01.07.2019

0

315

5 minutes.

No person is insured against temporary disability due to illness. In this case, he is obliged to go to a medical institution, get help and open a sick leave. The employer, on the basis of a certified document, compensates for days of absence from work in the prescribed manner. The amount depends on the employee’s insurance length. In addition, the legislation of the Russian Federation (FZ-225) provides for a number of cases when sick leave is paid 100 percent. In what situations will the monthly salary be full, despite absences? Let's try to figure it out.

Concept of sick leave

Temporary disability of a citizen can be caused by various health problems. During this period, he cannot perform his direct functions at the enterprise. In this case, the company, guided by labor legislation, is obliged to pay him for sick leave. Compensation is provided on the basis of a sheet issued by a medical institution and certified in the prescribed manner. In what cases does it open:

- Diagnosis of pathology that interferes with normal work.

- The need to care for a family member.

- The period of pregnancy and childbirth.

- Days of quarantine.

- The need for hospital stay during the period of prosthetics.

- Completion of treatment in a sanatorium.

The main provisions of the relative period of incapacity for work, including information about when 100% sick leave is due, are reflected in the law “On Compulsory Health Insurance”. This is where it is written down what documents the employee will need to provide in order to receive full compensation, and what nuances may affect the reduction of the final amount.

Confirmation of experience

Depending on the basis for performing work at the enterprise (contract, employment agreement, temporary employment agreement), a mandatory package of documents is filled out in relation to the employee. And the fact of performing official duties is reflected in the work book. Alternative papers (instead of a work book) that will be needed to pay for sick leave include:

- employment agreement;

- order from the head of the enterprise to hire an employee;

- a certificate from the bank confirming the existence of a financial account and the regular transfer of wages to it.

In addition, you need to know that the following types of work performed are taken into account for the insurance period:

- military service;

- all types of work with drawing up a contract;

- any activity that requires mandatory life insurance for an employee.

Conditions for payment of compensation for illness

Registration of compensation for temporary disability has a number of differences from the calculation of other payments. It is not so much the employee’s earnings that are taken into account, but his length of service:

- Availability of 5 years of service – 60% of the salary.

- Continuous work from 5 to 8 years – 80%.

- Work in the organization for more than 8 years – 100%.

It is important to know! When calculating, fully worked years and months are taken into account; calendar days are taken into account, not working days. But when looking for an answer to the question, 100 sick pay is accrued from what length of service, you should understand that not only it, but also the nature of the disease is taken into account.

The procedure for determining the amount of benefit

Benefits for loss of ability to work due to illness or injury are paid in the first 3 days at the expense of the policyholder; in the remaining period, funds are transferred from the budget of the Social Insurance Fund of the Russian Federation. The same government agency transfers money when caring for a sick relative or needing prosthetics. How is the benefit amount determined:

- The date from which the calculation of the insurance period begins is determined, for example, the first day of the onset of illness.

- The period of work activity and the time periods included in the length of service are established.

- Everything is summed together to get an accurate result. If necessary, you can use a calculator to calculate. Data is converted to months, assuming that 30 days = 1 month.

If the length of service is insufficient, for example, less than six months, then the employee receives no more than the minimum wage level established in the region. In other cases, the amount will be 60-80% of the salary.

Rules for payment of compensation

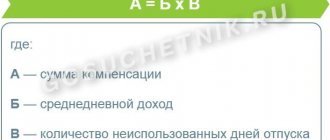

At enterprises, employees have the right to receive payment during loss of ability to work. What amount of payment is due is determined by specialists based on length of service and amount of earnings. Sick leave compensation is calculated using the following algorithm:

- Determination of average earnings for the billing period.

- Calculation of average salary per day.

- Calculation of the amount of daily allowance.

- Establishing a specific amount of benefits to be paid.

Attention! The basis for payment of the sheet is the provision of a document certified in accordance with the established procedure on time. The Social Insurance Fund makes transfers only if there is confirmation in the database of previously made insurance contributions.

