Home / Labor Law / Payment and Benefits / Compensation

Back

Published: March 18, 2016

Reading time: 6 min

0

2624

The dismissal of a pensioner related to staff reduction is no different from the dismissal of any other employee. Pensioners do not have any advantages in this situation - dismissal will be carried out on the basis of the general procedure in force at the enterprise or in a specific organization .

Management's actions in this case, justified by legal norms, should include only two stages - the offer of a vacancy and, in the event of a refusal from the employee, formalization of dismissal.

According to the law, compensation upon dismissal for pensioners in case of staff reduction will be the same as for a regular laid-off employee. The amount of payments will include the average salary for the last two months and severance pay.

- The legislative framework

- What payments are due?

- How to file a resignation?

Regulation by law

Previously, in legal terms, rules were adopted that allowed the dismissal of a citizen upon reaching retirement age. However, since 1992, entry into venerable years cannot be used as a reason for dismissal of a citizen due to reduction (although this does not apply to some professional categories). A certain part of the bosses, when dismissing a number of employees, adheres to the fact that citizens of retirement age are relatively protected in legal terms when compared with other people (since they have a slightly different type of income). However, this contradicts legislative norms and can be understood as a discrepancy with the principle of equal rights and opportunities for employees (part one of the second article of the Labor Code) and an infringement of certain categories of citizens (third article of the Labor Code).

Dismissing a citizen of retirement age due to staff reduction (as well as other groups of employees) is permissible only when it is not possible to allow him to continue to perform his job duties. In other words, the company cannot provide a person with a suitable position that matches his professional skills, salary level, and health status.

Note ! _ Another option is the pensioner’s independent refusal to continue working. Before dismissing a citizen of retirement age due to reduction, he must be informed of all possible outcomes.

Article 3 of the Labor Code of the Russian Federation

Based on the first part of Article 179 of the Labor Code of the Russian Federation, pensioners may have some privileges during layoffs, since they usually have greater qualifications compared to other employees.

The protection of employees of retirement age of the social plan is specified in the Labor Code of the Russian Federation. If an employer is going to ask a pensioner to vacate his job, he must study Article 81 “Termination of an employment contract at the initiative of the employer,” which discusses all permissible conditions:

- destruction of the organization;

- reduction in the number of employees due to economic problems;

- low qualification of the employee;

- new management of the company;

- presence of disciplinary sanctions;

- absenteeism;

- showing up at work while drunk;

- committing legal violations at work;

- disclosure of corporate data considered secret.

As you can see, retirement age is not included in the list of reasons, so using this reason to dismiss an employee is unacceptable and is a violation of the law.

Excerpt from Article 81 of the Labor Code of the Russian Federation

Note ! _ When the number of employees is reduced for objective reasons, then general rules apply to retirees, on the basis of which the reorganization is carried out.

Most of the important information is found in Chapter 27 of the Labor Code of our country. The title is as follows: “Guarantees and compensation for employees who are faced with termination of the contract.” It contains several small articles - 178, 179, 180, 181. Having studied the presented text, it is impossible to note any striking differences between the dismissal of a pensioner and other categories of citizens. Thus, the rights of citizens of retirement age are similar to the rights of employees of other ages.

Article 178 talks about severance pay paid after leaving the workplace. Based on the Labor Code, it amounts to one salary and is issued within a couple of months. This period is counted from the moment you leave work. Note that if an employee contacted the Employment Center less than two weeks after leaving his job and they could not help him find a new job, then he may receive severance pay for a month more.

Article 178 of the Labor Code of the Russian Federation

Touching upon practice, we can say that court verdicts vary. The reason is that the Labor Code of the specified chapter does not write whether it is necessary to equate an unemployed person after dismissal due to reduction to a person who is unemployed but receiving pension payments.

Note ! _ Logically, we can conclude that these categories of citizens have nothing in common. However, there are situations when applicants sought to provide them with severance pay from their superiors for three months precisely on the basis of omissions in the Code. True, such cases are rare. This problem is still very acute, causing a lot of controversy.

