Remuneration according to the Labor Code of the Russian Federation

They are determined in accordance with the profession, position, qualification category and qualification category of the employee. Additional payments, allowances and incentive payments due to the employee (for example, for long work experience in the specialty, high qualifications, deviations from normal working conditions) are indicated in the employment contract, or it makes reference to the relevant regulatory legal act or collective agreement providing the grounds and the terms of their payment. In this case, the employee must be familiarized with them against signature.

The criterion for determining wages is the quality of work, which characterizes its complexity, responsibility, tension, heaviness, and independence. The quality of work is manifested primarily in its complexity - the level of tasks performed by the employee.

Another criterion for determining the main part of wages is the conditions of the work performed, which are also important for the second - compensatory - part of wages, since tariff rates and salaries are relatively rarely set taking into account working conditions.

A component of wages are incentive payments (additional payments and bonuses of an incentive nature, bonuses and other incentive payments).

It should also be noted that the minimum wage (minimum wage) does not include compensation, incentives and social payments, that is, it consists exclusively of the main (tariff) part. It follows that the tariff rate, salary (official salary) of an employee cannot be lower than the minimum wage provided for by law

As stated in Article 131 of the Labor Code of the Russian Federation, wages are paid in cash in the currency of the Russian Federation (in rubles). In accordance with a collective agreement or an employment contract, upon a written application from an employee, remuneration may be made in other forms that do not contradict the legislation of the Russian Federation and international treaties of the Russian Federation. The share of wages paid in non-monetary form cannot exceed 20% of the accrued monthly wage. Payment of wages in bonds, coupons, in the form of promissory notes, receipts, as well as in the form of alcoholic beverages, narcotic, poisonous, harmful and other toxic substances, weapons, ammunition and other items in respect of which prohibitions or restrictions on their free circulation are established , not allowed.

Article 132 of the Labor Code prohibits any kind of discrimination when establishing and changing wage conditions.

Employer's liability

Article 142 of the Labor Code stipulates that the employer and (or) the employer’s representatives authorized by him in the prescribed manner, who have delayed the payment of wages to employees and other violations of wages, are liable in accordance with the Labor Code and other federal laws. The Criminal Code establishes liability for non-payment of wages for more than 2 months.

In case of delay in payment of wages for a period of more than 15 days, the employee has the right, by notifying the employer in writing, to suspend work for the entire period until payment of the delayed amount (Part 2 of Article 142 of the Labor Code).

An employee who was absent from the workplace during his working hours during the period of suspension of work is obliged to return to work no later than the next working day after receiving written notification from the employer of his readiness to pay the delayed wages on the day the employee returns to work.

Civil and labor legislation provides for material and disciplinary liability. If the actions (inaction) of an official contain elements of a crime, then he can be brought to criminal liability, and if these actions (inaction) are in the nature of an administrative offense, then it is possible to bring the guilty person to administrative responsibility.

Minimum size

The minimum wage (SMW) is the minimum established by law that an employee must receive for an hour, day or month of his or her work activity. This figure is established in accordance with Law No. 82-FZ.

The main function of the minimum wage is to regulate the level of wages throughout the country. Also based on this indicator, the amount of benefits for those temporarily unable to work, for pregnancy and childbirth, as well as for various social insurance purposes is determined.

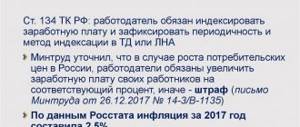

According to the Labor Code of the Russian Federation:

- The minimum wage is established throughout the country at the same time;

- the amount of the minimum wage in private companies is established by the employer at his own expense, and in budgetary companies the funds are taken from the state budget accordingly;

- The minimum wage cannot be lower than the subsistence level of the working population;

- the monthly salary of an employee who worked strictly according to his schedule cannot be lower than the minimum amount.

It is worth considering that the salary may be less than the minimum wage, but only on the condition that other allowances will cover this difference and all components of the salary in total will not be less than the permissible minimum.

The procedure for paying wages to employees

According to Art. 136 of the Labor Code, a worker receives payment based on the results of his work at least twice a month. Payment is calculated after the work is completed. The maximum period for transferring funds is 15 days from the end of the period for which it is calculated.

Each time when transferring payment to a working employer, the established Art. 136 TC payment procedure:

- The amount of earnings is calculated.

Salary according to art. 129 of the Labor Code of the Russian Federation is a combination of several types of payments, among which there is always remuneration for work, so the calculation comes down to calculating salary or income at the tariff rate. If necessary, the calculation includes adding the amounts of incentives and compensation due to the employee for the time worked.

Employees are notified in writing of income and the amounts on which it is calculated, i.e.

- about the size of the salary parts;

- the amount of other payments;

- on the grounds and amount of deductions.

