Salary payment terms

In accordance with the Labor Code (136 Labor Code of the Russian Federation), employers are required to pay wages every half month, at least. Based on labor legislation, specific dates for salary payment must be established in one of the documents:

- internal labor regulations;

- collective agreement;

- employment contract.

In this case, you must adhere to the following requirement: wages must be paid no later than 15 calendar days from the end of the accrual period. That is, the advance should be paid no later than the 30th of the current accrual month, and the main part should be paid in the next month, no later than the 25th.

But since in case of early payment the rights of employees are not infringed, it is not a violation. If wages are paid ahead of time, employees will receive money earlier, which undoubtedly does not constitute an infringement of rights for employees.

Important! The company’s internal documents should indicate the exact dates of payment of the advance and the main part of the salary.

Salaries can be paid ahead of schedule

The Ministry of Labor answered questions from employers regarding acceptable terms and amounts of salary payments. Of course, problems did not arise on their own, but were dictated by life situations. And ministry officials considered it possible in a number of cases to allow employers to meet workers halfway, justifying this by the fact that deviation from the norms does not lead to a worsening of their situation. But in case of obvious violations of the law, there must be an unequivocal refusal.

The Labor Code of the Russian Federation establishes basic rules for the payment of wages. Salaries are paid at least twice a month. The date of payment is fixed in the salary regulations or other local document (labor rules, employment contract). The first part of the salary is paid from the time actually worked during the first half of the month. For violation of salary payment deadlines, employers are subject to liability, including criminal liability.

Deadlines for payment of salaries and other income

Article 136 of the Labor Code of the Russian Federation obliges wages to be paid at least every half month. The specific date for payment of wages is established by internal labor regulations, a collective agreement or an employment contract. Salary for the second part of the month must be paid no later than 15 calendar days from the end of the period for which it was accrued (clause 6 of Article 136 of the Labor Code of the Russian Federation).

It is prohibited to issue salaries to employees with a break of more than 15 days. The gaps between the first and second parts of the salary should not be longer than 15 days (14 - 16 days, taking into account the number of days in the month).

If a specific date is not established in internal documents, then their norms will be considered invalid. The consequences are at least a fine under Article 5.27. Code of Administrative Offenses of the Russian Federation “Violation of labor legislation and other normative legal acts containing labor law norms.”

If the salary payment day coincides with a weekend or non-working holiday, then the salary should be transferred on the eve of this day (Part 8 of Article 136 of the Labor Code of the Russian Federation).

The Labor Code of the Russian Federation establishes the basic conditions that employers must adhere to when paying hired personnel:

- Salaries must be paid every six months;

- exact dates must be approved by local regulations of the employer;

- The salary payment deadlines fixed by internal documents cannot be violated.

Thus, each employer has the right to independently decide in what numbers he will pay his employees, the main thing is that there are no violations.

Based on this, in response to an employee’s request to pay him money for the time worked once, and not twice a month, the company must refuse (Part 6 of Article 136 of the Labor Code of the Russian Federation). The employer does not have the authority to change the “salary” requirements of the Labor Code of the Russian Federation, even on the basis of written statements from employees. Paying wages once a month is a violation.

But when asked whether it is possible to issue salaries ahead of schedule, officials answered positively.

The maximum permissible period of time during which the employer’s obligations to pay wages must be fulfilled should not exceed 15 calendar days after the end of the accrual period. And the advance must be paid in the current month. If this condition is met, early payment of wages will not be considered a violation. Moreover, this does not infringe on the rights of the employee.

At the same time, the payment of wages according to the Labor Code is limited in frequency only by the fact that wages must be paid at least 2 times. If you want to pay your salary more often, for example, every week, you have the right to do so (see letter of the Ministry of Labor dated 02/03/2016 No. 14-1/10/B-660).

Advance payment

Let us note that the old concept of advance payment, although still in use, no longer fully complies with the new standards. Now this is the first part of the salary. And it should be calculated based on the time actually worked in the first half of the month, and not as a percentage of the employee’s monthly earnings. The first part of the salary should include bonuses and additional payments related to the regime and working conditions.

The Ministry of Labor in letter dated 02/05/2019 No. 14-1/OOG-549 noted that when calculating the advance payment, the following must be taken into account:

- salary (tariff rate) of the employee for the time worked;

- bonuses for hours worked, the calculation of which does not depend on the assessment of the results of work for the month as a whole, as well as on the fulfillment of the monthly norm of working time and labor standards (for example, compensation for night work, bonuses for combining positions, for professional excellence, for length of service work, etc.).

