Who can receive benefits?

This type of financial assistance from the state is paid to persons who are involved in caring for a baby after his birth and until he reaches one and a half years. In this case, whether the child’s parents work, are in training, or are not employed at all does not matter.

Not only the child’s mother, but also his father (but strictly one of them) or the one who officially took the child under his guardianship has the right to receive benefits.

One important nuance should be noted: if the period of caring for an infant can last three years, then the payment of benefits continues exclusively for eighteen months, after which parents have to rely only on their own strength and resources.

Benefit payment procedure

Child care benefits must be issued monthly at the same time that regular employees of the organization are paid their salaries.

You might be interested in:

Application for leave without pay sample filling in 2019

There are two ways to comply with this legal requirement:

- The benefit is given to the employee in advance for the month that is currently underway. For example, on the day the salary for July is paid (the date is the first half of August), benefits for August are issued.

- The benefit is issued along with the monthly salary on the same day. For example, in the first half of August, when employees receive salaries for July, benefits for July are also paid.

The entire benefit can be paid if the employee applies to the organization after the child reaches 1.5 years of age, but before he turns 2 years old.

If the application is submitted after this date, then the decision on payment of benefits will be made only by social insurance. He will need to provide evidence that it was not possible to submit an application within the established time frame due to the prevailing circumstances.

The organization does not have the right to transfer benefits in advance for several months at once (for example, 2-3 months in advance). If such a fact is discovered, Social Insurance has the right to refuse to compensate the organization for expenses incurred.

The employee has the right to choose the method of receiving benefits monthly. If this method is known to the organization (for example, transfer to a salary card), then the details may not be indicated in the application.

Attention! If the employee wants to receive money in some other way (for example, to a personal bank account or by postal transfer), then the exact information for crediting the amounts must be attached as an attachment.

Where to apply

Women who have a permanent job must write an application to their employer.

The payment procedure occurs in such a way that first the company’s accounting department calculates and gives the maternity leave the amount due to her, and the Social Insurance Fund then compensates the organization for these funds in full.

If a woman works in two places at once, she can choose which company she would like to receive this type of financial support from. If two types of benefits coincide for a working mother (maternity and child care benefits), she needs to decide in favor of one of them.

If a young mother does not officially work anywhere, she should send an application for benefits to social services. protection.

Documents accompanying the application for child care benefits up to 1.5 years old

One application to receive benefits will not be enough. It must be supported by several additional papers. These include:

- a document certifying the birth of a newborn;

- a certificate from the husband/wife's employer stating that he/she did not receive benefits through the accounting department of his company (if there is no official spouse, then you can do without this certificate);

- if the woman is divorced, a copy of the divorce certificate will be required;

- when working simultaneously at two different enterprises, you will have to bring a certificate indicating that the second employer did not assign or pay benefits to the applicant;

- if the application is sent to the social department, in addition, you may need a copy (extract) of the employment record taken from the last place of work or a certificate stating that the applicant does not officially work anywhere (you can get it at the labor exchange).

When and in what quantity will the money arrive?

The benefit is paid monthly for up to one and a half years.

Its size is set individually and depends on the level of the woman’s official salary. The higher the salary, the higher the benefit will be, in addition, territorial coefficients and inflation values are taken into account.

Non-working women receive a strictly established amount, which depends on the “minimum” wage. In 2021, for example, the benefit is 2908.62 (for the first child) and 5817.24 (for the second and all subsequent ones). It must be said that there is also a maximum benefit threshold - even for working mothers with high earnings it cannot exceed the amount of 23,120.66 rubles.

All of the above figures are not final and are adjusted annually.

Features of the document

If you need to fill out an application, read the recommendations below; they will help you avoid mistakes and save time.

Today, an application for receiving benefits for child care up to 1.5 years can be formed in any form or, if the employer’s representative or social security offers a document form, according to its type.

The application can be written on a regular sheet of any suitable format (but it is better to choose standard A4), by hand (without inaccuracies, errors or corrections) or on a computer.

Only one requirement must be met: the application must be certified by the personal “live” autograph of the person on whose behalf it was formed.

It is better to draw up the document in two identical copies.

- One of them must be given to the employer or government employee. organ,

- the second one, after a sign of receipt has been placed on it, keep it.

Do I need to write to provide maternity leave?

It is necessary to write an application; it is written evidence that the employee really wants to go on parental leave to care for a child up to 1.5 years old.

If there is no application, and maternity leave has ended, the employee is obliged to go to work and begin work duties.

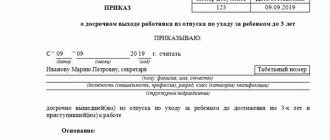

The employer himself will not be able to issue an order to grant maternity leave; for this he needs to receive documentary justification.

If the employee cannot come to work in person and submit an application, then it can be sent by mail. It is advisable to use a return receipt letter to ensure that the employer has accepted the documents.

The application must be accompanied by:

- a copy of the birth certificate (if there are several children, then copies of the others are also attached, this is necessary for the correct calculation of care benefits up to 1.5 years; for the second and subsequent years, the minimum maternity allowance is higher);

- original certificate from the father's (mother's) place of work stating that he has not been assigned maternity benefits until 1.5 years of age (if the second parent is not officially employed, then such a certificate is obtained from social security by registration);

- certificate of earnings for 2 years - required only for those cases where the applicant had income from other organizations during the period for calculating benefits (the last two years). Based on a certificate from your current place of work, all income will be taken into account.

