The rules regarding how to apply for sick leave after dismissal should be known to every employee who has decided to leave the company of his own free will. But what standards are enshrined in the legislation of the Russian Federation in 2021? What are the grounds for payments, in what time frame will a person receive benefits, and when is a refusal by the employer possible? Not every employee of an enterprise knows how to get paid for the time he spent on sick leave. Moreover, many questions arise regarding the payment of sick leave if the illness occurred during the dismissal of a person from the company, or immediately after leaving the enterprise. There are a number of rules and conditions that you should remember about paying sick leave when leaving at your own request. All of them are contained in federal laws, which we will analyze. Key Points No one is immune from illness.

Payment of sick leave after dismissal

A pregnant woman can apply for funds on a general basis. To receive funds, the employee must resign by agreement of the parties.

There are additional exceptions in connection with which sick leave will be paid:

- If the employee was dismissed for compelling reasons, namely: caring for a sick relative;

- due to a change of residence;

- Due to health reasons, the employee cannot continue her activities in this region.

You can only receive funds for the above reasons.

Is the leave payable after leaving due to retirement?

In Russia, the retirement age is 60 years for men and 55 years for women. Having resigned due to age, an employee has the right to paid sick leave in the same way as employees who terminated the contract on other grounds.

A sick leave certificate from a pensioner must be accepted by the former place of work if the date of its opening falls no later than 30 days after the day of dismissal.

In this case, if an employee leaves work and then falls ill within a month, he is entitled to social disability benefits.

In this case, the reason for dismissal does not matter - personal desire, retirement, agreement of the parties.

To be paid, sick leave must be provided by the pensioner no longer than six months after termination of the employment contract. Otherwise, it will be considered invalid and payments will not be made.

Sick leave insurance is paid to a pensioner only in the event of his or her own illness. Caring for a sick family member is not included in social benefits upon dismissal.

Payment of sick leave after dismissal of an employee

- Payment of sick leave after dismissal at the initiative of the employee

- Is sick leave considered work?

- Is sick leave paid to pensioners after dismissal?

- Sick leave pay after layoffs

- Paid maternity leave after dismissal

Sometimes a person becomes ill during the process of dismissal or transfer to another job. That is, he no longer fulfills his professional duties in his previous place, but has not yet officially taken a new position.

How an employee is paid sick leave after leaving work, and in what cases the organization is obliged to pay compensation - read about this, as well as what pensioners and pregnant women can count on in such situations, in the current review material on the designated topic.

Can a working pensioner be fired while on sick leave - Legal assistance from a lawyer

This must happen at least 14 calendar days before the expected date of termination of the employment contract. After submitting the application to the employee responsible for personnel matters, a 2-week period begins, otherwise called working off. The term “working out” does not appear in the Labor Code of the Russian Federation.

2 weeks is only the period during which the employer must find a replacement for the resigning employee. Find out what stamps should be on a sick leave certificate here. After 14 days, the organization issues an order stating that the employee is fired.

This document is given to the resigning employee for review under a personal signature, or, in the case of a territorial remoteness of the citizen, is sent to him by mail with acknowledgment of delivery.

REAL ASSISTANCE FROM A LAWYER.

TelephoneE-mail: You can leave it by clicking on the Reply button Similar questions Is it legal to quit while on sick leave, even if it is at your own request? I was on sick leave, I wrote a statement. If, after the statement, I go to the labor exchange of my own free will, how much should I be paid and for how long? Can the general director of an LLC sign an application of his own free will to an employee for dismissal during liquidation? Is it possible for a pensioner to be dismissed on his day off according to his statements.

Features of the procedure for voluntary dismissal during sick leave

The application must contain the following points:

- last name, first name, patronymic and position of the resigning employee;

- name of the organization in which the employee works;

- the wording “At your own request”;

- the date from which the citizen plans not to go to work;

- date of document preparation;

- personal signature of the employee.

It is important to know that if an employee is on sick leave, he also has the right to withdraw his resignation even on the last day of the employment contract with the company.

And if at that time a new employee had not been hired by the company, then after the permanent employee leaves the sick leave, the employer must continue to work with him.

Dismissal of one's own free will during sick leave The process of dismissal of one's own free will begins with the employee submitting a resignation letter to the employer.

Dismissal due to health reasons or illness. Can they be fired while on sick leave?

There is an explanation from the Federal Service for Labor and Employment on this matter.

The letter explains that the employee has the right to warn the employer about the upcoming dismissal, both during the period of work and while he is on vacation or during illness.

The day of dismissal may also fall on any of the specified periods, including possible dismissal on the last day of sick leave.

Attention

Therefore, if the notice period for dismissal is 14 days, the employer must dismiss on the day indicated in the resignation letter.

What to do in the event of a prolonged illness of an employee In practice, a situation may arise when an employee submitted a letter of resignation on his own initiative, but fell ill during the two-week notice period for dismissal.

Can I fire a pensioner who is on sick leave?

The duration of illness does not matter, and the amount of payment will be 60% of earnings.

[

Return ] ✔ Payment of sick leave.

If the sick leave was opened before the employee was dismissed or was closed after the termination of the employment relationship, it must be paid. You can present sick leave for payment within 6 months.

[ Return ] ✔ Dismissal on the last day of sick leave On your own initiative, you have the right to resign on the last day of sick leave, but the law obliges you to notify your employer in writing of your upcoming dismissal two weeks in advance.

The employer, in turn, cannot fire you at his own request; this is dictated by Art.

Will a pensioner be paid sick leave after dismissal?

That is, payment is calculated in the amount of the average salary for the last two years of work. But the percentage of payment depends on the length of service under an employment contract with the presence of contributions to the insurance fund.

Accordingly, if a pensioner’s work experience is 8 years or more, he will be credited 100% of his salary for each day of illness. If less than 8 years, but more than 5 years - then 80%, in other cases - 60% of average earnings.

The benefit is due for all days when the pensioner was on treatment, including the last day of dismissal. It is also worth taking into account that when going on sick leave, if the pensioner expressed a desire to leave his place of work on that day, the day of dismissal remains the same. Termination of an employment contract with an employee during a period of incapacity for work is possible if he himself wishes to do so. Example An employee wrote a letter of resignation with the desired date of termination of the contract on January 15, 2021.

This is important to know: How to retire with mixed military experience

Benefit calculation

Important details:

- By-laws establish that the payment is 60% of the employee’s average earnings for each day on sick leave.