In case of early dismissal, the pensioner is not required to work

The redundant employee does not have an obligation to his employer to provide the required service under other dismissal options. The period of mandatory work before layoff, which is usually two weeks for a person who has fulfilled all the terms of the employment contract, according to the current legislation of our country, is automatically canceled.

Rights of an employed pensioner

A working citizen of retirement age, based on labor laws, is no different from an ordinary employee, who is subject to absolutely all labor rules.

The rights of an employed pensioner are equal to the rights of other employees. Please note that working pensioners are entitled to some privileges:

- The Labor Code does not allow discrimination against an employee based on his age. Thus, a pensioner cannot be fired or not hired because of his status.

- Often, citizens of retirement age have more experience and qualifications. If layoffs are planned due to staff reduction, it is natural that more qualified workers have an advantage over others.

- Management must provide a working citizen of retirement age with an extraordinary leave of two weeks. The salary does not remain with him.

- If a pensioner wants to leave his job of his own free will, he is not required to work for the mandatory two weeks.

Working pensioners have some privileges

Does the law allow the dismissal of a pensioner due to staff reduction?

The Labor Code prohibits discrimination based on age and health status, including against pensioners. Professional and business qualities are the only basis for starting and terminating an employment relationship (Part 2, Article 3 of the Labor Code).

IMPORTANT!

There is an exception for the bulk of civil servants: reaching 65 years of age (the maximum age for service) is grounds for dismissal (Part 2 of Article 79 of the Federal Law of July 27, 2004).

Working pensioners do not enjoy any benefits, since they are not listed in the category of beneficiaries (Part 2 of Article 179 of the Labor Code), which include:

- having two or more dependents;

- the only breadwinner in the family;

- received an occupational disease or injury from this employer;

- disabled people of the Great Patriotic War and combat operations;

- improving their qualifications in the field without interruption from production.

You cannot fire an employee who is on vacation or sick leave (Article 81 of the Labor Code). The dismissal of pensioners due to staff reduction occurs according to the general rules (Part 1 of Article 179 of the Labor Code), and there is no reason to doubt whether a pensioner is entitled to severance pay upon dismissal: this category of employees has the right to payment. The procedure for terminating a contract with pensioners is regulated by Articles 179, 180 of the Labor Code. To do everything correctly, you should perform the following basic steps:

| Notify individually against signature at least 2 months before the date of proposed dismissal. | Part 2 Art. 180 TK |

| Offer internal employment options. | Part 2 Art. 180 TK |

| With the consent of the employee, terminate the employment contract with him ahead of schedule - before the expiration of 2 months. | Part 3 Art. 180 |

Warn the employment center about the upcoming layoff of workers:

| clause 2 art. 25 FZ-1032-1 dated 04/19/1991 |

| Pay all amounts due upon settlement and compensation. | Part 1 Art. 178 TK |

IMPORTANT!

Pensioners are assigned an old-age or long-service pension; unemployment benefits are not paid to pensioners who are laid off. According to paragraph 2 of Art. 3 Federal Law-1032-1 dated April 19, 1991, they do not receive unemployed status.

The procedure for dismissing a pensioner at his request

If a citizen of retirement age decides to resign on his own, then the process follows the general rules on the basis of a corresponding application. The employee does not have to state the reasons for such a decision, as for any application of his own free will. The words “due to retirement” are incorrect and contrary to the law, because reaching retirement age and dismissal cannot be interconnected.

Note ! _ In the application, you will still have to write that the resigning employee is a pensioner, exempt from the need to work for the mandatory two weeks based on the eightieth article of the Labor Code.

Example of a resignation letter

Sometimes the reason for leaving work may be written down in the work book in the following form (this is not necessary): “Dismissed at his own request due to retirement age/retirement.”

The procedure for laying off a working citizen of retirement age:

- When a decision has been made to fire a certain number of employees, management must issue an order to create a reduction commission.

- Having received the corresponding conclusion from the commission, the director makes an order to destroy the rates, indicating the reasons for this decision, and to dismiss the employees working at this place - by name.

- If you plan to reduce the number of employees, you must send a written notice to the employment service and the organization’s trade union three months in advance.

