MIP online legal encyclopedia - » Articles on Inheritance » Inheritance by will » Inheritance tax by will

Get an expert opinion on a will in two clicks

When receiving an inheritance, the heir is required to pay a number of taxes in accordance with the following regulations:

- Federal Law No. 78,

- Art. 217 clause 18 part 1 of the Tax Code of the Russian Federation,

- Federal Law No. 212,

- Art. 333.24 clause 22 part 1 of the Tax Code of the Russian Federation.

The heir should be told in detail what taxes and duties the heir must pay.

Taxes

According to Art. 217, paragraph 18, part 1 of the Tax Code of the Russian Federation, the heir does not have to pay tax when receiving property under a will. But in the same article of legislation, a category of remuneration is highlighted, upon receipt of which the heir is still subject to tax. These rewards include the following categories:

- A reward given to the author of a literary work or scientific work and passed on by inheritance;

- The remuneration that is due to the inventor of an industrial design or utility model, patented in the name of the testator, and which is inherited;

- Remuneration to the author of a landmark or piece of art, passed on by inheritance.

Heirs who receive an inheritance in these categories must pay a tax in the amount of 13% of the total value of the inheritance.

Important! If the heir decides to refuse the inheritance under the above categories, he will still have to pay a tax of 13% if he refuses the inheritance within three years from the date of death of the testator.

Do I need to pay tax on an apartment received under a will?

Usually, after receiving real estate, heirs seek to sell them. This is caused by the lack of need for housing, the need to receive money, and the presence of disputes between the heirs of a deceased citizen. If the apartment is sold before three years after the death of the testator, then you will have to pay a tax to the state in the amount of 13 percent of the cost of the housing. Tax is paid to the Federal Tax Service at the place of residence of the heir acting as a taxable person. If a person is not a resident of the Russian Federation, then the tax amount can increase up to 30 percent of the value of the property. At the same time, the current legislation of our state does not offer personal income tax benefits in the case of the sale of an apartment, including various socially vulnerable categories of Russians.

As noted above, you can avoid paying taxes if you simply wait three years after the death of the testator. But is it possible to sell housing if less than three years have passed since it was received as an inheritance?!

There is an option in which the amount of personal income tax is reduced to zero rubles, but this rule applies only if the cost of living space is inexpensive. The tax reduction process itself operates as follows: a tax (no more than one million rubles) or acquisition costs for entry and registration of inheritance are deducted from the base cost of selling a residential property. Then the result is multiplied by thirteen percent. If expenses are less than one million, then a deduction in the amount of this amount is applied. That is, the heir may well apply a tax deduction for the sale of real estate in practice and save.

- The taxpayer is required to reside on the territory of the Russian Federation for at least six months;

- The residential property in the form of an apartment must be located on the territory of Russia;

- The seller and buyer of the apartment must not be close relatives (parents, sisters, brothers, grandparents, grandchildren).

As indicated above, the minimum cost of downsizing an apartment is one million rubles. Is it possible to do this procedure if you are not officially employed and do not pay personal income taxes to the state? Yes, but only the procedure can be carried out in the future after you have settled down to work officially, that is, the legislation allows citizens to receive a deduction at any time during employment. That is, the period for receiving a tax deduction, as many citizens think, is not limited to three years.

When selling or alienating shared real estate, declarations from each shareholder are required to be submitted separately. The declaration records the amount of the tax burden, which depends on the price of its share. The tax deduction is applied by dividing it (in percentage terms) according to the size of each share (in other words, not every individual shareholder uses one million rubles, but this amount applies to the entire residential property acting as an inheritance estate).

You will not be subject to inheritance tax, since you are a first-degree heiress. You will need to pay for notary services: for applications, requests and certificates in the amount of approximately 10 thousand rubles (if the apartment is inexpensive, if you live and are registered there, etc.). This amount is calculated by the notary based on many conditions. It will also be necessary to pay a fee to register ownership of your property in Rosreestr. It costs 2 thousand rubles. Further, a property tax in the amount of several thousand rubles will be assessed annually.

If you live in this apartment and it is your only property, then you will have a benefit on property tax: you will not pay it. But, if you do not register the inheritance in your name, you will not be able to bequeath this property further, and your heirs will have to prove ownership in court, which is much more expensive. If you do not live in this apartment, then you definitely need to arrange everything correctly and on time, rent out the property and receive additional income to supplement your pension.

