate (Form N T-10) and an advance report (Form N AO-1).

The procedure for processing documents for a business trip in 2021

A sample algorithm for how to properly arrange a business trip in 2021 looks like this:

- Make sure that the employee can be sent on a business trip. This is necessary because there are groups of employees who cannot be sent on business trips or can only be sent with their permission. Thus, pregnant workers, minors and those working under an apprenticeship contract cannot be sent on trips. You should ask for written permission from employees with young children or disabled children, especially single parents, as well as those employees who care for relatives.

- Create an order. In 2021, you can use the T-9 or T-9a form, as well as an internal document. There is no need for a service assignment.

- Issue funds. The company must pay the employee for travel tickets, housing, and also issue daily allowances. The total amount of the advance to the employee is established in a local act of the organization or by the employee himself in a memo, which must be approved by the manager. If an employee goes abroad, then the daily allowance must be paid in foreign currency only for going abroad. Within the Russian Federation, all daily allowances are issued in rubles.

- Complete the necessary documents. At this stage, a travel certificate and other documents described in the first section of this article are usually issued.

After this, the employee can safely go on a work trip, after which he will need to:

- Prepare an advance report. This document is completed within three days after the employee returns to the workplace. The advance report is filled out by him using Form AO-1 and submitted to the accountant. If it is customary for the company to fill out reports, then they must be completed and submitted along with the expense report. You also need to attach documents confirming expenses - hotel bills or rental agreements, tickets and boarding passes, checks, forms, waybills, etc. The accountant must give the tear-off counterfoil to the employee so that he can confirm the execution of travel documents in 2021 and their transfer for accounting.

- Give away the excess amount issued. It is transferred to the cash desk within three days after submitting the advance report. Before this, you will need to fill out a cash receipt order. If the employee does not give these funds, then the employer can withhold them from the salary after a month, but no more than 20% of the salary at a time. Expenses in foreign currency are converted into rubles at the rate current at the time of filing the expense report. If an employee received funds in rubles and then transferred them into foreign currency, they will be transferred back to rubles at the exchange rate at that time.

- Compensate for overspending. The employee can spend either less or more than what was issued. So, if all excess expenses are considered justified according to the advance report, then the employee can be paid for the overexpenditure in full using an expense cash order. In 2021, expenses for obtaining a foreign passport and visas will also be reimbursed.

After this, the procedure for sending an employee on a work trip can be considered officially closed, and information about it is entered into the business trip log, provided that there is one. If you act according to the template indicated above and follow all the rules for registering a business trip in 2021, then the company, and especially its accounting department, will easily avoid problems with reporting in the field of business trips. And since accounting was significantly simplified in 2021, it is almost impossible to make mistakes when arranging and paying for business trips in 2021.

Examples of correct wording

To make it easier for you to decide on the preparation of documents, we will give several examples of business trip purposes with the correct wording. Maybe you will even find one among them that suits your specific case well:

Administration and Directorate

- Opening of a new structural unit

- Negotiations on concluding a long-term supply agreement

- Unscheduled personnel inspection of a remote branch

- Expanding business connections

Sales department

- Market research

- Negotiations with potential wholesale buyers

- Comparative analysis of competitive products

- Advanced training: sales training, exchange of knowledge and experience

Researchers

- Participation in visiting exhibitions, conferences and presentations

- Collection of information for research activities

- Conducting field research

- Studying primary sources of scientific works

Agricultural sector

- Visiting exhibitions dedicated to new technologies in agriculture

- Sales of products at fairs and similar events

- Purchase of agricultural machinery

- Purchasing fertilizers or feed for livestock

Above are the most common reasons for business trips for the named groups of employees. Of course, some of them are universal and can be performed by employees of different departments. So, for example, completing a training may be the purpose of a business trip for a director, and a representative of the sales department may be involved in a supply agreement.

What documents to prepare

It is very convenient when an organization employs a specialist who knows how to arrange a business trip. But in times of massive layoffs, many small business owners have to do their own accounting and most of the official paperwork.

Private entrepreneurs and employees who have not completed accounting courses, if necessary, are interested in how travel allowances are processed.

It is no secret that this procedure includes several stages.

