19.09.2019

0

265

5 minutes.

The working population has the right to receive social support from the state in retirement, and, with significant work experience, to have special privileges. The length of service required to be awarded the title “Veteran of Labor” differs significantly from the minimum. To obtain it, you will have to carefully collect all documents confirming your work time.

The legislative framework

Quite a lot of citizens of the Russian Federation, upon retiring, receive the status and preferential benefits of a labor veteran. This is due to the fact that many people start officially working quite early and continue their work experience for quite a long time.

In addition to pension payments and preferential incentives of federal significance, some of them award an honorary badge, medal, gubernatorial certificate, or other awards to those citizens who are eligible to receive them.

It is precisely such people, with significant work experience, who receive the status of a veteran of labor activity.

Today, all questions about the procedure and conditions for obtaining the title, as well as all benefits provided, are regulated by the following legislative pact:

Federal Bill No. 5 “On Veterans” (Articles 7 and 22) clearly defines the required length of service to obtain status, as well as the provided local social support measures specific to this particular category of labor veterans.

Documentation for obtaining such status is considered exclusively from Russian citizens. To obtain status as a foreigner, he will need to obtain Russian citizenship.

Accounting for experience outside the territory of the Russian Federation will be taken into account only under the current agreement of the countries of the Union of Independent States.

If there is none, then becoming a veteran of labor activity is not allowed in Russia.

How to fill out an application

When applying for an honorary veteran title, the pensioner personally or his authorized representative must fill out an application. A blank form is always available at the territorial social protection authorities and is available to anyone. It is important to enter the data carefully, without erasing or crossing out. Firstly, you can take the paper with you and fill out all the necessary fields yourself at home. Then submit it along with the rest of the documents.

The second option is to write down the data on the spot with the help of employees and immediately begin filling out the application.

- When filling out, be sure to make sure that the header of the application contains the name of the institution to which the application is being submitted. If the information is not printed immediately, then you need to write it down yourself.

- Next, you will need to indicate the applicant’s personal information: full name (in some cases, you need to have your passport at hand, as sometimes you need to indicate your registration address).

- You need to pay close attention to the “Grounds for assigning status” column. How to correctly indicate the information can be asked immediately at the center where the application is taken. A detailed explanation is also available on the government services website. If the pensioner has been awarded several times, has orders, or has distinguished himself for great achievements in his work, then there should be no problems with filling it out.

- Do not forget to list in writing the complete list of documents that is provided at the window along with the application form.

- Finally, to finish filling out the application, a signature and date of submission of the form is required at the end. Either the pensioner himself or his authorized representative signs.

After submitting the entire package of documents, the territorial division of social protection legally considers applications for a certain time. Each region of the country makes its own decision on the specified time frame for considering applications. So, in most situations, social security authorities collect all information about the applicant and make a decision within 30 working days from the date of receipt of the package of documents.

In Moscow, this period is shorter, since according to internal regulations it should account for no more than 30 calendar days (all weekends and holidays are counted). The territorial body has the right to spend another 5 days notifying the veteran about the assignment of status or refusal. That is, the total period in Moscow and the Moscow region does not exceed 35 calendar days.

Application form for preparation and issuance of a certificate:

Statement of claim to the court for the obligation to assign the title:

Who can be awarded the title and how many years must they serve?

To officially obtain the title of veteran of labor based on length of service, you must meet all the necessary criteria and collect all the required documents to obtain the title.

The criteria for awarding the title of labor veteran are:

- An employee who has retired and has received awards from the state;

- Pensioner with honorary titles of the Russian Federation/USSR;

- A worker who has been marked with a departmental award for his work (gratitude from the ministry, medals, badges, a letter of gratitude from the Ministry, governor or president, having a government award for work);

- The total amount of experience must be at least fifteen years. In addition, this length of service should not be interrupted; simply put, a person must work at one enterprise for at least fifteen years without being fired (only promotions are allowed).

