Home » Alimony » Alimony from severance pay upon layoff (dismissal)

In accordance with paragraph 18 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated December 26, 2017 No. 56, child support is collected not only from wages, but also from some other income of the parents. Deductions in favor of the minor are withheld from fees, remunerations, additional payments, pensions, scholarships, etc. Is alimony collected from compensation payments in case of layoff (dismissal)?

What is severance pay?

Reduction of employees in an organization can be carried out for various reasons:

- staff reduction due to a decrease in enterprise income;

- bankruptcy of the company;

- closure of an organization and termination of the activities of a legal entity.

In each of these cases, the enterprise employee is left without work and livelihood, because it is not always possible to immediately find a new place of work. The state foresaw this point, and in order to protect a person who lost his job from financial problems, he obliged the company to pay monetary compensation to the former employee. This is severance pay, and it is equal on average to three salaries officially established at the conclusion of the employment contract. So, an employee who has been laid off receives the following payments after leaving the company:

- salary for the last month worked;

- compensation for vacation, which he did not have time to use;

- severance pay.

Severance pay

Thanks to the money received, a person is protected from the stress of being deprived of a source of income, and has enough time left to look for a new job.

Basic information

An employee who is dismissed due to staff reduction or liquidation of an enterprise receives severance pay on the day of dismissal. The size of this payment corresponds to the amount of average earnings and is calculated by the organization’s accountant using a special formula.

The maximum size is regulated by the collective agreement of the enterprise, the minimum - by the Labor Code of the Russian Federation and other legislative acts.

For the second and third months, severance pay is transferred to the person only if the interested person contacts the former employer, providing him with a work book where there is no record of employment.

Upon dismissal, alimony is also withheld from the severance pay of an employee of the Ministry of Internal Affairs and a military personnel.

At the same time, the law additionally establishes a list of payments from which alimony is not collected. These include payments from the employer due to the death of a close relative, the birth of a child, registration of a marital union, etc.

Withholding of alimony from severance pay

Russian legislation has an officially recognized list of income from which alimony should be deducted. Severance pay is recognized as one of them (). The Resolution states that alimony must be collected from any benefits given to the employee during the period of employment during layoffs at enterprises. Let's consider the conditions and procedure for collecting alimony from severance pay during layoffs.

Conditions for collecting alimony from severance pay

Deductions from severance pay in favor of the alimony payer will be made only if a number of conditions are met:

- the presence of a court order regarding the established amount of alimony;

- the presence of an alimony agreement between former spouses, certified by a notary (this is a prerequisite).

Types of collection of alimony for adult children

Also, the recipient of alimony has the right to demand payment of interest on severance pay only if we are talking about a minor child. In all other cases, the entire amount of severance pay will be transferred to the employee of the enterprise to whom it was assigned (except for the deduction of taxes). So, alimony from severance pay will not be collected in the following cases:

- presence of a disabled child over 18 years of age;

- presence of disabled parents and other relatives;

- assignment of alimony for the maintenance of the wife.

Attention! This order is established, so there can be no exceptions.

The procedure for collecting alimony from severance pay

Russian legislation strictly establishes the order of payment of alimony. That is, in what sequence payments will be made to the bank from the organization’s budget. Each company has a partner bank that provides it with a current account for storing and maintaining funds. The following deductions are made monthly from this fund:

- taxes;

- alimony;

- wages, etc.

The procedure for paying and collecting alimony

Data for deductions is provided to the bank by the accounting department, and this data clearly establishes the amounts of payments, the details by which they should be deducted, as well as the payment number, which determines its urgency and importance. Alimony payments come number one. This means that if there are not enough funds in the company’s bank account to cover all the needs, the bank will carry them out in descending order of importance (which is reflected by the payment order number).

The first payment that will be made from severance pay is alimony for a minor child. Therefore, if for some reason alimony does not reach the recipient, there is a reason to contact the relevant authorities, because this payment should have been made in the first place.

Further, the order of payment of alimony will occur according to the following scheme:

- Submission by the chief accountant to the partner bank of an order on the payment procedure indicating the recipient’s details.

- Whether the bank makes a money transfer to the account of the alimony recipient (by post or to a bank account - depends on the decision made in court).

- Receipt of funds by the recipient.

Video - Alimony from the unemployed and other nuances of collecting alimony

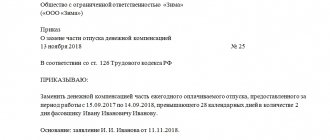

The amount of severance pay and alimony from it

As mentioned above, severance pay, according to Russian law, is equal to three salaries fixed in the Employment Contract. The amount of alimony payment is fixed by a court order or a notarized alimony agreement.

