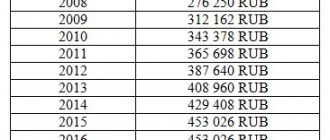

One of the most common ways to use maternity capital is to use money to improve housing conditions. In 2021, the certificate size will be 453,026 rubles. This is a very impressive amount, but it is still not enough to buy a home. Therefore, families decide to apply for maternity capital with a mortgage from Sberbank. This financial institution is one of the leaders in issuing loans for the purchase of real estate. Therefore, many clients choose this bank. In this article we will talk about the rules for applying for loans, the documents you will need, and the amount you can count on.

Where can I get a loan?

You will be interested in: How to earn 2000 rubles in a day: methods, types of earnings, tips and recommendations

Most often, maternity capital is issued for a mortgage at Sberbank. This financial institution is considered a leader in the number of loans issued for the purchase of real estate.

At the beginning of 2021, you can count on mortgage rates from 8.5% to 11.6% in this bank. In some cases, the final rate may be even lower. For example, if the client participates in a government program to subsidize mortgages. The percentage also varies greatly depending on what kind of housing you plan to purchase: under construction or finished.

You may be interested in: “Ile de Beaute” loyalty program: how to check your card balance

To apply for a mortgage using maternity capital at Sberbank, you will have to submit an application at one of the branches of this financial organization. In this case, you will need to provide a list of certain documents, which varies depending on the method you choose to confirm your earned income, as well as some other factors. We will talk about them later in this article.

A prerequisite for applying for a mortgage against maternity capital at Sberbank is the allocation of a share in the purchased housing for each family member. To do this, you must first visit the branch of the Russian Pension Fund at your place of residence in order to conclude the necessary obligation.

Basic conditions for obtaining a loan for maternity capital

Any holder of this certificate can receive a mortgage with maternity capital (hereinafter referred to as MK) from Sberbank. Preferential loan processing using maternity capital from Sberbank is designed only for obtaining housing under construction or for new buildings. Maternity capital can also be used to repay part of the mortgage amount for the construction of private houses, but in this case, no government subsidies are provided.

Bank requirements for the borrower:

- Russian citizenship;

- permanent place of work;

- age - from 21 to 75 years;

- co-borrower - by default the spouse.

Thanks to the last point, the issue of employment should not worry those mothers who are on maternity leave.

In this case, the role of the applicant for receiving a loan is usually performed by the spouse in whose name the certificate with maternity capital was issued. The terms of a loan against maternity capital from Sberbank in 2021 provide not only for the presence of a certificate, but also a special account statement indicating the balance of funds.

Conditions

To take out a mortgage using maternity capital from Sberbank, you will need to meet certain conditions. This assistance from the state can be used as a down payment for purchased housing or to pay interest.

You may be interested in: Taxes on summer cottages - description, requirements and recommendations

Among the conditions mat. capital for a mortgage in Sberbank there is also a clause stating that in order to purchase real estate by attracting credit funds, you should not wait three years to use the certificate. This can be done immediately after the baby is born. This provision is contained in the Federal Law regulating state support for families with children.

According to the terms of the mortgage for maternity capital at Sberbank, you can submit an application on how you plan to use these financial resources as soon as you issue the certificate itself.

It is worth considering that the law prohibits using this money for commissions, fines, penalties and interest that the family may have incurred while using a mortgage loan taken out earlier.

To transfer funds to repay the mortgage, the certificate holder must provide an application for the distribution of shares to children and spouse in the housing that is purchased on the mat. capital. Only after this the Pension Fund starts the procedure for using the funds.

It is worth emphasizing that, in accordance with the terms of the mortgage against maternity capital at Sberbank, this obligation must be fulfilled within six months after the encumbrance on the apartment or house is removed and the loan debt is repaid.

What is maternity capital and how to get a loan for it

Maternity capital is a measure of state support for young families who have given birth to or adopted two or more children. Is it possible to take out a loan against maternity capital? The answer is clear - yes! But there are some rules.

Maternity capital can be spent on various purposes: children’s education, mother’s pension, etc. But the main way to spend payments is still to improve housing conditions.

Of course, there are cases when maternity capital is denied. There can be many reasons for non-issuance of a certificate.

