Sample order for reimbursement of expenses - travel expenses

Questions often arise about in what periods the organization must compensate for the money spent by an employee on the needs of the organization and on a business trip. If an employee spent his money on the needs of the organization, he is obliged to provide an advance report within a certain time frame. On its basis, the organization must compensate the costs to the employee.

Guarantees for employees

Article 167 of the Russian Federation indicates important nuances of the order for reimbursement of expenses. If an employee is sent on a business trip, then his position and average earnings are retained, and expenses are compensated.

It follows that the employee has certain guarantees:

- Job preservation.

- Maintaining the same payment.

- The employer is obligated to cover expenses for the employee, namely travel and stay on a business trip.

Storage periods for orders

There are two storage periods for orders: 5 and 75 years. If an employee goes on long-term, domestic business trips, and works related to difficult conditions, then in this case the orders are stored in enterprises for 75 years.

If an employee is sent on a short-term business trip, then the orders are stored for 5 years.

Sample order for reimbursement of expenses

An order for reimbursement of expenses is issued after the end of a business trip, if there have been cases where employees spent money in excess of the advance taken.

The following documents should be displayed in the sample:

- Full name of the employee.

- Date of business trip.

- Job title.

- Place direction.

- Reason: reimbursement of expenses.

- The responsible party who carries out the order.

A log of orders for individual personnel is kept, which records the order for reimbursement of expenses.

A sample order for reimbursement of expenses can be downloaded from the link.

Reimbursement of travel expenses for an employee

The collective agreement specifies the procedure and amount of reimbursement of expenses. For example, a boss’s order regarding reimbursement of expenses in connection with business trips.

If an employer sends an employee on a business trip, then in this case he must reimburse the following expenses:

- Way to go.

- Housing.

- Daily allowance.

- Other expenses with notification to the boss.

An employee who works for an organization can count on compensation for travel expenses and other reimbursements related to business trips. Costs include the purchase of tickets to and from the destination, daily allowances, expenses related to the purchase of living space and other types of expenses.

The accountant must take into account the payment of compensation amounts. Otherwise, this will lead to a conflict situation with the inspection authorities and to losses in the financial affairs of the organization.

The Labor Code of the Russian Federation considers the concept of “business trip”. A business trip is an employee’s departure outside of permanent work by order of the boss for a set period of time to complete a service assignment. An employee goes on a business trip only if he has an employment contract.

Article 168 of the Labor Code of the Russian Federation contains standards for formulating costs associated with business trips. More detailed information is contained in Resolution No. 749.

The resolution states that travel expenses for travel in the Russian Federation include:

- Expenses for public transport in accordance with the station, airport, if the employee is located outside his city and at the same time he must confirm the expenses with relevant documents.

- Payment for insurance of passengers in transport.

- Payment for travel tickets with bedding.

When traveling abroad, the employee is compensated for the following expenses:

- Registration of a visa, foreign passport.

- Airport and consular fees.

- Car entry fees.

- Registration of health insurance.

- Other payments.

A company needs to complete a lot of paperwork to reimburse an employee for business trip expenses.

When sending an employee on a business trip, the following HR documentation forms are approved:

- Order form T-9a to send an employee on a business trip.

- Certificate of form N T-10.

- Preparation by an organization of a task to be carried out on a business trip - form N T-10a.

The first step is to draw up a service assignment and a report on its implementation (Form N T-10a), in which the management determines the purpose of the business trip. The next step is an order from personnel officers to send the employee on a business trip. The order indicates the worker’s surname and initials, his specialty and the place where the business trip is taking place.

Next comes the issuance of a travel certificate, which proves the length of time the worker is on a business trip. The certificate is issued in one copy, given to the employee and must be with him throughout the duration of the business trip.

: Important topic

Please note that a travel certificate is considered mandatory if business trips are carried out within Russia, and when traveling to foreign countries, the certificate is not issued.

While an employee is abroad, a mark is placed in his passport that certifies that he has crossed the state border. When an employee returns from a business trip, he needs to attach a photocopy of his passport to the report, which should contain notes about crossing the border.

Before leaving, the employee must receive an advance from the accounting department, which is intended to reimburse expenses for the business trip.

After arrival, an enterprise employee is required to write a report on a business trip about the task completed. The advance report is shown to the accounting department of the enterprise in Form N AO-1, which is approved by the Resolution of the State Statistics Committee of the Russian Federation.

advance report:

- A completed business trip certificate.

