What is the report for?

The SZV-STAZH report and the procedure for its formation were approved by Resolution of the Pension Fund Board of January 11, 2021 No. 3p. In SZV-STAZH with the “initial” information type, you need to include all employees and performers (contractors) under civil contracts. Every year, such a report must be submitted to the Pension Fund authorities no later than March 1 of the year. See “SZV-STAZH: new reporting for all employers: 2021.”

Pension Fund bodies that have received SZV-STAZH reports will monitor the accrual of length of service of individuals to form their pension rights.

SZV-STAGE upon dismissal in 2021: how to fill out

No later than the day of dismissal or the day of termination of the contract, draw up a certificate and give it to the employee against signature.

The employee can leave a signature confirming receipt of his copy of the certificate, for example, on the second copy of the certificate, which remains with the employer, or on the resignation letter. See in what other situations it is necessary.

Upon dismissal, fill out the SZV-STAGE in the usual manner (Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2019 No. 3p). In the module "" in the "Funds/NDFL" section, select "SZV-STAGE". If salary data was entered into the “Salary and Personnel” module, then to prepare a report, click the “From Salary” button.

In the form that opens “Filling out SZV-STAZH according to ZiK data”, in the “Type of information” drop-down lists, select “Initial” and “Include in report”, select “Selectively”.

In the “Select Employees” form that opens, check the full name of the employee for whom you want to prepare a report and click “Select.”

Three types of report

The report form provides that it can be compiled with one of three typical characteristics:

- Type “initial” – when information is submitted for the first time;

- “Additional” type – if the original data contained errors that did not allow the data to be distributed among the personal accounts of the insured persons;

- Type “appointment of pension” - if the insured person, in order to assign an insurance pension, needs to take into account the data of the reporting period (year), for which the SZV-STAZH form has not yet been submitted.

As you can see, this type of information as “Upon dismissal” does not exist. But does this mean that the SZV-STAZH form does not need to be issued to an employee when dismissing him? The answer to this question is given to us by the legislation on individual (personalized) accounting.

Who submits the report

Information in the form SZV-STAZH must be submitted to the territorial divisions of the Pension Fund of the Russian Federation:

- organizations and their separate divisions;

- individual entrepreneurs, lawyers, notaries and private detectives.

The named persons must include in the report on the SZV-STAZH form all of their employees who perform work under employment or civil law contracts (Article 1, paragraph 1, Article 8, Article 15 of the Federal Law of 01.04.1996 No. 27-FZ ). Individual entrepreneurs, lawyers and notaries who pay pension contributions only “for themselves” do not have to submit information on the SZV-STAZH form for themselves.

SZV-STAZH - to every dismissed person

Paragraph 2 of Article 11 of Federal Law No. 27-FZ dated April 1, 1996 “On personalized accounting” establishes that no later than March 1, policyholders are required to submit SZV-STAZH reports to the Pension Fund of Russia.

RULE OF LAW

The policyholder annually, no later than March 1 of the year following the reporting year (except for cases where other deadlines are provided for by this Federal Law), submits information about each insured person working for him (including persons who have entered into contracts of a civil law nature, the remuneration for which is In accordance with the legislation of the Russian Federation on taxes and fees, insurance premiums are calculated) the following information:

- insurance number of an individual personal account;

- last name, first name and patronymic;

- the date of hiring (for an insured person hired by this policyholder during the reporting period) or the date of concluding a civil law contract, for the remuneration for which insurance premiums are calculated in accordance with the legislation of the Russian Federation;

- the date of dismissal (for an insured person dismissed by this policyholder during the reporting period) or the date of termination of a civil contract for which insurance premiums are calculated in accordance with the legislation of the Russian Federation;

- periods of activity included in the length of service in the relevant types of work, determined by special working conditions, work in the Far North and equivalent areas;

- other information necessary for the correct assignment of an insurance pension and funded pension;

- the amount of pension contributions paid for an insured person who is a subject of the early non-state pension system;

- periods of labor activity included in the professional experience of the insured person who is a subject of the early non-state pension system;

- documents confirming the right of the insured person to early assignment of an old-age insurance pension.

