In this article we will look at a payment order to the Pension Fund. Let's learn about the rules for filling out an order. Let's look at common mistakes.

Organizations and individual entrepreneurs, as job creators, are required to pay insurance premiums every month for the employees of their enterprises, and in the case of individual entrepreneurs without employees, also for themselves.

Obviously, you need to fill out the payment order correctly, otherwise the funds will not find their recipient, the contributions will be considered unpaid, a fine and penalties will be imposed, and in extreme cases the current account may be blocked. It is believed that the preparation of such documents is an activity that does not require special skills, but it would be safer to entrust this to a qualified employee.

Every month, the 15th is the deadline for making payment of contributions; on this date, payment documents must be completed and sent, and the money must be transferred.

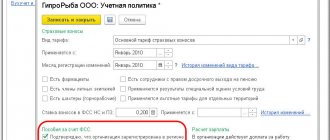

For insurance contributions to the Pension Fund from cash receipts of enterprise employees within the framework established for 2021. limit (876 thousand rubles) the tariff is 22%, and for payments above this limit - 10%.

In 2021, big changes came into force regarding payment orders; from now on, control over payment and submission of reports on contributions to the Pension Fund belongs to the tax service, which means sending documents and money is now also carried out to the Federal Tax Service (at the place of registration of the entrepreneur or at the location of the LLC and separate departments). Already from January 1, 2017. compulsory contributions (including those paid for periods ending before this day) must be transferred with the designation in the payment slip of the tax authorities. Calculations (including updated) for insurance payments for 2010-2016. sent to the Pension Fund and the Social Insurance Fund according to the requirements of the laws that were in force at that time. Read also the article: → “We issue a payment order in a new way.”

Deadlines for payment of insurance premiums on payment orders to the Pension Fund of Russia

The table shows the due dates for payment of contributions for different categories.

| Who makes the payment | LLCs and individual entrepreneurs making payments for individuals | LLCs and individual entrepreneurs who do not make payments for individuals | Heads of peasant farms |

| Payment deadline (month and year – calendar) | 15th of each month (when payment is made for the previous month) | – December 31st of this year (fixed payment); – April 1 of this year (payment in the amount of 1% on income above 300 thousand rubles for the past billing period) | December 31st this year |

The amount of insurance premiums for individual entrepreneurs in 2019

The Tax Code of the Russian Federation determines the amount that an entrepreneur must send to the budget for compulsory insurance for himself. They include two parts. You can calculate them on our online fixed payment calculator for individual entrepreneurs.

Fixed payment

From January 1, 2021, a constant amount is established for these payments, which is fixed in the Tax Code of the Russian Federation and does not depend on the minimum wage.

Thus, individual entrepreneur contributions must be paid in the following amounts:

| Year | In the Pension Fund of Russia, rub. | In the Federal Compulsory Medical Insurance Fund, rub. | Total |

| 2018 | 26545.00 | 5840.00 | 32385.00 |

| 2019 | 29354.00 | 6884.00 | 36238.00 |

Attention!

When making the calculation, it is not taken into account whether the entrepreneur actually worked or not. The obligation to calculate such payments arises from the moment of registration in the Unified State Register of Individual Entrepreneurs and ends when the business is closed. When these procedures are carried out throughout the year, a situation arises in which an individual must recalculate the amount of fixed payments for the year, taking into account the actual time worked. The amounts need to be adjusted in proportion to the operating time.

1% on excess income

The second part must be paid to those individual entrepreneurs whose total income exceeds 300,000 rubles.

To determine it, the following algorithm is used:

(Individual entrepreneur revenue - 300,000)*1%

An entrepreneur can simultaneously work in several modes at once, then his income must be added up for each of them.

An entrepreneur's income is determined by:

- If UTII is applied, the so-called imputed income is taken into account, calculated according to the rules established by the Tax Code of the Russian Federation.

- When simplified, “income” is based on the amount of actual revenue received by the individual entrepreneur.

