The essence of the legislative act

From 2021, increases in benefits occur only for non-working pensioners and amount to a percentage close in size to inflation:

- 2016 - 4%;

- 2017 - 5.8%;

- 2018 - 3.7%;

- 2019 - 7.05%;

- 2020 - 6.6%.

If you add up all the values over 5 years, you get 27.15% of the bonuses that were not accrued to citizens who continue to work. The state froze this money until the dismissal. The Pension Fund indexes payments upon receipt of confirmation of termination of the employment contract.

Recalculation frequency

Pension recalculation after dismissal is done once a year on August 1. Increased benefits have been issued since January. An extraordinary review is carried out if:

- increased the IPC for the period before the beginning of 2015 due to the inclusion of non-insurance periods in the calculation;

- there are unaccounted contributions from a citizen who saved from his earnings while employed in another country;

- assigned a disability group;

- dependents appeared;

- established a regional coefficient.

What affects the indexing size?

The amount of additional payment after dismissal depends on the level of inflation for previous periods. Both the fixed rate and the insurance share should be reconsidered. Let us remind you what is taken into account when determining the insurance rate:

- mandatory payments that are concentrated on the personal account of each payer;

- total length of service, taking into account insurance and non-insurance stages;

- number of points;

- the cost of one point in a specific period;

- personal coefficient and its value;

- maximum standard

Important!

The annual calculation coefficient cannot be higher than 3.0. The maximum amount of additional payment in 2021 is 250 rubles within the established standards.

Resumption of indexation upon dismissal

Due to the law adopted in 2021, the indexation of payments was frozen. While a citizen is working, the size of the pension does not change. As soon as he resigns, the state issues an increase for 5 years.

Deadlines for receiving the new amount

The procedure for recalculating benefits takes several months. This is due to the scheme for the pension fund to receive documents confirming dismissal. Therefore, it is necessary to take into account the employer’s reporting deadlines and all processes for making changes.

Actions for a pensioner to receive indexation:

- December - writing a letter of resignation;

- January - the employer will transfer information for the last month to the Pension Fund, but the citizen is still documented to be employed;

- February - the organization submits documents to the state for January, where this person does not appear, and a recalculation is launched;

- March - within a month, the Pension Fund calculates a new benefit, including interest for past years;

- April - a person receives an increased pension and a shortened amount for the quarter during which he did not work.

Thus, a new benefit after dismissal can be received after 90 days.

Is it necessary to contact the Pension Fund after dismissal?

From the second quarter of 2021, employers provide monthly simplified reporting for each employee, and the tax service informs the fund about the termination of activities of self-employed pensioners; based on this data, pensions for working pensioners are indexed after dismissal. A citizen has the right to independently provide data on the basis of which the pension will be indexed, but a personal visit to the territorial Pension Fund with an application for recalculation is not mandatory.

Increasing the pension amount

A pensioner, upon resigning, receives all indexation payments for 5 years, which is about 22%. The government increases the payment once a year by the inflation rate.

Indexing process

The increase procedure is regulated by Federal Law No. 400-FZ “On Insurance Pensions”. The resolution on the increase is adopted by the Government of the Russian Federation.

The basic and insurance components of pensions are increasing.

What factors influence the amount

The amount of the pension is affected by:

- index date;

- increase percentage;

- basic payment in state currency;

- assessment of the pension coefficient in rubles.

Calculation of the amount after dismissal

Accurate data is provided by the Pension Fund through its own website or government services portal. But you can calculate it yourself.

Citizens who became pensioners before 2021 missed 6 stages of increase:

| Month and year of indexation | % increase | Amount of stable payment, rub. | IPC, rub. |

| February 2021 | 1,04 | 4558,93 | 74,27 |

| February 2021 | 1,054 | 4805,11 | 78,28 |

| April 2021 | 1,004 | 4805,11 | 78,58 |

| January 2021 | 1,037 | 4982,90 | 81,49 |

| January 2021 | 1,0705 | 5334,19 | 87,24 |

| January 2021 | 1,066 | 5686,25 | 93 |

To calculate the amount of additional payments after the end of employment, it is necessary to take into account all increases over the past period. Calculation using the example of a pension equal to 11,524 rubles. 59 kopecks (100 IPC for 71.41 rubles and a fixed component of 4383.59 rubles):

- insurance part - 71.41 * 1.04 * 1.054 * 1.004 * 1.037 * 1.0705 * 1.066 = 9300 rubles;

- fixed - 4383.59**1.054*1.037*1.0705*1.066=5686.25 rub.;

- IPC amendment - 3 points for 3 years multiplied by 93 rubles = 837 rubles;

- we add up the calculated amounts and get the amount of the updated payment 15823.25 rubles.