This is very important because the amount of temporary disability benefits for an existing employee directly depends on his length of service. But, in our case, experience is not taken into account. And this is probably fair. The dismissed person needs to be supported, but the employer no longer treats him as one of his own, therefore, according to the legislator, payment cannot be made in the amount of, say, 80 or 100%. On the other hand, benefits below 60% of average earnings cannot be calculated either. This is the balance that is maintained. - Average earnings are determined for the last two years of work.

The calculation is carried out as follows:

- The amounts of all income for 2 years are summed up.

- The result is divided by 730 - the total number of days for the given period.

- The resulting average earnings are multiplied by the number of days of disability.

Let’s say pensioner Petrov, who worked as a senior foreman, resigned from Granat LLC and went on sick leave. He was ill for 5 days. Over the last two years, I earned 700 thousand rubles. Petrov earned 700,000/730=958.9 rubles per day. 958.9*5=4794.5 rubles – the amount he should receive from his former employer.

We pay sick leave to a former retired employee

Law). If we consider the issue of receiving assistance during pregnancy and childbirth, then in this case payments are made by the employer in the presence of certain circumstances (clause 14 of Order of the Ministry of Health and Social Development No. 1012n). Payment is made in the following case:

- Sick leave occurred within 30 days from the date of dismissal.

- The calculation was called:

- the spouse moving for permanent residence to another city;

- an illness that prevents you from continuing to work;

- the need to care for a sick family member, including disabled people of group 1.

If the dismissal occurs for other reasons, then the woman loses the right to receive maternity benefits. The amount of the benefit and the procedure for calculating it are determined by regulations.

Procedure

To be fully eligible to receive benefits, you must:

- Provide your former employer with a certain package of documents.

- Apply for funds in a timely manner.

List of documents

Let us note that labor legislation, in general, does not give retired pensioners any special status . Any employee who leaves the organization and goes on sick leave after that will be required to:

- in fact, the certificate of incapacity for work is sick leave;

- passport;

- work book to establish that a person is not working.

Documents must be submitted within six months from the date of dismissal.

How to direct?

Probably the easiest way: contact your former employer personally. Face-to-face communication is always better than correspondence. True, you need to make sure that you have evidence of acceptance of documents on hand . You can take a certain receipt for receipt of papers. Or, make sure that information about the acceptance of documents is presented in the appropriate journal.

If a pensioner cannot come to his former employer, then he can:

- Send the papers by mail - registered mail with notification and a list of the contents.

- Issue a power of attorney for a representative who will transfer sick leave at the principal’s former place of work.

Attention : the deadline for submitting documents is 6 months from the date of termination of the employment contract.

Payment of sick leave after dismissal of a pensioner

Illness after care according to the letter of the law (review of legislation) In accordance with the requirements of labor legislation, an employee has the right to terminate an employment contract even during incapacity (Article 80 of the Labor Code of the Russian Federation). Legal relations in the field of social insurance, in particular in case of illness, are regulated by the Federal Law of December 29, 2006 No. 255-FZ “On Mandatory Social...”. Basic guarantees for the payment of benefits to an employee during the period of temporary disability are established by Article 183 of the Labor Code of the Russian Federation. In the case of a dismissed employee, the law obliges the employer to pay him for sick leave within 30 days from the date of payment (Article 5 of the Law). In this case, the calculation of the monthly period begins from the moment the employee familiarizes himself with the dismissal order, as a result of which a work book must be issued.

Is it possible to quit while on sick leave and under what conditions?

The Labor Code (LC) of the Russian Federation is a set of laws designed to protect the rights of working citizens. Dismissal is one of the inevitable aspects of working life. The Labor Code of the Russian Federation clearly regulates situations in which an employer is allowed to fire its employees. Let's consider an important point: is it possible to quit while on sick leave on your own initiative, and can the employer do this?

Legal options for dismissal on sick leave

Labor legislation clearly interprets that the dismissal of an employee on sick leave at the initiative of the employer is illegal (Article 81 of the Labor Code of the Russian Federation). When an employee applies to the courts regarding wrongful dismissal, the court, as a rule, takes the side of the applicant.

In this case, the employer will be obliged to reinstate the employee at his previous place of work and pay him wages for the period of forced absences.

There are several situations that allow the dismissal of a sick employee on legal grounds. This is only possible in the following cases:

- complete liquidation of the organization;

- dismissal of an employee on sick leave at his own request;

- dismissal by agreement of the parties;

- expiration of the fixed-term employment contract.

Dismissal at one's own request is initiated by the employee himself, therefore, even while he is on sick leave, dismissal occurs on a general basis.

It is worth noting that the employer does not have the right to refuse to dismiss an employee at his own request.

The Constitution of the Russian Federation guarantees every citizen the right to freedom of choice of type of work activity (Article 37).

Article 80 of the Labor Code of the Russian Federation regulates the procedure for terminating an employment contract: the employee must notify the employer of his desire to resign 2 weeks before the expected date of dismissal.

Nuances of the dismissal procedure during sick leave

Despite the fact that the listed options for dismissal on sick leave are legal, there are some nuances that must be observed.

Additional Information

Special attention should be paid to dismissal during the probationary period. After all, it can cause a lot of problems.

In practice, termination of employment during the period of sick leave at one's own request during the probationary period occurs very rarely.

In this case, the organization must be notified three days before the proposed dismissal and then by writing a statement in the established form.

- If the termination of the employment contract is initiated by the employer during the employee’s ability to work, then if the employee falls ill before the appointed date of dismissal, including on the last day of work, the dismissal procedure is suspended and resumed only when the citizen recovers and returns to the workplace.

- If an employee quits of his own free will and falls ill during the 2-week period of work, then the work in this case is not extended or postponed. This rule is also valid if an employee, while on sick leave, submits a resignation letter. Thus, in fact, service does not occur or occurs only partially if the employee manages to recover before the end of its term. In addition, you can quit without service in the following cases: when moving for permanent residence to another locality,

- when a spouse is transferred to work in another area,

- during pregnancy,

- if it is impossible to live in this region for medical reasons,

- if you need to care for a child or other family member,

- upon retirement, etc.

The table shows the procedure for terminating an employment relationship while on sick leave.