- The notice period for employees is two months, and they must also be presented with job options.

- When citizens of retirement age are included in the list of dismissed workers, they are entitled to certain compensation.

Before dismissing a pensioner, the employer is obliged to provide him with alternative positions at the same enterprise

Before dismissing a retiree, the boss should familiarize him with the options for maintaining employment in the company. The new workplace must meet the requirements of the pensioner: match his education, his working skills, and the salary must be at the level of the previous one. A person may well not accept this offer and look for a new job without waiting until two months have passed.

Note ! _ The volume of payments remains at the same level.

Early dismissal of a pensioner due to staff reductions

Based on the same legal act, the employer, warning the employee about his decision to terminate all possible employment relationships with him, can include in this warning a proposal for this employee, consisting of early dismissal. Naturally, in order for the employer to exercise this right, all the required guarantees prescribed in the Labor Code of the Russian Federation must be observed on his part in relation to the dismissed employee.

To carry out this simple event, all necessary conditions provided for by the current legislation of our state must also be met. This means that the initiator of the early termination of the employment agreement and all labor relations accompanying this agreement must be the employer, and not the employee who has been laid off. The employee, in turn, is obliged to express in writing his agreement with this fact in the current situation.

In a situation where the end of the notice period has not yet arrived, but the employee has already found a new job, he is obliged to inform his current superiors in writing about his intention to terminate the employment agreement. If all of the above conditions are met, the employer has every right to early terminate all employment relationships with this employee.

Payment terms

Time periods set for payments due to pensioners laid off due to staff reduction:

- severance pay is provided on the date of dismissal;

- compensation for finding a new job is paid within two months (every month);

- Payments for the third month of job search can be provided based on official paper issued at the employment center.

If a pensioner has not found a job while registered with the Central Employment Service, he will be paid benefits for the third month

Is it possible to appeal a dismissal order?

A pensioner, like any other specialist, has the right to appeal an order if the employer violates the procedure. Among the most common reasons for dismissal to be considered illegal are:

- notification deadlines were violated;

- all available vacancies were not offered;

- the union was not notified and its written position regarding the union members was not received;

- staff reduction actually covered up the need to fire specific individuals;

- the employer did not take into account the requirement for a preferential right to continue working in this organization or with an individual entrepreneur.

In practice, there may be other grounds that are provided to a dismissed person to be reinstated at work and receive compensation for the period of forced absence.

Severance pay for the third month after the pensioner was laid off

A citizen of retirement age dismissed on the basis of reduction has the right to receive compensation in the amount of average monthly earnings for the third month after dismissal if a list of such conditions is met (part two of Article 178 of the Labor Code, letter of the Ministry of Finance of Russia dated March 15, 2006 No. 03-03-04 /1/234):

- this employee must register with the employment service within two weeks from the date of dismissal;

- this employee was unable to get a new job three months after dismissal;

- there is a decision from the employment service to maintain average earnings for the third month.

Note ! _ Payments to a person of retirement age do not eliminate the impact of the rules prescribed in the Labor Code concerning this category of citizens in terms of retaining their average monthly earnings, including in the third month after leaving the workplace, if the case fits the criteria prescribed above (definition Krasnodar Regional Court dated September 27, 2012 in case number 33-19551/2012).

Excerpt from Article 178 of the Labor Code of the Russian Federation

There is an assumption that providing a person with old-age pension payments is grounds for refusing to pay him compensation for the third month after dismissal. However, the courts call this opinion erroneous, because if a person is not recognized as unemployed (and a retired citizen cannot be recognized as such, because he has money to live on), this does not prevent the employment center from satisfying his application for a suitable job (based on the decision of the Central District Sochi court dated January 25, 16 in case number 2a-856/16).

To formalize the decision to retain the average monthly salary for a citizen of retirement age for the third month, the employment service must assess the existence of special circumstances that prevent him from finding a job.

Note ! _ If suitable jobs existed and were provided to the pensioner, and he refused them without a good reason, this will be the basis for the court to annul the decision of the employment service to provide and maintain benefits.

