Home/Sick leave

Various health problems of a citizen become the basis for declaring temporary disability. The manager must pay a monetary benefit for the sick period classified as an insurance risk.

Attention

His payment is provided according to a document called a certificate of temporary incapacity for work. It is a guarantee of the social plan. To purchase the right to use the guarantee, you need to register with the insurance fund.

The concept of sick leave according to the Labor Code of the Russian Federation

Article No. 183 of the Labor Code of the Russian Federation reveals topics covering the concept of leave for temporary disability. This is forced leave associated with illness, which is called sick leave. During the illness, the employee, without performing functions under the employment contract, receives a guaranteed cash benefit. To do this, you need to issue a certificate of temporary incapacity for work (hereinafter: sick leave).

When sick leave is provided according to the Labor Code of the Russian Federation:

- upon diagnosis of diseases due to which the ability to work has been lost;

- if there is a need for mandatory care for someone from the family;

- during pregnancy and childbirth;

- during quarantine days;

- in case of need for stationary prosthetics;

- upon completion of an inpatient course of therapy in a sanatorium (up to 24 days).

Please note:

The right to pay benefits upon completion of recovery in sanatoriums can be used by: pregnant women at risk, patients with angina pectoris, cerebral circulatory disorders, diabetes, myocardial infarction. As well as those who have undergone certain types of operations, parents of a disabled child undergoing sanatorium rehabilitation. This is confirmed by the medical verdict that individual care is required.

Temporary disability of an employee

Receiving temporary disability in itself does not guarantee the accrual of compensation funds. To be eligible to apply for social benefits, a citizen is required to pay monthly insurance contributions to the Social Insurance Fund.

Groups that can count on accrual of hospital funds include:

- Citizens who have entered into employment contracts with employers.

- Civil servants of various ranks.

- Individuals who are engaged in private business or have their own practices (lawyers, lawyers, etc.).

A mandatory condition for calculating payments is the regular deduction of a set percentage of funds to the Social Insurance Fund. Funds are contributed by the employer in the amount of 2.9% of the employee’s accrued salary. These amounts form the general insurance fund, from which funds are paid to pay off sick leave and maternity payments.

Throughout the entire period of work, the employee has the right to go on sick leave, and upon provision of it, receive the amounts due. The same right remains with him for another 30 days after dismissal. Subsequently, if he does not find employment in another place of work or does not begin to pay insurance premiums on his own, this right is lost.

Payment for sick time is regulated by various laws. The most extensive information is presented in:

- Federal Law “On Compulsory Social Insurance in Case of Temporary Disability” FZ-255.

- Labor Code of the Russian Federation.

Article 183 of the Labor Code of the Russian Federation establishes the obligation for employers to accept ballots and pay compensation for them. According to this article, the employer has no choice between accepting sick leave and refusing. Although there are legal conditions under which the ballot will not be paid for. Federal Law-255, in addition to the conditions of social insurance, regulates the issuance of ballots, their completion, as well as the amount of payments for them.

A sick leave certificate is issued in the following cases:

- The illness or injury affects the employee himself.

- A close relative who is considered a family member has fallen ill and requires care.

- For pregnancy and childbirth.

You can present the ballot for payment only after it is closed by the medical institution.

Decor

Sick leave is issued according to the Labor Code of the Russian Federation in the manner specified by the relevant instructions.

The document is issued:

- attending physicians of the LPF;

- healthcare workers in private practice;

- health workers with secondary education (at the initiative of local health authorities);

- attending physicians at anti-tuberculosis sanatoriums, prosthetics research institutes.

To register a document, the Ministry of Health and Social Development of the Russian Federation has approved a specially designed form.

According to the Labor Code of the Russian Federation, sick leave can be issued only in licensed medical institutions, public or private . A certificate of incapacity for work issued abroad is replaced upon return to the health care facility with approval by the local administration.