ActionsDetails

| 1. A citizen writes an application for leave on sick leave. Together with it (or after) a letter of resignation is drawn up. | It must be written there “at your own request”. |

| 2.The employer studies the submitted documents. | From this moment the countdown of 2 weeks begins. |

| 3.After 14 days from the date of notification of dismissal, the boss draws up an order to terminate the employment relationship. | It is presented to the person being dismissed for review. The corresponding entry is made in a special accounting journal. If the employee cannot personally come to the employer, he must send a copy of the order by registered mail. |

| 4. A record of dismissal is made in the work book. | It is necessary to indicate Article 80 of the Labor Code of the Russian Federation. This means that the employee himself decided to terminate the relationship. |

| 5. As soon as the order comes into force, the employee receives a work book and pay slip. | An act is drawn up about this. |

| 6. The person being dismissed contacts the accounting department for payment. | After this, you can sign in the accounting journals for receiving funds in full, as well as for issuing a work book to a subordinate. |

| 7.If the employee refuses to sign, a special act is drawn up in which all actions are recorded. | If it is not possible to make a personal visit to obtain a “labor” document, you will have to send a notification of the need to make a payment by registered mail. Then a trusted person can receive the money and work book. |

Submitting a resignation letter

An application for resignation of one's own free will, including while on sick leave, is written by the employee in any form.

The application must contain the following points:

- last name, first name, patronymic and position of the resigning employee;

- name of the organization in which the employee works;

- the wording “At your own request”;

- the date from which the citizen plans not to go to work;

- date of document preparation;

- personal signature of the employee.

It is important to know that if an employee is on sick leave, he also has the right to withdraw his resignation even on the last day of the employment contract with the company. And if at that time a new employee had not been hired by the company, then after the permanent employee leaves the sick leave, the employer must continue to work with him.

The voluntary dismissal process begins with the employee submitting a resignation letter to the employer. This must happen at least 14 calendar days before the expected date of termination of the employment contract.

After submitting the application to the employee responsible for personnel matters, a 2-week period begins, otherwise called working off. The term “working out” does not appear in the Labor Code of the Russian Federation.

2 weeks is only the period during which the employer must find a replacement for the resigning employee.

After 14 days, the organization issues an order stating that the employee is fired. This document is given to the resigning employee for review under a personal signature, or, in the case of a territorial remoteness of the citizen, is sent to him by mail with acknowledgment of delivery.

Then the personnel employee (accountant, employer) makes an entry in the employee’s work book about dismissal at his own request, indicating Article 80 of the Labor Code of the Russian Federation and hands over the work record. After which the citizen is given a payslip indicating the payments due to him. The final stage is receiving the calculation from the accounting department.

Source: https://otdelkadrov.online/8183-osobennosti-protsedury-uvolneniya-po-sobstvennomu-zhelaniyu-vo-vremya-bolnichnogo

Payment of sick leave to a pensioner after voluntary dismissal 2021

Hello, in this article we will try to answer the question “Payment of sick leave for a pensioner after voluntary dismissal 2021”. You can also consult with lawyers online for free directly on the website.

Sometimes situations occur when a worker’s illness occurs after dismissal. What should I do? Who should pay, in what order?

Is sick leave paid to a dismissed employee? When and who will pay? Is it worth documenting the fact of illness? — questions that arise for citizens during the transitional stage between terminating a contract with one employer and not concluding one with another. Within 10 days, the former enterprise (individual entrepreneur) is required to calculate insurance compensation based on the average salary of the employee for the two previous calendar years, taking into account the maximum and minimum restrictions established by law.

conclusions

The law provides for payments during the employee’s treatment, even if he has already been fired. This rule applies if no more than one month has passed since the termination of the employment contract.

In case of illness of a retired pensioner, disability benefits will be paid in the amount of 60% of his average salary calculated over the last two years.

Compensation must be accrued for all days of sick leave within 10 days from the submission of the document, and paid on the established paydays in the organization.

Retirement age and dismissal

When calculating the amount that will be paid to the employee during the period of incapacity, the average daily earnings or minimum wage are used. The average daily wage is calculated based on total income for the previous two years, taking into account bonuses and other allowances.

To exercise this right, the employee must notify the employer in writing of his desire to resign no later than two weeks*.

How much do you need to pay per month? In this case, everything is quite individual for each preschool educational institution. The basis for calculating insurance compensation after dismissal is the illness of the insured person himself, regardless of the treatment regimen (inpatient, outpatient), pregnancy, subject to the above conditions. Allowance for caring for a child or other family member is not accrued or paid.

Who should

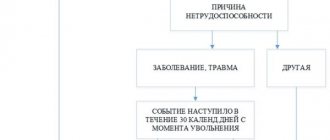

So, the procedure and features of the appointment, as well as the terms of payment and the amount of temporary disability benefits are generally regulated by Federal Law No. 255 FZ. According to the provisions of the above law, payment of benefits to a dismissed insured person is possible subject to the following conditions:

- the illness or injury of the employee himself occurred within 30 calendar days from the date of termination of work under the employment contract; sick leave for caring for a sick child or other relative is not subject to payment (Part 2 of Article 5 of Federal Law No. 255 Federal Law);

- the former employee did not register with the Employment Center in due time and did not get a new job, since in this situation paying sick leave would be the responsibility of the Employment Center or another employer;

- The dismissed employee applied for benefits no later than 6 months from the date of restoration of his ability to work (establishment of disability), that is, from the moment he received a certificate of temporary incapacity for work (Part 1, Article 12 of Federal Law No. 255 Federal Law).

If the third condition is not met, and the application occurred later than the specified period, then the decision to assign benefits is made by the FSS if there are valid reasons, which are listed in Order of the Ministry of Health and Social Development of the Russian Federation dated January 31, 2007 No. 74) (Part 3 of Article 12 of Federal Law No. 255 FZ ).

Payment of sick leave after dismissal

If the policyholder does not have funds or the dismissed employee has been ill for a long period (more than 6 months), then the employer is obliged to submit an application to the Social Insurance Fund, which will provide financing within a month and transfer the money to the applicant’s current account.

The employer transfers all documentary information provided by his former employee to the Social Insurance Fund within 3 working days.

It is impossible to obtain the document by going to an ambulance, a blood transfusion center or a hospital emergency room. Private clinics also do not issue sick leave certificates.

Indexation after dismissal

When severing employment relations with the employer, many are concerned about how pensions will be indexed after the retiree is dismissed from his permanent place of work. Recalculation of pensions for working pensioners after dismissal will occur in accordance with the general procedure. In 2015, 2 waves of indexation are planned:

- • February indexation increased payments by 7.5%. Here, both parts will undergo an increase - savings and insurance, that is, the entire payment will increase in full. The fixed payment will be equal to 4386.59 rubles for old-age pensioners, and for 80-year-old citizens and disabled people (group 1) – 8767.18 rubles.