- A receipt that confirms accommodation during a business trip.

- Travel expenses documents.

- Other documents on expenses associated with business travel.

It is necessary to take into account that if the employee was on a business trip abroad, then the report he will provide in a foreign language, for this enterprise, the papers will have to be translated into Russian.

If the translation of documents is not taken into account, this may lead to a conflict with the inspection authorities. The head of the enterprise is obliged to approve the advance report. There are two categories of compensation payments to a traveler.

The first category provides a list of the following payments:

- Payment for employee work.

- Compensation to business travelers for expenses related to the performance of work duties.

The second category includes reimbursement of employee travel expenses. They take into account other expenses that relate to the organization. Payments that fall into the second category are of great importance for accounting and taxation.

All expenses of the organization, including business trip expenses, are recognized in accounting when all agreements are consistently implemented. Otherwise, there will be debt in the accounting records.

In this case, expenses associated with the business trip are recognized in accounting based on the approval of the employee’s advance reports.

Determination of daily allowance

The term “per diem” refers to the financial resources that are required for the accommodation of workers, as well as for the performance of assigned work.

According to the Supreme Court, an employee asserts his rights to per diem when he has to live outside the city.

If a business trip lasts more than a day and the employee works away from home, then in this case he must receive a daily allowance. However, there is a Supreme Court ruling that states that the time an employee spends on a business trip is not related to the calculation of per diem.

The court gives permission to organizations to pay money to an employee if he was on a business trip for less than a day, since this compensates for his expenses, and not by acquiring benefits.

Order of expenses for purchases at the expense of employees

If an employee purchases necessary goods for the company at his own expense, then she must compensate him for the costs. Inspectors have no complaints about expenses in tax accounting. At the same time, it is necessary to submit a statement from the worker and an order for reimbursement of costs.

For individual inspections, these documents are sufficient. But the rest also require a general order for the organization on the procedure for reimbursement of costs. In the current situation, for security reasons, it is necessary to have such an order available. Moreover, it will allow you to avoid unpleasant situations. For example, an employee may purchase a product that the organization does not need.

There are some cases when employees must purchase goods for the enterprise without receiving financial statements in advance.

The algorithm for reimbursement of expenses must be regulated:

- Within what period must the employee submit an application for reimbursement of expenses, as well as supporting documents?

- Cost compensation period.

The order fixes the maximum amount of purchases that the worker makes with his own financial resources, with further reimbursement of expenses. Employees are required to read the order and sign.

Order on reimbursement of expenses for medical examination of employees

Employees who work in high-risk conditions are required to undergo medical examinations at the expense of the enterprise. Employees retain their average earnings while undergoing a medical examination.

There are three types of mandatory medical examinations:

- Preliminary medical examinations are carried out upon employment of workers.

- Periodic medical examinations are carried out throughout the entire period of work.

- Extraordinary medical examinations, which are carried out at the request of the employee.

The order of the Ministry of Health and Social Development of Russia establishes standards for financing medical examinations.

In a situation where an employee spends his funds on the needs of the organization or on a business trip . The company must reimburse the employee for these expenses. To do this, you need to correctly draw up an order for reimbursement of expenses.

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

Source: https://biznes-delo.ru/vzyskanie/prikaz-na-vozmeshhenie-rasxodov-obrazec.html

Determination of daily allowance

The term “per diem” refers to the financial resources that are required for the accommodation of workers, as well as for the performance of assigned work.

According to the Supreme Court, an employee asserts his rights to per diem when he has to live outside the city.

If a business trip lasts more than a day and the employee works away from home, then in this case he must receive a daily allowance. However, there is a Supreme Court ruling that states that the time an employee spends on a business trip is not related to the calculation of per diem.

The court gives permission to organizations to pay money to an employee if he was on a business trip for less than a day, since this compensates for his expenses, and not by acquiring benefits.

Sample order for reimbursement of expenses on a business trip

An order to reimburse an employee for expenses is an official order from the director. Based on the document, the employee is reimbursed for all financial resources that he spent out of his own pocket for the needs of the company while on a business trip or in other circumstances.

What should be displayed

The header of the document should contain the following:

- full name of the organization;

- the date when the order was drawn up;

- registration number;

- title;

- wording: “Based on the reporting documents provided... (the full name of the employee is written here) I ORDER”;

- text;

- signature of the person responsible for the execution of the order and its transcript;

- director’s signature and its transcript;

- signature of the employee (who needs to reimburse the expenses) and its transcript in the familiarization column.

