Sick leave after dismissal according to the Labor Code of the Russian Federation

According to Art. 183 of the Labor Code of the Russian Federation, if a person quits, finds a new job, and then falls ill, the period of incapacity for work is paid by the new employer .

If a person quits, less than thirty calendar days have passed since that moment, and he has not yet managed to find a new place of employment - payment is made at the expense of the previous employer .

If all the above conditions are met on the part of the employee, but the previous place of work no longer exists, is undergoing bankruptcy proceedings, does not have enough financial resources - payment is made at the expense of the local division of the Social Insurance Fund (based on Part 4 of Article 13 of Article N 255-FZ ).

After dismissal, the following health problems are subject to insurance and are covered by sick leave benefits:

- any illness or injury;

- artificial termination of pregnancy or IVF procedure;

- prosthetics (for medical reasons, and not at personal request, including “beauty surgery” or laser vision correction);

- if a person stayed in sanatorium-resort organizations for health reasons, and there is documentary confirmation of this, certified by a doctor.

Payment of sick leave after dismissal occurs only if the person with whom the employment contract was directly concluded is temporarily disabled.

If sick leave is taken in connection with caring for an incapacitated family member, then after dismissal it is not paid . This issue can be challenged in court, but the court is more likely to side with the employer.

Attention! You must apply for sick leave benefits no later than six months from the date of receipt of your sick leave. If an employee applies for paid sick leave afterward, his case is reviewed by the Social Insurance Fund. He will take the employee’s side only if he has a good reason for the delay.

Valid reasons are:

- force majeure circumstances, such as natural disasters, catastrophes;

- injury or illness due to which the employee was unable to work (Example: complex fractures, spinal injuries that led to paralysis of the limbs, eye injuries that required long-term restoration of vision, and so on);

- moving to another locality;

- illegal dismissal, which led to forced absenteeism;

- death or serious illness of a close relative (Example: an employee’s parent has died or become paralyzed and needs constant supervision);

- other reasons may also be considered by the court and recognized as valid. The lawsuit is initiated by the employee.

Working off

Many people have a question: what to do with the work off, which is also due when quitting during sick leave at your own request?

By law, the employee must notify the employer two weeks in advance, and in writing. But sick leave in case of voluntary dismissal cannot increase this period or extend it. This means that sick leave during service upon dismissal is counted as service itself. The rules are described in Article 80 of the Labor Code.

Thus, to the question of whether sick leave is considered work upon dismissal, we can safely answer: yes.

If an employee received sick leave on the day of dismissal, then he must be paid benefits not for one day, but for the entire period of illness. This is due to the fact that the benefit is paid for the entire period of illness of an employee who works in the organization under an employment contract (Part 2 of Article 5 of the Law of December 29, 2006 No. 255-FZ). And the day of dismissal is considered the last day of work (Part 3 of Article 84.1 of the Labor Code of the Russian Federation). In this case, you need to take into account the insurance period.

An employee who falls ill (injured) after dismissal must be paid sick leave benefits in one case: the illness occurs (injury received) within 30 calendar days from the date of dismissal. The amount of benefits that needs to be paid to the employee can be reimbursed from the Federal Social Insurance Fund of Russia. Such rules are established in Part 3 of Article 13 and Part 2 of Article 4.6 of the Law of December 29, 2006 No. 255-FZ. Regardless of length of service, pay benefits in the amount of 60 percent of average earnings.

Who is entitled to payment after dismissal?

Any employee who was dismissed (no matter for what reason), issued a certificate of incapacity for work less than thirty days after dismissal and applied for payment before six months had expired from the date of dismissal has the right to receive sick leave pay.

All other nuances (reason for dismissal, on whose initiative the decision to terminate the employment relationship was made) have no legal significance.

How many days can I wait for compensation from the moment all documents are submitted?

After the person who presented the sick leave has applied for payment, the policyholder is obliged to schedule the payment of temporary disability benefits no later than 10 calendar days from the date of the application.

As stated in paragraph 1 of Article 15 of the Federal Law of the Russian Federation No. 255-FZ, payment of compensation must be made on the next day of payment of wages .

We told you more about how and when sick leave is paid for here.

Documents for payment processing

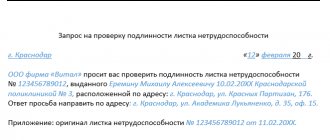

To confirm the employee’s right to payment of sick leave after dismissal, the following documents :

- Passport to confirm the employee’s identity.

- Sick leave certificate to confirm the grounds for payment of sick leave benefits (be sure to provide the original!).

- A work record book to confirm that the employee has not found a new place of employment at the time of the opening of sick leave. It is permissible to present the work record book in photocopy format.

- Certificate of income for the last two years to determine the average salary of the employee.

If an employee falls ill before or after dismissal

Regardless of whether the employee fell ill before or after dismissal, payments are calculated based on his length of service:

- If the employee’s work experience is more than eight years , payments are 100% of the average salary .

- If the work experience is from five to eight years - 80% .

- If the work experience is up to five years - 60% .

The larger payment amounts do not depend on anything. Their amount is strictly fixed, determined by law and calculated based on the employee’s length of service .

