Concept and types of guarantees and compensation

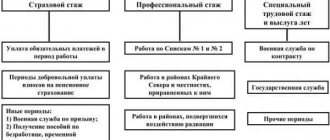

The concepts of guarantees and compensation, as well as cases of their provision, are provided for in Chapter. 23 Labor Code of the Russian Federation.

In Art. 164 of the Labor Code of the Russian Federation enshrines the following concepts: guarantees - means, methods and conditions by which the exercise of the rights granted to employees in the field of social and labor relations is ensured; compensation - monetary payments established for the purpose of reimbursing employees for costs associated with the performance of their labor or other duties provided for by the Labor Code of the Russian Federation and other federal laws.

Guarantees have two forms: monetary and non-monetary. Cash guarantees are divided into two types: guarantee payments and guarantee additional payments. They are paid to the employee in order to prevent a decrease in the employee’s earnings. In general, guarantees are aimed at providing workers with a real opportunity to exercise their rights in the course of their work.

In contrast to guarantees, compensation aims to reimburse employees for costs associated with the performance of work duties.

In Art. 165 of the Labor Code of the Russian Federation establishes the following cases of providing guarantees and compensation:

- when sent on business trips;

- when moving to work in another area;

- when performing state or public duties;

- when combining work with training;

- in case of forced cessation of work through no fault of the employee;

- when providing annual paid leave;

- in some cases, termination of an employment contract;

- due to a delay due to the employer’s fault in issuing a work book upon dismissal of an employee;

- in other cases provided for by the Labor Code of the Russian Federation and other federal laws.

When guarantees and compensation are provided, the corresponding payments are made at the expense of the employer. If an employee, in the interests of any bodies or organizations, performs state or public duties (jurors, donors, etc.), then these bodies or organizations make payments to the employee in the manner and on the terms provided for by the Labor Code of the Russian Federation, federal laws and other regulatory legal acts of the Russian Federation. In these cases, the employer releases the employee from his main job for the period of performance of state or public duties.

At the same time, listed in Art. 165 of the Labor Code of the Russian Federation, a list of types of guarantees and compensations is given along with the general guarantees and compensations provided for in other sections of the Labor Code of the Russian Federation (guarantees for hiring, transfer to another job, wages, etc.).

Thus, this list of types of guarantees and compensation is not exhaustive, especially since labor rights cannot be “torn off” from the guarantees that are enshrined in most sections of the Labor Code of the Russian Federation. Therefore, in this textbook, guarantees and compensation to employees related to the termination of an employment contract (Chapter 27 of the Labor Code of the Russian Federation) are discussed in the chapter “Employment contract”; enshrined in ch. 25 of the Labor Code of the Russian Federation, guarantees and compensation to employees in the performance of state or public duties in relation to trade union bodies and the Labor Union, respectively, are discussed in the chapters on trade unions and on the procedure for considering individual labor disputes, etc. Other types of guarantees and compensation are considered in close connection with the norms related to wages.

Military duty

Military personnel have always been considered a separate caste in terms of social guarantees. Today at the legislative level (special laws) they are provided for:

- Guaranteed opportunity to work. This includes a fixed term of service, promotion in rank, salary increase, and advanced training.

- Additional reward. Monthly and one-time bonuses, one-time payments when moving, in connection with the end of service, taking into account the existing length of service.

- Additional guarantees. Free medical care and assistance, food rations, travel reimbursement for business trips and vacations.

- If a citizen is called up for military service temporarily (military training), then such citizens retain their place of work, their position, and the average salary.

Remember, the social protection of military personnel is regulated not by general, but by special legislation, which provides for extended guarantees and compensation.

Guarantee payments and guarantee surcharges

Guarantee payments and guarantee additional payments are associated with maintaining the employee’s wages in the absence of the employee at work and when there are no results of his work.