- In the case of a simplified “income-expenses” system - based on the amount of actual revenue received. At the same time, there is no need to reduce the obtained value by the amount of expenses incurred - this is on the one hand, since the specifics are not spelled out in the Tax Code. On the other hand, the court considered Zharinova’s case, in which the court sided with the entrepreneur and contributions were calculated from the difference in income minus expenses.

- In the general mode, the income received by the entrepreneur is taken into account. However, in this case, the individual has the right to deduct professional deductions from these income.

- For a patent, the estimated value of the patent is used as income.

Payer status in payment order for insurance premiums

The issue of the status number of who pays the insurance premium remained unresolved for a long time. The Tax Inspectorate argued that the only correct option for filling out field 101 for an employer making contributions for employees is status “14”. Many accountants of organizations and entrepreneurs continued to enter the numbers “08”, indicating the status of the payer transferring contributions to the budget of the Russian Federation. And bank employees, in turn, did not accept payment documents, either with the first or second status. At the moment, the problem has been resolved; for the information of insurance premium paying organizations, the correct status would be “01”, i.e. status of the payer-legal entity. From January 1, 2021 when making payments to funds, statuses “09”, “10”, “11”, “12”, “13” are intended for entrepreneurs, notaries, lawyers, farmers and individuals, respectively.

Payee in a payment order for insurance premiums

Everything is simple here - enter the tax service details into the document:

- by location of the company (if you are a legal entity);

- on registration of individual entrepreneurs (obviously, if you are an entrepreneur).

To find out this data, just follow the link https://service.nalog.ru/addrno.do and indicate who you are (legal entity or individual entrepreneur). Then you should provide the location of your business or enter your tax office number.

The service will provide information that is relevant on the day of the request, which must be indicated in the payment document.

OKTMO in the payment order to the Pension Fund of Russia

If the addresses of organizations and the registration of the entrepreneur have not changed, then OKTMO will not change. The fact that now insurance payments will be transferred to the tax office and not to the Pension Fund does not matter.

There are two ways to find out whether you are entering this code correctly into the payment document:

- If you know the municipality in which the company or entrepreneur is located, this service will suit you: https://www.nalog.ru/rn52/service/oktmo/

- If you find it difficult to indicate a municipality, this resource will help you out: https://fias.nalog.ru/ExtendedSearchPage.aspx

Current BCCs for payment of insurance premiums, penalties and fines to the Pension Fund of Russia

When specifying the BCC, you need to be extremely careful, because if they are indicated incorrectly, the contribution will not be considered paid. Here you need to consider the following points:

- The first three digits of the code are 182 (due to the fact that the tax service now administers payments to the Pension Fund);

- For contributions for December 2021 a special BCC applies (and it doesn’t matter if the payment is made later than January 1, 2017);

- For the payment of penalties and fines for late payments, the Pension Fund also provides separate codes for the period 2021 and 2021;

- Fixed payments (for individual entrepreneurs without employees) for the time before and after 01/01/2017. are listed under various BCCs.

This table outlines the costs for different payment purposes.

| Purpose of payment | 2016 | 2017 |

| Payment of insurance premium to the Pension Fund of Russia | 18210202110061000160 | 18210202110061010160 |

| Payment of the fine | 18210202110063000160 | 18210202110063010160 |

| Payment of penalties | 18210202110062100160 | 18210202110062110160 |

| Payment of a fixed payment | Within the income limit: 18210202140061100160 When exceeding the income limit: 18210202140061200160 | 18210202140061110160 |

Deadlines for payment of FP IP

The rules of law establish the requirement to pay fixed payments within a fixed time frame. The first amount of the fixed payment of the individual entrepreneur must be sent to himself before the end of the current year, that is, before December 31. At the same time, the entrepreneur decides when exactly and in what part to pay contributions.

He can divide this amount into monthly or quarterly shares, or pay the fees with a single payment document at once. The basic rule is that payment must be made before the end of the year.

