Innovations in calculating ELN in 2021

Let's start with the basic data involved in processing certificates of incapacity for work, regardless of whether you are processing a paper certificate or a digital one - the changes will affect everyone.

In 2021, the minimum wage (hereinafter referred to as the minimum wage) was increased, and now it is 12,130 rubles.

The limit on an employee’s total income for the year, which forms the upper limit for sick leave payment, in 2021 amounted to 865,000 rubles.

Thus, the new limit values when calculating the amount of sick leave benefits are the corridor: from 370.85 rubles. up to RUB 2,150.68 for 1 day of incapacity.

As for sick leave certificates in digital form, their processing now takes less time, since, unlike the paper equivalent, the Social Insurance Fund receives the electronic health certificate and processes it faster.

Read on in the article about how to set up electronic sick leave certificates in 2021 and how it will work.

Actions of an employee to receive an electronic tax record

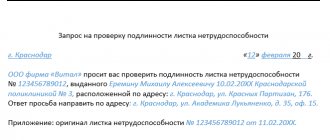

To receive an electronic sick leave certificate in 2021, the employee’s actions consist of providing written consent to each medical institution where the patient plans to be served for disability. When contacting a medical institution, the patient communicates his desire to issue a certificate of incapacity for work in digital form. The specified consent is standard, the template is downloaded from the FSS website and filled out according to the sample:

When the doctor considers it necessary to close the ELN, the patient is given a coupon indicating the parameters required by the employer for further processing. Losing a ticket does not entail any consequences. An employer can find a document by last name, SNILS number, and duration of illness.

If necessary, the patient registers in the FSS personal account, or on the government services website to check and upload hospital documents. If an employee does not want to register, then information on the sheet can be obtained by contacting the Social Insurance Fund.

Company management does not have the right to prohibit employees from receiving ELN. The company is obliged to make settings in the software and organize work with electronic sheets.

Results

The patient cannot receive an electronic sick note. The doctor will prepare this digital document in a special program, sign the UKEP and send it to the FSS. He will provide the patient with a unique sick leave number, which should be transferred to his organization. The employer will use this number to find sick leave in the Social Insurance Fund database and supplement it with the data necessary for calculating benefits.

To avoid problems with electronic sick leave, medical institutions, employers and the Social Insurance Fund must be informationally connected with each other.

In the absence of such interaction, the patient is issued a paper sick leave, which has the same legal force as its electronic counterpart. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Processing of electronic sick leave by the employer

The employer must hold an explanatory conversation with the team regarding the receipt and processing of the ENL. The employer needs technical readiness to receive an electronic tax record; it is better to set up the software in advance and train an accountant or other authorized representative.

Registration in the system

When the FSS introduced electronic sick leave certificates in 2021, updated functionality appeared for employers.

The personal account of employers provides access to the electronic personal information for all employees of the organization. The service responds to requests that arise from the employer, helps to understand how to fill out an electronic sick leave certificate to the employer and initiate its sending for verification and payment.

To work in the system, install FSS certificates at the workplace of the manager or the representative authorized to sign and send sick leave. Installation is carried out on the basis of GOST R 34.10-2012. You can download the certificate here.

Processing of electronic tax records is also assumed in the main accounting programs.

Registration of benefits

The mechanism for issuing benefits under ELN is simplified by reducing the bureaucratic burden - now there is no need to receive, process and organize the storage of a certificate of incapacity on paper. Digital data exchange reduces the time it takes to process sick leave and process payments.

Since January 1, 2021, a pilot project providing for the exclusion of the “offset scheme” of payments has already been operating in 50 regions of Russia. As part of the project, the amount of benefit payments generated from the Social Insurance Fund is transferred directly to the employee, bypassing the transfer of the organization. The territorial bodies of the Social Insurance Fund carry out their activities in relation to the registration of benefits and direct payments - on the basis of the resolution of the Government of the Russian Federation dated April 21, 2011. No. 294.

