How to formalize a change in an employee’s salary: unified order form

The first steps in the procedure are drawing up a memo, as well as getting this document approved by management. Then they ensure that changes are made to the staffing schedules.

The order is an order to change the salary

This is why the order itself is issued. It must describe exactly what changes are being made to the staffing table and in what order. It is also necessary to indicate what served as the basis for reducing or increasing the salary.

The procedure for making changes is completed after the salary is finally approved. It is mandatory for the employee to familiarize himself with the document. Afterwards, the personnel officer corrects the personal file. A copy of the order is sent to the accountants. Finally, an additional agreement is expected to be concluded with the subordinate.

Salary increase

The step-by-step procedure for increasing an employee’s salary looks like this:

Step 1. Execution of the basis document

An increase in wages can be carried out for various reasons, fixing the new amount in:

- Regulations on wages.

For example, it may be indicated here that, after working a certain amount of time, the employee’s salary increases by an n-sum or by a percentage of the established salary (for example, after a year of work - by 2%, after 2 years - by 3% and after 3 years - by 5%). This approach is used to provide an additional incentive for the employee to continue cooperation.

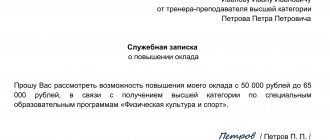

- Memo from the head of the department.

In it, the employee’s immediate supervisor can ask for a salary increase, indicating the reasons and amount. The form of the memo is not approved by law; it can be drawn up in free form:

- Employee statement.

The application is also drawn up in free form. It is advisable to indicate the arguments in favor of increasing the salary and provide figures: for example, the dynamics of changes in indicators upward, as well as the amount by which the employee asks to increase his salary.

Step 2. The director decides to increase wages

Such a decision must be recorded in the order, familiarizing the employee with it against signature.

Step 3. Making changes to the staffing table

To do this, also develop an order describing the essence of the changes and the start date of the new staffing table.

Step 4. Drawing up an additional agreement to the employment contract

Art. 3 of the Labor Code of the Russian Federation prohibits discrimination in the field of labor relations. Consequently, by increasing the salary of one employee, employees of similar positions have the right to claim discrimination of rights.

To minimize risks, we recommend:

- Introduce a new unit with an increased salary into the staffing table: for example, transfer an employee from the position of manager to the position of senior manager.

- Reward the employee with regular bonuses.

Registration of salary changes for all employees or several

It often happens that management decides to change salaries for all employees or for a certain group. If the salary increases, then no prior agreements will be required.

You just need to formalize an agreement that the working conditions are changing. For example, that wages are increasing. The document sets out the reasons for such grounds along with the period during which the changes will apply.

But employees have the right to refuse such adjustments. For example, when a salary increase contributes to the loss of the right to one of the benefits.

If one of the subordinates refuses, but the others do not, then for the first one it will be necessary to provide for a reduction in job responsibilities. Otherwise, the situation will look like discrimination to inspectors.

Salary Guide: Responsibility for Violations

Wages (employee remuneration) - remuneration for work depending on the qualifications of the employee, complexity, quantity, quality and conditions of the work performed, as well as compensation payments (additional payments and allowances of a compensatory nature, including for work in conditions deviating from normal, work in special climatic conditions and in areas exposed to radioactive contamination, other compensation payments) and incentive payments (additional payments and incentive allowances, bonuses and other incentive payments). This definition is provided for in Part 1 of Art. 129 Labor Code of the Russian Federation.

Read more

In most cases, if innovations concern all personnel, and the organization maintains a staffing table (SH), the employer formalizes the changes in the form of a SH. Amendments to it are made in accordance with the order of the head of the organization or a person authorized by him. You will find a sample SR below.

If the changes affect only part of the staff, it is more advisable for the employer to draw up an order to change salaries in free form. To do this, use our sample.

It should be remembered that if the organization has a ShR, a new salary is assigned to the position. Therefore, if a position is occupied by several employees, and only one of them needs to increase their salary, a new position will have to be introduced.

Due to the decrease

The employer has the right to change the salary downward if the enterprise faces adjustments regarding organizational and technical conditions. But even in this case, you cannot pay wages below the minimum wage. Otherwise, the worker’s situation worsens, and the Labor Code of the Russian Federation does not allow such an outcome.