If the court decided to deduct alimony in the amount of 25% of the former spouse’s salary, then this percentage will be deducted from the severance pay.

Example: the salary of a laid-off employee under the Employment Contract was equal to 10,000 rubles. This means that the alimony collected monthly was equal to 2,500 rubles. When laid off, an employee receives severance pay in the amount of 30,000 rubles. This means that the following will have to be transferred to the alimony recipient’s account: 2500 x 3 = 7500 rubles. How to calculate the amount of severance pay

How do bailiffs withhold alimony payments?

According to the legislation of the Russian Federation, a bailiff has the right to collect debt for alimony payments in the following cases:

- The writ of execution contains an instruction to collect alimony from periodic payments;

- If the debtor’s funds, as well as the latter’s property, do not allow him to fulfill the instructions of the writ of execution.

If wages or other periodic payments are not able to cover the amount of alimony, the bailiff has the right to foreclose on the debtor’s property, as well as seize his accounts or property.

If alimony debt for child support is withheld from the salary of the person making the payments, then the deduction is carried out by the accounting department of the company where such a person works. The writ of execution is transferred to the employing organization by both the claimant and the FSSP service as part of the enforcement proceedings.

Payments and procedure for withholding alimony upon dismissal by agreement of the parties

The entire procedure for withholding alimony described above concerned the dismissal of an employee from an enterprise; let us consider the procedure for deduction in case of voluntary dismissal by agreement of the parties.

If an employee wants to terminate the employment contract at his own request, he will not be paid severance pay. He will receive the following payments:

- salary for the last month worked;

- vacation pay.

According to Russian legislation, alimony will be deducted from both payments in the amount established by the Court Order or the alimony agreement. Judicial procedure for collecting alimony

conclusions

Let's highlight a few key points on this topic:

- Only child support for minor children is withheld from severance pay.

- The retention procedure is identical to the standard procedure.

- Severance payments are not subject to income tax. Therefore, the entire accrued payment is subject to alimony. The exception is amounts exceeding 3 times the average salary.

- Additionally, amounts necessary for the commission for transferring funds to the recipient may be withheld.

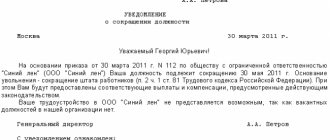

- After dismissal, the company is obliged to send written notice to the bailiffs about the employee’s resignation within 3 days.

Responsibilities of the administration of the former employer after the dismissal of an employee

If the laid-off employee was a payer of alimony, then the employing organization has a number of other responsibilities that it must carry out during layoffs.

So, the employer’s responsibilities after reducing the alimony payer:

- Notification of bailiffs that an employee has been laid off (the letter must be sent to the organization of bailiffs addressed to the person responsible for the execution of the Court Order).

- Notification of the court, which made a decision on the payment of alimony and established its amount.

- Notifying the alimony recipient that the payer is left without a permanent income (at least for the near future, until he finds a new job).

All these measures are necessary in order to provide the recipient of alimony with a guarantee of a decent existence. Because lack of work does not relieve the payer of responsibility. For non-working citizens, Russian legislation also provided for the procedure for paying alimony and established their approximate amount. Warning the bailiffs is necessary so that they take strict control of the situation and do not leave the receiving party without alimony.

If the employing company is somehow involved in shaping the future fate of the laid-off employee (for example, with its help he found a new place of work), then the administration of the former employer must notify all of the above persons about this fact. Legal documents on severance pay upon layoffs

The state takes strict control over the life situations of alimony payers in order to provide the weaker sections of the population with protection and a decent existence. Failure to comply with any of these points entails liability and fines may be imposed on the violator.

The company is also obliged to provide a completed writ of execution to the bailiff service, which must indicate:

- the total amount of alimony paid during the employee’s period of work in the organization;

- the number of days (months) during which alimony was deducted;

- amount of debt and its period.

If the employer, for some reason, did not notify the relevant authorities about the dismissal or reduction of an employee, or did not bring to their attention information about his future fate that he has, then a fine will be imposed by the state. Who exactly was responsible for the improper information will be clarified privately, but often the head of the company bears responsibility. The fine is 10,000 rubles.

Video - Alimony from an unemployed person. How much should he pay?

Who is responsible

It is important to understand that in case of incorrect filling out of papers or failure to comply with some point, administrative liability is provided with a fine of up to 10 thousand rubles. As part of the investigation of such a case, the persons involved are identified, a protocol is drawn up for each and an interrogation is conducted. If the amount of severance pay is calculated incorrectly or the writ of execution is filled out incorrectly, then the manager of the enterprise where the payer was employed bears responsibility.

