Home / Labor Law / Vacation / Educational

Back

Published: 06/07/2016

Reading time: 10 min

0

1062

The time an employee is absent from the workplace for valid reasons related to his studies in educational institutions is called educational leave. The rules for the provision and payment of such leaves are regulated by law: articles 173 to 177 of Chapter 26 of the Labor Code of the Russian Federation.

Not everyone gets paid leave. There are a number of requirements for both the employee and the educational institution.

An employee can receive compensation only if he is receiving education at this level for the first time. That is, if this is a second higher education, the vacation will not be paid. If he studies at the initiative of the employer, which is stated in the employment agreement, then compensation is due.

Employees studying at several educational institutions at once can receive leave with preservation of earnings for only one of them of their choice.

An employee has the right to receive guarantees and compensation regardless of what field of study he is studying, and whether the educational profile is related to his work activity. Also, the payment of benefits is not affected by the start time of training: before concluding an employment agreement or after. The amount of time worked at a given enterprise also does not matter.

An employee is entitled to benefits and compensation only if the educational institution in which he is studying has state accreditation. Its availability can be found in the call certificate, on the basis of which the employee is granted leave.

The amount of compensation is calculated from the employee’s average monthly earnings, which is calculated in the same manner as for paying the main vacation.

Vacation is provided in calendar days.

- Duration and payment Higher education for bachelor's, specialist and master's degrees

- Training of highly qualified personnel (higher education)

- Secondary vocational education

- Secondary and basic general education

- Payment for non-working holidays

How study leave is paid: legislative framework

Legislative information regarding who can be given study leave and the procedure for paying it is contained in the Labor Code of the Russian Federation (Articles 173-177, 287, etc.), the Federal Law “On Education in the Russian Federation,” and a number of orders of the Russian Ministry of Education.

An employee who combines work at an enterprise and study can take advantage of the study leave allotted to him. In addition, study leave can be paid if a number of necessary conditions are met, such as the primary requirement for obtaining a certain level of education and the form of study. Study leave should not be confused with other types of leave at work; it cannot be replaced or replace them.

Depending on the goals and levels of study, employees may be granted study leave, which:

- paid (it is additional, while the employee is paid the average salary);

- paid (it can be used by a student employee, but he will not receive a salary during this period).

Who is entitled to it?

If an employee is studying, according to the norm of Article 173 of the Labor Code, he has the right to study leave, which can be divided into two types:

- leave for admission and completion of studies;

- leave to take intermediate exams.

At the same time, an employee can study in any form (full-time, part-time) and in any institution:

- in vocational schools (or other institutions of secondary and vocational education);

- in universities; in schools (including evening schools);

- in postgraduate, doctoral, master's studies;

- at retraining or advanced training courses.

It also doesn’t matter when you start studying - before employment or during work.

The only clause regarding the ban on vacation is the circumstance if the employee studies in several places at once. In this case, leave is granted only for one place of study (at the student’s choice).

When can leave be denied?

If an employee began training on his own initiative and the employer is not interested in him receiving a diploma, then he will most likely be denied student leave.

In this case, there are two ways to solve this problem:

- training in your free time;

- receiving leave without pay.

If for the first option you do not need to negotiate with the employer, then for the second you will need his consent.

Leave at your own expense is granted only if there is a good reason for this. Examples of valid reasons are not listed by law, and therefore whether to grant leave or not is decided without particularly relying on anything.

Sick leave pay during study leave

If an employee falls ill while on study leave, this does not affect payment for study leave. The employer does not have the right to withhold accrued money. If an employee falls ill during study leave, it may be extended. The employee must contact the educational institution with an application to extend study leave during illness. The educational institution will issue the employee a new summons certificate with different start and end dates for educational leave. The total duration does not increase. The employee will submit a new challenge certificate to the HR department. Based on this, the company will issue him the rest of his educational leave. Temporary disability benefits for sick days are not paid based on paragraphs. 1 tsp. 1 tbsp. 9 of the Federal Law of December 29, 2006 No. 255-FZ and subparagraph “a” of clause 17 of the Regulations approved by Decree of the Government of the Russian Federation of June 15, 2007 No. 375. If the employee continues to be ill after the end of the study leave, then he has the right to benefits with the day he was supposed to go to work.

How is student leave processed?

