The Constitution of the Russian Federation fully regulates the legislative right to civil inheritance of housing. What does this give?

Citizens have the opportunity to become guaranteed owners of real estate left by a deceased person (testator).

This process is called inheritance. This term is conventionally divided into two types: inheritance by law and inheritance by will.

The first type comes into play in the absence of a will and, therefore, all persons who claim to receive an inheritance participate in it.

Necessary documents for registration of inheritance

The procedure for registering an inheritance is quite complicated.

It requires quite a lot of time and, moreover, possession of the necessary legal knowledge concerning the rights of each of the applicants for the inheritance.

Legal norms state that the inheritance process must be carried out directly by the notary service at the location of the property or at the place of residence of the testator.

But in situations where it is not possible to contact budget offices, private notaries have the right to perform such actions.

Also, the procedure for registering an inheritance can be carried out on a territorial basis.

In order to better understand this procedure, you first need to know what actions need to be taken.

In particular, you need to take care of the following aspects:

- prepare and submit an application to the notary services for you to be issued a certificate of inheritance;

- accept an inheritance and open an inheritance case;

- negotiate with other heirs;

- collect and prepare the necessary documents from the relevant authorities, the Department of Municipal Housing and other authorities (this is necessary in order to obtain a certificate of inheritance);

- from a notary, obtain a certificate of your right to inheritance by will or by law, and also pay the state fee;

- collect and prepare the necessary documentation in order to continue the state registration of ownership of the property that is inherited by you.

Then, based on the received certificate, contact the Office of the Federal Registration Service.

List of documents:

- a duplicate or original of the death certificate of the testator;

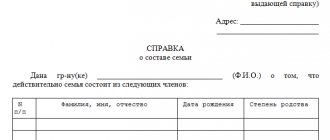

- a certificate stating where the deceased was registered at the time of death, including indicating the people who lived with him in the same territory;

- birth certificate of the deceased, marriage certificate, etc. (that is, those documents that confirm your family ties with the testator);

- extract from the house register;

- a document indicating the apartment or any other inheritance, and which is indicated in the certificate of ownership;

- floor plan, explication, certificate of cadastral value of property at the time of death of the deceased and cadastral passport.

Do not forget that these documents and the application for acceptance of the inheritance or the right to inheritance must be submitted to the notary's office only in the place where the inheritance was opened.

This must be done within 6 months.

How to register ownership of an apartment after inheritance?

If the apartment is located in another locality, then the applicant has the right to enter into inheritance remotely. To do this, the heir must approach the notary at his place of residence, submitting a standard package of documents. Here he also writes a statement accepting the inheritance. The notary then sends these papers to the specialist conducting the inheritance case in the hometown of the deceased.

Once the certificate is received, the heir can begin to register ownership of the property.

The collected documents are submitted to the notary, who keeps the second copy of the will.

The period for entering into an inheritance according to law and will is the same and is 6 months. But if the specified period was missed, then you can try to restore it in court.

The notary will issue a certificate of inheritance no earlier than six months after the death of the testator, regardless of the date the application was received.

You must contact Rosreestr with this certificate and an identification document. This is where an application to take ownership is written.

6

Will for a minor child or grandchild

The Civil Code of the Russian Federation reinforces the right of every capable citizen to...

52

Application for inheritance

Filing an application to enter into inheritance is the first step of registration...

23

Deprivation of inheritance rights

According to Part 3 of the Civil Code of the Russian Federation, inheritance is carried out in favor of...

38

Tax on inheritance

Part 3 of Federal Law No. 156 “Civil Code of the Russian Federation” dated November 26, 2001….

Upon entry into inheritance rights in relation to an apartment, according to the law, the property passes to the relatives of the testator in accordance with the principles of priority.

The heirs of the first stage, who have priority over other categories, include spouses, children and parents of the deceased. The heirs of the second priority are the grandparents, brothers and sisters of the testator. The rights of inheritance are transferred to them only in the absence of heirs of the first priority.

- original and copy of the owner's death certificate

- documents confirming the relationship with the former owner of the apartment (marriage certificate/birth certificate)

- a certificate confirming the registration of the owner at the time of his death, as well as evidence of the fact of cohabitation with him

- deed evidencing acceptable title to property

- extract from the residents' registration book.

The entire list of documents is provided to the notary at the place of opening of the inheritance.

An application for the issuance of a certificate of rights or acceptance of property should be attached to the listed package of documents.

Opening an inheritance case within six months from the date of death of the testator

In order to open an inheritance case with a public or private notary, you need to submit an application for acceptance of the inheritance.

Don't forget that you must submit the application in person.

An important point is that citizens who have reached the age of fourteen have the full right to submit an application without the consent of their parents or guardians.