Dates of sick leave

According to the Labor Code of the Russian Federation, sick leave covers the entire period of incapacity for work. The document is issued on the day of determination of incapacity for work and includes the entire time of absence from work, both on weekdays and weekends. Before the examination is carried out, issuing sick leave is unlawful. This is possible only by decision of a special commission in special cases.

Exceptions to the general rule regarding issuance times

- In case of a controversial issue regarding reinstatement at work. The amount of sick leave benefits for this period is determined from the moment the court decision is made.

- Persons working under a fixed-term (less than 6 months) contract in accordance with the Labor Code of the Russian Federation are paid up to 75 days of forced disability. The exception is tuberculosis patients.

- If the illness is registered from the moment the contract is concluded until the end of its validity, sick leave is issued from the moment of the planned start of work for 75 days.

- Working disabled people receive benefits for 4 months without a break or 5 months throughout the year.

If an employee seeks medical help closer to the end of a work shift, incapacity for work is determined from the next day, taking into account the consent of the applicant. If a person is sent to a health care facility by a health center, the hospital document is registered from the hour of admission.

What guarantees exist and how are they implemented?

During the period of sick leave, the employee is subject to additional guarantees of social protection. The following points should be highlighted here:

- Payment of compensation for the entire period of incapacity. The norm is determined by law. To receive money, a worker simply needs to issue a sick leave certificate at a medical institution, and then provide it to the employer. Payment for the period specified in such a document is mandatory.

- Protection against illegal dismissal. The legislator provided that for the entire period of being on sick leave, the administration does not have the right to dismiss an employee. Even in cases where the date of a previously planned dismissal fell during the period of illness. Here it is necessary to transfer this date to the end of the illness and only after that apply it in practice.

- Protection from disciplinary action. When an employee is sick, the employer cannot “in absentia” bring him to disciplinary liability. Applies to cases where a disciplinary offense has already been previously considered, but no decision has been made.

- The need for compensation applies to all periods - business trips, vacations, rest periods between shifts.

- To exercise your right to receive money as compensation, as well as to confirm the legality of your absence from work, you need one document - a sick leave certificate. Issued by specialized medical institutions. Their list is determined at the level of government decree.

Remember, with a valid employment contract, all legally confirmed periods of absence from work must be compensated. An employee’s workplace cannot be abolished and the employment relationship cannot be terminated.

Payment rules

Funding for sick leave according to the Labor Code of the Russian Federation is provided by compulsory insurance. The first three days must be paid at the expense of the employer’s finances, the remaining period - at the expense of the insurance fund. Individuals who care for a sick member of their family, a child, during pregnancy, or during the birth process have the right to receive benefits entirely from social insurance funds.

For your information

Payment for sick leave is sometimes issued at the previous place of employment when an illness is detected within 30 days after the termination of the work assignment.

Other citizens can count on benefits:

- employees of municipal and state institutions;

- self-employed entrepreneurs, lawyers, farmers;

- persons who are voluntarily insured with formalized payment of contributions.

Part-time workers also have the right to benefits (Article 287, part 2).

Benefit calculation

Sick leave benefits are calculated as a percentage of earnings.

- 100% of earnings - in case of occupational disease, occupational injury, its aggravation, with at least 8 years of experience;

- 80% - with 5-8 years of experience;

- 60% - with less than 5 years of experience.

The insurance period is calculated according to the order of the Ministry of Health and Social Development No. 91. It is confirmed by a work book.

Higher sick leave benefits under the Labor Code of the Russian Federation are established for:

- disabled war veterans;

- participants in the liquidation work after the accident at the site of the Chernobyl nuclear power plant, located in the zones of resettlement of minor citizens from this zone and supervising them;

- persons who received a certain dose of radiation in the conditions of the Semipalatinsk test site;

- donors who donated two norms, the maximum permissible, of blood per year;

- persons interacting with chemical weapons;

- workers in areas located in the Far North.

If the length of service does not exceed 6 months, the amount of payments is not higher than the minimum wage, taking into account the coefficients.