Compensation payments for performing work in conditions that deviate from normal and are part of the salary must also be paid at least every half month upon completion of work (see letter of the Ministry of Labor of the Russian Federation dated April 18, 2017 No. 11-4/ОOG-718). These are additional payments when performing work of various qualifications, combining positions, overtime, night work, weekends and non-working holidays.

Example. Payment of additional payment for combining positions

In the company, the date of payment of wages in the form of an advance falls on the 20th. The final payment for the month is set for the 5th of the next month.

The employee's salary is 30,000 rubles. For combining positions, he is given an additional payment of 15% of his salary.

The standard working days of the month is 21. On the date of issuance of the advance, the employee worked 13 days. The accountant calculated the employee's salary for the first half of the month:

earnings for the time actually worked is 21,357.14 rubles. (30,000 rub. + 30,000 rub. × 15%): 21 days. × 13 days).

Can the amount of the advance exceed the amount actually earned?

The officials responded in the negative. After all, wages must be paid in full in accordance with (paragraph 5, part 1, article 21 of the Labor Code of the Russian Federation):

- with the qualifications of the employee;

- with the complexity of labor functions;

- with the quantity and quality of work performed.

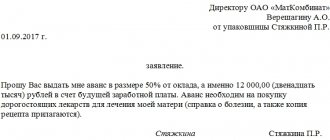

Let us remind you that the Labor Code of the Russian Federation retains the concept of an advance in the sense of paying employees part or all of their salary ahead of schedule on account of future earnings, for example, a week or even several months in advance. The employee has the right to ask for an advance payment before payday, and the employer can meet him halfway (see letter of the Ministry of Labor of the Russian Federation dated May 10, 2017 No. 14-1 / OOG-3602). The main condition for such an advance is that the employee has not yet earned the requested amount.

The provision on such an advance (condition for payment of the advance, cases and procedure for its payment) must be included in the collective agreement or local regulations.

Responsibility for violation of deadlines for payment of wages

The employer is responsible for failure to pay wages on time.

Firstly, the Labor Code of the Russian Federation establishes responsibility to employees.

For delays in payment of wages, vacation pay, dismissal payments and other payments due to the employee, the employer is obliged to pay them with interest (monetary compensation) in an amount not less than 1/150 of the Central Bank refinancing rate in force at that time on amounts not paid on time for each day of delay starting from the next day after the due date for payment up to and including the day of actual settlement. In case of incomplete payment of wages and (or) other payments on time, the amount of interest (monetary compensation) is calculated from the amounts actually not paid on time (Article 236 of the Labor Code of the Russian Federation).

Also, in accordance with Article 22 of the Labor Code of the Russian Federation, an employer who has delayed the payment of wages is obliged to compensate for damage caused to employees in connection with the performance of their labor duties, as well as to compensate for moral damage in the manner prescribed by labor legislation. The amount of compensation may be established by the parties, and if no agreement is reached, by the court.

Secondly, there is administrative responsibility for delayed salaries. It occurs specifically for such an offense as non-payment of wages and incomplete payment on time (Parts 6, 7 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation) and entails a warning or the imposition of an administrative fine:

- for officials in the amount of 10,000 to 20,000 rubles;

- for individual entrepreneurs – from 1000 to 5000 rubles;

- for legal entities – from 30,000 to 50,000 rubles.

For repeated violations, if these actions do not contain a criminal offense, the sanctions are stricter:

- a fine on officials in the amount of 20,000 to 30,000 rubles or disqualification for a period of 1 to 3 years;

- fine for individual entrepreneurs - from 10,000 to 30,000 rubles;

- fine for legal entities - from 50,000 to 100,000 rubles.

Thirdly, there is criminal liability for wage violations.

If the salary is paid only partially (less than half or paid below the minimum wage) for three months or more out of selfish or other personal interest, then the head of the organization (branch, representative office or other separate divisions of the organization) may be punished under Article 145.1 of the Criminal Code of the Russian Federation.

The fine ranges from 120,000 rubles. The extreme penalty is imprisonment for up to 3 years with deprivation of the right to hold certain positions or engage in certain activities.

