Buying a house or cottage for maternity capital - terms of the transaction and benefits

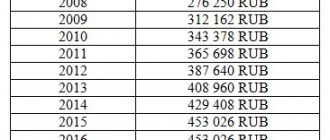

Until recently, maternity capital (MC) was considered a way of state support for families with two or more children (since 2021 it is paid for the first child). The program has been running since 2007: during this time, the amount of capital has been indexed several times - from 250,000, the amount of state subsidies increased to 466 thousand 617 rubles. More than 9 million families received assistance, and the President extended the program for the third time - this time until 2026. From January 1, 2020, maternity capital can be received at the birth of the first child, and for the second they will pay an additional 150,000 rubles or (if they have not received a certificate for the first) they will pay 616,000 rubles.

The MK certificate is issued once. The funds provided by him can be spent after the child reaches the age of 3 years. In some cases, you are allowed to use the money before reaching this age.

All financial transactions related to MK are controlled and carried out by the Russian Pension Fund. This organization makes decisions on issuing money for the purposes specified by parents and deals with the legal purity of transactions with maternal capital.

Where can you spend it:

- for the purchase of an apartment/house or its construction, including a mortgage;

- children's education;

- mother's pension;

- purchasing necessities for disabled children;

- construction or reconstruction of an individual housing construction project, if the dacha is registered as a residential building (a bill is being considered in the State Duma).

There are also constantly proposals to allow spending maternity capital on the purchase of a car, but so far such amendments have not been considered.

According to the Pension Fund of Russia, the most pressing area for using family capital is improving housing conditions. The money can be spent on buying an apartment or house, repaying a loan or mortgage, building and reconstructing housing.

Read all the details about the state financing program for families with children in the article “All about maternity capital.”

The topic of this publication is buying a house using maternal capital. Amounts of 466 thousand rubles. It is unlikely to be enough to purchase a full-fledged home, so along with state money, parents will have to use their own savings.

Maternity capital can become a kind of base or foundation for the acquisition of real estate.

Using government funds you can pay for:

- down payment when purchasing an apartment or house on credit;

- mortgage debt and interest;

- one-time purchase of housing (with the addition of your own money if necessary).

Maternity capital will help if banks do not issue housing loans to families due to lack of money for a down payment or due to insufficient income. A certificate for maternal capital becomes a kind of lever with which you can get the business of buying a house off the ground.

It should be noted that not all credit organizations agree to work with maternity capital in conditions of economic instability. Only a few dozen Russian banks agree to pay a mortgage or issue a housing loan against a certificate.

The Pension Fund does not always accommodate the owners of maternal capital, especially when the money is invested not in the direct purchase of new apartments, but in the construction or reconstruction of housing.

We advise parents who have difficulties using government subsidies to consult with specialists in the field of civil law on all issues.

Buying a private house with maternal money is not the easiest undertaking, however, it can be successfully accomplished if you approach the matter competently and thoroughly.

Buying a dacha for mat capital

In 2021, the concept of “dacha farming” was abolished. Now the law separates gardening and horticultural non-profit partnerships. In the CIS it is allowed to build residential buildings, as well as transfer garden buildings to the residential category. ONT can only have outbuildings.

Until 2021, it was impossible to buy a dacha with family capital. The law allowed the construction of a house only on land intended for individual housing construction - individual housing construction. But now, according to the law, it is possible to build housing on garden plots.

The bill has already been adopted in the Duma and approved by the Federation Council. Wherever the wording “land plot for individual housing construction” appears, the phrase “or for gardening” has been added. The registration procedure has not changed. You'll still have to wait until your child reaches age 3 (unless you're using it for a down payment or paying off mortgage debt).

The house/dacha must be located on the territory of Russia and meet the requirements:

- detached building;

— maximum 3 floors, height up to 20 m;

— there must be signs of permanent residential premises: including communications, roof and supporting structures.

The package of documents for purchasing a summer house is the same as for a regular residential building. If you engage a construction organization or want to compensate for construction costs, you need a separate package of documents.

The procedure for preparing documents for a garden house that meets all the requirements, and the transaction process itself, are the same as when buying a house on a plot for individual housing construction. Housing must be registered as the common property of the spouses and all children, determining its share for each.