In accordance with paragraph 4 of Article 11 of the Federal Law of 04/01/1996 No. 27-FZ, on the day of dismissal of the insured person or on the day of termination of a civil contract for which insurance premiums are calculated, the policyholder is obliged to transfer to the insured person the information provided for in paragraph 2 Article 11.

Paragraph 2 of Article 11 of Federal Law No. 27-FZ dated 01.04.1996 talks about the information contained in reporting in the SZV-STAZH form. Consequently, on the day of dismissal of an employee or on the day of termination of a civil law contract, the organization or individual entrepreneur is obliged to issue the insured person with a completed SZV-STAZH form.

In the SZV-STAZH report, in general, it is necessary to include information on all insured persons. In section 3 “Information about the periods of work of insured persons,” individuals are listed in a list.

However, a dismissed employee is prohibited from issuing a report if it includes information about other people. The fact is that such information refers to personal data. And it is impossible to disclose personal data of individuals without consent. Also see “Personal data from July 1, 2021”. Upon dismissal, only one person must be indicated in SZV-STAZH. After all, this report concerns only him.

How to fill out SZV-STAZH for a working pensioner

We have provided a sample report below.

Sample of filling out the SZV-STAZH information form for a working pensioner

Section 1. In the report of SZV-STAZH about.

Since you are reporting for a pensioner. Section 2. Enter the period - 2021.

Because the employee is retiring this year.

Even though it continues to work. Section 3.

In columns 1-5, indicate the employee’s full name and SNILS.

In columns 6 and 7, write down the period of work of the individual - from 01/01/2019 to the date when the employee retires. If the employee was on leave without pay or was sick, then indicate the periods in separate lines with the codes “NEOPL” or “VRNETRUD”, respectively.

Fill out the remaining columns only if the employee worked under special conditions. He worked in the Far North, in difficult and harmful working conditions. Resolution No. 3p.

Sample of a completed report

Let’s assume that the employee has been employed under an employment contract since 2014. However, he resigned of his own free will on April 18, 2017. On the day of dismissal, he must be issued a SZV-STAZH certificate. The employee contacted the HR department for a report on the length of service.

In the “Work period” field in Section 3 of the report, the accountant will show the time period from the beginning of 2021 to the date of dismissal: from 01/01/2017 to 04/18/2017.

As follows from the conditions of our example, the employee has been employed under an employment contract since 2014. And for the entire period of work before the date of dismissal, contributions were accrued and paid for remuneration in his favor and, as a result, insurance experience accumulated. But why, then, in section 3 of the SZV-STAZH issued upon dismissal, did you indicate only 2021? The fact is that in paragraph 2.3.2 of the Procedure for filling out the SZV-STAZH, approved by Resolution of the Board of the Pension Fund of January 11, 2021 No. 3p, the following is directly stated:

Quote from the filling rules

“The dates indicated in the “Operation period” column of the table must be within the reporting period specified in section 2 of the form and are filled in: “from (dd.mm.yyyy.)” to “to (dd.mm.yyyy.) "".

Thus, if you strictly follow the rules for filling out the SZV-STAZH, only one reporting period can be recorded in the report - 2021.

HAVE A QUESTION!

But is it necessary to issue the employee the same reports for previous years: 2014, 2015 and 2021? Logically, such reports need to be provided to him so that the person gets a general idea of the deductions for him and his length of service for the entire period of work. But what about the fact that until 2021 the SZV-STAZH form was not yet in effect?

Or, upon dismissal, is it still possible to issue one SZV-STAZH form for the entire period of work? There are no answers to these questions yet. Let's hope that the FIU will soon publish some clarification in this regard.

When and why is SZV-STAZH filled out in 2019 upon dismissal?

SZV-STAZH is a new annual reporting form, which began only in 2021. The certificate is intended for the Pension Fund of Russia. It contains data on the insurance experience of the company’s employees, as well as on the payment of contributions from their income.

If your employee quits or retires, then you are obliged to issue him a certificate in the SZV-STAZH form. Include only this employee in the report.