Fines for late payment of wages

For the first time a company fails to pay wages on time, it faces a fine:

- For legal entities – from 30,000 rubles to 50,000 rubles;

- For individual entrepreneurs – from 1,000 rubles to 5,000 rubles;

- For officials - from 1,000 rubles to 5,000 rubles, or a warning.

If the company is re-engaged for violating the payment deadlines, the fine will be higher:

- For legal entities – from 50,000 rubles to 70,000 rubles;

- For individual entrepreneurs – from 10,000 rubles to 20,000 rubles;

- For officials - from 10,000 rubles to 20,000 rubles or disqualification from 1 to 3 years.

What's happened?

The Ministry of Labor of Russia, in letter No. 14-1/B-582 dated July 26, 2019, answered the question of the employing organization whether it is possible to pay an employee a salary earlier than the date established in the collective and labor agreement. Not if the payday falls on a weekend or non-working holiday, but for other reasons, for example, at the request of the employee himself. The employer was concerned that in this case there would be more than 15 days between the two parts of the salary as provided for in Article 136 of the Labor Code of the Russian Federation. And this is an administrative offense, for which a large fine is imposed.

Early payment of wages

However, some companies are concerned that if the first part of the salary is paid early, it will take more than half a month before the second payment is made. Will there be a violation in this case?

If the company’s internal documents set exact deadlines for paying salaries, for example, the 15th and 30th, then you need to adhere to exactly these deadlines. However, there are also situations when it is necessary to pay wages ahead of schedule. For example, before the New Year holidays, some companies try to pay the advance for December ahead of schedule, for example, on the 28th or even the 25th. The next payment of the main part will be on January 15, respectively, more than 15 required days will pass between these dates. Let's look into this situation. According to the Labor Code, payment of wages earlier than the approved date is possible only if the payment day falls on a weekend. In this case, the salary is issued on the eve of the due date of payment. And this is not a violation (136 Labor Code of the Russian Federation).

But if the payment was made on the 28th instead of the 30th, this may already constitute a violation, since the required period between payments of 15 days will be exceeded. The Labor Inspectorate may prosecute for such a violation under Article 5.27.1 of the Code of Administrative Offenses. However, there will be no penalty for a one-time early postponement of salary payments. The main thing is that this is due to the forced conditions that have developed within the company. For example, the chief accountant goes on vacation, and no one else can issue salaries. In this case, an order to pay wages ahead of time will be required.

Important! Paying wages ahead of schedule is possible only if the approved payment date falls on a weekend, or in a particularly extreme case. It is important that subsequent payments occur on time.

Responsibility

An administrative fine for paying wages ahead of schedule provides for the imposition of obligations on the guilty official up to 5,000 rubles, and on a business entity up to 50,000 rubles. The amount of the penalty increases if repeated violations are detected throughout the calendar year.

Salary payment procedure

To avoid troubles, the head of a business entity is recommended to adhere to the procedure for paying wages to his employees. The administrative documentation must reflect situations in which payments can be made earlier. If it is necessary to make payments earlier than the regulated date, it is recommended to make amendments to the documentation so that during the inspection the company will not be fined.

Paying wages to a new employee

If a new employee gets a job with the employer in the second half of the month, then he is not entitled to an advance at the end of the month. For the first time he will receive his salary only next month, no later than the 15th. Accordingly, the required period for payment of wages will be increased, but this will not be a violation, but only if for the rest of the employees the payment of wages is made on time. It is also possible to regulate such payment in an employment, collective agreement or wage regulations (

Payment of taxes upon early payment of wages

Taxes for early payment of wages are accrued as usual. The employer transfers personal income tax from employee income, where he acts as a tax agent, as well as insurance premiums.

According to Art. 226 of the Tax Code, the deadline for payment of personal income tax must be no later than the next business day after the resident receives income. If the employer transferred the salary ahead of schedule, then he must also adhere to the specified rule so that there is no risk of accrual of late penalties when paying personal income tax.

But, according to paragraphs. 2 tbsp. 233 of the Tax Code, the date of actual payment of income is the last day of the month for which wages are calculated. Therefore, from an advance paid in advance, personal income tax is not transferred until the salary is paid.

Insurance premiums are transferred within standard terms : before the 15th day of the month following the month of receipt of income.

