24.09.2019

0

32

6 min.

A person's incapacity is his inability to earn money on his own, exercise his rights and fulfill his civic duty. This condition is associated with two main factors: serious pathology or age. And if in the first case the subordinate is forcibly removed from official duties, then dismissal due to retirement most often occurs on the initiative of the worker himself. We will find out exactly how from the article below.

Do I have to pay on my own?

The arrival of retirement age is a legal basis for taking a well-deserved rest. However, there is no requirement in current legislation that a retired employee must resign.

Thus, if the employee reaches retirement age, he has every right to continue working . Moreover, he can work as long as he is able to perform his functional duties in full.

Employers should be aware that they cannot forcibly dismiss an employee of retirement age. This is contrary to labor law and may entail administrative liability.

Some features

Civil dismissal at one's own request for retirement is an identical procedure for all areas of activity, both government and commercial.

However, a number of labor relations fall outside the general norms:

- the transition to pensioner status of law enforcement officers, security agencies, and military departments occurs using separate rules determined by the ministries of these institutions;

- settlement with retired hired workers, when the employer is an ordinary person, consists, in fact, of simply leaving work, since there can be no official relationship, other than a semi-symbolic agreement, with a non-legal entity.

Another non-standard point is to go through the procedure again when someone who has already left somehow returns to the ranks of the workers, and then wants to pay back again. The practice is that in this case it is not prohibited to formalize the resignation both as a regular dismissal and as another departure for a well-deserved rest. There are no specific instructions in this regard in the law.

The following situation is that a potential pensioner works at two enterprises, but wants to apply for a pension only at one of them. There are no special provisions for such a case; the candidate calmly resigns in the prescribed manner where he wants to do this, and continues his work activity where he wants to stay.

When can you quit: grounds and reasons

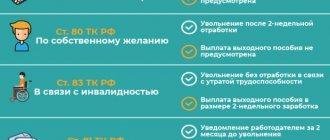

In Art. 77 of the Labor Code of the Russian Federation provides a general list of grounds for dismissing employees from their positions. However, there are only two legal grounds for terminating an employment contract due to retirement. This includes the following:

- Personal initiative of the employee (clause 3, part 1, article 77) - in this case, dismissal is made on the basis of a statement of resignation due to age, written by the pensioner himself.

- Agreement of the parties (clause 1, part 1, article 77) - with this option, an agreement is concluded between the employer and the pensioner, which sets out the individual conditions for terminating the employment contract.

In all other situations, the company management must have legal grounds for dismissing a pensioner, regardless of his will. Eg:

- violation of labor discipline;

- reduction of staff or personnel;

- Liquidation of company;

- the occurrence of circumstances beyond the control of the parties to the employment contract, etc.

Privileges and restrictions

In Russia, there are 2 deviations from the general age threshold for a number of categories of citizens:

- Early retirement is allowed.

- It is not permissible to hold a position after reaching certain years under any circumstances.

The first category includes:

- combatants with disabilities received during combat;

- specialists from the Far North;

- mothers with 5 or more children;

- parents of a child with disabilities;

- those suffering from rare diseases;

- miners, underground workers;

- military personnel;

- doctors, teachers;

- classical ballet dancers;

- flight attendants;

- laid off 2 years before the key age.

Second category:

- civil servants cannot remain in office after 60 years, with the consent of management - 65 years;

- teaching staff - the deadline for teachers is 70, the rector's office is 65 years;

- military - each rank has its own threshold - from 50 to 65 years.

Today, proper retirement from work due to age is the key to a quiet life on an honestly earned salary. Therefore, you need to take care of this as early as possible.

If you find an error, please select a piece of text and press Ctrl+Enter.

Didn't find the answer to your question? Find out how to solve exactly your problem - fill out the form below or call right now: +7 (ext. 692) (Moscow) +7 (ext. 610) (St. Petersburg) +8 (ext. 926) (Russia) It's fast and free!

How many times can a pensioner resign?

To begin with, it is necessary to emphasize that a citizen can acquire the right to receive a pension, as well as the pensioner status itself, only once in his life. In this regard, you can quit your job due to retirement only once.

From the above, it follows that if the work book already contains an entry about dismissal due to retirement, then a working pensioner will not be able to terminate the employment contract a second time for a similar reason. In the future, the basis for leaving will be only the employee’s own desire.