- Lack of grounds for extradition;

- termination of the grounds for receiving additional measures of state material support;

- deprivation of parental rights of a spouse;

Maternity capital becomes a good help for obtaining a mortgage. It can be used in full to pay the down payment on the mortgage, and you can also add your own savings to it, thereby increasing the payment amount. In addition, maternity capital can be used to pay off current payments. Using maternity capital, you can buy an apartment with a mortgage in a new building or on the secondary market, exchange old housing for a new one, participate in shared construction, build your own private house, etc.

From 2021, the payment amount was 453 thousand rubles; in 2017, until 2021, there will be no changes in the amount of family capital (indexation) due to the influence of inflation and other financial reasons.

Rules

Maternity capital can be taken out against a mortgage from Sberbank for the purchase of finished or under construction housing. In this case, the borrower must meet certain requirements.

To get approval for a mortgage under the mat. capital in Sberbank, the client must be 21 years old. The loan should be repaid at a maximum of 75 years. If his employment and income are not confirmed, then this bar is reduced for 10 years.

You must be a citizen of the Russian Federation. According to the conditions for registering maternity capital for a mortgage in Sberbank, you must be at your last official place of work for at least six months. Moreover, over the last 5 years, in total, you need to work for at least one year. Only clients who officially receive their salaries into an account opened with Sberbank can ignore the latest requirements.

An important role is also played by the fact that in the process of registering maternity capital for a mortgage in Sberbank it is allowed to attract co-borrowers. There should be no more than three individuals. In this situation, their income is taken into account when determining the maximum loan amount available to you. In this case, the co-borrower must necessarily be the spouse himself, with the exception of situations where he is not a citizen of Russia or a marriage contract has been concluded between the husband and wife, which stipulates the conditions for separate ownership of property.

You may be interested in: How to link a card to a Qiwi wallet: instructions and possible errors

It should be remembered that before going to the Pension Fund, in order to formalize how you will manage the money, you must first conclude a loan agreement.

Requirements for borrowers

Regardless of the chosen housing on the primary or secondary real estate market, the borrower is subject to extremely clear requirements:

- minimum age – 21 years;

- the last loan payment can be made by the borrower who is no more than 75 years old;

- maximum number of co-borrowers – 3 people;

- the borrower's spouse necessarily becomes a co-borrower;

- work experience of at least six months in the last place, at least one year of continuous work experience over the last 5 years;

- presence of Russian citizenship.

In exceptional cases, when citizens cannot provide a certificate of income and do not receive wages through Sberbank, the maximum age at the time of loan repayment will be 65 years.

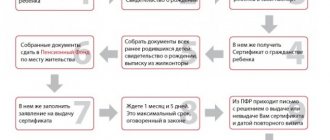

Procedure

You can find out all the details of applying for a mortgage using maternity capital at Sberbank online. We will dwell on them in this article. The following procedure awaits you.

- All necessary documents are submitted to the bank in full.

- If the financial institution makes a positive decision, the borrower selects the property that he plans to purchase. After this, a package of documents regarding it should be submitted to the bank.

- Sberbank employees must approve the property, after which the loan documentation is signed.

- Rights to real estate are registered in Rosreestr.

- A housing loan is being issued.

- For the Pension Fund, you need to obtain a certificate from the bank stating that you have received the loan. Please note that if you plan to cover part of the down payment using the certificate, you will need a certificate from the Pension Fund indicating the balance of maternity capital. However, it is not necessary to receive it before submitting an application. The law allows for this three months after the loan is approved.

- borrower;

- the property for which you are applying for a mortgage;

- client's employer.

The client has the right to take out a mortgage against the mat. capital in Sberbank in a branch that falls under one of three conditions. It must be located at the place of registration:

Refinancing a mortgage with maternity capital

After using maternity capital, further refinancing causes big problems. If you decide to invest it in a loan, then banks may refuse to refinance.

Refinancing is possible in cases where children do not own the property. If they have shares, then institutions are likely to refuse the submitted application.

Therefore, before investing capital, carefully analyze the proposed conditions. Carefully study all the options to make the right decision.

If refinancing is possible and the children do not have a share in the apartment, then the procedure can be completed according to the following scheme:

- Contact other banks and ask them to offer you conditions.

- Collect responses from agencies. Provide them to your financial institution and ask them to reduce the rate.

- If your bank refuses to change the conditions, then enter into an agreement with another institution.

- After completing the procedure, the new bank will pay the balance of the loan, and you will become its client.

