Inheriting a car

Like any property, a car can only be inherited if it is registered as the property of the testator. Therefore, if a citizen bought a car by power of attorney, then his heirs will not be able to claim it. Moreover, they will not be able to receive the deceased’s money paid for him.

If the testator is the owner, then the car can be inherited:

- According to an inheritance agreement. To do this, the owner of the vehicle must enter into an agreement with a potential heir during his lifetime. Moreover, any legal entity or citizen can act as an heir. The document is certified by a notary. It is necessary to obtain the consent of the heir to enter into an agreement.

- According to the will. The will must be drawn up by a notary. The contents of the will are kept secret from the heirs and third parties. Relatives, other citizens, organizations, and the state can act as heirs.

- In law. If the owner of the car has not drawn up an inheritance agreement or will, then the car is inherited by his relatives. The first priority heirs are the spouse, children and parents. The car will be divided among all the heirs of the same line who submitted an application to the notary in equal shares.

Separately, it is necessary to highlight the dependents of the deceased. These are citizens who were supported by the owner for at least 1 year before his death.

If a potential dependent is a relative, then in order to be included in the heirs, he must prove the fact of regular receipt of financial assistance from the deceased and his own inability to work (minor age or disability).

If the potential dependent is not a relative, then the fact of being a dependent will have to be established through the court. He must prove his own disability, being supported for at least 12 months, living together and maintaining a common household.

The dependent receives a share in the inheritance of the deceased, on an equal basis with the heirs of the queue entering into rights.

In addition, dependents, minor children, disabled adult children, parents, spouses have the right to a mandatory share in the inheritance when drawing up a will. The testator is obliged to provide for them a share in the property of at least ½ part of the share that they would have received during inheritance by law.

Take the survey and a lawyer will share an inheritance action plan in your case for free

You might find it useful:

State duty calculator for inheritance

Samples of inheritance documents

Consultation with a lawyer on inheritance

How to inherit a car?

Algorithm of actions when inheriting a car:

- Preparation of documents.

- Contacting a notary.

- Conducting an assessment.

- Payment of state duty.

- Obtaining a certificate of inheritance rights.

- Registration of a car with the traffic police.

The heir can register the deceased's car as his own or through a representative. To do this, you need to contact a notary and issue a notarized power of attorney. It must indicate all the powers that the heir wants to transfer to the representative: drawing up documents, contacting government agencies, filing applications, etc. The representative performs his duties only within the powers specified in the power of attorney.

Note! If the heir of the deceased is a child under the age of 18, then the documents are drawn up by his parents or guardians. But the right of ownership arises from the minor.

Statement

To enter into an inheritance, you must submit an application to the notary for acceptance of the inheritance and the issuance of a certificate of inheritance rights. The application must be submitted within 6 months from the date of death of the owner of the car.

The application must include the following information:

- name of the notary office;

- heir data;

- title of the application;

- information about the death of the owner of the car;

- grounds for inheritance (will, family relationship);

- vehicle information;

- a list of other property of the deceased;

- information about other heirs known to the applicant;

- date and signature.

Sample application

Consultation on document preparation

Documentation

To inherit a car, you must prepare the following documents:

- civil passport of the heir;

- death certificate of the property owner;

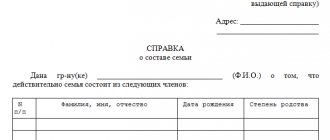

- a certificate of the last place of registration of the deceased;

- title document for the car (sale agreement, donation agreement, certificate of inheritance rights);

- PTS;

- STS;

- documents on the basis of which inheritance occurs (will, documents on family ties).

State duty

The amount of the state duty depends on the family connection with the deceased. Therefore, it is advisable to present documents about family ties to the notary even when inheriting under a will.

Successors will have to pay:

- 0.3% of the cost of the car - to the surviving spouse, children, parents, sisters and brothers;

- 0.6% of the cost of the car - to other legal successors.

When inheriting a car, benefits for paying state duty are received by:

- minors and incompetent heirs are exempt from payment;

- disabled people of groups 1 and 2 – 50% discount on the cost of the property.

Additionally, you will have to pay for legal and technical services of a notary:

- when filing an application for acceptance of inheritance – 1,000 rubles;

- when issuing a certificate of inheritance rights - depending on the prices of the regional notary chamber.

Grade

The calculation of the notary's state duty is based on the results of the assessment report. Therefore, the heirs will have to order an expert assessment of the car from an independent company.

Procedure:

- Choosing a company.

- Conclusion of an agreement and payment for services.

- Providing a car for evaluation.

- Receive an assessment report.

Note! When concluding a contract, check with the appraiser that you have a valid license to appraise vehicles. And also whether he is a member of the SRO.

The appraiser may offer to conduct an assessment without inspecting the car, using documents. Since moving a car after the death of the owner is not recommended, you can use this option. However, you must be prepared for the fact that the assessment result will be less accurate.

Certificate of right to inheritance

The certificate is issued 6 months from the date of death of the owner. This is the title document for the property.

Heirs can ask for a general certificate for everyone or a separate one for each.