Mandatory base

Any dismissal due to old age in the Fatherland is controlled by two laws of the Russian Federation:

- “On state pension provision”;

- “On labor pensions in the Russian Federation.”

Laws today are constantly under the close attention of people’s representatives, who are thinking about their fundamental changes. As of 2021, the established rules are still in effect:

- women have the right to retire at the age of 55;

- men - from 60.

Important! In June 2021, a new procedure and stages for increasing the retirement age were approved. The increase will be gradual, the increase schedule is explained in more detail in the video below.

What the reform offers:

- increase the minimum threshold for receiving maintenance by age for women under 60 years of age;

- for men - up to 65 years.

The reform has been approved, but many questions remain that will be clarified and clarified in the near future. In any case, the legal basis determining dismissal upon retirement due to old age remains in the 2 above-mentioned laws.

How to do it right: nuances

The general procedure for voluntary dismissal, including leaving for legal rest, is described in Art. 80 Labor Code of the Russian Federation . This is quite simple to do, but it is necessary to take into account all the rules and nuances outlined in the current legislation.

How to apply?

The employee only needs to prepare a statement of resignation from his position at his own request. At the same time, it must be clarified that the reason for such a decision is retirement. This document is prepared in writing addressed to the head of the organization. There is no single template, so an application is drawn up in any form.

The following information must be included in your resignation letter due to retirement:

- Introductory part - here the name of the employing company, the full name of its director and information about the resigning person are indicated (full name, position, name of the department in which he works).

- The main part - this section expresses a request for voluntary dismissal in connection with retirement. The employee must also indicate the exact date of departure from the organization.

- Finally, the employee’s signature and the date the application was written are affixed.

The completed document must be handed over to the HR department or handed over to the head of the company. In turn, on the part of the employer, the fact of dismissal of an employee due to retirement is formalized by an appropriate order.

What documents are needed?

To complete the entire process of dismissal due to retirement, the employer will need the following basic documents:

- a written statement written by an employee who has reached retirement age;

- an order to terminate the employment contract, prepared in Form No. T-8 (it is also possible to use your own template for this document);

- personal card (form No. T-2) – it must contain a record of the employee’s dismissal;

- settlement note - this document details all the amounts that must be paid to the departing employee;

- agreement on termination of the employment contract - prepared in the case when the dismissal is carried out according to an agreement reached between the employer and the retiring employee;

- employee’s work book – it contains a record of the date, reason and basis for termination of the employment relationship;

- documents issued to the employee in person - in addition to the work book, this includes extracts from the forms SZV-M, SZV-STAZH, calculation of insurance premiums (section 3), form 2-NDFL and other papers related to the employee’s work activity that are issued according to his statement.

An employer should be extremely careful when documenting the fact of termination of an employment contract. If even one violation is committed, such dismissal may be considered illegal.

Order

In general, the procedure for dismissing an employee into retirement includes the following algorithm of actions:

- First of all, a person who wants to leave the organization must prepare a written statement of resignation of his own free will in connection with the onset of retirement age.

- The completed application must be submitted to the head of the company where the specific employee works. This can be done through the HR department or by handing the application to the employer in person.

- The next step is to prepare a formal order to terminate the employment contract due to the employee’s retirement.

- Next, employees of the accounting department and human resources department must document this procedure. This includes making an entry in a personal card, preparing a settlement note and other documents.

- Then, all payments due to him by law must be made in favor of the pensioner. Money can be issued in person or transferred to a bank card (currently, most organizations operate cashless payments).

- On the last working day, a retiring employee must be issued a work book containing a record that the employment contract has been terminated and he was dismissed at his own request, and other documents listed in the law.

It is also worth emphasizing that the date of dismissal will be considered the last working day of the departing employee.

What guarantees and benefits do they provide?

In general, we can list the following main types of guarantees and benefits provided for retiring pensioners:

- they can leave their position only at their own request or on the basis of an agreement concluded with the employer (except for cases when it comes to staff reduction, violation of labor discipline, etc.);

- pensioners are exempt from the two-week work period provided for in Part 1 of Art. 80 Labor Code of the Russian Federation;

- Dismissal due to retirement is not an obstacle to further employment.