Important! Refinancing is a fairly expensive procedure. To collect documents and go through all the stages, you will need to spend a certain amount. Therefore, before making a decision, you should calculate the real benefits of moving to another institution.

Mortgage size

Any branch of this financial institution will help you calculate a mortgage in Sberbank using maternity capital.

When purchasing a finished home, the client can count on an amount of 300,000 rubles for a period of up to 30 years. In this case, you must make a minimum down payment of 15% of the value of the property. If the borrower does not confirm income and employment, then the amount of his down payment must be at least 50%.

It is important to note that the mortgage amount cannot exceed 85% of the assessed or contractual value of the property. This housing is then registered as collateral.

When purchasing housing under construction, the client can count on the same conditions, but the final mortgage interest will be much lower. If the loan is issued under a preferential program with the participation of the developer, the loan cannot be issued for more than 12 years.

Advantages and disadvantages of this type of lending

Using maternity capital as a down payment on a mortgage with Sberbank has a number of advantages:

- Attractive interest rate.

- You can pay off all or part of the down payment.

- You won’t have to spend a long time collecting the required amount to transfer it to the bank after registration.

- It is possible to improve living conditions right now.

- There are preferential rates for programs for young families.

- You will appreciate the excellent conditions.

- There are no additional fees.

- Special conditions apply for salary clients.

- Individual approach to consideration of the received request.

- You can attract co-borrowers to increase the maximum loan amount.

Flaws:

- You'll have to spend a little more time on the design.

- Additionally, visit the Pension Fund.

- Any mortgage loan involves an overpayment.

- You will have to repay the loan received over a long period of time.

If you decide to take out a loan to buy an apartment, you will have to overpay. But often clients simply have no other choice. Upon receipt, review the repayment procedure and request an estimate of future payments.

Interest rates

Currently, Sberbank has different base rates. When completing a transaction for the purchase of finished housing, the client can count on 11% per annum.

With a down payment of 50%, it increases to 11.6%. For the purchase of housing under construction, the base rate is 10.5%. When participating in the subsidy program for a period of 7 to 12 years, it is reduced to 9%, and for a period of up to 7 years - to 8.5%.

At the same time, there is a system of reducing and increasing the interest rate. For example, when purchasing an apartment using the DomClick portal, the rate is reduced by 0.3%. This is a special service designed for selling, buying and searching for real estate.

If you have a salary card with Sberbank, then for life insurance you can reduce the rate by 1%, and when purchasing housing from certain developers for a period of up to 12 years, reduce it by another 2%. Also, for electronic registration of property rights without visiting the multifunctional center and Rosreestr, the rate is reduced by 0.1%.

If you don’t have a salary card, then you can confirm your income using a certificate according to the sample issued by the bank, or 2-NDFL, which will allow you to reduce the final percentage by another 0.3%.

For example, when purchasing a property for 5 million rubles, the minimum contribution will be 750 thousand rubles. If you take out the maximum 30-year loan with proof of income, life insurance, and electronic enrollment, you can expect a rate of 11%.

To approve the loan, you need a monthly income of 57,820 rubles. The monthly payment will be 40,474 rubles.

Procedure for obtaining a mortgage in 2021

Before contacting the bank for loan approval, you need to think carefully about your decision and use a mortgage calculator to calculate the loan amount at home, which will not be difficult to repay. In 2021, the credit policy in the state has changed. Mortgage rates rose, although this was very predictable. True, the increase was insignificant, by about 1-1.5%. Leading Russian banks continue to issue mortgage loans even without significant government support.

Having decided on a property and having a pre-approved mortgage, the client should visit the bank. The loan officer will need documents for the home being purchased, as well as an appraisal report. Once approval is received from the bank's headquarters, you can proceed to finalize the transaction.

After registering the sale and purchase, you must send an application to the pension fund to dispose of maternity capital funds to improve housing conditions (more details: about the nuances of using maternity capital as a down payment on a mortgage).

Package of documents

To apply for a mortgage using maternity capital at Sberbank, the documents you will need to provide depend on many factors. Basic package includes:

- application form;

- passport of the borrower and all co-borrowers with a registration mark;

- certificate for you to receive a mat. capital;

- certificate from the Pension Fund office about the accumulated balance of funds. capital;

- confirmation of employment and income.

