Should I submit 6-NDFL zero if there are no employees?

You wanted to know how to fill out the zero 6-NDFL, and the request “6-NDFL zero sample filling” in a search engine led you to this material.

So let's figure out whether the zero 6-NDFL, a sample of which you are looking for, is submitted, or in this situation you can do without submitting a report. 6-NDFL is the reporting of a tax agent, which:

- It is compiled quarterly and includes data on an accrual basis. Moreover, section 1 in 6-NDFL forms data for the period from the beginning of the year, and section 2 - only data from the last quarter of the reporting period (letter of the Federal Tax Service of Russia dated February 18, 2016 No. BS-3-11/650).

- Contains generalized figures of accruals in relation to employee income and related personal income tax.

Read more about the form in this section.

It, as well as 2-NDFL reporting, must be submitted by employers who have employees to whom they pay income (clause 2 of Article 230 of the Tax Code of the Russian Federation). Thus, the obligation to submit 6-NDFL in the absence of payment of income to individuals (and, accordingly, in the absence of tax on them) during the reporting period does not arise for the employer.

Therefore, form 6-NDFL with zero indicators does not need to be submitted to the Federal Tax Service. Although, if such a report is sent, the inspection will be obliged to accept it (letter of the Federal Tax Service of Russia dated May 4, 2016 No. BS-4-11/7928). To avoid questions from tax authorities, it is advisable to send them a letter explaining the reasons for not submitting this report. It can be drawn up by analogy with a letter of the same nature, which is usually sent by employers who have not carried out business activities during the year and have not paid income to employees to the Federal Tax Service instead of reporting under 2-NDFL.

You will find our recommendations for drawing up such a letter and its sample in the material “Filling out an explanation to the tax office for 6-NDFL - sample.”

When form 6-NDFL cannot be zero

If the company had at least one payment for the entire year, then you need to be careful with the zero report on Form 6-NDFL.

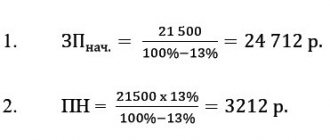

Example. When the 6-NDFL report will not be zero The company was registered in the 1st quarter of 2021. It included one director who was on vacation at his own expense. For the 1st quarter, the company submitted a zero form 6-NDFL - there were no accrued income or withheld personal income tax. In the 2nd quarter, data became available to fill out the report. In May 2021, the director worked for the entire month. His salary was calculated and personal income tax was calculated. Paid in June. In June we paid the tax to the budget. From June 1, the director again went on leave at his own expense until September 30. For the 2nd quarter, the company submitted Form 6-NDFL, in which sections 1 and 2 had already been completed in relation to accrued income accrued, withheld and transferred within the established period of personal income tax. There will be no “solid zeros” in the report for the 3rd quarter. Section 1 must be completed in it - regarding accrued income and withheld tax.

Read in the berator “Practical Encyclopedia of an Accountant”

Composition of form 6-NDFL and general procedure for filling it out

Situations when you need to make a report if there is no salary

At the same time, the question of whether it is necessary to submit 6-NDFL zero is by no means idle, since 6-NDFL is compiled on an accrual basis for the year, and the situation regarding the payment of income to employees during this year may change. For example, the following options may arise:

- there are no payments throughout the year - then not a single 6-NDFL report is submitted for this year;

- payments appeared only in the 4th quarter of the reporting year - there is no need to submit quarterly reports, but filing annual reports will be mandatory;

- payments arose in the 3rd quarter of the year - they do not submit reports for the 1st quarter and half a year, but they must be submitted for 9 months and a year, even if there are no more income payments in the 4th quarter;

- payments appeared in the 2nd quarter - a report for the 1st quarter is not needed, but all subsequent ones are mandatory, even if income in the 3rd and 4th quarters was no longer paid;

- payments took place in the 1st quarter, but are absent in subsequent ones - reports must be submitted for the entire year.

ConsultantPlus experts explained step by step the procedure for compiling and submitting a report:

If you do not have access to the K+ system, get a trial online access for free.