- • The second, April, wave of pension increases has not yet taken place. The recalculation of a pension after dismissal by an employee will depend on the level of inflation, the pension fund income growth index and the state of the economy as a whole. As a rule, the size of the second stage of increase is significantly smaller than the first. Only the insurance portion can be increased, and then only slightly.

Refusal to index a pension for a working pensioner has many negative aspects, primarily for workers of that age themselves:

- There is confusion with the so-called points. An increase in payout entails an increase in these coefficients. For a working pensioner, points are increased through contributions. If the indexation of the pension will be carried out after the dismissal of the pensioner, it is not clear which points will be taken into account - indexed or not.

- Before the pension is indexed after dismissal, it is important for the employee to immediately receive compensation (increase points) in order to have equal rights with citizens on full state support.

- There is also a natural question about finding employment for a pensioner. If he gets a job, for example, during the summer months, should he be classified as a working citizen and stop indexing the due payment? The question remains open about receiving other income that is declared independently - royalties, patents, rents and other things.

- Retired individual entrepreneurs will also suffer in some way. After all, even having acquired a patent for economic activity, a pensioner can work and make a profit, or he can suspend business.

That is, there are more questions than answers: who should be classified as working pensioners, how to index their pensions in the present and future periods. However, it is certain that the pension will be indexed only after the dismissal of the retired employee.

From January 1, 2021, the amount of sick leave benefits will change

The amount of payment is also affected by the employee's length of service. There are certain requirements for the total duration of work, depending on which the payment will be made as a percentage:

- employees who have worked for more than 8 years are paid 100% of their salary;

- if the duration of work is from 5 to 8 years – 80%;

- from 6 months to 5 years – 60%;

- less than 6 months – calculation is carried out on the basis of the minimum wage.

From the date of provision of a certificate of temporary incapacity for work by a former employee, funds are transferred within 10 days. If the retiree’s illness is chronic, for example, pulmonary tuberculosis, and the treatment involves long-term treatment, lasting several months, then benefits are paid on the days wages are paid. A competent person - a specialized doctor or local therapist issues a certificate of temporary incapacity for work, indicating the disease code. The doctor should not make any special notes in the document about the patient’s lack of employment.

The citizen will not receive more than this amount. Payment for sick leave after dismissal must be made within a month from the date of submission of the application and documents.

In most cases, even after leaving work, a citizen has the right to receive sick leave payments, but it is necessary to make sure that certain conditions have been met.

Also, to the required extent, the company pays sick leave for the care of a resigning employee’s child if he or she became ill before the parent quit.

Sick leave after dismissal - unpleasant situations are not uncommon when a person feels unwell, an illness worsens or is injured after he has paid off from work. Changing jobs in itself can cause stress and provoke a painful condition.

In turn, if a person falls ill within 30 days from the date of dismissal, then his former employer also has an obligation to pay sick leave, but not in full, but in the amount of 60% of the average salary of the former employee (clause 2 of Art. 7 of Law No. 255-FZ).

Sick leave after dismissal - unpleasant situations are not uncommon when a person feels unwell, an illness worsens or is injured after he has paid off from work. Changing jobs in itself can cause stress and provoke a painful condition.

Payment of sick leave after dismissal occurs in exactly the same way as in the case of a working citizen. No matter what the reason for the disability.

Accordingly, more experienced teachers work in such groups to monitor the development of lagging children.

What to do in case of sick leave when a pensioner leaves work? Will the leave be paid if an employee quits due to retirement if he gets sick on the last working day?

In this case, it is a sick leave certificate issued by a medical institution and certified by the seal and signature of the attending physician.

The country's legislation provides guarantees and compensation for citizens upon termination of an open-ended contract with an employer, who is obliged to ensure the fulfillment of a number of obligations for a certain time after the termination of cooperation.

How long after dismissal can I show sick leave? An employee has the right to payments within thirty days after his dismissal.

This is important to know: Additional payment for rural experience for pension: what professions

The law obliges the employer to pay employees compensation for the period of temporary disability. Former employees are also entitled to payment in cases established by law and in approved amounts.

A former employee who has registered with the employment center and received the status of unemployed in the manner prescribed by law can count on paid sick leave on the basis of clause 1 of Art. 28 of the Law of the Russian Federation “On Employment of the Population in the Russian Federation” (as amended on April 30, 1999).

How is sick leave paid after dismissal? Is it true in all cases or are there exceptions? How many days can you be on sick leave to receive benefits? How does settlement work with a quitter?

After calculating the benefit, the accounting department issues a new certificate of sick leave for correct reflection in the future policyholder’s records. Failure to issue results in distortion of data at the next place of work, which, when receiving the document untimely, will be forced to recalculate.

According to clause 2 of Article 13 No. 255-FZ, an employee can count on compensation only if an illness occurs or an injury occurs.

If the sick leave lasts more than 2 weeks or the date of termination of the contract by agreement has already arrived, the employee will continue to receive compensation for sick leave, while being in the status of dismissed. Thus, in this interpretation, the 2-week period after the employee submits a letter of resignation cannot always be considered as mandatory for working off.

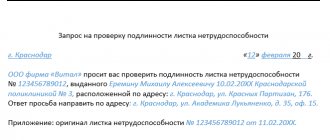

A dismissed employee is required to provide sick leave no later than 6 months after the occurrence of the insured event. Moreover, this case must occur within 30 calendar days after dismissal. Only then will the Social Insurance Fund accept the certificate of incapacity for payment.

Such a sheet is a confirmation for filing claims on the basis of which compensation is paid to the employee upon the occurrence of an insured event. The form is prepared according to a strict form, in accordance with the requirements of the Ministry of Health.

A sick leave certificate after dismissal is filled out by a doctor in the same way as for a working citizen. But only if the person does not work anywhere and is not registered with the labor exchange. The form does not require entering data for dismissed workers, so the doctor fills out his part in accordance with established standards and in accordance with all the rules.

How is payment handled for a fired person?

In general, the procedure for paying sick leave after dismissal of a pensioner is as follows :

- First, the applicant must contact a medical institution to obtain a certificate of incapacity for work.