To verify your income, you can use one of several methods:

- working citizens submit a certificate of income for the last six months from their place of work;

- pensioners - a certificate of the amount of their pension for the previous month;

- entrepreneurs - tax return for the last reporting tax period.

Even more options exist to confirm employment. You can do this in the following ways:

- if this is the main place of work, then you should provide an extract from the work book, a copy of it, or a certificate from the employer with information about the borrower’s length of service and position;

- if this is a part-time job, then a copy of the employment agreement or contract, bound and certified page by page (on the last page it is signed by the employer indicating the total number of sheets);

- for an entrepreneur - a certificate of registration of an individual entrepreneur (if the original is missing, it can be replaced by a copy certified by a notary), as an alternative, you can use a record sheet from the Unified Register of an Individual Entrepreneur or a certificate of inclusion of an individual entrepreneur in the Unified Register.

Is it possible to get a loan secured by maternity capital in cash?

Unfortunately, despite the explicit ban on transferring maternity capital in cash, there are still advertisements inviting MSC owners to resort to cashing out government subsidies.

Some citizens, in order to make money, succumb to such fraudulent actions, for example, by presenting documents about a non-existent property or putting into the contract a knowingly larger amount than the actual cost of the residential premises (often they purchase completely dilapidated, emergency housing, or existing only on paper, which in no way cannot cost 450 thousand rubles). Do not follow the lead of scammers - law enforcement agencies and the Pension Fund will definitely check the purity of the transaction, and if illegal actions are detected, penalties will be applied to the violator, including in the form of actual imprisonment. According to the Rules adopted by Decree of the Government of the Russian Federation No. 862 of December 12, 2007, all payments related to the use of maternity capital funds are carried out only by non-cash method.

Channel One, “Good Morning” program from 09/02/2015

Scheme for improving housing conditions through a targeted loan

In order to improve living conditions by obtaining a loan against mat. capital, the certificate holder must do the following:

- Select a property that meets all the necessary requirements in terms of technical and sanitary standards. In the case of purchasing housing on the secondary market, the condition must be met that the purchased housing should not be considered unsafe or unfit for habitation.

- Collect information about all financial institutions (banks and credit cooperatives - CCPs) providing such loans. Study the conditions for providing funds and choose the most suitable option for yourself.

- In accordance with the requirements of the selected organization, provide the necessary package of documents for concluding a loan agreement. Find a suitable home seller and sign a tripartite purchase and sale agreement between the seller, buyer and financial institution - that:

- the buyer acquires and the seller alienates the real estate in his ownership at an agreed price;

- to pay for the cost of housing, the buyer sends the seller a loan against maternity capital provided by a financial institution;

- after registration of the transaction in Rosreestr, the loan issued to the buyer is repaid by the Pension Fund upon an application for the disposal of maternity capital funds, which the buyer must submit to the Pension Fund of the Russian Federation within the time period established by the agreement (the sooner, the lower the total amount of interest payable).

After the buyer’s debt to the financial institution is fully repaid, the encumbrance in the form of a mortgage is removed from the purchased housing, and the family will need to register an apartment or house in the shared ownership of the spouses and children within 6 months (to this end, the corresponding application for disposition is submitted to the Pension Fund in advance notarial obligation).

What documents will be needed for this?

The main documents for obtaining a targeted loan include the following:

- application form;

- maternity capital certificate;

- a certificate from the Pension Fund about the balance of MSC funds (its validity period is 30 days);

- passports of the borrower and (if any) the co-borrower, who may be the second spouse;

- marriage certificate or divorce certificate;

- documents confirming the birth of children;

- documents for the purchased property: purchase and sale agreement and bank details for transferring money to the seller;

- extract from the Unified State Register of Real Estate for the purchased residential premises;

- certificate of persons registered in this living space or the absence of such (valid for 30 days).

When applying to the Pension Fund for an order to repay a loan:

- pension insurance certificate (SNILS);

- a copy of the loan agreement concluded with a financial organization;

- a copy of the mortgage agreement, if the terms of the loan require the registration of housing as collateral until the principal debt is fully repaid and interest is paid;

- a notarial obligation, within 6 months after the transfer of maternity capital funds or the removal of the encumbrance by a financial organization, to allocate shares in the ownership of the purchased housing to the second spouse and children.

Additional documents

You may be interested in: How to view loan debt for free?

