How can you use maternity capital up to 3 years

The purposes for which maternity capital can be spent for up to 3 years are defined:

- improving living conditions through the use of targeted loans/loans;

- goods and services necessary for social adaptation of disabled children;

- supervision of preschool children, their education;

- monthly payments for a child with whose birth the right to a certificate becomes available.

Is it possible to cash out maternity capital up to 3 years

There is no such way to get the full amount in hand. The word cash is used in two contexts:

- You can use maternity capital for up to 3 years for the listed purposes. You can receive real money in your hands legally and without having to report on targeted spending only through a monthly allowance for your second child.

- Conclude a transaction of dubious transparency, as a result of which money will be transferred to the account of an individual. Subsequently, they are fully or partially transferred to the recipient of maternity capital. He spends funds for other purposes. The law prohibits and prosecutes such schemes, but in practice it is not always possible to prove abuse. Inflated prices for housing and its formal purchase from relatives allow you to use a mother’s certificate for up to 3 years.

What payments from maternity capital up to 3 years can you receive?

Families with a second (or subsequent) child are entitled to a monthly benefit from maternity capital before 3 years of age if the income for each family member is less than 1.5 subsistence minimums (418-FZ, Art. 1 (download) and).

Basic rules for receiving:

- the monthly payment amount is equal to the minimum subsistence level for the child;

- the cost of living indicator in the region of residence is used for calculation and assessment;

- the second child must be born after 2017;

- payment is processed upon application to the Pension Fund or through the MFC - you can fill it out on the spot;

- the maximum period for receiving benefits is until the age of the second child is 1.5 years;

- if you apply for benefits before the second child is 6 months old, the amount will be paid for each month starting from the moment of his birth;

- If the application is submitted after the child is 6 months old, the payment will be made from the moment the application is submitted.

Procedure for disposing of maternal capital

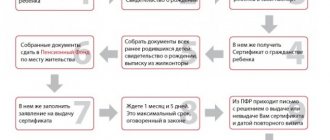

To manage maternity capital funds, you must submit a corresponding application to the Pension Fund of Russia. This can be done in person, or through a legal representative or proxy. There are several ways to apply:

- Personal visit to the Pension Fund or MFC. The address and telephone number of the hotline can be found on the Pension Fund website in the “Contacts” section.

- By post with certified copies of documents.

- Using online services on the official website of the Pension Fund or the State Services portal. To gain access to all services of government websites, you must have a verified account in the Unified Identification and Authentication System (USIA).

The application can be submitted after 3 years from the date of birth (adoption) of the child, or immediately (in cases established by law).

The application is submitted together with an identification document of the applicant. If the certificate holder uses the services of a representative, then it is also necessary to provide documents confirming his authority and identity. The full list of required documents depends on the direction of use of maternity capital.

The period for consideration of an application for disposal is one month , starting from the date of submission. After the request is satisfied, the funds are transferred to a specific bank account within 10 working days . In case of dissatisfaction, the applicant is given a refusal indicating the reason.

What compensation can you use maternity capital for without waiting 3 years?

Families have the right to use maternity capital for up to 3 years to compensate for expenses associated with the upbringing and social adaptation of children.

Recommended article: How to sell a house bought with maternity capital

Providing for disabled children

Basic Rules ():

- expenses are compensated upon their occurrence;

- You can reimburse expenses for any of the children in the family (the one in connection with whose birth the certificate was received, or any other);

- the list of goods and services that can be compensated has been approved and contains 48 items of goods and services for social adaptation;

- the list does not include services, special equipment, and events that are guaranteed by Federal Law No. 181 of November 24, 1995;

- To receive compensation, you must submit an application to the Pension Fund/MFC.

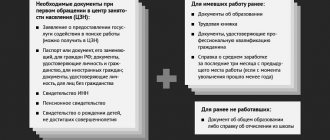

Package of documents submitted along with the application:

- passport of the certificate recipient;

- representative's passport and notarized power of attorney (if submitted through a representative);

- rehabilitation/habilitation program that was in effect on the date of payment for the reimbursed purchase;

- documentary evidence of the fact of acquisition and the amount of payment (agreements, checks, acts, etc.);

- inspection report - drawn up by the social service authority at the place of application to the Pension Fund - the period for providing the service is 5 days from the date of application;

- account details for crediting compensation - the owner of the account and the certificate must be the same.

After submitting your application, it will be reviewed within a month. If the requirement complies with the law, a positive decision will be made. After this, the money will be credited to your account within 2 weeks.

Preschool education

From 2021, you can use maternity capital for up to 3 years to pay for services provided to any of the family’s children within the framework of preschool education, maintenance, supervision (). The main condition is that the institution has a license. The certificate holder fills out an application to the Pension Fund or MFC in the prescribed form. Attached to it:

- the agreement on the basis of which the services are provided;

- additional agreement - if necessary, stipulate some conditions in accordance with the requirements of the Pension Fund;

- calculation of the cost of payment.

The Pension Fund will review the application within a month. If the decision on compensation is positive, the money will be transferred within 10 working days for the periods specified in the application. When clarifying the amount of payment, the certificate holder sends a corresponding application to the Pension Fund.

