Clarifying points

- In Russian labor legislation there is the concept of “extended vacation” of 42 or 56 calendar days. It is assigned to such categories of employees as teachers.

- Payment of compensation to an employee must be made at the time of dismissal or no later than the day after the dismissed person submits a request for payment.

- Continuous work experience includes both the time of actual work and the time of maintaining a job - time spent on sick leave, non-working holidays and weekends.

- Absenteeism without a valid reason and time off for vacation are not included in continuous work experience; therefore, these days are not included in the calculation when compensating for vacation.

How to calculate the number of vacation days upon dismissal

Payroll calculation should not be difficult, but the question of how to calculate leave upon dismissal is more complicated, since the number of days may exceed the basic duration.

This is possible due to previously unused or additional days. In order not to make a mistake, you first need to determine the total working time, which gives the right to receive annual paid rest (Article 121 of the Labor Code of the Russian Federation). In this case, it is necessary to take into account the specifics of providing additional vacation periods: for work under hazardous working conditions, etc. Then you need to determine the total number of days that are due for the entire period of work with the employer. If the number of days turns out to be fractional, then the number is rounded in favor of the employee (letter of the Ministry of Health and Social Development of the Russian Federation dated December 7, 2005 No. 4334-17). After this, based on the data from time sheets (or other labor accounting documents), the days that the employee has already used are subtracted from the result obtained.

As a result, the remaining quantity is calculated.

- Actual time worked (FOV ) = the last 12 months (or less, but actually worked) - excluded periods.

- Number of days per time worked (KDOV) = (FOV / 12 months) / (the required number of vacation days in the employment contract / 12 months).

- Number of vacation days (KDO) = KDOV +/- remaining days.

Example 6

An employment contract for an indefinite period was concluded with the employee on November 2, 2009. The employee resigns of his own free will on December 14, 2009. It is required to calculate the number of calendar days of compensation for unused vacation upon dismissal.

The duration of work in the organization was 1 month and 12 days. Vacation compensation is due to any employee who has worked for more than 15 calendar days.

The contract with the employee was concluded for an indefinite period, therefore the rules established by Article 291 of the Labor Code of the Russian Federation for employees with whom a contract was concluded for a period of up to two months cannot be applied. The amount of compensation is determined based on the generally established vacation duration of 28 calendar days. The length of service giving the right to leave is 1 month. Therefore, the employee is entitled to compensation in the amount of 28 days / 12 months. x 1 month = 2.33 days

In educational budgetary organizations, teachers and professors who resign after 10 months of the academic year have the right to receive compensation for the full duration of vacation of 56 calendar days. If a teacher resigns during the academic year, he is entitled to proportional compensation at the rate of 4.67 days for each month worked.

Which days are taken into account?

You can understand how to calculate compensation for unused vacation by determining the principle for calculating vacation days that are reimbursed in money. The number of such days depends on how long the person worked before leaving. Days worked per year are rounded up to months. If more than half a month has been worked, the length of service for calculating payments is rounded up, if less than half, vice versa. To receive payments in 28 days, it is enough to work a full 11 months (without rounding). They also compensate all 28 days for citizens who worked from 5.5 to 11 months and were dismissed due to the liquidation of an enterprise, conscription into the army or staff reduction. But if an employee works for less than half a month, he will not receive compensation.

Example: Panfilov I.L. has been working at the company since April 10, 2014. Each working year of Panfilov begins on April 10. He will retire on August 15, 2021. Over the last working year, he worked for 4 months and 5 days. Rounding down occurs since less than half the month was worked. Provided that Panfilov has already used rest days for previous periods, compensation is accrued for 4 months. During this time of work he is entitled to 9.33 days of rest. See below for the formula we used to calculate unused days.

Important! There is no rounding of unused days. The management of the company has the right to decide to round days to whole numbers, but they must do this not in an arithmetic way, but in favor of the employee. So the number 9.33 is rounded to 10 whole days, and not to 9 (letter of the Ministry of Health and Social Development of Russia dated December 7, 2005 N 4334-17).

Calculation in non-standard situations

When calculating payment for unused vacation, the following situations may arise:

- The person resigning has worked for less than half a month - no compensation is awarded to him (clause 35 of the Rules on regular and additional leaves, approved by the People's Commissariat of Labor of the USSR on April 30, 1930 No. 169).

- Income is present only in the month of dismissal. Then the average earnings are determined for this month by dividing the accrued salary by the calculated value of the average number of calendar days in it (clause 7 of the Decree of the Government of the Russian Federation of December 24, 2007 No. 922), which is calculated from the number 29.3 in proportion to the share of calendar days of work in the total number of days in the month of dismissal (clause 10 of the Decree of the Government of the Russian Federation dated December 24, 2007 No. 922).