Does an ex-wife have the right to inherit after the death of her ex-husband?

How to enter into an inheritance after the death of a father?

The car is inherited by several heirs

» Recommendations to the heir May 27, 2021

Rules for inheriting a vehicle

The estate includes the movable and immovable property of the testator. Inheriting a vehicle follows a standard procedure, but has some peculiarities. The heirs will need to comply with the regulations established by law on the timing, sequence and rules for transferring ownership of the vehicle in order to fully protect their interests in each specific case.

Car inheritance rules

The movable property of the testator is subject to registration at the notary office and the State Traffic Safety Inspectorate. To apply to the inspection, you will need a certificate of inheritance, issued by a notary within six months after the death of the car owner. The actual acceptance of the inheritance, that is, its use without notarization, should be as brief as possible, since it may cause complaints from other applicants for the inheritance and traffic police inspectors during inspections. It should be remembered that if there is a power of attorney for the right of management, the document is considered invalid from the date of death of the owner.

When contacting a notary, participants in the inheritance process will need to write a standard statement of their rights. You will need a death certificate of the testator, a certificate from his last place of registration, a will or a certificate of kinship. The basis for consideration of the issue is the vehicle passport issued in the name of the owner.

Having received a certificate of right to inherited property within the six-month period established by law, you should contact the traffic police.

A PTS in the name of the testator, a certificate of previous registration, an application for deletion and registration in a new name, a receipt for payment of state duty, a certificate of rights to the inherited car are presented.

A previously issued general power of attorney to a third party is revoked on the day of death of the owner who issued it. If desired, the heirs have every right to file a claim in court to return the vehicle to the inheritance estate.

Transport evaluation during inheritance

An assessment of the value of the property is required to calculate the state duty paid for issuing a certificate of inheritance. An assessment is also needed when sharing property between several participants in a relationship.

The assessment is carried out by independent appraisers; the act of established value is a legal document and is required for notarial review.

The report of the independent expert company must contain information about the market value of cars of this brand. The document reflects the credentials of the organization itself, an indication of the compulsory vehicle insurance carried out and other information. The notary has the right to challenge the assessment if it contains questionable information. In controversial situations, when there is no agreement between the heirs, each of them can conduct an expert assessment independently. The notary takes into account the minimum amount of the established value.

Inheritance of a vehicle by several citizens

A car is an indivisible property; accordingly, it can be owned on the basis of shared participation. Most often, the object of inheritance is transferred to one of the applicants, the rest must receive monetary compensation for their share of the inheritance. Here you will also need an appraisal report, but if one of the heirs does not agree with the amount offered to him, then the matter will be dealt with in court.

If the share ratio is different, and one of the applicants can count on a small amount of the cost of the car, then the notary makes an independent decision to appoint the owner of the one who has the main share. In addition, the availability of a garage, driver’s license and the need for a given vehicle are taken into account.

If close family members living together are called to inherit, then the car is registered as joint ownership in equal shares of ownership. Citizens can be issued a single certificate of inheritance, and when contacting the traffic police, they independently decide for whom to issue a PTS. The second owner will be able to drive the inherited car by proxy and at the same time be the legal owner of part of the property. Re-registration for one owner will require the official consent of all heirs, regardless of the size of their shared ownership.

The situation with inheriting a car is complicated by the presence of a preferential category of heirs.

Regardless of the presence of a will or division by law, minors, disabled family members, as well as disabled dependents who were in the care of the testator, regardless of relationship, have the right to an obligatory share of the property. If there are several applicants and it is impossible to jointly decide on the ownership of the car, the case is considered in court.

Inheritance of a car by several heirs

Free legal consultation in Moscow

This certificate will be the basis for the re-registration of a motor vehicle (car, motorcycle, etc.) in the name of the heir in the State Traffic Inspectorate (clause 35 “g” of the “Rules for registration of motor vehicles and trailers for them in the State Road Safety Inspectorate”, adopted by the Order of the Ministry of Internal Affairs of the Russian Federation dated January 27, 2003 N 59). To acquire an inheritance for a car, the heirs must accept it.

Car inheritance

Like any property of a deceased person, a car can be subject to inheritance. Inheritance of a car is formalized both by law and on the basis of a will. Based on the law, family members of the deceased, distributed in order, can claim to inherit a car. The primary right to receive a car here will be the parents, spouse, and children of the testator. Other relatives are in subsequent queues. According to the will, the right to the car will be given to the person specified in it.

The procedure for inheriting a car after the death of the owner according to a will

Like other categories of property, a car, like an apartment. can also be inherited by law. and by will. The features associated with this process relate not to the method of inheritance, but to the specifics of the vehicle. You can only inherit your own car, registered in accordance with all the rules, when the name of the testator appears in the PTS and other papers.

Inheritance of a car by several heirs

In order to acquire the right of inheritance, in accordance with the Law, the heir must accept it no later than 6 months after the death of the testator. If no appeal is received, then the car may become the property of the state. When inheriting a car, you need notarized confirmation of acceptance of the inheritance, because for registration with the traffic police you need a document on ownership, in this case it is a certificate of inheritance. There are situations when it is possible to extend the period for accepting an inheritance.

