Inheritance issues are always complex. And the point is not only that legally they are not entirely clear to people without the appropriate education. The loss of a loved one in itself is difficult for every family member. In addition, it is after the death of a relative that a huge number of standard conflicts arise regarding the division of property between heirs.

The division of property after the death of one of the spouses is no exception. In our article we will talk about how to formalize an inheritance after the death of a wife and on what principle, according to the law, the division of property will take place.

What property is inherited?

Cases involving the death of a husband or wife are legally considered on the basis of gender equality. That is, the lawyer’s consideration of inheritance issues will be conducted identically and impartially. However, before talking about inheritance shares, one cannot fail to mention such an important feature as jointly acquired property.

How much does it cost to inherit an apartment?

The procedure for accepting the inheritance of an apartment is subject to a state fee. If the testator draws up a will, 100 rubles are paid for certification of the document, which is reflected in clause 13 of part 1 of Art. 333.24 Tax Code of the Russian Federation. In addition, an additional 300 rubles are charged for opening the envelope and reading out the closed document. The specified amount is reflected in clause 14, part 1, art. 333.24 Tax Code of the Russian Federation. In case of inheritance of a spouse's apartment, the testator is not obliged to pay anything by law.

In the process of accepting an inheritance of real estate, the heirs additionally pay for the services of a notary for the proclamation of the will, acceptance and approval of an application for acceptance of the inheritance, sending requests, accepting a petition to renounce the inheritance, etc. Payment for the services provided is not regulated by the norms of the Tax Code of the Russian Federation; all tariffs are set individually by a specialist. Additionally, heirs pay a fee for obtaining a certificate of inheritance.

The amount of the fee is established by clause 22, part 1, art. 333.24 of the Tax Code of the Russian Federation, and depend on the cost of the apartment and the status of the heirs:

- Children (this also includes those who were adopted), husband or wife, parents, brothers and sisters of the testator - 0.3% of the amount of inherited property. At the same time, the cost of the duty cannot be more than 100,000 rubles.

- Other heirs – 0.6% of the declared price of the inherited property. The maximum duty amount is 1 million rubles.

What is joint property?

After marriage, all acquired property will be jointly acquired. This applies not only to those purchases that are made in shared ownership, but also to many others. According to the law, jointly acquired property will be considered:

- Cash (salaries, benefits, pensions, scholarships, income from commercial activities);

- Real estate (land, houses, apartments or other objects);

- Property (cars, furniture, household appliances, etc.);

- Investments (bank deposits, securities, etc.).

Warning

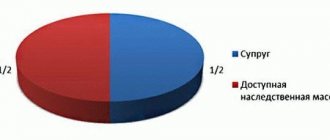

After the death of the wife, all jointly acquired property is divided into two equal parts. Half becomes the property of the spouse, and the other half, which belonged to the deceased, is already inherited in order of priority (by law) or by will. That is, the spouse’s share cannot be distributed, since he had equal rights to this property.

Read about the mandatory spousal share in inheritance by law here.

Nuances

The procedure for inheriting a wife's real estate is distinguished by its subtleties and nuances, which are recommended to be taken into account. Otherwise, unforeseen difficulties may arise, which will require additional time and effort to resolve. Therefore, the heir must take into account the following:

- All property of the testator is conventionally divided into personal and joint. By the provisions of the will, the heir-spouse may be deprived of his or her share of the deceased's personal property. However, the will should not limit the rights of the heir to receive a share of the joint property acquired during the marriage.

- Part 2 art. 1119 of the Civil Code of the Russian Federation indicates that the testator has the right to announce the requirements of the will during his lifetime. However, this is not the responsibility of a citizen, so often in practice the provisions of the document remain secret until the death of the person.

- The spouse may be recognized as an unworthy heir in accordance with Art. 1117 of the Civil Code of the Russian Federation. In this case, the rights to the property are transferred to other recipients of the inheritance by law, or to third parties in accordance with the will.

- If the wife has drawn up a will, the former spouse has the right to inherit the apartment only if he was indicated as an heir in the will. This rule is reflected in Art. 1119 of the Civil Code of the Russian Federation.

- A will is a legally significant document that can be revoked in court. This requires a valid reason - the act was drawn up by an incapacitated person; the testator was influenced by third parties.

- In order to determine the existence of a will for an apartment, it is necessary to carefully examine the personal belongings of the deceased wife. You can also contact any notary, who will check the presence (absence) of the document through the general notary register.

