Who is an auditor

To ensure a correct assessment of the situation in a particular unit, enterprise, in a certain sector of the economy or in the country as a whole, various control methods are used. Thanks to him, the achievement of set goals is ensured. Therefore, it can be argued that control is one of the main means of developing a course and resolving all issues that will ensure adequate operation of the controlled object.

The performance of these functions is entrusted to control and audit units operating at enterprises and institutions. And the specialists involved are auditors.

Based on the foregoing, it can be argued that an auditor is a specialist who most often has a higher economic education, certain work experience and is authorized by management to conduct an audit - an audit of the economic and financial activities of an institution, enterprise or division.

Conclusion

Probably only children don’t know who the auditor is. The profession is quite difficult, it is difficult to imagine what demand there is for it. However, every person working in an enterprise or at its facilities has met with an auditor at least once.

This profession is popular not only thanks to Gogol, but because of its seriousness and importance. We can say that the fate of this or that institution depends on the auditor. After all, everything depends on his assessment, analysis and decision.

You might be interested in the article: Who is Cashier?

History of the profession

The meaning of the word auditor, which comes from the ancient Latin revisor, is interpreted as “revising.”

The history of the emergence of this profession goes back to Ancient China, Greece and Rome. Thus, control over state income and expenses in Athens in the 5th century. BC e. carried out by the People's Assembly. All financial transactions in the Roman Empire were controlled by the Senate and a staff of hired auditors. Therefore, we can safely say that an auditor is a profession that has existed for many centuries.

The first law requiring annual audits of enterprises in England appeared in the 60s of the 19th century. At the same time, similar laws were approved in France and other developed countries of Europe. The reason for this was the different interests of the direct owners of certain industries and their managers.

Not trusting financial information from accountants, owners and shareholders of enterprises invited special auditors (inspectors) in order to verify the accuracy of the reports received from subordinates.

Historical reference

The roots of the auditor profession go back to ancient times. For example, in Greek Athens in the 5th century BC, the income and expenses of the state were controlled by the people's assembly. But in the Roman Empire this was done by the Senate and hired auditors.

In England, the first law was passed in the 1860s, according to which enterprises were required to conduct audits annually. Around the same period, similar law enforcement acts were introduced into practice in France and other European developed countries.

What was the impetus for the adoption of laws on audit activities? It turns out that the reason was a clash of interests between the owners of production and those who were hired to manage them. Having reasons not to trust the information provided in the reports by accountants, the owners and shareholders called auditors for an audit. Thus, the owners had the opportunity to check the correctness of the figures received from their subordinates.

In Russia, auditors appeared several centuries ago. Since then, this profession has changed significantly. In the 18th century, the main duties of the inspector were to take a census of the tax-paying population for the purpose of calculating taxes. Today, the professional functions of an auditor have not only grown significantly in scope, but have also changed dramatically.

Description of the profession

The name of the auditor profession owes its origin to the Latin word revidere. It means “to look” or “to look after.” In principle, the essence of the work comes down to the meaning inherent in its name. Regardless of the area where the future auditor plans to work, his main task is observation and detailed collection of information about the object under study.

For example, the main purpose of inspecting an enterprise that produces food is to determine the general sanitary condition or control the quality of manufactured goods. The state auditor pays a visit to the tax authorities to determine the degree of quality in the performance of its functions by this service.

We emphasize that the auditor’s job is only to check a specific enterprise. He has no right to give independent orders or issue decrees. The controller must transfer all collected information to the relevant authorities, which will make decisions and take action.

Traditionally, auditors operate according to the following scheme:

- Receiving a task and developing a test plan.

- Conducting an audit.

- Drawing up a report for the owners of the company being inspected and for persons who have access to the relevant information.

Railway audit service

The position of auditor on the railway appeared in 1937. It was established due to an increase in the number of errors made by railway workers. Worker mistakes often led to dangerous situations on the tracks. Therefore, the authorities decided to create a special service and assign it the responsibility of monitoring everything that happens on the railway.

Let us note that the measures taken by the authorities were successful. The service coped with its tasks perfectly. To increase the efficiency of its work, the range of powers and responsibilities of auditors was gradually expanded.

