- the employer at the main place of work prohibits employees from working anywhere else;

- pensioners and people with disabilities agree not to legalize relations with the employer, so as not to lose the opportunity to receive social benefits for disability or an annual increase in pensions;

- there is no possibility of official employment, for example, for foreign citizens;

- the person does not have the necessary documents for work, for example, a medical certificate or driver’s license;

- a person agrees to work without registration in order to avoid paying alimony or debts under writs of execution;

- the employer offers a higher salary due to tax savings.

Without formalizing an employment relationship, an employee cannot count on the required social guarantees; difficulties also arise in the case of payment of compensation for an injury received at work. Fulfillment of labor duties without proper registration is not taken into account when calculating the amount of the pension and does not count towards the insurance period.

The employer takes the risk associated with the lack of official relations with employees, due to savings on paying taxes and other contributions to the budget, maintaining personnel records, and accounting.

However, such a scheme for hiring labor makes it impossible to hold the employee financially liable for damage caused to the employer.

List of documents

- The most important thing is the citizen's identity card. First of all, this is a passport. The following will help you verify your identity in the absence of the main document: driver’s license, international passport. A photo provided will confirm the match.

- If you are a resident of another state, registration is required. The Labor Code establishes that if you live in another city and are not registered at your place of residence, the employer cannot refuse you employment. It is not logical for organizations to accept such personnel. If the position involves financial responsibility, this is fraught with consequences.

- , a state pension insurance certificate is drawn up by the employer.

- An individual taxpayer number is a document that is not included in the list of required papers. The organization should not make reference to it. If you are an individual entrepreneur, this is your responsibility. In practice, they still ask to present such a document. It's easy. The tax office at your place of residence will quickly issue a TIN.

- Employment history . Its presence is necessary. Without it, employment at the official level is impossible. When working part-time, a work book is not required. The HR specialist is obliged to provide and formalize it, subject to employment for the first time.

- Persons liable for military service and people subject to conscription are required to have military identification cards. This category consists of men. Their age is 18-27 years. Conscripts provide identification. Citizens in reserve - a military registration card (military) or a certificate of temporary affiliation.

- Qualifications, certain skills, special training are confirmed by education ( certificates, diplomas ). Sometimes even sports certificates can come in handy. There is a personal example when an employer, when choosing two candidates with similar work experience, knowledge, age and gender, chose a candidate with sports achievements.

- Certain areas of activity require a medical examination. A medical book is needed in trade, medical professions, in the field of catering and education. Sanitary and epidemiological supervision draws up the necessary documents. Lack of health confirmation by government centers is the reason for refusal of employment.

The specifics of the work determine a number of additional papers in individual cases. Article of the Labor Code No. 65 establishes the necessary list.

Fine

If the fact of work without registration is proven, then the liability will be as follows:

- A legal entity may be subject to a fine, the amount of which can reach 100 thousand rubles.

- Responsible officials will also receive a fine of up to 20 thousand rubles.

In some cases, an enterprise may be forced to compensate officially unpaid wages for the entire period of actual employment.

There is also tax liability. The fact is that with such registration of employees, there is evasion of not only income tax, but also payments to social funds.

It should be noted that usually in such companies accounting, registration of personnel and other documents are not carried out in whole or in part. And this may entail additional liability.

It is important to know

- Written form is required when drawing up an employment contract. The document has two copies. Request your copy.

- When signing that you have read all the local documents of your place of work (bonus regulations, travel regulations, set of work rules within the team, job descriptions), be sure to read all of the above.

- The acceptance document is the order. Everything is recorded in the work book. You need to fill out an application. This will serve as the basis for admission.

- The prohibition of contract terms that reduce guarantees or limit rights is established by law. Article No. 9 of the Labor Code excludes violation of the basic provisions of labor relations. The Code acts as a guarantor.

- Article No. 67 of the code regulates the obligation to sign an agreement within 3 working days.

- Regardless of the signing of the agreement, the beginning of the relationship will be an actual crime to duty. In court, the absence of an agreement will negatively affect the proceedings. You will prove the fact of labor. It will be hard. The contract is your assistant and protector. Take it seriously, because it regulates your life.

Recruitment

The law on the employment of an employee contains regulations for the procedure, a list of documents required to be provided to the employer and the personnel department.

What acts protect the rights of an applicant for a position:

- the Labor Code of the Russian Federation in chapters 10 and 11 contains the procedure for drawing up labor agreements and work books containing data on the length of service of the citizen being accepted;

- Government Order No. 225 dated 2003, with amendments and additions made in 2008, Labor Ministry Order No. 69 dated 2003 contains regulations on how to correctly fill out a work book, how to keep records and store forms that take into account the length of service of working personnel;

- State Statistics Committee Decree No. 1 of 2004 offers an example of documents created when employing an employee: orders for registration, a sample personal card.

Resolutions were adopted at the state level and are mandatory. Violation threatens the perpetrators not only with fines, but also with administrative penalties. This applies to employees and managers, even heads of institutions.

The fact of non-compliance with the requirements of the law is discovered as a result of an inspection by the inspectorate for supervision of the implementation of labor legislation.

When a new employee is hired, the employer needs to understand who he is recruiting.

Basic rules for official employment:

- The first step is to check the papers provided by the applicant. To perform official duties, certain knowledge and qualifications may be required. Therefore, you should not be surprised if the employer asks you to provide documents confirming special education or the presence of the necessary skills;

- the employee familiarizes himself with internal documents regulating the behavior of the enterprise’s employees and requirements for appearance. A document on non-disclosure of trade secrets must be signed. These documents are signed personally by the employee;

- the HR department or an authorized employee prepares a form of employment contract or agreement. The paper is provided to the applicant for review and, upon agreement with all conditions, is signed. The agreement has two copies: one remains in the HR department, and the second is given to the employee;

- An order is being prepared for the enterprise to hire a new employee for a position. Here they indicate the workplace, department, salary, duration of the probationary period;

- The employee personally fills out a personal card. Form T-2. The information received about the new employee is sent to the accounting department and entered into a time sheet that takes into account the time worked;

- filling out a work book. If this is a citizen’s first job, then this form is created and executed directly by the employer.

The first point of the procedure was to check the information provided by the person about himself, education and experience.

So, what is needed to get hired for a job in a company:

We recommend you study! Follow the link:

Procedure for dismissing an employee due to transfer

- document confirming the identity of the applicant. As a rule, a passport is required. Law No. 65 of the Labor Code of the Russian Federation says that you can provide another piece of paper that will verify personal information about the applicant. Additionally, they may require an identification number issued by the tax authority;

- confirmation of work experience before this enterprise. The work record remains in the HR department until the employee is dismissed;

- information about the education received. When accepting a citizen for a job that requires certain skills and abilities, confirmation is needed that the person has the specified knowledge;

- certificate from a medical institution;

- SNILS. The employer issues an insurance certificate independently if the employee is hired for the first time;

- Men provide the HR department with information about registration with the military registration and enlistment office;

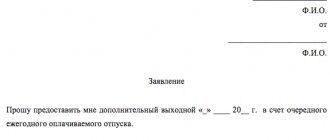

- The hired employee writes his or her own application for employment.

The documents provided must contain reliable information about the employee. Otherwise, the employer has the right to apply Article 81 of the Labor Code and dismiss. Not only does a citizen face administrative liability, but also criminal liability for forgery of information.

Unofficial employment

The phenomenon of informal employment does not lose its relevance and has always existed. This path is possible if you enter into a civil law agreement. In this case, the employer does not pay taxes. An employee receives an offer to increase their salary above the market rate. It's profitable. But is it as profitable as it seems at first glance? You will lose your right to a pension. The country's budget is losing billions.

Advantages of informal employment for the employer:

- no need to pay the state social insurance pension fund;

- the possibility of terminating informal labor relations with an employee at any time after he has completed the required amount of work;

- no need to notify the employee about layoffs or payment of compensation;

- lack of document flow related to the hiring, employment and dismissal of an employee;

- no additional payments;

- non-compliance with the work and rest regime.

Advantages of informal employment for an employee:

- higher income due to the absence of the need to pay personal income tax (NDFL), contributions to extra-budgetary funds;

- the ability to terminate the contract without obligation;

- the possibility of evading obligations, alimony payments, and debt to the bank.

Positive aspects of official employment

Undoubtedly, such employment has a lot of advantages for the employee:

- Receiving remuneration clearly established in the employment contract .

- Employees of organizations and enterprises have the right to health and social insurance . In case of illness, they receive temporary disability benefits.

- The employee has the right to vacation . Annual paid leaves and additional ones related to training are provided.

- Some categories of workers, such as disabled people, women with children, of an age determined by law, have benefits established by law.

- The enterprise makes deductions from the wage fund amounts to the Pension Fund.

- The employee has a length of service , on the basis of which the pension is calculated.

- Upon dismissal due to staff reduction, those dismissed are entitled to compensation payments .

- Unemployment benefits for laid-off employees are much higher.