This document must be issued by the attending physician. The procedure for registration and issuance of a certificate of incapacity for work is described in detail in the order of the Ministry of Health and Social Development of the Russian Federation dated June 29, 2011 No. 624n. - The next step is to collect a package of necessary documents. In addition to the sick leave certificate, it will include the pensioner’s passport and work book.

- The applicant must deliver all collected documents to the accounting department of the former employer.

- In turn, accounting department employees must make the necessary calculations and pay sick leave.

Additionally, it is worth emphasizing that in order to receive sick pay after dismissal, a former employee, including a pensioner, does not need to write a separate application.

It is enough to submit the documents listed above. The only exceptions are those cases when we are talking about the payment of sick leave in the territory of a constituent entity of the Russian Federation participating in the pilot project of the Social Insurance Fund of the Russian Federation.

In what sizes?

The specific amounts of benefits paid in the event of a temporary absence of the opportunity to engage in labor activity are prescribed in Art. 7 of the Law of the Russian Federation No. 255. Thus, if we are talking about paying sick leave to a resigned employee, including a pensioner, then the amount of compensation provided by law will be 60% of his average salary.

When is money credited?

As a general rule, the employer must accrue temporary disability benefits within 10 days from the moment the pensioner provides the necessary documents. In this case, the payment itself is made on the next day of payment of the next salary established in a particular organization. This procedure is indicated in paragraph 1 of Art. 15 of the Law of the Russian Federation No. 255.

If we are talking about territories participating in a pilot project that provides for direct payments from the Social Insurance Fund of the Russian Federation, then the timing will be slightly different.

First, the employer will have to send all papers submitted by the former employee to the Federal Social Insurance Fund of the Russian Federation within 5 days. In this case, the payment of the benefit itself will be made by employees of the territorial office of this government body within 10 days from the date of receipt of the full set of documents.

The main advantages of receiving benefits

Sick leave after dismissal is paid if it is open within 30 calendar days from the date of dismissal.

From January 1, the highest and lowest amounts of benefits that are paid to employees as a result of illness will change upward. The purpose of payments is regulated by Federal Law No. 255-FZ dated December 29, 2006, as amended on June 27, 2018 “On compulsory social insurance in case of temporary disability and in connection with maternity.”

Since the day of dismissal is considered his working day, benefits will be calculated in a different way.

Number of unemployed in Russia for 2021 According to official data, today there are over 3.8 million unemployed citizens in the country. This figure is presented according to officially compiled statistics, taking into account all estimates of the employed population, as well as other segments of society that do not belong to the working population. As a percentage, this value is 4.9%.

After dismissal, a person usually notifies the medical organization of the change of job during a visit.

Entry in the work book

It is mandatory that when leaving work of one's own free will while on sick leave, a corresponding entry is made in the work book.

When making an entry in the work book, the personnel employee must indicate the following:

- serial number of the current entry in accordance with the registration log;

- date of dismissal;

- details of the dismissal order;

- directly the record of dismissal, the wording may look like this:

“The employment contract was terminated at the initiative of the employee, clause 3 of part 1 of article 77 of the Labor Code of the Russian Federation.”

The entry is affixed with the seal of the organization and the signature of the manager or authorized person indicating his last name with initials and position.

If an entry is made incorrectly, it is not acceptable to cross it out; you should make a new entry below and indicate that the previous one is incorrect.

Sick leave after dismissal of a pensioner at his own request 2021

You can quit in connection with retirement only once. If after that the employee finds a job again and decides to quit, then such dismissal occurs in the general manner. That is, if upon retirement, service is not required, then during a normal dismissal, in general, the employer must be warned in advance. For more details about this, see Resignation due to retirement is possible only after reaching the legal age.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website. It's fast and free!

The employer is required to pay sick leave after voluntary dismissal in a year, subject to certain conditions.

Payment terms

The final deadline for transferring funds to a dismissed pensioner depends on several factors:

- speed of submission of documents confirming illness;

- period and dates of transfer of funds for such payments at the enterprise.

The law establishes a period of no more than 10 calendar days from the moment the employee submitted a certificate of incapacity for work. Often, the employer timed such compensation to coincide with the transfer of wages, so the funds can arrive both on the first day after submitting documents, and after some time.

The second option is more likely, since it is convenient for the employer and does not contradict the legislation of the Russian Federation. As a result, the employer is obliged to transfer funds as temporary disability benefits to a dismissed pensioner under certain circumstances.

If the illness relates to the former employee himself and the documents are completed before 30 days after the termination of the employment relationship. Payment is made in the standard manner upon submission of a properly completed disability certificate. The deadline for transferring funds is specified by law up to 10 days from the date of submission of documents.

With age, a person's health deteriorates. It is not surprising that situations are common when a pensioner leaves an organization and then goes on sick leave. Will the former employer pay such a dismissed employee any money?

In the article we will consider the procedure for a pensioner in the event of incapacity for work after retirement. Legal awareness in this case will help you avoid problems and receive due payments.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

Sick leave after dismissal in 2021

A dismissed employee is required to provide sick leave no later than 6 months after the occurrence of the insured event. Moreover, this case must occur no later than 30 calendar days after dismissal. Only then will the Social Insurance Fund accept the certificate of incapacity for payment. You can resign due to retirement only once.

If after this the employee finds a job again and decides to quit, then such dismissal occurs in accordance with the general procedure. That is, if upon retirement, service is not required, then in the case of a normal dismissal, in general, the employer must be warned in advance for more details on this, see.

You can resign due to retirement only after reaching the legal age. For information, retirement age is the legally established age at which a person participating in state pension insurance can count on receiving an old-age pension.

Currently, the retirement age in Russia is Art. The average daily earnings is .01 rubles. This is the established percentage for dismissed citizens. Average earnings per day will be .8 rubles. This means that the temporary disability benefit for 10 days will be rubles. Of these, 4 rubles are paid by the employer for 3 days, and the remaining 6 rubles are paid by the Social Insurance Fund. Refusal to pay The organization in which the employee previously worked has the right to refuse to pay sick leave if it was not properly completed or the deadline for provision has expired.

If the duration of sick leave is more than six months, then the issue of dismissal of the employee and registration of benefits is simultaneously regulated by the Social Insurance Fund, which makes a decision on payment of sick leave. There is a certain procedure in accordance with which documents must be processed in the organization. Registration of sick leave after an employee leaves work must also take place in accordance with this procedure, and the organization must transfer all funds within a month.

If the deadline set for payment of funds is not met, the employer may be fined or even arrested. How is sick leave issued after dismissal in a year? In order to issue sick leave, the employee must provide the following documents within the period established by law: Confirmation that after dismissal the employee did not work anywhere else is a work book.

