When resigning at your own request, you should know which certificates the employer is required to issue when dismissing an employee at his own request in 2021, and which can be obtained, if the subordinate so desires, upon written application.

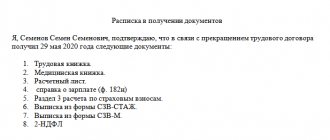

Any process of terminating an employment contract at one’s own request is accompanied by the execution and issuance of documents to the employee on the last day of performance of his duties. The package of documents for dismissal in 2021 is the same for everyone, regardless of the reasons for leaving, employee status and other factors. On the day of termination of obligations under the employment agreement, the enterprise issues:

- employment history;

- a copy of the dismissal order;

- certificates regarding the employee’s income and work at the enterprise.

Important! At the request of the employee, documents relating to the amount of his income, deductions, deductions, length of service and other issues within the framework of the employment contract with a specific employer can be issued to him upon written application even after dismissal in 2021.

The wording of the grounds for dismissal is entered into the work book in strict accordance with the article of the Labor Code of the Russian Federation, which regulates the procedure for dismissal from office at will. The employee must be familiarized with the order in writing.

On the last working day, the employee is paid in full.

Dear readers! The articles contain solutions to common problems. Our lawyers will help you find the answer to your personal question

free of charge To solve your problem, call: You can also get a free consultation online.

Employment history

On the day of termination of employment with the employer, the employee must receive his work book.

It should contain a record of an employee’s hiring for a specific position, records of movements in the company in different positions, if any. At the end - a record of dismissal with a mandatory indication of the article of the Labor Code that is the basis for the reason for dismissal.

All entries in the work book are certified by the signature of the person responsible for maintaining work books, as well as the company seal.

The employee himself also puts his signature in the work book. The employee signs on receipt of the work book in a personal card (form No. T-2) and in the book for recording the movement of work books and inserts for them.

If the employee cannot pick up the work book on the day of dismissal, then the employer must send him a notice of the need to pick up the work book or, in agreement with the employee, send it by mail.

Read also “When will electronic work books be introduced?”

Requirements for preparing certificates

Dismissal certificates containing information about payments to subordinates and contributions to funds are prepared by accounting employees, signed by management and certified by the company's seal.

Personnel documents are prepared by personnel department employees. Copies of orders must be certified: for this purpose, a note “true” or “copy is correct” is made on the certificate, the signature of the person who certified the act, and a transcript (full name, position), and the seal of the enterprise are affixed. The date of certification is indicated, since over time the original may become invalid.

Help on form 2-NDFL

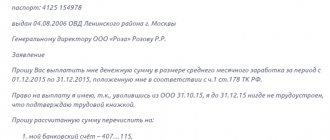

To receive a certificate in Form 2-NDFL, an employee must write an application.

The number of requests for a 2-NDFL certificate from an employer is not limited. If it is lost, the former employee can re-apply to the former employer. The employer's refusal to issue a certificate is unlawful. For refusal to issue a certificate in Form 2-NDFL, the employer may be held liable.

Read also “Certificate 2-NDFL: fine for false information”

Papers on demand

The manager is obliged to give the dismissed employee, upon request, copies of the necessary documents that relate to his work activities. Government bodies and personnel services of companies at the new place of work of citizens who happened to quit have the right to request papers. Art. 89 of the Labor Code determines that every person has the right to make a request to receive the personal information he needs, which is reflected in the archive of the previous enterprise. Information about what certificates are issued to an employee upon dismissal (2017) at his request is contained in the list below:

- accident reports;

- extracts from personal files, orders for employment, transfers and dismissals, certificates for individual periods of employment at the enterprise;

- information about salary and all aspects related to it: deductions and deductions, 2-NDFL income, average for 3 months for the employment center;

- information about the staffing table of the position of the dismissed citizen.

All of the above data are provided only upon application, but many reputable enterprises, when dismissing an employee, include a 2-NDFL certificate in the mandatory list of issued papers, without waiting for the former employee to apply.

It is possible to receive a document again if it is lost, and the manager has no right to refuse this. The originals remain at the enterprise.

Certificate of earnings for the two calendar years preceding dismissal

The resigning employee will present a certificate of the amount of earnings for the two calendar years preceding the dismissal to his future employer. It is needed so that the new employer can calculate the employee’s temporary disability benefits and other types of social benefits paid from the Social Insurance Fund.

If for some reason the employee was not given such a document on the day of dismissal, then he can write an application to the employer with a request to issue a certificate. The employer has three days to complete this. If it is impossible to obtain a certificate on the day of dismissal, the employer, as in the case of delivery of a work book, must send the employee a request for his personal appearance or for sending a certificate by mail.