The following persons are not provided with sick leave benefits:

- suspended from work for this period (in the absence of salary);

- persons released from work (with or without pay);

- those who caused intentional damage to their own health (by court decision);

- persons under arrest.

According to the Labor Code of the Russian Federation, payment is made through the accounting department.

Conditions for calculating benefits

The benefits due to the worker are calculated by the company and paid simultaneously with the payment of wages. The employer is responsible for their correct and timely accrual. The list of conditions that form the basis of calculations is established at the legislative level.

An employee has the opportunity to compensate for his disability only in the following cases:

- if due to illness, injury, artificial termination of pregnancy or insemination, he (she) was unable to perform the labor functions assigned to him for some time;

- when absence from work arose due to the need to care for a sick family member. This could be a child, husband (wife), parents of the worker;

- in the case of prosthetics performed (personally by an employee) in a hospital setting;

- the onset of quarantine. Such a situation may arise regarding a specific employee, or one of his children, that because of this they cannot attend kindergartens or schools;

- referral to hospital sanatorium-resort institutions for treatment, final recovery after a long illness.

Remember, for the benefit to be calculated, two factors must be present simultaneously - the reason provided by law, as well as its correct documentation.

An example of calculating sick leave according to the minimum wage

The minimum wage is approved by the legislation of the Russian Federation, taking into account territorial coefficients and is taken into account when regulating wages, determining the amount of benefits and other social purposes (tax calculations, for example).

The minimum wage value is used when calculating benefits:

- if the employee has not yet received a salary;

- if the average earnings are below the minimum wage.

Sick leave is calculated using the formula: Minimum wage ×24:730.

This is how the average daily earnings for 1 day are determined. 24 is the number of months in 2 years, 730 is the number of days, respectively.

From July 2021, the minimum wage is 7,800 rubles.

7800×24:730 =256.44 rubles – average earnings.

When working on a part-time basis, payment is determined based on the time worked. Example: during the previous two years, a citizen worked part-time. The average salary was less than the minimum wage. The benefit calculation will look like this:

7800×24:730×0.5=128.22 rub.

Example of calculating sick leave based on salary

It is important to correctly determine the calculated period of sick leave. Salary for the previous 24 months is taken into account. This is 730 days for calculations in 2017. First, one-day earnings are calculated. Why should the total amount earned be divided by 730?

The structure of earnings considers all types and categories of payments. The maximum monetary amount for calculating benefits was adopted in 2017 in the amount of 755,000 rubles. (in 2015 – 670,000, in 2021 – 718,000). The total amount of money earned over the past two years for calculating benefits cannot be higher than the sum of the two corresponding figures.

Example. Citizen Antonov was temporarily disabled due to ARVI from January 14 to January 23, 2021. Before that, he worked in the organization for 6 years. To calculate average earnings, we take into account the periods of the two previous years: 2021, 2015. In 2015, he earned 360,000 rubles, and in 2016 – 480,000 rubles. The total income for two years is 840,000 rubles.

The maximum base value for the two previous years in rubles: 670,000 + 718,000 = 1,388,000 . Antonov’s total income does not exceed this amount. Therefore, it is used in calculations. This includes all payments for which insurance premiums were transferred. His experience is 6 years, included in the period from 5 to 8 years. Therefore, the benefit must be calculated with a coefficient of 0.8 (or 80%).

So, the benefit must be paid in 10 days.

Average daily earnings: 840,000:730=1150.68 rubles.

The amount of the benefit due for a period of 10 days, taking into account the coefficient of 0.8, is as follows:

1150,68×0,8×10=9205.48 RUR.

Certificate of incapacity for work during pregnancy and childbirth

For the payment of benefits during pregnancy and childbirth, documentary evidence under the Labor Code of the Russian Federation is also a sick leave certificate.

Women have the right to receive it:

- working: citizens of the Russian Federation, insured citizens of foreign states and stateless persons;

- for whom the fact of pregnancy occurred within 12 months before officially receiving the status of unemployed: those dismissed during the liquidation of the enterprise, upon termination of entrepreneurial work, the powers of a lawyer;

- who have adopted a child under 3 months;

- IVF participants;

- dismissed due to the transfer of a spouse to another territorial location or the need to care for sick family members, disabled people, if there is no more than a month left before maternity leave;

- entrepreneurs, private legal workers who voluntarily pay fees.