What is provided in the laws

To obtain maternity capital for the purchase of housing, it is worth understanding the intricacies of the regulations governing this area. As of 01/01/21, the central place is occupied by Federal Law No. 256, in which:

- the basic concepts of this issue are revealed;

- indicates who is entitled to assistance from the state;

- it describes what a family capital certificate is and how it is issued;

- the size of the capital is indicated, and so on.

The rules for applying for assistance are contained in. They describe in detail what the state certificate form looks like and what information is included in it. In addition, the Decree specifies where to apply to receive government assistance.

Requirements for the property - is it possible to buy a house in a rural area?

According to the law, not every house can be considered as a full-fledged piece of real estate. To satisfy the conditions of the program for purchasing housing under mat capital, the house must be more than just a building with a roof and walls. The home should provide maximum comfort for the owners - first of all, for the children.

Basic requirements for a house purchased with family money:

- location on the territory of the Russian Federation;

- presence of a heating system;

- availability of electricity, water supply and sewerage;

- the percentage of wear is not higher than 50%.

Purchasing with family capital a house in disrepair or requiring major repairs is prohibited by law.

Another necessary condition is that the land plot on which the house is located must also be purchased (or leased).

Important nuance

You cannot purchase land with maternal capital funds!

As for buying a house in a village (rural area), there are no restrictions on the geographical location of the property being purchased. If you can register in a locality, and it contains all the benefits of civilization, then it is quite possible to buy it for MK.

Each option for purchasing housing with state support is discussed individually with employees of the Pension Fund. They are the ones who must provide parents with comprehensive information on all issues regarding the disposal of the certificate.

If it is not possible to reach an agreement with representatives of the Fund, you can attract certified specialists in the field of social benefits and, with their help, develop an individual strategy for purchasing a home.

Terms and procedure for transfer of ownership rights

Registration of the transaction in Rosreestr in accordance with the legislation of the Russian Federation is carried out within ten days, after which a corresponding entry is made in the Unified State Register of Real Estate.

Documents required for registration with Rosreestr

In order to register a transaction in Rosreestr you will need:

- Application for registration of transfer of ownership.

- Contract of sale.

- Passports of the parties to the transaction.

- The act of acceptance and transfer of real estate.

- Seller's title documents.

- Receipt for payment of state duty.

- Consent of the seller's spouse, certified by a notary.

- Receipts.

- Mortgage agreement.

- Maternal certificate.

Purchasing a house with a plot of land using the funds of a maternal certificate is a complex procedure, therefore, before concluding a purchase and sale agreement, you should carefully check the property, as well as study the requirements for such transactions established at the legislative level.

How to complete a transaction for the purchase and sale of housing using maternity capital

Since it is not possible to receive maternity capital funds in cash, certificate holders have access only to bank transactions - non-cash transfers of funds to the seller’s account.

When choosing a property to purchase, you should immediately discuss the specifics of the transaction with the owners. Not every home owner will agree to transactions with maternity capital.

Fact

For some, such transactions seem troublesome and dubious, since their knowledge of maternal capital is limited to general information. People who have never dealt with certificates believe that they will have difficulties with cashing out funds in the future and generally prefer “real” money.

You will either have to find a financially competent seller, or convince him that they will not have any difficulties with the money transferred by the Pension Fund. The only thing is that you will have to wait for this amount to be credited.

Step 1. Looking for a house

Most transactions for buying/selling a house with the help of maternity capital are concluded with the previous owners of the property. That is, buyers need to pay the main attention to the secondary market.

There is a simple explanation for this - new houses are usually built privately and by order of their future owners. Families looking to buy a brand new home or buy one with a mortgage are unlikely to find a suitable property.

Banks give loans mainly for apartments. True, some financial organizations offer their clients exclusive options and, as an exception, issue loans for cottages.

Typically, such proposals are the result of cooperation between banking organizations and construction companies that are building new suburban villages with modern houses made of timber, frame or aerated concrete.

Objects are handed over to construction companies on a turnkey basis and are built to the stage of interior finishing. At the same time, banks issue loans for such transactions with favorable commissions.