Sick leave will not be paid in such situations, or the stipulated percentage will be reduced. The employer gives a reasoned refusal in writing. If you disagree with the decision received, you can challenge it in the prescribed manner. For example, first of all you need to contact the labor inspectorate, and then the court.

Restrictions

Even in situations where full compensation is due, there are exceptions that significantly reduce the amount of allowable payments. The main ones include:

- violation by the patient of the treatment order and regimen during inpatient treatment;

- insufficient work experience, which is necessary to have for sick leave payments;

- exceptions related to the opening of a certificate of incapacity for care.

Table 2 "Exceptions for sick leave"

| No. | Patient (age, years) | The longest duration of each individual sick leave | Maximum number of sick days per year that are payable |

| 1. | 0-7 with special diseases (according to the FSS list) | Everyone is paid | 90 |

| 2. | 0-18 (disabled) | – | 120 |

| 3. | 0-18 (presence of a disease from the list of subparagraph 4.5 of paragraph 5 of Article 6 No. 255-F3) | – | Everyone is paid |

| 4. | 0-7 | – | 60 |

| 5. | 7-15 | 7 | 45 |

| 6. | Other | 15 | 30 |

When is a 100% payment due?

Having figured out how long the 100th sick leave is paid, you should determine the rights of the employer when making calculations. He can make sure that the employee is entitled to full compensation by asking him for certificates about the amount of his salary for previous years.

You don't have to work 8 years to get 100% coverage for a work injury. But it must be registered accordingly, since an investigation is required at the enterprise in order to take measures to prevent them in the future. In what cases is sick leave paid 100 percent:

- Child's illness. The sheet opens in the presence of any disease that does not allow him to be left alone at home. The period does not exceed 2 months if the child is under 7 years old. Parents or legal guardians have the right to receive the document. A disabled person is provided with care for up to 4 months a year.

- Quarantine. You can receive compensation subject to an official announcement at the federal or regional level. The sheet is paid for all days, including weekends and holidays. If the restriction is introduced in the kindergarten, then the pediatrician writes out the document; you must contact him on the first day of quarantine.

- Recovery after surgery. Even regular outpatient therapy is compensated, but provided that the employee has more than 8 years of experience. The sick leave certificate must reflect that the citizen is undergoing a certain type of treatment, which does not allow him to return to work after medical procedures. Such a sheet is usually opened for 10 days.

- Caring for an adult relative. If a citizen is forced to care for a loved one after he has undergone serious treatment, then he can open a sick leave and receive compensation from the Social Insurance Fund. It is provided regardless of the type of therapy (inpatient, outpatient). The sheet is opened for 10 days, full payment is due subject to 8 years of service.

- Going on maternity leave. The length of service requirement is only six months; in this case, the woman has the right to count on receiving full earnings in her hands.

How many days of sick leave are paid 100 percent does not depend on external factors. Compensation applies to all days indicated on the duly certified sheet.

It is important to know! The donor has the right to receive paid sick leave in full, that is, he is compensated for his average daily earnings.

Minimum wage changes in 2019

In 2021, the minimum wage will increase in stages. The first increase will be on January 1st, the next increase will be on May 1st. The final figure will be 11163.00 rubles. (SDZ RUB 367.00) These figures are taken into account to calculate benefits when the employee was previously listed as unemployed or did not provide a certificate of income from previous jobs.

If the sheet was opened on April 30, the amount of average daily earnings is 311.98 (since the minimum wage on this date is still 9,489.00 rubles). According to the Labor Code of the Russian Federation, there are no grounds for recalculation at the time of closing the sheet.

Calculation examples:

- On April 25, 2021, manager Anisimova provided a certificate of incapacity for work 7 days in advance. Has a proven experience of 6 years. Certificate No. 182-N was provided only for 18 months, SDZ for this period is 1,420 rubles. Then for the remaining 6 months the average daily earnings will be calculated based on the minimum wage. Accrual: SDZ for a period of 2 years: (311.98 + 1420.00)/2 = 865.99, payment for 7 days: 865.99 * 7 * 80% = 4849.54.