Women receive benefits under the Labor Code of the Russian Federation without registering sick leave:

- full-time students;

- those in military service;

- employees in the internal affairs department, criminal authorities;

- working in the drug control service.

To apply for benefits in one of these cases, a certificate from a medical institution is sufficient.

Women are not entitled to this benefit:

- housewives;

- part-time and evening students;

- notaries, lawyers who do not voluntarily pay fees.

The duration of such certificates of incapacity for work varies depending on the individual picture of pregnancy: from 140 days for a normal, without pathologies, period, to 194 for a pregnancy with complications, multiple births. Benefits are paid at 100% of earnings.

The average daily earnings for calculating these benefits cannot exceed 1901.37 rubles.

Certificate of incapacity for work

A document evidencing an employee’s temporary incapacity for work is a certificate of incapacity for work, otherwise called a sick leave certificate. A certificate of incapacity for work has the right to be issued by a doctor of a medical and preventive and sanitary and anti-epidemic institution. In areas where there are no doctors, sick leave certificates are issued by paramedics or nurses.

A sick leave certificate is a legal and financial document, and is also important for recording illness with loss of ability to work, that is, it also has an accounting and statistical nature.

It is issued upon the onset of incapacity for work due to illness, accident, pregnancy and childbirth, quarantine with removal from work, nursing, abortion, and in some types of sanatorium-resort treatment. It is prohibited to issue a certificate of incapacity for work retroactively: it must be issued exclusively on the day of the onset of incapacity for work.

A certificate of incapacity for work can be issued, extended and closed in accordance with the current rules. Those guilty of issuing a certificate without serious grounds or filling it out incorrectly may be punished administratively or criminally.

Specifics of child care benefits

When treating a child under 7 years of age, according to the Labor Code of the Russian Federation, the parent is issued sick leave for the full period of treatment, but not more than 60 days per year in total. And when the disease is included in the list approved by the Ministry of Social Development, then up to 90 days.

From 7 to 5 years, for individual episodes, a document is drawn up up to 15 days, in total no more than 45 per year.

For caring for a disabled person under 15 years of age, payment is required for the entire period by episode, a total of no more than 120 days.

The benefit is issued for the entire duration of treatment of children under 18 years of age from the first and other generations living in the resettlement zone, evacuation of people who suffered radiation exposure and became disabled as a result.

A person caring for a child under 3 years of age and a disabled child receives sick leave for the entire duration of his own illness (since he is not able to provide care).

Commentary on Article 183 of the Labor Code of the Russian Federation

During the period of temporary incapacity for work, the employee retains his place of work (position).

The employer is also obliged, on the basis of a temporary disability certificate, to pay the employee temporary disability benefits.

The rules and conditions for the payment of benefits for temporary disability, as well as the amount and duration of its payment are currently regulated by Federal Law No. 255-FZ of December 29, 2006 “On compulsory social insurance in case of temporary disability and in connection with maternity” (as amended by 03.12.2011).

