When is maternity benefit calculated based on the minimum wage?

If the employee had no earnings at all for the 2 years preceding the year she went on maternity leave, the benefit is calculated based on the minimum wage (clause 11(1) of the Regulations on the specifics of the procedure for calculating benefits, approved by Decree of the Government of Russia dated June 15, 2007 No. 375).

The following formula is used for this:

(minimum wage x 24: 730) x DO

24 - the number of months over two years during which the benefit is calculated;

Articles on the topic (click to view)

- Is sick leave considered income?

- What to do if you have extended sick leave for pregnancy and childbirth

- What to do if your employer does not accept electronic sick leave

- What to do if you are not given sick leave

- How many days does it take for sick leave to arrive from the Social Insurance Fund?

- What to do if the place of work is not indicated on the sick leave

- Are sick leave taken into account when calculating maternity leave?

730 is a fixed value equal to the number of days in two years;

DO - number of days of maternity leave.

The duration of leave under the BiR depends on how many children were born and how the birth itself went:

- 140 days - during pregnancy with one child and uncomplicated childbirth;

- 156 days - during pregnancy with one child and complicated childbirth;

- 194 days - when pregnant with two or more children.

BENEFIT SIZES FROM JANUARY 1, 2021: TABLE

In the table we present the new benefit amounts from January 1, 2021 and compare the changed values with 2021. New values in the table are highlighted.

| Type of benefit | by the end of 2021 | from January 1, 2021 |

| Benefit for registration in early pregnancy | RUB 628.47 | RUB 628.47 |

| One-time benefit for the birth of a child | RUR 16,759.09 | RUR 16,759.09 |

| Minimum monthly allowance for child care up to 1.5 years | RUR 4,465.20 | 4512 rub. |

| Maximum monthly allowance for child care up to 1.5 years (per child) | RUB 24,536.57 | RUB 26,152.33 |

| Minimum amount of maternity benefit |

|

|

| Maximum amount of maternity benefit |

|

|

| “Putin” monthly payments for the first and second child | See “Amounts of Putin’s benefits in 2021 by region.” | Depends on the subject of the Russian Federation |

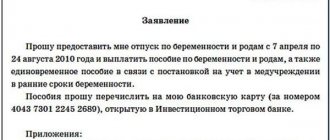

A pregnant woman who has an official place of work can obtain a sick leave certificate for pregnancy from a medical institution and provide it to the employer for the calculation and payment of B&R benefits.

The amount of maternity benefits depends on the woman’s income, but the benefit cannot be lower than the minimum allowable value calculated from the minimum wage.

From January 1, 2021, this amount is RUB 51,919.

An example of calculating maternity benefits based on the minimum wage

Let's consider several situations.

Example 1

Lawyer Stepanova A.S. is pregnant with her first child. Worked in the organization for 7 months. I had no earnings in 2021 or 2021. The birth took place without complications.

Example 2

The conditions are the same, but the employee is pregnant with twins, and the birth was complicated.

Example 3

The employee is pregnant with one child, the birth was without complications. In 2021 and 2021, I worked under an employment contract and had a small income:

In this case, the benefit must be calculated in two ways:

Then choose the largest benefit amount.

Since maternity leave according to the minimum wage is greater than the benefit calculated based on average earnings, the employee will receive 55,831.23 rubles.

The following articles will help you calculate benefits in other situations:

Let's sum it up

- If there is no earnings in the two years preceding maternity leave, maternity benefits are calculated based on the minimum wage established at the beginning of the year the employee goes on maternity leave.

- The amount of the BiR benefit in 2021 for an employee without earnings is 55,831.23 rubles.

- If a woman had a small income (under an employment or civil contract), the B&R benefit must be calculated first according to average earnings, then according to the minimum wage, and then select the one where the amount of maternity benefits was greater.

If you find an error, please select a piece of text and press Ctrl+Enter.

When is the minimum B&R benefit paid?

Expert opinion

Lebedev Sergey Fedorovich

Practitioner lawyer with 7 years of experience. Specialization: civil law. Extensive experience in defense in court.

The minimum amount of the benefit will be if the employee worked for less than six months before going on sick leave according to the BiR (we are talking about the total length of service).

Benefits should also be calculated from the minimum wage in cases where the average daily earnings are lower than the minimum possible.

In other situations, the payment is assigned according to the average daily income, and its size does not depend on the length of service (as with the payment of regular sick leave), but is limited by the maximum limit (more information about the maximum benefit amount is here).

Example of calculating maternity benefits

The accountant calculated the benefit based on the employee’s average earnings:

The woman will receive the entire accrued amount in her hands, since this type of benefit is not subject to income tax.