The text itself should contain the following information:

- Full name of the employee who needs to be reimbursed.

- The structural unit in which the employee works, as well as his position, rank, class, qualifications.

- Wording: “To pay as compensation for expenses in excess of the advance received in connection with the stay in ... from ... to ... year ... rubles .... kopecks ... (amount in words).”

- Basis and listing of supporting documents.

- Wording: “Control over the implementation of this order is entrusted to ... (position and full name of the responsible person).”

Guarantees for the organization's personnel

Article 167 of the Labor Code of the Russian Federation spells out important points that are worth paying attention to when drawing up an order. If a company decides to send its employee on a business trip, then he must retain his position and average monthly salary, in addition, the organization must compensate for all costs.

From the above it follows that the following guarantees have been established for the organization’s personnel (who were sent on a business trip):

- The job is saved.

- The same salary remains.

- The director of the organization covers all expenses for the business trip.

What expenses must the organization compensate?

Based on Article 168 of the Labor Code of the Russian Federation, an organization that decides to send one of its staff on a business trip must necessarily compensate for:

- Fare:

- if the employee used his personal car;

- if the employee had to rent property, for example, a car;

- if the employee had to travel by public transport or use a taxi.

- Expenses for rented residential premises under a rental agreement.

- Daily allowance (employee expenses for personal needs, for example, food).

- Other expenses:

- mobile connection;

- Internet;

- currency exchange.

Note! An order for reimbursement of expenses should be issued only after the employee has returned from a business trip.

How many years is a document kept in the archive?

Orders are stored in the archives of any organization:

In the first case, those orders are stored in which employees were sent by the director on international business trips and business trips within the Russian Federation, the duration of which is no more than 10 days. As for the second case, such orders for reimbursement of expenses are kept for so long, in which it was indicated that the employee is sent:

- on a business trip in the Russian Federation for a period of 10 to 60 days;

- on international business trips for a period of 10 to 60 days.

Requirements that must be observed when filling out the document

When drawing up an order, the specialist must comply with the following requirements:

- Maintain the legal distance between the edges of the page and the text.

- The document is published on a white, high-quality sheet of A4 paper.

- Write the date of the document in Arabic numerals

- The amount to be compensated must be written in numbers and in words.

- The document must contain all the signatures plus their transcript.

- Seal.

Mistakes that are made when filling out a document

Most often, when filling out an order, a specialist may make the following mistakes:

- spell the name of the organization incorrectly;

- omit or write incorrectly the date of the document;

- do not indicate the registration number;

- do not write the amount to be compensated in words;

- incorrectly write the name of the employee who needs to reimburse expenses;

- do not indicate the position;

- do not indicate the responsible person;

- make corrections with a simple pencil or a pen of a different color;

- write the text in illegible handwriting;

- make a lot of corrections in the document;

- make spelling mistakes;

- incorrectly indicate the amount to be reimbursed;

- artificially age a document;

- erase the text.

How to correct mistakes made

If an error is found in the document, you must do the following:

- Rewrite/retype the document. You can use this method if an error is noticed:

- before the manager’s signature was affixed;

- at the time of signing.

- Issue a new order. But before you start issuing a new one, you need to create an order canceling the order, which contains various types of errors. It should contain the following:

- registration number;

- the date it was compiled;

- document's name;

- the beginning of the text, starting with the words: “Declare invalid” or “Consider invalid”;

- grounds for cancellation;

- who is responsible for corrections;

- signature.

Conclusion

So, if an employee spent his money on the needs of the organization during a business trip, then the company is obliged to reimburse him for everything. To do this, you need to correctly and competently draw up an order.

It records the maximum amount of money that the employee spent out of his own pocket for the needs of the company.

But before issuing an order, the employee must submit an application for reimbursement of expenses along with supporting documents within two weeks.

Amount of travel expenses in 2021: daily allowance

Update: March 15, 2021

The responsibility of each employer is to pay the employee sent on a business trip for travel expenses stipulated by labor legislation. The legislator includes daily allowances as such travel expenses.

Payment of daily allowance to an employee is aimed at compensating for his additional expenses arising due to the fact that the employee is on a business trip outside his permanent place of residence.

Travel expenses (per diems) in 2021 are paid by the employer in the amount established on the basis of Art. 168 of the Labor Code of the Russian Federation.

How are travel expense standards determined in budget organizations in 2021?