Inheriting a car: what difficulties await you

The car cannot be used for six months. After the death of the owner, the heir must submit an application to the notary office and only after 6 months can begin to re-register ownership of the car. passport a document confirming the place of residence of the deceased; a passport for a car; a registration certificate; papers that will confirm the relationship; an assessment certificate. In addition to the papers required in this case, you will definitely need a professional assessment of the car.

7. Your inherited right of ownership of a car (trailer) is subject to mandatory state registration with the traffic police authorities at the place of residence of the heirs. certificate of the right to inheritance by law or by will + notarized copy, agreement on the determination of shares, agreement on the division of inherited property + notarized copy, court decision in 2 copies, title documents for a car (trailer) + photocopy.

Accordingly, it is easier to do as they say on the spot, especially if the task is to quickly carry out registration actions, and not to organize a symposium on the topic of civil legislation and its connection with registration rules. In fact, it was easy when the heirs came to the traffic police with the buyer and there, right at the window, all but one wrote a refusal in his favor (hello _Mikhalych). One person who did not refuse was entered into the title and the car was re-registered to the buyer without any problems.

Inheriting a car: how to register an inheritance correctly?

The procedure for inheriting a car is specified in detail in Russian legislation, and there are both general provisions and specifics for transferring the right to a vehicle. to receive property, it is necessary to submit to a notary a corresponding application within 6 months from the date of death of the testator, confirming the desire to enter into an inheritance. The inheritance case is opened by a notary at the place of opening of the inheritance (the last place of residence of the deceased, which is confirmed by a certificate from the Housing Office) there are 2 main options, according to to whom the car is inherited - by law (the order of heirs is established by the Civil Code) and by will.

Law Club Conference

Ownership of a car and transactions with it

transactions in which a car changes ownership.

Persons to whom the owner, by proxy, has transferred the right to use and (or) dispose of a car are the owners (but not owners!) of the car. However, a car may have several owners - for example, a car was inherited by several heirs at once. In addition, if a car was purchased by spouses during marriage, then it is the common property of the spouses, regardless of whose name it is registered in (unless, of course, otherwise provided in the marriage contract of the spouses).

How is a car inherited? Procedure for entering into inheritance

In order for the vehicle to be transferred to the heir, he must submit an application to the notary's office and then receive a certificate of inheritance. The certificate is the basis for registration of a vehicle in the name of the heir at the State Traffic Inspectorate, and also confirms the ownership rights to the received property.

since the place of opening of the inheritance is usually the last place of residence of the testator, the notary must provide a certificate from the housing maintenance organization. The certificate is issued to the heirs after 6 months from the date of opening of the inheritance, since during the specified period another heir to the property (car or other vehicle) may appear . The issue of timing of adoption is also important.

The procedure for registering a car by inheritance

The last document can be completed by contacting licensed appraisers. Please note that a car's estate valuation must be done at the time of the owner's death, not at the time of purchase. Professional appraisers are also preferable because they will carry out the procedure more accurately and will also be able to prepare the appraisal report and all accompanying documents correctly. You should contact a notary with a package of all necessary documents. Obtaining a certificate of inheritance rights makes it possible to contact the traffic police to re-register the vehicle to the heir.

Inherited car

To continue using the vehicle, the heir must contact a notary's office and obtain a Certificate of Inheritance. Based on it, the traffic police authorities will be able to re-register the car to the new owner. To obtain the right to movable property left by the testator, it is necessary to contact a notary within 6 months from the date of opening of the inheritance (that is, the day of death of the testator) and provide him with all documents confirming inheritance rights. It is possible to actually accept the inheritance if the heir uses the car, pays taxes for it, and monitors its technical condition.

How to register a car as an inheritance at the traffic police

Lawyers say that re-registration of an inherited car is a fairly simple procedure. At the initial stage, you should collect documents that are standard when inheriting any property. Such documents include: a death certificate of a person transferring property by inheritance, confirming that the heir is related to the deceased, documents, which are (marriage certificate, birth certificate, other documents) a civil passport. a car registration certificate confirming that the deceased person was the owner of the car; a vehicle passport; an act of appraising the value of the inherited car. An appraisal of an inherited car is necessary to obtain the appropriate certificate from a notary.

Free legal consultation

Registration of an inherited car with 4 heirs

Hello! husband died I inherited two cars. heirs are me (my wife), our daughter, my husband’s parents. We received a certificate of inheritance, which indicated 4 heirs for each car. we need to register the cars with the traffic police, one in the name of my father-in-law, the other in my name. The traffic police say that there should be only one heir. what should we do in this case? buy each other's shares?

May 18, 2015, 09:17 Lily, p. Upper Tatyshly

Lawyers' answers (3)

Good afternoon. YOU can enter into an agreement on the division of jointly acquired property or even divide it through the court - one heir has a car, the other is paid the market value of his share in the car.