Example of pension indexation

Since January 1, 2021, pensions have increased by 6.6%. The size of the increase takes into account the ratio of pension income in 2021 and the cost of living for this category:

- higher - the premium will be 6.6%;

- lower - 6.6% and last year's additional payment is added to the minimum pension.

What is the essence of the process

In 2021, it was decided to suspend the indexation of pensions for citizens who continue to work upon reaching retirement age.

The measures taken should significantly save budget funds - while the pensioner is working. If he quits, he receives an indexed pension with compensation for months of employment.

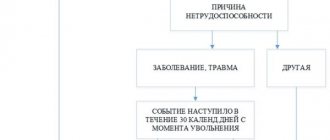

The increased pension will be accrued after 30 days, counted from the first month following the month in which the employment relationship was terminated.

That is, if a person quit on September 5, then accrual will be made only in November. Accordingly, it is more profitable to stop working on the last day of the month, so that the countdown starts from the 1st day of the next month.

The resolution on the adoption of this procedure was signed by the President in July 2021; in 2021 this is the current law.

How much does a working pensioner lose now?

In 2021 alone, the retiree lost a 6.6% increase. With a benefit of 15 thousand rubles, the additional payment was 990 rubles. And per year the amount is 11,880 rubles.

The average income of an elderly Russian in 2015 was 12,500 rubles. Calculation for the entire period of validity of the moratorium on increasing payments to pensioners who continue to work:

| Year | Indexation size, % | Average pension per month, rub. | Losses per year, rub. |

| 2016 | 4 | 13000 | 6000 |

| 2017 | 5,4 | 13702 | 8424 |

| 2018 | 3,7 | 14208 | 6084 |

| 2019 | 7,05 | 15209 | 12019 |

| 2020 | 6,6 | 16212 | 12045 |

Losses over 5 years amount to 44,572 rubles.

When will it be possible to get a job again?

A citizen who quits his job can return after 1 calendar month. If you terminate your employment contract in December, you can get a job back in February.

Will indexing disappear?

The indexed payment amount will remain after employment. If a person wants to see a raise in January 2021, he must leave his job in December 2021.

In April 2021, the citizen will be given a pension increased by 6.3% and an allowance not received in the first 3 months of the year.

Nuances of pension recalculation

The Pension Fund recalculates payments when:

- a person reaches the age of 80;

- the medical commission assigns a different disability group.

When recalculating for employed pensioners, the following are taken into account:

- profit from investments of pension savings;

- funds received that were not taken into account in the previous calculation.

Declaratory recount is used in the following cases:

- occurrence of dependent persons;

- stay in the regions of the Far North and similar territories;

- accumulation of work experience in areas with unfavorable climatic conditions.

After the 2015 pension reform, the state provides an elderly person with the right to recalculation with the addition of non-insurance length of service, including:

- maternity leave;

- time in service in the RF Armed Forces;

- caring for a disabled person of group I, a child with disabilities or a relative who has reached 80 years of age;

- stay of wives/husbands of military personnel in military service in places with no likelihood of employment;

- the presence abroad of spouses of employees sent abroad for official reasons;

- suspension of participation in the work process due to criminal prosecution, as a result of those rehabilitated;

- military service during a period when compulsory pension insurance did not apply to this category of citizens.

List of documents for the Pension Fund

When submitting an application, the interested party provides:

- identity document - passport of a citizen of the Russian Federation, international passport, service document of a citizen of the Russian Federation, diplomatic passport, etc.;

- papers and certificates proving non-insurance periods of time included in the insurance period, if they are not in the pension recipient’s payment file - birth certificate of children, etc.

