published: 04/19/2016

Often the process of entering into an inheritance is associated with hassle and headaches. And it's not just about financial costs. Many different conditions sometimes significantly impede the acquisition of the required property. One of these conditions is the deadline for entering into inheritance. Often, for one reason or another, heirs do not receive the inheritance on time, which is why they risk being left with nothing. And in some cases, you still manage to defend your right to own property. On what circumstances does the fate of the inheritance depend?

Confirm your relationship or show a will

First, it is important to know that you can inherit any property if your name is included in the will of the deceased. If there is no will, then you can claim the inheritance on the basis of relationship with the testator.

To receive an inheritance under a will, you must visit any notary who works at the place of residence of the deceased. You need to bring the following documents with you: your passport, a will with a note from the notary who executed it that it was not changed or cancelled, as well as an archival certificate for F-9 from the passport office about the last place of registration of the testator. Based on these documents, the notary will open an inheritance case and tell you what other documents are needed to formalize the inheritance.

You may be interested in: Lawyer services for inheritance disputes.

To whom does the property of the deceased go if the heirs do not appear?

Inheritance occurs according to two algorithms:

- By inheritance . If the deceased during his lifetime made a decision about who the heir is and formalized his expression of will by a notary, the property is inherited by the persons indicated in the document. You can challenge it, but there must be good reasons for this. A lawsuit will have to be initiated.

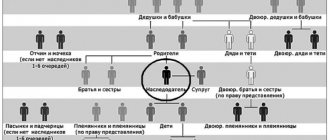

- In order of priority (by law) . What happens to property if there is no will means the transfer of assets to people who are closely related. There are 7 queues. The sequence is from the first to the seventh. But the right to property also arises for people who were dependent and not relatives.

If no one has declared a claim to join, the property is inherited by the state. But the problem is often that some were physically unable to react in a timely manner. And the law allows you to assume the rights of the owner even six months after the death of the testator.

What to do if the testator did not leave a will?

If the testator did not leave a will, then the inheritance is transferred to the closest relatives - the heirs of the first priority, specified in Article 1141 of the Civil Code of the Russian Federation. If there are no such people or they have refused the inheritance, then it is the turn of the second-order heirs and so on. An inheritance under the law is formalized in exactly the same way as an inheritance under a will, only instead of a will, the notary must provide documents confirming the relationship with the deceased.

To do this, it is necessary to submit a number of documents, from which it will become clear how distant relatives are connected through other family members. Here are the simplest examples. You can prove your relationship with your father and mother using your birth certificate, with your grandparents using the birth certificate of one of the parents who is their child, and in some cases a marriage certificate to explain the difference in surname.

And to prove your relationship with an uncle or aunt, you must provide three birth certificates - yours, your uncle's or aunt's, as well as a parent who is related to the deceased, so that it can be seen that your parent and the testator are children of the same parents. For each situation, the notary will tell you what documents can confirm the relationship.

You may be interested in: Pre-trial dispute resolution.

What to do if the 6 month period has already passed

How to enter into inheritance after 6 months? This right can be obtained by declaring one’s own desire to an authorized person. Despite the need to obtain this right within six months following the death of the testator, the law also allows for the late exercise of inheritance powers.

What to do if more than six months have passed, and the person was not able to come, did not have time to enter into an inheritance? First of all, consider whether the reasons that detained the subject are valid. Was he unaware of the death of a relative, was he ill, was on military service, or was busy with other events that required his constant presence?

Obtaining the powers of an heir, in the presence of such circumstances, is possible. Legislative acts allow you to obtain property rights, but the path will be a little longer and more difficult. You will have to contact the judicial authorities with a corresponding statement, negotiate with other parties to the case, persuading them to relinquish their acquired powers, renounce the values and again begin the process of dividing them.

Recommended reading: Testator - who is he?

Lawyers note two types of restoration of lost succession powers:

- judicial;

- extrajudicial.

Entry into inheritance rights through court

Judicial proceedings will help the successor in the event that he was unable to get to the notary according to the deadline established by law. It can be justified by valid reasons supported by official documents. A person submits an application for consideration of a claim for restoration of the right to submit documents, with the obligatory attachment of papers confirming the reasons for his absence.