Since 2007, the amount of temporary disability benefits depends on the total duration of the insurance period, and not on continuous work experience. At the same time, the insurance period for determining the amount of benefits for temporary disability, in contrast to continuous work experience, includes only periods of work of the insured person under an employment contract, state civil or municipal service, as well as periods of other activities during which the citizen was subject to compulsory social insurance in case of temporary disability and in connection with maternity. At the same time, if as of January 1, 2007, the duration of continuous work experience was greater than the duration of the insurance period, then the periods included in the insurance period are summed up with the continuous work experience. In particular, the duration of continuous work experience was longer than insurance if military and equivalent service for the period before January 1, 2007 was included in the continuous work experience (Part 2 of Article 17 of the Federal Law of December 29, 2006 N 255-FZ ; clause 5, article 23 of the Federal Law of May 27, 1998 N 76-FZ “On the status of military personnel”). From January 1, 2010, military and equivalent service (in particular, service in internal affairs bodies, in the penal system, in the fire service) is included in the insurance period to determine the amount of benefits, regardless of whether dismissal from military service followed. before January 1, 2007 or after the specified date (Part 1.1 of Article 16 of the Federal Law of December 29, 2006 N 255-FZ, Article 1 of the Law of the Russian Federation of February 12, 1993 N 4468-1 “On pension provision for persons who served in military service , service in internal affairs bodies, the State Fire Service, authorities for control of the circulation of narcotic drugs and psychotropic substances, institutions and bodies of the penal system, and their families" (as amended on July 1, 2011) <1>; p. p. 2.1, 19.1 Rules for calculating and confirming the insurance period for determining the amount of benefits for temporary disability, pregnancy and childbirth (as previously in continuous work experience), if the periods of such service were not included in it before January 1, 2007 (Art. 17 Federal Law of December 29, 2006 N 255-FZ).

——————————— <1> VSND and the Armed Forces of the Russian Federation. 1993. N 9. Art. 328; NW RF. 1995. N 49. Art. 4693; 1996. N 1. Art. 4; 1997. N 51. Art. 5719; 1998. N 30. Art. 3613; 1999. N 23. Art. 2813; 2000. N 50. Art. 4864; 2001. N 17. Art. 1646; N 53 (part 1). Art. 5030; 2002. N 2. Art. 129; N 10. Art. 965; N 22. Art. 2029; N 24. Art. 2254; N 27. Art. 2620; N 30. Art. 3033; 2003. N 2. Art. 154; N 27 (part 1). Art. 2700; 2004. N 27. Art. 2711; N 35. Art. 3607; 2006. N 6. Art. 637; N 52 (part 3). Art. 5505; 2007. N 1 (part 1). Art. 35; N 49. Art. 6072; N 50. Art. 6232; 2008. N 7. Art. 543; N 19. Art. 2098; N 30 (part 1). Art. 3612; 2009. N 18 (part 1). Art. 2150; N 30. Art. 3739; N 45. Art. 5271; 2011. N 27. Art. 3880; N 30 (part 1). Art. 4595.

The rules for calculating and confirming the insurance period for determining the amount of benefits for temporary disability, pregnancy and childbirth are approved by Order of the Ministry of Health and Social Development of Russia dated 02/06/2007 N 91 (as amended on 09/11/2009) <1>.

——————————— <1> BNA. 2007. N 15; RG. 2009. 14 Oct.

Since January 1, 2007, all cases where benefits in the amount of 100% of average earnings were paid without taking into account length of service have been abolished. However, a benefit of 100% remains after January 1, 2007 for employees who worked before January 1, 2007 and received a benefit of 100% of average earnings, regardless of the length of insurance coverage. In particular, such workers included persons who had three or more dependent children under the age of 16 years.

The rules for calculating benefits for temporary disability are established by the Regulations on the specifics of the procedure for calculating benefits for temporary disability, pregnancy and childbirth, monthly child care benefits for citizens subject to compulsory social insurance in case of temporary disability and in connection with maternity, approved by the Decree of the Government of the Russian Federation of June 15 .2007 N 375 (as amended on March 1, 2011) <1>.

——————————— <1> NW RF. 2007. N 25. Art. 3042; 2009. N 43. Art. 5088.

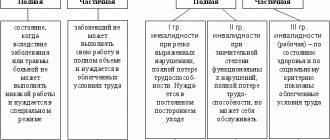

The amount of temporary disability benefits and the duration of its payment in a particular case are given in table. 1.