Reducing employee salaries has clear legal restrictions

As for the manager’s actions, they will be as follows:

- Issuing an order stating changes to the staffing table. Each employee must be familiarized with the order and signed.

- Notifications indicating the reasons for the salary reduction are sent to employees no later than two months before the actual changes. Separately, opportunities to resign are provided for those who do not agree with the new provisions. The director is obliged to offer another suitable position to those who are not at all satisfied with the new salary. If the other party refuses the proposed options, the manager has the right to terminate the agreement.

- An act of refusal is drawn up if the citizen does not agree to sign documents or get acquainted with them. The document is also required for situations where there is a refusal to perform work under new conditions.

- An additional downgrade agreement is drawn up for those who agree. And also you cannot do without an order regarding changes in salary.

Setting and changing salary

As a rule, for a newly appointed employee, the initial salary (salary) for the probationary period is set depending on the company’s policy (for an example, see Table 1). During the probationary period, he receives wages in the amount of salary established for the probationary period - without additional payments (bonuses or bonuses). After successful completion of the probationary period, the official salary is established based on an assessment of the employee’s qualification level and in accordance with the company’s accepted level of payment for this position (most often it is agreed upon for a period of one calendar year).

| Payment for the probationary period | Payment after trial period (%) | Duration of probationary period (months) |

| 80% of the base salary for this position | 100 | 3 |

The salary of a particular employee (as opposed to the level of payment for a position) is not a strictly fixed value; it “evolves”, reflecting the process of a person’s professional and career growth. Salaries should be reviewed regularly, with adjustments usually made to the base salary. At the same time, due to changes in the strategic goals of the company or the objectives of the division, the size and frequency of payment of bonuses, bonuses, commissions, etc. may be revised. The grounds for adjusting the individual base salary of employees are:

- assessment of the results of professional activities;

- change in job level.

A general review of the amount of official salaries and wages of company employees occurs as planned, usually once a year. The basis for it is the change in the inflation index and the assessment of professional activity. Changing the employee's base salary based on an assessment of professional performance is carried out in order to objectively reward him for the quality of work during the assessed period. The review of salaries for professional activities is usually carried out once a year, before the process of reviewing salary budgets for the next period begins. The base salary also changes depending on the evaluation of the employee's performance. The adjustment percentage is determined when developing a corporate assessment system (an example of calculating adjustment percentages is given in Table 2).

table 2

| No. | Grade | Base salary adjustment |

| 1 | Unsatisfactory | is reduced by 10% (if an employee receives such an assessment a second time, then the question of his dismissal should be raised) |

| 2 | Satisfactorily | decreases by 5% |

| 3 | Fine | remains at the same level |

| 4 | Great | increases by 10% |

| 5 | Perfect | increases by 15% |

If an employee has worked for the company for less than six months and has not yet undergone an assessment procedure, his base salary is not revised (based on the assessment of professional performance). A change in the base salary when changing a position is carried out if an employee is transferred to a position that provides for a different (higher or lower) salary category. There are different types of employee movements within the organization: horizontal and vertical - within the function and within the company. Each of them corresponds to its own percentage of change in the base salary - as a rule, it does not exceed 30% (for an example, see Table 3).

Table 3

| Type of movement | Description | Change in base salary |

| Movement within the category - horizontal advancement (transfer) | Transfer to another position without promotion. In general, the requirements for an employee remain the same. Job responsibilities change, but remain at the same level of complexity. Powers and responsibilities remain the same. Transfer is possible both within one function and between functions within the entire company | 5% increase |

| Promotion within a job class (function) - vertical promotion within a function | Transfer to a higher position within one function. The knowledge and skills of an employee required to perform job duties relate to the same area, but they are subject to new, higher requirements. | Increase from 10 to 15% |

| Vertical promotion within the company | Transfer to a higher-level position, which requires the employee to have fundamentally different knowledge and skills. His new functional responsibilities are also radically different from his previous ones. | Increase from 15 to 30% |

The next change in the rank (position, grade) of an employee should be made no earlier than six months after the previous one. Traditionally, it is recommended to promote an employee to a position (with a higher pay level/category) step by step - transfer to one level. Promotion with movement through one job level is allowed only in exceptional cases (by a special decision of the personnel commission or the head of the company). Moving employees through two or more category levels is not permitted. If an employee is transferred to a position that provides a salary level lower than the existing one, his salary is revised taking into account the reasons for the transfer:

- Unsatisfactory performance of an employee in a previously held position. In this case, wages are reduced (usually ranging from 10 to 30%).