On some preferential regimes, it allows you to take into account the amounts of transferred insurance premiums towards taxes due:

- For UTII - if an individual entrepreneur makes payments for compulsory insurance during the reporting quarter, he has the right to take such payments into account when calculating the single tax. For example, UTII for the 1st quarter can be reduced if the contribution was paid within the period from January to March inclusive.

- Under the simplified tax system, insurance premiums can be used to determine the advance tax payment, and at the end of the year in the total tax amount.

Timely payment of fixed payments for individual entrepreneurs without involving persons under special regimes sometimes allows one to reduce taxes to zero based on the results of its activities.

Important! Starting from 2021, according to the new law, the deadline for paying a portion of 1% in excess of the individual entrepreneur’s revenue of 300,000 rubles is set until July 1 of the year following the reporting period.

Filling out a payment order to the Pension Fund

Fields [1] and [2] are not filled in; they are needed for bank employee records.

The document number is entered in field [3].

Field [4] is intended to indicate the day the payment order was issued in the format DD.MM.YY.

Field [5] must contain information about the type of payment. We write:

- [By mail], if the document is sent through a post office;

- [Urgent] if the contribution needs to be taken into account as soon as possible;

- [Electronically], if the money will be transferred by electronic payment;

- [___] if you pay in person.

Field [6] is set to <01> (not <08> and not <14>!).

Field [7] must contain the amount to be paid in words, and [8] in numbers.

In the place of the document that we have designated [9], you provide information about your company:

- TIN (consists of ten digits for an LLC and twelve digits for an individual entrepreneur);

- Checkpoint (entrepreneurs do not fill out);

- name of the enterprise (or initials of the entrepreneur);

- Account number from which funds are debited;

- name of the bank (BIC, correspondent account) of the payer.

In field [10] you enter information about the recipient of the funds:

- bank of your Federal Tax Service (name, BIC);

- name of the Federal Tax Service, No. of its account.

Fill in field [11] (enter only the information indicated below):

- In the section <Type of transaction> we put <01> (i.e. we indicate that this is a payment document);

- In<Payment order> set <5>;

- We have <Code><0>.

Area [12] will contain:

- KBK,

- OKTMO,

- Basis of payment:

- TP (current payment);

- ZD (payment for expired periods, applied for additional payments according to updated calculations);

- AP (payment upon issuance of an inspection report by Federal Tax Service employees);

- TR (transfer of funds at the request of the tax office).

- Payment period:

- MS.01.2017 (if payment is made for the month);

- KV.01.2017 (for additional payments according to “clarifications”);

- GD.00.2016 (for additional payments according to “clarifications” and at the request of the Federal Tax Service for conducting an inspection).

- Document number -<0>. If funds are transferred according to “clarification” or at the request of the tax office, we will write down the number of the calculation or decision of the Federal Tax Service.

- Date of the paper, set <0> or the date of submission of the updated calculation (the date of the decision of the Federal Tax Service).

Field [13] -<Purpose of payment>. The line must contain information that the contribution is made to the Pension Fund for period N.

And finally, the area [14] contains handwritten or electronic signatures of people who have the right to sign such documents.

In addition, you will see at the bottom of the document “M.P.” (place of printing). It is needed if the payment order is submitted in paper form, but LLCs and individual entrepreneurs have the right to refuse to put it in then. Read also the article: → “”

Sample of filling out a payment order to the Pension Fund for periods starting from 2017

Joint Stock Company “Alfa” belongs to the Federal Tax Service Inspectorate No. 8 for Moscow. Based on the results of work for January 2021. the company paid insurance premiums to the Pension Fund in the amount of two hundred thousand rubles. The payment order will look like this:

Sample of filling out a payment order to the Pension Fund for periods before 2017

