If a job is lost, the state gives a citizen a certain period of time so that he can find a new job. The employment center helps him with this, where they offer available vacancies and pay unemployment benefits. But in order to receive financial assistance, you must follow the rules established by the center. Otherwise, the benefit will be canceled temporarily or completely.

What is the reason for suspending payments?

The main reason why payments may be terminated is a violation of the procedure for fulfilling the requirements of the TsZN inspector. An additional reason is the occurrence of cases in which it is inappropriate to pay benefits to a citizen (for example, calling him to military training). Registration is a procedure when the state offers its assistance in finding a job to an able-bodied citizen, and the accrual of social assistance is a temporary measure. Therefore, if payments stop, a citizen has the right to count on state support in finding a job or improving his qualifications.

The payment period has expired

Financial social assistance is a temporary measure. According to Law 1032-1 (the latest amendments came into force on January 1, 2021), it is provided only for 6 months a year and if during the entire period the citizen still does not find a job (he will attend all interviews, advanced training courses, but there will never be a suitable vacancy for him).

At the discretion of the inspector, payments may continue for up to 12 months. But the following intervals for possible receipt of social assistance are used:

- no more than 12 months in total for 18 calendar months;

- no more than 24 months in total for 36 calendar months.

Employment of a citizen

The termination of financial assistance for unemployment occurs when a registered citizen signs an employment contract. It doesn’t matter how he got the job: he found an employer on his own or the Employment Center helped him with this. The same will happen if a citizen becomes an entrepreneur.

Deception of the Central Bank for the sake of enrichment

Deception by the labor inspector and concealment of an unofficial source of income (from work or other commercial activities) is a reason for suspending unemployment benefits. The following situations can be perceived as deception:

- Providing an extract from the accounting department with an inflated value of the average salary (it is from this that they start when determining the amount of assistance).

- Concealing the fact of employment during registration. Even if a citizen does not work officially, he must notify the Labor Center about this.

- Submission of false documents. This could be a fictitious work book with signatures and seals from non-existent enterprises, a medical certificate for missing re-registration, and so on.

- Concealing the fact of receiving pension payments (due to age or health reasons), distance learning (payments are not accrued during this period).

- Concealing the fact that the applicant wishing to register is the founder (or co-founder) of a commercial organization. This is also true if the company is registered outside the Russian Federation.

According to Art. 35 Federal Law No. 1032-1, the above violations are the reason for termination of payments, deregistration of the unemployed and for opening a case under Art. 159-2 of the Criminal Code of the Russian Federation. The punishment is determined by a court decision, up to and including imprisonment.

Long absence without good reason

The citizen is obliged to regularly visit the inspector for re-registration (no more than 2 times a month). At this time, the unemployed person is provided with information about available vacancies, given directions for training, and so on. Failure to appear without good reason for re-registration (or provision of fictitious documents justifying failure to appear) is grounds for refusal of further accruals.

Moving to another place

When moving to another locality or area, which is served by another branch of the Central Education Center, enrollment is also stopped. It is recommended to notify the inspector in advance of your intention to change your place of residence. The unemployed person retains the right to register with a new central employment center at their place of residence. Payments will be resumed if there is an available time interval for their accrual (6 months for the last calendar year).

Common Mistakes

One of the most common reasons for non-payment of the required benefits is considered to be errors in the process of registering status and in compliance with established rules. To avoid them, you should carefully study the most common ones.

Visit to the employment center

The demands of the service employee cannot be ignored. If a person is assigned to appear at a certain time, he must definitely come.

Neglect of this rule may lead to the fact that the payment of financial support will not only be suspended, but reduced. Moreover, a citizen is automatically deprived of his official status as a person who does not have a job.

Training from the employment center

If an unemployed person is sent to courses and he starts playing truant, he will also be deprived of financial support. Submission to courses is carried out for the following purposes:

- education;

- professional development;

- retraining.

Accruals can not only be suspended, but completely stopped. It doesn’t matter here whether a person was employed or not. It also does not matter whether or not an application was submitted to be deregistered from the labor exchange.

Job offers

Quite often, citizens believe that they can safely refuse the proposed employment options. At the same time, they believe that the basis for refusal may be a common reluctance to accept the proposed options.

There is an opinion that you can refuse employment only because the option seems unsuitable. This is wrong. An argument of this kind cannot be accepted as a reason for refusing a selected position.

Important ! The term “inappropriate” has a clear definition.

A suitable place of work is considered if the following factors are present:

- Compliance with qualifications.

- The place corresponds to professional suitability.

- Work will not harm your health.

- The place of work is located within transport accessibility.

- The most important thing is that the vacancy corresponds to the conditions that were present in the previous position.

If employees of the employment center offer a job where at least one of the listed conditions is violated, the unemployed can refuse the offer without problems and without consequences.

In Russia, the one who knows his rights wins

If you want to know how to solve your specific problem, then ask

our duty

lawyer online

.

It's fast, convenient and free

or by phone:

Moscow and region:+7

St. Petersburg and region:+7

Federal number:+7

How can I restore my payments?