Reaching retirement age is not grounds for dismissal, but the employer may offer such an employee a different position. This is permitted if the employee himself gives written consent.

A working pensioner can be fired on the general grounds: A pensioner has the right to quit his job upon reaching retirement age.

For men in Russia it is set at 60 years, and for women - 55 years. In some cases, it is possible to retire early. If a pensioner decides to resign on this basis, then he can do it once in his life. In this case, a resignation letter can be submitted even one day before the expected date of dismissal. The employee writes a corresponding statement, and the employer issues a corresponding order. On the employee's next payday, all benefits due to him or her will be paid.

This is important to know: Pension experience for unpaid years

Not every fired person exercises his right to sick pay. However, if he fell ill between 1 and 30 days after dismissal, the possibility of receiving payments exists.

Moreover, for three working days the compensation is paid by the employer, and the rest is paid by the Social Insurance Fund. Sick leave payments after dismissal apply to the employer only if the employee himself has an illness. Documents confirming absence from work due to illness of relatives (for example, children or disabled people) do not allow you to qualify for any payments.

But, if all the requirements are met, the employer or his representative must accept a certificate of incapacity for work from an employee of the organization with any period specified on it. The opening date in the document is May 30, and its closing date is September 7. To confirm that he did not find a new job and did not register with the employment center, the employee provided a copy of his work record book.

An official document that exempts you from work during health problems is a sick leave certificate. Only medical institutions can issue it in accordance with the procedure approved on August 1.

The form is issued by a doctor to insured persons who fall ill. It is issued to those who fell ill during the day after leaving the employer. Time of sick leave Features of receiving days Issued for diseases such as acute respiratory infections, influenza, etc.

The legality of dismissal during sick leave depends on the initiator of the procedure. A situation may arise that an employee submitted a letter of resignation, but suddenly fell ill.

What should the employer do in this case? Should I wait for the employee to recover or fire him after the expiration of the daily period required by law? Is it even possible to fire someone while on sick leave at their own request?

Can an employer fire an employee on his own initiative? Let's figure it out. Each of the reasons for dismissal - before maternity leave or dismissal of an employee who is on sick leave, by agreement of the parties - must be proven documented: certificates from social security, medical institutions, from the husband’s place of work, from the housing department, homeowners’ association at the place of residence, etc.

When a company employee falls ill almost immediately after quitting, sick leave after dismissal is paid for another 30 calendar days. The employee is obliged to come and hand over sick leave after dismissal to the employer to obtain temporary disability benefits.

But only if he did not find a new company. Also see: Contributions received by this insurance institution on time guarantee compensation to the worker if he goes on sick leave. The legislation of the Russian Federation does not provide for the employee’s retirement age as a reason for dismissal.

According to Art. Moreover, in the second case, the days the employee is on sick leave are included in the period of compulsory work between the dates of the application for dismissal and the actual dismissal.

Unless otherwise specified in a separate agreement, the relevant period is 2 weeks. So if an employee has been undergoing treatment for more than 2 weeks since submitting the application, then after recovery he does not need to go to work.

Having been cured and receiving compensation for a certificate of incapacity for work is provided within the framework of the mechanisms we discussed above, the citizen ceases to be an authorized or obligated party in legal relations with the company in which he worked at the time of going on sick leave.

Everyone knows that in the event of illness of its employees, an employer is obliged to pay them monetary compensation, the amount of which depends on the length of service and the average salary of the employee. However, few people know that the Labor Code also obliges the employer to pay sick leave for former employees. Calculation of wages for a specified period Here, those funds in which contributions to the Social Insurance Fund were deducted are taken into account, but are not taken into account:. We help protect your interests in legal matters.

How long can a working pensioner remain on sick leave?

According to Article 183, the employer must pay temporary disability benefits, which are specified in federal laws. Article 7 of the federal law “On compulsory social insurance in case of temporary disability and in connection with maternity”, benefits are paid in the following amounts:

- If a person is insured and has eight or more years of experience - 100% of the average salary.

- If the duration of the insurance period is from five to eight years - 80%.

- If the insurance period is up to five years, then 60% is paid.

In paragraph 1 of Article 6, the above-mentioned federal law specifies that benefits for temporary disability due to injury or illness are paid to the insured employee for the entire period until his full recovery (or determination of disability, with the exception of the following cases (parts 3 and 4 of this article).

Long sick period

To obtain disability, the Commission that determines the patient’s disability meets after the person has been on sick leave for ten to twelve months.

This period is the maximum for continuous sick leave.

After an injury Patients have the right to remain on sick leave as a result of an injury for a long time, based on the complexity of the case.

In some cases, doctors restore a citizen within one to two months, while in others it takes a longer time, up to twelve months.

Question answer

Good afternoon The pensioner worked for two weeks and has been on sick leave for half a year.

There is no longer any possibility of replacement. And there is a very great need for the position.

What is the right thing to do in this case? (Even when he returns from sick leave, he will not be able to physically perform his duties, but he does not want to quit voluntarily.) Answer Hello, Vera.

In addition, Article 81 of the Labor Code of the Russian Federation directly prohibits the dismissal of an employee at the initiative of the employer during the period of his temporary disability and while on vacation (except in cases of liquidation of the organization).

Forcing an employee to resign at his own request or for other reasons is also prohibited by law.

Dismissal of a working pensioner on sick leave

Pravoved.RU 252 lawyers are now on the site

- Labor law

- Protection of employer's rights

is it possible to fire a pensioner during a long period of sick leave? the staffing position is occupied; the company has limited funds (budget); there is an overexpenditure of funds; dismissal during sick leave; Victoria Dymova Support employee Pravoved.ru Similar questions have already been considered, try looking here:

- How to fire an employee who is on long-term sick leave?

- Is it possible to declare myself bankrupt if I am on long-term sick leave?

Lawyers' answers (2)

- All legal services in Moscow Holding employees accountable Moscow from 5,000 rubles. Return of defective goods Moscow from 5000 rubles.

How many months can a working pensioner be on sick leave?

