Dismissal can occur not only based on the wishes of the employee or employer, but also under the influence of other circumstances. These include reducing the company's workforce. In this case, the employee is entitled to redundancy payments and additional compensation for the period while he is looking for a new job. This procedure must be performed in compliance with all labor legislation requirements.

general information

Downsizing in an organization takes place according to the following scenario (starting point – 01/01/17):

- Making a decision to reduce staff - 01/01/17

- The selection of candidates for dismissal, minus privileged persons, who either cannot be laid off, or in the last place under Art. Art. 179–180 Labor Code of the Russian Federation.

- Drawing up a new staffing table.

- Registration of a single order on reduction - 02/01/17.

- An offer to candidates to take other available positions in the company.

- Written notification to employees about layoffs no later than 2 months before dismissal – 02/01/17.

- Dismissal and full payment – no earlier than 04/02/17.

- Payment of salary for the second month is not earlier than 06/02/17.

- Payment for the third month based on a letter from the employment agency - no earlier than 07/03/17.

What is required during downsizing and liquidation

Dismissal against one's own free will is always a stressful situation. Especially when you didn’t deserve it: you conscientiously performed your work duties, didn’t play truant, didn’t violate discipline. However, if you were fired due to staff reduction or in connection with the liquidation of the enterprise, you are reliably financially protected for several months after dismissal. This article will talk about how the dismissal procedure for reduction or liquidation occurs and the payments that you are entitled to.

Before leaving

According to Art. 81 of the Labor Code of the Russian Federation, liquidation of an organization (or termination of the work of an individual entrepreneur) and reduction of staff are grounds for termination of an employment contract.

In accordance with Art. 180 of the Labor Code of the Russian Federation, the employer is obliged to notify you in writing, against signature, of the upcoming dismissal due to liquidation or reduction, at least two months before “hour X”. If employees who have entered into an employment contract for a period of up to two months are fired, they must be notified no less than 3 calendar days before the date of dismissal (Article 292 of the Labor Code of the Russian Federation), and seasonal workers - no less than 7 calendar days (Article 292 of the Labor Code of the Russian Federation). 296 Labor Code of the Russian Federation).

This is what an order may look like, on the basis of which a notification of an upcoming layoff is drawn up

The notice (or warning) indicates the date of the upcoming dismissal, as well as its basis - the corresponding article of the Labor Code of the Russian Federation (Article 81 part 1 clause 1 - in case of liquidation, Article 81 part 1 clause 2 - in case of layoffs).

If you are being laid off, the notice must offer you the available positions at the enterprise - this is a requirement of Art. 180 Labor Code of the Russian Federation. Moreover, emerging vacancies must be offered to you until you are fired.

Upon receipt of such notice, you must sign for it and either accept or decline the offer of one of the positions. In the first case, a transfer will be carried out, and in the second - dismissal. Remember that the period during which you must accept or refuse an offered vacancy is not established by law.

By agreement with your employer (it must be fixed in writing), you may not work for the allotted two months and quit earlier. In this case, you will have to be paid compensation in the amount of your average salary, calculated in proportion to the days remaining before the expiration of the two-month period.

This stage ends with the issuance of an order for your dismissal, which contains information about the warning notice issued to you, as well as the agreement to terminate the employment contract before the expiration of two months (if there was such an agreement). You will be familiarized with this order and asked to sign.

What payments are due for reduction and liquidation?

One of these payments was discussed a little higher - it is due in the event of your dismissal before the expiration of the notice period. In addition to this, you must be paid:

Thus, according to Art. 178 of the Labor Code of the Russian Federation, in case of reduction or liquidation, you are entitled to 3 “additional salaries” - the first is issued “in advance” on the last day of work, and the other two - later. All these compensations are paid to you not by the state, but by your employer.

On the day of dismissal

The day of termination of an employment contract with an employee (or the day of his dismissal) is his last working day (Article 84.1 of the Labor Code of the Russian Federation). On this day, according to Art. 140 of the Labor Code of the Russian Federation, you must be paid the following amounts:

On the same day you should be given a work book. If for some reason you cannot receive it on the day of dismissal, the employer must send a written notice to your home address, from the date of which it is released from liability for the delay in your work. In order to receive a book later than the day of dismissal, you will have to contact your employer in writing, who is obliged to issue it within 3 working days from the date you submitted this application (Article 84.1 of the Labor Code of the Russian Federation).