In some cases, you may need additional documents. For example, if you leave another property as collateral, you will need documents on the collateral provided to you.

If the borrower has temporary registration, then you cannot do without a certificate confirming that he has received registration at the place of his actual residence.

If it is not possible to provide papers on official employment and income, you will need additional papers with which you can confirm your identity. This could be a military ID, international passport, driver’s license, federal government employee ID, pension insurance certificate, that is, SNILS.

When applying for a preferential mortgage at a rate of 6%, birth certificates of all the client’s children are required. If they do not indicate citizenship, then documentary evidence that it is Russian.

If we expect to apply for a loan under the “Young Family” program, then provide a child’s birth certificate, marriage certificate, as well as proof of relationship if you use the income of the applicant’s parents in the calculations.

After approval of the application, it is recommended to submit documents for the property that you have taken out as a mortgage. For example, an equity participation or purchase and sale agreement. You will also need documents that confirm payment of the down payment if maternity capital is used to cover the principal amount of the debt.

Please note that at Sberbank you can electronically register a transaction. In this case, employees of the financial institution independently send the entire package of documents to Rosreestr, and the client receives them already registered.

Recommendations when choosing a loan under MK

Before getting a mortgage, it is advisable to calculate the parameters in advance using an online calculator.

The bank sets the loan size based on the results of calculating the client’s income. If the client’s income does not allow him to repay the desired amount quickly, the bank offers to extend the period for repayment. This will entail an increase in the interest rate. In such a case, it is advisable to find options for additional confirmation of income, for example, attracting a co-borrower. Then his income will also be taken into account when calculating a loan for a larger amount. The terms of the housing contract provide that all co-borrowers are given a share in the housing purchased on credit. For this reason, these individuals must be as reliable as possible.

Conditions for receiving payment in 2021

After receiving an affirmative response from Sberbank to issue a loan under MK, you will need to visit the bank in order to transfer the required amount of money under the certificate to repay the loan installment.

Options for using funds from MK:

- partial repayment of the mortgage;

- repayment of a larger amount of loan debt;

- repayment of the down payment.

Including owners in the contract

You should be aware that the contract can be drawn up before or after the birth of the child.

If he is born at the time of fulfillment of loan obligations, parents can request money from the certificate to repay the debt. An important requirement in such a case is the inclusion of all family representatives, including the child, as owners in order to provide the appropriate share of the property. Similarly, the rights of children in whose name maternity capital is provided will be protected by law. It is possible to repay the loan not only with partial, but also with full repayment. It is important to consider: the terms of a loan against maternity capital from Sberbank in 2021 are such that funds from MK can only be spent on the main part of the loan, and not on paying fines, accumulated debt or commissions.

Preferential mortgage

Many families may be attracted by a lucrative offer: to take out a real estate loan when a second child is born in the family in 2021 at a rate of 6%.

This state mortgage subsidy program is valid for those parents who have a second or subsequent child between January 1, 2021 and December 31, 2022. They can get a loan for real estate at a minimum rate. This opportunity is provided to them in the relevant government decree.

In this case, the maximum loan size is 6 million rubles. When purchasing housing in Moscow, St. Petersburg, Moscow or Leningrad regions, it doubles.

For the birth of a second child, the state subsidy is provided for three years, and for the birth of a third or subsequent child - for five years. It is important that the total term of the preferential mortgage cannot exceed 8 years. This means that if during the existence of the program a third and then a fourth child appears in the family, the subsidy will be provided not for 10, but for 8 years. This is the maximum possible period.

When the subsidy expires, Sberbank increases the interest rate.

When applying for a preferential mortgage, the down payment must be at least 20%. However, the purchase of real estate is allowed only on the primary housing market. It must be unfinished if purchased under an agreement for participation in shared construction, or already ready for use.

Another mandatory condition is that the borrower’s life in this case is insured by one of the companies accredited by Sberbank for the entire term of the loan.

Criticism of the program

Some sociologists and economists believe that government subsidies for mortgage loans cannot solve the demographic and housing problems of Russians. Experts believe that MK makes citizens poorer. Mothers with many children give birth to children in order to receive budget money, without thinking about how they will support the younger generation. The funds issued by the state allow you to repay only part of the mortgage loan. The family is forced to pay off the remaining amount of the debt from their own savings.