Stages of registration of study leave:

- Request from a subordinate for additional admission (with the attachment of a summons certificate), its consideration and approval;

- Drawing up a vacation order in the standardized T-6 form, which is the basis for calculating and paying vacation pay, assigning it a number and recording it in the order book;

- Familiarization with the subordinate's order against signature;

- Drawing up a settlement note using one of the standardized forms, submitting it along with a copy of the vacation order to the accounting service for calculating vacation pay (if the vacation is compensated);

- Making the required entries in the work report card. time (in case of vacation compensation – “U”, otherwise – “UD”);

- Filling out the columns in the “Vacation” section of the employee’s Personal Card T-2 indicating the start and end dates of the vacation;

- Calculation of vacation pay and their payments.

After the vacation has ended, the employer must request from the subordinate the 2nd part of the summons certificate - a confirmation certificate for transferring it to the financial service. A copy of it is kept in the student’s personal file for 5 years.

If the document is missing, the subordinate is deprived of the right to the next additional permit.

Payment for study leave and maternity leave

Women on maternity leave are entitled to only one leave: either educational or parental leave (clause 20 of the resolution of the Plenum of the Supreme Court of the Russian Federation dated January 28, 2014 No. 1). If an employee receives higher education for the first time, she can go on paid study leave. There is only one requirement: the educational institution must have state accreditation (Article 173 of the Labor Code of the Russian Federation). Consequently, parental leave will be interrupted. This is the case when paid study leave is more profitable than children's leave. During the session, the student will receive 100% of the average earnings, and during maternity leave - only 40%. Interruption of parental leave is simple. The employee writes a statement in free form, and the HR department prepares a corresponding order. What will happen to child care benefits for children up to one and a half years old? This benefit for the month in which the paid study leave falls is calculated in proportion to the calendar days of work (Part 5.2 of Article 14 of the Federal Law of December 29, 2006 No. 255-FZ). If you do not do this and give benefits for the entire month, the FSS will partially refuse compensation.

How is study leave paid for part-time students in 2021?

Pay study leave for part-time students in 2021 if the employee studies at a university, secondary vocational or general education organization. Articles on the topic Payment of travel for an employee's educational leave When leave is due after maternity leave What income code to use for compensation for unused leave upon dismissal in 2021 Vacation followed by dismissal: how to properly arrange in 2021 Vacation in January 2021: how to count vacation days

This is also important to know:

Continuous service after dismissal at will: meaning and benefit

In addition to the status of the educational institution, check that the employee has not previously received education at the appropriate level, is studying successfully and in a program that has state accreditation.

Provide the employee with such leave only if he is going to take exams or defend his diploma. If necessary, pay for the part-time student's travel. He has the right to this only once a year and if he studies in a program that has state accreditation (Articles 173, 173.1, 174 of the Labor Code of the Russian Federation).

In addition to paying for travel, the employer can set a part-time student a shortened working week or provide one day off from work per week. Moreover, during the period of release from work, the employee will receive 50% of average earnings. But not below the minimum wage level. Such guarantees are provided for in Article 173 of the Labor Code of the Russian Federation.

Payment and registration of study leave in 2018

Any employer may encounter a situation in which an employee needs this time. For this reason, he must know and comply with the rules governing the provision of study leave to an employee under the Labor Code of the Russian Federation.

Study leave concept

The law does not directly use the term “study leave”. The Labor Code talks about guarantees and compensation for employees receiving education. This period is one of them.

It is additional leave and provides payment. The term "study leave" is also used.

According to the Labor Code (Article 173), it is not provided in all cases and requires compliance with a number of conditions.

Grounds for granting study leave

Before calculating the amounts due and days off from work, the employee must clarify whether student leave is paid in his case. The law establishes the following conditions that guarantee the receipt of free time and maintenance of content:

Get free legal advice by asking a question in the form below!

- obtaining education at the appropriate level for the first time;

- visiting an institution with state accreditation.

To send an employee to study, both conditions must be present simultaneously.

The employer also needs to know whether study leave is paid, as incorrect application of the relevant rules may lead to taxation problems.

There are also requirements regarding the nature of employment. Study leave, provided for in Article 173 of the Labor Code, is provided only at the main place of work (Article 287 of the Labor Code of the Russian Federation).

In case of part-time work, the employee will have to take days at his own expense or use the annual rest period. Read more about providing part-time leave on our Internet portal https://otdelkadrov.