Table 1

| Categories of workers | Payment period | Benefit amount as a percentage of average daily earnings |

| In case of illness or injury | ||

| Employees who are not disabled (part 1 of article 6, part 1 of article 7 of the Federal Law of December 29, 2006 N 255-FZ (as amended on July 24, 2009)) | For the entire period of release from work specified in the certificate of incapacity for work, or from the date of onset of disability indicated in the certificate of incapacity for work, until the date of establishment of the employee’s disability, which is indicated in the certificate confirming the fact of establishment of disability, issued by medical institutions -social examination (certificate form approved by Order of the Ministry of Health and Social Development of Russia dated November 24, 2010 N 1031n <1>) | 60%, but not more than 1 minimum wage - if the employee’s insurance coverage is up to 6 months; 60% - if the employee’s insurance period is from 6 months to 5 years; 80% - if the employee’s insurance experience is from 5 to 8 years; 100% - if the employee has 8 or more years of insurance experience, as well as in cases where, before January 1, 2007, he had the right to a benefit in the amount of 100%, regardless of length of service |

| Disabled workers (except for those with tuberculosis) (Part 3 of Article 6, Part 1 of Article 7 of the Federal Law of December 29, 2006 N 255-FZ (as amended on July 24, 2009)) | No more than 4 months in a row or a total of 5 months in a calendar year | |

| Employees with tuberculosis who have been diagnosed as disabled (Part 3 of Article 6, Part 1 of Article 7 of the Federal Law of December 29, 2006 N 255-FZ (as amended on July 24, 2009)) | From the date of onset of incapacity for work indicated on the certificate of incapacity for work until the day of restoration of working capacity or until the day of revision of the disability group due to tuberculosis | |

| Employees with whom an employment contract has been concluded for a period of up to 6 months (except for patients with tuberculosis) (part 4 of article 6, part 1 of article 7 of the Federal Law of December 29, 2006 N 255-FZ (as amended on July 24, 2009) ) | No more than 75 calendar days | -//- |

| Persons with whom the employment contract was canceled (except for patients with tuberculosis), if the disease or injury occurred during the period from the date of conclusion of the employment contract until the day of its cancellation (Part 4 of Article 6, Part 1 of Article 7 of the Federal Law of December 29, 2006 N 255-FZ (as amended on July 24, 2009)) | From the day on which the employee was supposed to start work, but not more than 75 calendar days | |

| Employees with tuberculosis with whom an employment contract has been concluded for a period of up to 6 months (Part 4 of Article 6, Part 1 of Article 7 of the Federal Law of December 29, 2006 N 255-FZ (as amended on July 24, 2009)) | For the entire period of release from work specified in the certificate of incapacity for work, or from the date of onset of incapacity for work indicated in the certificate of incapacity for work until the date the employee was diagnosed with disability | |

| Persons with tuberculosis with whom the employment contract was canceled, if the disease occurred during the period from the date of conclusion of the employment contract until the day of its cancellation (Part 4 of Article 6, Part 1 of Article 7 of the Federal Law of December 29, 2006 N 255-FZ (as amended on July 24, 2009)) | From the day on which the employee was supposed to start work until the last day of release from work indicated on the certificate of incapacity for work, or until the date the employee was diagnosed with disability | |

| Employees whose disability began before the downtime period and continues during the downtime period (Part 1, Article 6 (as amended on July 24, 2009), Part 7, Article 7 (as amended on December 8, 2010) of the Federal Law dated December 29, 2010). 2006 N 255-FZ, Article 157 TC) | During the period of downtime for the entire time of release from work specified in the certificate of incapacity for work, or from the date of onset of incapacity for work indicated in the certificate of incapacity for work until the date the employee was diagnosed with disability | At least 2/3 of the average salary of an employee during downtime due to the fault of the employer or at least 2/3 of the tariff rate, salary (official salary), calculated in proportion to the downtime during downtime for reasons beyond the control of the employer and employee, but in both cases no more than: 60%, but not more than 1 minimum wage - with an insurance period of up to 6 months; 60% - if the employee’s insurance period is from 6 months to 5 years; 80% - if the employee’s insurance experience is from 5 to 8 years; 100% - if the employee has 8 or more years of insurance experience, as well as in cases where, before January 1, 2007, he had the right to a benefit in the amount of 100%, regardless of length of service. Not paid for downtime caused by the employee |

