Paying taxes affects every Russian, but there are categories of citizens who donate money to the budget for their own plots on preferential terms. By what rules is land tax calculated for individuals and legal entities and what is its interest rate?

Land is taxable property regardless of the legal status of a citizen. Individuals and organizations are required to regularly transfer the state land tax. However, the tax rate, which varies depending on the category of land, and the payment deadlines for different regions of Russia are not the same. This is a consequence of empowering local management to determine the listed indicators at their own discretion.

Land tax payers

There are cases when people do not take money for plots. For example, if it is rented or used by a person for an unlimited time. In other circumstances, money must be paid.

This is done by citizens who have land:

- regularly used to meet household needs;

- registered as property;

- inherited for life.

When the land belongs to the mutual fund, it pays off the debt incurred to the state. By law, taxes are paid exclusively by the owner. In Russia, when paying land tax, a list of beneficiaries is defined, which includes:

- citizens who received disability groups 1 and 2;

- veterans who went through the Great Patriotic War;

- fighters of other local conflicts;

- persons who have received privileges from the municipality;

- religious organizations;

- government agencies of the executive branch;

- societies uniting people with disabilities;

- unification of peoples living in the northern regions of Russia.

The last 4 items on the list are legal entities. They calculate the amounts transferred to the state budget and submit a tax return to the Federal Tax Service themselves. Individuals are not burdened with such concerns. For them, the necessary calculations are carried out by employees of the Tax Service. The results are then sent to direct tax payers.

Land tax is paid no later than October 1. This is an all-Russian indicator. Local authorities have the right to change it.

However, it should not go beyond the limits listed below:

- the final date for payment by an individual is November 1;

- legal entities transfer money before February 1.

Land tax is paid for the year following the reporting period. In 2021, a citizen working for hire pays for the land registered in his name for 2021. If the money is not paid by the specified deadline, the control service will impose a fine - 20% of the amount of the shortfall, which is written in the notification sent to the citizen. Penalties will also be calculated for each overdue day - 1/300 of the current refinancing rate established by the Central Bank of the Russian Federation.

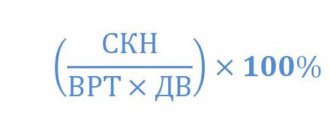

Land tax rates

The tax rate cannot exceed 0.3% of the cadastral value of the plots:

- occupied by housing stock and utility infrastructure facilities and acquired for housing construction, except for plots used in business activities (the exception is valid from the tax period of 2021);

- purchased for personal farming, gardening, vegetable gardening. Starting from the 2021 tax period, the rate applies to plots of this group if they are not used in business activities;

- from the tax period of 2021 - general purpose land plots intended for citizens to carry out gardening and vegetable gardening or intended for the placement of other public property.

The tax rate for other plots should not exceed 1.5% of the cadastral value.

The interest rate when calculating the tax is set by the municipal authorities that own the territory of the municipality on which the site is located. The percentage is displayed in the notification from the Federal Tax Service in the “Tax rate” column.

For this:

- on the official website of the Federal Tax Service, go to the “Services” section;

- in the “Reference Information” section, click on the “Reference Information on Property Tax Rates and Benefits” tab;

- select the type of tax “Land tax”;

- indicate the tax period for which the rate is calculated (maximum last year);

- indicate the name of the subject of the Russian Federation (region or territory);

- enter the name of the municipality on whose territory the site is located and select an object from the list (indicated in the Unified State Register of Real Estate);

- click the “Find” button, in the window that opens, click “Details” opposite the information about the regulatory act;

- The information block below reflects the rates in force in the region for certain categories of real estate.

Thus, it will not be possible to determine the land tax rate by cadastral number. To calculate the amount to be paid, additional information about the site, benefits and rates established in the region will also be required. Most of the necessary information is contained on the official website of the Federal Tax Service and the tax notice. If necessary, request an extract from the Unified State Register of Real Estate to ensure that the information on the cadastral map is up to date.

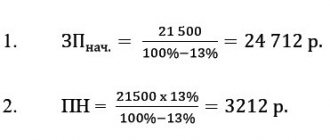

Formula for calculating land tax for individuals and legal entities

In order not to bother themselves with mathematical calculations, organizations and individuals use the opportunities provided by the Internet. There is an online calculator for calculating land tax on the Federal Tax Service website. Receiving the payment amount is not particularly difficult. You just need to enter the cadastral value of the plot in the field provided by the program.

You can calculate the tax manually. Citizens who have shares in a land plot use the formula:

STk x N x D x K = Land tax payment, where:

- STk – cadastral value of land;

- N – land tax rate expressed as a percentage;

- D – shared ownership of a citizen;

- K is the coefficient included in the formula when using a plot registered in one’s name for an incomplete tax period.

The taxable purpose (in other words, the base) of the land tax follows from its name. Citizens have to pay for the land they own. The calculation is based on a cadastral valuation carried out no later than January 1 of the following year following the current tax period.

The tax is collected exclusively from lands located within the territory of the municipality. The State Cadastre enters the information received about them into a special database and transmits it along the chain to the Tax Service. Here the data must appear before February 1 of the year in which payment documents are generated. Next, Federal Tax Service employees calculate the amounts payable for individuals and send them mail notifications.

The cadastral value is not constant. Its size changes for the following reasons:

- moving the boundaries of the site;

- changing the category to which the land previously belonged;

- changing the way land is used.

Another player in the calculation formula is the tax rate. It is part of the cadastral valuation and is limited to:

- 0.3% – for agricultural and limited-use lands, as well as plots intended for summer cottages, architectural work and development;

- 1.5% – for other land holdings.