Attention!

online/7020-poryadok-polucheniya-dlitelnost-otpuska-predostavlyaemogo-sovmestitelyam

First vacation

An employee who has recently been hired has the right to use vacation 6 months after employment.

Read more about the first vacation on our website here

The correctness of the calculations is important for both parties to the employment contract.

For the employee, the training period is associated with expenses that need to be planned, and the administration needs to make payments without breaking the law. Let's look at how study leave is paid.

The latest changes to the law were made in 2014. Calculation of student leave in 2021 is made according to rules that have been in force for several years. You can familiarize yourself with these standards by using the current version of the Labor Code. The easiest and most reliable way to find out how study leave is paid in 2021 is to use the legal information system.

Duration of vacation

The rules governing the duration of this period are established in Chapter 26 of the Labor Code of the Russian Federation. How student leave is paid depends on the level of education received and the type of activity associated with the release from work.

If we are talking about obtaining higher education, then the number of days provided will depend on the course the employee is studying. Before calculating your student leave, you need to read Art. 173 Labor Code of the Russian Federation.

It is important for the employer to know whether study leave is paid for distance learning. If the employee is a full-time student, the company is not obliged to provide him with this period. The law only provides for the receipt of vacation days at your own expense.

note

According to labor legislation, study leave is not included in the length of service, since at this time no contributions are made to the Pension Fund. You can read more about the types of leave included in the length of service in this article

Payment of study leave under the Labor Code for employees who are applicants for academic degrees and participants in training programs for highly qualified personnel is provided for in Art. 173.1 of this document. Employees studying by correspondence are entitled to a 30-day release from work.

Before calculating study leave, it is necessary to add to the specified period the time required to travel to the educational institution (if it is located in another area).

Important!

When defending a candidate's or doctoral dissertation, the duration of leave is 3 and 6 months, respectively.

For students receiving secondary vocational education by correspondence or part-time, the following duration of vacation is provided:

- 30 days are provided for courses 1 and 2;

- in subsequent courses this period is increased to 40 days;

- The period for preparing for state exams and passing them can be up to 2 months.

Let's figure out whether the employer is obliged to pay for study leave if the employee receives secondary vocational education full-time. As in the case of bachelor's and master's degrees, such an employee can only count on days at his own expense (Article 174 of the Labor Code of the Russian Federation).

Situations are possible when an employee receives secondary education. We are talking about evening schools. For such employees, the law also provides for payment of student leave. The Labor Code (Article 176) guarantees the following periods:

- 9 days, if we are talking about certification according to the basic general education program;

- 22 days when passing exams as part of the secondary education program.

For convenience, you can use examples of calculating vacation pay in 2018 for study leave, which can be found on any specialized online portal.

Documents required for registration of study leave

To exercise the right to leave, the employee will have to present a number of documents.

- An application drawn up in any form. The text must indicate the reason for the leave and its duration.

- A document issued by an educational institution. In the case of universities, we are talking about a summons certificate. It consists of 2 parts: the first indicates the timing of training activities, and the second is filled in upon their implementation.

Registration of study leave is carried out according to the general rules applied to the annual rest period:

Certain issues regarding the provision of student leave

Sending employees on student leave is associated with a number of features. In many cases, employees receive a second higher education. Whether study leave is paid in this case will depend on the terms of the collective agreement and/or employment agreement.

If they contain appropriate conditions, then the employer is obliged to provide the specialist with the guarantees enshrined in these documents. When there are no such provisions in the text of agreements, the rules of Art.

177 of the Labor Code of the Russian Federation: study leave for obtaining a second higher education is not paid .

In cases where an employee is simultaneously a student at 2 or more institutions, release from work is provided at his choice within the framework of one training program.

Note! The granted study leave is not subject to monetary compensation or reduction, and Art. 125 of the Labor Code of the Russian Federation prohibits recalling an employee.

Adding this period to annual leave is possible only with agreement with the employer.

Knowledge of the listed rules will allow the specialist to calculate the time required to prepare for certification, and the employer to avoid violations that threaten liability.

Duration of study holidays

The duration of educational leaves, as well as the possibility of paying for them, depends on the level of education received by the employee and the purposes of providing such leaves (passing an intermediate, final certification, entering an educational institution, preparing a final work, passing final exams).