4>Receiving an E-Number from an employee

When the patient has regained his ability to work, the sick leave sheet is closed and a form is issued, which lists the necessary information about the patient, the duration of the illness, and the ENL number. A coupon with information is sent to the employer, using which you can find the ENL in your personal account and load it into the accounting program.

Electronic sick leave certificates in 2021 are more convenient for employers to process. Even without receiving an ELN coupon from the employee, the employer finds the document by last name, SNILS number, and duration of illness.

Actions of the employer after the closure of the ELN

After receiving the status “closed”, the policyholder receives access to editing. The “To be completed by the employer” tab requires entering data on average earnings, the employee’s length of service, period of illness, and cause of disability.

The program has a built-in automatic calculator that calculates the amount of benefits to be paid. Taking into account the entered data, the service breaks the amounts into two parts: at the expense of the employer and at the expense of the Social Insurance Fund.

There is no obligation to store electronic information on paper.

Conditions for switching to ELN

Based on Article 13 of Law No. 255-FZ, a sick leave certificate is issued electronically to a sick employee only with his written consent. Moreover, if the employee gave such consent, and it later turned out that his employer does not yet work with the ELN, the right to benefits will remain. As explained by specialists from the Federal Social Insurance Fund of Russia, in this case, the medical organization, at the request of the employee, must cancel the ETN and issue him a sick leave certificate on paper (letter dated 08/11/17 No. 02-09-11/22-05-13462).

ATTENTION. For employers, the transition to ENL is also voluntary. No liability has been established for those who do not gain access to the Social Insurance Unified Information System and will not be able to work with the new format of sick leave. Likewise, no “bonuses” are provided (exemption from inspections, faster reimbursement of expenses, etc.) for those who connect to the electronic sick leave system.

To start working with the new system, you need to perform a number of actions. First, it is necessary to conclude an agreement on information interaction with the regional office of the FSS.

Secondly, you need to purchase an enhanced qualified electronic signature (if you don’t already have one). You also need to install a special program on the computers of employees working with electronic signatures to verify electronic signatures and protect information.

Receive an enhanced qualified electronic signature certificate in an hour

Finally, thirdly, it is necessary to select the software with which the organization will work with ENL. Currently, there are three options for such software (subparagraph “a” of paragraph 10 of the Rules, approved by Resolution No. 1567). Thus, you can use software provided by the state: the policyholder’s personal account on the Social Insurance Fund website with access through the state portal, available on the Fund’s website.

You can also use special accounting services that have the ability to work with electronic sick leave. For example, all actions necessary to work with ENL can be performed in the system for preparing and sending reports “Kontur.Extern”.

Work with electronic sick leave and submit all related reporting through Kontur.Extern

Next, you need to inform all employees that the organization has switched to working with ENL. In particular, it should be explained to employees that they can now demand that medical institutions issue sick leave in electronic form, which will undoubtedly save them time.

Payment of benefits via electronic slip: who pays

If an electronic sick leave was generated in 2020

If an employee of the organization falls ill, then the organization takes over the payment of the ELN for 3 days, and from the 4th day the payment comes at the expense of the Social Insurance Fund. If there has been an accident at work, an occupational disease or an illness of a family member, then the Social Insurance Fund pays benefits from the date of opening the sick leave.

If the organization does not participate in the pilot project for direct payments, the organization pays the benefit in full and further reimburses the expenses incurred, in the amount established by law, from the Social Insurance Fund. Otherwise, the employer transfers only the proper amount, and part of the Social Insurance Fund is paid to the employee’s bank account.

Peculiarities of the procedure for calculating benefits on the basis of ELN

Features in the processing of ELN are due to the possibility of electronic processing. There are a lot of ways to process ENL: through the Foundation’s personal accounts, through the government services website, using accounting programs participating in the implementation of the ENL implementation project. It simplifies the receipt of sick leave, the calculation of payments, and the transfer of the ELN register to the FSS gateway.

The discovery of an electronic tax record in the FSS service already indicates the authenticity of the issued sheet and is subject to calculation.

To effectively process electronic sick leave, train your team, show them actions that reduce labor costs - then the speed and accuracy of working with electronic sick leave will increase.