Guarantee payments are the retention of wages for an employee (in whole or in part) for the period of failure to fulfill his work duties due to valid reasons established by law. These payments include the following: payment for the time of forced absence of an illegally dismissed employee upon his reinstatement at work or upon changing the wording of the dismissal (Article 374 of the Labor Code of the Russian Federation); payment of severance pay (Article 178 of the Labor Code of the Russian Federation); payments in the amount of average earnings during annual basic and additional paid vacations (Articles 114, 116, etc. of the Labor Code of the Russian Federation), as well as during educational additional (targeted) leaves (Articles 173 - 176 of the Labor Code of the Russian Federation). Guarantee payments also include payment for the time spent performing state or public duties. The employer is obliged, according to Art. 170 of the Labor Code of the Russian Federation, release the employee from work while maintaining his place of work (position) for the duration of the performance of state or public duties, if these duties, in accordance with federal law, must be performed during working hours. In these cases, the body that engages the employee in these duties during his working hours makes a payment in the amount determined by law, another regulatory legal act or a decision of the relevant public association.

In case of temporary disability, the employer pays the employee temporary disability benefits in accordance with Art. 183 of the Labor Code of the Russian Federation and federal law. The rules and conditions for the payment of benefits for temporary disability, as well as the amount and duration of its payment are currently regulated by Federal Law No. 255-FZ of December 29, 2006 “On compulsory social insurance in case of temporary disability and in connection with maternity.”

The rules for calculating benefits for temporary disability are established by the Regulations on the specifics of the procedure for calculating benefits for temporary disability, pregnancy and childbirth, monthly child care benefits for citizens subject to compulsory social insurance in case of temporary disability and in connection with maternity, approved by the Decree of the Government of the Russian Federation dated 15 June 2007 N 375.

In case of damage to the health or death of an employee due to an accident at work in accordance with Art. 184 of the Labor Code of the Russian Federation, the employee (his family) is compensated for his lost earnings (income), as well as expenses for medical, social and professional rehabilitation or corresponding expenses in connection with the death of the employee.

During the medical examination, employees who are required to undergo such an examination in accordance with the Labor Code of the Russian Federation are retained the average earnings at their place of work (Article 185).

On the day of donation of blood and its components, as well as on the day of the associated medical examination, the employee is released from work. After each day of donating blood and its components, the employee is provided with an additional day of rest, which, at the request of the employee, can be added to the annual paid leave or can be used at other times during the calendar year after the day of donating blood and its components. When donating blood and its components free of charge, the employer retains for the employee his average earnings for the days of donation and the days of rest provided in connection with this (Article 186 of the Labor Code of the Russian Federation).

When an employer sends an employee to vocational training or additional vocational education outside of work, he retains his place of work (position) and the average salary at his main place of work. Employees sent for vocational training or additional vocational education outside of work to another location are paid for travel expenses in the manner and amount provided for persons sent on business trips (Article 187 of the Labor Code of the Russian Federation).

Guarantee additional payments are made in cases established by law: during special breaks included in working hours (Article 109 of the Labor Code of the Russian Federation); with additional breaks for feeding a child (children) under the age of one and a half years (Article 258 of the Labor Code of the Russian Federation); additional payment to employees under the age of 18 with a reduced duration of daily work (Article 271 of the Labor Code of the Russian Federation); additional payment for women working in the Far North and equivalent areas (Article 320 of the Labor Code of the Russian Federation); when an employee is transferred in accordance with a medical certificate to another lower-paid job, he retains his previous average earnings for one month from the date of transfer, and when transferred due to a work injury, occupational disease or other work-related health damage - until permanent loss of professional ability to work or until the employee recovers (Article 182 of the Labor Code of the Russian Federation); when transferring pregnant women and women with children under the age of one and a half years to another job while maintaining average earnings (Article 254 of the Labor Code of the Russian Federation).

Compensation payments

In this paragraph, it seems necessary to sequentially consider each of those cases when the employer is obliged to reimburse the employee for expenses incurred in connection with the performance of his labor function. Unlike guarantee payments, which are established in order to prevent loss or reduction of wages for periods when the employee did not actually work for good reasons, compensation payments are aimed at reimbursement of actual costs incurred.