We present in the table a list of persons entitled to paid (unpaid) educational leave, indicating their duration.

| Employees entitled to study leave | Purposes of granting study leave | Duration of study leave | Possibility of paying for study leave |

| Employees sent for training by the employer or enrolled independently in state-accredited bachelor's, specialist's or master's degree programs in part-time and part-time forms of study and successfully mastering these programs (Article 173 of the Labor Code of the Russian Federation) | Passing intermediate certification in the first and second years | 40 calendar days | Vacation is paid |

| Passing intermediate certification in the second year when studying in a shortened time frame | 50 calendar days | ||

| Passing intermediate certification at each of the subsequent courses | 50 calendar days | ||

| Passing the state final certification | Up to 4 months | ||

| Employees admitted to entrance examinations in educational organizations of higher education (Article 173 of the Labor Code of the Russian Federation) | Passing entrance exams | 15 calendar days | Vacation is not paid |

| Workers - students of preparatory departments of educational organizations of higher education (Article 173 of the Labor Code of the Russian Federation) | Passing the final certification | 15 calendar days | |

| Employees studying in state-accredited bachelor's, specialist's or master's degree programs on a full-time basis (Article 173 of the Labor Code of the Russian Federation) | Passing intermediate certification | 15 calendar days per academic year | |

| Preparation and defense of final qualifying work with passing final state exams | 4 months | ||

| Passing final state exams | 1 month | ||

| Workers completing training programs for scientific and pedagogical personnel in postgraduate (adjunct) studies, residency and assistant internship programs through correspondence courses (Article 173.1 of the Labor Code of the Russian Federation) | Training under highly qualified personnel training programs | 30 calendar days within a calendar year | Vacation is paid |

| Employees admitted to seek the academic degree of Candidate of Sciences or Doctor of Sciences (Article 173.1 of the Labor Code of the Russian Federation, Decree of the Government of the Russian Federation dated 05.05.2014 No. 409 “On approval of the Rules for granting leave to persons admitted to seek the academic degree of Candidate of Sciences or Doctor of Sciences”) | Preparation for dissertation defense | 3 months - for a candidate for a candidate of science degree; 6 months - for a doctor of science degree | |

| Employees who successfully master state-accredited educational programs of secondary vocational education in part-time and part-time forms of education (Article 174 of the Labor Code of the Russian Federation) | Passing intermediate certification in the first and second years | 30 calendar days | |

| Passing intermediate certification at each of the subsequent courses | 40 calendar days | ||

| Passing the state final certification | Up to 2 months | ||

| Workers admitted to entrance examinations in educational organizations of secondary vocational education (Article 174 of the Labor Code of the Russian Federation) | Passing entrance exams | 10 calendar days | Vacation is not paid |

| Workers completing state-accredited educational programs of secondary vocational education for full-time study (Article 174 of the Labor Code of the Russian Federation) | Passing intermediate certification | 10 calendar days in the academic year | |

| Passing the state final certification | Up to 2 months | ||

| Employees who successfully master state-accredited educational programs of basic general or secondary general education through part-time and part-time courses (Article 176 of the Labor Code of the Russian Federation) | Passing the state final certification of the educational program of basic general education | 9 calendar days | Vacation is paid |

| Passing the state final certification of the educational program of secondary general education | 22 calendar days |

This is also important to know:

Accident at work: what is it, types of payments, actions of the employee and employer

Payment order

The order to pay for study leave is an example of unnecessary bureaucracy. The initial document is quite sufficient for accounting purposes. The main thing is that it includes the phrase “paid” or “with wages”. This is allowed for part-time students if the time of their absence falls within the legal standards:

- 40 days annually - for freshmen and sophomores;

- 50 days annually - for other students;

- four months in the last year of study - for graduates;

- 30 days annually - for graduate students or residents;

- three and six months - for applicants for the degree of candidate and doctor of science, respectively, who have gained access to defend their dissertation.

Documentation of sending an employee on study leave

The basis document for sending an employee on study leave, as well as for him to receive other guarantees and compensation related to combining work with training, is a summons certificate, the form of which is approved by Order of the Ministry of Education and Science of the Russian Federation dated December 19, 2013 No. 1368. It is worth noting that this The certificate form was introduced in 2014 and immediately replaced two forms of challenge certificates, which were previously used separately for registration of studies in higher educational institutions and separately in secondary specialized educational institutions.

In 2015, the specified form of certificate-call was updated by orders of the Ministry of Education and Science of the Russian Federation dated 03/02/2015 No. 134, dated 05/26/2015 No. 525.