Minimum maternity payments in 2021 should be assigned without taking into account the percentage of payments based on length of service. If a woman with 2 years and 3 months of experience were accrued regular sick leave, the average daily income in the calculations would only be partially taken into account (in the amount of 60%), but for maternity benefits this rule does not work - 100% of the average income is always taken.

Minimum wage from 01/01/2019 for 140, 156 and 194 days of maternity leave

The B&R minimum benefit is a maternity leave payment provided to those pregnant employees who do not have sufficient income to receive higher pay.

This amount is a guaranteed minimum payment that a woman will receive if she does not have sufficient work experience or income.

Moreover, if a regional coefficient has been established in the region , then it must be reduced by the minimum maternity benefit established for the year the maternity leave began.

The minimum wage depends on the minimum wage and is calculated using the formula:

Min.average daily wages = Minimum wage * 24 months. /730 [/stextbox]

- Min.average daily wages — this is the minimum average daily earnings, calculated from the minimum wage;

- days of maternity leave - the number of days of maternity leave, according to the sick leave (three options are possible: 140, 156 or 194);

- 24 months — this is the number of months in the billing period for calculating maternity benefits;

- 730 - the number of days in the billing period, which is taken to calculate the minimum benefit.

In 2021, the minimum maternity payment is calculated as follows:

Min. allowance for BiR in 2021:

- for 156 days = 370.85 * 156 = 57852.60 rubles;

- for 194 days = 370.85 * 194 = 71944.90 rubles.

All employed women are entitled to 140 days of maternity leave during normal pregnancy.

156 days of maternity leave are granted to pregnant women whose childbirth was complicated; 16 days are added to the standard duration upon discovery of relevant circumstances.

194 days are provided for pregnancy with twins, triplets or more.

Minimum amount of maternity payments in 2021

In general, to calculate maternity benefits, add up payments from the previous 2 years (subject to Social Insurance contributions) and divide them by 730 days, or 731 if there was a leap year (Article 14 of Law 255-FZ).

When going on maternity leave in 2021, the taxable income of 2021 and 2021 is summed up. In this case, the calculated benefit is compared with the benefit calculated from the minimum wage valid on the day the employee goes on leave under the BiR. (from January 1, 2020, the minimum wage is 12,130 rubles per month - law dated December 27, 2019 No. 463-FZ).

Thus, the minimum amount of maternity pay in 2021 for 1 day of leave according to the BiR will be:

12 130 x 24 months. : 730 = 398.79 rub.

If the actual daily allowance is higher than the allowance from the minimum wage, vacation pay under the BiR is calculated based on the woman’s actual earnings; if it is lower, it is calculated according to the minimum wage.

Example

The employee is going on financial and economic leave in January 2021. Her salary accepted for calculation for 2021 is 98,370 rubles, for 2021 - 96,540 rubles.

The accountant first calculated the employee’s average daily earnings (actual) for the billing period:

(98,370 + 96540) : 730 = 267.00 rub.

Then he compared it with the minimum daily allowance:

RUB 267.00 < RUB 398.79

Since the minimum amount of maternity benefits turned out to be greater than the allowance from the actual salary, the amount of payments will be calculated by an accountant from the minimum wage - 398.79 rubles each. for each day of vacation according to BiR.

In order to accrue maternity benefits in full, it is necessary to take into account the duration of leave according to the BiR: multiply the daily amount of the benefit by the number of days the employee is absent.

What is the minimum maternity benefit, labor and sick leave?

There is a minimum daily average earnings limit for calculating maternity benefits. Use it if the employee has no earnings during the billing period or is less than the minimum wage as of the start date of maternity leave.

This is important to know: Sick leave at your own expense at work

Take monthly earnings for the billing period as equal to one minimum wage per month, the formula is as follows:

Minimum average daily earnings = minimum wage as of the start date of maternity leave x 24: 730

If in the area where a woman works, regional coefficients are established by law, then when calculating maternity benefits based on the minimum wage, take such coefficients into account.

An example of determining the minimum limit of average daily earnings for calculating maternity benefits

Employee of Gazprom LLC E.V. Ivanova brought a sick leave certificate confirming her maternity leave. The vacation period is 140 calendar days - from July 17 to December 4, 2021 inclusive. Ivanova’s insurance experience is more than six months.

The billing period is 2017–2018. The number of calendar days in the billing period is 730.

The employee works full time, Gazprom LLC is located in the Krivosheinsky district of the Tomsk region, where the regional coefficient is set at 1.3.

An exception is the situation when there was no earnings in the billing period or the actual average monthly earnings turned out to be lower than the minimum wage for an employee for whom a part-time working regime was established at the time of the insured event. In this case, the average salary from the minimum wage for calculating benefits must be determined in proportion to the employee’s working hours.

This procedure follows from the provisions of Part 1.1 of Article 14 of the Law of December 29, 2006 No. 255-FZ, paragraph 15.3 of the Regulations approved by Government Decree of June 15, 2007 No. 375.