Today, the railway audit service not only monitors the situation directly on the tracks and on trains, but also monitors the order in the documentation that accompanies activities in this area. In addition, any repair and construction work cannot be completed without its inspection and permission.

Financial Audit Commission

In the field of finance, the position of auditor appeared relatively recently. Along with it, a special body arose - the audit commission. Its main task is to monitor operations in the budget of the document-checked and “colored” – black and gray, that is, illegal – accounting department.

Members of the audit commission are elected at the board of directors or at a meeting of the joint stock company. This body must be absolutely independent and impartially fulfill its obligations. Only in this case can the company's owners gain confidence in the fruitful operation of their assets, which should be a source of profit and not loss.

In government agencies, audits are also not uncommon. The functions of the supervisory body are assigned to the permanent Accounts Chamber.

Features of the profession

The auditor inspects various production organizations and companies and assesses the situation as a whole.

In order for all planned goals to be achieved, the specialist outlines a plan for carrying out the work, but they often have their own methodology for conducting an audit, developed over the years.

The specialist monitors the work of companies and employees, and also checks compliance with sanitary standards and rules. Evaluates and checks how working documentation and reports are maintained.

Often, organizations do not always comply with all requirements and work standards, but before the arrival of the auditor, all shortcomings and errors that exist in the organization’s work are eliminated.

The control and audit department is responsible for the work of the auditor; such departments are located in large cities. Typically, an auditor has a higher economic or legal education; in order to work in this industry, you need to undergo special training.

A specialist in this area must have leadership qualities, the ability to manage, and must have at least a little work experience.

Personal qualities of an auditor:

- quickly navigate in any situation;

- good memory and intelligence;

- correct execution of reports and conclusions.

Rights

The auditor has the right:

Request and receive the necessary information and documents related to the issues of its activities.

Make proposals to the immediate supervisor to improve work related to the responsibilities provided for in this job description.

For favorable conditions for professional activity.

Require management to provide assistance in the performance of their professional duties and rights.

For all social guarantees provided for by law.

What to write about yourself in an auditor's resume

In the “About Me” section, you can enter additional information that is directly related to your professional activities and which will help to characterize the applicant’s competence in more detail. The auditor can talk about his methods of control and inspection.

The specialist performing the compliance check must have certain professional ethics, as well as bear financial and legal responsibility, so in this section you can briefly talk about personal qualities.

It is not recommended to include information about hobbies, marital status or number of children in the application form.

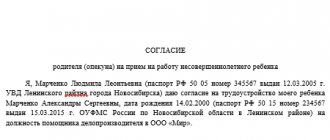

A sample block in a resume for a job as an auditor may look like this:

ABOUT ME:

- I conscientiously perform my duties. I have developed mathematical abilities. I accurately count piece and weight goods. I try to get along with my colleagues. In difficult situations, I try not to lead my relationships with my colleagues to conflicts.

Responsibility

The auditor is responsible:

For failure to perform or improper performance of the duties provided for in this instruction, within the limits determined by the labor legislation of the Russian Federation.

For offenses committed in the course of carrying out their activities - within the limits determined by the administrative, criminal and civil legislation of the Russian Federation.

For causing material damage to the employer - within the limits determined by the labor and civil legislation of the Russian Federation.

Job description of an auditor of a trade organization

[organizational and legal form, name of organization, enterprise]

[position, signature, full name of the manager or other official authorized to approve the job description]

Job description of an auditor of a trade organization [name of organization, enterprise, etc.]

This job description has been developed and approved in accordance with the provisions of the Labor Code of the Russian Federation and other regulations governing labor relations in the Russian Federation.

Requirements for a specialist

The work of an auditor is very responsible. He is obliged to make informed and adequate decisions, taking into account their impact on the further development of the enterprise. Therefore, quite high requirements are imposed on the applicant; he must:

- Have an excellent understanding of prescriptive documentation, as well as regulatory and guidance materials related to organizational rules and accounting standards.

- Know the methods and types of preparation of accounting documents.

- Correctly review documentation.

- Check whether the accounting of the company's property is maintained correctly.

- Be able to read charts of accounts and account correspondence.

- Understand the legislation that affects the economic and financial activities of a company, its economic development, the organization of labor and production processes, as well as how to manage them.