Payment for kindergarten with maternity capital for up to 3 years

We told you how to use maternity capital for up to 3 years to pay for supervision and maintenance. Please note that when using state money for these purposes, the parent loses the right to receive compensation:

- 20% for 1st child;

- 50% for the 2nd;

- 70% for the 3rd.

Purchasing housing with maternity capital up to 3 years

You can use maternity capital before 3 years for credit/loan payments ():

- as a down payment;

- according to schedule (principal + interest).

You can buy an apartment on the secondary market, take part in shared construction, build or buy a house with maternity capital for up to 3 years. The fundamental condition is the participation of the organization that will issue the loan (usually a bank). To transfer money directly to the seller, you must wait until the child is 3 years old.

Using maternity capital for up to 3 years for a down payment

The money is allowed to be spent for this purpose in whole or in part. If they are not enough for the down payment, you will need to add your own. Approximate order:

Recommended article: Seller's risks when selling an apartment for maternity capital

- Start choosing a home to purchase - this can be done as the first stage or in parallel with the next two.

- Receive a certificate from the Pension Fund of Russia.

- Apply for a loan. It would be appropriate to contact several banks at the same time to compare offers.

- Get approval for the amount, select a lender if necessary.

- Submit an application to the Pension Fund to use the funds.

- Wait for consent.

- Submit to the bank the documents for the purchased housing and the notification received from the Pension Fund about the balance of financial capital.

- Get the transaction approved by the bank.

- Sign contracts for the purchase of real estate and for a loan.

- Execute with a notary an obligation to allocate a share to everyone in your family after repaying the debt and removing the encumbrance.

- Submit your registration documents to the Registrar's Office. Many people find it convenient to contact the MFC for this.

- Having received the agreement with a registration mark, submit an application to the Pension Fund for the transfer.

- Provide the lender with the registered agreement, consent to the transfer from the Pension Fund and other documents in accordance with the loan agreement.

- Make sure the calculations are completed successfully.

Receive maternity capital for up to 3 years to repay the existing mortgage

The law allows the use of maternity capital if the child is under 3 years old for early repayment of the mortgage loan - principal and/or interest. The loan can be issued to either spouse at any time, including before the birth of a child and before marriage. After attracting state support, an obligation comes to allocate a share to each family member (). Registration procedure:

- Get a certificate.

- Submit an application to the bank for early repayment.

- Get information from the bank about the balance of the debt.

- Execute a notarial obligation to allocate a share to each family member after the encumbrance is removed.

- Submit an application to the Pension Fund for disposal of the money due to you.

- Wait for notification from the Pension Fund about the results of the application review. Application review period is 1 month.

- If the result is positive, the money will be sent to the bank to repay the loan within 10 days after consideration.

- If the result is negative, you will be told the reason for the refusal.

Where is it allowed to send maternity capital in 2021?

Due to the fact that legislation is constantly being improved, in 2016 the purposes for using the certificate expanded.

State aid could be invested in four different areas. This rule also applies in 2021. In addition, the owner of the certificate is not prohibited from spending the money in parts in different areas defined by law. These currently include:

- improving family living conditions;

- payment for services of educational institutions (for any child);

- contribution to the pension savings fund for the mother;

- compensation for the purchase of rehabilitation means for disabled children (any child);

- monthly cash payments until the child reaches 1.5 years of age (from 2021 - 3 years), in connection with whose birth/adoption a maternal certificate was issued.

On a one-time payment of part of the maternity capital

Back in 2009, the legislator provided certificate holders with an official opportunity to cash out some funds from the certificate.

In 2009-2011, this amount was 12,000 rubles, in 2015 - 20,000, in 2021 - 25,000. Today this law is no longer in force. To receive a one-time payment, it was necessary to contact the territorial branch of the Pension Fund of the Russian Federation with a corresponding application. To receive a one-time payment, you had to contact the Pension Fund office with an application. The money was allowed to be spent on urgent needs, that is, the legislator did not define goals for it. However, he introduced some restrictions. These included the following rules:

- payment was allowed to be received only once;

- it was considered anti-crisis and was transferred to the account of the certificate owner.

Attention! At the moment, the law on lump sum payment has lost force.

Matkapital for housing

Most citizens, when considering how to use capital from the state, choose to spend on housing.

At the same time, mother’s money is allowed to be invested:

- in the construction of individual housing construction projects, residential buildings, including through joint efforts (housing cooperative) with or without the involvement of a contractor;

- reconstruction of premises, which implies a change in their intended use;

- payment of the first mortgage payment;

- reimbursement of interest on a housing loan;

- repayment of existing mortgage debt (principal, not including penalties);

- acquisition of the whole or part of a residential property, provided that the remaining share is already owned by family members or is acquired simultaneously with this part.

Important! The main condition for the application of a housing certificate is the allocation of shares in the property to all family members, including minors and the unborn (a special condition is specified in the obligation).

Investing in children's education

An order for the use of maternity capital is allowed in 2021 to pay for training and related services. It does not matter which child’s education the budget money is allocated to (by account, by degree of relationship).