1. The head of the company issues a business trip order in the T9 form. He contains:

- FULL NAME. employee;

- his personnel number;

- job title;

- division of the company (department, sector, department) in which the employee works;

- goals and objectives of the trip, its timing, sources of financing (usually employer funds);

- destination.

A document is attached to the order - the basis for the business trip (memo or invitation).

Until 2013, it was also necessary to prepare a job assignment and a travel certificate. These forms are no longer required to be filled out. The labor costs of accountants have been reduced, but new questions have arisen: how to confirm the fact of a trip for official reasons and how to prove that the purpose of the trip has been achieved?

In this regard, many organizations continue to issue travel certificates to employees. This is a small and at the same time very informative document. The purpose on the travel certificate is the same as on the order.

2. The employer purchases travel tickets and books a hotel room.

3. The posted employee signs that he has read the order, receives travel tickets and information about his place of residence.

4. Daily allowances are calculated. According to the law, they are:

– 700 rub. per day – when traveling within the territory of the Russian Federation.

– 2500 rub. per day – for foreign business trips.

The employer may, on his own initiative, increase payments, but in this case he will be obliged to contribute to the budget the personal income tax accrued on amounts exceeding the specified values.

5. The employee’s salary is calculated for the period of his stay outside the place of his main duty. It is the average daily earnings multiplied by the number of days of a business trip. If the time spent on a business trip falls partly on weekends or holidays, the salary for that day is calculated at double the rate.

6. Upon returning from a trip, the employee fills out an advance report on expenses incurred in Form No. AO-1 and attaches supporting documents: travel tickets, a voucher for hotel accommodation, a waybill, checks for payment of fuel and lubricants, if necessary.

7. Summing up: was the purpose of the trip achieved? The employee prepares a written report or submits documents confirming the fact that the official task has been completed.

Business trip arrangements

In order for a business trip to be taken into account in tax, accounting and management accounting, it is necessary to formalize it correctly. First of all, a business trip assignment is drawn up, dates and deadlines are set. The travel candidate must familiarize himself with the document drawn up and give his consent or refusal in writing.

If the answer is positive, the manager issues an order to send the specialist on a business trip. The employee is issued and issued a travel certificate and a work assignment. Upon completion of the trip, the traveler must provide a progress report and expense report with supporting receipts, receipts, and tickets.

Since 2021, a change has been made to the legislation, according to which the issuance of a certificate and official assignment is no longer mandatory. Instead, they use a memo. But many organizations continue to draw up these documents for internal accounting purposes.

When using personal or corporate vehicles, a memo and a waybill are required, as well as a power of attorney and other documents confirming the legality of using a particular vehicle.

How to write a business trip report - example and formatting rules

A business trip report is a sample document drawn up in any form, which is approved by a local act for the enterprise. Each organization determines the need to use it in practice independently. Since 2015, again, you can do without this form.

If you decide that you need a business trip report, an example of its structure should contain several blocks:

- details of the document indicating the place of its preparation, date and registration number;

- the period for which the trip report form is filled out;

- the reason that served as the basis for sending on a business trip;

- tasks that had to be completed during a business trip;

- achieved results (it is better to describe them in as much detail as possible).

When filling out a business trip report, the writing example may contain a concise summary of the results of the trip or a more detailed disclosure of the current situation. Sometimes the allocated space to reflect the results is not enough. In this case, you are allowed to attach a blank A4 sheet and continue presenting the information on it.

A business trip report, a sample of which is being developed by the enterprise, is needed to justify the need for a specific business trip to regulatory authorities. It is for this purpose that detailed answers are given about the results of the trip. If the set goal was not achieved, then the trip report must contain an explanation of the reasons that served as an obstacle to completing the task.

Why do you need business trips?

When an employee goes on a business trip, management determines for him a clear task that he must complete during the trip. The task may concern various areas of the organization’s economic activity. Examples of business trip purposes include the following:

- concluding contractual relations for supplies or sales with contractors;

- negotiations on cooperation;

- resolution of disputes, conflicts and other issues related to the legal side of activities;

- purchase of equipment, raw materials and materials;

- business conferences, participation in gatherings and exhibitions related to the company’s activities;

- promoting goods in new markets, expanding the customer base;

- participation in research projects related to the company’s activities;

- staff development;

- research of sales markets, competing organizations and other marketing issues;

- setting up equipment, software and working with other technical issues in subsidiaries or divisions;

- Conducting inspections of the operation of the branch network and divisions.

