Our lawyer for inheritance disputes will help resolve the dispute with the heirs: professionally, on favorable terms and on time!!! There are really a lot of questions about how the inheritance is divided, who gets what, and most importantly, in what amount, so let’s figure it out.

USEFUL : watch the VIDEO with advice from an inheritance lawyer and ask your question in the comments of the video to receive a free answer from a lawyer

How is the inheritance divided if there is no will?

When a citizen dies, he becomes the testator of his property to his loved ones, who become heirs. During their lifetime, many people do not think about how their property will be managed in the future, so they do not make a will in case of death. The scope of inheritance is regulated by civil law and other laws. There is a distinction between inheritance by will and inheritance by law, in case there is no will. If there is no will, then inheritance is determined by law, that is, in order of priority (see below for how the inheritance is divided between lines).

To receive an inheritance if there is no will, you need to perform a number of actions:

- Submit an application at the place of opening of the inheritance with a notary

- Provide a package of documents to the notary along with the application (this is necessary in order to obtain a certificate of inheritance, as well as establish the fact of inheritance). Usually they are asked to provide a passport, documents confirming the grounds for inheritance and a payment order for payment of the state fee.

- Obtain a certificate of inheritance and divide the inheritance between all claimants (since there is no will, the property is divided in turn, but the heirs can also enter into an agreement among themselves on the division of property.

- Register the ownership of real estate (if you inherited real estate, you need to register ownership of it).

USEFUL : it turns out that everything goes according to the law, as usual, watch the VIDEO on registering an inheritance and ask a question in the comments of the video

Bequeath property that does not yet exist

Base. Civil Code of the Russian Federation Art. 1112, Art. 1120

How it works. The inheritance includes the property that belonged to the testator at the time of death. At the same time, a car may be indicated in a will five years ago, but if it was later sold, this is not an inheritance. You can bequeath anything, even without a list of property, but simply “everything movable and immovable.”

At the same time, even property that does not yet exist can be distributed in a will. For example, spouses can bequeath to each other property that they acquire in the future. When drawing up a will, they do not yet have a common apartment, but the will can indicate that the husband will bequeath all the property to his wife. And they haven’t saved any money yet, but they have already agreed that according to the will, all contributions will go to the spouse.

Base. Civil Code of the Russian Federation Ch. 63, art. 1150, art. 1151

How it works. If you have property that will remain after death, it is not necessary to think in advance about its distribution, draw up documents and pay a notary. You can do nothing at all. This does not mean that the inheritance will not go to anyone or will go to the state. Relatives will divide it according to the law: everything is provided for in this case in the civil code.

If there is no will, all property will go to the first priority heirs: parents, spouse and children. If there are no close relatives, it will be divided by grandmothers, brothers and sisters. As a last resort, there are aunts, uncles and children of nephews. And if there is no one at all, then the state will not refuse to take the property for itself as escheat.

Without a will, property will never be received by people without kinship or any connections. For example, the collection of dishes will not go to the kind neighbor who looked after the testator. The common-law wife with whom the man has lived for 20 years will not receive the money in the account. And the car will go to his own son, who has not called his father for ten years, but will not go to his stepdaughter, who cared for her stepfather as if she were her own.

If everything is clear with the heirs - these are the spouse and natural children - then they will receive their shares without a will.

Base. Civil Code of the Russian Federation Art. 131, art. 572, art. 1150, RF IC Art. 40

How it works. To divide property or transfer it to anyone you want, it is not necessary to write a will. You can manage your apartment, car and money during your lifetime. For example, an apartment can be transferred to the wife under a marriage contract - then children from the first marriage will not claim the property.

But the peculiarity of a will is that during life it does not impose any obligations at all: if they wanted, they wrote it, if they wanted, they canceled it or chose other heirs. And a marriage contract, gift or sale are transactions that affect rights during life. It will no longer be possible to take the apartment away from your spouse if she decides to file for divorce.