Sample application and its submission

The application can be submitted in person by coming to a branch of the Russian Pension Fund or remotely through the State Services website.

Application form:

How it works

If a pensioner does not have the opportunity to send an application to the territorial office of the Pension Fund of the Russian Federation that makes social payments, it is permissible to come to any branch. In addition, you can send an application through the official website. When registering remotely, the citizen is required to provide papers within 5 days.

The recalculation of the fixed payment amount must take place from the 1st day of the month following the submission of papers.

How long will it take for indexation to be received if documents are submitted late?

If the documents are not provided within 5 days, the Pension Fund does not consider the submitted application.

After receiving the full package of papers, the pension fund has 5 days to respond and notify the applicant. In case of a negative decision, the employee of the institution is obliged to justify the reason for such a conclusion. A pensioner can challenge an illegal refusal in court.

Responsibility for delay

From the moment of requesting additional information or documents from a government agency, as well as if there are errors in the execution or inconsistency of certificates, the applicant has 5 days. In case of failure to comply with the requirement, the fine is 1 thousand rubles.

Will pensions for working people be abolished altogether?

The issue of abolishing pensions is being discussed by the Government of the Russian Federation. 32% of the population is over 60 years old, and income from employed citizens does not cover the Pension Fund budget deficit.

The State Duma is considering options:

- abolition of labor pensions and provision of targeted assistance to those in need;

- abolition of social benefits for working elderly citizens, proposed in 2021 by the Ministry of Finance;

- termination of special calculation of pensions for military personnel;

- raising the retirement age;

- increase in payments to the Pension Fund from the economically active population from 22% to 40%.

From 2021, the state has increased the retirement age by 5 years. Other measures have not yet been taken by the government.

Recalculation of pension after termination of work

The pension increase after the pensioner stops working is carried out automatically - the citizen does not have to send a corresponding application to the Pension Fund with a request to recalculate the amount of the payment. After the recalculation all indexations carried out by the state during the period of a citizen’s work after retirement will be reviewed, as well as contributions to the pension fund, new values of pension points received for transfers during the last work, and their current value. If necessary, the payment amount will be increased to the subsistence level.

If a pensioner, after dismissal and indexation, decides to go back to work, a reduction to the previous level is not provided . Such citizens will not lose anything, since the size of the insurance pension does not change, and the amount that is added will not be taken away.

When a person who has reached the age of incapacity for work decides to resign, he is required to notify the territorial office of the Pension Fund about this. This responsibility of a citizen is described in Federal Law No. 400. At the same time, the pensioner’s independent decision to resign and notification of the Pension Fund of the Russian Federation do not in any way affect the timing of payment processing.

After consideration of the submitted application, the reporting citizen will begin to receive an indexed pension next month.

It is recommended to adhere to the following rules when dismissing:

- It is best to submit the application to the Pension Fund on the last calendar day of the month, as this will allow you to apply a multiplying factor when calculating the payment from the next day

- To receive the indexation of 6.6% planned for January 2021, it is important to take into account that the pensioner was officially dismissed on the first day of the new year.

Will indexing be returned?

In recent years, benefits have been increasing only for unemployed elderly citizens. The news reports the likelihood of unfreezing the indexation of payments to employed pensioners next year. No final decision has been made. But from July 1, 2021, this category of citizens will receive an increase when taken under guardianship:

- their own grandchildren if their father and mother died or were deprived of parental rights;

- adopted children;

- disabled children.

There is no final answer to the question of accruing a 6.3% increase to working pensioners in January 2021. A proven way to get indexation is to quit your job in December and get a job again in February.

Are there additional payments up to the cost of living?

Additional payments and social increases to pensions are paid to people whose income is less than the minimum subsistence level (SL) established in a specific region of the Russian Federation. unemployed persons are entitled to them ; they are paid extra as long as the pension is issued at the same level, that is, does not exceed the amount of the monthly minimum. It follows from this that pensioners engaged in working activities do not have the right to receive additional payments from the state budget.

The only additional payment, the right to which working pensioners retain, is the annual one-time benefit introduced in 2021. As of 2021, its size is 5,000 rubles. It is paid to every person who has reached retirement age.