Compensation payments are ways of social support for citizens performing a socially useful function who find themselves in a difficult situation.

Funds to help citizens of the Russian Federation are allocated both from budgets at various levels and from wage funds of enterprises. This depends on the type of compensation stipulated by legislation. They are conventionally divided into two large groups:

- compensation under labor legislation;

- social payments.

Both needy citizens and those exposed to harmful factors, forced to move, and so on can apply for compensation payments.

About incentive payments

Incentive payments include:

- bonus payments;

- allowances and surcharges;

- other incentive payments.

The establishment of all of the above payments (as well as their features in a particular organization) is made through the execution of collective agreements, agreements, local regulations in accordance with labor legislation and other regulations that contain labor law norms (2nd part of Article 135 of the Labor Code RF).

The adoption of local regulations (for example, regulations) is carried out taking into account the position of the representative body of workers (if there is one), and should not negatively affect the position of the employee in comparison with the current legislation. Thus, if the listed payments are provided for by a collective agreement (agreement), a local regulatory act of the organization, a provision regarding them must be included in the employee’s employment contract.

Premium payments

Bonuses are not only an element of wages, but also one of the types of incentives for an employee who conscientiously performs work duties (Articles 129 and 191 of the Labor Code of the Russian Federation).

The bonus regulations usually contain:

- list of employee positions that are subject to bonuses;

- scale and amount of bonuses;

- frequency and periodicity of bonus payments (for example, based on the results of work for the year, quarter, month or other other period, taking into account the specifics of production).

These bonuses are included in wages and are payable for periods longer than half a month. Bonuses can also be awarded for labor results, achievement of certain indicators, i.e. after evaluation of indicators.

The terms of bonus payments are established by local regulations. In this case, the assignment of bonuses with deviations from the established deadlines will not be considered a violation of the requirements if there are specific payment dates in the company’s position, for example, payments based on the results of work for the year, which will be paid only in April of the next year (6th part of Article 136 Labor Code of the Russian Federation).

Under the conditions established by the regulations of the enterprise, according to which bonus payments are not made or are assigned in a smaller amount, the employer is given the right not to accrue a bonus to the employee or to reduce its size.

sample order regarding reduction of the monthly premium.

sample order to deprive an employee of a bonus.

Where to apply to receive

Due to the multiplicity of types of compensation, various bodies are involved in their appointment. All types of payments specified in the Labor Code are required to be made by employers.

Social guarantees can be provided by:

- social protection authorities;

- Pension Fund;

- local administrations

- other.

Attention!

There is no income tax due on compensation payments. They are not included in the total salary. Many compensation and social payments have been indexed since February 1, 2018 by 1.025%.

Dec 29, 2021 14:38lgoty-vsem.ru

About compensation payments

The second element of wages in accordance with the Labor Code of the Russian Federation is compensation payments.

The payments under consideration should be distinguished from those indicated in Article 165 of the Labor Code of the Russian Federation for reimbursing the employee for costs that are associated with the performance of labor or other duties and are not included in wages.

The list of compensation payments approved by Order of the Ministry of Health and Social Development of the Russian Federation No. 822 dated December 29, 2007 includes certain payments.

In particular:

- payments to employees who perform hard work or work in conditions recognized as harmful or dangerous;

- payments for performing work duties in areas with special climatic conditions;

- payment for work in conditions that deviate from normal, including performing work of different qualifications, combining positions, working overtime, working on night shifts, etc.;

- various allowances for work within the framework of employment with information that may represent state secrets, including work with codes.

In accordance with Article 149 of the Labor Code of the Russian Federation, when performing work in conditions deviating from normal conditions, the employee must be paid appropriate additional payments established by the labor (collective) agreement. Such additional payments are not limited to the maximum amount. At the same time, their minimum amount should not be lower than those established by laws or other regulations.

Types of compensation

There is a classification of payments according to the nature of frequency: one-time, annual and once a month. Recipients of compensation from the state can be:

- victims of man-made disasters (“Chernobyl Nuclear Power Plant”, MPO “Mayak”);

- caring for disabled people;

- mothers/other relatives raising children under 3 years of age;

- students who went on academic leave;

- unemployed military wives;

- family members of fallen soldiers;

- residents of the Far North.

Compensation under the labor code

Please note: all compensation payments are made from the employer’s budget. Labor legislation describes a system of payments to employees whose employment has changed due to the request or fault of the employer. What applies to compensation payments:

- assignment to work in another region;

- business trips;

- obtaining education in a working profile;

- termination of the employment contract for reasons beyond the control of the employee;

- appointment of an employee to public and government work;

- failure to provide a work book on time at the time of dismissal.

Social Security payments

The legislation determines that the social security system is responsible for compensation:

- Child care is given to a family member (wife, husband, guardian) who raises children under 3 years of age.

- Persons who are forced to care for disabled family members.

- Victims of man-made accidents.

- To military personnel and family members of those killed in action.

- For internally displaced persons (one-time relocation allowance and monthly allowance).

- Disabled people (compensation in lieu of treatment costs if they give up a car).

- Residents of the Far North (compensation for travel to vacation spots and payment at the time of moving to the European part of the Russian Federation).

Additional pay for work in dangerous or harmful conditions

Employees who perform their work duties in dangerous or harmful conditions are entitled to an increase in wages (Articles 146 and 147 of the Labor Code of the Russian Federation). Such compensation is not established provided that the working conditions in question are recognized as safe according to the results of a special assessment or the conclusion of the relevant state examination (Article 219 of the Labor Code of the Russian Federation).

Employees retain their right to receive increased wages if this is confirmed by the results of workplace certification, which was carried out before the introduction of a special assessment of working conditions by Federal Law 426, i.e. before January 1, 2014.