State duty

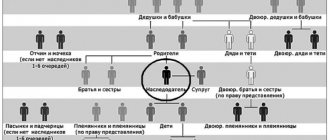

According to Federal Law No. 78, the heir now does not have to pay taxes on the inheritance received (except for the cases described above), he will still have to pay the state duty. A fee is paid for obtaining a certificate of ownership of inherited property. The amount of the state duty is regulated by Art. 333.24 clause 22 part 1 of the Tax Code of the Russian Federation and depends on the degree of relationship between the testator and the heir:

- For first-priority heirs, which includes spouses, children and parents of the testator, the state duty is 0.3% of the total value of the inheritance, but not more than 100 thousand rubles.

- For all heirs, except first-priority ones, the state duty is 0.6% of the total value of the inheritance, but not more than 1 million rubles.

In addition, the article states that persons who lived with the testator on his territory during his lifetime and received this area as an inheritance are exempt from paying state duty.

Who is charged inheritance tax?

The law exempts recipients of inherited property from paying personal income tax (personal income tax). It remains to be determined whether the inheritance received is taxable:

- by will;

- by law (without a will).

Expert opinion

Stanislav Evseev

Lawyer. Experience 12 years. Specialization: civil, family, inheritance law.

Regardless of the degree of relationship and the basis for accepting the inheritance, taxation is not applied to the heirs.

However, this does not mean that entering into an inheritance is free of charge. When registering the property of the deceased through a notary office, the citizen pays a state fee. According to general rules, the fee is paid before the commencement of notarial acts.

The amount of the fee is determined by the notary when preparing the relevant documents. The calculations are based on the inventory, market or cadastral price of the objects.

The fee is withheld from all applicants, regardless of the degree of relationship and methods of accepting the inheritance. The only difference is the amount of the mandatory fee that the heirs must pay. The exception is preferential categories of recipients of property rights.

Inheritance taxation

Despite the fact that in most cases the heir does not pay inheritance tax, upon receiving inherited property he also receives the obligation to pay property tax. This requirement is specified in Chapter 32 of the Tax Code of the Russian Federation. Having received ownership of the inheritance, the heir also acquires the obligation to pay tax, which is calculated on the basis of the cadastral value of the inherited property.

There are several categories of citizens whose responsibilities do not include paying taxes on inherited property. This includes the following persons:

- Disabled people of groups 1 and 2, disabled since childhood;

- Military personnel, members of their families, retired military personnel;

- Heroes of the Russian Federation and the USSR, persons who received the Order of Glory of three degrees;

- Persons professionally engaged in creative work and occupying premises specially equipped for this purpose;

- Persons who have outbuildings with an area of less than 50 sq.m., located on gardening lands or individual housing construction.

The cadastral value, if it is not indicated in the documentation for the property, must be calculated by authorized bodies licensed to carry out appraisal activities.

Payment of property tax

Since the heir, in respect of whom, in accordance with the will, is entrusted with the obligation to execute the testamentary refusal, in no way can acquire ownership rights to the hereditary property that is the subject of the testamentary refusal, but only acquires another property right to it with a limited right of disposal, the obligation to pay this tax from he (the heir) does not arise

– he is not a payer of property tax transferred by inheritance, since such property does not become his property by inheritance.

The heir becomes obligated to pay tax

only if such property becomes his property on the grounds stated above.

The legatee, accepting the legacy of a will, is not obliged to pay tax on property transferred by inheritance for two reasons:

- he is not the heir;

- the property becomes his property not by inheritance, but by testamentary refusal.

Land tax

According to ch. 31 of the Tax Code of the Russian Federation, the heir is obliged to pay land tax when receiving a land plot as an inheritance. The tax amount is calculated by the tax service based on the cadastral value of the land plot as of January 1 of the current year.

How to pay tax

Inheritance taxes must be paid before entering into an inheritance and obtaining the corresponding property rights. In other words, the notary who is handling the inheritance case will not issue ownership rights to the heir until he brings him a receipt for payment of the state duty and all taxes.

In order to pay tax, the heir must contact the tax service and request a form in Form 3-NDFL. Within the specified time frame (check with the tax service), you need to fill out the form and, together with your passport, a certificate of the value of the inheritance, and a certificate of ownership (get it from Rosreestr), come to the tax service at the place where you received the inheritance. After receiving a receipt for payment of the state duty, the heir must pay it at any bank.

