The essence and features of regulation of the concept of the marital part of property in inheritance

According to the law, common property can be divided into two independent types and be:

- Share – provides for the mandatory allocation of separate shares for each participant.

- Joint - does not provide for the allocation of individual shares.

Property legal relations, including between spouses who have entered into a legal marriage, are regulated by current legislation. Basic principles and concepts apply both during the life of both spouses and after the death of one of them.

The list of key principles on which the relevant requirements and norms of the Family Code of Russia are based in the framework of resolving conflicts that arise within the family includes the principles of voluntariness and equality of marital rights. According to article number 1150, the right of inheritance acquired by the surviving spouse, in accordance with the will and the provisions of the current law, does not detract from the legal rights in the allocation of the part of the property belonging to this spouse, which is considered joint and acquired during marriage as community property.

According to current legislation, the common property of spouses is any property that they acquired during their legal marriage. This condition is covered in paragraph one of articles number 33, 34 in the Family Code, as well as paragraph one of article number 256 in the Civil Code of the Russian Federation. After the death of one of the married couple, who is a direct participant in the property acquired in a legal marriage, and subject to the appearance of a new or new participants in this property - heirs - the property loses its joint status. Thus, in accordance with paragraph three of article number 244 of the Civil Code of Russia, the general rules speak of the transition of common property into shared property. A notary is involved in the consideration of such cases. The specialist’s task is to determine the optimal way to formalize the rights of the spouse and other heirs who survived the testator in a particular case.

The law determines the following order in which a certain part of the property is inherited by the surviving spouse of the testator:

- First of all, the spousal share in the inheritance is allocated from property that is considered joint and acquired in a legal marriage through paid acquisition.

- Then the remainder of the property in question is inherited among all heirs. The list of heirs in this case also includes the spouse.

At this stage, several questions may arise. For example, does the list of obligations of the surviving spouse include registration of rights to the marital share? Should a notary register the rights to the spousal share? Does a spouse have the right to refuse if he is entitled to a spousal share?

The procedure and methods for allocating a share belonging to a spouse by law

In their legal practice, notaries use two different ways to resolve this situation:

- 1. Registration of the rights of the spouse and heirs who survived the testator due to the death of the latter consists of including the property that was jointly owned into the total estate in the inheritance. In this case, the obligatory share of the husband or wife is not allocated, and the inheritance becomes the property of the heir. At the same time, experts do not take into account the fact that the share in the inheritance belonging to the testator’s husband or wife is not included in the total estate, including in the absence of the fact that this person timely applied to a notary for the purpose of issuing the obligatory part of the property.

- 2. According to the second method, it is provided for the establishment of shared ownership of the spouse who survived the ex-husband or wife due to the death of the latter, in property that was their common property. This method is implemented through the allocation of marital shares in accordance with article number 75 and the Civil Code of the Russian Federation. In connection with the death of a husband or wife, the second participant in the property has the right to submit an application in the established form for the marital share directly to the notary. The latter, in turn, is obliged to issue a certificate confirming the ownership and marital share of the ex-husband or wife in the common property. As a rule, the size of the spousal share is equal to half of the total amount of property.

There are cases when certain problems may arise when inheriting property if this property is real estate. For example, the testator was legally married at the time of purchasing the apartment and lived in this apartment for several years with his wife and son. Accordingly, the wife and husband were the owners of common property. As a result of the death of the testator, his wife executed a waiver of the marital share belonging to her in accordance with the law, transferring her rights to her son. The testator's son received an official certificate confirming the right of inheritance legally from a notary and was the full owner of the residential area in question. Some time later, after the son’s marriage, conflicts arose between his wife and mother, on the basis of which the son decided to evict and subsequently sell the apartment. If this decision were to come to fruition, the injured party would be the potential buyer of the residential space. In practice, the mother filed a lawsuit to claim her own rights to half of the living space, as a share in the joint property acquired with her husband during the marriage.

Other situations are also common. The apartment was purchased in the name of a certain A. during her legal marriage. Later, the husband of citizen A. died, and the owner herself, who bought the apartment, turned to a notary in order to enter into legal inheritance rights to the property of the deceased in connection with the death of her ex-husband. During a consultation with a notary, citizen A. found out that, given that the status of owner of the apartment belongs to her alone, the woman does not need to register an inheritance. At the same time, the experts explained to A. that until the official registration of the inheritance has been completed and the marital share has not been separated, the woman will not receive the right to conduct any transactions with this apartment. Naturally, these circumstances upset citizen A., as well as the loss of time, since due to incorrect information from the notary, the woman was unable to enter into the legal rights of the heiress in a timely manner, and therefore it will not be possible to sell the apartment quickly. The most correct solution in such situations in the framework of obtaining rights to the property of the deceased would be for the owner to separate the marital share in the living space in question in the amount of one-half of the total amount of property. The remaining part would provide for the opportunity to enter into inheritance rights for all legal heirs of the first priority, which in this case are citizen A. herself, as well as the minor daughter of the spouses. According to the current legislation, citizen A. would have to receive the status of the owner of ¾ of the share of the living space, while her daughter would have received a share of ¼ of it.