Submission deadlines

Documents are submitted along with the application at the end of maternity leave, so that the employer can issue maternity leave for up to 1.5 years immediately after the end of sick leave under the BiR.

Documents can be submitted later than the end of the labor and employment leave, but then you will have to go to work from the next day. As soon as the employer receives the application, he will be able to issue maternity leave from the date specified in the text.

According to the law, an employee may or may not go on leave until the child is 1.5 years old. He can leave it for work at any time or go back into it again. Article 256 of the Labor Code of the Russian Federation states that this period of maternity leave can be used in full or in parts by any of the relatives. For example, the mother of the child can go first, then she can go to work, and leave the leave for the grandmother.

Thus, the deadline for submitting documentation is not limited in any way and depends only on the wishes of the child’s relative.

If you need to immediately go on maternity leave after completing maternity leave without going to work, then the application should be submitted at the end of the sick leave.

How to register correctly?

When writing the text of an application, difficulties usually arise of the following nature:

- Do I need to write separately for the provision of leave and payment of benefits, or can the two requests be combined in one document?

- Do I need to request leave until the child is 1.5 or 3 years old?

As for the first question, the applicant decides it independently. You can indicate two requests in one application - take out parental leave and assign an allowance for it for up to 1.5 years. You can split two requests into two documents and submit them at the same time. There are no strict rules in this regard.

As for the second question, Article 256 of the Labor Code of the Russian Federation talks about the right of an employee to take care leave until the child reaches 3 years of age.

The Labor Code does not have the concept of “maternity leave for up to 1.5 years,” so it is logical to write in the application the correct wording from the Labor Code of the Russian Federation and indicate the desire to go on maternity leave for up to 3 years with payment of benefits for up to 1.5 years.

At the same time, it is also issued for 3 years -.

From a legal point of view, this would be the most correct option.

Often women are afraid to leave immediately before 3 years, thinking that after 1.5 years the benefit payment will stop, and they will have to sit on maternity leave without money for another year and a half. However, these fears are unfounded. At any time, you can submit an application for early leave from work, which gives you the right to begin work duties on the day specified in the text. By law, the employer cannot refuse to interrupt the maternity period.

Sometimes the employer himself asks to write an application up to 1.5 years, an order is issued for the same period -. After a year and a half has passed, you have to again write an application to extend the maternity leave to 3 years, while a second order is issued from 1.5 to 3 years.

This process is more complex and incorrect from a legal point of view.

Nevertheless, two application options are proposed below; in the first, the woman asks for one and a half years of maternity leave, in the second, three years. You can select the desired sample, adjust it and submit it to the employer.

The text must indicate the child’s full name, date of birth, and the date on which parental leave begins.

You need to verify the document with your personal signature.

Download an application for leave up to 1.5 years of age for a child - sample.

Download an application for provision of up to 3 years - sample.

Contents and example of the document

When formulating the text of the application, keep in mind that it must comply with certain standards of business documentation:

- In the “header” indicate the name of the employing company or the social service department, depending on where exactly you are submitting the application.

- Then write your last name, first name, patronymic (sometimes you need to include data from your passport here).

- Next, indicate the word “Application” - in the middle of the line and below - the request itself for the appointment and payment of child care benefits (here also indicate his full name, date of birth and all papers attached to the application).

- At the end, please sign and date it.

Related documents

- Application for parental leave (sample)

- Sample certificate of non-use of vacation and non-receipt of monthly child benefit

- Certificate of income of an individual (Form 2-NDFL)

- Completed sample business card

- New form P14001

- Acceptance certificate of cases (example)

- Act of write-off of motor resources

- Shareholder Questionnaire (for individuals)

- Questionnaire for registration of citizens in hotels, sanatoriums, holiday homes, boarding houses, etc. (Order of the Ministry of Internal Affairs of the Russian Federation dated September 23, 1995 No. 393)

- Order form

- Ballot for voting at the general meeting of shareholders

- Ballot for voting at the general meeting of shareholders (on changing the charter of an open joint stock company)

- Ballot for voting at the general meeting of shareholders on the election of the board of directors (supervisory board)

- Ballot for voting at the general meeting of shareholders on the election of the counting commission

- Ballot for voting at the general meeting of shareholders on the election of members of the audit commission

- Ballot for voting at the general meeting of shareholders on the approval of the external auditor of the company

- Ballot for voting at the general meeting of shareholders on approval of the company’s annual report

- Ballot for voting at the general meeting of shareholders on approval of the agenda

- Ballot for voting at the general meeting of shareholders on approval of the procedure for distribution of profits

- Ballot for voting on several issues on the agenda of the general meeting of shareholders (sample)

- Journal of registration of transactions on shares of shareholders. Sheet 1

- Shareholder account card

- Book of registration of personal accounts of shareholders. Sheet 1

- Book of registration of personal accounts of shareholders. Sheet 2

- Book of registration of personal accounts of shareholders. Sheet 3