Read also “Recalculation of salary after dismissal”

Rules for providing certificates

Proof of the fact of transfer of documents is: a signature on the original copy, an autograph on a separate sheet or in the registration book. The last option, using inventory numbers on primary sources, eliminates misunderstandings when fulfilling the employer’s responsibilities for issuing certificates. The process of document replication occurs when the basic rules are followed:

- any paper is handed over to the employee against receipt;

- the period for issuing a copy does not exceed 3 days;

- the presence of an employee’s debt to the company does not affect the obligation to provide a certificate;

- failure of a citizen to appear at the HR department is not an obstacle to the execution of the document transfer: sending is carried out by registered mail;

- All papers related to the employee’s work activity are certified and handed over free of charge.

For violating the deadlines for submitting papers when dismissing an employee of an organization or its manager, you will have to pay a fine; administrative liability and disqualification for 1–3 years are provided for this.

Personalized accounting information

Since 2021, the personalized accounting information that an employer must provide to employees upon dismissal has increased.

Read also “Personalized accounting: document forms approved”

Extract from reporting on insurance premiums

This is section 3 of the insurance premium calculation completed in relation to the resigning employee. When filling out, you must indicate the code of the period in which the employee is leaving.

If an employee is dismissed in 2021, he must also be given information in the RSV-1 form for all previous periods. That is, at the time of dismissal in 2021, the employee will receive extracts from RVS-1 for 2016 and earlier years.

Extract from the SZV-STAZH form

As a general rule, all employers submit a report to the Pension Fund of the Russian Federation on the new form SZV-STAZH for the first time for 2021 in 2021 (no later than March 1). However, if an employee retires in 2021 due to old age, the SZV-STAZH must be submitted to the Pension Fund ahead of schedule, no later than three days from the date the employee applied for a pension. This applies to both employees under employment contracts and civil law contracts.

The employer is obliged to hand over the information in the form SZV-STAZH (extract for a specific employee) to the employee who is leaving without retirement. The report is provided on the day the employee is dismissed. Or on the day of termination of a civil contract. In this case, there is no need to submit an early report to the Pension Fund.

Date the SZV-STAZH to the employee’s last day of work. Report type – “Pension assignment”.

Read also “Information on the insurance experience of insured persons (form SZV-STAZH)”

Information about insurance experience in the form SZV-M

From 2021, an organization or individual entrepreneur (policyholder) is obliged to issue to the insured persons, upon their request, copies of the SZV-M handed over for them within a period of no later than five calendar days from the date of application. To protect yourself from claims of failure to meet deadlines, you should ask the employee to write a written statement in any form.

The number of reports in the SZV-M form per employee must be equal to the number of months that the employee worked in the organization or with an individual entrepreneur.

Each person is given a personal separate sheet only with information about him in the SZV-M form. That is, in the table of the form for the reporting month, under serial number 1, only one line will be filled in - for the employee to whom the form is issued.

Registration and issuance of the SZV-M form upon dismissal

An extract from the SZV-M form is a confirmation of the employee’s insurance experience. The document must reflect the following information:

- Name of the organization;

- Company details;

- reporting period;

- information about the employee;

- employee tax identification number;

- SNILS of the employee.

Paragraph 4 of Article 11 of Law No. 27-FZ of 04/01/1996 states that an extract from SZV-M must be prepared for the period of work in 2021. You should use the document form SZV-M, which was adopted by Resolution of the Board of the Pension Fund of the Russian Federation No. 83p. from 01.02. 2016.

In the extract from the SZV-M form, you must fill out all sections. In this case, in section 4 you need to enter information only about the employee who is leaving.

As for the procedure for filling out the SZV-M form, it was not issued by the Pension Fund. Recommendations for filling out the form can be found in the sample document form.

Please note that in the current legislation there is no rule that would determine the person involved in the preparation of this document. The organization must independently appoint a responsible person.

Other documents

Article 62 of the Labor Code establishes the employer’s obligation to provide, upon the employee’s request, copies of documents related to the employee’s work activities. This is, for example (the list is not closed):

- copies of orders for transfers to another job;

- salary certificates;

- certificates about the period of work with this employer;

- acts on industrial accidents and any other documents directly related to the employee’s work activity and affecting his rights.

If a request has been received for a local regulatory act, for example, a staffing table, you can make a certified extract relating only to the applicant.

The employer is required to issue copies of orders for employment and dismissal on the basis of Articles 69 and 84.1 of the Labor Code, respectively.

And Article 89 of the Labor Code gives an employee the right to request copies of any record containing his personal data within the framework of the Federal Law of July 27, 2006 No. 152-FZ “On Personal Data”.

Read also: “What documents should be issued to employees”

Registration and issuance of Extracts from section 3 of the insurance premium calculation form

Now it is the employer’s responsibility to prepare an extract from section 3 “Personalized information about insured persons” of the calculation of insurance premiums on the day the employee resigns. The Federal Tax Service has combined two separate documents into one - 4-FSS and RSV-1. The document indicates contributions and income for the dismissed employee.

The document reflects information about the last three months of the reporting period in which the employee was dismissed - from the beginning of the quarter until the day of dismissal.

