When going on maternity leave, an employee submits the necessary documents to the employer, including a certificate of earnings for 2 years, which will help to correctly calculate maternity benefits. The rules and features of the calculation are set out in Law 255-FZ.

Increasing the benefit from 1.5 to 3 years of age for a child to the subsistence level from 2021 - the latest news.

Rules and formulas for calculation

To calculate a monthly maternity benefit for a child up to 1.5 years old, you first need to calculate the average daily earnings for the last 2 years, then compare it with the permissible limits, and then calculate the amount of the benefit.

The formulas for calculation are as follows:

Benefit up to 1.5 = 40% * Average daily earnings * 30.4 (30.4 is the average monthly number of days).

Average daily earnings = Income for 2 years / (Number of days in 2 years - Excluded periods).

In general, the calculation algorithm is as follows:

- The accountant sets the billing period and counts the number of calendar days in it.

- It is determined whether there is a right to replace the accounting years.

- The presence of excluded days is checked.

- The total income for 2 years is calculated.

- Average daily earnings are calculated.

- The resulting value is compared with the minimum and maximum.

- A monthly allowance is considered.

General rules and important nuances are set out in Article 14 of Law 255-FZ.

When to go to work

The legislation only limits the period of rest associated with caring for a son or daughter.

The rules do not prohibit returning to work earlier than the agreed time. Therefore, the release date will be:

- next after the baby's third birthday;

- any before the specified date at the discretion of the woman.

Clue! If an employee decides to take a second care leave while on the previous one, it is taken out on the next working day after the third birthday of the first child.

How to process a vacation interruption

The employee's return to work is accompanied by the issuance of an order.

The vacationer must submit the appropriate application. Based on it, an order is drawn up. There is no special form for it. You must provide the following information:

- Position provided to the vacationer:

- the one she left with;

- equivalent;

- Start date of service;

- Cancellation of an order issued earlier (in case of early exit).

Clue! The employee is introduced to the original against her signature. Copies are sent to:

- to accounting;

- to the immediate manager (relevant for large enterprises);

- if necessary - to the employee.

When is the minimum wage taken?

The minimum wage for calculating care benefits for up to 1.5 years is taken in the following cases:

- Earnings for the last 2 years on average per month are below the minimum wage;

- there is no income in the 2nd billing period;

- work experience does not exceed six months.

In these cases, the benefit for a full month is 40% of the minimum wage for the first child, and for the second or subsequent ones - the minimum value for the unemployed, from February 1, 2021 = 6554.89 rubles.

If the work experience is less than 6 months, the following condition must be met: for a full month, the employee should not receive more than the minimum wage. Examples of calculations for less than six months of experience can be found here.

In what cases is it calculated from the minimum wage?

Monthly benefits up to 1.5 years are calculated from the minimum wage in the following cases:

- If the employee had no income .

- If the actual average earnings are below the minimum wage .

In the first case, the average daily earnings are determined by the formula:

SRDZ = minimum wage * 24: 730

When calculating, we take the minimum wage value that was established at the time the employee went on maternity leave with the child. Thus, the minimum wage in 2021 from January 1 is 9,489 rubles per month . Regional coefficients established for the area where the insured event occurred are applied to this value.

In the second case, when calculating average monthly earnings, you should compare the resulting value with the current minimum wage. If the value is lower, the benefit is calculated based on the minimum wage. In any case, the final benefit amount should not be lower than the minimum established by law.

Example, if the experience is less than 6 months

The right to parental leave is not limited by length of service. However, length of service not exceeding six months significantly affects the calculation of benefits.

Example conditions:

Employee Mazhorkina A.A. worked for an oil and gas company from December 25, 2021 with an official salary of 150,000 rubles.

On March 1, 2021, the employee is granted parental leave with payment of the required benefits.

Considering that this is her first place of work, the employee’s length of service at the time of the insured event is 3 months. and 6 days, which is less than the legal minimum.

In this case, the monthly benefit for up to 1.5 years is calculated based on the minimum wage.

The employee did not exercise the right to register temporary disability due to pregnancy and childbirth, and therefore the benefit is calculated from the date of birth of the child, that is, from March 1.

The calculation will look like this:

9,489 rubles *24 /730 = 279.09 – average daily earnings.

In this case, the leap year is not taken into account, since one more day in the year does not affect the size of the minimum wage.

We compare the daily income received with the minimum: 279.09 is less than 311.97, so we use the minimum wage rate for the calculation.

Benefit = 9489 * 40% = 3795.

We compare with the limit values. The employee has her first child, 3795 is more than 3142.33 rubles, which means the amount of her benefit will be 3795.00 rubles.

Example for low income

An employee’s salary cannot be less than the minimum wage (Article 133 of the Labor Code of the Russian Federation). But when calculating benefits, errors are common when the average monthly income is less than the minimum wage.