Source: https://rnis-pfo.ru/592-obrazec-prikaz-na-vozmeshhenie-rashodo/

When is it necessary to apply for reimbursement of travel expenses?

Expense items covered by the organization sending the employee on a business trip are set out in Article 168 of the Labor Code, as well as Regulation No. 749, approved by the Government of the Russian Federation dated October 13, 2008.

The presented regulations summarize such expenses under the single concept of “advance for a business trip.”

In order to accurately carry out calculations, the accounting department of the enterprise specifies all the components of the specified advance payment in accordance with the Tax Code of the Russian Federation and the Accounting Regulations “Organization Expenses” PBU 10/99.

Thus, in accordance with the norms of tax legislation, daily expenses are determined in the amount of 7,00 rubles for business trips within the territory of the Russian Federation and 2,500 rubles for foreign trips to perform an official assignment.

There is also an item for additional travel expenses, agreed in advance with the head of the sending company.

The very concept of “advance” stipulates that payment must be made before the start of the business trip.

However, in practice, situations often arise when an employee, while performing his work duties away from his permanent place of work, did not have enough advance payment amount and had to spend his own funds.

Legislative acts provide for the obligation of enterprises (organizations) that sent an employee on a business trip to compensate for the expenses of a business trip that exceed the amount of the advance payment issued.

Funds to cover travel expenses associated with a business trip are issued by the accounting department of the sending organization (enterprise).

When receiving an advance for a trip, the employee is warned of the need to provide a report on the expenses incurred within three working days after returning from the business trip.

It is in this report that you must indicate all expenses exceeding the amount of the advance payment.

The report is submitted along with supporting documents, which include payment receipts, travel documents, checks, etc.

Each amount paid by an employee from personal funds must not only be documented, but also justified, i.e. The head of the sending enterprise (organization) has the right to demand that the employee specify the costs incurred and justify their necessity.

The decision to reimburse an employee for personal funds spent on a business trip is made by the boss. It should be taken into account that in case of inappropriate spending, compensation for travel expenses may be refused.

Also, the company may not return funds that indicate extravagance (for example, an employee used a taxi when public transport was available).

How to prepare for payment of money to an employee?

An order for reimbursement of travel expenses is issued by the head of the enterprise (organization) sending the employee on a trip, after his return and provision of an advance report.

The procedure for appropriate compensation is prescribed in the company’s local regulations. Here the types of expenses from the employee’s personal funds that will be returned to him, as well as the maximum amount of compensation, can be specified.

The order of the head of the enterprise (organization), on the basis of which the accounting department makes the reimbursement, must be drawn up in accordance with the general requirements of office work.

The submitted document should display the following information:

- information about the employee (full name, position);

- information about the official trip (dates, information about the order of assignment, place of execution of the official assignment);

- the amount of compensation and the reason for it;

- the person responsible for putting the order into effect.

The specified document is recorded in the order journal.

An example of an order for reimbursement of travel expenses - word.

This is what the sample looks like:

Amount of travel expenses in 2021 per diem

Business trips are an integral part of the activities of any organization. Domestic labor legislation guarantees to seconded employees reimbursement from the employer for travel costs, rental housing, additional agreed expenses, and daily allowances.

The amount of travel expenses per diem in 2021 is all expenses incurred by an employee in connection with being in a locality remote from his permanent place of residence. Not included: housing costs, travel tickets. The latter amounts are reimbursed separately by the employer.

To carry out competent accounting and tax policies, it is important to know who sets the standards for reimbursement of travel expenses.

The amount of travel expenses in 2021, including daily allowances, is not determined by any domestic legislative act. The Labor Code determines that the norms and amounts of such compensation must be determined by local documents officially approved at each enterprise.

Daily allowance rates for business trips in 2021

The law gives companies that conduct commercial activities the right to independently set the amount of travel allowances per day. The only point that the state regulates is the establishment of limits that are not subject to income tax and withholding contributions to the Social Insurance Fund.

The norm has been in effect since 2021 and provides for the following non-taxable minimums:

- business trips to another region of the Russian Federation – 700 rubles;

- work trips abroad – 2500 rubles.

The maximum travel allowance allowance in 2021 remains unlimited. As for the minimum size, entrepreneurs cannot set the size below the norm established for employees of budgetary institutions. The norm for daily travel expenses in 2021 for civil servants is 100 rubles (enshrined in Resolution No. 729).

