What documents are issued upon dismissal?

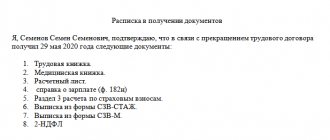

The list of documents that must be given to an employee on the day of dismissal is strictly regulated. It includes:

- work book – on paper or STD-R form;

- certificate of income and paid tax (formerly 2-personal income tax);

- extract from the SZV-M report;

- extract from the SZV-STAZH certificate;

- extract from section 3 of the RSV;

- Certificate in the form of the Social Insurance Fund upon dismissal - about earnings for 2 years before the year of leaving;

- Certificate of average earnings for the last 3 months - in case of dismissal due to layoffs or liquidation.

There are situations when an employee does not show up at work on his last day of work. In this case, he is sent a notice of the need to appear for documents or agree to have them sent by mail.

To do this, use the option of a registered letter with acknowledgment of delivery.

Example of filling out Section 3

An example of filling out Section 3 is as follows. It includes 2 subsections: the first of them reflects the personal data of employees, and the second - the amount of payments and insurance contributions.

Subsection 3.1 (together with basic information about the employee)

In the subsection you must fill in the following lines:

- 010 - correction number (a dash if the original DAM is submitted, 1, 2, etc. - when submitting corrective information);

- 020 — encoding of the billing period;

- 030 - indicates the year for which information is being submitted;

- 040 - serial number of an individual (personnel number or serial number);

- 050 — date of delivery of the DAM;

- 060-150 - personal information about an individual;

- 160-180 - coding in the human insurance system.

An example of filling out this information is presented below:

Subsection 3.2 (3.2.1 - lines 190-250 and 3.2.2 - lines 260-300)

In the subsection you need to fill in the following lines regarding remuneration and insurance premiums:

- 190 - month;

- 200 - code of the insured person;

- 210 - amount of payments;

- 220 - base for calculating insurance premiums;

- 230 — incl. under GPC agreements;

- 240 - the amount of calculated insurance premiums;

- 250 - in just 3 months (payments and insurance premiums);

- 260 - month (according to additional tariff);

- 270 — tariff code (according to additional tariff);

- 280 - amount of payments;

- 290 - the amount of calculated insurance premiums (according to the additional tariff);

- 300 - in just 3 months (remuneration and insurance premiums) at an additional tariff.

An example of filling out this information is presented below:

Sometimes in the 1C program, information in Section 3 is formed incorrectly for employees who were on leave without pay during the reporting quarter. In such a situation, the program leaves empty cells in the columns intended to reflect payments and the base for calculating insurance premiums. To correct the situation, you must manually enter zeros, and then the reports can be sent to the Federal Tax Service.

How to fill out SZV-M and SZV-STAZH for a dismissed person

In the event of termination of an employment contract with an employee, he is given the following personalized accounting information in the Pension Fund:

- SZV-STAZH – for the current year ;

- SZV-M – for the current month .

Important

Both forms are issued only with data on the resigning employee.

The SZV-STAZH form is filled out according to the usual rules - in accordance with the resolution of the Pension Fund Board of December 6, 2018 No. 507p. It must contain sections 1, 2, 3. Blocks 4 and 5 are completed only in case of a pension.

The registration procedure is as follows:

- Section 1 provides the policyholder’s identification data – TIN, KPP, registration number in the Pension Fund of the Russian Federation, company name;

- in section 2 indicate the year for which the form is submitted;

- in section 3 in the table indicate full name. the dismissed person, his SNILS, the period of work in the current year - starting from January 1 and ending with the date of dismissal.

In the SZV-M form, in accordance with the resolution of the Pension Fund Board dated 02/01/2016 No. 83p, all sections are filled out. It states:

- Section 1 – identification information about the policyholder;

- section 2 – month number and year for which the report was compiled;

- form type code in section 3 – ISHD;

- in section 4, in the tabular section, the full name, SNILS and TIN of the dismissed person are given.

If an employee requests in writing copies of other reports (for example, for earlier periods), the employer does not have the right to refuse him and is obliged to provide them.

Preparation of statements on insurance premiums

When issuing documents to an employee, it is necessary to maintain the confidentiality of personal data, access to which may be available to the control authorities processing the data, the employer and the employee himself. The provision of data must comply with the following conditions:

- Form SZV-M with data on all employees of the enterprise is not provided. Upon dismissal, a person receives an extract with information relating only to the employee himself. When dismissing several employees at the same time, a document is generated for each person separately.

- The SZV-Experience form has been adopted since 2021, which allows you to include information about the employee’s data only from the specified period. The employer makes a decision on issuing information for earlier periods independently or provides data from the RSV-1. The legislation does not provide clarification on this issue.

When issuing an extract, the employer must not submit reports on the forms ahead of schedule. The information in the statements relates to the dismissed employee and cannot be changed by the reporting date.

