Who needs it and why?

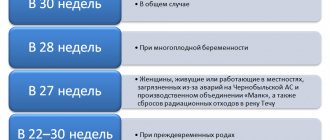

If an employee temporarily does not perform his work duties due to illness, injury, pregnancy, he is obliged to provide sick leave as confirmation and to receive the appropriate payment. Temporary disability benefits are paid by the accounting service within 10 working days from the date of receipt of the closed sick leave.

The size of the payment directly depends on the length of service and the salary received. The company pays a set amount to the employee from its own funds, and then receives compensation from the Social Insurance Fund. The only exception is the first three for sick leave; the employer pays for them himself.

Before payment is made, the temporary disability sheet must be checked for authenticity and correct completion. If the sheet is found to be invalid or counterfeit, no payment will be made. In addition, if fraudulent activities are detected, the perpetrator may be held accountable.

Free legal consultation

+7 800 350-51-81

Authentication can be verified for both paper and electronic sick leave certificates. Both employers and employees themselves are interested in ensuring that the sheet is valid. As for the paper version, they have several degrees of protection that you should pay attention to:

- water marks;

- text indicated under the column “doctor’s signature”;

- paper composition;

- manufacturer's name;

- additional elements viewed in ultraviolet light.

As for the electronic document, it was introduced only in 2017. As of 2021, this type is widely practiced and issued on a par with paper ones. The main difference is that the document is not handed out to the employee, but is stored electronically in the Social Insurance Fund database, to which employers also have access. Accordingly, counterfeiting of this type of sheet is practically impossible.

State services FSS amount of payment for sick leave

Citizens who recently got a job and have worked for less than six months receive no more than a fixed amount (7,500 rubles), which since July 2021 in the Russian Federation is 1 minimum wage. Average earnings According to the new rules, the average earnings or average daily wage of an employee is the amount of money actually earned over the last 2 years, which includes various additional payments, divided by the number of days actually worked, including holidays and weekends (730). Table of contents:

- for those who have more than 8 years of experience, 100% of the benefit is due;

- employees with 5 to 8 years of experience receive benefits in the amount of 80% of the accrued amount;

- For those who have officially worked for less than 5 years, the Social Insurance Fund will be able to pay only 60% of the benefit.

We recommend reading: How to show income in the 6NDFL form if during the period the employee has a negative accrual in advance, took a vacation and quit

How to check

If you suspect the authenticity of a temporary disability document, you can check this in several ways:

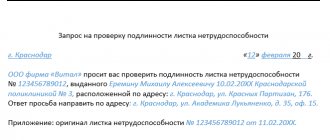

- Using an identification number through the FSS . This is done by sending a corresponding request to the Federal Insurance Service. Fraud is determined by 9 serial numbers and 3 barcode numbers. When making a request to the Social Insurance Fund, you must indicate information about the employee (full name), the name of the medical institution that issued the sheet. The application is sent via registered mail. The review period is 1-2 weeks.

- Through a clinic or other medical institution. In this case, you will also need to make a request. In the case of sanatoriums, ambulances, and blood transfusion stations, this will not be required.

- Through the official website of the FSS , through the “information for employers” section. The authenticity of the issued document cannot be verified there, however, there is information about stolen hospital forms. If you have exactly the same one in your hands, you can confidently say about fraudulent actions. In this case, you must remember that the data is updated only once every 1-2 months.

- Through the organization's security service . As a rule, such bodies exist in large enterprises, government services and banks. Accordingly, the inspection will be carried out by competent employees using the methods described above.

Important! The easiest way to identify discrepancies is to check the authenticity of the sick leave certificate based on external signs. It is worth carefully examining the paper document, checking it for watermarks, and so on.

How to check the status of sick leave on the FSS website

- check sick leave status;

- gain access to data regarding EL disability;

- search for electronic sheets according to certain criteria that can be specified by the user in any quantity and sequence;

- view all benefits already accrued to the applicant;

- familiarize yourself with the documents available in the database.

- organization of a unified register of sick leave provided by employees of enterprises and organizations;

- changing entered data, transferring documents to other statuses;

- verification of documents and the ability to quickly respond to suspicions regarding the authenticity of documents.

We recommend reading: Benefits for labor veterans of the Perm region in 2021

Who carries out

The employer, the security service and the employee can check the sick leave . In the latter case, you can write an official request to the Social Insurance Fund or to a medical institution if the issued document is in doubt.

In addition to these persons, the information may be verified by the Insurance Service and the medical institution where the document was issued. The doctor can check the sick leave on the FSS website; in this case, the “ITU office” section opens. After searching for a document, information appears about when the document was issued, whether an adjustment was made, whether there was an addition or cancellation. In the latter case, the grounds are also prescribed.