In this case, the benefit is calculated from the minimum wage.

9489*40%= 3795 rubles.

Examples for 2021

Example 1

Initial data:

Parental leave is issued from August 19, 2021. Earned in 2021 = 890,000, in 2021 = 715,000. In 2021 there were 12 sick days.

Calculation:

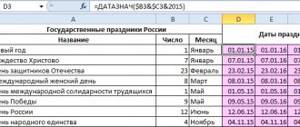

- The billing period is from 01.01.2017 to 31.12.2018. Number of days 730.

- There is no right to change years, since there was no maternity leave in the specified period.

- Excluded days = 12 days of incapacity.

- Total income = 755,000 + 715,000 = 1,470,000 (for 2021 we take into account only 755,000, since this is the maximum amount of income that can be taken into account when calculating maternity benefits).

- Average daily earnings = 1,470,000 / (730 - 12) = 2047.35.

- 2047.35 is more than the minimum daily wage (370.85) and less than the maximum (2150.68).

- Benefit = 2047.35 * 30.4 * 40% = 24,895.78.

Example 2

Initial data:

Maternity leave for up to 1.5 years is issued from December 15, 2021. In 2017, 75,000 was earned, 2021 was also not fully worked out, the income was 82,000. There are no excluded days.

Calculation:

- The billing period is from 01.01.2017 to 31.12.2018.

- There is no right to change years.

- There are no excluded periods.

- Total income = 75,000 + 82,000 = 157,000.

- Average daily earnings = 157,000 / 730 = 215.07.

- 215.07 is less than the minimum 370.85, which means that the minimum wage is accepted for calculating monthly income.

- Benefit for a full month = 11280 * 40% = 4512.

Minimum and maximum restrictions

For the unemployed

For those who are not working, social security pays a minimum amount of child care allowance.

It doesn’t matter who takes the vacation - mom, dad, grandma or another family member. The indexation of the minimum child benefit in 2021 took place on February 1, according to the previously established procedure, which was accepted as temporary for the period 2021-2021, but has now become permanent.

The indexation coefficient is approved by the Government of the Russian Federation. From January 1 to February 1, 2021, the amount of minimum maternity leave: 3,277.45 and 6,554.89 rubles. (for the first and second).

From February 1, 2021, the indicators increase to 3375.77 and 6751.54 rubles. These values are set for a full month.

To calculate for incomplete care, you need to multiply this indicator by the number of days of child care and divide by the total calendar number of days.

The maximum benefit for unemployed citizens is not relevant, since all unemployed people receive the minimum possible payment.

For working people

To establish a minimum limit for benefits, each employer is required to calculate the amount of average daily earnings based on the employee’s actual income and the minimum wage. If the result of the calculation of earnings is lower, then you need to pay 40% of the currently valid minimum wage for a full month. To calculate for an incomplete month, an adjustment is made using the formula indicated above.

From January 1, 2021, the minimum wage is 12,130 rubles, so the minimum amount of payments for children under 1.5 years old for a full monthly period is 4,852 rubles.

It is unacceptable to pay less than this amount for the first child up to 1.5 years of age.

To calculate the maximum payment up to 1.5 years, the limit for average daily earnings should be taken into account. It is calculated based on bases called the maximum for insurance premiums: 815,000 for 2021 and 845,000 for 2021. The maximum amount of care payments in 2021 is 27,651.51 rubles.

If there are two children, then a restriction is taken into account - the amount of maximum payments cannot be more than 100% of the employee’s average salary, but also less than the minimum amount.

It is important to consider when the vacation began. If an employee went on maternity leave in 2021, then there is no need to recalculate for the beginning of 2021. It is necessary to pay the amount that was calculated when going on parental leave, since according to the law, payments for up to 1.5 years are calculated once at the start of care.

Such a system is possible with continuous vacation of up to 1.5 years. If, at the beginning of 2021, an employee interrupted it and began, for example, performing work duties for a month, and then left again, then in 2021 a recalculation should be made taking into account current indicators and the amount should be paid in an increased amount.

The employee has the right to interrupt child care at any time and return to work early for a full or part-time day.

Example in 2021

Example conditions:

The employee goes on maternity leave at the beginning of 2021, and the first month will be incomplete, since he leaves on January 13. His total earnings were 700,000 for 2021 and 720,000 for 2021. There were 60 sick days over the two-year period.

Calculation of benefits for an incomplete month:

- Total income for 2 years = 700,000 + 720,000 = 1,420,000.

- Worked by employee = 730 - 60 = 670 days.

- Average daily income of an employee = 1,420,000 / 670 = 2,116.24.

- Average daily earnings from the minimum wage = 12130 * 24 / 730 = 398.79.

- Average daily earnings according to the maximum bases = (755,000 + 815,000) / 730 = 2273.97.