Mortgage terms plus maternity capital do not take into account the current state of the domestic economy. The majority of Russians live quite poorly, and the cost of a mortgage loan remains at a fairly high level (compared to the rates offered to their citizens by American and European banks). Lumpenized layers of Russian society actively use criminal schemes to cash out government certificates. The money received is drunk and stolen. The quality of life of children from disadvantaged families is constantly declining. Budget subsidies contribute to the further impoverishment of the broad masses.

The main beneficiaries of state housing programs were Russian regions with a traditionally high birth rate (North Caucasus, Tatarstan, Bashkortostan, etc.). Russian sociologists have failed to identify a direct connection between population growth and budget financing of mortgages. Russian authorities may change legislation regarding the use of MK. It will be allowed to be used to pay for the current needs of the family.

Mortgage calculator

To draw up a schedule and amount of mortgage repayment, you can use a special calculator on the official website of Sberbank of Russia.

Click on the “Take a loan” section on the main page, find and click on “mortgage plus maternity capital” in the drop-down menu.

On the page that opens, select the option of purchasing finished or under construction housing.

After a brief description of the option, find the “Calculator” section. Enter the loan amount and property price. The amount of the down payment and the loan amount are calculated automatically.

Enter the amount of maternity capital, the date the mortgage was issued and the loan term. Indicate general information about the borrower (category, gender, age), his average monthly basic income.

In the “Accurate calculation” column, if desired, indicate the borrower’s additional income, the average monthly total family income and add information about co-borrowers.

Click the “Calculate repayment” button.

A repayment schedule and table will appear on the right, the total amount, terms, amount of the monthly payment and total overpayment, as well as the start and end dates of payments.

Using the calculator, you can estimate the probability of issuing a mortgage and its size in accordance with the parameters specified in the calculator, as well as calculate a mortgage with government support.

You can clarify the conditions and a complete list of required documents at a Sberbank branch.

Credit calculator

An online loan calculator is a mini-application that allows you to make quick calculations based on data specified by the user. It is not connected to any client databases, and does not send requests to servers for Sberbank specialists to use the entered data in the future. Thus, anyone can make a preliminary calculation based on real or planned figures. For example, expecting a salary increase, you can determine a feasible loan amount. Or: young families will be able to calculate a mortgage loan from Sberbank with maternity capital in the form of a down payment.

Calculations can be done in several ways based on:

- required loan amount;

- feasible contribution;

- income level of the potential applicant.

In any case, after the calculations, a table, graph and summary of credit conditions will appear.

Ready housing

Sberbank offers to buy an apartment that is no longer a new building under the “Purchase of Finished Housing” program. The maximum amount that an applicant can indicate in the application form is 45 million rubles. In certain cases, a loan may be provided without confirming the client’s employment and income. The loan agreement can be drawn up for 30 years, which is not the longest loan term among competitors.

The minimum level of credit rate is offered to customers who own Sberbank debit cards and are willing to make a significant down payment. Its size should significantly exceed 10% of the cost of the purchased object.

Housing under construction

For those who wish to move into one of the apartments of a building that is being prepared for delivery or is still in the design stage of construction, Sberbank offers to become a participant in the “Purchase of Housing Under Construction” lending program.

- In this case, as in all lending programs for the purchase and construction of real estate, the lender enters into loan agreements for a period of up to 30 years.

- The minimum amount that you can ask the bank for a loan is 45 thousand rubles, and the maximum is 45 million rubles.

- The amount of the down payment may affect the reduction of the tariff rate to a minimum, the value of which is 13% per annum.

The conditions of both programs can be used by anyone who meets the requirements for borrowers, including young families with maternal capital, pensioners (with a limited loan period) and military personnel (NIS participants enjoy reduced rates under the NIS program).

Registration of a mortgage loan

You can apply for a housing loan under special programs at Sberbank for maternity capital both online and by contacting the bank in person

It is important to know what requirements Sberbank imposes on the borrower, and most importantly, what documents will need to be provided to the specialist to complete the transaction

You can get a mortgage using maternity capital without providing a bunch of documents to the bank; just two will be enough. However, the down payment in this case must be at least 50% of the cost of the purchased home.