Reference! There is a limit (67,000 rubles), above which wages are no longer taken into account. If the employee’s salary for the last year exceeded this amount, then the salary before it is taken into account.

The minimum benefit is limited to the minimum wage . If an employee’s monthly earnings are less than the minimum wage, or his work experience has not yet reached six months, then the final earnings for the last two years (based on this amount, the average salary of the employee is calculated in order to calculate the required percentage from it) will be equal to the minimum wage multiplied by 24 months (that is, two years).

If maternity leave falls into the calculation years, then these years are replaced by the previous ones. But for this you need to fill out an appropriate application.

Attention! The employer does not have the right to reduce the payment to 60% after dismissal. It is illegal. Also, the employer does not have the right to pay only the day when he was given a certificate of incapacity for work - sick leave must be paid in full. This is either an employer's misunderstanding of the law or a malicious attempt to take advantage of the employee's legal illiteracy.

Is it possible to pay the employment service?

The employment service does not pay for sick leave, even if the person is registered as unemployed. This department already pays social benefits to the unemployed. During illness, it does not disappear, does not change (that is, the sick person continues to receive financial resources), but it does not increase, so in fact, this department does not provide for sick leave payment.

Reference! A sick leave certificate can serve as confirmation of a valid reason why an unemployed person did not undergo the re-registration procedure or did not appear for interviews.

If a person is not registered with the labor exchange, but is looking for work on his own after leaving his previous job, then he has the right to demand payment for sick leave from his previous employer.

Registration of dismissal during sick leave

In accordance with Article 81 of the Labor Code of the Russian Federation, a company does not have the right to dismiss an employee on sick leave on its own initiative.

Exception: if the company goes through liquidation and ceases operations. In another case, the employer is obliged to wait until the employee returns from sick leave. Only then does he have the right to terminate cooperation on his own initiative.

However, the employee has the right to submit a statement of desire to terminate cooperation with this company. The employee and his boss may decide to terminate cooperation by mutual agreement.

An application for resignation of one's own free will is drawn up in free form and must contain:

- the employee’s clear desire to leave the organization;

- date of the last working day;

- signature.

It can be done in writing, by hand, or on a computer. It can be sent to the place of employment using a registered letter, since the employer must have the original resignation letter certified by the employee’s signature, otherwise the dismissal may subsequently be declared invalid. It is not necessary to appear at the place of employment in person.

In accordance with the Labor Code, an employee is required to complete two weeks of work before completely ceasing cooperation with the company. In this case, work off begins from the day the employer received the letter of resignation, that is, the period of incapacity due to illness is also included in work off .

Example : an employee decided to quit and at the same time felt very unwell. She submitted a letter of resignation to her employer and at the same time a certificate of incapacity for work for five days.

In this case, the employer is obliged to pay for these five days, and after that the employee is obliged to either extend her sick leave after dismissal of her own free will, or go to work, as prescribed by law. But its work begins from the day the application is submitted, that is, minus sick leave, it should last another eight days.

Maternity nuances

But the law provides an exception for employees who have valid reasons for dismissal. Sick leave after dismissal by agreement of the parties in 2021 for pregnancy and childbirth, if it occurs within 30 days after dismissal, must be paid by the employer for the reason (clause 14 of the order of the Ministry of Health and Social Development dated December 23, 2009 No. 1012):

- inability to live and (or) work in a given region due to health reasons;

- transfer of the spouse of a pregnant employee to work in another region, her relocation to her husband’s place of residence;

- needs of supervision of sick relatives or disabled people of group I.

Each of the reasons for dismissal - before maternity leave or dismissal of an employee on sick leave, by agreement of the parties - must be proven documented: certificates from social security, medical institutions, from the husband’s place of work, from the housing department, homeowners’ association at the place of residence, etc.

Example of payments after dismissal of an employee

The employee resigned on January 20, 2021. On February 6, that is, seventeen days later (falls under the thirty-day rule after dismissal), he, having not yet found a new job, fell ill and took sick leave for seven days. The employee's work experience is six years. In 2021, he earned six hundred and forty thousand rubles, and in 2021, due to the pandemic, his income dropped to six hundred thousand.

Calculations:

- Billing period: 365+366=731 days;

- 640,000 + 600,000 = 1,240,000 rubles - total earnings for the billing period;

- 1,240,000 / 731 = 1,697 - average earnings;

- 1,697/100*60=1.019 - daily allowance

- 1.019*7=7.133 rubles - amount to be issued.

The employer is obliged to pay this amount to the employee within a month from the date of submission of the sick leave certificate..

Deadlines

You can receive issued sick leave after dismissal in 2021 within a month. If there was a voluntary dismissal during sick leave, and it continues for a long time (and not necessarily with one sheet, but with several, continuous by date), payment still comes at the expense of the former employer.

If the period of sick leave exceeds six months, then the issue of simultaneous dismissal and sick leave is regulated with the help of the Social Insurance Fund, which has the final say in how to pay for the leave.

The employer is not exempt from complying with the general procedure for processing documents when leaving on sick leave at his own request. Money for sick leave must be transferred on the next payday.