| For former employees whose illness or injury occurred within 30 calendar days after dismissal (Part 1, Article 6 (as amended on July 24, 2009), Part 2, Article 7 (as amended on December 8, 2010) of the Federal Law dated December 29, 2006 N 255-FZ | For the entire period of release from work specified in the certificate of incapacity for work, or from the date of onset of incapacity for work indicated in the certificate of incapacity for work until the date the employee was diagnosed with disability | 60%, but not more than 1 minimum wage - with an insurance period of up to 6 months; 60% - if the employee has been covered for more than 6 months |

| When caring for a sick family member | ||

| Employees when caring for a sick child under 7 years of age at home or while staying together with the child in the hospital (Clause 1, Part 5, Article 6 of the Federal Law of December 29, 2006 N 255-FZ (as amended on July 24, 2009) ) | For the entire period of release from work specified in the certificate of incapacity for work, but not more than for: - 60 calendar days in a calendar year, if the disease is not included in the List of diseases of a child under 7 years of age, in the event of which the payment of temporary sick leave benefits - the responsibility for the period of child care is carried out no more than 90 calendar days a year for all cases of care for this child in connection with the specified diseases, approved by Order of the Ministry of Health and Social Development of Russia dated February 20, 2008 N 84n; | For outpatient treatment (clause 1, part 3, article 7 of the Federal Law of December 29, 2006 N 255-FZ (as amended on July 24, 2009)): - for the first 10 calendar days in the amount of: 60%, but not more than 1 Minimum wage - with an insurance period of up to 6 months; 60% - if the employee’s insurance coverage is up to 5 years; 80% - if the employee’s insurance experience is from 5 to 8 years; 100% - if the employee has 8 or more years of insurance experience, as well as in cases where, before January 1, 2007, he had the right to a benefit in the amount of 100%, regardless of length of service; — for the following days 50% regardless of the insurance period |

| — 90 calendar days in a calendar year, if the disease is included in the List approved by Order of the Ministry of Health and Social Development of Russia dated February 20, 2008 N 84n | When staying in the hospital with a child (clause 2, part 3, article 7 of the Federal Law of December 29, 2006 N 255-FZ (as amended on July 24, 2009)): 60%, but not more than 1 minimum wage - with insurance experience up to 6 months; 60% - if the employee’s insurance coverage is up to 5 years; 80% - if the employee’s insurance experience is from 5 to 8 years; 100% - if the employee has 8 or more years of insurance experience, as well as in cases where, before January 1, 2007, he had the right to a benefit in the amount of 100%, regardless of length of service | |

| Employees when caring for a sick child aged 7 to 15 years at home or while staying with the child in the hospital (clause 2, part 5, article 6 of the Federal Law of December 29, 2006 N 255-FZ (as amended by 07/24/2009)) | No more than 15 consecutive calendar days and no more than 45 calendar days in a calendar year | |

| Employees when caring for a sick disabled child under 15 years of age at home or while staying with the child in the hospital (Clause 3, Part 5, Article 6 of the Federal Law of December 29, 2006 N 255-FZ (as amended on July 24, 2009) ) | No more than 120 calendar days in a calendar year | |

| Employees caring for an HIV-infected child under 15 years of age at home or while staying with the child in the hospital (clause 4, part 5, article 6 of the Federal Law of December 29, 2006 N 255-FZ (as amended on July 24. 2009)) | For the entire period of release from work specified in the certificate of incapacity for work | |

| Employees when caring for a sick child under the age of 15 years with his illness associated with a post-vaccination complication, at home or while staying with the child in the hospital (clause 5, part 5, article 6 of the Federal Law of December 29, 2006 N 255-FZ (as amended on July 24, 2009)) | ||

| Employees when caring for a sick child with malignant neoplasms, including malignant neoplasms of lymphoid, hematopoietic and related tissues at home or while staying with the child in the hospital (clause 5, part 5, article 6 of Federal Law of December 29, 2006 N 255 -FZ (as amended on July 24, 2009)) | -//- | -//- |