The application includes the following data:

- the name of the judicial authority that will accept the case for consideration;

- Full name of the legal successor, address of residence and registration, telephone contacts;

- Full name of the defendants who have already received inheritance powers;

- Full name of the testator (dates of birth and death, place of residence, registration);

- information about the opening of succession, the property contained in it;

- the reasons for the violation that contributed to missing the deadline prescribed by law for obtaining inheritance rights, their confirmation by official documents;

- request for restoration of deadlines;

- applications (if available);

- date, signature.

Having prepared the claim, the subject attaches to it documentation confirming the veracity of all information specified in the text (personalities of the subjects, inheritance, evidence of missed deadlines). The employee who accepted the application puts a mark on it and sets a date for consideration by the court.

As the proceedings progress, the heir proves the impossibility of obtaining his own successor rights in a timely manner.

Good grounds (according to the judge):

- location outside the Russian Federation;

- stay under treatment for an illness in an appropriate institution;

- lack of information about the death of a relative;

- other facts.

In the course of actions to assert the right to participate in legal succession, the court may accept some of the valid reasons presented by the subject. The countdown of the deadlines required to comply with succession will change and will begin from the date when the person returned, was discharged from the hospital and received information about the death of the testator.

Important! When, at the end of the judicial investigation, the authorized person receives information about the availability of the necessary information from the heir and the opportunity to appear before the notary, the claim will not be satisfied. In this case, missing the date will be evidence of a voluntary refusal to receive property.

The court's help is sought when there is actual receipt of rights to use property, but proper registration of powers through a notary has not been carried out. For example, the heir and testator had the same place of registration, used common property, and jointly managed it. After the death of the testator, nothing changed, the use of the valuables continued, their repairs or utilities were paid for.

Such a procedure, when within six months from the date of death of the testator, the property, even a small part of it, was actually accepted by the new subject, the inheritance is usually considered accepted. To obtain documents confirming this fact, an application to the court is required. The claim will be called “about the actual acceptance of the inheritance.”

A statement of claim of this type will contain the following information:

- Full name of the successor and testator (grounds of inheritance - law or document, existence of priority, family relations);

- property to be transferred;

- actual entry into rights.

We recommend reading: Statement of claim for restoration of the period for accepting an inheritance

The following documents are attached to the application:

- applicant's passport;

- certificate confirming the death of the testator;

- extract from the house register;

- passports – technical and cadastral;

- documents confirming the fact of ownership and management (utility bills, receipts for the purchase of building materials).

Entry into rights without trial

You can receive an inheritance when all the dates are missed in another way. If there are other legal successors who have received property by law, without violating the deadlines, it is required to obtain their consent to include a new heir for the next division of values.

The procedure for conciliation is as follows:

- the subject writes requests to other persons who are legal successors of a relative, indicating the desire to redistribute the inherited property of the deceased, or to receive financial compensation (when the values have been realized);

- it is allowed to create one conciliation sheet for all successors or several for each;

- the document is transmitted to the subjects, personally, through a representative, by mail;

- the finished agreement is certified by notaries in the presence of all people involved in the process;

- the authorized person notifies each participant about a new procedure for dividing the property of the testator, or depriving them of previously received shares;

- upon reaching an agreement, the issued certificates are liquidated and new documentation is issued in return;

- State registration authorities make an updated entry;

- in the absence of previously received documents, papers are issued that take into account the decreased shares of all legal successors.

Experience shows that difficulties arise in reaching agreements. Especially when a newly announced successor lays claim to a significant part of the property already divided between other entities. When agreement cannot be achieved, one has to turn to judicial oversight bodies for help. This type of obtaining authority is not often used by people who have a legal education and actually manage property.

Two options for inheritance

The period for entering into an inheritance is six months, which is calculated from the moment of death of the testator. But in some situations these deadlines may change.

If the inheritance is opened on the day of the expected death of a citizen, then it can be accepted within six months from the date of entry into legal force of the court decision declaring him dead. If the heirs refuse the inheritance or are deprived of the right to receive it, then the inheritance can be accepted within six months from the moment such a right arises. If it so happens that all the heirs did not accept the inheritance, then it can be accepted within three months from the end of the total six-month period for accepting the inheritance.

And if you unexpectedly found out that you have become an heir, and then discovered that the period allotted by law for receiving it has expired, then there is no need to panic right away. The law provides late heirs with the opportunity to restore their rights to property. This is stated in Art. 1155 of the Civil Code of the Russian Federation. At the same time, there are two ways to enter into inheritance after the expiration of the allotted period - extrajudicial and judicial.