The following conditions for spending funds are mandatory:

- the educational institution must have state accreditation;

- You are only allowed to choose an establishment located within the state borders of Russia;

- a beginning student should not be more than 25 years old (it is not necessary to enroll in a paid university immediately after graduation).

Important!

It is permitted to use maternity capital to pay for students’ accommodation in a dormitory, as well as utilities. In addition, family capital funds can be used to pay for children’s visits:

- sports schools and sections;

- music and art educational institutions;

- courses on studying foreign languages.

Attention! All educational institutions listed above must have a license.

Payment for kindergarten

Many mothers who are choosing how to use maternity capital are attracted by the opportunity to pay for their children to attend a good private kindergarten.

This possibility is stated in government decree No. 931 dated November 14, 2011. To implement it, the following conditions must be met:

- make sure that the preschool institution is licensed;

- carries out its activities in the country;

- conclude an agreement corresponding to the established template;

- highlight in it the price of services for child support:

- nutrition;

- upbringing;

- socialization;

- ensuring hygiene standards.

Download for viewing and printing:

Decree of the Government of the Russian Federation of November 14, 2011 No. 931 “On amendments to the Rules for the allocation of funds (part of the funds) of maternal (family) capital for the education of a child (children) and other activities related to the child’s education ( children) expenses”

Important! It is prohibited to use funds from the state budget for educational services in the garden, paid clubs, sections and other funds from the state budget.

Pension for mother

The entire amount of state support or only a part can be invested in old age, that is, used for pension provision. This method of spending maternity capital is the least popular at present. If it is implemented, money can be received:

- at one time;

- as urgent payments (at least 10 years);

- for life in equal shares after reaching the appropriate age.

Attention! If the recipient of the pension contribution dies, her contribution will be transferred to the heirs within the framework of current legislation.

Regional maternity capital up to 3 years

Local governments support families having second and third children. The nature and amount of assistance depends on the economic capabilities of the region. The total number of programs is about 70.

In many regions, regional family capital is paid. The rules of use may be similar to those that work at the federal level, or they may differ significantly (for example, in terms of the number of children, the ability to use up to 3 years old, the intended purpose).

An alternative to maternity capital in some areas is a one-time benefit, which can be used at your own discretion without having to report. There is a program under which families receive land to build a house.

For complete, up-to-date information for a specific region, contact your local social security authorities.

Recommended articles: Regional maternity capital: how to apply for it and what to spend it on

How to get a loan for maternity capital in a consumer cooperative

How to use maternity capital for housing without a mortgage

Recommended article: Is it possible to buy an apartment with a mortgage from your parents?

Loan for maternity capital up to 3 years

There are situations when immediately after the birth of a child or even after the expiration of a period of 3 years, it is impossible to obtain a mortgage with maternity capital or is not rational. The bank may not approve the transaction, the deadline may not suit the client, there may be difficulties in collecting a complete set of documents for the bank, and other reasons.

For many, an attractive way to use maternity capital for housing for up to 3 years is to join a credit cooperative and then apply for a targeted loan. The activities of such organizations are regulated by the Federal Law on Credit Cooperation (No. 190 of July 18, 2009) and are controlled by the Central Bank.

Cooperatives, within the framework of laws, independently establish rules for issuing loans to their participants. The general scheme looks like this:

- Share fee for participation in a cooperative, sometimes an additional entrance fee.

- Application to the Pension Fund for the disposal of maternal capital with the participation of the cooperative.

- Obtaining approval from the Pension Fund.

- Applying for a loan, the characteristic features of which are:

- the interest rate is higher than in the bank;

- the requirements for purchased housing are more loyal than those of banks;

- within a few months;

- the amount is approximately equal to the available capital balance.

- Submitting an application for transfer to the Pension Fund.

- Repaying debt using maternity capital.

Requirements for credit cooperatives:

- works from 3 years;

- is listed in the register of the Central Bank;

- is a member of the SRO.

Until 2015, in order to buy an apartment with up to 3 years of maternity capital, many turned to microfinance organizations. Due to numerous abuses and offenses, the purpose of which was to withdraw maternity capital in cash for up to 3 years, the law prohibited such loans.

Where is it not allowed to spend family capital?

There is a constant discussion in society about other areas for investing maternity capital. Almost half of certificate holders have not decided where to spend government assistance. Citizens are not satisfied with the directions defined in the current legislation. Thus, proposals have been made to include in the list of permitted purposes:

- purchase of vehicles;

- investing public money in a dacha;

- acquisition of land;

- compensation for apartment renovation costs;

- consumer loan payment.

Some of the stated proposals were discussed in the State Duma. Thus, since 2009, the legislative body has regularly introduced draft amendments to the law of December 29, 2006 No. 256-FZ, which provides for the purchase of a car for transporting passengers using a certificate.

Important!

All of the above methods of using maternal capital are prohibited by law .

In addition, there are other restrictions on the investment of public money included in the budget for the payment of state support to families with children. Thus, they are prohibited from repaying loan debt resulting from penalties.