In organizations where payments to workers are made in cash through the accounting department or cash desk of the company, notification is made using a payroll, which is signed by a familiar employee. If an employer uses the services of a credit institution to pay employees, then, as a rule, workers are notified by sending information to the employee’s phone, posting information about accruals in their personal account on the bank’s website, or in another way.

The salary is transferred to the employee “hand to hand” in cash or transferred to an account with a credit institution.

Forms and systems of remuneration

Forms and systems of remuneration are established in Chapters 20, 21 of the Labor Code.

Article 131 of the Labor Code provides for the possibility of paying wages in two forms:

The monetary form is the main one, since it is money that represents the universal equivalent. The natural form can only be used partially (no more than 20%) and must be provided for by a collective agreement; it cannot be established by internal local acts (orders). In addition, a written statement from the employee is required, indicating his consent to receive part of the salary in kind. Paying wages in alcoholic beverages, as well as in goods whose circulation is limited by law, is unacceptable (Article 129 of the Civil Code).

Depending on economic indicators, the measurement of wages is divided into time-based, piece-rate and piece-rate.

- piecework wages depend on quantitative and qualitative indicators of labor;

- time-based - depending on the time spent and qualifications of the employee;

- The lump sum wage system is established not for a specific production operation, but for the entire volume (cycle) of work, i.e. payment is made for completing a chord task.

Currently, there is a tendency to improve the system of payment and incentives for workers, used in the practice of companies in combination with additional payments and bonuses for the personal contribution of the employee, which leads to an increase in the company’s income.

Additional forms of remuneration include contract and commission forms.

- contract involves payment for work stipulated by the terms of the contract;

- commission payment is based on the commission agreement, which regulates the relationship between the commission agent and the principal.

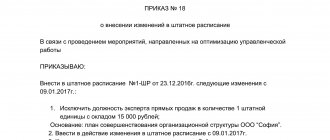

Salary Regulations

A salary regulation is a document within an organization that records detailed information on employee remuneration. This regulatory act should stipulate:

- salary calculation system;

- how the company stimulates its employees;

- types of awards;

- possible deductions from wages;

- information on accounting for the cost of paying wages in tax expenses;

- other conditions.

That is, looking at this document it should be clear how employees receive payment for their work. The Wage Law does not require companies to have a wage clause, but it can significantly simplify the process during tax audits.

Procedure for payment of wages

Salary payments can be made in two main ways:

- By paying cash from the company's cash desk. Salaries are paid according to the location of the company. If it is paid elsewhere, it must be specified in the employment contract.

- By transferring funds to the employee’s bank card. This can be a card linked to a salary account, or any other employee debit card. An employee has the right to change the bank to receive his salary at any time. To do this, he needs to write a written statement to the employer at least 5 working days before receiving wages.

In the near future, it is planned to completely transfer salary payments to non-cash form.

The place where payments in kind are made must be fixed in a collective or employment agreement.

Typically, wages are divided into an advance payment and a final payment (it is the second payment that represents the final payment of wages). The amount of the advance is determined in any order. This can be a fixed amount (for example, 5,000 rubles) or an advance tied to the salary (for example, 50% of the salary). In this case, the advance is paid in full without reducing personal income tax, and the final payment is transferred minus the advance and personal income tax.

On paydays established by the enterprise, maternity benefits, temporary disability benefits and child benefits are also paid. Whereas vacation pay is paid three days before the start of the vacation.

Thus, the employer’s responsibilities include not only the fact of issuing wages, but also compliance with payment deadlines. Salaries must be paid at least 2 times a month, maintaining intervals between payments of at least 15 days. The final payment is made no later than the 15th day of the month following the settlement month. The specific timing of payment of wages is determined by the employer at its discretion. He must fix them in an employment or collective agreement or in another legal act. Salaries can be paid in cash from the company’s cash desk or in non-cash form on a card.

Dear readers, each case is individual. If you want to find out how to solve your particular problem, call:

- Moscow.

- Saint Petersburg.

Holds

Deductions from wages are an integral part of it. They are divided into several groups:

- Required. Deductible in accordance with current legislation. These include personal income tax and deductions under executive documents. In this case, the employee's consent is not required.

- At the initiative of the employer (cases prescribed in labor legislation). This may be reimbursement of an advance issued on account of wages that the employee did not work. In addition, these may be funds that were issued directly for a business trip or other activity, but were not spent for their intended purpose. Sometimes it happens that an employee is paid extra money due to a calculation error. Then the excess will also be withheld later. There may also be a number of other points specified in the law on the payment of wages.

- At the initiative of the employee. Such deductions usually go towards union dues, loan repayments, charity, voluntary insurance, etc.

The amount withheld cannot exceed 50% of the entire salary.