- Due to reorganization changes within the company. In this case, the person must be warned in advance about the proposed changes (a decrease is permissible within the limits provided for by the legislation of Ukraine).

If an employee is transferred to a position at a higher level, but his salary is less than the minimum acceptable level of payment for this position/in this category, his salary is increased - at the first stage, usually to the minimum acceptable level. In this case, the amount of the increase should not exceed a certain percentage of the previously paid salary (for example, 15%). With a simultaneous increase in an employee's official salary in connection with the assessment of his professional activities and promotion, the percentages of increases of all types intended for him, as a rule, are summed up. If the organization provides for the work of a personnel commission, then extraordinary changes in official salaries are carried out in the following order:

- The director of the department submits a proposal for the employee to the personnel commission.

- The personnel commission makes a decision.

- The head of the company approves the decision of the personnel commission.

If the company does not have a personnel commission, then extraordinary changes in official salaries are approved by the decision of the manager. An employee may be given a salary that is greater than that provided for in the Regulations, but in this case such a decision must be approved by the personnel commission and/or the head of the organization. When an employee combines two positions within the company, the work for the combined position is not paid in full: as a rule, it is a certain percentage (most often from 30 to 50%) of the salary level of this position.

https://www.hr-academy.ru/to_help_article.php?id=79

Share link:

Due to the increase

The salary increase procedure occurs at the same moment when an employee is transferred to a new position. And in this case, you cannot do without an additional agreement. It describes the new position along with the amount of remuneration for the work.

Once the parties sign the agreement, a final order is issued. For this, forms T-5 or T-5a are used. It is necessary to indicate the exact size of the bet after the increase. Information on the transfer is entered into the work book.

Watch the seminar on wages, minimum wage, salary and indexation:

Compilation rules

Since the procedure and rules are not regulated by law, it can be drawn up in any form. At the same time, in institutions and organizations of the public sector, the document must contain a link to the main administrative document of the parent company (or central office), the legal basis.

The rules for execution are no different from any other management personnel document, namely: the order must contain all the necessary details - the date of preparation, the date of entry into force, describe in detail the circle of persons to whom it applies, have the necessary visas and approvals.

Salary reduction: legality, permissible reasons

In most cases, salary reduction is a legal action that does not violate applicable regulations. The main thing is that the employer himself complies with all the rules specified above. It is permissible to reduce wages both for one employee and for all at once.

A downward change in salary is permissible if the following conditions are met:

- Reorganization of an enterprise when the technical and organizational conditions for performing work change.

- Demotion of employees.

- A real decrease in the company's income. In this case, the manager reduces salaries to avoid a complete shutdown of production.

Without the reasons described above, employers have no right to reduce wages.

Legal basis for salary increases

The amount of money that must be paid to the employee based on the results of work is fixed in the employment contract. This is the salary that an employee is entitled to for all the time worked or the amount of work performed.

Salaries are paid monthly, and their amounts are regulated by Article 135 of the Russian Labor Code. Article 134 of the Labor Code states that it is necessary to increase wages. This is due to inflation in the country and rising prices.

At the same time, the HR and accounting departments need to carry out very painstaking work so that the salary increase is justified and formalized properly.

According to Article 129 of the Labor Code, wages can be increased in the following ways:

- raise the tariff rate;

- raise the base salary, which is specified in the employment contract.

In addition, management can set increased percentages on compensation and rates, and decide on bonuses and additional payments. Such additional funds are listed in Article 129 of the Labor Code, which states that the manager can personally decide to increase the salaries of his employees, on his own initiative.

How does the minimum wage affect employee wages?

The minimum wage, which stands for minimum wage, is set at the state level. In 2021, Federal Law No. 421 is in force in the Russian Federation, in which the minimum wage is set at 9,489 rubles. This is 85% of the living wage. In the future, the government plans to equalize both of these indicators, so the minimum wage will increase, which employers should take into account.

Important

Each Russian region has its own minimum wage, established by local authorities. This is what local employers need to focus on.

As Article 133 of the Labor Code states, the monthly income of an employee who has worked the entire reporting period cannot be less than the minimum wage, so this is a very important indicator. True, if an enterprise is not subject to the minimum wage agreement in the region, changes in this indicator will not affect the wages of its employees.