An employer should be guided by generally accepted rules when developing its policy. The employee must be provided with living conditions that are not inferior to the conditions at his permanent place of residence. To avoid possible disputes, the company’s management should take into account the developed minimums:

- if the trip does not involve leaving your region - 200-300 rubles;

- service assignment to another region – 500 rubles.

Determining the amount of daily allowance for foreign business trips

Non-profit institutions are guided by Resolution No. 812, the rules of which determine the recommended amounts separately for each country.

Entrepreneurs can use similar daily allowance rates for business trips in 2021 as recommendations. Also, the employer should not forget about the non-taxable limit. Amounts exceeding this minimum must be subject to personal income tax and insurance contributions.

The employer independently determines compensation for business trips abroad, as well as the advance currency for purchasing travel tickets and paying for housing. If it is a foreign currency, the calculation is carried out in accordance with the current exchange rate of the Central Bank.

Another important change in this direction is the mandatory resort fee from May 1, 2021. The payment amount is 50 rubles per person. Everyone who stays longer than 24 hours in the Crimea, Sevastopol, Krasnodar, and Altai Territories, including employees staying here on a work visit, is required to pay it.

Payment of daily travel expenses in 2021

Travel expenses in 2021 for a one-day trip

According to the norms of domestic legislation, a business trip that lasts no more than a day does not provide for the payment of daily allowances. In fact, the employer is only obligated to reimburse the employee for travel expenses. If this includes travel provisions, current expenses may also be reimbursed.

Regarding one-day trips abroad, most often employers reimburse 50% of the established accrual rates.

Compensation is not provided if it is possible to return home for the night. Such issues are determined in agreement with management and depend on the remoteness of the place of work, the specifics of transport links, and the specifics of the tasks assigned to the employee.

Documents establishing daily allowance rates in non-profit organizations

The non-budgetary sector of the economy independently sets daily allowance standards for all types of work trips. According to the norms of the Labor Code, their size must be specified in the official local documents of the company.

The amount of daily allowance can be stated:

- a separate clause in the collective agreement;

- business trip regulations;

- by separate order;

- order on daily allowances for business trips (each organization develops a sample independently).

Here is a sample order on the amount of daily allowance for a business trip.

Source: https://okbuh.ru/otchetnost/razmer-komandirovochnyih-rashodov-v-2021-godu-sutochnyie

In what cases are expenses reimbursed?

Before planning a business trip, an enterprise needs to familiarize itself with up-to-date information on the procedure for organizing and financing it.

The basic rule, according to the law, remains maintaining the salary and position at the same level during the period of absence of the traveler.

Reimbursement of funds to the employee is established in the following situations:

- The person spent his own resources on the business trip;

- The employee paid for the service in advance, but the trip was cancelled;

- The company closed the project on the day of the planned departure.

Order for reimbursement of expenses to an employee. sample and form 2021

Compensation refers to monetary payments to an employee for expenses incurred in connection with the performance of his or her official duties. When using a personal car for business purposes, an employee may be provided with compensation for the fuel and lubricants used.

Fuels and lubricants (fuels and lubricants) include gasoline, diesel fuel, liquefied gas, motor and transmission oils, cooling and brake fluids.

The decision on compensation for fuel and lubricants for employees using personal transport for business purposes must be formalized by order of the director. The amount of reimbursed expenses should be indicated in a written agreement, as required by Art. 188 Labor Code of the Russian Federation.

To determine the consumption standards for fuel and other fuels and lubricants, you can use the Order of the Ministry of Transport of Russia dated March 14, 2008 N AM-23-r.

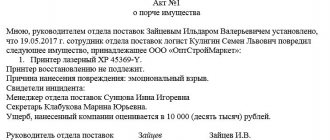

Documenting

Any expenses must be documented, only then can they reduce the tax base. This rule also applies to reimbursement of employee expenses in connection with the operation of a personal car.

To reimburse fuel and lubricants, the following documents are required:

- Confirmation of the employee's ownership of the car (Certificate of Vehicle Registration).

- Order for reimbursement of expenses.

- An additional agreement to the employment contract establishing the amount of compensation.

- Confirmation of the business nature of the trips.

- Economically sound calculation of compensation for fuel consumption.

- Documents confirming expenses incurred (receipts, sales receipts and cash registers).

Sample additional agreement

Points 5 and 6 are confirmed by a completed waybill, which indicates both the route of the trip and the speedometer readings, from which you can calculate the mileage and determine the amount of gasoline required for the trip.