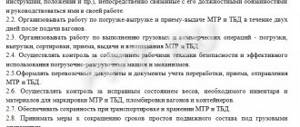

Responsibilities

When starting an audit, the controller-auditor, whose responsibilities are clearly defined, cannot go beyond the established framework:

- before the audit, it is necessary to notify the head of the audited organization about the start of the audit;

- during the event, it is necessary to inform him about the identified violations and shortcomings and take measures to eliminate them;

- monitor the legality of financial and business transactions, the safety of property;

- check compliance with discipline, establishment and reliability of accounting;

- control the quality, accuracy and actual availability of primary documents;

- identify mismanagement, extravagance, waste, theft, shortages;

- note cases of illegal expenditure of inventory and budget funds for personal purposes, etc.;

- the auditor’s responsibilities include objectively and with utmost precision establishing the identified facts of violations (and their causes), indicating the perpetrators and the amount of damage caused;

- report and discuss the results of the audit with employees of the audited organization;

- check the powers of employees and the legality of their actions;

- maintain information confidentiality;

- formalize the results of the inspection in writing, in accordance with established standards;

- auditors must be correct, but only have business relations with employees of the organization being audited;

- maintain self-discipline;

- improve skills;

- Verify the timely implementation of orders issued after the results of the previous audit.

What skills are needed?

These are the personal qualities and abilities you will need to become an auditor.

- Ability to work with documents. One of the main components of the auditor’s work is checking accounting documentation. To carry it out correctly, a specialist must be able to study documents and obtain the information he needs from them.

- Attentiveness. Often, financial statements take up several volumes of filing documents. This happens especially often if the organization is large enough. The auditor’s task is to check this large amount of data and not miss anything important from it.

- Perseverance and patience. As already mentioned, a specialist works with large volumes of documents and information in general. This kind of work requires patience and perseverance.

- Good knowledge of international and Russian accounting standards. Since one of the tasks of a representative of the profession is to check accounting documents for errors, he must be well aware of the rules by which they are filled out.

- Willingness to travel. Inspection activities very often involve traveling. Sometimes you even have to go to another locality, sometimes very remote. The specialist must be prepared for such a work regime.

What education is needed and where can I go?

To become an auditor, an economic accounting education is required. You can get it:

- at the university;

- in secondary school;

- at specialized courses.

What subjects need to be taken?

To enter the economics department of a higher educational institution, you must pass the following subjects:

- Russian language;

- mathematics;

- social science;

- foreign language.

To become a secondary school student, you need to pass far fewer exams. You only need two items:

- Russian language;

- literature.

Studying the courses does not require passing entrance examinations or submitting Unified State Examination results.

How long to study after grades 9 and 11?

In the Secondary School of Education, training upon admission after the eleventh grade will take two years and ten months, and if entering after the ninth - three years and ten months.

Is distance learning possible?

Today, with the development of communication technologies, you can learn almost any profession remotely. The auditor is no exception. There are quite a few online courses where you can get this specialty without leaving your home using Skype.

Universities and academies

Here are five Moscow higher educational institutions where you can get a specialty.

- High School of Economics. Training here for twelve months costs 400,000 rubles.

- Russian Economic University named after G. V. Plekhanov. The cost of a year's study at this university is 270,000 rubles.

- Financial University under the Government of the Russian Federation. The price of study is 220,000 rubles for one year.

- All-Russian Academy of Foreign Trade. The price of studying at this university is 360,000 rubles per year.

- Moscow State University named after Mikhail Lomonosov. The cost of studying for a year is 450,000 rubles.

And these are universities in St. Petersburg with a similar program.

- St. Petersburg State Economic University. The cost of a year's study here is 198,000 rubles.

- Baltic State Technical University "Voenmech" named after D. F. Ustinov. For two semesters of study at this university you need to pay 143,500 rubles.

- St. Petersburg State University of Civil Aviation. The cost of a year of study is 148,720 rubles.

- St. Petersburg State Agrarian University. The price of study is 89,440 rubles per year.

- St. Petersburg Mining University. The cost of training for a year is 260,000 rubles.

