Many Russian citizens who took out a housing loan have already received a tax deduction for mortgage life insurance. For those who do not yet know about this opportunity, we will tell you about it right now. What kind of deduction is this? To whom and when can it be provided? How much you can save on this - all the details are in this review.

Tax deduction. How it works

Let's start with the basics. There are taxes that are calculated as a certain percentage of the tax base. Such a base for different taxes can be: the amount of income, sales volume and other indicators.

For ordinary citizens (individuals), the main tax is the well-known personal income tax (). For many years, its size has been 13% of the tax base - the amount of income of an individual (). But the Russian Tax Code (TC) provides for a reduction in tax by the amount of deductions. The tax is calculated as 13% of a person’s income minus allowable deductions. The Tax Code defines standard, social and other deductions.

For example, social deductions are defined, and there is also a tax deduction for mortgage life insurance. This kind of compensation (reimbursement) for the borrower’s expenses is intended to partially alleviate his financial burden and return the tax on life insurance on the mortgage. He has to pay a huge amount of money, starting with the costs of applying for a loan (independent appraisal, realtor fees, mandatory insurance, and others), and then monthly payments for many years.

It is beneficial for the state and the banking institution for the mortgage borrower to insure his life, but this type of insurance is not required in a mortgage (). To encourage the borrower to conclude an insurance contract for voluntary life insurance, since the beginning of 2015, a tax deduction has been established for those who have concluded such an agreement with the insurer.

What does this give to the borrower? He gets back some of his money spent on insurance premiums. In addition, he insures his life, which can provide financial support in case of unfavorable developments.

Amount of tax deduction for life insurance

The maximum amount to be refunded is 13% of the policyholder's contributions under the contract. However, there is a limit upon reaching which you cannot receive more than the established amount.

The amount of compensation for an insurance contract should not exceed the maximum amount, which is 13% of the annual personal income tax paid to the treasury. Even if the expenses exceeded the established limit, it will not be possible to return more than this amount.

If the borrower has already received any compensation provided for in Article 219 of the Tax Code, then the maximum amount will be reduced by the amount of expenses on the basis of which an additional social benefit is requested.

But there are a number of exceptions that relate to compensation for expensive medical services and the return of funds spent on children’s education. These deductions will not reduce your limit.

The total amount of funds returned for all social tax deductions should not exceed 16,500 rubles per year. If at the end of the reporting period the deduction is not paid in full, the remaining portion is carried over to the next year.

To whom will part of the insurance costs be returned?

Let’s take a closer look at who and under what conditions the tax authorities will allow you to take advantage of the deduction for mortgage life insurance.

First, about the features of the contract with the insurer:

- the contract is concluded only with an insurance company licensed for this type of service;

- the duration of the contract is from five years;

- Only contributions paid since January 2015 (the moment the right to this reimbursement arises) will be taken into account;

- It is the client’s life that is subject to insurance (reaching a certain age);

- fees are paid only from the client’s personal funds;

- the insurance contract specifies the beneficiary (recipient of insurance compensation upon the occurrence of an insured event). To receive a tax deduction for mortgage life insurance, it is the borrower who must be recorded as the beneficiary (or his immediate relatives, including the previous and subsequent generations).

About the amount of deduction

Let's look at some of the restrictions established by the code. Although it is calculated at 13 percent of the insurance premiums actually paid, the entire amount does not always go to the borrower.

First limitation

. There is a maximum amount of contributions paid, from which you can take 13%; according to the law, this is 120 thousand rubles (). If the annual amount of insurance premiums turns out to be more than the established limit, this is indicated in the application, and the amount of the deduction is calculated only from 120,000 rubles. 13% of this limit will be 15,600 rubles.

Second limitation

. The taxpayer can receive this deduction amount only if personal income tax was paid (withheld) in the same amount or higher.

Let's give two examples.

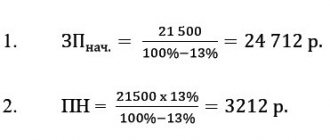

Example one, the year 2021 is the tax period.

The borrower Ivanov entered into an insurance contract for 6 years. For the entire year, he paid 110,000 rubles in insurance premiums. His salary in the same year amounted to 400,000 rubles, from which he paid income tax of 50,000 rubles. Ivanov’s personal income tax refund for mortgage life insurance (deduction) will be 110,000 x 13% = 14,300 rubles.