INDEXATION OF BENEFITS FROM JANUARY 1, 2019

There will be no indexation of child benefits from January 1, 2021. In 2019, child benefits will be indexed only from February 1, 2019. The indexation coefficient is approved by the Government of the Russian Federation (Federal Law dated December 19, 2016 No. 444-FZ.) Indexation from February 1, 2019 will affect the following benefits:

- a one-time benefit for women who registered in the early stages of pregnancy;

- lump sum benefit for the birth of a child;

- monthly child care allowance.

In this regard, from January 1 to February 1, 2021, “children’s” benefits should be paid in the same amounts as in 2021. Let us summarize the amounts of “children’s” benefits in the table from January 2021.

| Type of benefit | Size from January 1, 2021 |

| Benefit for registration in early pregnancy | RUB 628.47 |

| One-time benefit for the birth of a child | RUR 16,759.09 |

In regions where regional coefficients are established, the minimum benefit amount is determined taking into account the coefficient (Part 6, Article 7, Part 3, Article 11 of Law No. 255-FZ of December 29, 2006).

Minimum, Maximum amount of maternity benefits, benefits for Pregnancy and Childbirth (B&R) 2021

The total amount of the maternity benefit in 2021 should be in the range from the minimum maternity benefit to the maximum amount of the B&R benefit:

Maximum maternity payments for pregnant mothers in 2021

Expert opinion

Lebedev Sergey Fedorovich

Practitioner lawyer with 7 years of experience. Specialization: civil law. Extensive experience in defense in court.

Knowing the maximum allowance per day, we will obtain the maximum maternity allowance in 2021 for normal childbirth with a leave duration of 140 days:

For women and expectant mothers whose insurance period does not exceed six months, the minimum wage is taken as the basis for the amount of maternity benefits.

The minimum maternity pay in 2021 will be:

Depends on the minimum wage - the minimum wage for the calculation period

Unlike regular sick leave, maternity leave is always paid 100% of the average salary, regardless of length of service.

Comparative table by year

Below is a table showing, for comparison, the minimum and maximum amounts of maternity benefits when calculating maternity benefits in 2021 and 2021.

A pregnant woman cannot receive maternity benefits that are less than the minimum and more than the maximum; the amount to be paid must be between the established limits.

| Year of the beginning of the maternity leave for BiR | Minimum size, rub. | Maximum size, rub. |

| 2019 | 51 919, 00 | 301 095, 20 |

| 2018 | 51 380, 00 | 282 493, 00 |

Sick leave for pregnancy and childbirth

One of the types of temporary disability certificate is maternity leave (Maternity Sick Leave). The document is needed so that a woman can apply for maternity leave and maternity benefits .

- Sick leave determines the start and end date of the period of incapacity for work in connection with the birth of a child.

- of maternity payments depends on the number of days indicated on the sheet .

First of all, sick leave is needed by working women who are insured against temporary disability. It also needs to be completed for women:

- those in the public service (in the internal affairs bodies, the penetration service, customs and other organizations);

- those who lost their jobs due to the liquidation of an enterprise and registered with the employment service within a year after that (for the period of incapacity for work, they are accrued maternity benefits, and unemployment payments are temporarily suspended);

- individual entrepreneurs (IP) who voluntarily joined the compulsory social insurance system and pay insurance contributions to the Social Insurance Fund (SIF).

WHAT BENEFITS ARE CALLED “CHILDREN’S” IN 2021?

“Children’s” benefits usually include payments related to the birth of children. The list of federal “children’s” benefits is given in the Federal Law of May 19, 1995 No. 81-FZ “On State Benefits for Citizens with Children.” Let's consider how, from January 1, 2021, the amounts of the most frequently paid “children’s” benefits will change (increase), namely:

- benefits for registration in the early stages of pregnancy;

- lump sum benefit for the birth of a child;

- monthly child care allowance up to 1.5 years;

- maternity benefits.

These benefits are paid by the employer. Therefore, if an organization or individual entrepreneur has employees to whom he is obliged to pay child benefits, then the employer should know the amount of child benefits from January 1, 2021. However, we note that in certain regions of the Russian Federation a pilot experiment is being conducted to pay benefits directly from the Social Insurance Fund budget. FSS units in the experimental regions themselves calculate and pay “children’s” benefits to employees.

Also in 2021, the Federal Law of December 28, 2017 No. 418-FZ “On monthly payments to families with children” is in force. It provides for two monthly “Putin” payments for children – for the first and for the second child. The right to receive a monthly payment in connection with the birth (adoption) of the first or second child arises if the average per capita family income does not exceed 1.5 times the subsistence level of the working-age population established in a constituent entity of the Russian Federation. Many people also call these payments “benefits”, so we also paid attention to them in this article.