Such cases include reimbursement to the employee of expenses associated with a business trip; with moving to another area; use by an employee of personal property by agreement or with the knowledge of the employer, etc. The list of such cases is not exhaustive.

Compensation payments for business trips are based on the standards provided for in Chapter. 24 Labor Code of the Russian Federation. First of all, in Art. 166 of the Labor Code of the Russian Federation provides the concept of a business trip: a business trip is a trip by an employee by order of the employer for a certain period of time to carry out an official assignment outside the place of permanent work. The duration of a business trip should not exceed 40 days.

The average earnings of an employee on a business trip are retained for all working days of the week according to the schedule established at the place of permanent work, falling during the business trip, as well as for the time spent on the road.

Maintaining a job (position) and average earnings during a business trip is a guarantee established by Art. 167 Labor Code of the Russian Federation. At the same time, reimbursement of expenses associated with a business trip is, on the one hand, a guarantee established by the same article. 167 of the Labor Code of the Russian Federation, and on the other hand, obliges the employer to make compensation payments to reimburse expenses associated with a business trip (Article 168 of the Labor Code of the Russian Federation).

The employer is obliged to reimburse the employee for travel expenses to the place of business trip and back, expenses for renting living quarters, daily allowances, and with the permission of the employer, the employee may be reimbursed for other expenses incurred by him. The employer may give written permission to reimburse additional expenses if they were incurred in the interests of production and he accepted the need for such expenses.

The procedure and amount of reimbursement of expenses related to business trips are determined by a collective agreement or local regulations, including for employers who are individual entrepreneurs.

The standards for travel expenses are established by Decree of the Government of the Russian Federation of October 2, 2002 N 729 “On the amount of reimbursement of expenses associated with business trips on the territory of the Russian Federation, employees who have entered into an employment contract to work in federal government bodies, employees of state extra-budgetary funds of the Russian Federation, federal government institutions."

This Resolution established that reimbursement of expenses associated with business trips on the territory of the Russian Federation to employees who have entered into an employment contract to work in federal government bodies, employees of state extra-budgetary funds of the Russian Federation, federal government institutions is carried out in the following amounts:

a) expenses for renting residential premises (except for the case when an employee sent on a business trip is provided with free accommodation) - in the amount of actual expenses confirmed by relevant documents, but not more than 550 rubles. per day. In the absence of documents confirming these expenses - 12 rubles. per day;

b) expenses for payment of daily allowance - in the amount of 100 rubles. for each day of being on a business trip;

c) expenses for travel to the place of business trip and back to the place of permanent work (including payment for services for issuing travel documents, expenses for using bedding on trains) - in the amount of actual expenses confirmed by travel documents.

Compensation payments when moving to work in another area are provided for in Art. 169 Labor Code of the Russian Federation. By such a move we mean that an employee moves due to a change of place of work to a permanent residence in another locality according to the existing administrative-territorial division. So, for example, when concluding an employment contract with an employer located in another location, the employee, by prior agreement with this employer, agrees on the types and amounts of compensation associated with the move. An agreement between the employee and the employer is reached before the move and is documented in writing. This type of compensation payment is characterized by the following:

- the move must be to another area, i.e. another locality;

- an indispensable condition for reimbursement of expenses must be a preliminary agreement (written agreement) between the employee and the employer on reimbursement of expenses caused by the move;

- expenses for relocation of the employee and his family members are incurred in the amount of actual costs confirmed by travel documents, or in the amounts that were determined in the specified agreement (contract).

It must be taken into account that in the absence of an agreement, reimbursement of expenses is made in an amount not exceeding the cost of travel by rail, water, air or road transport, taking into account the corresponding category of amenities (compartment car, business or economy class, etc.). Other compensation payments are made either by analogy with organizations financed from the federal budget, or in other amounts, but certainly by agreement of the parties to the employment contract.

For organizations financed from the federal budget, the amount of expenses reimbursed in connection with the relocation of an employee by prior agreement with the employer to work in another area is established by Decree of the Government of the Russian Federation of April 2, 2003 N 187 “On the amount of reimbursement by organizations financed from funds federal budget, expenses for employees in connection with their relocation to work in another area.”