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

The challenge certificate issued by an educational institution consists of two parts: directly from the challenge certificate and the tear-off spine for it. If an employee does not provide the employer with a completed form confirming his actual presence at an educational institution during the period of study leave, he may lose the right to the next study leave. On the page we will provide a sample of the call certificate.

After presenting the summons certificate to the employer, the employee must write an application for leave. The application can be prepared in the following form.

| To the director MBOU DOD "Kindergarten "Fairy Tale" Nesterova G. N. from the teacher Petrova I. N. Statement Please provide me with study leave with pay for the period from 09/07/2015 to 09/20/2015 to undergo intermediate certification at the Federal Budget Educational Institution of Higher Professional Education "Pedagogical University". I am attaching a summons certificate to the application. 09/02/2015 Petrova I. N. |

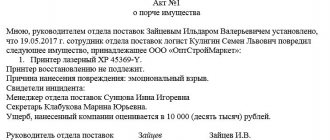

After the head of the institution approves the application, an order is issued to grant the employee leave. The accountant accrues vacation pay based on such an order. To do this, he fills out a note-calculation on calculating average earnings when granting leave, dismissal and in other cases (f. 0504425), and then information about study leave is entered into the employee’s personal card.

Is leaving for a session allowed at the company?

Combining work with study, an employee has a need to attend intermediate sessions.

This circumstance gives rise to many questions as to whether study leave is required and whether it is possible to apply for it while receiving a second higher education.

The answer to the question posed is negative, since study leave is provided only for those employees who are receiving higher education for the first time, with the exception of certain cases provided for by law (this will be discussed in more detail below).

At the same time, when leaving for a session, an employee can use part of his main vacation , having previously agreed on this issue with management.

You should know that training an employee who has a bachelor's degree in a master's program is regarded as a continuation of receiving his first higher education. In this regard, such a person has the right to go on study leave.

Legal basis for concluding a student agreement

In accordance with Article 177 of the Labor Code of the Russian Federation, guarantees and compensation related to the acquisition of education are provided if it is acquired for the first time.

However, these privileges can also be received by an employee who already has one higher education, subject to the following condition: the person must be sent to study by the employer. In this case, an appropriate employment or student agreement must be concluded between them. In all other cases, the employer has every right to refuse to grant the employee study leave .

Calculation and payment of study leave

In order for study leave to be paid, certain conditions must be met:

- the employee receives this education for the first time;

- the employer himself sent his employee for training;

- the form of training must be part-time or part-time;

- the educational institution has the appropriate accreditation.

An employee can receive education:

- at the university;

- at evening school or gymnasium;

- in a technical school or college;

- at school.

When can you count on vacation?

The employer himself sends for training

If the employer himself sends an employee for additional training, then they can enter into an agreement on this, which will stipulate all the necessary conditions.

A common practice is when an employer, sending an employee for training, takes on all the costs associated with this (payment of training costs, travel, accommodation, business trips). A vacation such as a business trip is issued and the employee is paid a salary for its period.

In return for such training, the employee undertakes not to resign for several years, and in the event of dismissal, to compensate the employer for the costs incurred for his education, on a proportional basis to the period not worked.

When using this scheme, admission to a university and registration of leave will consist of the following stages:

- Concluding an agreement with the employer on sending for training.

- Sending documents to an educational institution and enrollment in it.

- Obtaining information about the period during which the training will take place and documentary notification of this to the employer.

- Payment by the employer of the cost of studying at the university.

- Calculation and issuance to the employee of funds necessary for his training, for example, payment of travel, accommodation and daily allowance (if training takes place in another city).

- An employee’s report on the results of the training completed (results of tests and exams) and the funds spent (by providing receipts).

If there is extra money left, then it must be handed over to the cashier , and if a debt has arisen on the part of the employer (the money issued was not enough), then it is necessary to write a statement indicating the amount of funds spent in excess of the limit and the reason for the excess.

It should be noted that only employees who successfully complete the curriculum and successfully pass the final exams can count on tuition fees and student leave.

The employee studies on his own initiative to gain additional knowledge

The employee enters an educational institution and pays for the training himself in order to obtain additional knowledge and a diploma, which he needed to continue working with the same employer as before.

In this case, if an agreement has been concluded with the employer on the provision and payment of student leave when the employee receives a second education, or this point is provided for in the local acts of the enterprise, then the employee will receive both leave and payment.