How is sick leave paid?

One of the two main purposes of sick leave is to become the basis for calculating social insurance benefits. Each day of incapacity for work according to the BiR is paid in the amount of 100% of the woman’s average earnings for two calendar years before going on maternity leave.

Calculation and payment of sick leave are carried out according to Russian legislation from contributions to the Social Insurance Fund . Even if the employer transfers benefits to the woman’s account, then he writes an application for reimbursement , and the funds are compensated to him by the Fund.

- Most other disability benefits are paid jointly by the employer and the Social Insurance Fund (the former pays for three days in the beginning, the fund for the rest of the time).

- For Russian women and foreign citizens working in the Russian Federation under an employment contract and insured against disability, sick leave under the BiR is paid the same.

How many days of maternity leave are payable?

Formally, maternity leave consists of two parts - prenatal and postnatal . Their duration varies depending on the circumstances of pregnancy and childbirth. According to Art. 10 of Law No. 255-FZ of December 29, 2006, a woman insured against temporary disability is paid:

- 70 days of sick leave according to BiR before childbirth (84 days for multiple pregnancy);

- 70 days - after the birth of the baby (86 - for postpartum complications, 110 - for the birth of several children at the same time).

This is important to know: Application for sick leave in the Social Insurance Fund

Days are counted from the conditional date of the expected birth. If they move in one direction or the other, the total number of days of maternity leave is still paid for the entire period of maternity leave:

- 140 days - in general;

- 156 days - if complications occurred during childbirth;

- 194 - when twins are born.

- If complications arise during childbirth or a multiple pregnancy is established, the medical organization where the birth took place issues additional sick leave for 16 or 54 days, respectively. They must also accrue and pay benefits for them.

- In the case where the payment has already been transferred to the woman for 140 days, a recalculation .

Several additional days of sick leave are also paid by law for women living or working in areas contaminated after the accident at the Chernobyl nuclear power plant, or the dumping of waste into the Techa River.

- Pregnant women from these regions go on leave according to BiR at 27 weeks .

- Before giving birth, they are paid for 90 (rather than 70) days, and maternity leave generally lasts 160 paid days .

Is maternity sick leave subject to personal income tax?

Personal income tax - personal income tax (income tax). In fact, maternity benefits, like payments for any other sick leave, are considered the recipient’s income . It is taken into account when applying for a subsidy and is indicated in income certificates for 3, 6 months or another period.

However, the fundamental difference between sick leave for illness or child care and sick leave for BiR is that payments for the first are subject to personal income tax, but for the second they are not. The law has a special clause in this regard.

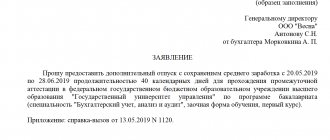

Rules for filling out sick leave

The current sick leave form in Russia was introduced in 2011 (Order of the Ministry of Health and Social Development No. 347n dated April 26, 2011). It is equipped with many degrees of protection against possible counterfeiting. The first part of the sick leave is filled out at a medical institution.

- It is recommended to fill out the form using printing media (printer). This speeds up the process and eliminates errors due to handwriting characteristics.

- When filling out manually, do not use a ballpoint pen. You can only use gel, pen or ink with black ink.

- Only printed capital Cyrillic letters are allowed.

- Filling out is done in Russian.

- Errors, blots and cross-outs are not permitted. The damaged form must be replaced with a new one.

- Letters are written in special cells, starting from the first cell in each line. You cannot go beyond the boundaries of the cell.

Filling out a certificate of incapacity for work by the employer

The second part of the sick leave according to the BiR is filled out by the employer.

- All the rules listed above regarding ink color, capital letters, and the features of filling cells must

- The employer checks that the doctor has filled out the form correctly. After all, the Social Insurance Fund may refuse to pay if the organization accepted sick leave with errors .

- The name of the organization can be indicated in full or in an abbreviated version in accordance with the constituent documents. There are only 29 cells provided for this on the sick leave. If there is no abbreviated name, and the full name does not fit, you can cut it off arbitrarily. The main thing is not to go beyond the cells. Dots, dashes, quotation marks, and other punctuation marks can be written or omitted.

- You need to fill in the column with the registration number of the policyholder, by which you can identify the latter. The number and code of subordination is taken from the report in Form 4-FSS.

- The employer must indicate the total amount of benefits paid and other required data (after calculation by the accounting department).

- The insurance period is indicated on the day of maternity leave. What matters here is whether the woman worked for the employer for more or less than six months.

Expert opinion

Lebedev Sergey Fedorovich

Practitioner lawyer with 7 years of experience. Specialization: civil law. Extensive experience in defense in court.

The employer must remember that minor flaws when filling out sick leave on the part of him or the doctor cannot be grounds for re-issuing the document.