Attention! To obtain a certificate from Rosreestr, you must request an extract of the appropriate form. This change in legislation was made on July 15, 2021. Before this, a new document was drawn up in Rosreestr, which confirmed the ownership of the heir. Now it is enough to take one certificate.

Author of the article

Kuznetsov Fedor Nikolaevich

More than 15 years of experience in the legal field; Specialization - resolution of family disputes, inheritance, property transactions, disputes over consumer rights, criminal cases, arbitration processes.

Do I need to pay tax when selling a share in an apartment received by inheritance?

The calculation of state tax occurs in the same way (according to clause 22 of Article 333.24 of the Tax Code of the Russian Federation) both when entering into an inheritance according to the law and according to a will from a notary. The amount of the state duty directly depends on:

- degree of relationship between the testator and the heir;

- the value of the property that the heir receives.

The degree of family ties is assessed after the death of the testator. If the husband bequeathed his property to his wife, and then they divorced, then the heiress will have to pay a higher tax, since at the time of receiving the inheritance she is no longer a first-degree relative.

To calculate state tax, any type of property value can be taken:

- Market price. It can be found out through an examination carried out by an independent appraiser. After the assessment, a documentary conclusion is issued. As a rule, it is the highest of all.

- Cadastral value. You can find it out in Rosreestr by receiving a certificate or cadastral passport.

- Inventory cost. Is the lowest. To find out the amount, you need to contact the BTI for a certificate indicating this information.

There are certain categories of property, upon receipt of which tax is not paid (according to Article 333.38 of the Tax Code of the Russian Federation). These are categories such as:

- real estate in which the heirs lived with the testator;

- bank deposits;

- remuneration received for copyright property;

- pension and benefits;

- insurance that is paid under a personal or property insurance contract;

- payments that are made in the event of the death of the insured person in an accident at his place of work, at the expense of the employer;

- payments to military personnel who are insured under compulsory personal insurance and who died while on duty.

There are also persons who are fully or partially exempt from paying tax when receiving an inheritance:

- heirs who have not reached the age of majority at the time of receiving the inheritance;

- persons with mental illness;

- citizens who are classified as disabled people of groups I and II;

- heroes of the Russian Federation;

- heroes of the Soviet Union;

- participants and disabled people of the Great Patriotic War;

- Knights of the Order of Glory;

- citizens declared incompetent.

Disabled people of groups I and II pay only 50% of the tariff established by the state. This benefit applies to all heirs and does not depend on the degree of relationship, line of inheritance and share in the inheritance received. There are no benefits for pensioners; they pay tax in full.

In addition to the established state tax, you will need to pay for notary services. Legal services are regulated by the Tax Code of the Russian Federation, but technical services are the personal income of a notary. Therefore, they are established individually, but taking into account the recommendations of the Federal and regional notary chambers. The amount of payment for notary services is approximately:

- 5,000 rubles – for a certificate of inheritance, which is issued for each property received;

- 3000 rubles – for each movable property received as an inheritance;

- from 1000 to 2500 rubles – for received bank or pension deposits;

- 500 rubles – for receiving preferential payments or the testator’s salary;

- from 200 to 500 rubles – for an extract, indicating the cadastral value of the inherited housing (at the heir’s request).

You can also secure the received property and take measures to protect the inheritance. This service will cost approximately 3,000 rubles.

For registration of inherited property, the established state tax is paid (according to Article 333.33 of the Tax Code of the Russian Federation) in the following amounts:

- 350 rubles – for land;

- 2000 rubles – for registering ownership of real estate + 350 rubles – for making changes to the USRN records;

- 200 rubles – for a share in the apartment;

- 350 rubles – for making changes to the registration certificate about the owner of the vehicle.

Although you do not need to pay tax for an inheritance, the process of formalizing and registering inheritance rights can require considerable costs.

In Russia there is the concept of “inheritance tax”. However, the term is used only in special cases, since such a tax was practically abolished in 2005. However, it is still not possible to receive an inheritance for free. The concept of state duty has replaced the tax.

The state duty is calculated based on the estimated value of the testator's property . However, unlike the previous form with taxation, the price for accepting an inheritance has become much less. And the degree of relationship with the deceased has almost no effect on the amount of payments.

Despite major changes to inheritance laws, some types of property owned by a deceased person are still subject to taxation . In addition, the recipient then becomes obligated to pay taxes on the property received, as well as debts on them. For example, a transport fee.