- There was no income in the billing period. Then, to calculate average earnings, they take the same period preceding it (clause 6 of the Decree of the Government of the Russian Federation of December 24, 2007 No. 922). If there is no income in it, then the average earnings are calculated from the salary or tariff rate (clause 8 of the Decree of the Government of the Russian Federation of December 24, 2007 No. 922).

- In the calendar year considered for calculating the number of days of vacation pay, there were vacations at one’s own expense, and their total duration for the year exceeded 14 calendar days. The difference between the actual length of vacation at your own expense and 14 calendar days should reduce the period for which the vacation will be paid.

- The employee took vacation in advance and then quits without working the entire calendar year related to him. Overpaid vacation pay must be withheld from him (clause 2 of the Rules on regular and additional vacations, approved by the People's Commissar of the USSR on April 30, 1930 No. 169), if there are no grounds for paying them in full.

Methodology for calculating average daily earnings for payment of severance pay

The payment of additional funds upon dismissal (severance pay) is regulated by Art. 178 Labor Code of the Russian Federation. This money is not accrued in all cases of employee departure, but only when the reason for dismissal, recorded in the work book and order, is one of the following:

- health inadequacy of the position;

- exit of an employee who previously held the position from which the person being dismissed is leaving;

- conscription of an employee to military or alternative service;

- refusal to move to work in another area.

In these situations, upon leaving, the employee is entitled to funds in the amount of their average earnings for 2 weeks.

If an employee is forced to leave due to:

- liquidation or reorganization of the company;

- reduction in numbers or staff,

then he is entitled to a compensation payment in the amount of average monthly earnings.

IN ADDITION: in all of the above cases, the employee is retained his average monthly earnings for the first time after losing his job (no more than 2, in some cases - 3 months from the date of dismissal, this amount also includes severance pay).

Calculation procedure

- The billing period for which the total income is determined is 12 months.

- If the length of service of the dismissed employee is less than a year, the calculation period is considered to be the time from the date of hiring to the first day of the last working month.

- It is necessary to take into account the number of days actually worked during this period.

When the last calendar year is fully worked, the calculation formula is applied:

Zwed.-days = (∑12 months / 12) / Day/month Wed.

Where:

- Zwed.-days – average daily earnings;

- ∑12 months – the employee’s total income for 12 months;

- Day/month Wed. – the average length of the month, recorded as 29.3 days.

When a billing period is not fully worked out, the formula is applied:

Zwed.-days = ∑Nmonth. / (N-1) + Days of non-weekly months

Where:

- Nmonth – number of full months worked;

- Day.week.month. – the number of days actually worked in an incomplete month.

Calculation example

Employee Rosomakhin V.M. worked for the company from April 18, 2015 with a salary of 20 thousand rubles/month. In the last year, based on the results of his work, he was awarded a bonus in the amount of 5 thousand rubles. Resigned due to staff reduction on 04/18/2017. Paid vacation days have been used in full. Over the past year, he has been on sick leave for a total of 20 days.

Let's calculate the average daily earnings for the compensation due to him. The funds received during this time amounted to 20,000 x 12 + 5,000 = 245,000 rubles. We apply the formula:

Average daily earnings Rosomakhina V.M. = 245,000 / 12 / 29.3 = 696.8 rubles.

When calculating compensation, funds paid for 20 days of temporary disability will need to be subtracted from the amount received.

Responsibility for non-payment of compensation for unused vacation

If the employer does not pay the resigning employee compensation for unused vacation, and the labor inspectorate finds out about this (for example, the employee writes a complaint), then the employer will be fined. The amount of the fine is (Part 6, Article 5.27 of the Code of Administrative Offenses of the Russian Federation):

- from 30,000 rub. up to 50,000 rub. — for a legal entity-employer;

- from 10,000 rub. up to 20,000 rub. — for officials of the legal entity-employer;

- from 1000 rub. up to 5000 rub. - for individual entrepreneurs.

By the way, if the employer pays compensation for unused vacation, but in violation of the established deadline, then along with this compensation the employer is obliged to pay the employee another compensation - for the delay in labor payments (Article 236 of the Labor Code of the Russian Federation).

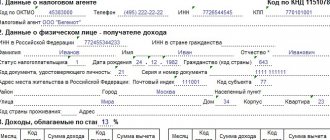

Reflection of compensation for unused vacation in certificate 6-NDFL

Material compensation for vacation in full is subject to personal income tax. Upon dismissal, the employee receives salary and compensation minus tax. In 2021, employers submit tax returns in Form 6 of personal income tax every quarter. Let's figure out how to reflect the amount of compensation for unused vacation in this calculation.

In Form 6 Personal Income Tax, 2 blocks of lines 100-140 are filled out separately: for salary and for compensation.

To reflect the PO:

- in line 100, enter the date of recognition of income in the form of wages for the last month;

- in line 110 - the date of personal income tax withholding (date of salary payment);

- in line 120 - the deadline for transferring the tax is the following day of salary payment.