Article 1165.Civil Code of the Russian Federation Division of inheritance by agreement between heirs 1. Inherited property, which is in the common shared ownership of two or more heirs, can be divided by agreement between them. The rules of this Code on the form of transactions and the form of contracts are applied to the agreement on the division of inheritance. 2. An agreement on the division of an inheritance, which includes real estate, including an agreement on the allocation of the share of one or more heirs from the inheritance, may be concluded by the heirs after issuing them a certificate of the right to inheritance. State registration of the rights of heirs to real estate in respect of which an agreement on the division of inheritance has been concluded is carried out on the basis of an agreement on the division of inheritance and a previously issued certificate of the right to inheritance, and in the case where the state registration of the rights of heirs to real estate was carried out before their conclusion agreements on the division of inheritance, based on an agreement on the division of inheritance. 3. Inconsistency in the division of inheritance. carried out by the heirs in the agreement concluded by them, the shares due to the heirs indicated in the certificate of the right to inheritance cannot entail a refusal of state registration of their rights to real estate received as a result of the division of the inheritance.

18 May 2015, 09:24

Have a question for a lawyer?

City not specified

Hello, Lilia! You probably didn’t understand the traffic police inspector quite correctly. It is possible to issue a certificate of inheritance rights to a car in shares to several heirs, but it is impossible to register it in the name of several owners. There are two ways out of this situation: 1. The heirs can enter into an agreement on the division of the inherited property and transfer the car to one of the heirs in exchange for his share in other property (another car). 2. Obtain certificates of inheritance rights to the car in shares for all heirs, but at the same time: If you are not going to sell the car, then the heirs need to decide in whose name the car will be registered with the traffic police. After receiving a certificate of the right to inheritance by all heirs, the heir in whose name it is decided to register the car must contact the traffic police and provide applications from all heirs to register the car in his name. If you are going to sell the car, then the heirs do not need intermediate registration with the traffic police. The new owner can register the car immediately in his own name. In addition to the certificate of inheritance, to register a car with the traffic police you will also need: 1. PTS of the car 2. Certificate of registration of the vehicle 3. Passport of the heir, statements of other heirs 4. Compulsory motor liability insurance policy You present a package of documents, pay the fee, show the car on the site for inspection (for registration, the body number, VIN, engine number are checked), wait for the result (new STS).

18 May 2015, 09:27

Client clarification

And if there is a share of a minor in the inheritance, is permission from the guardianship authorities required? in what form is it issued?

18 May 2015, 10:26

City not specified

When registering in the name of one of the heirs, permission from the guardianship department is not required, since the child’s share is not alienated. If the child is a minor (under 14 years of age), the application is written on his behalf by his legal representative (mother). If the child is over 14 years old, the application is written by the child himself with the consent of the mother.

When drawing up an agreement on the division of inherited property, permission must be obtained. It is issued in the form of an order or instruction and contains an obligation, in the event of alienation of a share in one car, to provide a share in another car, and, if necessary, to additionally pay compensation (if the market valuation of the cars is very different).

18 May 2015, 10:32

Looking for an answer? It's easier to ask a lawyer!

to our lawyers - it’s much faster than looking for a solution.

The procedure and subtleties of inheriting a car

In the process of inheriting a car, property rights and obligations are transferred from the deceased person to his heirs. In this case, the car can be inherited within six months from the date of opening of the inheritance. Inheritance is considered to have taken place when the heir actually owns the property or when he submits an application for acceptance of the inheritance to a notary.

All actions of the heir must be carried out in a timely manner and in accordance with the rules on extending the period for accepting an inheritance. Only a legally capable person can be an heir.

Any person has the right to refuse an inheritance. The statement can indicate in favor of which persons he is doing this or not indicate anyone.

The document that confirms the fact of death is a Death Certificate issued by a medical institution. The place of opening of the inheritance is the last place of residence of the testator. To open an inheritance case, you must contact a notary who is assigned the address of the testator by order of the Ministry of Justice.

It is important to consider that if citizens die on the same day, then they cannot be heirs after each other. Therefore, for example, if spouses die at the same time, and according to documents the car belongs to the husband, then the wife’s heirs cannot lay claim to it.

One of the nuances of inheritance is that people who have committed intentional unlawful acts against the testator, his will or other heirs cannot inherit. Of course, all these circumstances need to be confirmed in court. However, the testator can bequeath his property to persons who have lost their rights of inheritance, in which case they have the right to receive an inheritance.

One of the subtleties of inheritance is that it must be carried out both by will and by law, and if there is a will, then it is considered first. If there is no will, it only indicates the fate of part of the car, or it only indicates the circle of persons deprived of inheritance, then inheritance by law comes into force. In addition, the car will be inherited by law if the will is declared invalid, there are no heirs indicated in it, or there are persons who will be recognized as heirs by virtue of their shares.

Persons who can inherit a car: - citizens who are included in the circle of heirs according to the law - citizens who are not included in the circle of heirs according to the law - legal entities - the Russian Federation and constituent entities of the Russian Federation - foreign states - international organizations.

Legal heirs can inherit in order of priority, which is determined by the degree of relationship to the deceased.

One of the subtle nuances of inheriting a car is ownership of the car by power of attorney. It may happen that the car was sold under a general power of attorney, but the re-registration to the new owner was not completed.