Who to send on a business trip

The choice of an employee to go on a trip depends on the purpose of the trip, examples of work assignments, its duration and the severity of the expected conditions. Different reasons for travel require specific knowledge and skills from the employee.

Thus, the execution of a supply agreement must be entrusted to a person savvy in business negotiations and diplomacy. This may be a specialist whose job responsibilities include procurement, planning and calculating the budget for business relations with suppliers, or a person who can competently explain his position and achieve optimal conditions in the concluded supply agreement.

If the purpose of the trip is to set up equipment or software, knowledge of office work and ordinary human charisma are not enough for the sent employee. An official with a technical background is sent on such a trip. The same situation occurs when conducting on-site inspections and audits. An accountant or economist should be sent on such a trip.

Sample of filling out a work assignment for a business trip

So, unified forms are more convenient, if only because they are already ready and only need to be filled out correctly. For the official assignment, a form is provided, which is called Form N T-10a “Official assignment for sending on a business trip and a report on its implementation.” From the name it is obvious that you can write a trip plan in it, and then the seconded employee will report there on its implementation. It follows from this that the form must be filled out by different people and at different times. First you need to complete the task itself. the official assignment for a business trip will be available at the end of the article, and when completed, the T-10a form looks like this:

Obviously, here the employee has not yet completed the task, so he has not yet filled out the report

We'll come back to this later, but for now let's figure out what to pay attention to when filling out the form. Step by step it will be something like this:

- Enter the name of the organization and its OKPO code at the top of the T-10a form.

- Register the form in a special journal and assign it a serial number. Typically, all business trip documents are registered together, this allows for better systematization of personnel document flow in different areas (hiring, dismissal, vacations and business trips). It is convenient to put a letter designation after the digital number; in the example given, “k” means business trip documentation.

- Enter this number in the form, and also indicate the date of its preparation.

- Indicate the last name, first name and patronymic of the posted worker, as well as his personnel number in a separate field.

- Next you need to fill out the table. In the left column you must enter the name of the structural unit of the posted employee, and in the second column - his position.

- The third column contains information about the destination. This is the name of the country and city, but when traveling around Russia it is enough to limit yourself to one city name. Next, you need to indicate the name of the company where the employee is being sent.

- You must write the start and end dates of the trip and indicate its duration in days. Separately, the form provides for indicating the number of days without taking into account the road. Essentially, this is the time that an employee must spend on completing a task. Travel time depends on the type of transport the employee will use to get to the destination and back, which means it may change if, for example, there are no train tickets for the required dates and the business traveler flies by plane.

- Another column (ninth) is intended to indicate the name of the organization that is paying for the trip. After all, sometimes it is possible to send an employee on a trip at the expense of partners if they are interested in a visit to a specific specialist. In our example, the payer is the employing organization itself.

- The last, tenth column is intended to indicate the details (number and date) of the document on the basis of which the task was drawn up. This could be a plan, a memorandum or an order for the organization.

- Below you need to fill out the fields about the purpose of the trip. It's best to keep this short as there isn't too much space. If the traveler faces several tasks, then it is best to make a numbered list so that the specialist can imagine the sequence of achieving the tasks assigned to him.

- After the document is drawn up, it must be signed by the head of the structural unit and the employee himself (that he is familiar with the task). The head of the organization certifies the form after the corresponding order approving the job assignment and the business trip has been prepared and issued.

At this point, the first part of filling out the T-10a form can be considered complete. The seconded employee leaves, completes the assigned tasks, and after his return it’s time to fill out the second part of the form. To do this, the head of the structural unit, who previously drew up the official assignment, must ask his employee about how successful the trip was. If the employee wants, and the boss agrees and there is an appropriate example, a short report on the completion of the business trip assignment can be written by the employee himself. It is enough to simply list all completed tasks and indicate the completeness of their completion. After this, the manager puts his resume about the results of the trip in the appropriate column, and then signs it. At this point, the preparation of form T-10a can be considered complete. In any form, the official assignment can be drawn up according to the same principle. There is nothing complicated about this.