Terms of use of loaned funds

The basic requirements and conditions of a mortgage for maternity capital at Sberbank will be common to existing programs:

- Age: from 21 to 75 years;

- Terms: up to 30 years;

- Available amount: from 300 thousand rubles;

- Down payment (required): at least 15% of the total amount;

- Collateral: purchased housing;

- Co-borrowers: spouse – required;

- Payment: in equal monthly installments.

Commissions and fines are charged by the bank in only one case - for late payment 20% per annum for the entire period from the first day until its repayment; for early (full or partial) repayment and issuance of a loan, no commission is charged.

List of documents

Even if you decide to take out a mortgage, where you need to provide only two documents, it will not be superfluous to know the full list of required papers. After all, the bank reserves the right to change this condition and require the provision of additional information about the borrower or co-borrower, which will be documented.

Along with the standard borrower/guarantor application form, 2 packages of documents are provided:

- Personal borrower/co-borrower: proof of identity, registration, income and length of service.

- For real estate: ownership, mortgage to the bank after execution of the purchase and sale agreement.

Collateral property is subject to compulsory insurance. According to the bank's terms, the insurance company can be selected from the proposed list established for each region or proposed by the borrower.

Look and study the full list of documents on collateral property.pdf and the list of documents on credited housing.pdf in advance, if the collateral is another property, in order, if necessary, to resolve all emerging issues before concluding the transaction. Study the example of filling out a loan application form.pdf to save time when filling out your own document.

Additional Information

You thought about taking out a loan to improve your living conditions much earlier than the addition to your family, and signed a mortgage loan agreement for several decades. After a certain period of time, you would like to reduce the debt to the bank by a certain amount of money. Your right to use the maternal certificate is protected by law in this case.

Come to the Pension Fund. The father/mother's appeal will be recorded in the application. Then the fund transfers the funds from the certificate to the bank’s account (it turns out that the use of MK occurs purposefully to improve living conditions). In order for MK to be submitted as an extraordinary payment on a mortgage loan, it is necessary to submit to the bank the established application according to the rules defining early repayment.

How to get a mortgage using maternity capital: which banks issue and what is needed for this

Then provide their copies along with the originals to the Pension Fund office. The transfer of money to the bank will be carried out within a period not exceeding one month and 10 working days, starting from the moment the application was submitted, unless, of course, the Pension Fund has grounds for refusal.

Nevertheless, the number of credit institutions accepting MSC funds increases annually. Special loan products are being developed for such borrowers. Lending conditions are different, but the most favorable ones are offered by large banks with state participation, in particular Sberbank or VTB.

How to pay off a mortgage with maternity capital at Sberbank

After the borrower has issued a housing loan from Sberbank and received a certificate of receipt of the loan (the document indicates the number of the loan agreement, the names of all borrowers and the mortgage amount), he needs to contact the Pension Fund (PFR) or the Multifunctional Center (MFC) with an application for disposal and necessary documents.

General package of documents:

- Passports of the certificate holder and his spouse.

- Marriage certificate.

- If applying through a legal representative, confirm his identity and place of residence.

- Confirmation of changes in personal data, if any.

- The obligation to allocate shares to all family members after the removal of the encumbrance.

To use maternity capital to pay the down payment, you must provide the following along with the documents from the main list:

- a copy of the loan agreement concluded with Sberbank;

- a copy of the mortgage agreement that has passed state registration;

- obligation to allocate shares.

To use maternity capital to repay the principal and interest, the certificate owner provides:

- a copy of the loan agreement for the purchase of housing;

- a copy of the mortgage agreement that has passed state registration;

- extract from the Unified State Register of Real Estate;

- if the housing construction project has not yet been put into operation - a copy of the registered agreement for participation in shared construction, or a copy of the permit for the construction of an individual residential building;

- if the loan is issued to pay the entrance fee and (or) share contribution to the cooperative - confirmation of membership in the cooperative;

- a certificate of the balance of debt and interest debt issued by Sberbank;

- an account statement confirming the non-cash transfer of mortgage funds.

Within a month, the Pension Fund of the Russian Federation will make a decision on the transfer of funds to MSK, after which they will be transferred to Sberbank within 10 working days.

Maternity capital funds can be used to fully or partially repay the mortgage. If, after the transfer of MSK, the borrower remains in debt, Sberbank will issue a new payment schedule taking into account the remaining amount of debt (at the borrower’s request, the size of the monthly payment or the loan repayment period can be reduced).