Salary reduction

Calculating the amount of earnings involves deducting various deductions from the worker’s income. A number of them do not depend on the efficiency and integrity of the employee. So, the employer in any case withholds the following amounts:

- personal income tax (Chapter 23 of the Tax Code);

- insurance contributions for social, medical and pension insurance (Article 425 of the Tax Code of the Russian Federation, Law “On Mandatory Social Insurance...” dated July 24, 1998 No. 125-FZ).

A number of deductions are made by court decision and do not relate to the employee’s work activity. For example, these are the amounts:

- alimony (section 5 of the RF IC);

- deductions from the earnings of those sentenced to correctional and forced labor (Article 50, Article 53.1 of the Criminal Code of the Russian Federation).

Salaries may be reduced by deductions related to the employee’s work activities, for example:

- deprivation of a mandatory bonus or reduction in its size if the conditions for such actions are provided by the employer (letter of Rostrud dated December 18, 2014 No. 3251-6-1);

- deduction of amounts previously transferred to the employee due to a counting error (Article 137 of the Labor Code);

- repayment of unspent advance payment for a business trip that has not been returned to workers (Article 137 of the Labor Code);

- compensation for material damage caused to the employer (Article 238 of the Labor Code);

- return of amounts from the employee’s previously paid wages if the employee’s guilt in idle time, failure to comply with labor standards (Article 137 of the Labor Code), etc. is proven.

Let's summarize. Salary is a guaranteed income for an employee, automatically accrued within the framework of labor relations for fulfilling labor standards and varying due to the worker’s qualifications, length of service, complexity of work or other grounds established in the Labor Code or by the employer. According to the Labor Code of the Russian Federation, wages consist of additional payments and remuneration for labor. The salary amount may be reduced by deductions. In accordance with Art. 136 of the Labor Code, remuneration is made from 2 times a month in 3 stages, including calculation of earnings, notification of the employee about it and, in fact, payments.

Payroll formula

In addition to the very fact of paying salaries, it is also important to take into account the rules for calculating them. This makes the process fair, which is of great importance for the formation of the relationship between employee and employer. As a rule, salaries are calculated according to formulas.

To calculate salary remuneration, use the formula:

ZP = O/Dk*Df + P - N - U,

where O is the employee’s salary; Dk - the total number of days on the calendar; Df - number of days actually worked; P - bonuses (allowances); N - tax (13%); U - various deductions.

To calculate piecework remuneration, use the formula:

ZP = C1*n1 + C2*n2 + P + DV - N - U,

where there are additional designations: C1, C2, etc. — piece rate per unit of labor; n1, n2, etc. — how many units the employee completed; DV - additional rewards (for example, working above plan).

Commentary on Article 271 of the Labor Code of the Russian Federation

For all workers under the age of 18 who, in accordance with Article 92 of the Labor Code, have reduced working hours and, in accordance with Article 270 of the Labor Code, have reduced production standards, payment is established in proportion to the time worked or in proportion to production (depending on the remuneration system) .

In proportion to the time worked, wages to employees under the age of 18 are paid on a time-based basis, which is typical for part-time work, and not for short-time work, which, in accordance with Article 92 of the Labor Code, is established for this category of workers. That is, for workers aged 15 to 16 years, the tariff rate (official salary) will not exceed 60% of the tariff rate (official salary) of an adult worker, and for workers aged 16 to 18 years - 90%.

In case of piecework payment, the labor of minor workers is paid at the piecework rates established for adult workers. Due to the fact that their working hours are shorter, their piecework earnings will also be less than that of an adult worker.

Students working in their free time from school are also paid in proportion to the time worked or production. Here we are talking about both students of general education institutions and students of educational institutions of vocational education - primary, secondary or higher. They are subject to the same payment rules as other workers under 18 years of age.

The employer, at his own expense, can establish additional payments for employees under 18 years of age that increase the level of remuneration for minor workers to the level of remuneration for workers of the corresponding categories for the full duration of daily work with time-based payment, with a piece-rate wage system - up to the tariff rate for time, by which the daily work hours of young workers are reduced.

In the case where these additional payments are provided for by a collective agreement, the costs of their payment, on the basis of paragraph 25 of Article 255 of the Tax Code of the Russian Federation, are taken into account in the organization’s expenses when calculating income tax.

Labor Code of the Labor Code of the Russian Federation Chapter 21. WAGES

Appeal ruling dated November 11, 2014 in case No. 33-14653/2014). This danger arises if the employment contract states that the bonus is part of the salary and a specific amount and frequency of bonuses are established (for example, monthly).

Therefore, it is better to indicate in the employment contract only a reference to the LNA on bonuses. If the terms of the bonus are formulated accordingly and payment is not guaranteed, then the court will uphold the non-payment (see, for example, the Appeal decision dated 05/07/2015 in case No. 33-3789/2015, the Appeal decision dated 07/08/2014 in case No. 33-27385).