If the travel document form developed by Goskomstat turns out to be difficult to fill out, you should develop and approve your own travel reporting document. The report must indicate the time of departure and return, the date and purpose of the trip, and the address of the destination.

Details about filling out the waybill are described in our article on the website.

Taxation of fuel and lubricants compensation

All types of legally established payments are not subject to taxation.

In accordance with paragraph 3 of Article 217 of the Tax Code of the Russian Federation, compensation is not subject to personal income tax, and in accordance with paragraph 1 of Article 420 of the Tax Code of the Russian Federation, insurance premiums are not charged on it.

Source:

Order for reimbursement of business trip expenses

You can add a topic to your favorites list and subscribe to email notifications.

About reimbursement of expenses for business trips

In order to streamline business trip expenses, in accordance with the Accounting Regulations “Organization Expenses” PBU 10/99 and Chapter 25 of the Tax Code of the Russian Federation “Organizational Income Tax”

1. Accounting: 1.1. Reimburse the posted employee for the costs of renting accommodation and travel to the place of business trip and back to the place of permanent work, as well as pay daily allowances within the limits approved by the Government of the Russian Federation. 1.2.

From May 20, 2005, daily allowances in Russia must be paid in the amount of 300 rubles for each day of travel; excess expenses for daily allowances must be reimbursed from the enterprise’s own funds. Payment for renting residential premises - based on actual expenses, confirmed by relevant documents. 1.3.

The daily allowance is paid to the posted worker for each day he is on a business trip, including weekends and holidays, as well as days on the road. The day of departure is the day of departure of the corresponding vehicle (plane, train, etc.), and the day of arrival is the day of arrival of the specified transport. 1.4.

Travel expenses to and from the business trip reimbursed to the posted employee include: • the cost of a plane ticket, train ticket, etc.

; • costs of paying for services for pre-sale (booking) of tickets; • costs of paying for the use of bedding on trains; • expenses for travel by public transport to stations (train station, airport), if they are located outside the populated area; • expenses for paying insurance premiums for compulsory transport insurance.

2. Persons who received cash on account, no later than 3 working days from the date of return from a business trip, submit to the accounting department a report on the amounts spent and make a final payment for them.

I reserve control over the execution of the order.

secretar-info.ru

Sample order for reimbursement of expenses

Questions often arise about in what periods the organization must compensate for the money spent by an employee on the needs of the organization and on a business trip. If an employee spent his money on the needs of the organization, he is obliged to provide an advance report within a certain time frame. On its basis, the organization must compensate the costs to the employee.

Sample order for reimbursement of expenses

An order for reimbursement of expenses is issued after the end of a business trip, if there have been cases where employees spent money in excess of the advance taken.

The following documents should be displayed in the sample:

- Full name of the employee.

- Date of business trip.

- Job title.

- Place direction.

- Reason: reimbursement of expenses.

- The responsible party who carries out the order.

A log of orders for individual personnel is kept, which records the order for reimbursement of expenses.

A sample order for reimbursement of expenses can be downloaded from the link.

Order of expenses for purchases at the expense of employees

If an employee purchases necessary goods for the company at his own expense, then she must compensate him for the costs. Inspectors have no complaints about expenses in tax accounting. At the same time, it is necessary to submit a statement from the worker and an order for reimbursement of costs.

For individual inspections, these documents are sufficient. But the rest also require a general order for the organization on the procedure for reimbursement of costs. In the current situation, for security reasons, it is necessary to have such an order available. Moreover, it will allow you to avoid unpleasant situations. For example, an employee may purchase a product that the organization does not need.

There are some cases when employees must purchase goods for the enterprise without receiving financial statements in advance.

The algorithm for reimbursement of expenses must be regulated:

- Within what period must the employee submit an application for reimbursement of expenses, as well as supporting documents?

- Cost compensation period.

The order fixes the maximum amount of purchases that the worker makes with his own financial resources, with further reimbursement of expenses. Employees are required to read the order and sign.

What should a business trip order look like?

In 2013, officials made unified forms of primary documents optional, giving entrepreneurs the opportunity to independently develop and approve forms, samples and forms for orders and instructions in local regulations. At the same time, there are no clear requirements and it is allowed to use the forms presented in Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 N 1.

Previously, the documents used to record employees sent on business trips were forms T-9 and T-9a, and if several employees were sent on a business trip at once. Now they can also be used.

This is what an unfilled business trip order looks like (sample T-9): you can find it at the end of the article. And then we will describe the filling algorithm.