Correcting errors in electronic sick notes

The human factor involves the occurrence of errors. Corrections are made to the sick leave statuses:

060 – sick leave filled by the employer.

070 – amounts payable have been accrued (for the “offset scheme”) or the “PVSO” register has been sent (for the pilot project for “direct payments”).

080 – amounts paid.

To make adjustments in your personal account, click the “Edit” button.

After which the necessary changes are made, the “Reason for corrections” and “Rationale for corrections” fields are filled in. Next, click “Save”.

To avoid errors, use the Manual Log, which displays the results of format and logical control and notifies you of the presence of errors.

When errors are detected by FSS employees, a notice regarding the benefit will appear in the manual.

Pros and cons of electronic sick leave

For policyholders, the transition to electronic insurance has undoubted advantages. These include:

- complete protection against payment for fake sick leave. The authenticity of the ELN is checked by the FSS at the stage of issuing the document by the medical institution. This means that the employer, when requesting an electronic sick leave using the number provided by the employee, receives a document for payment that has already been verified and approved by the Fund;

- no need to store sick leave certificates and present them during inspections. All information about ELN is always at the disposal of the FSS, which can check it without the participation of the organization. This means that you will not have to present electronic sick leave certificates during inspections. This is confirmed on the FSS website.

There are also conveniences for workers who issue electronic sick leaves. They can receive the appropriate payment faster, since in order to assign a benefit, they do not need to give the original document to the employer, but only need to provide its number. In addition, the electronic form of sick leave makes it impossible to lose or damage it. Finally, in the ENL there simply cannot be errors in indicating information about the employer, since the medical institution takes all the information from the Social Insurance Fund database.

As for the disadvantages of switching to a new system, perhaps the most significant of them at the moment is the lack of regulation of the procedure for correcting errors made by the employer when filling out his part of the electronic tax record. FSS specialists note that changes are not made to the electronic sick leave certificate itself, and all corrections are reflected “on paper” and stored by the employer. At the same time, software tools for working with electronic sick leave allow for correction of information in the electronic sick leave, including after the benefit has already been paid.

REFERENCE. The rules for making changes to the ENL are contained in the draft order of the Ministry of Health of Russia “On approval of the Procedure for generating certificates of incapacity for work in the form of an electronic document.” It provides for the possibility of re-sending a corrected electronic sick leave to the Social Insurance Unified Insurance System. In this case, the reason for the correction and the justification for the changes made must be indicated. All documents must be certified with the employer’s digital signature (clause 52 of the draft order).

Also, difficulties when working with electronic devices may arise due to technical failures in the functioning of the corresponding electronic systems. This leads to the inability to receive an electronic sick leave by number, fill it out or send it, etc. Judging by the information posted on the FSS website, errors in the operation of systems are quickly eliminated.

The employer's obligation to join the electronic data exchange system

Federal Law of May 1, 2021 No. 86-FZ provides for the introduction of sick leave certificates in digital form.

The employer has an order to conduct clarifications with the staff, talk about the ELN and the right of employees to receive a certificate of incapacity for work in electronic form. However, not all companies have the technical equipment to process ELN. Then the employer can only ask his employees to receive sick leave on paper, but has no right to force them to do so.

An employer should think about joining the information space, as it provides benefits. ELN cannot be forged, there is no need to store it on paper, and there is no need to track the ink color and letter size. The built-in calculator will make the calculations, and the Social Insurance Fund will quickly receive the completed ENL and promptly check and transfer the benefits.

What to do if you couldn’t get an electronic sick leave

You came to see a doctor and asked him to issue you an electronic sick leave. But they refused, offering you a paper version of the document. What to do?

It’s okay, calmly agree to a paper form - it has the same legal force as an electronic sick leave. And they will pay the same amount of benefits for it.

NOTE! You may be refused to issue an electronic document if for some reason the medical institution is not connected to the Social Insurance Unified Information System. If the medical institution has all the capabilities to issue sick leave electronically, the refusal is illegal. To resolve the issue in such a situation, try filing a complaint with the head physician of the medical institution.