The legislative framework

| Legislative act | Content |

| Article 136 of the Labor Code of the Russian Federation | “Procedure, terms and place of payment of wages” |

| Letter of the Ministry of Health and Social Development No. 22-2-709 dated February 25, 2009 | “On the timing and procedure for payment of wages accrued by the advance method, as well as bonuses” |

| Article 236 of the Labor Code of the Russian Federation | “Financial liability of the employer for delay in payment of wages and other payments due to the employee” |

Rate the quality of the article. Your opinion is important to us:

Early: is it possible?

The Labor Code of the Russian Federation, as amended in 2021, does not contain a ban on early payment of wages, and liability in the Labor Code of the Russian Federation is provided only for delayed payment of wages.

However, the Labor Code of the Russian Federation also requires that wages be paid every half month, and the date of payment itself must be fixed. However, the employer will not make changes to the employment contract or internal labor regulations every time an early payment is made.

Therefore, formally, payment of wages on dates other than those established falls under a violation of wages (Part 1 of Article 142 of the Labor Code of the Russian Federation) and can be regarded as a violation of labor legislation under the Code of Administrative Offenses of the Russian Federation (Part 1 of Article 5.27 Code of Administrative Offenses of the Russian Federation).

Conclusion: if you pay early, there is a risk that there will be more than half a month between payments.

How an advance is paid - new rules and payment procedures

/ / December 3, 2021 0 Rating Share How an advance is paid according to the latest amendments made to the legislation, every employer at any enterprise should know. What does the advance amount consist of?

When and with what frequency should wages be paid for the 1st and 2nd parts of the month? What liability will the employer bear for failure to comply with these deadlines?

These and some other nuances regarding the advance can be learned from this article. The wording of the Labor Code of the Russian Federation applicable to the field of wages does not use the term advance.

Instead, the concept “salary for the first half of the month” is used. The Law “On Amendments...” dated July 3, 2016 No. 272-FZ introduced some amendments to the Labor Code on advance payment.

New rules for calculating salary advances in 2021

The rules for calculating salary advances for the first half of the month have changed.

Accountants underpaid employees, which could result in serious fines. The Ministry of Labor has released new rules - download them and use them in your work.

Download and use at work! According to Article 136 of the Labor Code of the Russian Federation, the employer must pay wages at least every half month. Moreover. The salary is divided into an advance (from the 1st to the 15th day of the month) and the second part of the salary (from the 16th to the 30th (31st) day of the month).

Is it possible to set the dates for issuing advance payments and salaries - the 20th and 10th?

How to reschedule if you need to give money earlier, information in the article “.

As indicated by the Ministry of Labor in letter No. 14-1/OOG-549 dated 02/05/2021, accountants should calculate the advance without a coefficient of 0.87. This factor reduces the advance by 13% and is illegal.

Experts clarified that calculation with a coefficient infringes on the rights of the employee.

It turns out that according to the new rules, the advance payment should increase by 13%.

How an advance is paid - new rules and payment procedures

> > May 23, 2021 How is an advance paid taking into account the latest changes in legislation?

Our article will discuss how to calculate the amount of the advance, how and when to pay it to employees, what sanctions await the employer for failure to pay the advance. The concept of “advance” is not enshrined in labor legislation. Since the employer is obliged to pay his employees wages every half month, payment for the first half of the month is called an advance.

How are advances paid under the Labor Code of the Russian Federation? Specific terms for payment of wages and advances are not established in the Labor Code of the Russian Federation.

The new advance payment rules applied from October 3, 2016 limited the payment period to 15 calendar days from the end of the period for which the salary was accrued. At the same time, the Labor Code does not prohibit making advance payments more often than every half month, for example, 3 times a month (every decade) or 1 time a week.

Today there is a promotion - consultation of lawyers and advocates 0 - rubles.

hurry to get an answer for free→

This Personal Data Privacy Policy (hereinafter referred to as the Privacy Policy) applies to all information that the website https://online-sovetnik.ru, (hereinafter referred to as Online Advisor) located on the domain name https://online-sovetnik.ru (and also its subdomains), can obtain information about the User while using the site https://online-sovetnik.ru (as well as its subdomains), its programs and its products.1. Definition of Terms 1.1 The following terms are used in this Privacy Policy: 1.1.1. “Site Administration” (hereinafter referred to as the Administration) - authorized employees to manage the site https://online-sovetnik.ru, who organize and (or) carry out the processing of personal data, and also determine the purposes of processing personal data, the composition of personal data to be processed , actions (operations) performed with personal data.1.1.2.

"Personal

Advance as a percentage of salary and fixed advance

The fixed amount for the advance can be set:

- in total terms;

- in the amount of a certain percentage of the salary.