The regional leadership sets tax rates for the population living within the municipality at its own discretion. However, it should not exceed the values specified in the Tax Code. The rate set by local authorities can only decrease.

Is it possible to find out the amount of taxation of land plots according to KN?

The amount of land tax is reflected in notifications from the Federal Tax Service, which are received no later than 30 days from the date of payment.

However, its absence is not grounds for non-payment. It is recommended to calculate the tax amount yourself to avoid errors in calculations. This can be done either by contacting the Federal Tax Service in person or via the Internet. In the second case, you will need information about the cadastral value, number, tax deductions and benefits for certain categories of individuals provided for

When calculating the tax, the interest rate established in the region, the cadastral value of the property, the period of ownership and the number of shares are taken into account. The necessary information about the land plot, in particular the cadastral number, can be obtained from the address in the public cadastral map on the official website of Rosreestr.

The information received must be entered into the calculator on the Federal Tax Service website, which will automatically calculate the tax. Thus, you can find out the land tax by cadastral number without even leaving your home.

Land tax for legal entities

Individual entrepreneurs are the same taxpayers and are required to pay the amount charged for land ownership on time.

In 2021, the following methods of settlement with the Tax Service are used:

- When the activity of developing a land plot is aimed at making a profit, you will have to perform the calculations and submit a declaration to the Federal Tax Service yourself.

- If the plot belongs to a businessman personally, he is regarded as an individual. In this case, the tax service will do everything. The citizen will only have to pay on time according to the notification sent.

According to the law, legal entities cover tax debts with advance payments according to the following scheme:

- duration of the reporting period – 1 year;

- it is divided into small sections in advances, which are paid at the end of the quarter;

- Such reporting may be canceled by local governments.

Taxpayers with the status of legal entities are required to fully pay the tax accrued for land at the end of the reporting year. Settlements with the Federal Tax Service are carried out on the basis of a tax return prepared independently and submitted within the deadlines specified by law. Here, not only the amount collected from the entrepreneur is written down, but also the taxpayer’s data, as well as the benefits entitled to him.

Calculation formula

Note! Since 2015, individuals, including entrepreneurs, no longer have to calculate land tax on their own. This responsibility is assigned to the Federal Tax Service. Payment is made according to the tax notice.

Land tax = Kst x D x St x Kv,

Cst – cadastral value of a land plot (it can be found on the official website of Rosreestr or using a cadastral map).

D – size of the share in the right to the land plot.

St – tax rate (you can find out the tax rate in your region on this page).

Kv – coefficient of ownership of a land plot (applies only in case of ownership of a land plot for less than a full year).

Example 1. Calculation of land tax for a full calendar year

Object of taxation

Petrov I.A.

owns a plot of land in the Moscow region. The cadastral value of the plot is 2,400,385 rubles.

Tax calculation

The tax rate for this land plot is 0.3%.

The land tax in this case will be equal to: 7,201 rubles. (RUB 2,400,385 x 0.3/100).

Example 2. Calculation of land tax for an incomplete calendar year

Object of taxation

In October 2021 Petrov I.A.

registered the rights to a land plot located in the Moscow region. Its cadastral value is 2,400,385 rubles.

Tax calculation

The tax rate for this land plot is 0.3%.

Land tax for three months of 2021 in this case will be equal to: 1,801 rubles. (RUB 2,400,385 x 0.3 / 100 x 0.25),

where 0.25 is the coefficient of time of ownership of a land plot (3 months / 12 months).

Example 3. Calculation of land tax for a share of land

Object of taxation

Petrov I.A.

owns ¾ of a land plot located in the Moscow region. Its cadastral value in 2021 is 2,400,385 rubles.

Tax calculation

The tax rate for this land plot is 0.3%.

The land tax in this case will be equal to: 5,401 rubles. (RUB 2,400,385 x ¾ x 0.3 / 100).

Example 4. Calculation of land tax taking into account benefits

Object of taxation

Combat veteran Petrov I.A.

owns a plot of land in the Moscow region. The cadastral value of the plot in 2021 is 2,400,385 rubles.

Tax calculation

The tax rate for this land plot is 0.3%.

The land tax in this case will be equal to: 7,172 rubles. ((RUB 2,400,385 – RUB 10,000) x 0.3 / 100),

where, 10,000 rub. – a benefit that is provided to Petrov I.A. due to the fact that he is a combat veteran.

Land tax benefits

Some payers may be able to take advantage of federal and local incentives. If the tax authority has information about the payer's right to a benefit, it will be taken into account when calculating the tax. But if the taxpayer noticed upon receiving the notification that the benefit was not taken into account, he needs to submit an application to the Federal Tax Service using the form from the order dated November 14, 2017 No. ММВ-7-21 / [email protected] The application is provided only once - then the benefit applies automatically.

Federal benefits

The indigenous peoples of the North, Siberia and the Far East, as well as their communities, do not pay land tax on plots that are used to preserve their traditional way of life.

When calculating the tax for certain categories of payers, the base is reduced by the cost of 6 acres of land area. The benefit is valid for disabled people of groups 1 and 2, Heroes of the USSR and the Russian Federation, WWII veterans, pensioners, parents of large families, and Chernobyl survivors. The full list of preferential categories is in paragraph 5 of Art. 391 Tax Code of the Russian Federation.

If there are several plots, the tax exemption benefit for 6 acres is valid only for one of them. The payer himself can choose which one. To do this, he needs to submit to any Federal Tax Service a notification about the elective land plot in the form approved by Order of the Federal Tax Service dated March 26, 2018 N MMV-7-21/ [email protected]