The only negative is that the total cost of such a house is slightly more than on the market, but the family receives high-quality and durable housing for life.

It is quite possible that a young family will be able to find such an option, but most often certificate holders have to choose houses on the secondary market. The choice of suitable real estate, especially in large cities, is quite rich.

If you like a house in a garden plot, then this option is also suitable, since today you can register on the territory of the garden plot. Most likely, the Pension Fund will give you permission to use capital.

But do not forget that the house should not be an unauthorized construction without documents and the status of a residential building. It must be a full-fledged economic facility and meet all the requirements discussed in the previous section.

Step 2. We register ownership of the land plot

It is impossible to buy a house without acquiring ownership of the land on which it stands. As a last resort, you can lease this territory for 100 years, and it will be considered practically yours. Land can also be inherited from relatives and parents.

This is an important point in the procedure and should not be forgotten. Please note that it will not be possible to purchase land using maternal capital funds. So you will have to bear this expense entirely on yourself.

Step 3. Collect documents and apply to the Pension Fund for permission

The decision to transfer funds to the account of the real estate seller is made by employees of the Pension Fund. They are the ones you need to turn to if you decide to take advantage of government support to improve your housing.

If the decision is positive, the Pension Fund covers the costs of purchasing the house (or part of them) and transfers the funds secured by the certificate to the seller of the home.

What documents will be required:

- An application from the certificate holder, written in the prescribed form (a sample can be obtained from the Pension Fund of Russia).

- Certificate of pension insurance.

- Certificate for maternal capital.

- Copies of passport and birth certificates.

- The obligation to register the ownership of the house for all family members.

- A certificate of the amount of temporarily outstanding debt to the seller of the house (if required).

- Marriage certificate (or divorce, if any).

- Details of the bank account to which funds are transferred.

The package of documents varies depending on the individual nuances of a particular transaction.

Please note that the decision to transfer funds (or refusal of such a procedure) is not made immediately. The buyer and seller will usually have to wait about 2 weeks. If all documents are in order and the property meets the requirements, the Pension Fund gives the go-ahead, and you move on to the next step.

Attention! If you are planning to take out a mortgage, you should also contact the bank before completing the transaction. In your mortgage application, you can indicate that you will pay off part of the debt with maternity capital. In this case, the bank will pay part of the money to the seller, and the Pension Fund will transfer the MK funds to the account of the credit institution - but only if the bank approves your application. Please note that not all banks work with maternity capital.

Step 4. Finalize the deal

The execution of a purchase/sale agreement is carried out in accordance with established rules. An important nuance is that all family members, including children, become owners of the house in equal shares. This is done in case of parental divorce, deprivation of parental and other life circumstances.

When drawing up a contract, consider the following nuances:

a) There are contracts with installment payments. It may indicate that the property becomes the property after payment of the entire amount. In this case, you need to submit an application to the Pension Fund in advance.

b) If there is no such clause in the contract, register the transfer of ownership in Rosreestr, and you can contact the Pension Fund after that.

It usually takes up to 2 months for the funds to be transferred to the seller's account.

Step 5. Taking ownership of the house

You now own the house. If you purchased it on credit, pay the monthly installments carefully, otherwise you will be charged fines and penalties. If the payment has been made in full, no further action is required: live with your whole family in your new home and enjoy comfort, space and privacy.

For clarity, I will present the above steps in the form of a comparative table

| № | Necessary steps | What to pay attention to | How long can it take |

| 1 | Searching for a home | It is worth looking for real estate to buy on the secondary market | Time is not limited |

| 2 | Registration of land ownership | You can’t buy land with maternity capital. | 1-2 weeks |

| 3 | Contacting the Pension Fund | All documents must comply with established standards | 1-2 weeks |

| 4 | Registration of the contract | Real estate must be divided into shares among all family members | a few days |

| 5 | Possession | In future transactions with real estate, ensure that transactions are completed correctly. | — |

Main stages of purchasing a home

Before purchasing a house using maternity capital, the interested person must select a suitable residential property. According to established rules, a potential buyer is required to notify the property owner that part of the funds will be allocated from the state budget. It must be recognized that not every seller is ready to participate in such a transaction.