You may be interested in: Representation in court in civil cases.

The extrajudicial method, or it is also called conciliation, is relevant only in situations where there are other heirs who have entered into inheritance rights on time. Moreover, all these people agree that the heir who missed the deadline for accepting the inheritance will also be included in the list of persons accepting the inheritance.

However, according to lawyers and notaries, in most such cases, relatives refuse to voluntarily share the bequeathed property with the latecomer, so the latter has to go to court.

In court, you can restore the missed deadline for accepting the inheritance and restore the status of the heir if the latter did not know and should not have known about the opening of the inheritance or missed this deadline for other valid reasons.

You may be interested in: Family law lawyer services.

The right not to inherit

In addition to the right of inheritance, heirs have the right not to enter into an inheritance. If you do not want to inherit property, it is enough not to actually accept it and not to claim your rights to it within a 6-month period.

Do not forget that if the inheritance is not accepted by any of the heirs, it will be considered escheated and transferred to the balance of the state.

The answer to the question whether it is possible not to enter into an inheritance is always affirmative: it is permitted not to accept the required portion of the property for any reason or motive.

Since, along with the apartment, car and everything else, the debts of the deceased can go to the heirs, if you do not want to pay the amount of money owed by the testator, you can not accept the inheritance or refuse it altogether.

We invite you to familiarize yourself with: Form for notice of termination of a lease agreement

Valid reasons for reinstating the missed deadline for entering into inheritance

The main difficulty in the process of restoring the missed deadline is to prove in court that the reason why you did not accept the inheritance on time is valid. The fact is that the law does not specify a list of valid and disrespectful reasons. Therefore, the court in each case considers the situation individually, guided by Resolution of the Plenum of the Supreme Court No. 9 of May 29, 2012 “On judicial practice in inheritance cases.”

Paragraph 40 of the resolution states that the court can satisfy the requirements for restoring the period for accepting the inheritance and recognizing that the heir has accepted the inheritance if it is possible to prove a number of certain circumstances. Firstly, the heir did not know and should not have known about the opening of the inheritance or missed the specified deadline for other valid reasons. Such reasons include: serious illness, helpless state, illiteracy, etc. (Article 205 of the Civil Code of the Russian Federation), if they prevented the heir from accepting the inheritance for the entire period established for this by law.

In this case, it is important that the late heir file a claim in court no later than six months after the reasons why he was unable to realize his right to inheritance on time were eliminated.

You may be interested in: Representation in arbitration court.

Distribution of inheritance when close heirs miss deadlines

In the case of a large number of applicants for an inheritance that passes in accordance with the law according to the degree of kinship to a deceased relative, if the time for contacting a notary is delayed, a difficult situation may arise.

If the primary heirs miss the designated period and more distant relatives apply in a timely manner, the inheritance may go to them if the first heirs do not show up at the notary, and he cannot find them due to an unknown residential address. Therefore, it is very difficult to challenge your inheritance right if a significant period has passed since the death of the inheritor. The heirs who managed to receive his property voluntarily will not part with it easily.

If distant heirs are notified of their right to inheritance not immediately after the death of a relative, but after some period of time, they will have little time left to enter into rights. Therefore, for them it is extended for another six months. For example, if there are less than three months left to enter into inheritance rights, another six months will be added to them.

Unexcusable reasons for reinstating the inheritance period

True, not all reasons are recognized by the court as valid in the case of accepting an inheritance. Clearly unexcusable reasons include living at a great distance from the deceased or a short-term health disorder (without bed rest and not in a hospital). It will also be an unconvincing argument for the court that the heir did not know about the death of the testator or that he had become his heir. The court will not take into account the statement that the plaintiff did not know about the terms and procedure for entering into an inheritance, which is very reminiscent of the situation with offenses - “ignorance of the law does not exempt from liability.”

You may be interested in: Obtaining a work permit for a HQS.

The fate of the inheritance of a deceased person, to which no one has claimed rights

If there are applicants for the inheritance, but they did not contact the notary within the allotted time and hopelessly missed the time of inheritance, and through legal actions they were unable to win it back, or there are no heirs at all, then the inheritance will be considered escheatable property. According to Article 1151 of the Civil Code, it will be transferred to the disposal of the state represented by the municipal institution at the location of the testator’s residential real estate.