Let's use the previous example, only now imagine that in April 2021, Alfa JSC discovered an error in calculating the amounts of insurance premiums for 2021. After filling out the updated calculation, it became clear that the debt to the Pension Fund was equal to 6,554 rubles. In this case, the payment document will look like this:

Author of the document

| Contract-Yurist.Ru offline Status: Legal company rating460 84 / 6 Private message Order a consultation | number of consultations: |

| noted as the best: | 5 |

| answers to documents: | |

| documents posted: | 927 |

| positive feedback: | |

| negative reviews: |

| 0401060 | |||||||||||||||||||||

| Admission to the bank of payments. | Debited from account plat. | ||||||||||||||||||||

| PAYMENT ORDER | № | electronically | 01 | ||||||||||||||||||

| date | Payment type | ||||||||||||||||||||

| Suma in cuirsive | Eight thousand rubles 00 kopecks | ||||||||||||||||||||

| INN 3792072114 | Gearbox 379201001 | Sum | 8000.00 | ||||||||||||||||||

| ASTRA LLC | |||||||||||||||||||||

| Account No. | 30109810100000070999 | ||||||||||||||||||||

| Payer | |||||||||||||||||||||

| "FOB" LLC, Ivanovo | BIC | 042406718 | |||||||||||||||||||

| Account No. | 30101810000000000718 | ||||||||||||||||||||

| Payer's bank | |||||||||||||||||||||

| GRKTS GU BANK OF RUSSIA FOR IVANOVSKAYA REGION. Ivanovo | BIC | 042406001 | |||||||||||||||||||

| Account No. | |||||||||||||||||||||

| payee's bank | |||||||||||||||||||||

| INN 3728012590 | Gearbox 370201001 | Account No. | 40101810700000010001 | ||||||||||||||||||

| UFK for the Ivanovo region (Inspectorate of the Federal Tax Service of Russia for the city of Ivanovo) | |||||||||||||||||||||

| Type op. | 01 | Payment deadline. | |||||||||||||||||||

| Name pl. | Essay. plat. | 3 | |||||||||||||||||||

| Code | Res. field | ||||||||||||||||||||

| Recipient | |||||||||||||||||||||

| 18210202010061000160 | 24401000000 | AR | 0 | 005274 | 24.11.2011 | VZ | |||||||||||||||

| 047025099339 Arrears on insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund for payment of the insurance part of the labor pension for 2009, paid according to the writ of execution of the Arbitration Court of the Ivanovo Region dated November 24, 2011 No. 005274 | |||||||||||||||||||||

| Purpose of payment | |||||||||||||||||||||

| Signatures | Bank marks | ||||||||||||||||||||

| M.P. | |||||||||||||||||||||

Download the document “Sample payment order for payment of arrears on insurance contributions for compulsory pension insurance”

The main difficulties when filling out a payment order at the Pension Fund of Russia

As we have already found out, payers of contributions to the Pension Fund have difficulties filling out those fields of the payment order in which it is required to enter details that have changed by 2021 due to the transfer of control over insurance contributions to the tax service:

- fields for indicating the budget classification code (pay attention to the first three digits, now you need to indicate “182” - the tax authority code; after that, make sure that you indicate the BCC related to payments for 2021 or 2021);

- fields for entering data about the payee (check the correct details of your Federal Tax Service office);

- fields for reporting the status of the fee payer (do not get confused, the status should not be “08” or “14”, for legal entities indicate “01”, for individuals - “13”, for individual entrepreneurs - “09”, for a notary - “10” ”, for a lawyer - “11”, for a farmer - “12”).

Comment on the rating

Thank you, your rating has been taken into account. You can also leave a comment on your rating.

Is the sample document useful?

If the document “Sample payment order for payment of arrears on insurance contributions for compulsory pension insurance” was useful to you, we ask you to leave a review about it.

Remember just 2 words:

Contract-Lawyer

And add Contract-Yurist.Ru to your bookmarks (Ctrl+D).

You will still need it!