Ivanov will receive this amount, since the amount of the annual deduction is 14,300 rubles. does not exceed the tax paid for the same period of 50,000 rubles.

Example two.

The borrower Sidorov, under an 8-year contract, paid 200,000 rubles in insurance premiums for the current year. His salary for this year amounted to 755,000 rubles, and income tax of 70,000 rubles was withheld. Tax refund for life insurance with a mortgage of 13% of 200,000 is 26,000 rubles. Taking into account the restrictions on the amount of paid contributions for calculation, 13% will be taken only from 120,000 rubles. Therefore, only 15,600 rubles will be deducted.

Important. The limit of insurance expenses of 120,000 rubles may include not only insurance expenses, but also expenses for medical services, purchase of medicines, education and other types specified in Article 219.

Let's consider two options for receiving a deduction.

Method 1. Go to the tax office

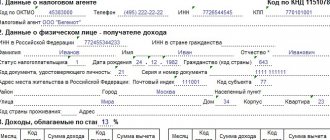

We write a statement that we want to return taxes for mortgage life insurance and provide originals and copies of documents. We also fill out a declaration for each year, which will be taken into account when paying.

The application is considered within three months. Next, the calculated deduction amount must be paid within a month.

What to provide to the Federal Tax Service

You will need to present:

- Russian passport of the applicant-taxpayer;

- 3-NDFL declarations for the required years;

- certificates from the accounting department from the place of work in accordance with the form on withholding tax on the applicant’s income for one or more years (or individual entrepreneur’s reporting);

- financial documents about insurance payment, these are usually checks, receipts;

- life insurance contract (and its copy);

- a copy of the insurer's (current) license.

You can come in person or send by registered mail.

It is possible to apply for a deduction online. To do this, you need to register on the State Services website, as well as the identity verification procedure on this website.

Then go to the tax office website in your personal account and send electronic documents from there. In order for them to be signed by the taxpayer and have legal force, an electronic signature will be required.

You can apply for a deduction through NI only at the end of the current year with paid insurance, along with submitting a declaration in form 3-NDFL.

How to get a tax deduction for life insurance on a mortgage

When purchasing a car, you must insure it. The most common types of insurance are CASCO and OSAGO. CASCO covers the cost of repairing your vehicle and is voluntary. In the event of an accident, it will cover all costs of repairing your and someone else’s car.

Refund for car insurance upon sale

There are a number of situations in which it is possible to return part of the funds paid for insurance:

- The insurance company has gone bankrupt or is closing;

- Car theft or serious breakdown;

- Death of the car owner;

- Selling a car.

The first three cases are very rare, so we will focus on the last one – selling a car. To get a refund for insurance when selling a car, you should contact the insurance company with the necessary package of documents, which will be presented below.

By the way, there is also material about what to do if a bank’s license is revoked, and I have a deposit there.

What documents are needed to get a refund for car insurance?

After selling your vehicle, you should contact your insurance company as soon as possible. You must have the following documents with you:

- MTPL agreement;

- Identification. Original and copy;

- A car purchase and sale document, which will confirm the registration of the sale of the vehicle;

- Receipt confirming payment of compulsory motor insurance;

- Your bank account.

If all the documentation has been collected, you should contact the insurance company and file an application for a refund.

1. You should indicate the name of the insurance company, its address;

2. Your full name, address, phone number;

3. The application itself must contain three requests:

- On termination of the insurance contract;

- On the return of the unused part of the purchased insurance;

- About transferring money to a personal account.

It is important to ensure that the insurance agent correctly dates your application, after which the money will be returned to you within 14 days. If the transfer is not received within the specified period, you should go to court. To do this, you will need to file a claim against the insurance company.

There are three types of insurance when taking out a mortgage loan, and the bank will push all insurance options on you.

What types are there:

- life insurance – when in the event of the borrower’s death, the bank covers its losses

- apartment insurance – compensation for losses in case of force majeure situations with the apartment

- insurance against loss of ownership rights to the apartment (title insurance) - if the fact of your purchase of the apartment is called into question, the borrower will receive compensation

Of all types of insurance, the bank can legally require only apartment insurance; the rest of the insurance is at your discretion.

- the contract is valid for at least 5 years;

- the insured person and beneficiaries - the policyholder himself, his spouse, child (including ward and adopted child), parent, adoptive parent;

- The policyholder makes contributions from his own funds.

If any of the above requirements are not met, a tax refund for life insurance on a loan is not possible.

In practice, credit institutions ask borrowers to draw up complex agreements that include several risks at once. As the Ministry of Finance indicates in message No. 03-04-07/40502 dated July 11, 2016, the tax deduction for life and health insurance under such contracts is provided only in part of the funds paid for the risk of death (loss of ability to work) or survival. The risks of accidents and illnesses, as well as loss of property, are not compensated.

Example 1

Nikolay entered into a comprehensive mortgage insurance agreement for the entire loan term - 10 years. At the request of the bank, he insured the property and, additionally, at his own request, life and health. The bank was named as the beneficiary for the risk of loss of property, and Nikolay himself for the remaining risks.

You can apply for a deduction at the tax office by providing, along with the declaration, a copy of the agreement, payment slips and marriage/birth certificates for relatives. The second option is to contact the employer, having previously received a special notification from the Federal Tax Service.

The purchase of an apartment, as well as subsequent loan payments, greatly burdens the family budget. Therefore, the state offers borrowers assistance in the form of compensation for life insurance costs when applying for a mortgage.

A tax deduction is due to any person who has entered into a life insurance contract under the conditions specified by law. Availability of a loan is not a categorical condition for receiving government assistance.

It doesn’t matter if a citizen comes to the tax inspector with the aim of obtaining compensation for insurance a year or two after drawing up a life insurance contract. Registration of a tax deduction may wait as long as three years. Therefore, a person can receive a tax deduction from mortgage insurance in 2021, even if payment under the insurance contract was made in 2015.

You can receive tax compensation for personal income tax when taking out life insurance every year for the entire duration of the insurance contract, but not forgetting about legal restrictions.

The mortgage loan is the longest-term loan available. Accordingly, the banking organization bears a huge risk of non-receipt of issued funds. To exclude such situations, the lender, when applying for a mortgage, sets insurance for the borrower as one of the conditions.

In this case, a mixed type of insurance is used, consisting of both personal and property safety guarantees. To clarify the issues that arise, the Ministry of Finance explains that compensation to a person for insurance premiums in this case is not provided. The position is explained by the fact that under a mortgage and related agreements, the recipient is the bank, but not the citizen.

Sviridov took out a mortgage in 2015, and with it an agreement on life insurance, property, etc. When paying fees, I expected to receive a refund of part of the expenses at the end of the year. But the Federal Tax Service refused him, because the recipient under the agreement is considered a credit institution. A man has the right to receive a deduction for interest and upon repayment of the loan.

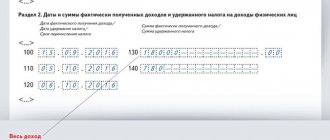

- declaration 3-NDFL;

- voluntary life insurance contract;

- payment documents confirming payment of insurance premiums;

- documents confirming the paid income tax (certificate 2-NDFL).

You can view the full list of documents here: Documents for tax deductions for life insurance

In case of early termination of a compulsory insurance contract in cases provided for by the rules of compulsory insurance, the insurer returns to the policyholder part of the insurance premium in the amount of the share of the insurance premium intended for insurance payments and falling on the unexpired term of the compulsory insurance contract or the unexpired period of seasonal use of the vehicle. There are 2 conditions in this paragraph:

- Only the portion of the premium intended for insurance payments is returned.

- Only the amount proportional to the remaining validity period of the compulsory motor liability insurance policy is returned.

Let's deal with them one by one. 1. Let's consider the requirements for the structure of insurance tariffs established by the Bank of Russia. Only 77 percent of the policy value is intended to ensure current insurance compensation under compulsory insurance contracts.

Refunds will only be made at the end of the established tax period. After verification activities, the tax deduction will be carried out within a month. At the same time, it is fashionable to receive financial compensation within three years.

The savings in this case are obvious.