Since all of these educational organizations are government institutions, they have a free department. The duration of study, as in other universities, in the listed ones is four years for bachelors and six for masters.

Colleges and technical schools

Below are five capital secondary specialized educational institutions where you can learn a profession.

- Economics and Technology College No. 22. The cost of a year of study is 60,000 rubles.

- Law College of the Law Institute of the Russian University of Transport (MIIT). For a year of study here you will need to pay 145,000 rubles.

- Metropolitan Business College. The tuition fee is 53,600 rubles per year.

- Metropolitan College of Service and Hospitality Industry. The cost of the one-year program is 35,000 rubles.

- College of Automobile Transport No. 9. Tuition price – 62,000 rubles for twelve months.

Similar educational institutions in St. Petersburg are listed below.

- St. Petersburg Polytechnic College. The cost of studying is 38,000 rubles per year.

- Petrodvorets College. The price of training at this vocational school is 45,000 rubles for one year.

- St. Petersburg College of Industrial Technologies, Finance and Law. The cost of studying is 35,000 rubles per year.

- Electromechanical College of Railway Transport named after A. S. Sukhanov. The cost of one-year college education is 40,000 rubles.

- College of Business and Technology, St. Petersburg State University of Economics. For twelve months of training you will need to pay 40,000 rubles.

All of the listed technical schools and colleges are financed from the budget, so they offer free education. Its term is two years and ten months for those who entered after the eleventh grade, and three years and ten months for those who completed only nine grades before admission.

Education

Only a specialist with an appropriate higher education, mainly economics, can work as an auditor. To be fair, it is worth noting that there are companies that sometimes make an exception and hire an undergraduate student. However, there are only a few such companies. Not everyone will take the risk and entrust such responsible work with finances and documentation to a completely “green” newcomer.

Auditors are almost always holders of diplomas from economic faculties of universities, most often in the profiles of “accounting and auditing”, “finance and credit”. You can study in these specialties at most universities in Russia, located in all regions, for example:

- Vladivostok branch of the St. Petersburg Humanitarian University of Trade Unions.

- Belgorod National Research State University.

- Stavropol Agrarian State University.

- Higher School of Economics (Moscow, branches in St. Petersburg, Perm, Nizhny Novgorod).

- Nizhny Novgorod Technical State University named after. R. Alekseeva.

To enter any higher educational institution for economics, you must pass the Unified State Exam in Russian, specialized mathematics and social studies (or foreign - at the discretion of the university).

Salary level

The size of an auditor's salary is influenced by several factors. First of all, this is the length of service and the payment system (based on the number of audits performed or salary).

According to information provided on the website russia.trud, the highest level of wages was recorded in the Yamalo-Nenets Autonomous Okrug. There, the average income of an auditor was a little more than 41,000 rubles. The Moscow region came in second place. The third position is occupied by the Komi Republic.

Approximately 70% of vacancies indicate a salary from 24,400 to 36,200 rubles. About 20% of advertisements contain data on salaries from 12,600 to 24,400 rubles, about 10% - from 36,200 to 48,000 rubles.

The future of the profession

According to analysts, the profession of an auditor will remain in demand for many years. The development of enterprises of various forms of ownership today is proceeding at an active pace. No one is going to let their activities take their course. Consequently, the workload of professional auditors and auditors will not decrease.

Representatives of this profession should not be afraid of total automation. At least the first wave of auditors will definitely not wash overboard. Analytical thinking, excellent memory, resistance to stress, perseverance and responsibility will help them keep their job or, if necessary, quickly retrain.

Sources

- https://BusinessMan.ru/new-revizor-eto-otvetstvennaya-dolzhnost.html

- https://edunews.ru/professii/obzor/ekonomicheskie/revizor.html

- https://irg77.ru/pravo/lyudi-i-pravo/professii/revizor/

- https://hr-metod.com/polezno/dolzhnostnye-instrukcii/prodazha-tovarov-i-uslug/dolzhnostnaja-instrukcija-revizora-torgovoj-organizacii.html

- https://specworkgid.ru/obuchenie-professiyam/revizor.html

- https://ru.wikipedia.org/wiki/%D0%A0%D0%B5%D0%B2%D0%B8%D0%B7%D0%BE%D1%80

[collapse]