- Employee Anisimova provided 7 days of sick leave on 06/01/2018, has been working at her current place since 01/10/2018, and has a salary of 40,000 per month. Has no experience. Accrual: 367 * 7 * 60% = 1541.40 rubles. Despite the salary in the current year, the calculation is made for the previous 2 calendar years. Current income for accrual will be taken into account only in 2021.

- Employee Shuvalov provided a certificate of incapacity for work for 21 days. Opened April 27, 2021, closed May 17. He has been working for the company since March of this year. Accrual: 311.98*21 = 6551.58 rubles. Since on the date of opening of the hospital minimum wage was 9489.00 rubles, the SDZ was 311.98 rubles, and not 367.00 (minimum wage as of May 17).

- The head of the department, Ilyushin, was ill for 20 days. He has been employed in the company for 3 years, with a total work experience of 11 years. The average salary is 2125 rubles. Accrual: 2021.81 * 20 * 100% = 40356.20 rubles. Since Ilyushin’s SDZ exceeded the upper limit value, the maximum permissible threshold of 20,170.81 rubles is used.

Income tax on the amount accrued during incapacity for work is withheld in the standard mode at the rate of 13%. Sick leave benefits are considered citizen income and are subject to taxation.

Algorithm for determining length of service for calculating temporary disability benefits in 2021

In order to accurately determine the insurance period for paying sick leave in full amount of wages, you must:

- Set the starting date from which the countdown for payment of benefits will begin. This will be the beginning of the sick leave indicated on the certificate of incapacity for work. The deadline for payments is the last date of sick leave before going to work.

- Determine the totality of insurance periods during which payments were made to the Social Insurance Fund over the last two years: years add up to years, months add up to months, days add up to days.

- Based on the fact that a month is equal to 30 days, it is necessary to convert all days into whole months and sum up all months.

- Similarly, calculate the years, where one year is 12 months and add to the previously calculated years.

- The sick leave record will only reflect years and months.

Dear readers, each case is individual. If you want to find out how to solve your particular problem, call:

- Moscow: +7 (499) 350-8059.

- St. Petersburg: +7 (812) 309-9401.

Or on the website. It's fast and free! Author's rating 72 Author of the article Mikhail Tareev Lawyer. Civil law Articles 149 written

Can compensation change if care is needed for a child or relative?

How is sick leave paid?

It has already been discussed from what length of service 100% sick leave is paid, now let’s figure out whether it is possible to issue a paper about incapacity for work if it is not the employee himself who is sick, but his relative. To provide care to a patient, all you need is a doctor’s testimony and an executed document addressed to the employee.

Changing the payment amount is possible, but only if the mother has taken sick leave to care for a sick child. By law, you are allowed to take no more than 10 days of disability leave, all of which will be paid in full. Therefore, many parents try not to exceed this period.

If the number of days is more than ten, then the mother will receive only half of the allotted amount. This rule applies only if the child is undergoing outpatient treatment. In the case of inpatient treatment, payments are made in full. When 100% sick leave is paid, the woman provides all the documents required for this.

Payment amount

General provisions for payment of sick leave taking into account the length of insurance

The main legislative standards that regulate the dependence of the percentage of sick leave on length of service in 2018 include:

- Federal Law No. 27 of 04/01/1996. This legislative standard fixes the most significant provisions of the social insurance system in the Russian Federation, and, in particular, the concept of insurance length.

- Federal Law No. 255 of December 29, 2006. This document regulates the functioning of the social insurance system in circumstances of temporary disability of an employed citizen, as well as other categories of the population.

- Order of the Ministry of Health and Social Development of the Russian Federation No. 91 dated February 6, 2007 - streamlines the algorithm for calculating the insurance period.

- Order of the Ministry of Health and Social Development of the Russian Federation No. 347-n dated April 26, 2011. This standard determines the form of sick leave, which is uniform for all medical institutions in the country.

- RF PP No. 375 dated June 15, 2007. It fixes the features of accounting for insurance experience indicators to ensure social benefits to the population.