In the event of the death of the actual owner, the car must become the property of the heir by inheritance, and the driver, who has a power of attorney, is left with nothing. In such a situation, the only thing that can be done is to agree with the heirs so that they do not lay claim to the car, after which you can re-register it in your name.

An important point is also that when receiving a car by inheritance, the heir is obliged to repay any debts of the previous owner.

Free legal consultation

If you need help in solving any legal problem that has arisen (return of a driver's license, assistance in an accident, consumer protection or any other issues), you can contact lawyers and attorneys for free help by filling out and sending an application for consultation. After a short time (if the application is sent during business hours), they will call you back and try to help resolve any issues that have arisen.

You can simply call lawyers from 9.00 to 21.00 using the toll-free hotline numbers

Request for a free consultation

We remind you that if the application is filled out correctly, a lawyer will call you back soon and will try to help resolve the problem.

In addition to issues in the field of protecting the rights of car owners, free legal consultations are available on other topics: real estate, inheritance, will, etc.

The personal information you provide (name, phone number) will not be published anywhere; it will only be available to the lawyer responding to you.

Sources: alljus.ru, urist-rostova.ru, pravoved.ru, www.avtokonsultacia.ru

Next

- Can a granddaughter claim her grandmother's inheritance if her son is alive?

- Can my father's sister claim inheritance?

No comments yet!

Share your opinion

You might be interested in

Color blindness is inherited from father to son

Registration of inheritance by heirs of the second stage

Law on inheritance in the DPR

What documents are needed to inherit an apartment?

Popular

Can a second-stage heir claim a share in the inheritance (Read 4)

Is it possible to renounce the spousal share when registering an inheritance (Read 3)

Is it possible to refuse a share of the inheritance in favor of another heir (Read 3)

Tax on money by inheritance (Read 3)

How is a car divided between heirs?

Heirs have the right to divide the car both before entering into inheritance and at any time after that.

How can you divide a car:

- Sell, and divide the money from the sale in accordance with the shares in the inheritance. The disadvantage of this option is the need to pay personal income tax in the amount of 13% of the transaction amount when selling a car that has been owned for less than 3 years.

- Determine the order of use.

- One of the heirs receives the car in full, and the other legal successors receive property of similar value.

- One heir takes the car, and the others receive monetary compensation for their shares.

The heirs can divide the car within three years from the date of opening of the inheritance according to the rules of Articles 1165 - 1170 of the Civil Code of the Russian Federation (part two of Article 1164 of the Civil Code of the Russian Federation), and after this period - according to the rules of Articles 252, 1165, 1167 of the Civil Code of the Russian Federation as follows:

- voluntarily (by agreement)

- through the court.

Regardless of the option chosen, the heirs will have to pay a state fee. To certify the agreement - a state fee to a notary (from 5,000 to 11,000 rubles), in case of a legal dispute - a state fee to the court.

Are you tired of reading? We’ll tell you over the phone and answer your questions.

Valuation of a car for inheritance

Based on the above package of documents provided to the notary, as well as in accordance with paragraphs. 5, 7 p. 1 art. 333.25 of the Tax Code of the Russian Federation, in order to determine the notary tariff (duty), it is necessary to establish the value of the inherited property through its assessment. Moreover, it is established at the time of the death of the testator .

The law clearly defines that assessments for motor vehicles are carried out only in accordance with the requirements and persons specified in Federal Law No. 135-FZ of July 29, 1998 “On Valuation Activities in the Russian Federation” (Federal Law No. 135), as well as forensic experts institutions of justice (as a rule, it is used in the judicial procedure for establishing the fact of acceptance of an inheritance).

To carry out the assessment, the heir must:

- Conclude an agreement with the relevant organization for its implementation (Article 9 of Federal Law No. 135).

- Provide the appraiser with the necessary documents and information (passport data of the appraisal customer, death certificate, PTS, vehicle registration certificate, mileage data, if possible, photo or other means description of the car (to identify defects, damage), information about repairs made, replacement of parts, etc.).

The timing of the relevant type of assessment is established by the organization with which the agreement for its conduct is concluded. Upon completion, the applicant is issued an assessment report , which must meet the requirements established by Art. 11 Federal Law No. 135. It must indicate:

- basis for the assessment;

- information about the appraiser;

- target;

- accurate description of the object (car);

- valuation standards for determining its value, its final value, restrictions, limits;

- date of determination of the assessment;

- a list of documents that the appraiser used to establish the quantitative and qualitative characteristics of the car.

In addition, the report must meet formal requirements , i.e. be on paper, numbered and bound page by page, have the appraiser’s seal, and it should not contain ambiguous interpretations that could be misleading. If the assessment report is prepared in electronic form, then, among other things, it must be signed with an electronic digital signature.

For your information

If the interested party does not agree with the appraiser’s conclusions about the value of the property, the report can be challenged in court (Article 13 of Federal Law No. 135), otherwise the information contained in it is reliable and has evidentiary value.

As a rule, the validity period of the data specified in such a report is limited and is 6 months.