These employees are reimbursed for the costs of their relocation and the relocation of their family members, as a rule, in the amount of actual expenses confirmed by travel documents, but not higher than the cost of travel.

Expenses for transporting property by rail, water and road transport (public) are reimbursed in the amount of up to 500 kg per employee and up to 150 kg for each moving member of his family in the amount of actual expenses, but not higher than the tariffs provided for the transportation of goods by rail.

Expenses for settling into a new place of residence are reimbursed to the employee - in the amount of the monthly official salary (monthly tariff rate) at the new place of work and for each moving member of his family - in the amount of 1/4 of the official salary (1/4 monthly tariff rate) at the new the employee’s place of work; payment of daily allowance to the employee - in the amount of 100 rubles. for each day of travel to a new place of work.

Expenses for moving members of the employee's family and transporting their property, as well as for arranging them at a new place of residence, are reimbursed if they move to the employee's new place of residence before the expiration of one year from the date of actual provision of living quarters by the employer at the new place of work.

This Resolution stipulates that in two cases the employee is obliged to return in full the funds paid to him in connection with moving to work in another area:

- if he did not start work on time without good reason;

- if, before the end of the work period specified in the employment contract, and in the absence of a specific period, before the expiration of one year of work, he resigned at his own request or was dismissed for guilty actions, which, in accordance with the legislation of the Russian Federation, were the basis for termination of the employment contract.

An employee who does not show up for work or refuses to start work for a valid reason is obliged to return the funds paid to him minus the expenses incurred for moving him and his family members, as well as for transporting property.

Compensation payments for the employee’s use of personal property are made in accordance with Art. 188 Labor Code of the Russian Federation. This article establishes that when an employee uses personal property with the consent or knowledge of the employer and in his interests, the employee is paid compensation for the use, wear and tear (depreciation) of tools, personal vehicles, equipment and other technical means and materials belonging to the employee, as well as reimbursement of expenses related to their use. The amount of reimbursement of expenses in these cases is determined by agreement between the employee and the employer, expressed in writing.

Decree of the Government of the Russian Federation of July 2, 2013 N 563 approved the Rules for the payment of compensation for the use of personal transport (cars and motorcycles) by federal state civil servants for official purposes and reimbursement of expenses associated with its use. The rules establish the procedure for paying compensation for the use of personal transport (cars and motorcycles) for official purposes and the procedure for reimbursement of expenses associated with the use of said transport for official purposes by federal government civil servants whose official activities involve constant official travel in accordance with their official duties. .

REDUCTION ADVANTAGE

An employment contract with an employee can be terminated by the employer in the event of a reduction in the number or staff of the organization's employees[3].

In this case, the employer is obliged to offer the employee another job available to him (vacant position)[4].

Extract from the Labor Code of the Russian Federation

Article 81. Termination of an employment contract at the initiative of the employer

[…]

Dismissal […] is allowed if it is impossible to transfer the employee with his written consent to another job available to the employer (both a vacant position or work corresponding to the employee’s qualifications, and a vacant lower position or lower paid job), which the employee can perform taking into account his state of health .

In addition, the Labor Code of the Russian Federation provides a preferential right to remain at work for employees with higher labor productivity and qualifications[5].

The Supreme Court of the Russian Federation[6] emphasizes that termination of an employment contract with an employee in the case under consideration is possible provided that he was warned personally and against signature at least two months in advance about the upcoming dismissal[7] and did not have a preemptive right to remain at work .

Disputes very often arise around the guarantee that the employer will consider the priority right to remain at work. The initiator, as a rule, is a dismissed employee.

It should be noted that often the employer does not consider the employee's advantage at all, but does not violate the law. This is possible in a situation where an entire position is excluded from the staffing table, rather than the number of employees for this position being reduced. This is confirmed in judicial practice.

An analysis of judicial practice shows that employees’ demands for recognition of dismissal as illegal are not always justified due to the employer’s failure to apply guarantees regarding the mandatory consideration of the preemptive right to remain at work. Much more often they are simply unfounded.