,get a qualified answer and free legal assistance within 1 minute! Your name: Region: Moscow and MOSankt Petersburg and LOAnother region ArkhangelskAstrakhanBarnaulBelgorodBlagoveshchenskBryanskVeliky NovgorodVladivostokVladikavkazVladimirVolgogradVologdaVoronezhEkaterinburgIvanovoIzhevskIrkutskYoshkar-OlaKazanKaliningradKalugaKemerovoKievKirovKostromaKras NodarKrasnoyarskCrimeaKurganKurskLipetskMakhachkalaMurmanskNizhny NovgorodNovosibirskOmskOrelOrenburgPenzaPermPetrozavodskPskovRostov-on-DonRyazanSamaraSaranskSaratovSmolenskStavropolTambovTverTomskTulaTyumenUlan-UdeUlyanovskUfaKhabar ovskKhanty-MansiyskCheboksaryChelyabinskChitaEngelsYakutskYaroslavl Phone: +7() for example (495) 6895658 Your question: Latest reviews Tatyana Alekseevna Many thanks to Olga Evgenievna for the short and clear answer! P. Kizner 03/04/2021 11:45:08 Anna Thank you for your answer to Olga Evgenievna.

How long can you legally remain on sick leave continuously?

The question relates to the city of Tolyatti Yes, it is possible, if he is not disabled.

Temporary disability benefits are paid to the employee for the entire period of temporary disability, confirmed by the relevant certificate of incapacity for work, until recovery or until the disability group is established.

This is stated in Part 1 of Article 6 of the Federal Law of December 29, 2006 No. 255?FZ.

The limitation of the period for payment of a certificate of incapacity for work to four consecutive months, but no more than five months in a calendar year, is established for persons who already have a disability group on the day of the onset of incapacity.

Thus, if an employee falls ill without being disabled, then temporary disability benefits are paid to him for the entire period of illness until the group is established.

How many days can you be on sick leave?

The maximum period is ten months, but it can be extended for another two months if: 1) the patient has suffered tuberculosis; 2) the employee was seriously injured; 3) the employee underwent reconstructive surgery.

If you have a long-term sick leave, you need to renew it every fifteen days. After two weeks, the patient must attend meetings of the commission that records his condition and level of recovery at the moment. We looked at how long you can be on sick leave.

Will it be paid? Labor Code and regulation of relations between employer and employee The Labor Code of the Russian Federation states in Article 81 that dismissal of an employee with temporary disability or on vacation is impossible (except for cases when the organization is liquidated or the activity of an individual entrepreneur ends).

How sick leave is paid to working pensioners

In this case, the service itself is responsible for paying for benefits. The amount of payment will depend on the one assigned to this particular category of the population. Payment is also affected by the reason why the pensioner was fired.

Acceptable reasons for dismissal At your own request and staff reduction, payments are made within a month under the conditions specified above.

But maternity benefits are not paid in this situation, except in cases of injury.

This can be explained by the fact that the law prohibits dismissing pregnant women.

Dismissal should be made only for extenuating circumstances, such as: moving to another place, work of a spouse and inability to work at this particular enterprise.

Source: https://jurist-company.com/kak-dolgo-mozhet-nahoditsya-na-bolnichnom-rabotayushhij-pensioner/

Sick leave for a working pensioner

For the site to work correctly, you must enable JavaScript support in your web browser settings. If your question concerns the activities of legal entities, you can ask it in the new PPT project for solving accounting and legal business issues. Svetlana 21 August 2014 13:22

print closed question working pensioner on sick leave after a car accident for more than 7 months.

Is it possible for him to be paid for sick leave for more than 4 months? The question relates to the city of Togliatti. Subject: Answers: August 21, 16:28 Yes, it is possible, if he is not disabled.

Temporary disability benefits are paid to the employee for the entire period of temporary disability, confirmed by the relevant certificate of incapacity for work, until recovery or until the disability group is established.

This is stated in Part 1 of Article 6 of the Federal Law of December 29, 2006 No. 255?FZ.

The limitation of the period for payment of a certificate of incapacity for work to four consecutive months, but no more than five months in a calendar year, is established for persons who already have a disability group on the day of the onset of incapacity.

Thus, if an employee falls ill without being disabled, then temporary disability benefits are paid to him for the entire period of illness until the group is established.

After establishing the disability group (if he continues to work in the organization), when paying for certificates of incapacity for work, the accountant will have to apply the specified limitation - 4 months in a row, but no more than 5 months in a calendar year. Email Password is someone else's computer

PPT.RU - Power.

Right. Taxes. Business

- Made in St. Petersburg

© 1997 - 2021 PPT.RU Full or partial copying of materials is prohibited; with agreed copying, a link to the resource is required. Your personal data is processed on the site for the purpose of its functioning.

If you do not agree, please leave the site.

Briefly describe the essence of the error (for example: a typo) and click “Submit” Send Message sent. Thank you! cancellation Question to a lawyer Contact the editors Tweet +1 ! Class

Legal advice Help from experienced lawyers and attorneys Expert advice Solving accounting and legal issues in the professional community Best specialists More than one answer You can ask a question for free here and now Personal question from a private person (labor disputes, social services)

questions, etc.) Professional question from a lawyer / accountant / individual entrepreneur about legal activities. persons

Can a working pensioner be fired while on sick leave?

[Return] ✔ Payment of sick leave.

If the sick leave was opened before the employee was dismissed or was closed after the termination of the employment relationship, it must be paid. You can present sick leave for payment within 6 months.

[ Return ] ✔ Dismissal on the last day of sick leave On your own initiative, you have the right to resign on the last day of sick leave, but the law obliges you to notify your employer in writing of your upcoming dismissal two weeks in advance. The employer, in turn, cannot fire you at his own request; this is dictated by Art.

However, if the dismissal initiative comes from the employer and the employee falls ill on the day when the dismissal was planned, it can only be carried out after his recovery, since in such a situation the dismissal of an employee on sick leave is illegal.

Is sick leave paid for pensioners from January 2021?

In this regard, the legislation has undergone changes: previously, the amount depended on continuous work experience - working without breaks for more than two weeks.

For insurance coverage of less than 5 years, the benefit is 60% of average earnings, from 5 to 8 years – 80%, from eight years – 100%. Almost all cases of a person’s disability with the payment of benefits are compensated to the employer by the Social Insurance Fund.

Attention A person who falls ill within a month from the date of dismissal, but does not find another job, can apply for payment within a period of six months.

In this case, documents related to caring for children or elderly citizens are not considered.

If all the rules are followed, then the sick leave must be paid.

What is the maximum period of sick leave an employee can count on?

In case of complications, sick leave increases to 156 days.