For example, in an employment contract, the conditions for bonuses can be formulated as follows:

The following wording can be used in the Bonus Regulations:

For some categories of workers, the law establishes mandatory salary supplements. Thus, northern bonuses are paid on the basis of Art. 315 TC, Art. 11 of the Law of the Russian Federation of February 19, 1993 No. 4520-1, and allowances for “harmful persons” - on the basis of Art. 147 Labor Code of the Russian Federation.

The allowances established by law (northern allowances, allowances for employees working in hazardous working conditions) must also be provided for both in the LNA and in the employment contract, which is confirmed by judicial practice (see the Appeal ruling dated February 24, 2014 in case No. 33-1457 , Appeal ruling dated December 18, 2013 in case No. 33-8030/2013).

For example, in an employment contract you can indicate the following: “A percentage increase of 50% of wages for work in an area equated to the regions of the Far North is applied to the actual accrued wages, including bonuses related to the performance of labor duties.”

print version

Forms of remuneration

According to the provisions of Art. 135 of the Labor Code, wages to employees are calculated on the terms of the employment contract concluded with them, taking into account the current remuneration system. Each employer develops its own remuneration system for its employees, focusing on its preferences and economic working conditions. At the same time, the adopted remuneration system cannot contradict the provisions of the Labor Code. Such provisions are automatically invalid and cannot be applied in practice.

There are two key types of forms of remuneration: time-based and piece-rate. The time-based form is used in enterprises when it is impossible to normalize production or there is no need for it. In this case, it makes more sense to pay employees for the time they work, rather than for the amount of work they do.

In this way, salaries are most often calculated for administrative personnel, lawyers and marketers, secretaries, etc.

The time period that underlies the calculations can be a day, a month (the most common type of payment is monthly salary) or another option. If an employee works part-time, then his salary is accrued only for the period worked.

Also, organizations often practice the use of a time-based bonus form, when a bonus for quality work done is added to the basic salary on a time-based basis. Bonuses can be paid on a regular basis or in a lump sum.

The piecework form of payment is usually applied to employees of production departments or specialists involved in the service sector. It is more profitable for the employer to pay them not for the time worked, but for the amount of work completed. For each unit of product produced or volume of services provided, the employee is charged a certain amount (also called the piece rate).

It turns out that the higher the productivity, the higher the salary the employee will receive. Therefore, this form of payment acts as an incentive to increase productivity for employees.

In small start-up organizations, a non-tariff form of payment may be used, in which employee earnings may depend on the financial performance of the company. In practice, tariff and non-tariff forms of salary calculation can be combined: for example, when an employee regularly receives a certain salary, and the other part of the amount (bonuses) is accrued to him based on sales results or the company’s financial results for the quarter.

Organization of remuneration at the enterprise

The organization of remuneration at an enterprise is a series of activities aimed at remunerating employees in direct accordance with the quality and quantity of work performed.

When organizing a system at an enterprise in accordance with which workers will be paid, it is necessary to take into account the need to use:

- tariff regulation of wages (tariff system of remuneration);

- development of the form and system by which the employee will be paid;

- determination of the system for the formation of official salaries;

- the need for bonuses;

- validity of indicators used in the bonus system.

The basis of labor rationing is the balance of labor costs that are necessary to produce any unit of goods or services under certain technical conditions. The main task in labor standardization is to develop and implement progressive standards at the enterprise.

The organization of remuneration is associated with solving a dual problem:

- give each employee guarantees that his work will be paid in relation to the results of his work and in accordance with the cost of labor in the labor market;

- ensure the employer makes a profit during the production process and compensates for costs.

The concept of salary and legislative regulation

A salary is a certain amount of money that an enterprise pays to an employee in proportion to his expertise and the amount of work performed. For most people it serves as the main source of income. The level of his well-being directly depends on the amount that the subject receives.

Enterprises that have hired employees distribute wages among everyone who is directly involved in the labor process. That is, it represents the cost of human resources that must be deployed to complete a job.

According to the regulation of wages at the legislative level, it should provide officially employed people with decent remuneration. If they do not receive this, they have the opportunity to obtain legal protection.

According to legislative regulation:

- wages cannot be lower than the minimum wage approved by the state;

- employees who have the same qualifications and perform the same work must receive identical remuneration, otherwise this is discrimination prohibited by law;

- under the influence of factors such as specialization, complexity and volume of tasks, the quality of their implementation, as well as working conditions can influence changes in wages;

- in budgetary organizations, the calculation of salaries, bonuses and other deductions occurs in the same way, while other enterprises can make independent decisions, according to internal documents.

In addition, an employee may receive financial punishment for poor quality work.