Since 2021, a new form of SZV-STAZH has been in effect. It was approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 N 507p. In the new form, column 14 has been changed. As before, it is filled out only for employees dismissed on December 31 of the reporting year. But now you need to write in column 14 not the symbol “X”, but the date of dismissal, for example, “12/31/2018”. Employers do not fill out data on the periods that are counted towards the insurance period of the unemployed. This information is provided by employment center employees. They compile SZV-STAGE for individuals who are registered as unemployed.

To fill out the SZV-STAZH form in 2021 upon dismissal (see sample filling below), you need to take into account several nuances:

- If an employee retires, you fill out the SZV-STAZH for him alone and send a certificate to the Pension Fund of Russia;

- If an employee leaves for other reasons, you fill out the SZV-STAZH form for him in two copies and give him one copy in his hands, the other remains in the company;

- In the SZV-STAZH certificate for 2021 for the Pension Fund of the Russian Federation, include all employees, including the dismissed employee, indicating the date of dismissal.

How to hand over a report to those fired

The legislation does not explain exactly how the SZV-STAZH report must be handed over to the former employee upon dismissal: in person, by mail or electronically. In our opinion, you can use any of these options. The main thing is to have confirmation that the dismissal reports were provided. At the same time, there is no liability for failure to issue SZV-STAZH upon dismissal.

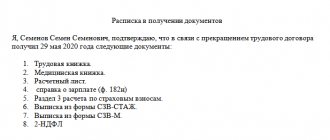

On the employee’s last day of work, pay him and give him:

- work book;

- a certificate of the amount of earnings in the form approved by order of the Ministry of Labor of Russia dated April 30, 2013 No. 182n;

- copies of information in the SZV-M form;

- a copy of information in the form SZV-STAZH;

- a copy of section 3 of the calculation of insurance premiums;

- other documents (upon written application from the employee).

Read also

15.01.2021

His surrender

Who issues it to whom?

In addition, the employer must comply with the legal requirement to hand over the SZV-STAZH form in the event of dismissal to all employees, along with the work book, payroll and dismissal order. Otherwise, the employee has the right to appeal a violation of the dismissal procedure, for which administrative liability is provided in the form of payment of a fine in the amount of 50,000 rubles, Art. 5.27 Code of Administrative Offences.

However, taking into account the innovation of this reporting form, law enforcement practice is just being formed, therefore the legal community will monitor the application of this type of administrative sanction provided for violation of labor legislation and the relevance of individual pension insurance accounting information to labor relations under the Labor Code of the Russian Federation.

Where and when to take it

In accordance with Article 11 of Law No. 27-FZ, when a pensioner applies for a pension, the SZV-STAZH form is submitted by the employer to the Pension Fund of the Russian Federation within 3 calendar days. At the same time, it must also be given to the pensioner along with the calculation of insurance premiums. In case of failure to submit the form to the Pension Fund, the legislator has provided for various types of fines depending on the type of violation. Let's consider them further:

- Failure to provide or incorrect provision of the form entails a fine on the employer or individual entrepreneur in the amount of 500 rubles. for one employee (17 Article 27-FZ);

- for the above, the manager may also be held administratively liable with a fine of 300-500 rubles. (Article 15.33.2 of the Administrative Code);

- Failure to provide information in the prescribed electronic form when there are 25 employees entails a fine of 1,000 rubles.

What documents are available upon request?

Due to the specifics of the work process or the reason for termination of the employment relationship, the employee may request in writing for the preparation and provision of various certificates.

According to form 182n

A certificate, the form of which has been unified since 2013 and corresponds to form 182n, is considered a document required to be provided upon dismissal. Previously, enterprises used form 4n, which had a significant drawback - there was no section to indicate the reasons for the onset of a citizen’s incapacity for work.

From January 9, 2021, new rules for filling out paragraphs 3 and 4 of the certificate and footnote “3” came into effect. The deadline for entering information on insurance premiums was January 1, 2021, since it was from this day that social payments became controlled by the Federal Tax Service.

As for the timing of submission, the accountant responsible for payroll is obliged to issue the document no later than the day of dismissal. If we are talking about receiving a corresponding request, then it should be responded to within 3 days.

By the way, it doesn’t matter when exactly the employment relationship was terminated; a former employee can request a certificate even after several years.