- You can reduce the amount of payment of 13 percent by finding documents from the purchase of a car, which indicate the cost of the purchased car. In this case, you need to subtract the cost of the car when you sell it from the purchase price of the car.

Method 2. The procedure for filing a deduction at your job

It is possible to return the tax for mortgage life insurance earlier, in the same year when the insurance was paid. This can be done at the place of your official work, through your employer, but you must provide permission from the tax office.

You can confirm your right to receive such a deduction from NI by submitting a written application to the Federal Tax Service with the necessary package of documents.

Within a month, NI will issue a permit (notification) of the right to deduction, which is submitted to the accounting department of the enterprise along with an application for a tax refund (deduction).

What do you need to present to the NI to receive a deduction?

First of all, about what the tax authorities will require. This is the same set of documents as listed above, but you do not need to provide certificates in form 2- and 3-NDFL.

How does a tax refund for life insurance work on a business mortgage? The accounting department of the enterprise, starting from the next month after receiving the application, will not withhold tax from the employee’s salary until the amount of the deduction is fully compensated.

Why may a tax refund be denied?

Tax authorities often refuse to receive a deduction, usually due to some inconsistency with the terms of the refund.

Let's consider the main reasons for the refusal, and whether the situation can be corrected.

Most often, the requirements of Article 219 are not met, for example:

- the duration of the contract is less than 5 years;

- beneficiary – bank;

- the subject of insurance - the life of the borrower or his family - is not clearly stated, the deduction does not apply to insurance against accidents and illnesses;

- the insurer has an invalid license at the moment, and others.

Advice: try to renew the contract, change the insurer.

To receive a deduction when concluding a comprehensive insurance contract for several types of insurance, you must obtain a certificate from the insurance company highlighting the amounts for each type.

Personal income tax on the redemption amount

The concept of the redemption amount under voluntary life insurance contracts is given in Article 213 of the Tax Code of the Russian Federation. It says here that in case of early termination of such contracts (at the request of either party), the insurer can pay a certain amount of money to the person who paid the premiums, which is specified in the insurance rules and in the contract itself.

If a person independently paid contributions under the agreement, then the redemption amount forms his taxable income only to the extent that it exceeds the amount of previously paid contributions. If the insurance company’s contributions were transferred by the employer, deducting them from the person’s salary, then the redemption amount is subject to personal income tax in full (letters of the Ministry of Finance of Russia dated 02/21/2017 No. 03-04-06/9998, dated 11/09/2016 No. 03-04-06/65672, Federal Tax Service of Russia dated October 6, 2016 No. BS-4-11/ [email protected] ). And the insurance company is obliged to calculate and withhold personal income tax.

Two reasons for refusal according to timing

The tax deduction for mortgage life insurance begins in January 2015. From here it is immediately clear why they will refuse a deduction for the years before 2015. The contract itself could have been concluded in previous years, but the deduction will be provided only for insurance premiums paid since 2015.

Second point. For social deductions under the same Tax Code, there is a statute of limitations of 3 years. In the current year, a taxpayer can apply for a deduction for the three previous years. A refusal will follow if personal income tax was not withheld during these periods, or a deduction is requested for periods outside the statute of limitations.

Other reasons for refusal to deduct:

- lack of an official place of work, white wages from which income tax is withheld;

- lack of Russian citizenship;

- payment for housing is not with personal or borrowed funds, but is financed with the help of the state, employer, and sponsors.

Popular review: The conditions for receiving a deduction for life insurance on a mortgage are quite acceptable; if you sign the right insurance contract and have an official salary, this is quite possible. And money is never too much, as you know.

Rate the author

(

1 ratings, average: 5.00 out of 5)

Share on social networks

Author:

Mortgage specialist Maria Yurievna Sokhan

Date of publication November 1, 2019 November 2, 2019

If the agreement date is earlier than the specified date

The transformation of legislation took place only in January 2015. However, what about people who signed the agreement earlier?

The opinion of the Federal Tax Service is that people have the right to claim benefits if they have the following grounds:

- the agreement is valid for more than 5 years;

- application is only permitted to payments made since 2015, but not earlier.

Svetlakova entered into a life insurance contract for 8 years in 2013. After the changes were made, she began to apply for a refund of part of the funds and was not refused.