Basic document for a business trip in 2021

The main document that is issued to an employee before a trip is a travel order. Based on his employee:

- Receives the right to go on a business trip.

- Receives an advance amount before departure.

- After returning, he can issue an advance report, according to which travel funds will be taken into account in tax reports and when paying the tax amount itself.

The order in 2021 must contain the following data:

- The name of the company where the traveler works and its OKPO.

- The name of the document, the date of its preparation and the number in the company’s internal records of documents.

- The full name of the employee going on a business trip, his position and personnel number.

- Place of arrival in the form of the name of the locality, country or organization to which the business traveler is going to work.

- Exact or approximate start and end dates of the trip, as well as its duration in days.

- The purpose of the business trip is that if this item is drawn up correctly, then you don’t have to fill out the official assignment and report on it.

- It is indicated who finances the trip - the sending or receiving party.

- Reason for travel - usually noted if the initiator was the employee and not his employer.

- Full name of the head of the organization or person in charge.

- Signatures of the employer and the traveler.

To draw up an order, the T-9 form is sometimes used, an example of how to fill it out correctly can be found in the document at the link, and here you can download a blank form. You can also use an internal document compiled specifically for the organization.

If not one employee, but a group, is going on a business trip, it is allowed to issue one order for them in the T-9a form (sample at the link), the principles for filling out which do not differ from the T-9 form. Here in 2021 you can also use your own form.

Business trips for sales managers

How to arrange a business trip for an employee responsible for customer service and product sales? Sales managers are usually given clear goals expressed in quantitative terms. His earnings and career prospects depend on how efficiently and effectively an employee implements a business plan.

If an employee responsible for working with clients fails to complete the main task of a business trip (make a sale), the employer still wants to get as much information as possible about the potential customer, the prospects for cooperation with him, as well as the reasons why the deal could not be concluded.

In addition, it is important for the head of a company aimed at expanding its customer base to understand which of the competing companies the potential customer cooperates with and on what terms the contracts are concluded. Therefore, when a sales manager goes on a business trip, he is given a multi-level goal, which includes tasks related not only to negotiations with the customer, but also to the collection of market information

Therefore, when a sales manager goes on a business trip, he is given a multi-level goal, which includes tasks related not only to negotiations with the customer, but also to the collection of market information.

The main job task might sound like this:

- conducting negotiations and establishing initial contact with Future Client LLC;

- concluding an agreement for the supply of materials for;

- expansion of the client base, studying market opportunities in the city of N-Ska;

- participation in the exhibition “Building Materials Today” on August 1, 2016;

- exchange of experience with sales managers of the Western branch of the company; participation in the corporate conference “Profitable Transactions”;

- training of new employees of the sales department of the Western branch;

- organizing and conducting the “Successful Work” seminar.

“Concluding a contract for the supply of goods” is the most popular purpose of business trips for employees responsible for working with clients. It can be revealed in tasks:

- meeting with a representative of the procurement department of Future Customer LLC, identifying and analyzing needs;

- visit to competitor enterprises LLC "Rival 1" and JSC "Rival 2" as a "mystery shopper": obtaining price lists, collecting information about the terms of cooperation with customers, drawing up a report for the marketing department, identifying the strengths of LLC "Rival 1" and JSC "Rival 2";

- negotiations with the head of the procurement department of Future Client LLC, demonstration of product samples, agreement on contract terms;

- meeting with the general director of Future Client LLC, signing a contract.

Upon returning from a trip, the sales manager is required to submit a report on the completion of each task and the results obtained. It is accompanied by protocols of negotiations, an analysis of the potential client's needs, materials for marketing research, copies of commercial proposals, and a signed contract (if any).

The goals of a business trip for the head of a client department or director of the sales department can be formulated in a similar way.

The following tasks may also be assigned to the management team:

- conducting an internal audit of sales transactions,

- control over the work of the company branch,

- participation in the meeting of the Committee to improve the quality of customer service,

- presenting a sales report to board members at the annual meeting.

Which ones?