Continuation is allowed. Caring for a disabled child under 15 years of age - maximum 120 calendar days per year. When caring for a child over 15 years of age, sick leave is given for a period of three to seven days. Read more about the sick leave limit for child care.

Sick leave is issued for the entire period of isolation established by the authorized bodies.

Sick leave is issued for a period of no more than 24 calendar days.

Payment of sick leave after voluntary dismissal in 2021

How is sick leave paid after dismissal, who should pay it, the amount and basic conditions for receiving it? These and some other questions may be of interest to many retired employees of an enterprise who, before taking a new job, managed to get sick. Sick leave after dismissal is paid if it is open within 30 calendar days from the date of dismissal. Any employee of a company that pays insurance premiums to the Federal Social Insurance Fund of the Russian Federation and, from this year, to the Federal Tax Service in case of temporary disability and in connection with maternity, can count on payment of their sick leave. At the same time, the following factors influence the amount of this benefit per year:.

WATCH THE VIDEO ON THE TOPIC: The dismissal date comes, and the employee is sick. What to do? — Elena A. Ponomareva

Housing subsidy 2. Social support for the population 3.

A dismissed employee is required to provide sick leave no later than 6 months after the occurrence of the insured event. Moreover, this case must occur no later than 30 calendar days after dismissal.

Work upon dismissal while on sick leave

If the work certificate is received before the expiration of two weeks from the date of termination of work indicated in the application, work is required.

It is possible to avoid work in accordance with Article 80 of the Labor Code of the Russian Federation under existing special circumstances, but documentary evidence will be required. For example, deterioration in health and the need to leave the region of residence as indicated by doctors, as well as a serious illness that interferes with the performance of official duties, if documented, are considered special circumstances.

How the law works

The law and its postulates apply in all cases except two circumstances:

- Dismissal due to liquidation of the organization.

- Dismissal due to staff reduction.

The fact is that dismissal for these reasons entails special financial responsibilities. One of them is payment of severance pay for three calendar months after the fact of dismissal.

The severance pay is actually equal to the average salary. And in our state there is no provision for receiving double payments: it will not be possible to work and “be sick” at the same time.

Thus, if a person receives temporary disability benefits, he will not be paid wages. And vice versa. These are mutually exclusive things. You can get one thing over the same period.

An employee has a new job

If a citizen of the Russian Federation managed to officially find a job in a short period of time, then he needs to contact a new employer. But there are situations when an employee stubbornly insists on compensation from the previous boss.

In this situation, the manager from his former place of work has the right to check the truth of his words: ask to see his work record book.

A former employee's child fell ill

The former employee’s incapacity for work is confirmed by a certificate of temporary incapacity for work. The same applies to diseases of minor children.

A sick leave certificate is issued at the discretion of the doctor, depending on the severity of the illness, to any of the parents or any of the guardians.

According to article five of Law 255-FZ, insured persons (all citizens of the Russian Federation) have the right to sick pay after dismissal in the following cases:

- Loss of incapacity for work of the former employee himself due to illness or injury.

- If it is necessary to care for one of the family members: an ordinary child under 14 years old, a disabled child, elderly parents.

- If there is quarantine in child care institutions (for children 7 years old and older).

- For prosthetics (installation of dentures, crowns by the insured person).

- If necessary, follow-up treatment in sanatorium-resort institutions on the direction of the attending physician (if there are certain diagnoses).

Thus, a certificate of incapacity for work is issued often, in the overwhelming majority of cases. The organization is obliged to pay sick leave for a child who was issued to a dismissed or other parent. But there are exceptions to every rule.

Thus, the document is not paid if the following circumstances occur (order of the Ministry of Health and Social Development of 2011 No. 624-n):

- When treating a child over 15 years of age, if he is in a medical inpatient facility.

- When treating a chronic patient, if he is in a period of remission (recovery).

- While on parental leave.

- While on maternity leave.

- When signing an order for annual leave, leave without pay.

- When doing work from home, part-time.

How will pensions be indexed for retired pensioners?

Although there is no information in the current legislation that would give the right to dismiss a pensioner in 2021 due to reaching the appropriate age, there are additional options with which you can end the employee’s career. Permitted ways to terminate a contract with a pensioner include:

Rules and procedures for applying for sick leave after dismissal

The first two reasons are the most common. If it is necessary to fire an employee or terminate a business relationship with him due to the liquidation of the company, the HR department must warn the employee about this several months in advance. Termination of a redundancy contract involves a change in the established schedule of the organization, where the previous position will now be lost. The employer must be aware that staff reduction cannot be accepted as a method of dismissing people of retirement age from the enterprise. As a result, you may be brought to administrative liability for this.

- the certificate of incapacity for work has been submitted to the previous employer within six months from the date of dismissal;

- a person who left the company’s employees did not get a job as a specialist in another company, did not become an individual entrepreneur, or did not register with the employment service;

- The certificate of incapacity for work was issued not in connection with the personal illness of the former employee, but to care for a loved one - sick leave for caring for a sick family member, including children, cannot be paid.

- A copy of the passport of a citizen of the Russian Federation.

- Sick leave with a doctor's signature.

- A photocopy of the work record book - it is necessary as proof that the person did not find a new job during this period and did not get a job.

Is sick leave included in the pay off upon dismissal?

It does not matter in what form the patient received treatment: outpatient

(i.e., periodically visiting a doctor and following his instructions at home) or

inpatient

(direct stay in the hospital) - payment of sick leave after dismissal if the above conditions are met must be made.

It seems that this employee is also not doing it very well (almost like the pregnant lady in the previous paragraph, but there are different life situations. By the way, if someone who was fired of his own free will continues to be ill for a long time during sick leave and receives several sick leaves that are not interrupted by date, they are still paid for by the former employer.

The question of paying sick leave after actual dismissal is of interest not only to employees, but also to many employers. This is because the calculation is often made after the employee has returned from sick leave.

Payment of sick leave to a pensioner

Lots of information on paying for sick people during service, before leaving. What is the correct way to pay sick leave within a month from the date of dismissal? After dismissal from the internal affairs department on November 30, 2021, I from 02/2 to 21/02/2021

We recommend reading: Queue for a Social Voucher in Moscow

9. I served in the federal fire service for 20 years and retired on length of service on 10/31/2021, and from 11/01/2021, I got a job at the State Public Institution “Mosoblpozhspas” as a fire equipment driver. From 02/18/2021 to 03/03/2021 I was on sick leave. I was paid sick leave at the minimum wage, does this comply with the legislation of the Russian Federation?