The order of the Federal Tax Service of the Russian Federation No. ММВ-7-11/ [email protected] dated 10.10.2016 contains a form for an extract on insurance premiums. The document contains the following information:

- information about the employee’s salary;

- about the insurance premiums that were accrued;

- employee passport details.

This document is prepared by the company's accounting department and submitted to the tax office. In a letter dated March 17, 2021 No. BS-4-11/4859, the Federal Tax Service explained the procedure for filling out section 3 of the Statement.

When filling out a document, you cannot correct errors using corrective means. Manual filling requires the use of blue, violet or black ink.

On the day of his dismissal, the employee must sign a certificate stating that he has received the payment. There is no unified form of calculation and therefore an organization can independently develop its own document template, in which the employee will need to indicate:

- FULL NAME;

- job title;

- signature;

- date.

It is necessary to take into account that the extract is issued not only when dismissing employees signed under an employment contract, but also to those persons who carried out activities under service agreements and civil law contracts.

Upon dismissal, what documents are issued to the employee in 2017?

Termination of an employment contract is a serious process that requires the employer’s attention and strict compliance with the law. the Labor Code is still in force . Its article 84.1 defines the procedure for dismissal, including clarification of details about the mandatory issuance of documents.

These include:

- a work book is a valuable document. It confirms the entire length of employment from the moment it began to the present;

- a document from the accounting department about income for three months. It is necessary if you apply to the labor exchange;

- certificate 2-NDFL for the year. It is mandatory for people wishing to receive a tax deduction in the future;

- on the pension contributions of the insured person to the Pension Fund.

What to do if documents are not issued

Labor legislation provides that when leaving work, an employee has the right to receive all the documents he needs that are related to work at this enterprise. The work book must be provided, and the rest - in accordance with a written application. This is provided for in Article 62 of the Labor Code of the Russian Federation.

To obtain certificates, you need to submit an application, which is written to the chief accountant or head of the human resources department. If difficulties arise when receiving documents, you can do the following:

- Submit your application through the secretary. In this case, it will undergo official registration, the incoming number and date of the document will be registered.

- You can contact the manual by mail. In this case, the letter must be registered with a description of the attachment and acknowledgment of delivery.

In these cases, the employee will have legally binding evidence that he applied for the certificates in question.

If the manager avoids completing the documents, there are grounds for contacting the Labor Inspectorate or the Prosecutor's Office. Penalties for evading the issuance of certificates include:

- For an official it will be 1-5 thousand rubles.

- For an enterprise 30-50 thousand rubles.

In this situation, the legislation will be on the employee’s side.

Dismissal of an employee due to conditions beyond the control of both parties

The Labor Code provides 12 reasons for dismissal on the specified grounds:

- Conscription of an employee for military service.

- Reinstatement of an employee who previously held this position by decision of the state labor inspectorate.

- Failure to be elected to office.

- Death of an employee or recognition as missing.

- Conviction to a punishment that precludes the possibility of continuing work.

- Extraordinary circumstances that prevent work from being carried out.

- Conviction to administrative punishment, as well as disqualification, making it impossible to carry out work.

- Expiration and suspension of a license or other special permit.

- Cancellation of a court or labor inspection decision on reinstatement.

- Termination of access to state secrets if work activity requires such access.

- The emergence of restrictions that impede the performance of labor functions.

- Recognition as completely incapacitated for health reasons.

Grounds for termination of an employment contract

The grounds for termination of an employment contract are listed in Art. 77 of the Labor Code of the Russian Federation and include dismissal:

- At your own request.

- At the initiative of the employer.

- By agreement of the parties.

- Upon expiration of the fixed-term employment contract.

- Due to the transfer of an employee to another employer or his appointment to an elective position.

- If the employee refuses to continue working due to a change in management.

- When the essential terms of the employment contract change.

- If an employee refuses to be transferred to another position (due to medical contraindications).

- If an employee refuses to be transferred to another location.

- Under conditions independent of both parties.

- In case of violation of the procedure for concluding an employment contract.

Note

: an employee may be dismissed for other reasons, not directly stated in the Code, but provided for by current labor legislation.

Responsibility of the company on the day of dismissal

It was previously mentioned that all certificates upon dismissal of an employee, both mandatory and at the request of the dismissed person, are issued within three days from the date of termination of the employment relationship or submission of the corresponding application to the personnel department. However, there is information that should be provided to the employee directly on the day of termination of the employment relationship. This includes data from the employee’s personalized account in the pension insurance system (Article 11 No. 27-FZ).

In this case, how are documents drawn up when leaving an employer?

- Firstly, this information is reflected in any form in a separate document;

- Secondly, the employee prepares written confirmation of the transfer of this information.

In terms of its composition, personalized accounting information includes information regarding:

- Information on the volume of accrued and paid insurance premiums;

- Data on the employee’s insurance experience;

- Information about the employer’s special contributions to the employee’s funded pension and other additional contributions.

The issuance of such information involves the handling of private data; therefore, the employee is not required to write an application for their provision. However, the employer has the right to issue such information strictly against the signature of the employee.