By paying an advance in a fixed amount, for example 10,000 rubles, the employer is at great risk. The risk is due to the fact that the employer is obliged to pay an advance in a constant amount, regardless of whether the employee was working or was, for example, on sick leave. Also, at the end of the month, the amount of the entire salary may be less than the advance paid. Therefore, employers rarely choose the first option for paying an advance.

The most common option is to determine the amount of the advance as a percentage of the salary. Since the Ministry of Health and Social Development indicates that the amount of the advance and salary should be approximately equal (letter dated February 25, 2009 No. 22-2-709), employers, as a rule, set the advance at 40–50% of the salary.

Example 2

The employee's salary is set at 40,000 rubles. The personal income tax amount will be 5,200 rubles. (40,000 × 13%)

| Advance amount | Prepaid expense | Salary |

| 40% | 16 000 (40 000 × 40%) | 18 800 (40 000 – 5 200 – 16 000) |

| 50% | 20 000 (40 000 × 50%) | 14 800 (40 000 – 5 200 – 20 000) |

As can be seen from the example, the amount of monthly salary when paying an advance of 50% is significantly less than the amount of the advance itself.

The employer decides independently how to pay the advance in 2019-2020. We recommend setting the advance at 40-45% of the amount of earnings with a correlation to the time actually worked: by the date of payment of the advance, the accountant is provided with time sheets of the time worked by employees, and the salary amount for the 1st half of the month is adjusted to the number of days worked.

Let's consider the procedure for calculating such an advance using the example of manager L. E. Artemov.

Example 3

The employee's salary is 25,000 rubles. We will calculate the advance based on 40% of the salary and the correlation for the actual time worked.

The planned amount of the advance is 10,000 rubles. (25,000 × 40%).

But since the employee worked 7 days instead of 10, the amount of advance payment to be issued will be 7,000 rubles. (10,000 ÷ 10 × 7).

The Labor Code of the Russian Federation does not prohibit employers from paying an advance as a percentage of wages. Moreover, this method of paying an advance is the most convenient. With it, the accountant does not need to process time sheets, and the employee knows in advance the amount he will receive for the first half of the month.

Often, employers pay employees an advance in the amount of 40% of monthly earnings, which makes it possible to achieve uniform payments in favor of the employee.

However, in some cases this advance payment method is not applicable. For example, when the employee did not fully work the first half of the month (due to sick leave, vacation, time off, etc.).

Paying an advance as a percentage of salary in such cases will result in the advance exceeding the employee’s actual earnings. Moreover, if there are no accruals in the payroll for the second half of the month, then the accountant will not be able to withhold personal income tax from the amount of the advance paid before the end of the month.

As for a fixed monthly advance, it is best to avoid using it.

According to controllers, paying advance payments to employees in a fixed amount is discrimination in the world of work and a violation of the rights of workers to receive wages in full (letter of the Ministry of Labor dated 08/10/2017 No. 14-1/B-725, letter of the Ministry of Finance dated 03/29/2016 No. 02-07-05/17670).

Therefore, even if the level of remuneration for all employees in the enterprise is approximately the same, paying a fixed advance is illegal.

Advance and terms of its payment

The employee can go to court.

As with delayed or non-payment of wages, untimely payment of advance funds may result in administrative liability for an employer of any type of activity.

However, the amounts of fines for government agencies, legal entities and individual entrepreneurs vary significantly.

Such an offense is punishable by fines, namely:

- If the advance is not paid at all, a fine will be imposed on officials in the amount of 1-5 thousand rubles. If this state of affairs is not noticed by the regulatory authority for the first time, then the amount of the fine increases to 20 thousand. In addition, if such precedents occur constantly, the boss may even be suspended from office for 1-3 years.

The same applies to individual entrepreneurs;

- legal entities are responsible for such offenses more strictly; in the initial case of an offense, the fine for them will be 30-50 thousand rubles, and in each subsequent case - 70 thousand.

Thus, as it becomes clear, late payment of an advance is strictly punishable by law, despite the fact that payments ahead of schedule are not prohibited by law and are regulated only by local regulations.

In general, the payment of funds to an employee is strictly regulated by the current norms of labor legislation and other by-laws.