| Workers when caring for other family members at home (clause 6, part 5, article 6 of Federal Law dated December 29, 2006 N 255-FZ (as amended on July 24, 2009)) | No more than 7 calendar days for each case of disease, but no more than 30 calendar days in a calendar year | 60%, but not more than 1 minimum wage - with an insurance period of up to 6 months; 60% - if the employee’s insurance period is from 6 months to 5 years; 80% - if the employee’s insurance experience is from 5 to 8 years; 100% - if the employee has 8 or more years of insurance experience, as well as in cases where, before January 1, 2007, he had the right to a benefit in the amount of 100%, regardless of length of service |

| During sanatorium-resort treatment | ||

| Employees undergoing follow-up treatment in sanatorium and resort institutions located on the territory of the Russian Federation, immediately after inpatient treatment (Part 2 of Article 6, Part 1 of Article 7 of the Federal Law of December 29, 2006 N 255-FZ (as amended by from 07/24/2009)) | During the period of stay in the sanatorium, but not more than 24 calendar days | 60%, but not more than 1 minimum wage - with an insurance period of up to 6 months; 60% - if the employee’s insurance coverage is up to 5 years; 80% - if the employee’s insurance experience is from 5 to 8 years; 100% - if the employee has 8 or more years of insurance experience, as well as in cases where, before January 1, 2007, he had the right to a benefit in the amount of 100%, regardless of length of service |

| Workers with tuberculosis undergoing follow-up treatment in sanatorium-resort institutions located on the territory of the Russian Federation, immediately after inpatient treatment (Part 2 of Article 6, Part 1 of Article 7 of the Federal Law of December 29, 2006 N 255- Federal Law (as amended on July 24, 2009)) | For the entire period of stay in the sanatorium | |

| During quarantine | ||

| Employees who have been in contact with infectious patients or who have been identified as carrying bacteria (Part 6, Article 6, Part 1, Article 7 of the Federal Law of December 29, 2006 N 255-FZ (as amended on July 24, 2009)) | For the entire period of suspension from work by Rospotrebnadzor authorities | 60%, but not more than 1 minimum wage - with an insurance period of up to 6 months; 60% - if the employee’s insurance coverage is up to 5 years; 80% - if the employee’s insurance experience is from 5 to 8 years; 100% - if the employee has 8 or more years of insurance experience, as well as in cases where, before January 1, 2007, he had the right to a benefit in the amount of 100%, regardless of length of service |

| During the entire quarantine period | ||

| For prosthetics | ||

| For workers undergoing prosthetics for medical reasons in a hospital specialized institution (Part 7, Article 6, Part 1, Article 7 of the Federal Law of December 29, 2006 N 255-FZ (as amended on July 24, 2009)) | For the entire period of release from work in connection with prosthetics, including travel time to the place of prosthetics and back | 60%, but not more than 1 minimum wage - with an insurance period of up to 6 months; 60% - if the employee’s insurance coverage is up to 5 years; 80% - if the employee’s insurance experience is from 5 to 8 years; 100% - if the employee has 8 or more years of insurance experience, as well as in cases where, before January 1, 2007, he had the right to a benefit in the amount of 100%, regardless of length of service |

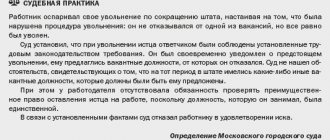

Dismissal during incapacity

According to the Labor Code of the Russian Federation, a manager does not have the right to dismiss an employee working on an indefinite basis during sick leave on his own initiative, with the exception of the fact of liquidation of the enterprise. If the contract is for a limited period, expiring at the stage of illness, the citizen’s dismissal is possible. The procedures necessary for this can be carried out in his absence, the due payments are transferred to the card, the documentation is sent by mail.

Dismissal at the stage of sick leave at the request of the employee or by agreement of both parties is possible.