Re-registration of a car after the death of the owner in the traffic police

The procedure for re-registration includes:

- Contact the traffic police department.

- Payment of state duty.

- Submission of documents and applications.

- Making changes to PTS, issuing new numbers (at the request of the heir) and issuing STS.

The list of documents for re-registration includes:

- civil passport of the heir;

- certificate of inheritance rights;

- PTS;

- OSAGO policy;

- STS:

- statement.

Receipts for payment of state fees do not need to be attached to the application. But you must pay it before submitting documents.

In 2021, the heir will have to pay for the re-registration of a car:

- for making changes to the PTS – 350 rubles;

- for issuing STS – 500 rubles. (for paper) or 1,500 rub. (for plastic);

- for changing registration plates - 2,000 rubles.

If you pay the state fee through the State Services portal, you can get a 30% discount on the fee amount. But to do this, you need to submit an application electronically and pay the fee by bank transfer.

Documents are submitted to any traffic police department, regardless of the place of registration of the heir. You must first confirm the reception day. Re-registration takes about 1 hour.

Insurance renewal process

To inherit a car, you need to take out a compulsory motor liability insurance policy. To do this, submit to the insurance company:

- statement;

- passport;

- certificate of inheritance;

- vehicle registration certificate;

- PTS;

- diagnostic card (if its validity period has expired, you must undergo a technical inspection to obtain it);

- notarized power of attorney for the representative (if he is involved in registration).

Having received the package of documents, the insurance company enters into an insurance contract, returning the registration certificate, certificate of inheritance, and car registration certificate in the name of the previous owner to the new owner.

Insurance is paid, and the cost of the policy may vary depending on:

- type of car (number of passenger seats, engine size, power, etc.);

- fixed place of car registration;

- purposes of using the vehicle;

- period of operation of the car;

- driving experience of the policyholder;

- term and functionality of the insurance policy.

If we talk about the benefits of insurance, they are as follows:

- in free evacuation of cars from the scene of an accident (the service can be used twice during the year);

- free delivery of fuel (no more than 10 liters);

- in technical assistance and advice on the road;

- in discounts on additional services and services.

Tax on a car after the death of the owner

In accordance with the letter of the Federal Tax Service of the Russian Federation dated April 16, 2010 No. 03-05-06-04/86, in the event of the death of the owner of the car, the following situation arises with the payment of transport tax:

- if the taxpayer received a notification about the need to pay the tax (sent through the State Services portal or by mail 30 days before the end of the payment period), then the transport tax debt passes to the heirs;

- if the notification was not received or the Federal Migration Service did not have time to issue the debt for payment, then the heirs are exempt from payment.

How to sell a car after the owner's death?

Heirs can sell the car immediately after receiving a certificate of inheritance rights. However, it is not necessary to register the car before selling it.

Note! The law prohibits the use and sale of a vehicle within 6 months after the death of the owner.

Procedure for selling a car:

- Find a buyer.

- Carry out a vehicle inspection.

- Draw up a purchase and sale agreement.

- Registration of an MTPL policy (by the buyer).

- Registration of the transaction with the traffic police.

Attention! If less than 10 days have passed since the receipt of the certificate of inheritance rights, then information about the heir is not entered into the PTS.

The heir can present to the traffic police when registering the car by the buyer a certificate of inheritance rights or a copy thereof. The document will be returned to him upon completion of registration.

There is a sample application for acceptance of inheritance for download

When submitting an application for inheritance, you must present a passport or other identification document to the notary. A list of documents for registering a car as an inheritance will be given to you at the notary's office.

When applying for a certificate of inheritance, you should collect a package of documents, including:

- passport;

- death certificate of the testator;

- will (if any);

- a document that confirms relationship with the deceased (this can be a birth certificate, marriage certificate);

- car registration certificate;

- PTS;

- vehicle assessment document.

The “Fundamentals of Legislation on Notaries” (Article 22) establishes the obligation to pay a state fee to obtain a certificate of inheritance. When contacting private notaries, you must pay for the service provided according to the tariff (see table):

| Relationship category | |

| Son, daughter – natural and adopted | 0.3% of the amount of the inheritance, but not more than 100,000 rubles. |

| Spouse, husband | 0.3% of the amount of the inheritance, but not more than 100,000 rubles. |

| Father mother | 0.3% of the amount of the inheritance, but not more than 100,000 rubles. |

| Brother, sister (full siblings only) | 0.3% of the amount of the inheritance, but not more than 100,000 rubles. |

| Other heirs | 0.6% of the amount of the inheritance, but not more than RUB 1,000,000. |

| Heirs who have not reached the age of majority on the day of opening of the inheritance | Released |

Life situations

Let's consider situations that may arise during the process of inheriting a car.

How to restore a title after the death of the owner?

To inherit a car, a notary may request a title. This is not the only document that can be presented to the notary's office. In return, you can submit a purchase and sale agreement or STS.

Subsequently, the heir will need a PTS. Without it, you cannot register a car, issue a compulsory motor liability insurance policy, or sell a car. If the document is lost or its location is unknown, then a duplicate can be issued.