Based on the provisions of the designated regulatory sources, such entities have the right to apply for hospital benefits:

- employees carrying out their professional activities on the basis of an employment agreement with the employer;

- employees of government agencies (including municipal and military entities);

- self-employed persons carrying out professional activities that do not require an employment agreement between the employer and the subordinate (it is understood that the subject independently makes regular insurance contributions to the Social Insurance Fund of the Russian Federation).

It is also appropriate to highlight a number of nuances related to the insurance period that need to be paid attention to when registering sick leave for an employee:

- if a person claims to have some experience, but is not able to document his words, the employer has the right to send a request to the Pension Fund of the Russian Federation in order to search for evidence;

- Sick leave benefits must be accrued no later than 10 days from the date the subject provides sick leave to the company’s accounting department. In conditions where local regulations define other deadlines that do not contradict those legally defined (for example, accrual of funds on the same day when sick leave was filed), they must be observed. Otherwise, the employer will be obliged to compensate the subject for days of delay;

- funds for the first 3 days are provided to the sick citizen by his employer. The employer also compensates for the further period, but for them the manager has the right to request compensation from the Federal Social Insurance Fund of the Russian Federation.

How to correctly determine length of service to receive full compensation

To determine length of service, there is no need to use complex formulas; it is enough to take information from the work book and other documents where the employee worked throughout his life and add up the resulting numbers. At the same time, it is important that from all places of work a person transfers funds for insurance premiums every year.

Here you can already answer the question, when is 100 percent sick leave paid?

Important! If the total figure does not exceed five years of experience, then the employee will be paid no more than 60% of the amount.

Also, the payment will depend on the type of sick leave. It can be continuous, when the employee is absent for several days, and intermittent, if the person goes to work for several hours, having a certificate of incapacity for work. In any case, the total coefficient of days that are specified in the certificate issued by the hospital is paid.

When the length of service is from five to eight years, in this case compensation is assigned in the amount of 80%. Starting from eight years of work, an employee has the right to 100% payment for these days. But before transferring compensation, you must provide the employer with a work record book. When 100 percent sick leave is paid, documents confirming the length of service must be required.

Interesting! In the event that the work is lost or damaged, other types of documents are taken as a basis. This may include extracts from orders, various work contracts, as well as salary slips.

Accrual of sick leave

Is it possible to be refused sick leave?

Sometimes there is a possibility that the medical commission may refuse to grant sick leave to an employee. There are several reasons for this decision, the main ones being:

• complete absence of signs of poor general condition of a person that could affect the work process; • the patient is in custody or under arrest; • the presence of a chronic disease that is in the acute stage at the time of registration of sick leave; • regular medical examination; • college and university students asking for help without a good reason.

There are other factors that influence the commission’s decision, because today many workers often abuse this type of leave. This is most likely due to the fact that an employee cannot be fired under any circumstances while on sick leave, and also due to the fact that payment is calculated for all days of incapacity for work. That is why clinic staff should be more severe towards all patients.

Number of days paid per year

When is maternity pay paid at work?

It is important to know not only for what length of service 100% sick leave is paid, but also how many days per year an employee can be compensated for illness. The general rules state that the entire number of days of incapacity must be compensated to the employee, but there are some rules:

- treatment in a sanatorium can be paid for if it lasts no more than 24 days;

- disabled people have the right to receive benefits for 4 consecutive months, or no more than 5 months per year (with the exception of tuberculosis patients);

- if an employee entered into an agreement, but was injured the next day and remained on sick leave throughout the entire agreement, then disability leave is paid for no more than 75 days.

- in case of tuberculosis, any temporary restrictions on reimbursement will be lifted.

From the information above, it can be understood that full payment of the certificate of incapacity for work will be made if the employee has eight or more years of experience. In this case, there should not be any violations on the part of the person.

If a single mother took several days of leave to care for a sick child, then she is also entitled to full payment of funds, but for outpatient treatment only ten days are paid. There will be no restrictions if the employee himself is sick or one of his relatives requires care in a medical facility.