It makes sense to re-register property during your lifetime if there are heirs with the right to an obligatory share. Because it will have to be given away, even if there is a will.

For example, a father left his ex-wife and son from his first marriage a two-room apartment. In his new marriage, he had a child - the father would like the second apartment to go to his new wife and their common daughter. He can write a will on them, but if his son from his first marriage dies before he comes of age, this child will still receive a share in the apartment of his parent’s second family.

But if there is a prenuptial agreement with the new wife or the apartment is immediately transferred to the daughter, there will be no need to divide - the son will not receive a share.

Base. Fast. Government No. 351, Civil Code of the Russian Federation, Art. 1128

How it works. So that after death a loved one can gain access to money in the bank, you can do without a will with a notary. Instead, they draw up a testamentary disposition in the bank. Such a document, as it were, replaces a will and is equal to it in legal force.

A testamentary disposition can only be executed for money in the bank; this cannot be done for an apartment or car.

Here's what you need to know about testamentary disposition:

- It must be issued in the bank where the money is located.

- All you need is a passport.

- There is no need for a notary; everything is certified by the bank.

- If there are several accounts in one bank, you can make one order.

- The money can be distributed among different heirs in any shares or left to someone alone.

- You can set the conditions for issuing a deposit. For example, that children will receive money only at 18 years old or that the wife will be able to withdraw 20 thousand rubles a month.

- Access to money is not given immediately, but according to a certificate of inheritance. Before this, you can withdraw up to 100 thousand rubles to compensate for expenses.

- A testamentary disposition can be changed or revoked.

- A separate will can be made for other property.

Base. Civil Code of the Russian Federation Art. 1140.1

How it works. Under a will, rights and obligations arise only after death. That is, during the life of the testator, the heirs still do not receive anything and do not owe him anything. But starting from 2021, inheritance agreements can be concluded in Russia. Such a document can provide for the obligations of the heirs during the life of the testator.

These responsibilities may involve monetary payments. That is, the owner of the property enters into an agreement with the heir, both are aware of its terms: “I bequeath to you my apartment and business, and you pay me 50 thousand rubles a month until your death.”

But the trick is that the heir is obliged to pay the money immediately, and will receive the apartment after the death of its owner. Then it may turn out that the apartment no longer exists: according to the inheritance agreement, it is not encumbered with anything and nothing prevents it from being sold or donated.

The testator can also enter into several contracts and indicate the same apartment in all of them. And then receive money from all the heirs, although in fact, according to the law, the agreement that was concluded earlier is valid.

How is the inheritance divided if there is a will?

If upon the death of a citizen there is a will drawn up, then the division of the inheritance will be divided based on its contents. The testator can include any persons who are heirs, and can also exclude someone. The testator has the right to bequeath any property to one or more persons. If the will does not provide for shares or rights to certain property, then the property is divided between the persons in equal shares. If an indivisible thing is indicated in the will, then it is divided in equal shares of the value of this thing, and in the event of a dispute between the heirs, this issue is resolved by the court.

The will is certified by a notary, written down from the words of the testator under dictation by a notary. After the notary has drawn up the text of the will, the testator must familiarize himself with it and sign it (if the testator, due to certain circumstances, cannot sign the document, then another person signs for him, and a note is made accordingly). It is also possible to draw up a closed will, which is handed over to the notary in an envelope.

The execution of a will is carried out by the heirs specified in the will from the date of opening of the inheritance, except if an executor of the will is appointed. If an executor is appointed, he takes all measures for the correct execution of the will provided for by law, since he is entrusted with powers.

The only thing that needs to be provided is that the law always takes the side of close relatives of the deceased and, regardless of the contents in the will, at least half of the share is inherited by minors and disabled children, disabled spouses and parents and dependents. They have the right to the inherited share, since it is obligatory.

USEFUL : if you are not satisfied with the will, watch the VIDEO on how you can challenge the will and ask your question in the comments of the video

Don't tell anyone about your will

Base.