But, if the heir has not reached the specified age, a guardian or parents must submit an application for him.

The person who filed the application has the right to withdraw it within six months from the date of opening of the inheritance.

In addition, you can refuse the will during the same period, according to the article of the Civil Code.

You must provide the same refusal to the notary service at the place where the inheritance was opened.

Also, if you are not legally competent, the guardianship and guardianship authorities, as well as your guardians, can write the refusal in your place.

Guardians and parents can refuse the inheritance that belongs to an incompetent child only with the consent of the guardianship and trusteeship authorities.

The application for refusal of inheritance is unconditional and unconditional.

Moreover, you, as an heir, have the right to refuse this inheritance by transferring it to another individual under a will.

You can issue a refusal in favor of absolutely any person, and here’s another important thing: the timely opening of an inheritance in no way depends on the potential heir, but the process of opening an inheritance case is an active action of the heirs.

The heir can write the application at the notary himself or send it by mail through his representative.

On the corresponding application, which was sent by the post office, the secretary of the village council or a notary, the authenticity of your signature must be certified.

Registration of a share in an apartment after death

Important

It can be argued that this is the simplest option in inheritance relations, since the wishes of the deceased are clearly expressed. However, a number of provisions of Russian legislation are aimed at limiting the will of the testator.

This is due to ensuring the interests of people with low social security; a mandatory share belongs to such a legal institution.

If other heirs refuse it, then the heir retains the right to sell the share to third parties. Suppose a mother and two daughters received equal shares in an apartment upon inheritance. However, the daughters are not interested in living in the same living space with their mother. Therefore, they can sell their shares to their mother, and she becomes the sole owner of the apartment.

If the mother does not want to purchase these shares, the daughters can put them up for sale, for example, through a real estate agency. Probably, the mother will not want to turn the apartment into a communal apartment. Therefore, this option is practically excluded. If a peaceful solution that would satisfy all relatives is really the sale of the inherited property and the division of the money received for it among the successors in equal parts.

The procedure for inheriting a share in an apartment In general, the inheritance of shares in an apartment occurs in the same order as in the case of inheriting an entire apartment. However, there are some nuances in this matter. An inheritance case is opened in a notary's office immediately after the owner of the real estate has died. First of all, find out whether there was a will.

Important

We invite you to familiarize yourself with: Tax deduction for pensioners: registration, documents, amount

It indicates the time of receipt of the certificate of ownership of the property. One small thing to pay attention to is taxes.

If the re-registration of an apartment due to the death of the testator occurs between distant relatives, you will have to pay 13% of the value of the property in the form of tax. Otherwise, the process will not be considered completed. Close relatives (parents, children, spouses) are exempt from taxes. Deed of Gift It is now clear how the re-registration of an apartment occurs after death. There is no other way. The only exceptions are annuity agreements and deeds of gift.

As a rule, a gift agreement is most often encountered in practice. It allows you to transfer the ownership of the entire apartment or part of it to another person during the lifetime of the owner of the property.

If the deed of gift is drawn up for close relatives, you do not need to pay tax.

If you acquire the right to an apartment through a gift agreement, take care in advance to obtain permission for the gift. In this case, there is no need to deregister persons living in the apartment.

The transfer of rights must also be completed through a notary.

The procedure for completing a real estate purchase and sale transaction can be divided into several stages:

- Preparation of certain documents for the apartment. The process is carried out by the seller. At the same time, you can search for buyers.

- Drawing up a purchase and sale agreement.

- Signing an agreement with the buyer. The new owner pays for the transaction, after which you can go to the MFC and register the agreement.

- Submitting a package of papers to Rosreestr to obtain a certificate of ownership of real estate.

Nothing special. The main problem when selling real estate is drawing up a legally competent contract. Now a sample of paper can be easily found on the World Wide Web.

Preparation of inheritance documents by a notary

Officials or notaries who perform notarial acts are required not only to verify the authenticity of the will, but also to register the will in the Inheritance Register.

In addition, the official must note absolutely all changes in the will, as well as record the refusal of it.

You will probably be interested in watching the mental map “How to receive an inheritance”, with step-by-step instructions for heirs

Or HERE you will learn about inheritance by will

How to register a vehicle:

Obtaining a certificate of inheritance

Only the heir who accepted this inheritance within the period established by law has such a right.

But there are also exceptions regarding situations where selective property is inherited.

In order for you to be able to receive the property that rightfully belongs to you without any problems, then you need to complete the following steps:

- submit an application with the required content directly to a notary (only at the place of opening of the inheritance);

- pay the state fee for issuing the certificate of inheritance.

You can receive your inheritance only after six months (occasionally there are exceptions when a notary reduces the period, but this feature occurs exclusively in cases where only one person claims his rights to the inheritance).