How to check electronic

As already mentioned, forging an electronic document is quite problematic. However, this does not mean that verification will not be needed, for example, by the employer. In this case, it can be done through the FSS website.

Attention! It is best to work on the FSS service by first registering using an account in State Services.

After access to the site is fully open, you should go to the “invalid certificates of incapacity” section and enter the electronic document number. If the search turns up nothing, then the sheet is valid.

The check can also be carried out by an employee. There are several ways to do this. First of all, also through the insurance service. To do this you need:

- Create an account on the FSS website and activate it.

- Go to the section “electronic certificates of incapacity for work”.

- In the field that appears, enter the document number and SNILS.

You can also search through the government services website. In this case, you only need to enter your SNILS number and check the currently available data.

Important! When applying for an electronic sick leave, the employee will need to provide the accounting department of his company with a unique identification number consisting of 12 digits.

View electronic sick leave through public services

She must find out the reason for the loss and confirm it with documents. If the reason is valid, such as a natural disaster, there is a chance to get a duplicate. If not, you will have to pay the employee benefits at your own expense. This will not happen with an electronic sick leave - the doctor sends it directly to the Social Insurance Fund.

If an inspector from the Social Insurance Fund discovers a lack of paper sick leave after the employer has received compensation, the inspector can deduct this amount from the businessman’s expenses for compulsory social insurance. All you have to do is either accept it or sue the FSS. It's expensive and time-consuming. There are no such problems with electronic sick leave sheets - the sheet is stored in your personal account on the FSS website.

We recommend reading: Request to the Internal Revenue Service about the employer's contributions

How to prove the authenticity of paper

The authenticity of a paper document can first of all be checked visually. The official sheet has the following external data:

- The leaf is divided into certain segments based on color Its center is blue, the edges are dark with a purple tint. Lines for entering information about a patient with a yellow impurity. The fake will be brighter, paler, or simply have no differences in color.

- used for the sheets is thick, with a rough surface . Reminiscent of the material on which banknotes are printed.

- a background grid on almost the entire surface of the document . It is not available only in sectors intended for a doctor’s signature. The fibers used in the manufacture of different colors are clearly visible under ultraviolet radiation.

- In the upper right corner there is a barcode with 12 characters. Under the field where the doctor’s signature is placed, there is a section with microtext.

- The presence of watermarks , which are clearly visible, indicates the authenticity of the sheet.

Where to download the database

There is no separate database storing information about invalid sick leave certificates in the public domain . All information can be obtained by employers, employees, and the defense service on the FSS website in the “invalid sheets” section.

The main point to remember is the relevance of the information provided. Information about new sick leave is not loaded into the database, but only after 1 or 2 months .

It is also useful to read: How many days is sick leave issued for?

Social insurance portal for calculating sick leave

- Specify the amount of earnings for the two calendar years preceding the date of the insured event.

- Divide the result by 730 (the number of days in the reporting period). This rule applies even to situations where they are leap years, such as 2021. In theory, the total number of days should increase by 1, which means that the amount of earnings must be divided by 731 days. But Law No. 255-FZ clearly states that it must be divided by 730, so this figure cannot be changed.

- The resulting figure is the average daily earnings. It will then need to be multiplied by the number of sick days, including weekends. The resulting product will become the required amount of temporary disability benefits.

We recommend reading: How many tickets do you need when passing your license in 2021?

For those who want to check the accuracy of the calculations, the FSS website has a special calculator program that will calculate everything itself. To do this, you only need to enter the initial data: wage system, employee work schedule, type of tariff rate, amount of time worked, dates of treatment, type of illness, and some other data. Using formulas already familiar to us, the system will calculate the specific amount of the benefit independently. To pay it to an employee, all you have to do is withhold tax.

If the check is unsuccessful

If the check carried out through the electronic database did not produce any results, and there is still no confidence in the authenticity of the document, it is recommended to make a request to the FSS . As already mentioned, the application contains information about the employee and the medical institution where the sheet was issued. The original sick note is also sent along with the request.

Upon completion of the established period (1-2 weeks), the applicant will receive an appropriate response about whether the document is real or not. If fraud is detected, the employee may be subject to disciplinary action, as well as criminal liability.

How to check a certificate of incapacity for work by number on the FSS website

The accrual of benefits for a certificate of incapacity for work is made after 10 days after its presentation. During this time, you must verify the authenticity of the document. If this happens later, you can recover the amount paid through the court.

A temporary disability certificate is a document filled out on an officially accepted form and necessary for a working citizen to confirm illness or other grounds for legal absence from work for a certain period.