- The amount of income calculated in paragraph 3 is greater than the minimum possible (2116, 24 > 398.79) and less than the maximum possible (2116, 24 < 2273.97), so the benefit will be calculated based on income.

- Benefit payable for a full month = 2116.24 * 30.4 * 0.4 = 25,733.48.

- Benefit for partial January = 25,773.48 / 31 * 19 = 15,796.65.

The employee will receive an allowance in the amount of 25,733.48 for each month, and for incomplete January he is entitled to transfer 15,796.65.

conclusions

To calculate the amount of maternity leave for the period of child care up to 1.5 years, you need to sum up the salary for the billing period and divide it by the number of days in this period. At the same time, you can take away maternity days and sick leave.

The resulting average income per day is multiplied by 30.4 and 40%.

It is important that the amount of daily earnings calculated from the employee’s income does not exceed the highest limit and does not fall below the minimum acceptable value.

Payment of accrued maternity benefits is made monthly on the day of settlement with personnel for wages.

Registration procedure

The law establishes an initiative procedure for temporary retirement. Therefore, the employee must herself declare her desire to receive it. This is done in writing in the form of an application. The algorithm for providing benefits is as follows:

- The employee writes a request, indicating on the paper the start and end dates of the rest period.

- The application must obtain an executive visa. The boss has no right to refuse provision.

- After approval, the package is sent to the personnel department.

- Based on it, an order is created, a copy of which is sent to the accounting department to organize payments.

- The personnel officer makes special notes on the T-2 form.

Clue! Mom must sign the order. She is provided with the first copy with the signature of the manager and details (number and date of publication) for review. If necessary, the employee is given a copy of the order.

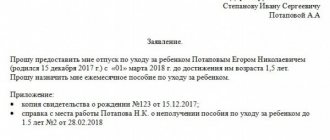

How to write an application

The general rules of personnel records management are subject to the will of the worker. It is written:

- on a blank sheet of paper

- following the format:

- header in the upper right corner: recipient data in the format position, surname and initials;

- personal data (full full name is written);

- the name of the appeal “Application” in the middle of the sheet with a capital letter;

- the essence of handling in compliance with three-centimeter margins:

- request for leave: indication of what kind of leave “to care for a child until he turns three years old”;

- start number;

- request for benefits;

- list of applications;

- signature and date.

For information! Part-time workers must submit applications for each place of employment. Maternity pay is paid by only one employer.

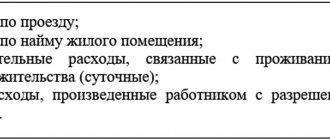

List of applications

To obtain paid time away from work, a minimum of paperwork is required. These include the following:

- the above application;

- a copy of the birth certificate of the baby;

- a certificate from the mother’s place of work stating that she continues to work if it is registered in the name of another relative.

Important! The application must indicate the desire to receive payment. Money is not credited automatically.

What is written in the order

The personnel order must fully describe all changes in the labor relationship with the employee. The following points should be included in it:

- Legislative basis: relevant article of the Labor Code;

- Type of holiday provided;

- Start and end dates;

- Instructing the accounting department to make payments:

- up to one and a half years;

- compensation in the amount of 50 rubles until the child’s third birthday;

- Grounds for issuing the order: appeal from a worker.

In addition, the document must be drawn up on a form containing information about the company’s details (in the header). The manager's signature is placed between:

- the name of his position (left);

- surname with initials (right).

Many companies develop rules according to which a document must be endorsed by the following specialists before the manager:

- accountant;

- lawyer;

- immediate superior.

Clue! The employee is required to put a signature on the administrative document and the date of review (coinciding with the registration date).

How to calculate - step by step instructions

To find out the amount of care benefit for up to 1.5 years for an incomplete month, you must first calculate the amount of payment for a full month, and then make adjustments taking into account the time spent on maternity leave.

Step-by-step instruction:

- Step 1. Determining the billing period and identifying excluded periods.

- Step 2. Calculation of average daily earnings.

- Step 3. Determining benefits for a full month.

- Step 4. Establishing the number of days included in maternity leave for an incomplete month.

- Step 5. Calculation of maternity benefits for an incomplete monthly period.

The procedure for calculating the amount of benefit to be paid to a parent caring for a small child for a full month is carried out according to standard rules. First of all, the citizen’s income that he received over the last 2 years of work preceding going on vacation is calculated.

Income amounts are taken for the entire calendar year, starting on January 1 and ending on December 31. However, if there is maternity leave in the year, you can replace the years with earlier ones.

At the same time, existing maximums in the amount of benefits are taken into account, which are calculated based on the base formed by social contributions. If the amount of funds received is greater than the established values, then the maximum allowable value is used for calculation. For correct calculation, the amount of income includes all funds received as wages from which insurance premiums were paid.