If you missed the deadline when you needed to accept the inheritance, then you need to provide the notary with the written consent of absolutely all available heirs.

This document will state that they are not opposed to you being included in the list of potential heirs to this property.

There are times when a notary may refuse to issue you a certificate due to actual actions on your part.

In this case, you can file a lawsuit and challenge the actions of the notary in a special proceeding.

If you entered into an inheritance in an actual manner and cannot prove it, then it is best to go to court, which, through the rules for establishing facts of legal significance, will establish your right to inheritance.

The notary refused to issue a certificate

Quite often, notaries refuse to issue a certificate of inheritance to heirs.

The reasons can be very different:

- incomplete package of documents;

- data inconsistency;

- missing deadlines;

- lack of indisputable evidence of actual acceptance of property;

- violation of the established order;

- removal from inheritance.

In most cases, citizens have to go to court. The procedure and deadlines for filing an application are determined by the provisions of the Civil Code of the Russian Federation and the Code of Civil Procedure of the Russian Federation.

The hearing of the case may take place within the framework of special or action proceedings. The second option is usually used when there is a dispute between relatives or if the actual heir cannot provide the necessary documents to the notary.

When preparing a claim, it is advisable to use the services of a specialized lawyer. If the court satisfies the claims, then subsequent registration of property rights will take place by court decision.

The heir just needs to wait until the procedural document comes into force. You are given a month to appeal.

Recognition of ownership of property in court excludes the possibility of re-applying to a notary. However, a judicial act, like a certificate issued by a notary, is a document of title.

The plaintiff/heir will have to visit the MFC or Rosreestr in the general manner. Otherwise, it will be impossible to dispose of property (donate, sell).

Registration of rights to an apartment inherited by an individual

In order to register your right to property, you need to contact the department of the federal registration service.

You will be provided with a list of necessary documents to resolve this issue.

But, it is worth noting that according to Article No. 131 of the Civil Code of the Russian Federation and Article No. 4 of the Federal Law “On State Registration and Transactions with It”

, there is an established obligation to state registration of rights to real estate, as well as all title documents that were issued after January 31, 1998.

It is for this reason that the right of ownership of this inheritance fully belongs to the heir from the date of death of the testator.

But not everything is as simple as we would like!

You can dispose of the inheritance only after state registration with the registration authorities and receipt of your right to inheritance.

How to register an apartment by inheritance in Rosreestr?

Registration of inheritance for an apartment after the death of the owner consists of several stages:

- Removing a deceased person from registration. To do this, you should submit an application to the registration authority, attaching the death certificate of the apartment owner. The applicant receives a certificate from the place of residence of the deceased about an extract from the passport office, confirming the fact that the owner was deregistered due to death.

- Contact a notary to whom the corresponding application should be submitted. Both the heir and his representative have the right to do this legally.

- Collection of the package of documents mentioned above. They will be needed in order to obtain property rights.

- Obtaining a certificate of inheritance. After six months and after checking all applications and documents by a notary, the applicant is issued a certificate confirming the ownership of the apartment by inheritance.

- Registration of property rights. If all stages are carried out correctly, grounds for state registration of rights to own real estate appear. To do this, you need to contact the registration chamber.

In accordance with Art. 1154 of the Civil Code of the Russian Federation defines the period that is allocated for entering into an inheritance - six months from the date of death of the owner of the apartment.

The starting point is the day of opening of the inheritance, the moment of death of the owner or the date of the court’s decision recognizing the owner as deceased.

The right to contact a notary is possible from these dates, depending on the situation. Before the expiration of six months, the heirs have the right to file claims for the inheritance of the apartment and at any time they can begin processing documents. But the heir can receive title documentation for the property after the expiration of six months from the date of death of the owner.

Inheritance refers to property received free of charge after the death of the former owner by law or will . In the first case, it is inherited by the closest relatives, according to the law. In the second, the heirs are those indicated in the will ( Chapter 62 of the Civil Code of the Russian Federation ).

The heir has the right to accept or refuse the inheritance.

Cars, apartments, houses and other valuable property are inherited. Real estate is the most common option.

It is important to understand that the inheritance does not become property on its own. It must be accepted in accordance with the deadlines and requirements established by law. According to Art.

1154 of the Civil Code of the Russian Federation, you need to enter into an inheritance 6 months after the death of the person from whom the rights to the property are transferred . During these six months you need to collect all the necessary documents and contact a notary.

The testator accepts or refuses the inheritance.

If the allotted time limit has expired, you will have to prove your rights in court.

An approximate scheme for entering into an inheritance is as follows:

- Before the expiration of the six-month period, contact a notary office. In fact, this is enough to get up to speed. The specialist will explain further actions and advise on any legal issues. When visiting a notary, it is recommended to take the death certificate of the person from whom the property is transferred, as well as a document confirming the relationship with the deceased (upon entry by law). If you enter into an inheritance under a will, it is the main document appearing in the transaction.