The employer has the right not to apply a special assessment at those workplaces where certification was carried out, from the date of completion of which more than five years have passed. As an exception, there are cases provided for in Article 17 of Federal Law No. 426. The minimum increase in wages when carrying out work in hazardous or harmful conditions is equal to 4% of the salary (tariff rate) established for performing various types of work under normal working conditions.

How is labor paid when performing work in areas with special climatic conditions? Such work of employees is subject to payment at an increased rate (2nd part of Article 146 of the Labor Code of the Russian Federation). In accordance with Article 148 of the Labor Code of the Russian Federation, labor activity in these areas is paid in a manner and in amounts that cannot be lower than those established by labor legislation or other legal acts.

In particular, the labor of citizens working:

- in the regions of the Far North and localities equivalent to them, regional coefficients and percentage increases in wages are applied (Article 315 of the Labor Code of the Russian Federation);

- in desert, high mountain, and waterless areas, the corresponding salary coefficients established by regulations are applied.

Percentage allowances and coefficients for work in special climatic conditions are included in the wages, which the enterprise is obliged to pay in full.

Those citizens who work part-time in such areas and localities, as well as citizens who go there to work on a rotational basis, can also apply for a salary taking into account the specified allowances and coefficients.

How is labor paid when performing work of varying qualifications? In accordance with Article 150 of the Labor Code of the Russian Federation, for workers with piecework and time-based wages, different payment procedures are provided for when carrying out work of different qualifications.

Namely:

- performance of labor duties with time wages is paid as work of a higher qualification;

- performance of labor duties with piecework payment is paid according to the rates of the work performed;

- When carrying out assignments that are paid below the rank assigned to the employee, the difference between ranks is compensated.

The procedure for paying for work on holidays (weekends), with a shift work schedule

Weekends are days of continuous rest provided weekly. The procedure for providing such days is established by Article 111 of the Labor Code of the Russian Federation.

The list of holidays and non-working days on the territory of the Russian Federation is established by Article 112 of the Labor Code of the Russian Federation. In accordance with Article 153 of the Labor Code of the Russian Federation, work on holidays (weekends) implies mandatory additional payment.

The minimum surcharge is:

- no less than double piece rate - for piece workers;

- no less than double the daily or hourly tariff rate - for citizens whose wages are paid at the daily or hourly tariff rate;

- no less than a single or hourly rate on top of the salary (if the volume of work does not exceed the monthly working time standard) and no less than a double daily or hourly rate on top of the salary (if the volume of work exceeds the monthly working time standard) - for citizens receiving an official salary.

Specific wage levels are established by a collective (labor) agreement or local regulations. It is possible that instead of an increased salary, the employee (at his request) will be given another day for the intended rest. In this case, the work is subject to payment in a single amount, and the day of supposed rest is not subject to payment at all.

Calling to work on additional days of rest is not considered as working on weekends, and therefore does not imply an increased salary.

Increased payment is subject to the entire period of work on a holiday or weekend, that is, every hour of work performed. The hourly rate is determined by dividing the daily rate by the number of hours of work performed daily.

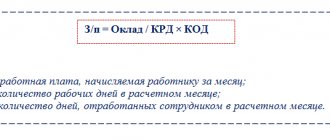

The procedure for calculating the hourly rate of citizens who receive a monthly salary is not strictly regulated.

We propose to provide for the following procedure in the local regulatory act:

- divide the monthly salary by the usual number of working hours in a particular month;

- divide the monthly salary by the average monthly number of working hours per year (i.e., by the value obtained by dividing the normal number of working hours per year by 12);

- divide the monthly salary by the average monthly number of working hours in the accounting period (i.e., by the value obtained by dividing the normal number of working hours in the accounting period by the number of months in such a period).

If the employment contract specifies a working time schedule according to which work is also expected on holidays (for example, with a shift work schedule), then the hours worked on holidays are subject to double payment.

Work on weekends is always carried out on top of the standard working hours and is subject to double payment, since it cannot be foreseen in advance either by the work schedule or by the working hours. As an exception, the case is considered when an employee who worked on a day off was given another day for supposed rest at his own request, paid in a single amount.

Encouraging young professionals in budgetary institutions

It is worth considering that this is an employee who has a secondary or higher education, and he first found employment in his specialty within a year after receiving it. It is believed that during the first three years, from the start of work, a person is entitled to additional payments. Their size is 40% of the salary rate. If the diploma is defended excellently, the amount rises to 50%. They can be installed only at one place of work, depending on the employee’s decision.

The status of a young specialist can be obtained by a person who:

- Is under the age of 35.

- Has a primary, secondary or higher education.

- Gets a job for the first time in your specialty immediately after receiving your diploma.

In Russia, there are no measures to support young and talented specialists yet. Most often, it is carried out by regional laws.

It is usually provided in the following form:

- Payment upon getting a job.

- Compensation for travel expenses.

- Loans on preferential terms, mortgages at a reduced rate.

- Reimbursement (part or all) of expenses for maintaining children in kindergartens, schools, etc.

Night shift pay

At night, each hour of labor is paid in a larger amount, the amount of which cannot be less than that specified by labor legislation (Article 154 of the Labor Code of the Russian Federation). This rule also applies to those citizens who were hired specifically to perform duties at night.

Government Resolution 554 of July 22, 2008 provides for one minimum amount of additional payment for night work for all workers, in particular, a 20 percent additional payment for each hour of work. The additional payment is calculated taking into account the hourly tariff rate (salary calculated per hour of work). It follows that when establishing additional pay for night work, other allowances or additional payments are not taken into account.

The period from 22.00 to 6 a.m. is considered night time.

Employers are legally required to reduce the duration of work on the night shift by one hour without further work. The exception is the cases indicated by Article 96 of the Labor Code of the Russian Federation.