Where to submit zero calculation 6-NDFL for 2021

Calculation of 6-NDFL, whether zero or normal (with indicators) is submitted to the Federal Tax Service at the place of registration of the tax agent (clause 2 of Article 230 of the Tax Code of the Russian Federation):

- organizations rent it out at their location;

- Individual entrepreneur - at the place of residence.

But, depending on the status of the organization or individual entrepreneur (or source of income), the procedure for submitting the report may change:

| Who receives income and where? | Where to submit 6-NDFL |

| Head office employees | To the Federal Tax Service at the location of the head office |

| Employees of separate units (OP) | To the Federal Tax Service at the location of each OP. Form 6-NDFL is drawn up separately for each OP, even if they are registered with the same inspectorate |

| Employees who receive income simultaneously at the head office and in the OP: | |

| To the Federal Tax Service at the location of the organization’s main office (indicate its checkpoint and OKTMO) |

| To the Federal Tax Service at the location of each OP (indicate the checkpoint and OKTMO of the corresponding unit) |

| OP employees receiving income in divisions located in the same municipality, but in the territories of different Federal Tax Service Inspectors | In the Federal Tax Service, where the OPs are registered. A separate calculation is filled out for each department |

| Employees of the largest taxpayers, including their OP | To the Federal Tax Service at the place of registration of the parent organization |

| Individual entrepreneurs on UTII or PSN | To the Federal Tax Service at the place where the individual entrepreneur operates on an imputed or patent basis. If the activity in the special regime is terminated, the calculation is submitted for the period from the beginning of the year until the day of termination of activity |

| Employees of individual entrepreneurs combining UTII and simplified tax system | For employees engaged in activities on UTII - to the Federal Tax Service at the place of conduct of such activities. For employees engaged in activities on the simplified tax system - to the Federal Tax Service at the place of residence of the entrepreneur |

Do I need a sample for filling out a zero report?

As we have already found out, you do not need to submit zero 6-NDFL reporting, so you do not need a sample for filling it out. A sample is needed to fill out a report with numbers. You can find the latest one here. And we want to remind you of the rules for filling out 6-NDFL.

So, section 2 shows the data from the last quarter of the reporting period:

- in specific figures, if payments and tax accrued on them take place;

- putting a zero instead of a digital value if there is no information about payments and tax accruals for these payments (clause 1.8 of the Procedure for filling out form 6-NDFL, approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11 / [email protected] ).

How to correctly fill out section 2 in the 6-NDFL calculation, read here.

Section 1 is filled in with data that includes values corresponding to the entire reporting period. At the same time they:

- will coincide with the data in section 2 for the first payment period, including if this period did not occur at the beginning of the year;

- will remain the same as in the previous reporting period if there were no payments in the last quarter of the reporting period.

Read about common errors in filling out 6-NDFL in the publication “Errors in 6-NDFL (full list).”

We’ll tell you how to correctly correct errors in 6-NDFL here.

Check if all indicators are zero

Zero indicators for form 6-NDFL are possible when the company does not operate and does not pay income to individuals. For example, this is a young, newly registered company or, conversely, a company that is being liquidated. There are other cases.

It is necessary to analyze whether the company made payments to individuals, and this is not only wages. The company can pay, in addition to salaries:

- dividends;

- financial assistance;

- rent, etc.

In addition, you need to remember that the calculation is filled out with an accrual total from the beginning of the year. This means that if, for example, there were payments in the 1st quarter, and then there were no payments until the end of the year, calculations will be needed for half a year, and for 9 months, and for a year.

If there are no and were not employees, 6-NDFL reporting is not needed. If there were no payments, there is no need to submit it.

Zero calculation 6-NDFL is easy to fill out.

On the title page, indicate the name of the company and its details, the period for which the report is being filled out, and the Federal Tax Service code to which it is submitted.

For all lines of sections 1 and 2 where total indicators are needed, enter zeros.

Results

The obligation to submit 6-personal income tax zero is not established by current legislation. However, this rule only applies to situations where there are no income accruals to employees throughout the year. In intermediate options, reporting must be submitted (although it is possible to submit it for less than a full year), but it will no longer be completely zero.