Additional payments in connection with retirement are not provided for in the Labor Code of the Russian Federation, but they can be prescribed in local acts of the organization.

What payments are available?

When calculating on a general basis (optional), the employee is charged:

- unpaid wages up to this point;

- compensation payments for unused vacation days (178th article of the Labor Code);

- bonus payments, if any.

Persons with disabilities are additionally paid severance pay accrued for two working weeks in the amount of the average salary.

Is work required when leaving on the employee’s initiative?

Usually, before finally leaving the organization, an employee is required to work in it for another 2 weeks (Part 1 of Article 80 of the Labor Code of the Russian Federation). However, this rule does not apply to persons who are forced to stop working. However, the law lists several similar situations. These include:

- admission to an educational institution;

- conscription into the army;

- retirement, etc.

Thus, an employee resigning due to retirement has every right not to work for another two weeks. In this case, the employer is obliged to terminate the employment contract on the date specified in the application.

In order to avoid service, the pensioner must indicate in his application that the reason for leaving is retirement.

When does the settlement take place?

In accordance with the provisions of Art. 140 of the Labor Code of the Russian Federation, upon dismissal, full payment must be made on the last day , that is, on the day of termination of the employment contract. Moreover, if the employee was not at work, then the money must be paid to him the next day after the organization receives a request for payment.

Article 140 of the Labor Code of the Russian Federation. Payment terms upon dismissal

Upon termination of the employment contract, payment of all amounts due to the employee from the employer is made on the day the employee is dismissed. If the employee did not work on the day of dismissal, then the corresponding amounts must be paid no later than the next day after the dismissed employee submits a request for payment.

In the event of a dispute about the amount of amounts due to the employee upon dismissal, the employer is obliged to pay the amount not disputed by him within the period specified in this article.

It is also worth emphasizing that for employees resigning due to retirement, no additional monetary compensation or benefits are provided. The calculation is made in accordance with the generally established procedure.

Thus, a pensioner who wants to resign from his position on his own can count on the following basic payments:

- the balance of wages for the period of time that he managed to work before the day of termination of the employment contract;

- monetary compensation for annual paid leave that was not taken.

The latter type of payment is not provided in the case when the pensioner wishes to go on vacation with subsequent dismissal. In such a situation, he will only be paid wages for the time worked.

Additional benefits and compensation may be paid in the case when the dismissal of a pensioner is made by agreement of the parties, or if the local acts of the organization provide for such payments.

Thus, a pensioner can leave his position only of his own free will or by agreement concluded with the employer. At the same time, he will not have to work for another 2 weeks before submitting an application. Otherwise, the dismissal procedure is carried out in accordance with the generally established procedure.

Dismissal of a pensioner due to staff reduction

In many enterprises, it is working pensioners who are subject to staff reductions. The dismissal procedure is carried out on a general basis.

The following procedure is provided:

- the employee must be warned by the employer two months in advance;

- an order is issued in the organization;

- Changes are being made to the staffing table.

Actions aimed at the possibility of “getting rid of” pensioners through staff reduction are illegal unless one of the following conditions is met.

Procedure for reducing the number or staff of employees:

1) the employer is obliged to inform the employment service about the upcoming layoff:

- 2 months – employer-organization;

- 2 weeks in advance – employer – individual entrepreneur;

2) the employer is obliged to identify persons who are prohibited from dismissal due to a reduction in numbers or staff.

The schedule must be changed: the position occupied by the pensioner is reduced.

Sometimes, in an employment contract, the employer prescribes benefits for pensioners if they have worked at a given enterprise for more than 20-25 years. Basically, this is the advantage of staying in a job when downsizing. At the same time, this is still not the employer’s obligation, but his right. However, the employer is obliged to respect this right if this condition was stated in the employment contract.

Important:

- the employer may offer the pensioner a position that is not subject to reduction;

- the basis for termination of the employment relationship may be the pensioner’s refusal of the position offered to him;

- the offer of a position and its refusal must be recorded in writing;

In case of staff reduction, the pensioner has the right to receive all benefits and compensations provided for by the Labor Code of the Russian Federation:

- wage;

- compensation for unused vacation;

- benefits for the first two months after dismissal;

- additional benefits are at the discretion of the employer.