Example:

Let us take as a basis for calculations the amount of the average employee’s earnings of 3,641.3 rubles. We point out that within two months after dismissal, the citizen was unable to find a new job; this month there were 22 working days.

The allowance for the temporary period of employment is: 3,641.3 * 22 = 80,108.6 rubles.

There are cases when a citizen manages to find a job during the second month from the date of layoff. Then he can also be paid benefits, but not for a full month, but only for those working days while he did not yet have a new position.

If a citizen finds a job within 2 months, he will be paid benefits for those days until he was employed

Note ! Neither severance pay nor benefits for a temporary period of employment are subject to taxes on personal income in a part not exceeding three times (for residents of the Far North and similar regions - six times) the average monthly earnings (part three of Article 217 of the Tax Code). That is, when the boss makes additional payments on his own, they are taxed at 13%.

Is unemployment benefit paid if a pensioner is laid off?

The issue of benefits for unemployed pensioners is resolved based on the provisions of paragraph 1 of Art. 31 Federal Law No. 1032-1. To pay benefits, a citizen must obtain unemployed status.

Important! According to paragraph 3 of Art. 3 Federal Law No. 1032-1, citizens who receive an old-age or long-service pension, that is, pensioners, cannot be recognized as unemployed. Therefore, they are not entitled to unemployment benefits.

A reasonable question may arise: does a pensioner even have the right to register with an employment center to assist in finding a job? The explanation is contained in the letter of Rostrud dated October 27, 2005 No. 1754-61. In it, the department notes that pensioners can apply for assistance in finding employment at the employment center and receive the necessary document (decision of this body) stating that they have not found a job.

In 2012, the Government of the Russian Federation adopted a decree “On the procedure...” dated 09/07/2012 No. 891, which defined the procedures for registering the unemployed and citizens in order to find suitable work. Accordingly, there are no legal obstacles for pensioners to register at the employment center to search for work, obtain the necessary information, and receive advice on employment issues.

When contacting an employment center, a pensioner acquires the status of not an unemployed person, but a citizen in order to find a suitable job, which allows him to receive the necessary assistance in finding a vacancy, taking into account his qualifications and health status. However, this status does not allow the pensioner to receive unemployment benefits.

Note! A different procedure applies to pre-retirees, and they have the right to apply for benefits.

Benefit for the following months after the retiree’s dismissal

What kind of payments are provided to laid-off pensioners if they worked in the Far North and similar areas? The rules here are similar to those that apply in other places:

- salary for the time period worked;

- compensation for vacation balances;

- severance pay.

Note that the time it takes to maintain the average salary per month (for the duration of employment) after terminating an employment contract is slightly different.

Article 318 of the Labor Code of the Russian Federation

As for people working in the Far North or similar areas, they are entitled to an average salary for a period of up to three months from the end of the employment contract, taking into account severance pay (Article 318 of the Labor Code).

In some situations, the salary may be left for this category of citizens for another three months - if this was the decision of the employment service or a number of the listed criteria are met:

- the citizen visited the employment service within a month after leaving work;

- this citizen was not employed by the employment service.

These rules of the Labor Code of Russia also affect citizens of retirement age who continue to fulfill their labor duties (letter of Rostrud dated February 11, 10, number No. 594-TZ).

Note! Compliance with the right to retain average monthly earnings for the next three months from the date of dismissal (up to six months) depends on the specific situation. Special cases must be established by the employment service. Even if the law does not provide a list of such “special situations”, this cannot be the reason for the decision on the part of the employment service to leave employees without average monthly earnings, provided only that the employees and the employment service itself follow the rules for providing public services for assistance in choosing a suitable place work (decision of the Kuril District Court of the Sakhalin Region dated February 27, 2018 in case number 2-19/2018).

Sometimes severance pay is paid for a longer period

Justification for dismissal

The dismissal of employees must be justified. The following are considered grounds for layoffs:

- company reorganization;

- reduction in production volumes;

- change in the main activity of the enterprise.

About the dismissal of a part-time worker at his own request, all the details are here. What are the reasons for dismissal at his own request without working off? The article tells what an employee can write in an application so as not to work out a 2-week period.

At the same time, a decrease in production volume entails a reduction in the number of employees, and a change in activity, as a result of which entire groups of employees are no longer needed by the employer, leads to staff reductions and the complete elimination of some positions.

The video describes the dismissal due to reduction of a working pensioner, as well as other workers.

Read about all the legal grounds for dismissing an employee here.

Payment for performing labor duties

Upon layoff of an employee, management must repay the debt to a citizen of retirement age for payment for work duties. The total amount includes salary, bonus, raises, bonuses and similar incentives. If a pensioner was fired in the middle of the reporting month, he is given money for the period that he actually worked. If an employee’s earnings are calculated based on output, then the monetary amount is calculated based on actual indicators (for example, the number of parts created before the reduction).

When providing a salary to a dismissed pensioner, management must credit and pay personal income tax and insurance contributions according to the rules established by law.

Note ! _ Let's look at an example. On November 14, 17, a citizen of retirement age was dismissed from his position as a storekeeper at Start LLC due to job reduction. The salary of this citizen is 18 thousand 712 rubles. Every month he receives a salary increase in the amount of 1 thousand 60 rubles.

On the date of dismissal, the citizen was accrued wages for the time actually worked - from November 1 to November 14, 2017. Let's calculate the amount:

(18 thousand 712 rubles + 1 thousand 60 rubles) / 22 working days * 10 working days = 8 thousand 987 rubles, 27 kopecks.

When accounting for withheld personal income tax, a citizen is provided with payments based on the following calculations:

8 thousand 987 rubles, 27 kopecks – 8 thousand 987 rubles, 27 kopecks * 13% = 7 thousand 818 rubles 93 kopecks.

When a pensioner retires, he must be paid in full.

What is severance pay?

The severance pay provided for a pensioner who has been laid off is a certain amount of money paid by the employer to the former employee on the day of dismissal. The amount and conditions for receiving benefits are prescribed in the Labor Code of the Russian Federation.

Having read article number 180, it becomes clear that in the event of a layoff, a pensioner, regardless of his length of service and other conditions of a different nature, must receive severance pay. In addition to the accrual of all payments provided by Russian law on the day of dismissal, the employee must receive a certain monetary benefit equal to the amount of his average salary for the monthly period.

IMPORTANT!!! Sometimes it happens that when individuals are hired, additional cases are included in the employment agreement that are not described in Article 180, but still oblige the employer to issue severance benefits. Also, individual clauses of the contract may establish an increased amount of such monetary compensation.

Vacation compensation

If a pensioner is fired, but has several days of vacation left, the boss must pay compensation for each day not used for rest.

A similar payment is provided both for unused annual leave and for days of additional leave provided to the pensioner, based on the rules specified by law.

The calculation of cash payments for vacation balances is based on the information presented in the fifth paragraph of Article 139 of the Labor Code.

SDZ = SGZ: 12 months: 29.3,

where SDZ is the amount of money received for each day of the remaining vacation (average earnings per day);

SGZ – employee’s profit for the past 12 months (average earnings for the year);

29.3 is the recorded average monthly number of calendar days.

Excerpt from Article 139 of the Labor Code of the Russian Federation

The amount of vacation compensation that was not used by a dismissed employee of retirement age is subject to personal income tax and insurance contributions according to the same rules.

Let's consider an example: a citizen was fired from the position of manager of a household due to layoffs due to the destruction of the enterprise. He was fired on October 1, 1717, and the citizen had 13 days of vacation left, which he did not have time to use.

To calculate the money provided in the form of compensation, accountants used the following data:

- the reporting period for calculating average earnings for the year is from October 1, 16 to September 30, 17;

- total income for the time period from October 1, 16 to September 30, 17 is 252 thousand 960 rubles;

- average daily earnings - 719 rubles, 45 kopecks (252 thousand 960 rubles / 12 / 29.3).

At the time of dismissal, a citizen:

- vacation compensation was credited - 9 thousand 352 rubles, 85 kopecks (719 rubles, 45 kopecks * 13 days);

- personal income tax calculated - 1 thousand 215 rubles, 87 kopecks (9,352.85 * 13%);

- compensation was made, taking into account personal income tax, 8 thousand 136 rubles, 98 kopecks (9,352.85 – 1,215.87).