Read more about zeros:

- “If the salary is not paid, fill out 6-NDFL correctly”;

- “The procedure for submitting 6-NDFL for individual entrepreneurs without employees”.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What are the possible risks if you decide not to submit a zero report?

The calculation is submitted only if the company made payments to individuals subject to income tax. If there are no payments in any month of the accounting year, then zero personal income tax reports are not required to be submitted to the tax office.

But the tax authorities do not have information about whether the organization made payments to employees or not. The fact that there are no such payments and the company has not lawfully submitted a report must be notified to the Federal Tax Service. This can be done in simple written form by bringing the letter in person, sending it by mail or electronically.

If you do not do this, the tax authorities will decide that the taxpayer did not report unlawfully. In this case, the inspectorate will block the company's bank accounts.

To correctly report on personal income tax, use the instructions and samples from ConsultantPlus for free. Experts have discussed how to fill out the form in different situations.

When annual calculations are not required

The obligation to transmit quarterly information in Form 6-NDFL is inherent not only to legal entities, but also to individuals operating as individual entrepreneurs. The declaration contains information about the funds accrued to the employee or contractor and the personal income tax withheld from them, as well as about the taxes transferred to the account of the tax inspectorate.

In accordance with paragraph 2 of Article 230 of the Tax Code of the Russian Federation and letter of the Federal Tax Service No. 3N-19-17/97 dated 06/08/2016, in the absence of financial payments in favor of the individual, there is no need to report taxes and fees or submit a zero 6-NDFL.

Tax agent status

The Tax Code of the Russian Federation (Article 226) states that a tax agent is considered to be any enterprise where hired personnel work and their wages are calculated. Actually, personal income tax is also withheld from the latter. In this case, the employer acts as an intermediary between the Federal Tax Service and the employees to whom salaries are issued.

And it doesn’t matter:

- whether citizens receive it in the form of cash or goods;

- whether we are talking about the payment of dividends.

In all cases, the business entity is a tax agent.

Grounds for submitting 6-NDFL

From 01/01/2016, all organizations and individual entrepreneurs that are tax agents for personal income tax are required to submit 6-NDFL reports to the Federal Tax Service on a quarterly basis.

6-NDFL reflects information for the entire organization on income received and personal income tax paid.

The 6-NDFL calculation consists of:

- title page

- Section 1, which provides general information on the organization or individual entrepreneur

- Section 2, which provides information on: dates, types and amounts of income and calculated taxes.

Letter of failure to submit 6-NDFL

All tax agents must submit 6-NDFL. If the agent regularly submitted reports, but since a certain period he had no employees, no remuneration was accrued, then the Federal Tax Service plans to receive a calculation, and for late submission of which a fine may be imposed. To avoid getting into such a situation, you can submit a zero calculation (which you are required to accept) or issue a letter explaining the reason for not submitting these reports.

There is no unified form for a letter provided by law, and an organization or individual entrepreneur draws up such a document in any form.

Informing the Federal Tax Service about the reasons for failure to submit 6-NDFL with an explanatory letter in free form is necessary in order to confirm not the delay in reporting, but the real lack of remuneration for employees. The letter must reflect:

- Full name of the head of the Federal Tax Service, number and locality

- information about the agent: details

- date of compilation and originating number

- name of the document (letter)

- text of the letter: basis for submitting 6-NDFL

- informing about the absence of payments and deductions

- a conclusion stating that an organization or individual entrepreneur is not a tax agent

Responsibility for failure to submit 6-NDFL

As with all non-submitted or untimely submitted reporting forms for 6-NDFL, punishment is provided, expressed in the following forms:

| Failure to submit tax register | 200 rub. for each document not submitted |

| For lack of tax register | 10,000 rub. |

| Understatement of the tax base | 20% of the unpaid tax, but not less than 40,000 rubles. |

| Delay 6-NDFL | 1000 rub. for each full (incomplete) month from the reporting deadline date to the date the report is submitted. The fine is imposed after the calculation is submitted within 10 working days. |

| 6-NDFL with errors (inaccurate information) | 500 rub. for each error, but if the updated calculation is submitted on time before the Federal Tax Service check, no fine is imposed |

The letter of the Federal Tax Service dated August 9, 2021 No. GD-4-11/14515 reflects that the Federal Tax Service has the right to block a bank account if the 6-personal income tax is not submitted within 10 days from the due date , similarly, this is possible in the absence of a letter or payment form.