Civil Code of the Russian Federation Art. 1123, Art. 1126 How it works. If you decide to bequeath property, you don’t have to tell anyone about it, don’t discuss distribution with relatives and don’t warn them about your will. At least this can always be kept secret from the heirs. And if you want, even from a notary. What will go to whom will become known only after the death of the testator.

Firstly, there is the secrecy of the will. When a notary draws up the text of a document, he knows what is written there. If the will is certified by the captain of the ship or the chief physician of the hospital, he also knows what will go to whom. But you can’t talk about it. Notaries and officials are obliged to maintain the secrecy of a will, and if they violate it, they will be punished, including a fine.

Secondly, you can make sure that no one sees the text of the will at all. To keep your will secret even from a notary, they draw up a closed will. The text is written on a piece of paper, signed with your own hand, placed in an envelope and sealed. And then two witnesses are called and the closed envelope is taken to the notary.

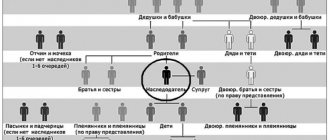

How is the inheritance divided between the queues?

When there is no will, the division of property between the heirs is divided in order of priority (according to the law), that is, as the law suggests. The heirs appear in different queues based on their status. The division of the inheritance occurs in the following order:

- 1st stage . Children, spouse and parents.

- 2nd stage . Full and half-siblings, paternal and maternal grandparents.

- 3rd stage . Full and half-siblings of parents (aunts and uncles).

- You need to know that if there are no heirs of the first priority, then the right of inheritance automatically passes to the second, if there is no second, then to the third, etc. If there are no heirs of the main three queues, then the inheritance will be divided between the following queues:

- 4th stage . Great-grandparents.

- 5th turn . Children of nephews and nieces and siblings of grandparents.

- 6th turn . Children of cousins' grandchildren and granddaughters.

- 7th turn . Stepfather, stepmother, stepdaughters and stepsons.

When inheriting by law, you need to know that adopted children and adoptive parents, as well as persons who were dependents, have the right to inherit. Adopted children and adoptive parents are treated as blood relatives. Dependents (disabled persons, such as minors) also have the right to inherit, whether they lived with the testator or lived separately. Otherwise, dependents receive inheritance in eighth order.

Inheritance by right of representation is also distinguished in this group. This is a situation when a person belonging to one of the queues dies even before the death of the testator, and the inheritance passes to the descendants of this person, for example, to grandchildren, children, full and half brothers and sisters.

Rules of inheritance by law

When it comes to inheritance, relatives of the testator have a lot of questions. Of course, first of all they relate specifically to the hereditary mass: what will be transferred and to whom.

Inheritance by law means that the deceased did not leave a will, that is, did not have time or did not want to formalize his will.

So how is an inheritance distributed without a will? Due to the absence of such a document, the division of the inheritance will occur on a general basis according to inheritance lines. The property of the deceased will be distributed in equal shares among all heirs of the first priority, if any.

In the absence of such, heirs of the second stage will be called to inherit and further by analogy.

You can study in more detail the issue of dividing the inheritance in the absence of a will in the article “Inheritance by law.”

How is the inheritance divided between spouses?

In accordance with the law, the property of spouses can be personal (for example, before marriage) and common (acquired joint property). An inheritance is something that the parties accept as a gift, that is, it belongs to them as personal property (for example, a wife inherited an apartment, personal property) and it is not subject to division. It’s another matter when both spouses are given an apartment as a gift, then it will be considered common joint property.

Situations may arise when a husband and wife become co-heirs of property, for example, they are both indicated in the will, or by law they received an apartment from their deceased son. They both have the right to inherit it.

Upon the death of a spouse (testator), the other spouse, by virtue of a will or law, has the right of inheritance to property acquired during the marriage, which is their common property. In some cases, a spouse may be able to claim the decedent's personal belongings if he provides evidence that during the marriage he made significant investments in the spouse's personal property (for example, repairs, reconstruction).