What is the personal property of spouses?

Whether property is personal is determined by the time of its acquisition and the method of receipt. So, for example, all property that you acquired before marriage will be exclusively yours. After marriage, it will not be considered joint property.

However, you can receive personal property while you are married. This will be considered all that you:

- Receive as a gift, either officially by deed of gift (for property worth over ten thousand rubles) or without drawing up this document;

Read how to draw up a deed of gift for an apartment here.

- You will inherit.

Attention!

After the death of the wife, her personal property will be inherited by law, that is, according to the lines of inheritance or by will. In this case, there will be no division into two equal shares, and the spouse cannot claim half of this property.

Who has the right of inheritance?

Inheritance of the wife's property can be made:

- According to the will. In this case, she independently indicates the heirs, and the will is read out by a notary;

- According to the law. The law establishes certain shares that are inherited by the relatives of the deceased. Depending on the degree of relationship, the share of the inheritance is determined.

Inheritance queues and inheritable shares

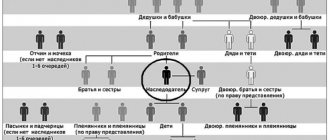

There are eight lines of inheritance in total, which are divided according to the degree of relationship. First in line are:

- Spouse;

- Parents of the deceased;

- Children born in this marriage.

The property is distributed among the specified heirs in equal shares. It turns out that after the death of his wife, the spouse will both own half of the jointly acquired property and be the heir to the share of the property of the deceased spouse.

Information!

If there are no heirs of the first stage, or they have refused the inheritance, then the right passes to the next stage. The second priority is the brothers, sisters and grandparents of the deceased. We should also not forget the fact that the heir may be excluded from inheritance for various reasons.

Inheriting an apartment after the death of a wife through court

As a general rule, acceptance of the inheritance of an apartment is organized through a notary. However, exceptional situations may arise in which the procedure is initiated through the court. District courts deal with cases regarding the inheritance of an apartment:

- Restoration of the period allotted for receiving the inheritance.

- Cases of refusal of a notary to issue a certificate of the right to acquire an inheritance.

- Establishing ownership of property during the inheritance process if the evidence provided is insufficient.

- Distribution of property in the event that the heirs do not reach an agreement voluntarily.

In all of these situations, it becomes necessary to appeal to the district court. The procedure for inheriting a spouse’s apartment through the court consists of the following steps:

- Contacting a notary to open an inheritance case and obtain a decision. In the event that we are not talking about missing the inheritance deadline, you should definitely contact a specialist. This is due to the fact that the notary’s reasoned refusal is essential evidence in the proceedings.

- Writing an application to the district court - in Art. 131 of the Code of Civil Procedure of the Russian Federation regulates the requirements for a claim.

- Collection of necessary applications - an indicative list is presented in Art. 132 Code of Civil Procedure of the Russian Federation. Each situation is individual, but the general list of documents is as follows: a will, or certificates confirming kinship (marriage); acts and documents confirming the validity of the reasons for missing the deadline for accepting an inheritance - a certificate from a medical organization; travel certificate; referral to a medical institution; foreign passport, etc.; documents confirming the death of the testator; extracts from the Unified State Register of Real Estate, certificates of registration of property rights; refusal of a notary to open an inheritance - if any; certificate from housing and communal services about family composition; duty payment receipt; other documents as necessary.

- Sending the collected documents and the claim to the court. You can send it either in person during office hours through the office, or in electronic format through the personal account of the State Automated System “Justice”.

- Taking part in the proceedings - at the appointed time you must appear in the courtroom, argue the stated requirements, and provide the necessary evidence. Based on the results of the proceedings, hear the decision made.

- Appeal the decision on appeal within 30 days from the announcement of the judicial act. This item is optional and is rarely used. The period for appeal is established by Art. 321 Code of Civil Procedure of the Russian Federation.

- Once the decision has been made, contact the notary again and obtain a final certificate of the right to inherit the wife’s apartment.

How is an inheritance processed?

Entering into inheritance is a fairly lengthy procedure that includes several stages. Initially, the inheritance is opened. The first day of opening the inheritance is the day of death of the testator, in this case the wife. Depending on the place of her residence, you will need to contact a notary who works in this area to accept the inheritance. If there is a will, the notary who certified this document handles the inheritance matter.

How to refuse inheritance of an apartment after the death of a spouse?