Art. 14 Federal Law No. 283 of 2021 provides for the possibility of obtaining a duplicate by the owner or his representative. To restore the document, you will need to contact the MREO OGIBDD of the Ministry of Internal Affairs in the region of residence of the deceased. The state fee for issuing a duplicate is 800 rubles. (clause 36 of article 333.33 of the Tax Code of the Russian Federation).

How to register a car after the death of my husband?

The procedure for re-registering a car after the death of a husband has its own characteristics. If the vehicle was purchased during marriage, the surviving spouse must:

- Contact a notary to allocate the marital share. As a general rule, spouses are entitled to ½ share of every property purchased during the marriage.

- Claim the priority right to inherit the car as a co-owner.

- Pay other heirs compensation for their shares in the ownership of the car.

- Pay the state fee.

- Obtain a certificate of inheritance rights.

- Re-register the car with the traffic police.

Thus, the spouse can become the sole owner of the vehicle.

A car to inherit for several heirs?

A car is an indivisible thing. Therefore, several heirs can own it only under the right of common joint or common shared ownership. This situation is popular if one of the heirs is a minor child or an incapacitated citizen. That is, a person who legally cannot use the car for its intended purpose. But he has no opportunity to ask for compensation for his share.

By law, 2 or more heirs can use a car, determining the order of use:

- voluntarily;

- through the court.

But in practice, it is better for one of the heirs to pay compensation to the others or sell the car altogether and split the money.

Snezhana Pogontseva

Lawyer, author-editor of the website (Family law, 12 years of experience)

Is it possible to drive a deceased relative's car?

Definitely not. From the moment the owner of the car dies, all documents issued in his name become invalid. These include PTS, STS, OSAGO and CASCO agreements, and a power of attorney for the use of a car. Therefore, the use of a vehicle after the death of the owner is prohibited.

Naturally, when checking documents, the traffic police inspector will not notice the catch. But when he checks the database, the driver faces serious problems. Since May 2021, information about the death of a car owner is received by the traffic police directly from the Federal Tax Service. The traffic police removes the car from registration without warning the heirs.

Therefore, a citizen who finds himself in such a situation will be issued a fine for using a vehicle without registration. In 2021 it ranges from 1,500 to 2,000 rubles. (Article 19.22 of the Code of Administrative Offenses of the Russian Federation).

Of course, putting a car in a garage for 6 months before registering an inheritance is not easy. Especially if the vehicle was registered to the deceased, but in fact it was used by another family member.

But in the event of an accident, the driver will not be able to use insurance; he will have to compensate the second participant in the accident for damages from his own funds, as well as repair the car at his own expense.

The law does not make an exception for the spouse of the deceased. If the car was purchased during marriage, but is registered in the name of the deceased spouse, the surviving spouse cannot apply to the traffic police for re-registration before the expiration of 6 months.

This is why buying a car by proxy is a bad idea. If the legal owner dies, the car is inherited. The actual owner loses rights to it.

Registration of a car inherited

After the heir receives a certificate of inheritance under which the car is transferred to him, he is obliged to re-register it in his name (as the new owner) with the traffic police within 10 days after its acquisition. The procedure for re-registration of a car is regulated by Order of the Ministry of Internal Affairs of Russia No. 1001 of November 24, 2008 “On the procedure for registering vehicles.”

To re-register the rights to the received car, the heir must submit the following documents, as well as the vehicle itself, to the registration authority (State Traffic Safety Inspectorate):

- corresponding application for registration;

- identification document of the applicant;

- documents confirming the authority of the applicant’s representative (if one is involved);

- vehicle passport;

- documents certifying ownership of the car - certificate of inheritance;

- insurance policy of compulsory civil liability insurance;

- a document confirming payment of the corresponding state duty (clauses 36-39, clause 1, article 333.33 of the Tax Code of the Russian Federation).

The amount of state duty payable for re-registration of a car received as an inheritance depends on the type of registration action that must be performed by the authorized body, in particular:

| Name of registration action | Size (RUB) | Note |

| Vehicle registration and issuance of plates | 2000 | If the previous numbers are not preserved |

| Issuance of PTS | 800 | If not saved |

| Issuance of a registration certificate | 500 | — |

| Temporary registration | 350 | — |

| Making changes to the PTS | 350 | — |

| Issuance of “Transit” numbers | from 200 to 1600 | Size depends on material of manufacture |

It is important to note that, regardless of how many heirs the car is transferred to, its registration is carried out only in the name of one person (clause 24 of the Order). Therefore, the “shared heirs” need to decide in advance the issue of which of them will have the car registered in their name.

Upon completion of registration actions, the new owner of the car, in accordance with clauses 40-42 of the Order, is issued a vehicle registration certificate, PTS (if it was missing), registration plates (if they are being replaced).

Lawyer's answers to private questions

After the death of my father, I inherited 2 cars. The heirs were my mother, me, grandparents. We received a certificate of inheritance rights. Each received a ¼ share of each car. How to register them with the traffic police?

You can register in the name of only one of the owners. Therefore, you need to decide to whom the cars will be registered. If the co-owners do not have a common opinion, then discuss the possibility of buying out shares.