USEFUL : if you have a dispute regarding the division of marital property, then contacting our lawyer will help resolve the issue and answer your question

Promise an inheritance and then change your mind

Base. Civil Code of the Russian Federation Art. 1130

How it works. You can change your will regarding the distribution of inheritance as many times as you like. If a will is written, it can be changed or even annulled. You can also write a new will. As a result, it may turn out that the same person wrote, for example, five different wills over the course of several years. But if we are talking about the same property, the last one - which is written later - always prevails.

For example, a father bequeathed an apartment to his daughters from his first marriage, and then married a second time. And he decided to bequeath the same apartment to his new wife. Because she looked after him, and her daughters didn’t even call. The father can rewrite the will, but not warn his daughters about it. There is no need to inform anyone except the notary about the changes, and no one’s consent is required either.

The heirs can be sure that the property will go to them because it was agreed so. And then it turns out that the will has been changed. And even if there is a will, the owner of the property can dispose of it as he pleases during his lifetime. Let's say a grandfather wrote a will for his grandson, and then changed his mind and gave the apartment to a social worker. The grandfather is not obliged to tell his grandson about this, and it will not be possible to cancel the gift transaction only on the grounds that “grandfather promised.”

We invite you to read: Valuation of a car for a notary and registration of inheritance

How is inheritance divided between children from different marriages?

In Russia there are more and more families where children from different marriages are growing up. Minor children have the right to claim an inheritance even from someone other than their own, if they live with him. By law, children are first in line to accept the inheritance from the testator, regardless of whether there is a will or not.

If the child is not his own (living, for example, with a stepfather) he will be recognized as a dependent and will also have the right to inherit, since he is a minor and disabled. Based on the law, a child from another marriage who is recognized as a dependent will inherit along with other heirs according to the law on an equal basis.

Make a joint will with your spouse

Base. Civil Code of the Russian Federation Art. 1175

How it works. Along with property, liabilities, such as loan debts, are also inherited. To inherit an apartment, it is not necessary to pay off the mortgage in advance. And in order to bequeath a business, you do not need to try your best to pay off all the loans and borrowings that were taken out for its development before your death. The apartment and business will go to the heirs anyway - along with the debts.

This does not mean that the heirs will go broke. They will be liable for obligations only within the limits of the inheritance. If the business is unprofitable and there is not enough money to repay the loans, their personal apartments and cars will not be taken away from the heirs. You can give away an unprofitable business or refuse an inheritance altogether so as not to pay off the debt.

It’s the same with a mortgage: it will be paid by the heir, who will become the owner.

If there is no inheritance other than debts, the relatives will not lose anything. They simply will not enter into an inheritance and will not be liable with personal property. A mother should not repay microloans for her deceased son, who had nothing. And a wife is not obliged to repay a loan for her deceased husband’s personal car if the car itself was sold long ago and there is no other inheritance.

Base. Civil Code of the Russian Federation Art. 1118

How it works. Previously, a will could only be drawn up by each person for himself, and there were no common wills. From June 1, 2021, joint wills for spouses appeared. A husband and wife can write one joint will. With the help of such a document, you can decide together who will receive the common property if one of the spouses dies or they die together.

A joint will solves the problem of marital shares, unnecessary heirs, and guarantees that the will of each spouse will be carried out accurately. For example, that the new wife will not leave children from her first marriage without an inheritance, and the husband will not arrange a surprise in the form of a will for the object of his first love.

But there are a lot of incomprehensible and strange things with marital wills. For example, a husband and wife can make a joint will, and then the wife will go and write her own. The husband will not know what exactly she wrote there. Or they will agree on something and then get divorced - the general will will no longer be valid. There are no joint wills in a civil marriage.

In simple and straightforward cases, a joint will can be a good tool for distributing property. But if everything is complicated, there are too many heirs on both sides, and there is no complete trust, it is better to draw up a marriage contract and a personal will.