Thus, if you believe that the employer is violating your legal rights, then you can always demand compliance with them, justifying your comments with the provisions of the Labor Code of the Russian Federation. If the employer does not correct the situation, then you can always file a complaint against his actions with government control and supervision bodies: the Prosecutor's Office of the Russian Federation, the Labor Inspectorate, and also in court.

Remember that the law always tries to protect the interests of both parties when disputes arise. However, in order to prove the illegality of your boss’s actions, you will have to collect a solid base of evidence: statements, invoices, payslips, employment contracts, and so on.

From this video you will learn about calculating salary advances.

Noticed a mistake? Select it and press Ctrl Enter to let us know.

Example

Let's calculate the amount of the advance to M.V. Makarov. in proportion to the time worked in the first half of the month. It will be 4,000 rubles. The employee will receive this amount on October 31, 2021.

In addition, in relation to newly hired employees, the employer’s local regulations can establish special terms and procedures for paying advances. For example, determine the amount of the advance as a percentage of the salary, depending on the interval of dates when the employee was hired.

Example

The local act establishes the days for payment of wages: wages for the last month - on the 10th, advance payment for the current month - on the 25th.

The employee was hired on the 2nd. The accounting department has no reason to pay a new employee wages on the 10th, because he did not work last month. Before receiving an advance, according to the general rules, on the 25th, the employee will have to work 24 days.

For such cases, the following rules can be established in a local act:

- if the first day of work falls on the period from the 25th to the 30th (31st) day of the previous month, then wages for hours worked are paid on the 10th;

- if the first day of work falls on the period from the 1st to the 9th of the current month, then an advance in the amount of 10% of the salary is paid on the 10th;

- if the first day of work falls on the period from the 10th to the 17th of the current month, then an advance in the amount of 20% of the salary is paid on the 25th;

- if the first day of work falls on the period from the 18th to the 24th of the current month, an advance in the amount of 10% of the salary is paid on the 25th.

Earnings paid in advance are included in further payroll calculations at the end of the month.

Since the problem of the deadline for the first payment of wages to a new employee has not been resolved by law, in our opinion, the best solution is to calculate the advance in proportion to the time worked, regardless of the date of conclusion of the employment contract.

Grounds for providing financial assistance to employees

The current labor and civil legislation does not regulate the procedure and reasons for which financial assistance is accrued by the employer, therefore the circumstances upon the occurrence of which this type of financial support is paid are determined only by the organization itself in local regulations developed by the employer.

Thus, the grounds for receiving financial assistance may be listed in the relevant Regulations or collective agreement. Also, some organizations stipulate such grounds directly in the employment contract or in the Regulations on bonuses.

At the same time, this is not an entirely correct approach, since the type of payment in question does not depend on the employee’s labor achievements and is a social support measure.

Most often, financial support is provided for the following reasons:

- The need for expensive treatment. At the same time, such treatment must be truly necessary, that is, it cannot be replaced by a more inexpensive option.

- Significant monetary damages. Such damage usually includes the consequences of emergencies, natural disasters, accidents, theft, and robbery experienced by the employee. The nature of material support in the listed situations can be not only monetary, but also material in nature - it is allowed to provide necessary things or products to the injured employee.

- Family circumstances (wedding, birth of a child, funeral).

- Retirement or employee going on vacation. In these situations, the payment is provided at a time to each employee.

- Other difficult life situations. Such circumstances include raising children with disabilities; temporarily unemployed spouse; raising children by a single mother or father and other similar situations that the employee can document.

It is worth noting that upon the death of an employee of an organization, his immediate relatives have the right to financial assistance (if they have a death certificate and documents that can confirm the relationship).

Is it possible to issue an advance ahead of schedule in 2021?

Moreover, the advance payment for two-time payment of remuneration for labor is issued from the 16th to the 30th (31st) day of the current month, and the deadline for transferring the final salary amount will be the 15th day of the month following the billing month. IMPORTANT! Failure to comply with the requirement not to exceed the maximum number of days between payments of the first and second parts of the salary may be grounds for labor inspectors to impose a fine of 50,000 rubles. (Article 5.27 of the Code of Administrative Offenses of the Russian Federation). You have the right to choose the dates for issuing the advance payment and salary yourself, having specified them in the collective or employment agreement, as well as in the internal regulations.

When determining these dates, the following must be considered:

- It is prohibited to provide for a date interval for payments of any part of the salary. For example, from the 15th to the 18th. According to Art.

In relation to such employees, the employer is not obliged to draw up any additional agreements in connection with the increase in the minimum wage starting from 2021.