The registration will take place as follows:

- On the eve of the session, the employee writes an application for student leave and attaches a certificate of summons from the educational institution.

- Based on these documents, the employer issues an order to grant the employee leave and informs the latter of this order.

If the employer refuses to conclude additional agreements regarding training and this is not provided for by any other acts of the organization, then he has every right to refuse to grant leave, even if he is interested in training the employee.

Reduced working hours

In addition to the right to study leave, an employee who combines work with study is provided with other guarantees.

Thus, an employee receiving higher or secondary vocational education through correspondence and part-time forms of study for a period of up to 10 academic months before the start of the state final certification has the right to reduce the working week by seven hours. This time is paid in the amount of 50 percent of average earnings, but not lower than the minimum wage. In this case, an agreement must be concluded between the employer and the employee, which indicates how the working time will be reduced: one day off from work per week or a reduction in working hours during the week.

When receiving education under highly qualified personnel training programs, the employee has the right to one day off from work per week, which is paid in the amount of 50 percent of the salary received. Also, the employer, at its discretion, can reduce the working week by two days for an employee who is studying in a training program for highly qualified personnel in his final year (correspondence department). This time is not paid.

If an employee receives basic or secondary general education through part-time study, then during the academic year he has the right to reduce the working week by one working day or by the corresponding number of working hours (if the working day is reduced during the week). In this case, it is also necessary to conclude an agreement that will determine the method of reducing working hours. Payment for these hours is made in the amount of 50 percent of average earnings, but not lower than the minimum wage.

Based on what documents is it compiled?

Let’s briefly look at who is entitled to a guaranteed pause for study. This will help you understand how to place an order for study leave.

This category of citizens includes:

- students of accredited organizations of higher and secondary vocational education;

- students of basic and secondary education organizations;

- graduate students, residents, part-time interns.

All of the above categories, under certain conditions, have the right to maintain the average earnings at their main place of work.

In order to correctly draw up guaranteed days for a session, including a sample order for granting study leave, the following documents are required:

- an employee’s personal application for additional rest (to pass the session);

- certificate of invitation from an educational organization, issued in accordance with Order of the Ministry of Education and Science No. 1368 of December 19, 2013.

How is study leave paid?

It is worth remembering that an employee can count on receiving payment for study leave only if he studies successfully. The very concept of “success” does not exist in labor law. Therefore, it is worth assuming that the employee must learn “without tails.” The employer is not obliged to give the employee paid student leave to retake them. An employee may take leave at his own expense to retake the test.

To qualify for study leave. The employee must write an application based on a certificate - a call from the educational institution. This document confirms that the employee must miss work for a valid reason.

Study leave is paid in the same way as regular leave. To calculate an employee’s average monthly earnings, you need to add up all of his “labor” income and divide by 12 months. Then the resulting number must be divided by the average number of days in a month. Since 2014, according to Art. 139 of the Labor Code of the Russian Federation, the average number of days in a month is 29.3.

With this calculation, the employee’s average earnings for 1 day in the accounting year are obtained. To find out the amount of compensation, you need to multiply this number by the number of calendar days of vacation.

For example, an employee, according to a summons certificate, must be present at the institute from February 14 to March 3, that is, 19 calendar days. During the year he earned 587,000 rubles. His average monthly income is 448,800 / 12 = 37,400 rubles. Then you need to calculate the average earnings for 1 day. You need 37,400 / 29.3 = 1,276.5 rubles. The total compensation for 19 days of study leave is 1,669*19 = 24,252.6 rubles.

Study leaves for employees combining work with training: duration

Providing study leave to an employee is possible for different periods of time, which is regulated by Art. 173-176 Labor Code of the Russian Federation. The maximum vacation time depends on the type of education, programs and other nuances.

According to Art. 173 of the Labor Code of the Russian Federation, when studying at higher educational institutions, the following is provided for the session:

- in the 1st and 2nd year of study – 40 days;

- in subsequent courses – 50 days.

According to Art. 174 of the Labor Code of the Russian Federation, when receiving secondary vocational training, leave is granted for the duration of the session:

- in the 1st and 2nd year of study – 30 days;

- in subsequent courses – 40 days.

Study leave should be granted for up to 4 months if the employee undergoes state accreditation or defends his thesis.

According to Part 2 of Art. 173 of the Labor Code of the Russian Federation, in 2021 the employer must provide 15 calendar days of unpaid leave to the employee for:

- passing entrance exams;

- final exams, if the employee is a student of preparatory courses.