How is the inheritance divided between the wife and children?

Upon the death of a spouse, according to the law, the inheritance is primarily inherited by the wife and children, even regardless of whether a will has been drawn up or not, since regardless of the contents of the will, they will still have the right to at least half the share (if the spouse is disabled) of the inheritance property equal to its legal (obligatory) share.

If the division of the inheritance occurs according to a will, then it usually indicates specific things that the spouse has the right to bequeath to each person. If the division of the inheritance occurs according to the law, then everything is divided in equal shares.

The wife also always claims the common joint property acquired during the marriage, and in some cases also the personal property of the spouse.

Appoint an executor of the will

Base. Civil Code of the Russian Federation Art. 1134, art. 1135, Art. 1136

How it works. The will can specify who will oversee its implementation. This is useful in complex cases: when a business needs to be divided between heirs, there is a testamentary assignment or a lot of property.

The executor of the will must agree in advance to accept such responsibilities. And then he can refuse them, and then the will will be executed by the heirs.

Here are the powers that can be delegated to the performer:

- Protection and trust management of property. For example, the inheritance includes a hotel and a restaurant. Until the heirs accept the inheritance and agree on how to divide it, the establishments must operate.

- Search for property and its return to the estate. For example, the will specifies several cars, but only one is in the garage. The rest are rented from taxi drivers, and they are in no hurry to return the vehicle. The executor of the will will look for them and take the cars to pass on to the heirs.

- Transfer of property to heirs. When there is a lot of property, the executor makes sure that everyone gets what is due to them. For example, the will specifies a collection of paintings and jewelry. If the heirs run in and start dividing everything themselves, there will be confusion or someone will not receive anything at all. The executor will control who gets what so that the will of the testator is respected.

- Control over testamentary refusal and assignment. What if the son gets an apartment, but won’t let his father’s wife in there - or kicks her out when he wants to sell the property. The executor will make sure that this does not happen - the testamentary refusal will have to be executed.

We suggest you read: Child support from the father: how much child support should the father pay for the child and how to apply for collection if he does not work

The executor of the will will receive money for all this and will reimburse his expenses - from the inheritance, of course.

How is the inheritance divided between children and grandchildren?

In the event of the death of grandparents, the inheritance first goes to their children and spouse. Based on the law, inheritance is possible by right of representation. The right of grant is a situation where a party dies in line before the death of the testator, then the inheritance is received by persons who have the right to the right of representation.

For example, if in the first place, the spouse died before the death of the testator, then his share can pass to the grandchildren by law (if they are not deprived of the inheritance).

Disabled dependents who have lived with the testator for at least a year can also claim an inheritance, for example, a minor grandson was dependent on his grandmother and lived with her, then he also has the right to inherit in the first place, regardless of whether his parents are alive or not. Disabled dependents, along with disabled children and spouses, have the right to inherit at least half of the share that would be due to each of them.

Our lawyer for inheritance disputes will help resolve the dispute with the heirs: professionally, on favorable terms and on time!!!

Provide for a testamentary refusal or assignment

Base. Civil Code of the Russian Federation Art. 1137, Art. 1139

How it works. Under a will, you can not only transfer property, but also force the heirs to do something. To do this, use two methods:

- A testamentary refusal is when an heir receives property, but in return accepts some property obligations. For example, a son gets an apartment, but he must allocate a room to his father’s second wife - she will use the apartment and live there until her death. Or the wife gets all the money on deposit, but she must buy food and medicine for her mother-in-law.

- A bequest is an obligation on the heir to do something for a socially beneficial purpose. For example, a grandmother bequeaths an apartment to her grandson with the condition that the heir will help a cat shelter. Or an entrepreneur bequeaths an ice cream factory to his children, but the heirs are obliged to conduct monthly free excursions for schoolchildren there and deliver ice cream to orphanages by June 1.