- The total experience must be at least twenty-five years for males, and at least twenty years for females. This work experience may include fifteen years of experience at one enterprise;

- Insurance experience of at least five years.

On December 19, 2005, amendments were adopted to the new law indicating the establishment of eligibility conditions for obtaining the title in each individual region at the local government level.

The total amount of experience must be at least fifteen years.

Conclusion

In what cases women are given labor veteran status depends on the procedure for calculating their pension length. Each of the categories (military, officials, pilots and astronauts, as well as “ordinary” pensioners) has its own length of service required for this honorary title. In addition, if you have only departmental awards, you still need to fulfill the requirements for experience in a specific industry.

- Work experience affects the size of the insurance portion of the pension. Read here what the minimum length of service is required to calculate a pension.

- The total length of service consists of days, months and years worked.

- The insurance period of employment can be calculated using a work book.

- The size of the pension benefit consists of three components - the insurance and funded part of the pension, as well as the pension one.

Preferential benefits

Absolutely all citizens who have been awarded an honorary veteran of labor receive a variety of preferential benefits:

- Providing treatment in city clinics without payment;

- Traveling on city transport without paying for travel;

- Fifty percent discount on housing and communal services;

- For working pensioners with veteran status, vacation is expected at a time convenient for the veteran;

- Compensation for the costs of laying gas pipes in housing;

- Free production and installation of dental prostheses in state-owned dentistry;

- Pension payments;

- Relief from property tax;

- Possibility to transfer personal income tax to another date;

- Exemption from taxation for individuals.

In addition to the above-mentioned preferential benefits, which are state-owned, regional authorities can provide their own types of preferential privileges.

You can clarify the list of benefits provided by the city authorities by contacting the nearest regional social protection center.

In addition to the above, a pensioner with the status of a labor veteran can receive the following benefits:

- Traveling by transport in suburban directions without paying for travel;

- Supplement to pension, made monthly and recalculated upward every year;

- Fifty percent discount on landline telephone fees;

- Free visit to a sanatorium-resort holiday once a year with payment of travel in both directions.

Free entry to a sanatorium-resort holiday

Who may be eligible to receive benefits?

The possibility of receiving benefits in most cases is a fundamental factor for starting to collect documents and undergoing the procedure for assigning status. Labor veterans can be:

- federal significance;

- regional significance.

Federal benefits are the same for all regions. Each subject of the Russian Federation establishes regional benefits independently. Only a veteran of a specific region can apply for regional benefits.

Federal benefits

Federal benefits:

- provide free services in public medical institutions;

- the right to free travel in public transport;

- benefits to utilities in the form of a subsidy of 50% of the housing area;

- payment for 50% of television and radio services;

- compensation for gas supply costs;

- freedom to choose the vacation period for a working veteran;

- tax benefits in terms of personal income tax, tax deductions, real estate.

For federal benefits, there is the possibility of so-called monetization of benefits, which gives the right to convert a number of federal benefits into cash equivalent. The opportunity is provided for the following types of benefits:

- transport;

- supply of medicines;

- treatment in sanatoriums and resorts.

Regional benefits

Regional benefits can vary greatly by region, which is largely due to the region's funding capabilities. Additional benefits may include:

- monthly pension supplement;

- social supplement if the pension amount is less than the regional subsistence level;

- drug subsidies;

- providing a 5% discount to the social card holder on essential products;

- subsidies of 50% when purchasing tickets for water and railway transport.

You can get acquainted with the list of benefits available to a labor veteran in a particular region at the local administration (department) of social protection of the population or on the official website of the authority.

Documents for obtaining a labor veteran

Before applying to the authorized bodies to obtain the status earned by length of service, veterans must collect the following documentation:

- Passport of a citizen of the Russian Federation and its photocopy;

- Completed application;

- Pensioner's ID;

- A document indicating the amount of the pension and a photocopy of it;

- Work book, with the specified work experience, and its photocopy;

- The entire list of awards received during work (take a badge, certificate, letter of gratitude, as well as documentation of ownership of awards);

- If the pensioner is still working - a certificate from the place of work;

- If a pensioner applies for honorary status without having any awards - an archival extract about work during the Second World War;

- Two 3x4 photographs.

When submitting a request to designate a labor veteran as an official representative of the candidate, an official power of attorney and a passport of the representative are required.

All of the above documentation is collected in a folder and submitted to the social security authorities at the place of registration for consideration. It is important that the necessary preferential payments are provided exclusively at the place of official residence.

That is why, in order to apply for benefits, it is necessary to have a residence permit exactly where the recipient lives, otherwise it is necessary to obtain a temporary or permanent registration before applying for a labor veteran.

After the documentation is accepted, the formation of a personal file begins, and the provided documents are transferred to a special commission, which is located in the regional Ministry.

The application is reviewed within two weeks (may vary depending on the region), after which a personal visit of the candidate (representative) is scheduled to notify the final result.

The veteran's badge and certificate are issued in person, upon appearance at the social security authorities, against the signature of the recipient.

If the commission's decision is negative, such candidate will receive a written notification of refusal. This document contains a list of reasons why a citizen is denied veteran status for labor services to his homeland.

The response period for refusal is up to five working days.

It often happens that veterans do not agree with the decision made. In this case, you can challenge the assignment in court.

If a citizen is confident that veteran status should be assigned and has all the supporting documentation, then a lawsuit makes sense.

What certificates are needed to obtain the title?

The main role for assigning honorary status to citizens is the certificates issued by certain structures:

- Tax Service;

- Ministry;

- Scientific organizations that are equivalent to departments;

- State Archive Service;

- And other government services.

The certificates of the Open Joint Stock Company "Russian Railways" are not taken into account, but if you have railway certificates from the Soviet Union, there is a chance for a positive outcome.

What medal or award gives the right to receive the status of a labor veteran?

There is also a basis in the case when a citizen has an order or medal, which is issued by the following government bodies:

- State Duma of the Federal Assembly;

- Prosecutor General's Office;

- Government of Russia;

- State Administration of the President;

- Chairman of the Constitutional Court;

- Head of a department or ministry;

- Russian honorary donor badge.

Medals and diplomas received for sports competitions, obtaining an academic degree or title, or for participating in national economic exhibitions do not allow you to claim honorary status.

Also, awards of the Congress of People's Deputies of the USSR are not listed.

How to calculate total work experience

To make the calculation correctly, you will need a document confirming employment.

This is usually a work book. However, during the period of activity there could be cases when the employer did not make pension contributions to the Fund. In this case, the Pension Fund does not take into account the period when there were no receipts of funds (Article 10, paragraph 1 of Federal Law No. 173). An additional condition for calculation is the fact that the citizen’s workplace must be located on the territory of the Russian Federation. To calculate length of service you will need to perform the following steps:

- If you have a work book, enter the dates of admission and dismissal from work in the empty fields.

- Indicate the number of years spent serving in the Armed Forces.

- Select the number of children you had to care for during maternity leave. For one small citizen, the length of service is accrued within 1.5 years.

- Click the “Calculate” button.

https://www.youtube.com/watch?v=f3MCn7p1r2c

The resulting period can be compared with data from the Pension Fund. The information is indicated on the first sheet of information about the status of the individual account of a citizen of the Russian Federation. You can obtain it from the Fund by personal visit or electronically through the State Services portal.

ATTENTION! If a citizen did not work under a contract, but was listed as an individual entrepreneur, the years for calculation can be taken in tax returns.

To calculate you will need to know:

- Periods of work for the entire period of activity. In this case, the day of dismissal is counted in the calculation.

- Years spent in military service.

- Duration of maternity leave.