Resumption of payments is possible subject to compliance with the conditions for re-registration and obtaining the status of “unemployed”. If benefits are stopped being paid due to violations, then enrollment can be restored only by decision of an authorized representative of the Government of the Russian Federation. And this is possible, for example, after payment of a fine or the end of the period of community service (if this is the penalty imposed by the court). Until this moment, even after submitting an application to the central registration center, registration will be refused.

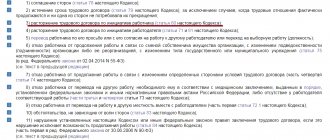

Grounds for refusal to register as unemployed

- Refusal of a person twice within 10 days from suitable work, including temporary work. A suitable job is one that meets the professional suitability, skill level, health status of the employee, meets the conditions based on the conditions at the last place of work and is within transport accessibility from it. For disabled people, suitable work must comply with the conditions developed in the rehabilitation program;

- Refusal of a citizen twice from work and professional training in case of lack of profession and work experience;

- Failure of a citizen to appear within 10 days for job selection without good reason;

- Failure of a citizen to appear within the established period for recognition as unemployed;

- Providing false documents and providing false information.

How do non-payment periods differ from suspension periods?

Non-payment is when not only the accrual of benefits is stopped, but the period of receiving social assistance is not counted. But the suspension of benefits is when funds are not accrued, but the period for receiving them is counted. And if in the future the unemployed person re-registers and follows all the inspector’s instructions, then he has the right to apply for financial assistance only if he spends the period of receiving it (no more than 18 months over 3 years). The period of suspension of benefit payments cannot exceed 1 month, after which the unemployed person is removed from the register.

Unemployment benefit amount

Unemployment benefits are calculated as a percentage of the average earnings for the last 3 months received at the last place of work (service). In accordance with the law, benefits are calculated: 1. First payment period (12 months):

- the first 3 months – in the amount of 75% of average monthly earnings;

- the next 4 months - in the amount of 60% of average monthly earnings;

- further – in the amount of 45% of average monthly earnings.

2. The second payment period (+12 months) is paid in the amount of: the minimum amount of unemployment benefit + regional coefficient.

Calculation of the amount of unemployment benefits is carried out on the basis of the official part of wages for the last 3 months.

The amount of unemployment benefits based on Decree of the Government of the Russian Federation No. 1423 dated November 24, 2017 is 4,900 rubles. The minimum benefit amount is 850 rubles.

Features of the complete abolition of monetary social support

The accrual of benefits is completely canceled in the following cases:

- deregistration of a citizen from the registration center (on his own initiative);

- change of citizenship (without retaining the right to work);

- previously registered, convicted under articles of the Criminal Code of the Russian Federation;

- Previously, payments were obtained fraudulently;

- assignment of a long-service pension;

- death of an unemployed person;

- the unemployed person himself refused social assistance (submitted an application);

- The citizen received one-time assistance to start his business.

The citizen is informed in writing about the termination of social payments. The responsibility of citizens for failure to comply with the conditions for registration with the Employment Center is regulated by Article 35 of the Law “On Employment”.

Legislative regulation in 2019

The government signed Resolution No. 1275 dated December 15, 2021. This document for the first time proposes an increase in benefits for persons left without a basic income.

The following changes are expected to occur in 2021:

- Setting maximum and minimum amounts for future pensioners. These will be 1,500 and 11,280 rubles, respectively.

- Many exceptions to the rules will apply to those approaching retirement age.

- Within 1500-8000 rub. the amounts of regular benefits will be found.

For other situations, the standard procedure for assigning benefits and transferring money is maintained.

Case studies

Citizen N registered with the Employment Center because the plant where he worked closed. Along with registration, he submitted an application for social financial assistance at the time of his “unemployed” status. After 2 months, the citizen found a job on his own, but reported this to the Central Employment Center only 1 month later. It turns out that for 30 days he illegally received benefits, and this is considered a violation. And in the future, if he re-registers, he will be deprived of the right to receive assistance.

Second case: citizen B registered with the Central Tax Service and submitted an application for payments. After 4 months, I changed my place of residence and submitted documents to the new Employment Center at my place of residence. The previous inspector was not informed about this.

Payments from both central payment centers were suspended due to suspicion of illegal enrichment of a citizen (Article 159-2 of the Criminal Code of the Russian Federation “Fraud in receiving payments”). He was threatened with a fine in the amount of an annual salary, but the court, taking into account the fact that the defendant had no evil intentions, appointed a probationary period. The citizen was able to restore the accruals only 7 months later (after the end of the trial).

An unemployed person may be legally or permanently deprived of social benefits. To avoid this, it is enough to comply with all the requirements of the TsZN inspector, as well as provide only reliable information about your current place of residence and employment.

Illegal receipt of financial assistance: statute of limitations

If control authorities determine that assistance was obtained illegally, the problem is resolved in one of two possible ways:

- the benefit is collected in court;

- Reimbursement is voluntary.

Court hearings are most often organized under such circumstances. But it happens that a long time passes before the necessary information is transmitted to the authorities. The standard statute of limitations will be three years. The main thing is that the citizen can prove his innocence.