Not all employee rights approved by labor legislation are listed. Working officially, a citizen has a number of advantages that are not directly outlined in the laws.

When receiving loans from a bank or other financial institution, as a rule, employees of the financial institution pay attention to the place of work of the potential borrower . Banks require a certificate of the client's salary. The period during which the borrower worked in his last place is also taken into account.

When obtaining a visa to some countries, you will need not only a certificate from your permanent place of employment, but also a salary certificate .

When applying for employment in a new place, the personnel service of the enterprise checks the entries in the work book about the previous place of work . It is not uncommon to request written characteristics of an employer. As a rule, preference is given to an applicant who has proven work experience in the required specialty.

Responsibility for informal employment

The employer is forced to consider the following options for liability when evading official registration of labor relations:

- administrative punishment. Penalties. The size is 50 thousand rubles;

- a ban on the activities of the organization until the circumstances are established and legal proceedings;

- profit deductions. Based on the decision of the tax authorities, deductions of funds may be 20%;

- fines, the amounts of which may vary.

Risks of informal employment for an employee:

- Non-payment of wages for work performed;

- Failure to provide leave;

- Refusal to provide social guarantees;

- Refusal to pay sick leave.

How is it beneficial for the employer and employee?

Such relationships are to some extent beneficial to both the employee and the employer.

That's why they are so popular. Pros for the employer:

- You will not have to pay contributions to the Pension Fund and Social Insurance Fund. The obligation to transfer insurance amounts to extra-budgetary funds is assigned to employers. Therefore, the main reason why enterprises prefer not to formalize a relationship with an applicant is the opportunity to save money.

- The hiring and dismissal of personnel is not accompanied by lengthy procedures established by law. If an organization decides that it no longer needs the services of a person, then the parties can terminate the employment relationship at any time. In this case, you will not have to wait for a set deadline, send notices of layoffs, pay certain compensation, etc.

- An employer can find a person for urgent work. For example, in the event of illness of a main employee, the employer finds an employee to temporarily perform certain duties.

- You won't have to pay for downtime. According to the Labor Code of the Russian Federation, if a worker cannot carry out activities for reasons beyond his control, for example, due to equipment breakdown, the enterprise is obliged to pay for this time. If an agreement has not been concluded with him, these amounts do not need to be transferred.

- There is no need to maintain personnel document flow. The lack of official registration allows the company not to burden itself with drawing up certain reports, filling out work books, personal files and other things.

- You can not pay wages, vacation pay, or violate the law. Sometimes unscrupulous employers specifically look for workers who agree to such conditions in order to obtain the necessary services from them without paying the agreed amount. Some practice a ban on providing employees with paid non-working time, most often this happens with educational leave and sick leave. Since a person does not formally have any rights, he cannot complain to government authorities.

There are also some benefits for the employee:

- Higher wages. In this case, the employer does not charge personal income tax or pay contributions to extra-budgetary funds, so he gets the opportunity to set a salary level that will be beneficial not only to him, but also to the employee.

- Limited legal liability. If a person is not officially registered, he does not bear any responsibility for material damage. This fact is the biggest advantage in this type of work.

- Possibility to avoid payments under writs of execution. Officially, a person is unemployed, so he may not pay alimony and some other amounts, for example, loan deductions.

- Opportunity to work if you cannot get an official job. Sometimes a person wants to find a source of additional income, a part-time job for a short time. Formalization in this case can be difficult, since the main employer sometimes prohibits such activities. Sometimes people deliberately look for such a job because they cannot get a job under an employment contract. This applies to pensioners, disabled people, and women on maternity leave.

It is these reasons that most often prompt employers and employees not to properly formalize their employment relationships.

GPC difference from an employment contract

The Supreme Court provided clarification. The court revealed a violation of procedural and substantive rules of law by lower courts that considered such disputes.

A number of differences:

- A certain action is performed by a person for payment under a service agreement. The deadline is clearly defined. In an employment contract, a person performs a labor function established by the employer. The deadline is not always clearly defined.

- The risks of a civil agreement are borne by the contractor. Loss of official employment is borne by the employer.

- A service provided one or more times is a feature of the GPC agreement. The Contractor has the right to delegate functionality to a third party. The labor responsibility belongs to the employee in the employment contract. He performs it every day, that is, he directly participates in the labor process.

- In both options, the process is important. In one case this is consolidated, in another it is not.

Negative aspects of official employment

Along with the positive aspects of official employment, in some life situations, working without an employment contract will be more preferable:

- Along with rights, a person receives responsibilities . In some cases, an agreement on full financial responsibility is signed with the employee.

- An employee of an organization is obliged to comply with labor discipline approved at the enterprise where he works.

- withholds income tax from the amount of earnings .

- When dismissing an employee who violated internal regulations and committed other offenses, a corresponding entry .

- Upon dismissal of one's own free will, the employer has the right to oblige the employee to work for a certain amount of time .

- In cases where enforcement proceedings , amounts are withheld from his earnings, according to the enforcement documents.

- In some cases, an employment contract may prohibit external combinations .

Very often, working without registration is beneficial to certain categories of the population . Pensioners very often take up such work because it is economically profitable. Only from August 2021, working pensioners will receive pension indexation in full. Until this time, pensions for this group of pensioners were not indexed.

Students often work in low-paid jobs . The positions for which they are accepted do not always correspond to the professions chosen by future specialists.

Sometimes unofficial earnings are much higher , and this attracts some people. The amount of earnings increases due to the employer’s savings on unpaid taxes and contributions.

In most cases, employment is required in accordance with current legislation . While receiving little benefit from informal work, a person loses a lot without even realizing it. Firstly, he loses the feeling of being protected by the current legislation. Secondly, he will not have an insurance work history necessary for calculating a pension. The required insurance contributions, which have a great impact on the size of the future pension, are not transferred. Thirdly, by concluding only a verbal agreement, a person runs the risk of being defrauded with payment . Promised vacations and other benefits may remain just promises. These are just the main disadvantages of unofficial work.

GPC - how to reclassify it as an employment contract

Previously, only the court had the right to make a decision (Part 4 of Article 11 of the Labor Code of the Russian Federation). Article 19.1 of the Labor Code of the Russian Federation in the new edition has changed this provision. She found that retraining was possible using the following options.

First option. Phys. a person, namely the performer, writes a statement to the customer.

Second option. The labor inspectorate or tax authority files a lawsuit.

Third option. A person performing labor duties files a claim in court if the customer has ignored a written request.

Fourth option. The labor inspector writes a presentation document. It has not previously been appealed in court. The employer fulfills the obligation as prescribed.

When considering a claim in court, the dispute will be interpreted in the direction of the employment contract (Part 3, Article 19.1 of the Labor Code of the Russian Federation). A disadvantage is created for the employer. All relationships will be considered labor relations from the date of their execution. Payments, compensations, and contributions to the employee will have to be compensated. The plaintiff has the right to demand compensation for moral damage. Most likely, the court will grant the claim. During judicial retraining, the assistance of lawyers is necessary.

What does an employer face for hiring an undocumented employee?

In a conflict situation, a citizen can file a complaint with the Labor Inspectorate and the Federal Tax Service, based on the results of which inspections will be carried out. The employee also has the right to file a claim in court . To do this, it is necessary to collect evidence, which can be presented: a pass to the workplace, invoices, acts, contracts and other documents. In addition, the applicant can invite clients and colleagues to court as witnesses.

Punishment for the employer

For unofficial employment, the employer is legally liable:

- in accordance with Art. 5.27.1 of the Code of Administrative Offenses provides for a fine for unofficial employment for officials and individual entrepreneurs in the amount of 2,000 to 5,000 rubles, for organizations from 50,000 to 80,000 rubles;

- according to Art. 123 of the Tax Code of the Russian Federation for failure by a tax agent to fulfill the obligation to withhold and transfer taxes - collection of a fine in the amount of 20 percent of the amount to be transferred to the budget;

- according to Art. 143 of the Criminal Code of the Russian Federation, violation of labor protection requirements, if this entailed through negligence the infliction of serious harm to human health, is punishable by a fine of up to 400,000 rubles, up to imprisonment for a term of up to one year.

Distant work

Anyone can work remotely. This is an excellent option for modern communication via the Internet. The contractor and the customer may be separated by several kilometers, cities or even countries. For example, a lawyer advises clients online, an accountant sends reports, a teacher teaches courses. This is possible from anywhere in the world, from any convenient location. An important condition for smooth operation is Internet access. The customer has the right not to pay personal income tax if the contractor is located in the territory of another state.

A full-time employee of the company also has the opportunity to work remotely. In this case, an agreement on remote work is concluded (Article 312.1 - 312.5 of the Labor Code of the Russian Federation).

Draw up a GPC agreement or employment relationship for a freelancer? The issue is resolved by agreement of the parties. Conclusion and registration occurs exactly the same as offline. In practice, the customer prefers not to enter into a contract at all. Be careful, never poison the originals of your documents.