On the day of dismissal (or earlier), you need to receive another very important document - a certificate of average earnings, which will need to be submitted to the Employment Center to calculate and receive unemployment benefits (it is issued by the state after you have been paid compensation for 2 or 3 months by employer). Despite the fact that the certificate will not be useful right away, try to get it while you go to work - it may be much more difficult to do this later.

Immediately after dismissal

You must visit your Employment Center (at your place of registration) within 14 calendar days from the date of dismissal. It is very important!

If you do not do this, the Employment Center will not issue a document, which is the basis for transferring the third “salary” to you. Simply put, without a decision from the Employment Center, you will only be paid 2 “salaries”, not 3.

As for documents, for the first visit to the Employment Center you will only need a passport. Next, the staff will tell you what documents you need to provide. Moreover, this or that set of documents will depend on whether you are simply going to receive compensation for the 2nd and 3rd months after dismissal or have decided to join the stock exchange as an unemployed person.

Receiving a second “salary”

After two months have passed since your dismissal, and provided that there is no record of a new place of work in your employment record, you can contact your former employer to receive your average earnings for the second month. To apply for the benefit you must:

Based on the above documents, an order is issued from the head of the organization, according to which you will be paid compensation for the second month.

Receiving a third “salary”

After 3 months after your dismissal, you can receive compensation for the third month, but subject to the simultaneous fulfillment of two conditions:

To apply for benefits for the third month, you need to provide your former employer, in addition to the documents listed in the previous case, one more piece of paper - the Decision of the Employment Center, confirming your right to receive this benefit. The procedure for issuing and paying the third “salary” is similar to the procedure for issuing the second.

Receiving the fourth and subsequent “salaries”

If you work in the regions of the Far North (or equivalent to it), you, according to clause 14 of Resolution of the Council of Ministers of the RSFSR No. 74 of 02/04/1991, can claim benefits for the fourth, fifth and sixth months after the date of dismissal. Compensation in these cases is processed at the end of each of these months, similar to the third “salary”, but provided that you have not found a job.

Sample application for benefits for the second and subsequent months:

The application form is approximate; the HR department of your former employer may offer its own version.

About the salary of the “redundant”

According to Article 178 of the Labor Code of the Russian Federation, a laid-off employee has the right to receive, on the last day of work, along with the final payment, severance pay in the amount of average monthly earnings (AMS). And also, if he does not find a job during the second and third months (in this case, a certificate from the SZN is required), he will receive the SWP for these months as well.

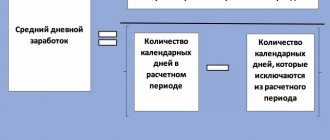

The SWP is calculated as follows:

- all a person’s income for 12 months is divided by the number of days actually worked - this is how the average daily earnings are obtained;

- Average daily earnings are multiplied by the number of days in the month for which redundancy benefits are paid.

Attention! A redundant person can always receive his money, no matter how much time has passed since the dismissal. Main:

- for the company to still function;

- and that the former employee document that he did not work during the periods for which he wants to receive the amounts.

Nuances of submitting an application

Temporary employees can receive a payment equal to two weeks' average salary. Those working under short-term agreements are not paid severance pay, since they cannot be reduced, because the requirement to notify the employee 2 months before the planned day of reduction is violated.

An important nuance is that a person’s absence of entries in his work book does not mean that he is not currently employed (some employers may create a new work book).

The previous employer cannot always verify that a former employee is unemployed, therefore there are many cases when benefits for the second month are received by an already employed person who is not responsible for this before the law.

Thus, severance pay according to labor legislation for the second and subsequent months is not due to everyone, and only applies to some cases of layoffs. To receive such compensation, it is necessary to draw up a written application accompanied by a list of all necessary documents.

When an employee is dismissed due to a reduction in headcount or staff, the employer is obliged to pay the former employee severance pay in the amount of his average monthly earnings (according to Article 178 of the Labor Code of the Russian Federation).

Let's find out in which case an employee has the right to receive benefits for the second month after such dismissal and what needs to be done for this.

How many payments are due?

Without considering special cases, according to the standard, you can receive a payment in the amount of the FFP three times:

- Directly on the day of dismissal - it is issued along with the salary for the last period, vacation pay, and arrears. The basis for issuance is an order of dismissal due to reduction.

- The second time - 2 months after the layoff, at the written request of the dismissed person , on the basis of which the employer draws up an order to pay money from the cash register. You will find a sample application for payment of compensation in case of layoffs just below in the article.

- The third time - 3 months after dismissal, also at the request of the person. But in this case, a certificate from the employment agency is paramount. In this certificate, the inspector confirms that the person has been registered with the SZN for 2.5 months and is still unemployed. Not everyone receives the third payment, because... usually they either find a suitable place through the SZN, or turn their nose up at every suitable vacancy and simply “don’t deserve” a positive decision from the inspector.

Additional compensation

So, on the day of dismissal, the employee received severance pay for the period of employment (for the first month).

The right to receive benefits for the second month arises for a dismissed employee after the second month after dismissal, provided that he was not employed during this period. At the same time, the legislation does not provide for a deadline for applying for payment of money to a laid-off employee .

The document confirming the right to receive benefits, in this case, is a work book, which does not contain a record of a new place of work.

There is no strict form of application approved by law, so it is written in simple written form. The organization's personnel service may offer its own application form, but if one is not available, then the application must be drawn up as follows:

- A cap. In the header of the application you must indicate:

- position of the head of the organization;

- FULL NAME. head of the organization;

- name of company;

- FULL NAME. dismissed employee;

- employee registration address;

- employee contact number.

- Text of the statement. The text of the application must contain the following information:

- a direct request to pay the average monthly income required by law upon layoff (indicating the date of dismissal and the period for which payment must be made);

- justification for payment (information about non-employment during the specified period);

- a list of documents attached to the application (for this type of compensation, a certified copy of the work record book);

- payment method indicating details (in case of transferring money to a bank account or card).

- Visa . At the end, you must put the date the application was written and the employee’s signature.

- applications for severance pay for the second month after layoff

- applications for severance pay for the second month after layoff

Typically, payment is made on the day of application or the next day, or on the days established by the organization for paying wages to employees. However, there are employers who are in no hurry to fulfill their duties. In this case, the dismissed employee must contact the Labor Inspectorate with a complaint.

Expert opinion

Musikhin Viktor Stanislavovich

Lawyer with 10 years of experience. Specialization: civil law. Member of the Bar Association.

Dismissal or layoff is always a stressful situation for absolutely any person. But in the event of a layoff, the dismissed employee is financially secure, as he has the right to the above payments.

In order not to reduce your standard of living and to be able to calmly find a new place of work, you need to know your rights, fill out the necessary documents in time and correctly.

Companies adapted in times of crisis and continue to optimize the expenditure side of their business. One option is to reduce the number of employees.

But the law also took care of the laid-off employee: additional payments and an extended dismissal period will help not to be left without work and without money.

In this article we will tell you everything about payments and provide a sample application for redundancy benefits for the second month.

Procedure for receiving benefits after 2 months

In order to receive benefits for the second month, you should contact your former employer. Typically, an application for benefits for the second month during a layoff is submitted to the human resources department or management.

Not a single law contains a strict form or at least a list of necessary details of an application for payment. So it is compiled in simple written form and, logically, should include:

Full name of the former employee, his passport details, registration address and postal contact phone number.- Introductory part - indicating the date of reduction and previous position.

- A clearly understandable request to pay the money required by law upon layoffs.

- Justification for payment - this will be the fact of unemployment at the time of application.

- The preferred method of receiving money is in cash or to a bank account.

- List of documents attached to the application.

Just the words of a former employee that a job has not been found is not enough. The only evidence is a work book, which contains no records of admission to other organizations after the date of layoff.

Naturally, when issuing compensation money from its own budget, the employer will definitely ask whether the dismissed person has the right to payment. Therefore, it is necessary to have the original work book with you. A copy is optional.

Important! The right to payment for the second month arises for a redundant person exactly 2 months after dismissal, if he has not yet found a job. However, if he got a job 1 month and one day after the layoff, he can receive compensation for one day.

Example:

- Ivanov was fired from Rosa LLC on 10/31/15.

- Ivanov’s average daily earnings are 2,500 rubles.

- He got a job at Buttercup LLC on 12/02/15.

For the day 01.12 he has the right to receive compensation in the amount of 2,500 thousand rubles.

Compilation example

The application must be drawn up in such a way that it corresponds to the structure below:

- a cap:

- manager position;

- Full name of the head;

- Name of the organization;

- Full name of the dismissed employee;

- employee's registration address;

- contact number.

- The text of the statement itself:

- request to pay the average monthly income due to the reduction;

- information about the lack of employment during this period;

- list of attached documents;

- details for receiving money (bank card, electronic account, etc.).

- dating, signature.

Sample application for payment of severance pay for the second month:

I ask you to pay me the average salary due to me for the second month of employment after dismissal on 07/01/2020 due to layoffs. I have attached a copy of my work record.

Application for payment of redundancy benefits for the third month sample

The two-week period also includes non-working days (Article 14 of the Labor Code of the Russian Federation).

An employment or collective agreement may establish increased amounts of severance pay. In accordance with the Determination of the Armed Forces of the Russian Federation dated September 10, 2021 N 14-B10-10, severance pay to a laid-off employee can be paid six times the amount. All companies and individual entrepreneurs need to submit some kind of statistical reporting. And there are so many forms of this reporting that it’s not surprising to get confused in them. To help respondents, Rosstat has developed a special service. using which you can determine what statistical reporting needs to be submitted to a specific respondent. However, unfortunately, this service does not always work correctly. The list of types of state control in which a risk-based approach is applied has been expanded.

Sample application for compensation for the third month of redundancy

In Part 3 of Art. 180 of the Labor Code of the Russian Federation states that the employer has the right to dismiss an employee early, without waiting for the day of layoff, as discussed above. This dismissal is completely legal, but the employee must be paid additional compensation in an amount equal to the salary that the employee could have received if he remained in his position until the official date of dismissal.

A prerequisite is considered to be payments for staff reduction, as well as the possibility of employees being transferred to another position in the same enterprise. The employer is obliged to provide employees with a list of positions that they can take instead of those that are subject to reduction. In addition, the employer is obliged to offer the employee a transfer to another job in another location, if available. Otherwise, dismissal occurs as usual.

Sample applications for payment of redundancy benefits for the first, second and third months

- the citizen must be registered with the employment department;

- during the period of registration, the unemployed must comply with all legal rules, including attempting to find employment in the directions of the employment service (refusal to work must be motivated);

- The citizen must have no earnings or income from other sources.

We recommend reading: How to calculate your pension yourself in Belarus in 2021

The application is registered according to the general rules of internal document flow. After approval by the manager, the document is sent to the financial service to calculate compensation. To correctly calculate compensation, the average earnings of a citizen at the time of dismissal are used.

Application for payment of redundancy benefits for the third month sample

- terms of payment of severance pay for the second month in case of reduction? Tell me how long it will take to pay the second month’s salary in case of layoff from the date of filing the application. In the same way, you can receive compensation for unemployed days if a person managed to find a job during the third month.

Based on the above and guided by Article 119 of the Family Code of the Russian Federation, Articles 131 and 132 of the Civil Procedure Code of the Russian Federation, I ask: To reduce the amount of alimony paid by me in favor of the defendant by decision of the Magistrate of Court District No. 95, No. 95/ 234 Copies of these documents must be made in the same quantity as there will be participants in the consideration of the claim, plus for the judge.

Benefit amount

An employee who is fired without his or her will has the right to receive certain amounts. This money is intended to provide for him while he is looking for work, but its payment is associated with some difficulties. The term and amount depend on a number of conditions.