After this, the buyer must take the following steps:

- Draw up a purchase and sale agreement (SPA)

- Submit documents to the Pension Fund authorities.

- Wait for approval or refusal to issue funds under the certificate.

If the documents for registration of maternity capital do not contain errors and are presented in full, the funds will be issued within 10 days, but not in cash, but in the form of a transfer to the account of the real estate seller: an individual or an organization.

Buying a house from parents (relatives) – features and nuances

The law does not allow commercial transactions between family members. If we are talking about attracting public funds, then certain restrictions are imposed on the actions of citizens who are blood relatives. The introduction of such measures is due to frequent cases of fraud with government subsidies.

Transactions between close relatives may have a mercantile purpose - cashing out funds, rather than improving housing conditions. Therefore, it is difficult to buy an apartment or a house from your grandmother (or grandfather) - most likely, the PF will not give consent. True, cousins are quite entitled to carry out such operations.

Pitfalls in buying a home through maternity capital - how to avoid being scammed

Family capital is solid money, which, although not cash, still attracts scammers and those who like to profit at the expense of others. To avoid fraud when dealing with maternal capital, we advise you to conduct all transactions involving the purchase of real estate with the participation of an experienced lawyer or realtor.

We have already written about who a realtor is and what he does in a separate article.

Professional services cost money, but it is better than being left without any funds as a result of a fraudulent transaction. And there are plenty of ways to deprive owners of their legal funds.

Example

Until recently, transactions with family capital were freely carried out by microfinance organizations and companies with dubious status. Some companies managed to illegally cash out hundreds of millions of rubles of government money through real estate transactions and other scams.

For this reason, back in 2015, any microfinance organizations were excluded from operations with maternal capital by law.

However, some “firms” (and not actually criminal groups) simply changed their status and continued their activities. The simplest options for deceiving certificate holders are the withdrawal of advance payments for imaginary assistance in transactions with maternity capital or the sale of real estate that does not meet the requirements of transactions with public funds.

Sometimes the certificate holders themselves initiate criminal transactions and scams for the purpose of enrichment. For example, they conclude fictitious sales and purchase agreements in order to transfer non-cash funds into real money.

Important information for those purchasing housing

Be sure to check whether its previous owners used the “mother’s” money, and if so, find out whether the transaction was completed according to all the rules.

There is a wide scope for fraud in the case of the purchase of housing under construction. MK can be used to pay for shared construction, and then resell the rights to participate. It is possible to allocate shares only after registration of ownership, so the scheme is often used by unscrupulous certificate holders to cash out funds.

How to start an apartment building

The house can be used not only to solve your own housing problem. In the real estate market, there is a strategy for making money on apartment buildings - they are divided into small studios and rented out for long-term or short-term rent. This allows you to get the maximum from each square meter of space, because when buying a house, one “square” of the house costs much less than in the case of buying an apartment, and the rental price (all other things being equal) is no different.

The house has other advantages: the presence of a personal plot, no problems with neighbors, etc. In addition, you can get a significant discount on a house: it is a large, expensive property, less liquid than an apartment. If you don’t have your own home, then you can use one or two studios for yourself, and rent out the rest. You can learn more about this strategy at the “Turnkey Apartment House” intensive course.

Mortgage against family capital

To get a loan to purchase a home, a package of prepared documents must be submitted to the bank. Each financial institution may have its own requirements for filing an application, but, as a rule, the following documents are requested to purchase a house using maternity capital:

- Statement (this is what it looks like, for example).

- Certificate for maternal capital.

- Passports of the borrower, guarantors, parties to the agreement (with a registration mark).

- Confirmation of the financial condition and employment of the Borrower/Co-borrower/Guarantor.

The loan application is reviewed within 30 days. After its approval, the bank may require:

- (submission allowed within 90 days from date of approval).

- A certificate from the Pension Fund about the balance of maternity capital funds (can be provided within the same period).

- , if a loan is requested to pay off the remaining debt or interest.

- Confirmation of the availability of other collateral for the loan.