Such situations, provided that the inherited property is an apartment, occur quite often. We recommend ordering a mandatory consultation with specialists for anyone who plans to own an apartment as a marital share in order to avoid wasting time and money in the future. No matter what the notaries tell you, the allocation and marital shares, as well as the renunciation of the marital share belonging to the husband or wife in accordance with the law, should be dealt with without fail when opening a case on the occasion of an inheritance.

Inheritance of a share in an apartment

You can enter into an inheritance and register an apartment, or rather a part of it, making it your own, after recording the fact of the death of the owner of the premises. If the owner is alive, acceptance of the inheritance is impossible.

To enter into an inheritance, 6 months after the death of the apartment owner, you need to collect a list of documents.

We recommend reading: How to register an inheritance for an apartment after the death of your mother

Heir Steps:

- Visit the registry office to exchange the deceased’s passport and death certificate for a death certificate.

- Make copies of the document.

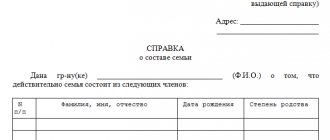

- Go to the passport office, remove the deceased person from the registration register, get a certificate of form No. 9, with the date of discharge.

- Prepare documents for the notary's office: passport, certificate confirming the owner's death, will, if available, certificate of termination of registration, birth or marriage certificate confirming inheritance.

- Inheriting an apartment involves filing an application with a notary, indicating the heir's intention to receive the property that was in the possession of the deceased person.

- The notary requires the submission of papers: a privatization agreement, a state certificate of property registration. You will need an extract from the Unified State Register and a cadastral passport. Notaries receive these papers on electronic media, which has reduced the time required for registering an inheritance.

Spousal share: conclusions on the allocation of the legal share of the inheritance to the spouses of the testator

Mandatory in accordance with the law, marital shares in inheritances are the part of the property (share) that is subject to allocation to the most vulnerable successor of the testator due to the death of the latter. In this case, the presence of a will and the actual will of the spouse does not matter. The concept of marital share means a share of the common property that is acquired jointly, acquired on a compensation basis during the period of living together in an official marriage and currently belongs to the surviving husband or wife of the testator.

We remind our clients that mandatory shares are not subject to inclusion in the total inheritance. This is due to the fact that during life, common property in the event of divorce is subject to fair, equal division between husband and wife. The shares in a divorce are equal to each other. Thus, allotment with marital shares is done before the property is divided into prescribed shares among the remaining heirs in accordance with the current law. Of course, in cases where the property was acquired jointly and is recognized as the common property of the ex-husband and wife.

In this case there is only one exception. It is relevant when a marriage contract is concluded between a husband and wife, the terms of which do not provide for the use of equal shares due to divorce or under other conditions. In such situations, the property can be divided into shares in accordance with the terms of this agreement. There are no other exceptions in such cases.

In addition, it is important to note that property that will be acquired during marriage and acquired free of charge is not common. Neither in the event of a divorce, nor after the death of one of the participants in the marital union, this property will be divided into shares. In this case, the inheritance is divided among the heirs in accordance with the law or the will drawn up by the deceased participant in the marital union. You can find out what share you can get in such a situation or in what order the inheritance will be divided into shares, in the corresponding section of our website or in consultation with a lawyer.

Still have questions about inheritance? Contact us and receive detailed answers at a convenient time.

Legal inheritance

According to the Civil Code of the Russian Federation, there are eight hereditary orders. Taking them into account, the principle of succession of each subsequent round of the queue occurs only if there are no applicants from the previous one or they refused the inheritance or were found to be dishonest. According to the transfer of part of the apartment without a will, the property will be distributed among the successors in equal shares.

The order will depend on the degree of closeness of family relationships. The first circle of succession includes the spouse, children and parents of the testator. However, for the other half of the deceased to be included in this category, their marriage must be registered and valid until the death of the testator. Otherwise, the former spouse will not be included in the first circle of inheritance, since the division of property has already occurred during the divorce process.

Next in line will be grandparents and sisters/brothers. The further queue is formed according to the degree of remoteness of family ties. The seventh level of priority is occupied by citizens who are not related by blood to the testator.

Expert commentary

Kolesnikova Anna

Lawyer

Legal inheritance of part of residential property is carried out according to general rules, that is, in equal shares.

Services for citizens and organizations

| Oral (face-to-face) legal consultation with the duty lawyer with the study of documents submitted by the client | from 2,400 rub. |

| Oral (face-to-face) legal consultation with an industry specialist lawyer with the study of documents submitted by the client | from 4,800 rub. |

| Study by a specialist lawyer of the case materials presented by the client, judicial practice in the case, development of the legal position of the defense (using professional legal resources), outside the framework of an oral consultation | from 1,200 rub. |

| Departure of the duty lawyer to the principal | from 3,000 rub. |

| Preparation of the primary written legal document (application, complaint, petition, legal opinion) | from 7,000 rub. |

| Oral (face-to-face) legal consultation from an industry specialist lawyer without studying documents | from 2,400 rub. |

| Oral (face-to-face) legal consultation of the duty lawyer without studying documents | from 1,200 rub. |

| Hourly wages for a specialist lawyer for comprehensive protection of the client’s rights | from 2,500 rub. |

| Lawyer's request to government institutions and organizations | 4,800 rub. |