Practicing accountants easily give various examples of business trip purposes and point out the following:

An employee's business trip must clearly be in the best interests of the company. The purpose of the business trip is formulated so that it is clear: the “travel” is beneficial for the company, directly or indirectly contributes to the enterprise earning profit, increasing the volume of activities, and improving the quality of goods and services. An employee of an organization cannot be sent on a business trip with the task of “resting,” “recuperating,” or “recovering.” For this purpose, vacations are provided - annual or for health reasons. The purpose of the business trip should not contradict the employee’s job description. Thus, an accountant cannot be sent on a business trip to negotiate with clients. And the commercial director of a company cannot be sent to another city for the purpose of “transporting employees.” The reason for the business trip must correspond to the duration of the “travel” and its route

If the purpose of a business trip is, for example, participation in an exhibition, an employee of the organization is obliged to “move” in the opposite direction within 24 hours after the end of the event. You should be extremely careful when justifying business trips on weekends. If a company employee goes to another city, for example, for negotiations on Monday, and the travel time is one day, then he can leave no earlier than Saturday evening

Otherwise, the cost of tickets or fuel and lubricants cannot be classified as expenses. It is better to avoid general formulations. It is important to indicate why exactly an employee of the organization is sent to work outside his place of permanent duty. Otherwise, controllers may have doubts about the legality of attributing travel expenses to tax accounting. The purpose of the trip should be formulated in such a way that an unambiguous conclusion can be made about whether the assigned task was completed or not. After the trip, the employee will have to submit a report on the results and attach documents confirming the completion of the assigned task. By the way, it is possible that the purpose of a business trip is not achieved. In this case, the employer requires an “explanatory statement” from the employee indicating the reasons why the official task could not be completed. If you have this document, travel expenses can be taken into account for tax purposes. If the purpose of the business trip is extensive and consists of several tasks, it is important to also write down the individual tasks of the trip, the completion of each of which will also need to be confirmed. If a specialist’s work is of a traveling nature and moving to another locality is associated with the performance of everyday affairs, then such a “travel,” according to the Labor Code, is not recognized as a business trip at all.

Who is prohibited from being sent on business trips?

In addition to the human factor, questions about the qualifications and personal abilities of candidates, there is another aspect in choosing an employee for a work trip. There are legal requirements regarding categories of citizens who cannot be sent on business under any circumstances. These include the following groups of people:

- minor employees, interns, interns;

- pregnant women;

- employees of the company working under an apprenticeship contract (except for business trips for the purpose of training);

- participants in election campaigns, candidates for political positions;

- people whose capabilities are limited by illness.

There are also groups of people who can be sent on a business trip only if their written consent is obtained:

- women with small children (up to three years of age);

- a single parent raising a child under five years of age;

- guardians of children under the age of majority;

- an employee whose family has a dependent in need of constant care.

Which employees can be sent on business trips?

Since the employee must be paid the average salary for all days of the trip for the purpose set by the employer and not inconsistent with the performance of his official duties, it is clear that the person must have an employment relationship with the organization sending him on a business trip (clause 2 of Resolution No. 749 ).

Any employee included in the organization’s staffing table, hired under an employment contract (not to be confused with civil contracts), if initially the conditions for performing job duties do not require traveling (couriers working on a rotational basis), can be sent on a business trip.

It is important to consider that a certain category of people cannot be sent on business trips at all, according to labor legislation:

- pregnant workers;

- employees who have entered into a student agreement with the organization;

- working youth (up to age eighteen);

- persons who are running for elective office in upcoming elections.

Also, the legislator requires written consent if it is necessary to travel outside the place of residence in order to fulfill the production tasks of employees who have certain benefits:

- mothers with children under three years of age;

- women or men raising a child under five years of age without a second spouse;

- workers with disabled children or caring for sick relatives (if there is a conclusion about the need for outside care);

- employees with a working disability group and working in certain conditions.

Business trip concept

This concept has a clear definition, which is prescribed in labor legislation. According to the Labor Code of the Russian Federation, a business trip is the direction of an employee by management on a trip with a specific task. At the same time, the destination is quite remote from the main place of work, the trip has a clearly formulated purpose, stated in the documents, and the time frame for its completion is limited. Registration of accompanying documents, reporting at the end of the trip, guarantees for the employee are regulated by labor and tax legislation. Possible purposes of the business trip are also spelled out, examples of which are presented below.