To remove account blocking you must:

- provide 6-NDFL

- submit an application to the Federal Tax Service stating that the income was not paid and the organization or individual entrepreneur is not a tax agent

The Tax Code of the Russian Federation does not stipulate the period for unblocking the account, so you must submit a letter to the Federal Tax Service stating that you are not a tax agent.

What happens if there is no report?

Whether it is necessary to submit zero 6-personal income tax in 2021 is decided by the payer himself. The state does not impose such an obligation. Based on this, we can safely say that no penalties are applied in the absence of a report. But you need to notify the Federal Tax Service about the lack of earnings payments immediately after the end of the reporting period.

Otherwise, the controlling inspection may consider such behavior to be tax evasion, failure to provide information, or violation of reporting deadlines and issue a fine of 1,000 rubles. This fee is intended for delays of no more than a month. In the future it may increase to 2000-4000 rubles. One of the methods of dealing with non-payers is to block the company's current accounts until the circumstances of the delay in tax payments are clarified.

There are penalties that apply not only to a complete tax return, but also to zero:

- Providing erroneous information – 500 rubles.

- Corrections and omissions in documents – 500 rubles.

- Willful change in the method of filing a declaration – 200 rubles.

We have figured out the question of whether you need to submit 6-NDFL without accruals every period or only once a year and what the consequences for its absence are. But it is not yet known where to submit documents. Any tax reports are submitted by legal entities and individual entrepreneurs at the place of registration of the main company. For non-resident units - at their location.

What income is shown in 6-NDFL

Personal income tax is payable not only on the employee’s basic salary. The list of taxable amounts includes other income, both in cash and in kind (clause 1 of Article 210 of the Tax Code of the Russian Federation):

- Interest-free loans issued to an employee by a company: in this case, the amount of interest saved by the employee is considered income (clause 1 of Article 212 of the Tax Code of the Russian Federation).

- Dividends (Article 214 of the Tax Code of the Russian Federation).

- Payment under a civil contract (Article 226 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance dated May 26, 2014 No. 03-04-06/24982).

- The cost of gifts exceeding 4,000 rubles per year (clause 28 of article 217 of the Tax Code of the Russian Federation);

- Other types of income, for example, from the sale of property of an individual (clause 1 of Article 228 of the Tax Code of the Russian Federation).

Whether to show non-taxable income in 6-NDFL, read this article.

Features of 6-NDFL and submission procedure

A distinctive feature of entering data into 6-NDFL is the generalized (rather than personalized) quarterly provision of information about employees. The document consists of two sections:

- Information collected since the beginning of the current year

- Data for the last quarter (3 months)

The completed form is submitted to the Federal Tax Service on the last day of the month following the end of the quarter. If the date falls on a weekend, it is moved forward to the next working day.

Providing reporting

The electronic version of the document using TCS (telecommunication channels) is transmitted to the department of the Federal Tax Service where the legal entity or individual was registered. If the company has up to 25 employees, it is possible to transfer the form to paper and fill it out in this form.

In cases where the organization does not carry out any activities (at first from the moment of registration, during a period of temporary difficulties, at the liquidation stage) and employees do not receive income, the company does not have data that could be displayed in 6-NDFL (the document becomes zero ).

According to the explanations of the Federal Tax Service, organizations that did not make wage payments have the right not to provide reports. Tax officers cannot demand the opposite, but if the tax agent himself decides to provide a zero 6-personal income tax for several quarters or for a year, then it will have to be accepted.

Zero reporting is completed quickly and does not require much effort from accounting employees. However, by providing it, the organization largely protects itself from many problems and unwanted interest from law enforcement agencies.