- Collect other documents (papers for the apartment, results of expert assessment, etc.).

- Pay the state fee. Its size is regulated by art. 333.24 Tax Code of the Russian Federation .

- Six months later, the notary issues a document indicating the right to the inherited apartment.

The heir has the right to choose any notary who will conduct the business. If there are several heirs, the decision is up to whoever contacts the notary first. And in the case when other applicants turn to other notaries, the specialist is obliged to redirect them to the one who took up the matter first.

After entering into an inheritance, it is required to register the transfer of ownership of the apartment in Rosreestr.

This can be done by contacting the nearest branch directly or submitting an application remotely through the official website. There is another organization called the MFC.

You can also submit a request through this multifunctional center. And he, in turn, after reviewing the papers, transfers the case to Rosreestr.

Solving problems with registration of inheritance rights

The main reason for any problems with registration is that you may not have all the necessary documents.

This issue can be resolved in two ways, namely:

- If you are partially missing certain documents, the notary will explain to you in detail how and what needs to be done to resolve this issue in court. Everything is extremely simple: you collect all the necessary documents and receive the right to inheritance, and otherwise, you go to court and resolve the issue of missing documents;

- If the documents proving your right to ownership of this or that property are lost and cannot be restored in any way, then you also cannot do without a lawsuit.

The legislation of the Russian Federation on the consideration of criminal and civil cases states that regardless of whether the documents were lost or missing at all, the defendants in this situation are both the heirs who accepted the inheritance and the authorities involved in issuing title documents, as well as the bodies that carry out registration of an individual's rights to property.

To resolve this issue, you must contact the heirs who already have a certificate of ownership of this inheritance.

If other heirs do not have the necessary documents, in this case the defendant is the body responsible for issuing the documents you need.

Registration of an apartment as property by inheritance

Documents that must be provided to the notary:

- Confirming relationship.

These include:

- birth certificate, marriage certificate, divorce certificate;

- documents on change of surname, name, patronymic;

- certificates confirming the fact of adoption, etc.

- Death certificate of the testator.

- On the testator's right to an apartment. It can be:

- extract from the Unified State Register, Unified State Register;

- state registration certificate;

- document on the basis of which the deceased became the owner: agreement of gift, exchange, purchase and sale, court decision, registration certificate, administration order, etc.

- The value of the cadastral value of the apartment. Such information is contained in an extract from the Unified State Register of Real Estate about the property, an extract from the Unified State Register of Real Estate about the cadastral value.

The law provides the grounds on which an inheritance can be registered if the deadline established by law has been missed:

- Valid reason for absence. For example, long-term treatment, imprisonment, etc.

- The heir did not know that an inheritance case had been opened.

In both cases, ownership of the apartment can only be obtained through the court. Statute of limitations for appealing to a judicial authority: 6 months from the day the reason ceases to exist.

That is, within 6 months after the citizen has completed inpatient treatment, he must file a lawsuit to restore the period.

Or for six months after I learned that the testator had died and it was necessary to declare inheritance rights.

Persons who were minors at the time of opening the inheritance also have the right to restore the term. They have the right to apply to the court within 6 months of their 18th birthday.

If the court decides to accept the inheritance by a relative who missed the deadline, it will determine the shares of all other heirs. Previously issued certificates will be invalidated.

To register the ownership of the apartment, the heir will need:

- Submit an application for registration of rights (MFC).

- Provide state duty and court decision.

An extract from the Unified State Register confirming ownership will be ready in 7-10 business days.

Registration of ownership of an inherited apartment occurs on the basis of a notarial certificate of inheritance.

In some cases, the heir will be able to register the right to the apartment by court decision.

If a relative actually accepted the inheritance, but did not receive a certificate, he is still the owner of the property. But in order to dispose of the apartment, he will need to contact a notary and prove acceptance of the inheritance.

The property that belonged to the deceased is transferred to the disposal of the closest relatives. There are three main degrees of relationship:

- Parents, children, spouse.

- Grandmothers, grandfathers.

- Siblings, then cousins and second cousins.

Accordingly, first of all, the inheritance goes to the closest people in terms of kinship. If they refuse, the property goes to the next category of relatives, etc.

As we have already found out, there are 3 grounds for receiving an inheritance:

- Will.

- Deed of gift.

- Law.

To register an inheritance, several steps must be completed. Multifunctional centers offer the implementation of public services. Here the process is faster and more convenient. Is it possible to register an inheritance through the MFC? Can. Below we will analyze the registration of an apartment by inheritance in the MFC, as well as any other real estate (house, etc.).