The manager cannot refuse to provide paper in Form 182n to a subordinate who has decided to stop performing official duties for the benefit of the organization. Ignoring a written statement allows a citizen to go to court to restore justice.

Why does an employee need certificate 182n at all? Everything is very simple: the document contains information about the income received during the last 2 years of work in the institution. If a citizen has worked less, the duration indicated in the certificate will be different. Information is needed so that a person can fully receive the benefits and benefits of a social nature that are due during the recovery of health, pregnant women, mothers caring for a baby who has not yet turned 1.5 years old, etc.

The certificate states the accounting data and reporting of the policyholder; accordingly, the accountant is responsible for issuing it.

Documents for download (free)

- Certificate of salary amount in form 182n

2-NDFL

A certificate in form 2-NDFL is intended for various cases, but first of all it confirms that income tax has been paid in relation to the employees of the enterprise.

Often citizens who decide to get a bank loan for any purpose apply for this certificate. This document is also needed when applying for a new job, since the amount of tax paid and the amount of previously received monthly income significantly affect the calculation of social benefits.

For example, if a woman came to work for another organization and after a short amount of time found out that she was in an interesting position, then the accountant will need this certificate to calculate sick leave related to pregnancy and childbirth and further maternity leave.

Many citizens are interested in what time period should be reflected in this document? If we are talking about a new organization for the benefit of which a person is going to work, then the HR specialist is often interested in information from a year ago, since 12 months is the generally accepted calculation period.

But situations are different, so retired citizens may be asked to provide information about both a longer and shorter period.

If an employee is going to return a property deduction, then he can write a request to provide him with a 2-NDFL certificate for 3 years. In response, he will be provided with 3 documents: 1 certificate for 1 year.

Sometimes it happens that an employee is simply registered at the enterprise. For example, a woman on maternity leave can apply for a 2-NDFL certificate. In this case, the accountant will be forced to refuse, since the time spent at home was paid for by the Social Insurance Fund, and it is not taxed.

The answer, most likely, will be a notification that due to the lack of income accrual and deductions, it is not possible to issue a certificate.

About insurance contributions transferred to pensions

A document reflecting information on insurance premiums is issued to the citizen in accordance with a written application. Typically, this paper is prepared simultaneously with a 2-NDFL certificate, a certificate of duration of performance of official duties, etc. By the way, regardless of the reason for the request, the employer is prohibited from refusing such requests, even if the former employee does not disclose the purpose of his request.

If a citizen has already quit, then the certificate must be drawn up within 3 working days, and if he has only written an application for termination of the employment relationship, then the document must be handed over on the last day of being at the workplace.

In order for the accountant to begin drawing up the paper, the citizen needs to write a request with the appropriate content addressed to the manager. The current regulatory framework does not provide for a specific form, so it is necessary to clarify the availability of an approximate sample in the organization.

A certificate including information about the insurance amount transferred to the Pension Fund is drawn up in accordance with the form used when transferring personalized information for each employee. A copy of this report is provided to the former subordinate within 5 days, and to the resigning employee on the last day of execution of the job description.

The transfer of insurance premiums is now monitored by the tax office. Institutions use a single form “Calculation of insurance premiums” for reporting. To provide an employee with a certificate of contributions to the Pension Fund, it is enough to fill out:

- Section 5, if the request specifies a period before 01/01/2017;

- Section 3, if information is required after 01/01/2017.

When printing, information about other employees is deleted, since they are personalized.

About the work period

Information about what position and for what period of time a citizen worked, of course, is contained in the main document about the length of service - the work book. The HR specialist is responsible for maintaining. Filling out is done manually, and by the time you apply for accrual of pension benefits, a lot of time has passed, so some entries can be difficult to read or they are questionable.

In this case, a specialist from the pension fund branch recommends contacting your previous place of work and obtaining a certificate confirming that you have performed your job duties.

The document is drawn up on the organization’s letterhead and contains information about the beginning and end of work in a certain specialty. Consequently, if a citizen first got a job as a general worker, and after receiving a diploma, became a specialist, then the personnel officer is obliged to indicate the sequence of occurrence of these events and confirm everything with signatures and seals.

This video contains information about what documents should be issued to an employee upon dismissal.