Pensioners are entitled to compensation for unused vacation

Payments when a working pensioner is laid off in 2021

In terms of payments that people of retirement age can claim when reducing staff, pensioners are equal by law to all other employees . That is, the age of the employee at which the dismissal occurred due to a reduction in the company’s staff does not play a role (Article 349.3 of the Labor Code of the Russian Federation). In general, upon dismissal due to reduction, an employee is entitled to the following payments:

- wages for the time actually worked in the interval between the day of the previous payment and the date of dismissal;

- compensation for unused days of annual paid leave;

- severance pay;

- payment for the period of incapacity for work (if the pensioner was undergoing treatment during the month in which the dismissal occurred);

- reimbursement of travel expenses based on an advance report (if the laid-off employee was on a business trip during the month during which the dismissal occurs).

Important! Salary, vacation compensation and severance pay must be paid to the dismissed pensioner, as well as to any other laid-off employees, no later than the actual date of dismissal and the issuance of a work book.

Let's consider the procedure for providing the mentioned payments due to pensioners upon staff reduction, in more detail:

| No. | Payment in case of staff reduction | Additional information |

| 1 | Wages for working days not previously paid | As in the case of dismissal for other reasons, when staffing is reduced, the employer is obliged to pay off its wage arrears to the dismissed pensioner, while withholding the amount of personal income tax and insurance contributions, as in the general case: ● if wages are calculated based on output, their size is determined based on actual indicators (for example, based on the number of products manufactured before the date of leaving work); ● if a pensioner was laid off in the middle of the reporting month, the amount of wages will be calculated for the days actually worked. The final payment will include all amounts provided for by the enterprise’s remuneration system: ● direct payment for time worked, ● bonus payments (regular, not timed to coincide with anniversaries and other events), ● salary bonuses, ● other systematic additional payments. |

| 2 | Compensation for unused vacation | If on the date of leaving work the pensioner did not have time to take his allotted days of paid leave, he must be paid compensation for each unused day of rest (having previously withheld personal income tax and paid insurance premiums): ● annual paid leave, ● additional rest due to a pensioner in accordance with the law. The amount of compensation will be calculated according to the formula (paragraph 5 of Article 139 of the Labor Code of the Russian Federation): RK = SGZ: 12 months. : 29.3 x CD, where SGZ is the average annual earnings for the last 12 months, 29.3 – average monthly number of days, KD – number of days of unused rest. |

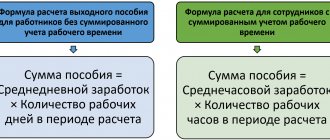

| 3 | Severance pay | When dismissal occurs due to staff reduction, the employer is obliged to pay the employee compensation (severance pay) in the amount of average monthly income. Its amount can be determined by the formula: VP = SDZ x KRD, where VP is severance pay, SDZ – average daily earnings, KRD - the number of working days in the month following the date of dismissal (within 30 days from the day following the date of dismissal). |

Which pensioners should not be laid off?

Some categories of citizens are considered socially protected, and some have significant services to the state. Therefore, they cannot be fired. Let's list them:

- veterans and disabled people of the Great Patriotic War;

- veterans and disabled combat veterans;

- citizens who were injured as a result of performing duties at work, but are capable of performing work duties;

- disabled people;

- citizens with dependent dependents;

- parents with many children.

Some citizens cannot be laid off

In the collective agreement, companies can also provide their own list of employees who cannot simply be fired. They are kept on staff even when the number of employees has been reduced to the maximum.

Is it possible

Is it possible to fire a pensioner due to staff reduction? This is the question an employer asks when the question arises of which category of employees needs to be reduced in the first place. On the one hand, the Labor Code of the Russian Federation does not contain grounds for dismissal - the onset of retirement age. But on the other hand, the legislator allows other reasons for dismissal in the code. We are talking, in particular, about the provisions of special laws, for example, on the state civil service, which sets a maximum period of service - 63 years for women, 65 years for men. In other words, with citizens who have reached this age, the contract is terminated.