Important! As of 2021, the largest amount of care benefit for up to 1.5 years is 24,507.26 rubles .

After determining the total two-year earnings, the average daily income of a citizen is calculated. For these purposes, the total amount of earnings for 2 years is divided by 730, which is the number of days in 2 years, excluding sick leave and maternity leave. If there are any, before dividing, you need to subtract them from 730 or 731, into which the total earnings are divided.

The next step is to calculate the benefit amount for the full month.

To do this, the resulting average daily earnings are multiplied by 30.4 (average monthly number of days) and multiplied by 40%.

The result is exactly the amount that the parent caring for the baby will receive for a full calendar month.

Next, you need to determine how much you need to pay for less than a month. This may be the moment of taking parental leave or leaving it; if you go to work early, the need for such a calculation also arises.

Payment for an incomplete month = Benefit for a full month * Number of days on maternity leave / Total monthly number of days.

For working people

The current legislation enshrines the monthly care allowance for up to 1.5 years is calculated

- The calculation uses the average daily income received over the last 2 years of work of the person who took the leave.

- The minimum and maximum sizes are established by law and are indexed annually.

- If there are any regional coefficients (for example, northern coefficients), they must be taken into account.

- The amount for an incomplete month is determined depending on the number of actual days when the baby was cared for.

To calculate the amount of money to be paid for an incomplete monthly period, standard algorithms are used. To do this, the calculation procedure is carried out in several steps :

- First, the benefits for the whole month are determined;

- Payments for those days when supervision was not actually carried out are deducted from the monthly amount.

Another calculation option is carried out as follows: first, the average daily payment amount is calculated, which is multiplied by the number of days when the baby was cared for.

The need to determine the amount for a partial day appears if:

- the parent is just going on maternity leave, so the actual billing month is incomplete;

- the employee decided to return to work after the end of maternity leave;

When a person periodically goes on maternity leave and returns from it, calculations are carried out in each such case.

Important! To calculate benefits for caring for a child under 1.5 years old for less than a month, the legislation in terms of Federal Law No. 81, as well as Federal Law No. 255, must be observed.

Example for 2021

Initial data:

An employee of the company is taking a vacation in January 2021.

His first month of receiving benefits is incomplete due to the fact that he goes on maternity leave on January 13th.

The total income he received over the previous 2 years is 700 and 720 thousand rubles.

During this period, he used 60 days of sick leave, and one year (2016) was a leap year.

The calculation in this case is carried out as follows:

- Total income received over 2 years: 600,000 + 720,000 = 1,320,000.

- The number of days that the employee worked during this period: 731 – 60 = 671 billing days.

- The average daily earnings are calculated as 1,320,000/671 = 1,967.21.

- He will receive benefits for a full month: 1967.21*30.4*0.4=23921.27.

- For partial January: 23921.27*19/31=14661.42.

According to these calculations, for the first partial month of going on leave to care for a small child, an employee will receive 14,661.42 for 19 days, and for all subsequent full months he will receive a payment in the amount of 23,921.27 rubles.

For the unemployed

Those citizens who did not have an official job at the time of the birth of the child and the registration of the subsidy are awarded the minimum amount of benefits. This situation is the same for all family members. At the same time, the basic values are regularly indexed and there were also increases in 2021.

The procedure for paying benefits to unemployed citizens.

To determine the amount for an incomplete month for unemployed persons, it is carried out based on the minimum wage indicators.

Minimum monthly payments up to 1.5 years for the unemployed:

- on the first from 3068.69 increased to 3142.33 ;

- on the second it increased from 6131.37 to 6284.65 .

To calculate benefits for an incomplete month, you must multiply the minimum monthly payment by the days of maternity leave and divide by the total monthly number of calendar days.

Example

Initial data:

An unemployed mother of her first child receives a care payment for up to 1.5 years in the amount of 3,142.33 rubles. The start of maternity leave is March 20, 2018.

Calculation for March:

Allowance for March = 12 * 3142.33 / 31 = 1216.39 rubles.

Online FSS calculator

The Social Insurance Fund of Russia (hereinafter referred to as the FSS) has created a “Benefit Calculator”. The calculation algorithm includes all legal norms, minimums and maximums. The service will help you calculate the amount of child care payments.

To find out the payment amount you need to fill in the following fields:

- date of birth of the child;

- time of benefit payment;

- amount of earnings for 2017–2018. When you select the item “Employee’s application to change the years of accounting for earnings,” the service allows you to enter data on income for other periods;

- bet size;

- the number of hours worked and the number of calendar days excluded.

Let's check the operation of the calculator using the last example.

After entering all the data, click on the “Calculate” button and go to the “Calculation” tab.

100% of the average earnings and the amount of benefits per child coincide with manual calculations. The calculator helped save time.

The calculator user can print the calculation results or display the data in a third-party interface - Excel.