If an employee leaves the company voluntarily, then on the last working day he will receive payment from the accounting department for all the time worked up to that point. You are also entitled to compensation for vacation if it was not used in full. The company does not incur additional expenses and does not pay benefits. This is due to the fact that the employee leaves the place of work voluntarily, of his own free will, the legislation in this case does not provide for any compensation.

Accordingly, the answer to the question “Is alimony withheld from this type of payment?” positive, but it is worth remembering that not everyone has the right to them.

Collection of alimony after dismissal

Regardless of the availability of work, a citizen is obliged to participate in the material support of his child. If he evades fulfilling his obligations, the recipient has the right to go to court to change the method of collecting alimony. When alimony payments are assigned as a percentage of income, lack of work does not allow alimony to be withheld due to zero earnings.

This situation has several options:

- Transfer of obligations to a fixed rate.

- Calculation of alimony as a percentage when receiving unemployment benefits.

- Calculation of alimony as a percentage, taking into account the average wage established in the territory of the Russian Federation.

The recipient of the funds or the bailiff can initiate a change in the terms of payment of alimony by going to court. If, after changing alimony payments, a citizen refuses to participate in the maintenance of the child, he will be brought to civil, administrative and then criminal liability.

Rubric “Question/Answer”

Can I avoid child support with severance pay?

Expert opinion

Semyon Frolov

Lawyer. 7 years of experience. Specialization: family, inheritance, housing law.

No, alimony from severance pay is mandatory. Even if you write a statement renouncing the VP, it will not have legal force. The employer is obliged to pay this amount in connection with the liquidation of the enterprise or staff reduction. Accounting is required to withhold alimony from severance pay (net of taxes).

The child's father was laid off at the company. How long should alimony be paid from his severance pay?

Expert opinion

Dmitry Nosikov

Lawyer. Specialization: family and housing law.

The period for transferring alimony is closely related to the date of payment of severance pay. The accounting department sends the transfer no later than 3 days from the moment the money is received in the employee’s account (Article 109 of the RF IC). This may include non-working days or weekends. In this case, payment will be processed the next business day. For example, if the third day falls on Sunday, the next day is Monday. Consider these points when expecting child support. You can also read our article “Term of payment of alimony by the employer“.

The ex-husband quit his job due to the reorganization of the enterprise. I know that he should have been given severance pay. But the child never received alimony from him. What to do in this situation?

Expert opinion

Semyon Frolov

Lawyer. 7 years of experience. Specialization: family, inheritance, housing law.

Find out where the child's father worked and go there to clarify the circumstances. If it is not possible to visit the employer in person, send a letter asking for clarification whether alimony was withheld from severance pay? It is also worth finding out whether the employee was actually laid off. Accounting will provide the necessary information. If the VP was paid, but alimony was not withheld, this is the fault of the company’s accountants . They are obliged not only to transfer the required amount, but also to repay the debt from their own pocket + pay a penalty in the amount of 0.1% for each day of delay (clause 2 of Article 115 of the RF IC). Usually, a few days after the accounting error is discovered, child support is transferred to the mother’s account. Otherwise, you will have to defend your interests in the prosecutor’s office or in court (see “What to do if alimony does not come?”)

Definition

Severance pay is compensation payments in favor of the employee due to termination of the employment contract due to the following reasons:

- liquidation of the enterprise;

- bankruptcy of the employer;

- reduction in the number of employees;

- reduction of the organization's staff.

This amount is equal to the average monthly earnings of the dismissed person and is paid for the 1st month when calculating, for the 2nd if it is impossible to find a job, for the 3rd in exceptional cases (upon registration with the employment service and the presence of a conclusion from this body). If the enterprise is located in the Far North, then the period of receiving benefits can last up to 6 months.

An amount and duration of receipt that differs from the standard rules may be established by agreement of the parties to the employment contract.

Amount and terms of payments

The percentage of alimony deduction (the amount of a fixed payment) is determined by a writ of execution or a notarized alimony agreement. From the benefit upon termination of the signed contract, this amount is paid in full in strict accordance with the specified executive documents.

The company is obliged to transfer the funds to the direct recipient of alimony strictly within three days from the moment of the final dismissal of the employee.

The company is obliged to withhold alimony only if the original of the enforcement document received by a private or state organization (issued court order, writ of execution or agreement regarding the payment of alimony, which must be notarized) was received by mail, directly from the bailiff or from the recipient of the alimony.

Dear readers! To solve your problem right now, get a free consultation

— contact the duty lawyer in the online chat on the right or call: +7 Moscow and region.

+7 St. Petersburg and region. 8 Other regions of the Russian Federation You will not need to waste your time and nerves

- an experienced lawyer will take care of all your problems!