In addition to unpaid or paid study leave, other benefits are provided.

Before the start of the final certification, the employee has the right to a shortened working week in accordance with Part 4 of Art. 173 Labor Code of the Russian Federation. Working hours are limited - up to 7 hours per week. An employee can take an additional 1 working day off or work for a limited amount of time.

During the exemption period, a specialist receives only 50% of the average salary, but not lower than the minimum wage. This is stated in paragraph 4 of Art. 173 Labor Code of the Russian Federation. In addition, the employer must pay once a year for travel to and from the place of study, but these amounts are not subject to insurance contributions.

Calculation of vacation pay for study leave

Algorithm for determining the payment amount, calculating study leave per year - example:

- We determine the working hours before vacation is granted. (for Vasya Pushkin this is February-April).

- We will assume that he worked all these months in full and did not miss working days due to illness or other reasons, and his earnings are 90,000 rubles. Holidays and weekends are taken into account in the final calculation.

- Now we calculate what Vasya Pushkin’s average daily earnings were before study leave using this formula - 90,000 rubles: 3 months: 29.4 (days per month on average) and we get 1020.40 rubles per day.

- Now we calculate how much he, in general, should receive for all 29 days of his vacation 1020.40 (rubles per day) * 29 days which, in general, gives us 29,591.83 rubles.

How many days of study leave are paid per year?

The number of paid study leave days per year varies depending on the place and direction of study, as well as some additional factors:

- University students, when passing intermediate certification in the 1st or 2nd year, receive 40 days of paid leave, in senior courses - 50 days when studying in the evening or part-time department;

- for postgraduate studies in the correspondence department – up to 30 calendar days;

- in accordance with the individual curriculum when passing state certification - up to 4 months. Training is carried out via correspondence or evening courses.

When receiving a second higher education, study leave is not provided. However, the conditions of such leave can be separately discussed personally with the employer.

Registration procedure

The registration procedure is very similar to that for a regular annual holiday.

Free legal consultation

We will answer your question in 5 minutes!

Free legal consultation We will answer your question in 5 minutes!

Call: 8 800 511-39-66

Ask a Question

Let's consider what steps must be taken to properly design it:

| The employee must write and submit to the employer an application for additional study leave and payment for it. | It is better to do this in advance, i.e. no less than 15 days before the start of training. It is important not to forget that traveling to an educational institution may also require some time. |

| HR department employees accept and register vacation applications | After this, they will have to prepare an order and submit it to the manager for signature. The employee himself must be familiar with the completed order and sign it. When all formalities are completed, it must be filed in a personal file. |

| Based on the order, a corresponding note is made in the employee’s personal card | The HR department also fills out its own part of the calculation note in the T-60 form |

| The half completed T-60 form is sent to the accounting department | Which makes the calculation and fills out its part of the document |

| No later than 3 days before the start of the vacation, the employee is paid the required accruals | They can be transferred to a card or issued in cash |

Application writing sample

An employee can prepare an application for study leave entirely independently. There are no strict forms for this document.

But preparing on your own may take extra time, which could be used to greater advantage.

In this situation, it is better to take as a basis a ready-made sample application, which you can use as a ready-made template, i.e. simply replace all the data with your own and indicate the correct information about the employer.

How to reflect in accounting and tax accounting

Employers must include vacation pay amounts as part of labor costs in tax accounting. It does not matter whether a general or simplified taxation system is used.

Personal income tax must also be withheld from this amount and transferred to the budget, and the employer must also pay insurance contributions on it.

In accounting you will need to make the following entries:

| Calculation of average earnings for the period of study leave | Debit account 20 – Credit account 70 |

| Calculation of insurance premiums | Debit 20 – Credit 69 |

| Withholding personal income tax | Debit 70 – Credit 68 |

| Payment of vacation pay | Debit 70 – Credit 50 (or 51) |

It should be taken into account that instead of account 20, other accounts can be debited (23, 25, 26, etc.), but always the same as when paying salaries.