Expert commentary

Potapova Svetlana

Lawyer

If there are possible heirs who have not shown themselves in any way during the entire allotted time for entering into the inheritance, without turning to either a notary or the court, the inheritance is transferred under the responsibility of the notary. He must take measures to preserve the property included in the inheritance in order to present it in case of demand to relatives who show up or for transfer to the state if the relatives do not show up. In order to protect savings and jewelry, they are transferred to the bank. To protect other inherited property left without an owner, a responsible person may be appointed, who is under the control of a notary.

How to restore the right to inheritance?

It is better to reach an agreement without litigation, but this does not always work out. Therefore, you have to go to court. Understanding who the defendant is, writing a statement of claim is not difficult. To do this, they visit a notary and clarify who has now inherited the property. In order for confidential information to become accessible, it is necessary to prove the existence of rights of claim. That is, it is required to present documents proving the existence of family ties.

Through the court

Litigation is initiated by filing a statement of claim. The document does not have a unified form, but there are general requirements for the design and text, which contains a list of attached evidence of correctness. The purpose of the procedure is to achieve inheritance and become the rightful owner of the property. The court's decision is final, and a second claim with the same conditions will not be considered.

What should be included in the claim?

The header of the application states:

- name of the court;

- information about the plaintiff;

- information about the defendant;

- Contact details.

The text briefly and concisely describes the situation, provides arguments, and states the requirement to enter into an inheritance and receive the property due. The main thing is that every word or phrase is justified. Therefore, links to articles and clauses of laws are provided.

The list of documents must indicate that a receipt for payment of the state fee is attached. Without it, the meeting will not take place, the claim will remain without consideration. When it comes to missing the deadline for entering into an inheritance, it is necessary to indicate why the timely application was not made. If the reason is frivolous, far-fetched, or unproven, there will be no changes in the distribution of the inheritance.

No trial

You can always contact the person to whom the property was inherited. Even if a refusal follows, in court this will be a confirmation of the desire to resolve the issue without scandal. When the opponent is an adequate person, you can always find a way out:

- Transfer the inheritance to yourself according to mutual desire.

- Receive money in an amount equal to the value of the disputed property.

- Divide the inherited values and formalize the transaction legally.

In any case, everything depends on the specific case, but pre-trial measures to resolve the conflict should not be ignored. And based on the results of the negotiations, the further algorithm of actions is determined.

Actions

Failure to appear at a notary's office in the first six months is regarded as a refusal by both the notary and the court. However, it is worth understanding that if the refusenik changes his mind and is able to restore the terms, he will have to share. Some buy out the share, but do not formalize the transfer of money and property. The result is a lawsuit, loss of valuables, time, and nerves. To prevent this from happening, it is enough to format each step correctly.

Waiver is a document certified by a notary. You will have to pay a fee. This must be done within six months after the death of the property owner. The procedure will take no more than 15-20 minutes. And when it comes to transferring money as compensation, an agreement is drawn up, which specifies the amount, terms, conditions, duties and responsibilities. It is better to formalize the fact of transfer via a bank transaction. Then a bank statement is sufficient proof.

What is escheat property?

This term refers to the process of transferring inheritance in favor of the state. This is possible when:

- There is no one to accept inheritance rights due to the absence of relatives.

- All applicants refused due to personal reasons.

- Heirs belong to the category of persons who do not have the right to claim.

- The refusal does not indicate the third party in whose favor it is issued.

- No one applied for recognition in a timely manner.

As soon as six months have passed after the death of the testator, if there is no subject ready to become the owner, everything acquired during his lifetime is transferred to the state.

To whom does it go?

In most cases, the legal successor is the municipality of the subject or district. If we are talking about an apartment, it is entered into the housing register. This means that square meters are used to meet the social needs of citizens. The Federal Tax Service is responsible for the safety, the manager is the Federal Property Management Agency.

These structures can be called defendants in the claim, but in fact the application is filed against the property itself, which is due by inheritance. In any case, it is possible to return it to yourself, depriving the state of the right to further dispose of valuables, and for this there is a special procedure that involves applying to the court at the location of the object of the dispute.

How to restore rights if this property has already been sold?

There are no clear rules formed into special sections of laws. Lawyers use the main articles of the Civil Code to defend their rights, and in most cases this actually works. In any case, you will have to solve the problem in court with the involvement of specialists who know the law and have legal practice.