To reflect compensation for unused vacation:

- in line 100, indicate the date of income recognition (last business day);

- in line 110 - the date of tax withholding (day of payment);

- in line 120 - the deadline for transferring the tax is the following day after the payment of compensation.

In lines 130 and 140 of section 2, enter the appropriate amounts.

Example 7

It is required to calculate the amount of compensation for unused leave upon dismissal for 5 months for a secondary school teacher. For 5 months of work, the teacher is entitled to proportional compensation at the rate of 56 days. / 12 months x 5 months = 23.33 days

For teaching employees whose vacation duration is set at 42 calendar days, upon dismissal, full compensation for unused vacation is paid in the amount of full vacation if the employee worked for 11 months in the corresponding calendar year.

If by the day of dismissal the employee has worked for less than 11 months, proportional compensation is calculated, the amount of which is 3.5 days for each month worked.

Design features

Requirement of Art. 122 of the Labor Code of the Russian Federation establishes that paid leave is provided to the employee annually on the basis of the vacation schedule (Article 123 of the Labor Code of the Russian Federation). During the vacation, the “vacationer” retains his place of work (position) and average earnings (Article 114 of the Labor Code of the Russian Federation), but he cannot be fired.

An employee can be dismissed only when he: has begun to perform his official duties; wrote an application for leave with subsequent dismissal, in this case the last working day will be considered the last working day, and the day of dismissal will be the last day of rest (Article 127 of the Labor Code of the Russian Federation).

The number of documents to be completed depends on whether the employer uses the following forms:

- unified (for the case under consideration - on the basis of Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1);

- own (approved independently in accordance with the law of December 6, 2011 No. 402-FZ);

- for public sector organizations (by order of the Ministry of Finance dated March 30, 2015 No. 52n, as well as departmental ones, for example, by order of the Federal Antimonopoly Service of the Russian Federation dated July 1, 2016 No. 887/16).

If unified ones are used, the personnel service prepares two orders: on providing rest to the employee (Form No. T-6); on termination of an employment contract with an employee (form No. T-8).

The same principle applies to settlement documents.

If the employer uses unified forms, the accounting service prepares two documents:

- note-calculation on the provision of rest (form No. T-60);

- settlement note upon termination of an employment contract (form No. T-61).

In public sector organizations and extra-budgetary funds, document forms of class 05 (order No. 52n) are used, in particular, the OKUD form 0504425. If unified forms are not used, then the documents are drawn up in the manner established by the budget legislation of the Russian Federation (for the public sector) or by the organization itself in accordance with Law No. 402-FZ.

Indexation of average earnings with salary increases

It happens that an increase in tariff rates, that is, an employee’s salary, occurred before or during a vacation. Then the average earnings need to be indexed and vacation pay will have to be recalculated.

Three indexing options are used:

- Let's say the salary was increased during the reporting period, which means that all payments are taken into account in the calculation of vacation pay from the beginning of the period until the month of the salary increase. To do this, you need to multiply the salary or vacation pay by the increase factor (Kpv): Kpv = He / Os, where He is the new salary, and Os is the old salary;

- The increase occurred later than the billing period, but before the start of the vacation, which means the entire calculated average earnings are multiplied by the Kpv (increase coefficient);

- The increase happened during vacation - only part of vacation payments is increased, starting from the date of introduction of new salaries.

Is it possible to replace vacation with monetary compensation without dismissal?

Replacement with monetary compensation without dismissal is permissible only for the part of the vacation period exceeding 28 calendar days (Article 126 of the Labor Code of the Russian Federation). This happens upon a written request from the employee. Days exceeding the main vacation can be replaced with money. Only those categories of employees who are entitled to additional days of rest (disabled people, teachers, doctors, northern workers, etc.) can receive cash remuneration instead of rest. Or if the employer has provided additional days for rest in the company’s local regulations. And then, not in all cases.

- The legal norm uses the wording “can be replaced,” which leaves the employer the right to refuse the employee financial compensation. Payment of money instead of providing extra days of rest is at the discretion of management.

- Vacation will not be replaced with money for pregnant women, minors and workers in hazardous and hazardous industries.

It is also not possible to accumulate vacation days for the previous year, and then take part of the double vacation over 28 days in cash. Article 126 of the Labor Code of the Russian Federation, when summing up and transferring vacations from one year to another, allows for the replacement of only part of more than 28 days in each year.

Dismissal after maternity leave or parental leave

An employee has every right to resign, even while on maternity leave. When calculating the amount of compensation, you will have to take into account how many days of unused vacation she still has left. According to labor law, compensation must be expressed in monetary terms, regardless of the reasons why the employee leaves his position.

In any case, after submitting the resignation letter, the required two weeks must pass, after which the employee comes to the personnel department and receives his work book, and then goes to receive a payment.

The employee may also resign immediately after the vacation. In this case, the employer will also have to include in the calculation compensation for the 11.67 calendar days of vacation due during maternity leave. The calculation here is carried out in exactly the same way as when dismissing other employees.