Transfer of inheritance rights between queues of heirs

It is noteworthy that the heirs of each subsequent line can inherit property only if the heirs of the previous ones are absent or have refused the inheritance. This is precisely the goal pursued by the legislator when determining the stages of inheritance. Let us consider in more detail the situations in which the right of inheritance passes from one stage to another.

Refusal of inheritance

It is no secret that when resolving issues related to accepting an inheritance, many disputes often arise between relatives, as a result of which deprived heirs may demand an equitable division of the inheritance.

Those who for some reason do not want to accept the inheritance have the right to refuse it.

In a situation where there are only two heirs and one of them refuses the inheritance in favor of the other, one heir will take over the inheritance, and he will inherit all the property. The application for refusal of inheritance must directly indicate the name of the applicant in whose favor the refusal was made.

Although sometimes the statement may not contain such an indication. However, in any case, this document must be notarized. In order to draw it up, you need to contact the notary who opened the inheritance case after the death of the owner.

If the will does not specify the inheritance of all the property of the testator, then in terms of inheritance by law there is no need to contact another notary office. More detailed information on the topic of refusal of inheritance can be found in the article “Refusal of inheritance”.

The concept of inheritance by right of representation

Inheritance by right of representation is a special legal institution of inheritance law. Theoretically, it sounds like this: heirs by right of representation can accept an inheritance if their direct relatives, who were supposed to accept the inheritance after the deceased, died before his death.

It is more convenient to explain this algorithm with an example. An elderly woman died. Her son, the only heir, died six months before her death. He is survived by his wife. After death, the apartment of the deceased should have become the property of her son, but he is no longer alive. And the heir of the son in the first place would be his wife. In this case, the testator's daughter-in-law is called upon to inherit by right of representation.

If there were other heirs of the first priority, the estate would be divided between them and the heir by right of representation in equal shares.

At the same time, if there are only heirs of the second and subsequent orders, then, provided there is no refusal of the inheritance on the part of the daughter-in-law, they are not called upon to inherit.

The features of this legal institution can be studied in more detail in the article “Inheritance by right of representation.”

The concept of hereditary transmission

In civil law, hereditary transmission means a situation in which the heir who was supposed to receive the inheritance died after the opening of the inheritance, but did not have time to accept this inheritance. Then the inheritance after him is accepted by his heirs.

The person who was supposed to accept the inheritance is called the transmitter, and the persons who ultimately inherit the property are called transmitters.

For example, the inheritance is divided after the death of the mother. Let's say she has an elderly daughter who has two sons. The daughter is seriously ill, the news of her mother’s death has weakened her health even more. A week after the mother’s death, she also dies, not having time to accept the inheritance. In this case, the daughter will be the transmitter, and her children, who instead of her will assume the rights to inherit the grandmother’s property, will be the transmitters.

This topic is quite complex; to understand it, it is worth reading the article “What is hereditary transmission.”

The order of inheritance by will

The testator, anticipating his death, may leave a written statement of will regarding the property belonging to him. Moreover, a will is simply necessary if a citizen wants his property to be:

- not divided equally;

- not transferred to first-degree heirs;

- inherited by non-relatives.

The situations in which it is necessary to make a will may be different. Thus, a bad relationship with children or a spouse leads to the fact that the testator can draw up a document for any other person. For example, the owner can assign property to a stranger who cared for him in the last months of his life, as a thank you or as payment class=”aligncenter” width=”663″ height=”424″[/img]

A will will also be needed if the testator has no relatives, but there is a person to whom he would like to transfer his property. In this case, to prevent the inherited property from becoming escheated, it is better to draw up a will.

To draw up a will, you should contact a notary.

The will is written by the will-maker in his own hand, except in cases where this is impossible to do due to physical disabilities or illiteracy. It is signed by the testator and certified by a notary. After this, the will will be kept by the will-maker until his death.

It is also possible to draw up a closed will - even a notary will not know its contents. It is drawn up in the presence of two witnesses who sign the envelope where this document will be stored.

More information on this topic can be found in the article “Inheritance by will”.