As for the reduction of the position in which the pensioner worked, in this case the general reduction procedure applies to this category of citizens. The legislator has not established any preferences for pensioners. The exception is cases when a pensioner belongs to categories of citizens who have a preferential right to remain at work.

For reference! Citizens have the right to combine work and receive a pension, except for cases expressly specified in laws and regulations. If the employer offers to write a statement of his own free will, so as not to spoil his reputation, because he will fire the pensioner due to the ban on work after retirement, do not agree. In case of such illegal dismissal, you can apply for protection of rights to the labor inspectorate or write a statement to the court.

How to lay off a pensioner legally

If the management of an enterprise plans to carry out a massive layoff of pensioners and other workers in connection with minimizing production, then it is necessary to act in accordance with the law. The procedure should be carried out according to the following instructions:

- By order of the director, a commission is formed to determine the scope of the reorganization. A list of persons who are expected to be reduced is determined.

- An order is issued with a list of employees who need to be fired, and a date for the upcoming event is set. Each employee on the list must familiarize himself with the contents of the internal document against signature.

- When the date for reducing the composition of the company, specified by the order, arrives, the pensioner writes a statement with a request to dismiss him due to the termination of his employment relationship due to a reduction in the number of personnel of the organization.

- The company's management issues an order in the T-8a form if many employees are leaving, or T-8 if it is possible to issue a separate order for each employee, indicating the date and reasons for termination of cooperation. The worker reads the document and signs it.

- The dismissed citizen is issued a work book, a calculation is made and a benefit is paid, taking into account all the required compensation.

Notification of employees about staff reduction

2 calendar months before dismissal, each employee included in the list of citizens subject to reduction by order of the company's directorate is given a notice of the upcoming procedure for terminating employment. If the enterprise has a trade union committee, then this structure should also receive a message about upcoming changes in the number of workers. The citizen is offered available vacancies (if available) corresponding to qualifications, knowledge and skills, with a similar salary level.

Before the expiration of two months before the date of reduction in the number of workers at the enterprise, a pensioner cannot be fired. Early termination of cooperation with a citizen is allowed if he has found a new job and notified the management of the previous organization about this in writing . All due payments for the laid-off worker in this situation are preserved.

Privileges and guarantees

When carrying out the procedure for downsizing or liquidating a company, persons receiving state subsidies are entitled to privileges. The employer must provide pensioners with the following guarantees:

- do not discriminate against individuals based on age, provide equal rights to work for older citizens compared to younger employees;

- take into account the qualifications, experience, knowledge and skills, high labor productivity of a pensioner when determining the list of employees subject to personnel reduction;

- provide additional unpaid leave out of turn for up to 2 weeks to a person receiving old-age benefits, upon his request;

- pay all subsidies established by the state when the number of workers in the company is reduced;

- do not force a pensioner to work for the required 2 weeks if the citizen decides to resign of his own free will.

Preemptive right to remain on staff of the enterprise

According to the provisions of the Labor Code of the Russian Federation, an employee receives an advantage when remaining in his position during the procedure for optimizing production at the enterprise, if he is highly qualified and performs duties in accordance with the provisions of the employment agreement. If a person of retirement age is actively working in production and his work is highly productive, then the company management must take these factors into account when compiling a list of employees to be laid off.

- Which pensioners will receive a pension increase in May 2020

- How to secure your luggage during flights

- 3 Sleep Myths That Are Harmful to Your Health

Which pensioners are prohibited by law from being laid off?

People belonging to socially unprotected categories of citizens who have served the Russian Federation and the enterprise have the right to remain in their previous position while minimizing the size of the company for objective reasons. These include the following Russians receiving a pension:

- those who took part in battles on the battlefields of the Great Patriotic War (WWII);

- those who received injuries in the Second World War that led to disability;

- having disabilities due to participation in other battles in hot spots;

- injured during work, but able to perform job functions in accordance with the provisions of the employment agreement;

- providing for minor dependents;

- falling under the definition of a privileged group that is not subject to reduction, in accordance with the provisions of the collective agreement;

- who are guardians of minor children, provided that they are the only employed family members.