Postings

| D 20 (23, 25, 26, 44, etc.) – K 70 | Average earnings for the period of study leave are calculated (the same accounts are debited as when calculating wages) |

| D 20 (23, 25, 26, 44, etc.) – K 69 | Insurance premiums are calculated for the amount of payment for study leave (the same accounts are debited as when calculating contributions from salary) |

| D 70 – K 68 | Personal income tax withheld from the amount of payment for study leave |

| D 70 – K 50 (51) | Study leave amount paid |

Average earnings accrued to an employee during the period of study leave:

- in tax accounting, both under the OSN and under the simplified tax system, it is taken into account in labor costs (clause 6, clause 1, clause 2, article 346.16 of the Tax Code of the Russian Federation);

- subject to personal income tax and insurance contributions (clause 1 of article 420 of the Tax Code of the Russian Federation).

Calculation of average earnings during study leave

The average salary for the time an employee is on study leave should be paid on time. A common question: “Are study leave paid 3 days before the leave, just like regular leave?” Let me explain. The law does not indicate how many days before the start of the vacation the average salary should be paid to the employee (do not confuse it with the annual basic paid vacation!).

The employee must receive average earnings before the start of study leave. Please note that it is wrong to pay the average salary after the employee brings a confirmation certificate.

You may have another question: what to do if the employee did not bring a confirmation certificate? In this case, reversal entries should be made in accounting for the amount of average earnings paid to the employee before the start of the vacation.

Carefully read Chapter 26 of the Labor Code of the Russian Federation, as this chapter has undergone changes due to the entry into force of the new Law on Education.

Documentary support of payment

General algorithm of actions when applying for study leave, as well as the corresponding payment:

- First, an employee who is a student must collect the necessary package of documents, which includes:

- Certificate of invitation from the university - this paper consists of two parts: certificate of invitation and certificate of confirmation.

The employee will have to provide the latter to the employer at the end of the study leave. The confirmation certificate is evidence that the employee used the leave granted to him as intended. You need to worry about receiving a summons certificate in advance, since its registration usually takes some time. The best option would be to request this document from the university 10 days before the session. - Application – written in the name of the employer. The application must indicate the reason for going on leave, the name of the university, the duration of the study leave, make a link to the certificate - call (the first part of it must be attached to the application) and make a note about maintaining wages.

- Once all the necessary documents are ready, they must be submitted to the organization’s human resources department.

- Next, the HR department specialist, based on the documents presented, prepares an order for granting study leave in the unified T-6 form. The employee must familiarize himself with it against signature.

You can learn more about the conditions and rules for applying for study leave during distance learning in a separate material.

When to receive money?

Study leave must be paid to the employee 3 days before the start of study leave (Article 136 of the Labor Code of the Russian Federation). In this case, the money can be issued to the employee’s salary card or through the accounting department of the employing organization. It all depends on the specific payment method used by the enterprise.

Thus, if the appropriate condition is met, the employee has the right to demand that the employer provide study leave when receiving a second higher education. The most important thing is to clearly know your rights and be able to accurately and timely remind your employer of them.

If you find an error, please select a piece of text and press Ctrl+Enter.

How study leave is paid for part-time students in 2021 if they do not meet the requirements

As already mentioned, the Labor Code prescribes minimum guarantees. The employer has the right to expand them by the norms of collective agreements or other internal documents. If the employer is limited only by the norms of the Labor Code of the Russian Federation, then part-time students studying in educational institutions not accredited by the state can only count on unpaid leave. The same applies to correspondence students receiving a second education of the same level, as well as other students who do not meet the mandatory requirements.

Sources:

- https://posobie-help.ru/kompensacii/otpusknye/oplata-uchebnogo.html

- https://trudinspection.ru/alone-article/otpuska/how-study-leave-is-paid-in-2015/

- https://zakonguru.com/trudovoe/otpusk/uchebnyj/kak-oformit.html

- https://www.klerk.ru/buh/articles/444761/

- https://www.kdelo.ru/uchebnyy-otpusk

- https://zanalogami.ru/oplata-i-oformlenie-uchebnogo-otpuska/

- https://www.buhgalteria.ru/article/n123076

- https://sovetadvokatov.ru/187-oplata-uchebnogo-otpuska.html

- https://school.kontur.ru/publications/317

- https://www.zarplata-online.ru/art/160595-qqkp-16-m11-uchebnyy-otpusk-kak-oplachivaetsya-v-2018

- https://www.gazeta-unp.ru/articles/3932-red-uchebnyy-otpusk-oformlenie-oplata

- https://www.26-2.ru/art/351821-uchebnyy-otpusk-oplata-i-oformlenie

Subscribe to the latest news