In Art. 217, paragraph 18 of the Tax Code states that only the income of the deceased, which the heirs will receive after his death, is taxed. Such payments include royalties related to copyright:

- for the sale of literary works and other objects of art created by the deceased;

- payment for scientific work;

- compensation for patents for any scientific inventions.

In these cases, the recipient is charged a tax upon entering into an inheritance - 13% of income . Payment is due at the end of the year when filing your tax return.

Also, a 13% tax is levied on an heir who sold movable or immovable property less than 3 years after the opening of the inheritance. Please note that 3 years are calculated from the date of death of the testator, and not from the date of entry into the inheritance. This rule is spelled out in Federal Law No. 212 of July 23, 2013.

A citizen who receives an inheritance opened before 2006 will have to pay the tax. Since other legislative norms were in force at that time, he will be subject to them. This situation is unlikely, since the procedure for acquiring rights usually lasts six months.

- Land plot

- Mortgage

- Buy

- Maternal capital

- Inheritance

- New building

- Exchange

- Sell

- Tips and tricks

- A private house

After the approval and publication of Federal Law No. 78-FZ of July 1, 2005. inheritance tax under a will was abolished. The year 2021, in terms of payments upon entry into the rights of an heir, is not burdened with any payments, except for the state duty.

Previously, in order to receive what was bequeathed, it was necessary to pay tax upon entering into an inheritance. The rate was calculated based on the degree of relationship if the value of the property received exceeded the minimum wage by more than 850 times. The heirs were identified in order:

- First priority: children, spouses and parents

- Second priority - brothers, sisters, grandparents

- Third priority - the remaining possible heirs not included in the first two groups

For each priority, the tax upon inheritance of an apartment or other property, the value of which was in the range of exceeding the minimum wage from 850 times to 1700 times the rate, was as follows:

- For first priority – 5% of the value of the property

- For the second stage – 10% of the value of the property

- For the third stage – 20% of the value of the property

As the value of the inheritance increased in terms of exceeding the minimum wage, the rates increased. At that time, there was an instruction in force created on the basis of a number of Federal laws regulating the procedure for registering and entering into inheritance.

Is inheritance taxable now? Not in the generally accepted sense of the word. When they mean inheritance tax under a will in 2021, this means that we are talking specifically about a duty. As for modern legislation, in matters of inheritance, Chapter 63 of the Civil Code of the Russian Federation has priority.

In Art. 217, paragraph 18 of the Tax Code states that only the income of the deceased, which the heirs will receive after his death, is taxed. Such payments include royalties related to copyright:

- for the sale of literary works and other objects of art created by the deceased;

- payment for scientific work;

- compensation for patents for any scientific inventions.

In these cases, the recipient is charged a tax upon entering into an inheritance - 13% of income. Payment is due at the end of the year when filing your tax return.

Also, a 13% tax is levied on an heir who sold movable or immovable property less than 3 years after the opening of the inheritance. Please note that 3 years are calculated from the date of death of the testator, and not from the date of entry into the inheritance. This rule is spelled out in Federal Law No. 212 of July 23, 2013.

A citizen who receives an inheritance opened before 2006 will have to pay the tax Since other legislative norms were in force at that time, he will be subject to them. This situation is unlikely, since the procedure for acquiring rights usually lasts six months.

The amount of state duty when entering into an inheritance under a will

The testator can make a will. In it, he has the right to indicate absolutely any persons who will become his successors. Also there he can distribute the shares of the heirs at his own discretion, and not in an equal amount, as required by law.

Expert opinion

Natalia Volkova

Inheritance expert

Ask me a question

The spiritual order must be written in adequate condition and certified by a notary or other persons replacing him. For example, the head of the prison, the head physician of the hospital and others. The full list of authorized persons can be found in Article 1127 of the Civil Code of the Russian Federation.

The amount that must be paid to receive an inheritance consists of 2 parts: a fee and a lawyer’s fee (on average 1.5-2.5 thousand rubles).

To complete the procedure, you need to come to the notary at your place of registration. Along with other documents, provide a receipt for payment of the fee. Its size differs depending on the closeness of the relationship.

Dependence of the amount of state duty on the order of succession

The inheritance tax under a will is:

- 0,3% from the price of property for father/mother, spouse, sons/daughters, brothers/sisters (maximum 100 thousand rubles);

- 0,6% for the remaining persons present at the spiritual disposal (no more than 1 million).

The inheritance case will not be opened until this percentage is paid.