Extracts must be completed properly. The document must have a title to indicate that the extract is part of the reporting form. The data is certified by the responsible person with a transcript of the position, the original signature and seal of the organization. If an enterprise refuses to use a seal, a corresponding entry is made in official documents.

Registration of RSV upon dismissal

Upon separation, the worker is given a certificate of insurance premiums upon dismissal in the form of an extract from section 3 of the insurance premium calculation form.

Section 3 includes subsections 3.1 and 3.2. The first shows the employee’s identification data. And in subsection 3.2 - the amount of taxable income and the amount of contributions accrued to the Pension Fund - both at the basic and at the additional rate for the worked months of the current quarter.

Form SZV-M

Another document that is issued to an employee upon dismissal is an extract from the SZV-M form. This statement confirms the employee's insurance record. This document must contain information about the employee, including his INN and SNILS, as well as the details of the employer. An extract for 2021 is being prepared only for the employee who is resigning (Law No. 27-FZ of 04/01/1996, Art. 11, Clause 4). The form used is approved by Resolution of the Board of the Pension Fund of the Russian Federation No. 83p dated 02/01/2016. In section 4 you need to include information only on the dismissed employee. It is prohibited to copy the entire report, since it is impossible to transfer personal data to other employees.

Each organization determines for itself who exactly issues such an extract. This can be done by both an accountant and a HR specialist. If this responsibility is assigned to personnel officers, then the accountant prepares the statement and then transfers it to the personnel department. After this, personnel officers, along with other documents, give it to the employee and receive a signature from him confirming receipt of the document. You can receive confirmation in one of the following ways: by signing a copy of the document or in a special journal, or by receiving a certificate from an employee confirming receipt of the document.

How to issue a certificate of earnings for 2 years

Another document that is provided to the leaving employee is a certificate in the Social Insurance Fund form upon dismissal about earnings for 2 years. It is drawn up on a form approved by Order of the Ministry of Labor dated April 30, 2013 No. 182n. It is necessary to calculate disability benefits for maternity leave at the next place of work.

It indicates in sections 1 the identification data of the policyholder and the insured (dismissed), respectively. In addition, section 3 provides the total amount of income from which contributions to VNiM are calculated. And in section 4 - information about periods of release from work with and without preservation of earnings, which are excluded from the calculation of average earnings for benefits.

Read also

23.04.2020

Fines for late issuance of documents upon dismissal from an employer in 2020

If the employee is not given documents on the day of dismissal, both the organization and the manager will face a fine.

For an organization, the fine will be from 30,000 to 50,000 rubles, and for a manager - from 1,000 to 5,000 rubles.

For a repeated violation, the fine will increase and amount to:

- for an organization - from 50,000 to 70,000 rubles;

- for a manager - from 10,000 to 20,000 rubles or disqualification for a period of 1 to 3 years (Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

Also on the topic: Features of filing a lawsuit against an employer for non-payment of wages

When is it necessary to issue copies of reports to employees?

Copies of personalized reporting are issued to employees without their request. The Law identifies three unconditional grounds for issuing these documents to each employee:

- the fact of submitting information about the employee to the Pension Fund as part of current reporting;

- dismissal of an employee (termination of the GPC agreement);

- registration of a pension by an employee.

Let's figure out how to correctly issue copies of personalized information for each of these grounds.

GROUND 1. Information about the employee has been submitted to the Pension Fund as part of current reporting

Employees must submit copies of reports within the deadline for submitting the report to

It turns out that a copy of section 6 of the report must be issued quarterly

- the report is submitted on paper - no later than the second month following the reporting period;

- the report was submitted electronically - no later than the second month following the reporting period.

And the extract from the employee should be sent monthly - no later than the day of the month following the reporting period.

At the same time, the Instructions for maintaining personalized records state that the organization must provide employees with copies of the information submitted regarding them within a week from the date of their receipt. And if errors are found in the submitted forms, then after submitting the corrected information, a copy of them will also need to be given to the employee

Obviously, there is no point in giving employees copies of reports submitted to the Pension Fund office, but not yet accepted. Therefore, perhaps, it is worth focusing precisely on the period specified in the Instructions.

There is no need to confirm the fact that copies of current personalized reporting have been issued to employees.

GROUND 2. Dismissal of an employee (termination of the GPC agreement)

In such a situation, the employee needs to provide copies of the reports on the day of dismissal (termination of contract). The Law on Personalized Accounting does not specify reports for what period. But the Instructions for maintaining personalized records, in turn, explain that you need to give the former employee copies of reports that you will later submit to

General payment procedure

Based on the norms of the Tax Code of the Russian Federation, the employer, when calculating and paying the amount of monthly remuneration to the employee, is obliged to make the following payments:

- Personal income tax - to the budget;

- insurance contributions - to extra-budgetary funds.

The transfer of personal income tax to the budget is carried out as part of the employer’s fulfillment of the obligations of a tax agent. In fact, the employee is the tax payer, while the employer assumes obligations to calculate personal income tax, withhold tax from the employee’s income and subsequently transfer personal income tax to the budget.