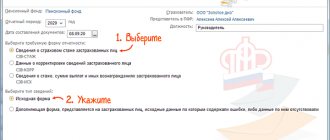

Filling out a payment order to the Pension Fund online on the Federal Tax Service website

For some, filling out a payment document online will seem like the easiest option due to the fact that you won’t have to look for forms and spend a lot of time dealing with new filling out rules.

Step 1 : Follow the link https://service.nalog.ru/

Step 2 : Enter your tax code, click “next”.

Step 3 : Find out the name of the municipality where your company is located (or where you are registered if you are engaged in entrepreneurial activity) and select it from the list provided, click “next”.

Step 4 : Select “payment order” in the “type of payment document” line, click “next”.

Step 5 : In the “Payment Type” column, select “payment of tax, fee, contribution”, click “next”.

Step 6 : Enter BCC, click “next”.

Step 7 : The status of the person who issued the payment document is “01”, “next”.

Step 8 : Basis of payment – “TP”, “next”.

Step 9 : Select the billing period, “next”.

Step 10 : Report the date on which the dues settlement was signed. If the day is unknown, simply click “next”.

Step 11 : Payment order – “5”, “next”.

Step 12 : Fill in the fields TIN, KPP, name, payment details, contribution amount.

Step 13 : Click “next”, “generate payment order”. Done, the completed document has been downloaded to your computer.

Legislative acts on the topic of payment order to the Pension Fund of Russia

This table lists the regulations.

| Order of the Ministry of Finance of the Russian Federation dated December 7, 2016 No. 230n “On amendments to the Instructions on the procedure for applying the budget classification of the Russian Federation” (changes approved by Order of the Ministry of Finance of the Russian Federation dated July 1, 2013 No. 65n) | About KBK assigned to the Federal Tax Service of Russia |

| Letters of the Federal Tax Service of the Russian Federation dated February 3, 2021 No. ZN-4-1/ [email protected] and dated February 10, 2021 No. ZN-4-1/ [email protected] | On the status of insurance premium payers in payment orders |

| Appendix 1 to the Regulations approved by the Bank of Russia on June 19, 2012. No. 383-P | Payment order details |

| Appendix 3 to the Regulations approved by the Bank of Russia on June 19, 2012. No. 383-P | Payment order form, numbers and names of its fields |

| Federal Law “On the abolition of the mandatory seal...” dated April 6, 2015 No. 82-FZ | About the fact that it is not necessary to have a seal for LLCs and JSCs |

| clause 3 art. 23 Civil Code of the Russian Federation, Resolution of the Federal Antimonopoly Service of September 12, 2008 No. F03-A51/08-2/3390 | About the fact that it is not necessary to have a seal for an individual entrepreneur |

| Order of the Ministry of Finance of the Russian Federation dated November 12, 2013. No. 107n | Rules for filling out new payment orders in 2021 |

Common mistakes

Error No. 1 : The organization's accountant, filling out a payment order to the Pension Fund of Russia, indicated the payer status code “14” on the basis that this was required by the tax inspectorate in Letter dated January 26, 2021 No. BS-4/11/ [email protected] /NP-30 -26/947/02-11-10/06-308-P.

Comment : Banks refused to process payment orders with status “14” and “08”, and it was decided to indicate status “01” for legal entities, starting from January 1, 2017.

Error No. 2 : In the payment order, the first three digits of the BCC were “392” due to the fact that the payment was made according to the updated calculation for 2021.

Comment : Despite the fact that the transfer of the insurance premium was made for 2021, the KBK should begin with the numbers “182”, with the code assigned to the tax service, since control over insurance premiums from 2021 is under its jurisdiction.

Error No. 3 : Filling out the upper fields “in the header” of the payment order to pay insurance premiums to the Pension Fund.

Comment : These lines are not filled in by the contribution payer; they remain empty for bank employees to enter data.

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Sample payment order for payment of arrears on insurance contributions for compulsory pension insurance”, as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |