Continuous work experience is the period of activity under an employment agreement. This concept was widely used in the USSR, since the calculation of benefits and other payments depended on it. Since 2007, it has practically lost its legal force. Currently, the term “insurance period” is used. Continuous will only be needed for some professions, as a way to receive income supplements. The article discusses the definition and features of continuous work experience in the Labor Code: what it affects, the main provisions and features of accrual. And also cases in which the length of service will not be interrupted.

The concept of continuous work experience according to the Labor Code of the Russian Federation

Continuous work experience (NTS) according to the Labor Code of the Russian Federation - the time during which work is performed in a certain organization is considered. To keep it, you need to get a new job no later than in 3 months. Before the 2002 pension reform, continuous service everywhere affected:

- the amount of disability benefits (sick leave payments);

- the amount of bonuses and allowances;

- receiving various benefits;

- possibility of an increased pension;

- registration of various social benefits.

Continuous service after dismissal at will or by article

The duration of a specific period is determined by factors such as the reason for dismissal, characteristics of the job, and others. In the Labor Code of the Russian Federation, this norm is replaced by the concept of “insurance period”. It is determined by the number of insurance premiums for the entire working period. The duration of work in each organization does not matter.

Why you need continuous work experience, read here.

In modern legislation, the “continuous work experience” norm is applied less actively. In practice, it persists in specific labor sectors.

Insurance experience

In 2007, the Law “On Compulsory Social Insurance in Case of Temporary Disability and in Connection with Maternity” No. 255-FZ came into force. According to it, the amount of benefits after sick leave is calculated based on the continuous insurance period. NTS is used only in a few professional industries.

Individual entrepreneur's work experience

Work as an individual entrepreneur is included in the total length of service if the individual entrepreneur regularly made voluntary payments to the Social Insurance Fund.

Some facts

The insurance period is calculated in proportion to the continuous one. When the insurance period is less than continuous, future benefits will be calculated based on the continuous period of service.

The list of evidence to confirm the length of service of an individual entrepreneur differs significantly from that of other employees. The fact is that the individual entrepreneur works for himself; he does not have an employer who would enter information about his work activity in the work book. Even if the individual entrepreneur subsequently gets a job with another employer, the period of work for himself is not recorded in his work book.

To check whether an individual entrepreneur has work experience, government agencies will need:

- Certificate of state registration as an individual entrepreneur (issued by the territorial body of the Federal Tax Service and confirms the start of work);

- Certificate of termination of the activities of an individual entrepreneur (issued there and confirms the end of employment);

- Documents confirming payment of contributions to the Social Insurance Fund.

An individual entrepreneur is granted a pension if he has at least 6 years of work experience. The calculation is made as usual. That is, all the years and months in which contributions to the Social Insurance Fund were regularly received are summed up.

If at some period of time a person was engaged in both entrepreneurship and part-time work in an organization, one of the jobs of the person’s choice will be included in the insurance period. But when determining the size of the pension, all contributions paid during this period of time will be taken into account.

Watch the video where it is discussed how an individual entrepreneur can confirm his experience

Basic provisions of the Labor Code of Russia

Continuous experience involves a period of work in one organization or company. When moving to another place of work, it may be interrupted. Only the insurance period is retained. NTS is retained for new employment under the following conditions:

- a new employment contract is concluded for a maximum period of 30 days;

- for regions of the Far North or work outside Russia, this duration is 60 days;

- in case of liquidation of an enterprise or reduction of staff, a new employment agreement can be concluded within 3 months.

If a husband or wife moves to work in another region, we are talking about moving the whole family. In this case, the second spouse’s work experience is not interrupted. No time frame has been established for the new employment agreement.

Continuous service is maintained only if the employee leaves at his own request. If the dismissal was “under an article”, only the insurance period is retained.

Continuity of service will not be needed when determining the size and procedure for calculating a pension.

Vehicle composition

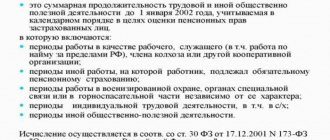

In order to make the calculations correctly, you need to know what is included in the length of service when calculating a pension. Today the list of periods is as follows:

- any types of working and creative activities carried out on the territory of the Russian Federation (including paid public works);

- work carried out outside the country (counted for employees of government agencies, diplomatic consulates, and for a number of other professions);

- periods of being on sick leave;

- periods of being in groups 1 and 2 of disability received in connection with the performance of work duties;

- military service by conscription;

- being on sick leave due to the need to care for an incapacitated family member;

- periods of vocational training;

- time of unjustified imprisonment (for example, for persons later rehabilitated, or citizens against whom criminal prosecution was terminated);

- the period during which the citizen remains unemployed;

- maternity and child care leave;

- periods of a citizen’s stay in the occupation zone, in besieged Leningrad and in concentration camps during the Second World War.

Is study time included in work experience? Yes, if we are talking about vocational training to which the citizen was sent by the employer while working for him. If we mean training in higher and secondary specialized educational institutions, it is not taken into account when calculating this indicator.

In addition to the above, the CU includes terms of forced unemployment of citizens. For example, a time when a woman could not work, because she was forced to accompany her husband when the latter moved to his place of duty.

Features of calculating continuous service according to law

To calculate continuous experience you will need one of these documents:

- employment history;

- labor agreement (contract);

- military ID;

- certificate from the archive (or from the last place of work);

According to the Labor Code of the Russian Federation, the concept of “continuous work experience” does not apply. But according to the Law of the Russian Federation “On Employment of the Population in the Russian Federation” No. 1032-1, continuity of length of service under an employment contract is possible during the following periods:

- pregnancy;

- baby care;

- studying at a university;

- conscription for military training;

- alternative (civil) service;

- performance of various government duties;

- part-time work;

- part-time.

Continuity of work experience is also ensured for officially registered unemployed people if they are paid benefits.

We also recommend that you read about the minimum length of service for calculating a pension in this material.

Until 2007, NTS was calculated according to the formula: insurance period + continuous. After this time, a calculation is made by adding up the periods of work at one place of work.

NTS is not interrupted even for valid reasons. These include:

- moving to another place of residence;

- business trip outside of Russia;

- caring for an HIV-infected child.

Continuous service can be renewed for a pensioner who has decided to return to work and for military personnel discharged from their previous place of service.

Evidence of work experience

All evidence is divided into documentary and testimonial. Preference is given to documentary evidence and only if it is impossible to obtain it, witness testimony is taken into account.

The list of written evidence of work experience is in the Regulations on the procedure for confirming work experience for the assignment of pensions in the RSFSR (approved by order of the Ministry of Social Security on October 4, 1991 No. 190). The most important of them is the work book. If it is lost or lacks all records of work, the following will be accepted as evidence:

- Extracts from orders on hiring and dismissal;

- Certificate;

- Financial documents on payroll;

- Employment contracts with a mark of execution;

- Membership card and trade union member card;

- Labor and registration lists;

- Pay books;

- Other written documents confirming the fact and duration of work.

In the absence of written documents, the testimony of at least 2 witnesses who worked together with the citizen at an enterprise or organization can serve as evidence of work experience (clause 2.1 of the above-mentioned Regulations).

conclusions

Continuous length of service used when working under an employment agreement is the time of activity in one organization. Has the following features:

- Continuous service was essential before the 2002 pension reform. With its help, disability benefits were determined, as well as an old-age labor pension. Later, this function began to be performed only by insurance experience.

- Since 2007, continuous service has only local significance. At the federal level, it applies only to a few professional industries. Their list includes work in medical institutions, as well as in the Far North and other regions with a difficult climate.

- There are good reasons for which continuous service is maintained even during breaks in work. These include studying at a university, conscription for military training, maternity leave, child care for up to one and a half years, and others.

- The main document for calculating continuous service is the work book.

When calculating continuous length of service, activities at the main job and part-time work are taken into account.

Nuances of calculating vehicle

In most cases, when calculating the total duration of the indicator under consideration, all time periods included in it are taken into account in a single amount. But there are exceptions:

- the terms of work in the far north and in regions equivalent to it, as well as work and service (with the exception of military service) in the exclusion zone after the Chernobyl accident are multiplied by 1.5 times;

- compulsory service is included in the length of service, its period is taken into account twice;

- the duration of work in leper colonies and anti-plague institutions, residence in besieged Leningrad, and stay in concentration camps is multiplied by two;

- double the duration of work during the Second World War (with the exception of activities carried out in occupied areas);

- the time periods of unjustified imprisonment, work in besieged Leningrad and during the liquidation of the Chernobyl Nuclear Power Plant, service in the armed forces during hostilities and treatment of war injuries are tripled.

As mentioned above, maternity leave is included in the length of service, but there is a nuance regarding the accounting for parental leave. The CU includes parental leave until they reach the age of three. But the total amount of such vacations cannot exceed 9 years.

There are also restrictions on the duration of involuntary unemployment. If a woman could not carry out work or socially useful activities due to the need to accompany her spouse to a place of military service or work abroad, she does not have to register as unemployed. Periods of forced downtime will be included in its TC. But their total duration should not exceed 10 years.

Advice! For a more accurate calculation of vehicles, citizens can use an online calculator. For example, on the website of the Pension Fund.

Self-calculation of length of service by a citizen can only be approximate. The exact duration of the TS will be determined by the Pension Fund specialists when you contact them. There are a lot of additional nuances in the algorithms of their actions. For example, if at some point in a citizen’s life there were two periods taken into account in the length of service, specialists will choose the most profitable option for the future pensioner when making calculations.

We remind you that even if you thoroughly study all the data that is in the public domain, this will not replace the experience of professional lawyers! To get a detailed free consultation and resolve your issue as reliably as possible, you can contact specialists through the online form .

Commentary on Article 121 of the Labor Code of the Russian Federation

Expert opinion

Gusev Pavel Petrovich

Lawyer with 8 years of experience. Specialization: family law. Has experience in defense in court.

To qualify for vacation, you must have a length of service. The procedure for calculating length of service giving the right to annual basic paid leave is regulated by Article 121 of the Labor Code of the Russian Federation.

First of all, it should be noted that the list of periods includes the period of suspension from work of an employee who did not undergo a mandatory medical examination (examination) through no fault of his own. According to paragraph 2 of the List, it is proposed to include in the length of service periods “when the employee did not actually work, but in accordance with labor legislation and other regulatory legal acts containing labor law norms, a collective agreement, agreements, local regulations, and an employment contract, he retained his place of work (position), including the time of annual paid leave, non-working holidays, days off and other rest days provided to the employee.”

The maximum duration of unpaid leave, beyond which these periods are not included in the length of service giving the right to annual basic paid leave, is 14 days. This way, you can take vacations at your own expense more freely.

If previously the eighth (and all subsequent) days of vacation at one’s own expense during the year were not counted towards the length of service giving the right to paid leave, then according to the current rules only the fifteenth day will not be counted (Article 121 of the Labor Code of the Russian Federation).

Work experience in specialty

In order to work in certain positions, it is necessary to confirm your work experience in the relevant specialty (work experience), that is, the duration of activity according to the qualification document. Such a document can be a diploma, certificate, certificate, etc. For example, to become a prosecutor of a constituent entity of the Russian Federation, you must have at least 7 years of service (work) experience in the bodies and institutions of the prosecutor's office in positions for which class ranks are awarded (Part 4, Article 15.1 of Federal Law No. 2202-1 of January 17, 1992 "On the Prosecutor's Office of the Russian Federation").

Read about how to calculate the corresponding type of experience and what documents confirm it in other articles on our website.

Estimate

Difference from insurance experience

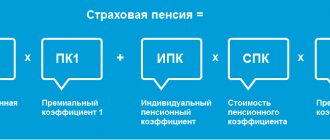

Many people have come across these concepts, but not everyone knows what the difference is between them. The insurance period is applied when determining the right to accrue a pension from 2015.

According to the current law, payments are assigned when a person reaches retirement age and has a total insurance record of at least five years. This period includes the time for which contributions to the Pension Fund were accrued and paid, as well as some periods during which the person did not work:

- caring for a disabled person of group I;

- caring for a disabled child;

- time of receipt of temporary disability benefits;

- caring for a child up to one and a half years old, but not more than six years in total;

- caring for an elderly person over 80 years of age.

Labor is used to determine the right to pension payments for citizens who worked before January 1, 2002. Currently, this concept is absent in legislation. The size of the pension accrued before the specified date depends on its duration. After this, payments are calculated differently.

If you are interested in how to make an extract from a work record book, read this material.

Read about whether it is possible to have two work books at the same time here.