At the legislative level, citizens are granted the right not only to accept an inheritance, but also the opportunity to refuse it. This provision is regulated by Art. 1157 of the Civil Code of the Russian Federation, according to which the heir has the right to waive the granted right. At the same time, a citizen can either transfer this opportunity to third parties or not transfer it at all. The process of refusing to inherit a spouse’s apartment consists of the following steps:

- Determination of the notary in charge of the inheritance matter.

- Writing a free-form application with a request to renounce the presented right to receive an inheritance in accordance with Part 1 of Art. 1159 of the Civil Code of the Russian Federation.

- Collection of necessary documents: applicant’s passport, will, if available. If a representative is acting on behalf of the applicant, a power of attorney must be provided.

- The submitted documents are attached to the inheritance file and reviewed by a notary. Based on the results of the review, the specialist excludes the heir from the circle of citizens entitled to receive the inheritance.

In accordance with Part 3 of Art. 1157 of the Civil Code of the Russian Federation, a submitted refusal to receive a spouse’s apartment as an inheritance cannot be subsequently canceled or supplemented. Thus, if a citizen sent a refusal, the document will not have retroactive force, that is, it is impossible to return the rights back.

If a refusal to inherit the spouse’s apartment has been formalized according to the law, it can no longer be annulled.

Basic documents for accepting an inheritance

After the death of the spouse, when the inheritance is open, it is necessary to collect the main package of documents to transfer them to the notary. You can provide them either in person, through a proxy, or even by mail, but all signatures and copies must be notarized. The personal presence of the heir is still most recommended.

The basic package of documents for opening an inheritance case includes:

- The heir's passport or other document proving his identity;

- Death certificate of the spouse or court decision declaring her dead;

- Documents that confirm the existence of relationship (for the spouse this is a marriage certificate, for children and parents of the wife - birth certificates);

- Papers that indicate the place of residence of the deceased (extract from the house register);

- Documents on the right of ownership of this or that property (documents for real estate, vehicles, etc.).

Information!

After the death of the wife, her husband must be issued a certificate of right to a share in the jointly acquired property. To correctly draw up this document, you will need papers indicating the dates of acquisition of real estate, vehicles or other property.

Additional documents for inheritance

To determine the shares of inherited property and confirm by what right the deceased owned it, additional documents are required. So, for example, they testify to the property right of the testator:

- Purchase and sale agreements;

- Court decisions on the appropriation of this or that property;

- Deeds of gift.

In addition, an assessment of the value of the entire inheritance is necessary. It is needed to determine the amount of state duty and fair division of the inheritance. In particular, an assessment will be needed if conflicts arise between relatives at the time of distribution.

Information!

The real market value is assessed with the help of specialized firms and government agencies. If the subject of valuation is located abroad of the Russian Federation, then the authorized bodies of the country where it is located should determine its price. After the assessment, these papers indicating the value of real estate, vehicles and other property are transferred to the notary.

Can a wife claim the inheritance of her husband and his parents?

Married life implies the formation of common goods, values, and concerns. Common material assets arise that belong equally to the spouses. The division of jointly acquired material wealth occurs in two situations:

- Divorce;

- Death of one of the spouses.

Legislative acts define the concept of “joint property”:

- Money accumulated during marriage;

- Real estate;

- Vehicles;

- Bank deposits;

- Securities;

- Stock;

- Bonds;

- Shares of the enterprise;

- Values.

Personal belongings, inheritance received, and objects of donation are considered separately. In the absence of joint expenses that increase the value of the objects, this property belongs to one spouse.

Let us consider in more detail whether a spouse has the right to inheritance received by his wife.

The will of relatives may provide for other conditions of inheritance and the procedure for distribution of property, for example, the father and mother of the spouse indicate in the will the son’s spouse as the heir.

The conditions for division of property specified in the marriage contract differ from those established by law.

It is possible to change the order of distribution of property through the court. It is necessary to prove material investments in the family property, provide evidence of the investment of personal funds that significantly influenced the value of the property.

Documentary evidence includes invoices, acts, contracts for work, photographs, and video materials. Photographs capture the condition of the object after inheritance and the result of the work. Witness testimony is an added advantage. The presence of significant arguments - the court recognizes the property as joint property, subject to division.

Recommended reading: When does a will come into force?

Judicial practice knows cases of a married couple living in inherited real estate. Shared life leads to the presence of expenses of the general budget. The spouse provides a lot of evidence of the existence of expenses associated with repairs, restoration, and redevelopment of the premises.