The following can count on payment of compensation in the amount of 2 weeks' earnings:

- Those dismissed due to changes in working conditions: company relocation, medical contraindications to work, recognition of incapacity.

- Dismissed due to inconsistent changes in the employment contract.

- Conscripts for military service.

- Dismissed due to the employee returning, for example, from sick leave or maternity leave.

All of them are provided with compensation of 2 weeks' earnings.

You can receive the amount on the last working day, the next day or on the day you receive your salary. If a department is reduced or a company is liquidated, payments can be made for up to 3 months. To do this, it is necessary to prove that over such a long period the employee was unable to find a new job.

For top managers, the Labor Code provides for additional compensation amounts. They are specified in Article 178 of the Tax Code of the Russian Federation. The amounts will be different in the following situations:

- For the head of the company, his deputy and chief accountant upon change of ownership.

- Upon dismissal without explanation. If we are talking about the dismissal of a manager, then the latter should not have any guilt before the company.

All of them have the right to a cash payment of at least 3 salaries per month. They are not entitled to severance pay.

In addition, if desired, the employer has the right to increase the amount of benefits or their number. All changes must be recorded in the employment contract.

Filing and hearing a case in court

An employee can file a claim with the court for recovery of severance pay within a year. From the date on which the required amount should have been paid to him in full (usually the day of dismissal). It is possible later, but then the plaintiff asks the judge in writing to restore the deadline for labor disputes.

If the essence of the dispute between the employee and the employer is dismissal in violation of the law, then it is advisable to present the demand for severance pay in a claim for reinstatement or change in the wording of the dismissal. The plaintiff may supplement the claim with a demand for compensation for moral damage and monetary compensation for delayed payments.

A claim for recovery of severance pay is considered within 2 months according to general rules in a court hearing.

Sample application for compensation for the third month of redundancy

Thus, taking into account the above, recognition of a citizen’s right to retain his average monthly earnings during the third month from the date of dismissal in accordance with Part 2 of Art. 178 of the Labor Code of the Russian Federation can be justified and lawful not only in the presence of the very fact of registration of a given citizen by employment service institutions in order to find a suitable job, namely when registering a citizen as unemployed, carried out within 10 days from the date of initial registration in an employment institution of the population, if within the specified period it was not possible to provide the citizen with suitable work.

When an organization is liquidated or its staff is reduced, the dismissed employee is paid severance pay in the amount of average monthly earnings. He also retains his average monthly earnings for the period of employment, but no longer than for two months from the date of dismissal (including severance pay) (clause 1. 2, part 1, article 81. part 1, article 178 of the Labor Code of the Russian Federation ).

We recommend reading: Preferential medications for group 3 disabled people

Sample application for compensation for the third month of redundancy

- wages for the last month - in proportion to the hours actually worked;

- severance pay – one average monthly salary for the month following dismissal;

- compensation - for missed vacation, work on holidays, weekends, etc.;

- average earnings for the second and third months - according to the decision of the Employment Service.

Downsizing is a legal way to restructure a company by reducing the number of employees. The procedure is strictly regulated by law and controlled by the State Labor Inspectorate.

Sample application for compensation for the third month of redundancy

Please note that the article also establishes the terms of dismissal - the employer has the right to terminate the employment contract no later than one month from the date of receipt of the reasoned opinion of the elected body of the primary trade union organization. During the specified period, periods of temporary incapacity for work of the employee, his stay on vacation and other periods of absence of the employee when he retains his place of work (position) are not counted.

The dismissal process and the procedure for compensation to employees is regulated by Art. 84.1 Labor Code of the Russian Federation. According to this bill, the employer is obliged to make all required payments to employees on the day of their official dismissal (wages, vacation compensation, severance pay due to layoffs).

How to receive redundancy benefits for the second month, sample application for payment

This practice is rare, since not everyone has the desire and financial capacity to increase compensation. In addition, increased amounts are not exempt from income and unified social tax.

The employer may offer the employee to terminate the employment agreement before the end of the period specified in the notice of layoff. If he accepts the conditions, then the dismissal is formalized by agreement of the parties or at the initiative of the employee. As a result, the fired person receives severance pay, but the compensation due upon layoff is not retained.