Paying an advance ahead of schedule: can you do this or not?

Probably, many of us are familiar with the situation when there is very little or no money, and salary is still far away. Some try to borrow from friends and acquaintances, while others take out small loans from the bank.

But few people know that you can get money from your employer. For example, by asking for financial assistance or advance payment ahead of schedule.

We will talk about how to ask for and receive an advance ahead of schedule, as well as what the size of the advance should be according to the law and much more in today’s article.

What is an advance?

To begin with, it would be nice to understand what an advance is, why it is needed and to whom it is paid.

An advance is a certain percentage of the salary that is paid to the employee in the middle of the pay period. Every accountant knows this definition.

Or, in simple terms, an advance is part of the salary that the employer pays you in the first half of the month.

Depending on the type of activity, as well as on what conditions are specified in the employment contract, the amount of the advance may vary in one direction or another.

Documents that must be provided to the employee

Example

As noted above, the procedure for paying such monetary benefits as financial assistance is fixed in the internal regulatory documents of the organization.

To receive financial support, an employee must submit an application addressed to the head of the enterprise, which must reflect the reasons for receiving this type of payment, as well as attach the relevant documents.

Let's take a closer look at what documents you will need to present to your manager in each of the above situations.

The need for expensive treatment:

- a doctor's note;

- agreement for the provision of paid services with the clinic;

- documents confirming payment for medications;

- prescriptions certified by the signature and seal of the attending physician;

- documents about the need for expensive treatment.

Significant monetary damage:

- Documents that confirm the fact of the situation and were issued by an authorized organization.

- A copy of the certificate of material damage, certified by the relevant authority.

Wedding, birth of a child:

- marriage certificate (copy);

- birth certificate (copy).

Death of close relatives:

- Death certificate (copy).

- A document that can be used to confirm relationship with the deceased.

Other difficult life situations:

- single mother's certificate;

- document confirming the presence of disability;

- documents confirming another difficult situation of the employee.

Express replies

What is considered the day of payment of wages by bank transfer?

The day on which the salary was received on the employee’s bank card. From now on, he can receive his salary and use it at his own discretion.

What document confirms the actual date of payment of wages to the employee?

Employee account statement. Typically, inspectors use payment orders and registers of crediting funds to salary accounts as evidence of violations. This mistake will allow you to successfully challenge the order and fines in court (Articles 26.2, 26.11 of the Code of Administrative Offenses of the Russian Federation).

Is it worth transferring salaries strictly on the established days in order to completely exclude claims from the State Tax Inspectorate?

No, it is better to prepare the necessary payment documents in advance and submit them to the bank in advance. It is risky to send payments on paydays: due to any force majeure situation, employees' salaries will be received with a delay. This is a more serious violation than premature payment (Part 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

What if the organization sent the payment on time, but the funds arrived on the employee’s card later than the payday?

Compensate employees for delayed wages for each day of delay in the amount of no less than 1/150 of the key rate of the Central Bank of the Russian Federation of the amount not paid on time (Article 236 of the Labor Code of the Russian Federation). The employer is financially responsible for the delay in wages, regardless of whether it is his fault or not.

Important Takeaways

1. The law does not prohibit transferring wages to an employee earlier than established by the employment contract, PVTR or collective agreement. The main thing is that the interval between payments does not exceed half a month. If the gap is larger, the inspector may impose a fine.

2. Pay December salaries as usual on the days established by internal documents. If the interval between the salary for December and January is more than half a month, you can pay part of the amount in December, and the final payment in January.

3. If the inspector finds fault with early pay, prepare a written explanation of why this is not a violation. Refer to the fact that paying wages ahead of schedule does not create problems for the employee, but, on the contrary, improves his situation.

Salary advance in 2021: calculation in a new way

All employers must pay wages at least twice a month. Look at the wages according to the Labor Code of the Russian Federation in 2021 and what new requirements the Ministry of Labor has introduced.

Also when it is necessary to pay an advance, how to withhold personal income tax, how to calculate the amount and whether it is necessary to issue a pay slip to the employee. Use it to avoid problems with inspectors Download>>> Salaries according to the Labor Code of the Russian Federation must be paid at least every half month. At the same time, specific dates are established by the company’s internal regulations.

Therefore, during one working month, an employee must receive wages at least twice. An advance is that part of the salary that an employee receives for the first half of his working month. However, there are two documents that contain such information: