Home / Labor Law / Payment and benefits / Sick pay

Back

Published: March 12, 2016

Reading time: 7 min

0

3037

Among the state system of protection of citizens there is a special part on compulsory insurance of all workers and their families in the event of disability.

These legal relations are regulated by Article 39 of the Constitution of the Russian Federation, in which disabled citizens are guaranteed to receive social assistance, as well as several federal laws. “On compulsory social insurance in case of temporary disability and in connection with maternity” can be especially highlighted

- In what cases does the employer pay for sick leave?

- ...insurance fund

- Reasons for reducing payments

Payment of sick leave through the Social Insurance Fund

Sick leave or disability benefits are provided for by Federal Law No. 255 of December 29, 2006. In accordance with Art. 3 The first three days are paid for by the employer, then payments are financed by Social Insurance (Social Insurance Fund, FSS). The current procedure provides for the calculation, accrual and payment of the benefit amount by the employer, and then he is compensated from the budget, that is, Social Insurance. There is no question of who pays, the employer or the state. The majority of benefits are paid by the state.

However, this system is quite cumbersome; employers often abused the deadlines for transferring funds. Therefore, in order to ensure the timely and full realization of their rights by workers, a “pilot project” was launched back in 2011 by Resolution No. 294 of April 21. This program provides for the calculation and transfer of funds towards benefits by the Fund's employees within a strictly limited time frame. That is, the main goal of the pilot project is to improve the situation of insured persons.

FSS payments

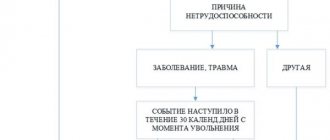

Social Insurance payments are made according to the general rule from the 4th day of sick leave. This rule, as we have already indicated, applies to cases when the employee himself falls ill or is injured.

In other situations, 100% sick leave is compensated by payments from the Social Insurance Fund of the Russian Federation. For example, in the case of issuing a certificate of incapacity for work during pregnancy and childbirth.

In fact, the funds are issued within a 10-day period by the employer, who then sends the documentation to the extra-budgetary fund to receive compensation.

In some regions there is a pilot project where the employer does not pay his own funds, but transfers sick leave to the Social Insurance Fund of the Russian Federation. The payment is made immediately from the funds of the fund.

Extension of the program to the regions

At the moment, it depends on the region who pays sick leave - the Social Insurance Fund or the employer, since regions are connecting to the payment system through the Fund gradually.

Since July 1, 77 regions have already been involved in the program; since July 1, the project has expanded to another 8 regions:

- republics: Bashkortostan, Dagestan;

- Stavropol and Krasnoyarsk territories;

- regions: Volgograd, Leningrad, Yaroslavl, Tyumen.

Lastly, the following constituent entities of the Russian Federation will join the direct payment system:

- regions: Krasnodar, Perm;

- regions: Moscow, Chelyabinsk, Sverdlovsk;

- Khanty-Mansiysk Autonomous Okrug;

- and capitals: Moscow and St. Petersburg.

This should happen from January 1, 2021.

Calculation example

For October we will see the following numbers:

Seven and a half thousand (minimum wage) * fourteen (days of treatment in January) / thirty-one (days in the month) = three thousand three hundred eighty-seven rubles.

Here is the calculation for February:

Seven and a half thousand (minimum wage) * six (days of treatment in February) / twenty-eight (days in a month) = one thousand six hundred seven rubles.

It should be noted that payment of sick leave at the expense of the employer must be timely. But let's get back to the calculation. Adding up the values, we get: three thousand three hundred eighty-seven + one thousand six hundred seven = four thousand nine hundred ninety-four rubles - the total payment for the days spent on treatment. Please note that only those who have eight or more years of insurance experience (one hundred percent) can rely on the amount received. You also already know how many sick days an employee can have at the expense of the employer.

Employee's procedure

The new law provides for the following procedure and deadlines for making decisions by the Social Insurance Fund:

- the employee, as before, brings sick leave to the employer’s accounting or personnel department. There he also draws up an application to the Social Insurance Fund (the form is provided by the employer) about the calculation and payment of benefits. The application must include the following information: registration address, full passport data, account or card number where funds should be transferred;

- the employer is obliged to calculate the employee’s average earnings within 5 working days from the date of receipt of the application. This indicator is necessary to calculate the benefit amount. The employer sends an electronic register to the Social Insurance Fund, where he indicates all the necessary data on the employee;

- The Fund makes a decision no later than 10 business days after providing the information in full. If the decision is positive, the transfer is made within 2 business days.

In practice, the Social Insurance Fund makes decisions and pays benefits very quickly, usually within 2 days, maximum 5 days.

Personal income tax and insurance premiums

Withhold personal income tax from the entire amount of sick leave benefits.

Withhold the tax no matter in connection with which insurance event (illness of the employee himself, caring for a sick child, etc.) the benefit is assigned. Personal income tax is also applied to benefits assigned in connection with an accident at work or an occupational disease. Such conclusions follow from paragraph 1 of Article 217 of the Tax Code of the Russian Federation and are confirmed by letter of the Ministry of Finance of Russia dated April 29, 2013 No. 03-04-05/14992. Personal income tax must be withheld on the day of payment of sick leave benefits (clause 4 of Article 226 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated October 10, 2007 No. 03-04-06-01/349). This day is recognized as the day of salary payment closest to the date of granting benefits (Part 1 of Article 15 of the Law of December 29, 2006 No. 255-FZ).

When paying temporary disability benefits to employees (including benefits for caring for a sick child), tax agents must transfer personal income tax from them to the budget no later than the last day of the month in which these incomes were paid. This is provided for in paragraph 6 of Article 226 of the Tax Code of the Russian Federation.

Contributions for compulsory pension (social, medical) insurance, contributions for insurance against accidents and occupational diseases for the amount of sick leave benefits do not need to be accrued (clause 1, part 1, article 9 of the Law of July 24, 2009 No. 212-FZ, subp. 1 clause 1 article 20.2 of the Law of July 24, 1998 No. 125-FZ). This also applies to the amount of benefits that the organization pays from its own funds for the first three days of incapacity.

Attention: if the Federal Social Insurance Fund of Russia does not accept the amount of temporary disability benefits as offset, then mandatory insurance contributions must be calculated for this amount.

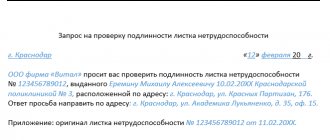

Based on the results of the inspection, inspectors from the Federal Social Insurance Fund of Russia will refuse to reimburse sick leave benefits if they were paid in violation of legal requirements. In particular, if the corresponding sick leave certificates are missing (wrongly completed).

In this case, the benefit amount is not considered insurance coverage for compulsory social insurance. Consequently, it does not apply to payments for which mandatory insurance contributions are not charged (clause 1, article 9 of the Law of July 24, 2009 No. 212-FZ). Therefore, it is subject to insurance premiums on a general basis.

Such clarifications are contained in the letter of the Ministry of Health and Social Development of Russia dated August 30, 2011 No. 3035-19.

Changes due to coronavirus

Due to the pandemic, the rules for calculating and paying sick leave have changed. Since social contacts must be limited as much as possible, issuing sick leave has become easier (they are compiled electronically). Employees forced to comply with quarantine receive sick leave. Pensioners who are prohibited or advised not to leave their homes should also not appear at the workplace in order to reduce the risk of their illness. They are also given sick leave for the period of self-isolation.

Who pays for quarantine sick leave in 2021?

In accordance with current legislation, quarantine is indicated by the code “03” and is paid in full by the Social Insurance Fund. This follows from the Temporary Rules approved by Government Decree dated March 18, 2020. They are valid from March 20, 2020. until 07/01/2020

There are also temporary rules for assigning benefits in the event of quarantine for citizens over 65 years of age, approved by the Decree of the Government of the Russian Federation dated April 1, 2020. No. 402. A working pensioner does not need to apply anywhere; it is enough to inform the employer about self-isolation.

The Social Insurance Fund must work very quickly, benefits are paid throughout the day (first for the first 7 days, then for the remaining time). But the employer must send the Fund all the necessary data on the employee.

Postings for sick leave at the expense of the employer

The transaction numbers are located depending on which expense account the person's wages are charged to. In fact, there are practically no differences from the usual salary: Dt 20, 23, 25, 26, 29, 44, 91 Kt 70.

The calculations indicated above apply only to those who have shown a certificate in form 2-NDFL from a previous place of work, if, of course, the place of work has changed in the last 2 years. For those who started working in another organization, but did not present a certificate in form 2-NDFL at the new job, sick leave will be calculated in accordance with the minimum wage (minimum wage - seven and a half thousand rubles (from 06/01/2017 - seven thousand eight hundred rubles).

Let's imagine that the employee was undergoing treatment from the seventeenth of January two thousand and seventeen to the sixth of February two thousand and seventeen. The specific example refers to two months: January and February. For January and February, you should count separately, since they contain different numbers of days: January - thirty-one days, February - twenty-eight days. Next, we will consider paying sick leave at the expense of the employer.

For what reason may a BC be refused?

There are situations when a citizen applies to a hospital institution for registration of medical insurance and is refused. The grounds for making this decision must be legal.

In fact, situations when a doctor can refuse are as follows:

- the patient has no signs of illness or injury;

- a citizen came to the doctor in a drunken state;

- the illness occurred in the citizen during any type of vacation;

- in the case of a chronic disease and when undergoing an examination to determine professional unsuitability;

- for caring for a child over 15 years old.

In addition to these rules, the patient should be aware that some medical institutions do not have the legal right to issue such forms.

Period for applying for compensation under the BC

The ballot benefit is considered a mandatory payment guaranteed by the state. In this regard, citizens are given up to six months from the moment the form is closed to transfer the document to their place of employment and receive the due payment.

There are restrictions regarding the timing of calculation and payment of compensation. No more than 10 days may pass from the receipt of the relevant application from the employee. At this time, according to the BC, the accountant is obliged to perform all calculations and familiarize the employee with the results.

As for the direct payment of funds, the benefit must be transferred to the card or issued personally to the employee on the first advance payment or salary at the enterprise.

It is important to strictly adhere to the established deadlines and document the date of issue of benefits, since violation of this rule may result in a serious fine.

After paying the money to the employee, the company has every right to apply for reimbursement of the money spent, but subject to existing rules. That is, in certain sick leave cases, the accountant will have to deduct the cost of three days from the amount paid.

In conclusion, it is worth noting one important thing - payment of benefits for a certificate of incapacity for work is the direct responsibility of the employer. In case of violation of this rule, the company will be held accountable and punished with a fine.