Finished the inheritance registration after the death of her husband. All property, including the car, was divided between me and 2 minor children of 1/3 share. How can I sell my car now?

Contact the guardianship department to obtain permission for the transaction. The money received from the sale of shares owned by children will have to be deposited into their personal bank accounts. If the guardianship department refuses to issue permission, then go to court. Justify the need to sell by saying that the car will not be used by children for many years, during which time it will lose value or become completely unusable.

The father was in his second marriage. He bought a car before marriage. A month ago he died. And his wife continues to use the car. There is wear and tear and the value decreases. How to stop this?

Contact a notary to ensure the safety of the inheritance.

A married mother bought 2 cars and registered them in her husband’s name. She died 2 months ago, and he is hiding these cars from me. And he and I inherit all the property in equal shares. What to do to receive an inheritance correctly?

Apply to the court to allocate the mother's marital share in these cars. Since they were married at the time of purchase, he is entitled to ½ share in each car. But the second half must be part of the inheritance. You are entitled to ¼ share of each car. To go to court, you do not need documents for the car; the court will request them from the defendant.

I want to buy a car from a girl who inherited it. She did not register him with the traffic police. Are there any problems with this car?

Registration is not a requirement. But difficulties may arise when identifying heirs who have not assumed their rights. The car may also be pledged. Please check the information carefully before concluding a transaction.

Selling an inherited car

When inheriting a car, the new copyright holder often asks the question: how to continue using it or sell it right away? This is due, first of all, to the fact that during the period during which the right to inheritance is formalized (6 months), the car cannot be used for its intended purpose, and its value decreases accordingly, or the heir simply does not know how to handle such property.

If the new owner of the vehicle wants to “part with” the newly acquired property, then in this case there are a number of the following nuances:

- Drawing up purchase and sale agreement in accordance with the requirements of the Civil Code of the Russian Federation.

- If the heir has not re-registered the vehicle in his name, but there is already a buyer for the car, then the new copyright holder does not have to contact the traffic police authorities. This means that he transfers the car and the documents necessary for its re-registration, including a copy of the certificate of inheritance (as a title document for intermediate ownership of the car) directly to the buyer, and the latter registers this car in his own name. This is beneficial for the heir, since he does not need to incur extra expenses for registering the property on himself.

- Payment of tax on the sale of a car, if there are no grounds for exemption from its payment (Chapter 23 of the Tax Code of the Russian Federation).

- We must not forget about the peculiarities of disposing of property that is in the right of common shared ownership (Article 246 of the Civil Code of the Russian Federation).

Contract for the sale and purchase of a car acquired by inheritance

To alienate property received by inheritance, including a car, through a purchase and sale agreement, the heir must be guided by the provisions of Chapter. 30 of the Civil Code of the Russian Federation, which regulates this type of transaction.

Information

Art. 454 of the Civil Code of the Russian Federation, purchase and sale means the transfer of property from one person (seller) to the ownership of another (buyer), and the latter, in turn, accepts it and pays the established price.

In this case, such an agreement must necessarily contain the following information :

- date and place of his imprisonment;

- information about the parties to the transaction, their names;

- the subject of the agreement (this includes the basic rights and obligations based on Article 454 of the Civil Code of the Russian Federation, as well as information about the alienated car (or the share in the right to it) in accordance with the PTS - a requirement of Article 455 of the Civil Code of the Russian Federation);

- information about title documents - PTS, in which the heir is already indicated as the owner, or a certificate of inheritance, in the case where the heir did not re-register the car in his name;

- cost of the car (Article 485 of the Civil Code of the Russian Federation);

- rights and obligations of the parties (their list is wide, but it is necessary to indicate the obligations for the transfer and acceptance of the car, conditions regarding its shortcomings);

- payment procedure and terms;

- establishing liability for non-fulfillment or improper fulfillment of obligations under the contract;

- conditions on the transfer of the risk of accidental loss of property;

- final and transitional provisions;

- signatures of the parties.

An integral part of the car purchase and sale agreement must be the act of acceptance and transfer between the parties, which is drawn up as an annex. It may indicate not only that the vehicle has actually been transferred from one person to another, but also that payment has been received by the seller.

Tax on a car passed on by inheritance

When receiving a car by inheritance, the heirs, as noted earlier, are required to pay a state fee for performing the relevant notarial actions (clause 22, clause 1, article 333.24 of the Tax Code of the Russian Federation). However, in a number of cases, the law establishes benefits for its payment (Article 333.38 of the Tax Code of the Russian Federation).

Attention

pp. 18 clause 1 art. 217 of the Tax Code of the Russian Federation exempts individuals who have received income in any form by inheritance from the burden of paying income tax (NDFL) - Ch. 23 Tax Code of the Russian Federation.

Moreover, after registering a car with the traffic police in the name of the new owner, which is also carried out only with the payment of a state duty (clauses 36-39, paragraph 1, article 333.33 of the Tax Code of the Russian Federation), he will have to pay an annual transport tax in accordance with the requirements of Chapter. 28 of the Tax Code of the Russian Federation (determined based on engine power).