Additional Information

- Maternity capital in the Leningrad region

- Maternity capital news

- Is it possible to spend maternity capital on buying a car?

- How to use maternity capital for a mortgage

- How to use maternity capital to build a house

Mortgage

A mortgage loan is issued only for the purchase of real estate. It is not suitable if the family plans to carry out redevelopment or development. When signing the contract, the apartment is registered as individual or shared ownership.

In order to apply for a loan, you need to collect documents.

These include:

- a certificate issued by the state stating the amount of the subsidy;

- registration from the Pension Fund (within 4 months after the loan was issued);

- borrower's passport;

- Certificate 2-NDFL for the last six months.

You need to take care of registering maternity capital in advance. To do this, an application, passport, birth certificates of children and SNILS are sent to the Pension Fund.

After submitting the required documents, the application is reviewed and a decision is made. If it is positive, then an application is sent to the Pension Fund about the expenditure of maternity capital on the mortgage.

The decision is made within a few days. Once approved, the applicant can view real estate offers for sale. The seller needs to be told in advance that maternity capital will be used. Indeed, in this case the deal is delayed for several months. This is due to verification of documents by the Pension Fund.

After all stages, the mortgage loan from Sberbank is finalized. An agreement on shared ownership of housing must be concluded. After all, when using maternity capital, both parents and children acquire the right to real estate.

The answer to the question whether a single mother can receive maternity capital can be given in the affirmative. Yes, a woman can qualify for social benefits.

On bail

The loan can be secured by maternity capital. In this case, government support is provided in the form of payment of the down payment or part of the loan.

You can use a certificate as collateral if:

- purchasing an apartment or house;

- improving living conditions;

- real estate construction costs;

- carrying out major repairs or reconstruction.

To apply for a loan using maternity capital as collateral, you need to go through several steps:

- obtaining a certificate;

- choice of housing;

- drawing up a purchase and sale agreement;

- visiting the bank with a full package of documents;

- receiving a decision and a letter indicating the deadline for making the down payment;

- drawing up a certificate from the Pension Fund about the amount of maternity capital;

- paperwork at the bank;

- provision of a loan agreement to the Pension Fund.

It is worth remembering that the applicant will not receive a cash loan in hand. Maternity capital money is automatically sent as a down payment from the Pension Fund to the bank's current account.

To apply for a loan secured by maternity capital, the borrower must be:

- an employed and capable person;

- a citizen of the Russian Federation with permanent registration in the country;

- holder of maternity capital;

- a person with sufficient income and a positive credit history.

The borrower must be at least 21 years of age and not more than 75 at the time of full repayment of the loan.

To apply, you will need to have certain documents available.

These include:

- statement;

- identity cards of the borrower and co-borrower;

- military ID (for men under 27 years of age);

- certificate confirming the official marriage of the spouses;

- children's birth certificates;

- income certificate;

- certificate for receiving maternity capital;

- an extract from an individual personal account issued by the Pension Fund of Russia;

- documents for the purchased property.

The client may be offered a loan at different interest rates. They vary depending on the amount and term of the loan, down payment, income, credit history, client status, and insurance. On average, mortgages are issued at a percentage of 11.5 to 13.

There are various ways to pay off debt.

Among them are:

- payment through a cash register or terminal in cash;

- transfer via bank card;

- transfer of money through Russian Post or another bank;

- automatic debit from your salary card.

Mortgage loan from Sberbank under capital capital

- The interest rate and other terms may vary depending on the program and housing you choose. The same applies to the down payment. For example, if we are talking about apartments under construction, then the down payment will be 15% of the cost of housing. For secondary housing, the contribution will be slightly higher - 20%.

- Sberbank does not prohibit the use of MK as a down payment, but only if the certificate is equal to it or even exceeds 15-20%. As a result, thanks to the certificate, you don’t have to deposit any funds at all.

- For secondary housing when using a certificate, the interest rate is 9.5% or more per year .

- The minimum amount that can be borrowed is 300 thousand rubles . The maximum amount of an object in the regions can be 8 million, and in the capital, Moscow region and St. Petersburg - up to 15 million.

- The minimum down payment amount is 15%.

- The maximum period for which a mortgage is issued is 30 years . However, it is important that the payer be no more than 75 years old .

- When applying for a mortgage under this State program, it is important that accident insurance is issued for the property. In the absence of such, the rate will be increased by 1% .