If controversial situations arise when the Pension Fund does not have data on maternity leave, military service or the period of work at a certain place, documents confirming the fact of length of service should be submitted to the Fund. This could be an agreement with the employer, a military ID, certificates.

In Russia, there is a basic Federal Law that defines the rules for calculating labor (insurance) pensions, their types, calculation formulas, and categories of citizens who are entitled to accruals. Federal Law-173 “On Labor Pensions...” was adopted in 2001. Amendments were made in July 2013. However, such measures were insufficient to improve the pension system.

From January 1, 2015, Federal Law 173 is not applied (except for calculation rules and formulas) in connection with the release of another document, namely Federal Law No. 400 “On Insurance Pensions”. The changes and additions came into force at the beginning of 2021.

All articles, clauses and amendments introduced into the Federal Laws do not contradict the Constitution of the Russian Federation. The main document of the state contains nine chapters, as well as final and transitional provisions.

The period that determines the work activity of a particular employer affects the receipt of annual paid leave, maternity leave, and payments for temporary disability.

According to the law, a citizen of the Russian Federation is entitled to paid leave for two weeks after six months of working in one place. After a year of working, you can take a month off from work.

Experience is very important for expectant mothers going on maternity leave. Previous income for the past several years is taken as the basis for calculating benefits and payments. If a woman was not officially employed before pregnancy, the benefit is accrued in the minimum amount.

The online pension service calculator allows you to calculate your length of service based on information taken from your work record book. It summarizes the period of activity and provides accurate data taking into account military service and child care periods. The calculator simplifies and saves time for counting.

Information about the length of service registered with the Pension Fund of Russia can be viewed and compared with information on the citizen’s individual account. If deductions from one of the employers have not been made, the Fund does not accrue seniority. In this case, there may be discrepancies between the length of service calculated by the calculator and the data established by the Pension Fund.

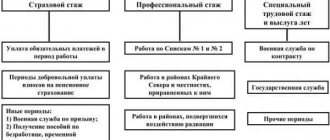

It may include certain periods during which the citizen performed duties related to his work activity. In addition, this should also include other periods of time when the employee, being employed, was not engaged in the performance of official duties, but they were counted toward his length of service.

The OTS counted all “working” periods in the chronological period. If a citizen’s work experience was interrupted, then no reset occurred, since from the moment of new employment the OTS continued to flow further.

This term should be understood as the total period of labor activity in particularly difficult conditions. This especially includes working in hazardous industries and in unfavorable climatic conditions. In addition, special experience is also calculated for teaching staff, as well as doctors, paramedics and nurses, regardless of specialization.

Attention! The periods of time during which special work experience was carried out must have papers confirming these facts.

There is also such a concept as “continuous work experience”. It should be understood as the period when the citizen worked continuously. For a long time, the amount of temporary disability benefits, as well as some other payments, depended on this parameter. Currently, the fact of continuous work activity is not legally significant.

The duration of an employee’s compulsory labor insurance is confirmed by such an important document as a work book. If the information specified in it is not entirely complete, then other supporting documents are used, such as:

- contracts;

- orders;

- certificates;

- salary slips.

To calculate, the following generally accepted rule is used: a period of 360 days is considered for one year, and a period of 30 days is considered for 1 month, regardless of calendar calculation.

The calculation procedure is quite simple. Based on documents containing relevant information, it is necessary to find out and write down the start/end dates of working periods. Then the duration of each of them must be determined with an accuracy of one day. After this, the resulting periods are summed up to the nearest year, month and day. This calculation has been used previously.

More on the topic Northern pension experience for men

The basis for assigning old-age benefits is the achievement of the required age. In 2021, it is 55.5 and 60.5 years for women and men, respectively. In addition, you must have a sufficient number of pension points. The insurance period, the period during which contributions were paid for the employee, also plays a significant role.

The OTS itself does not affect the assignment of a pension. However, given that the vast majority of people who are about to retire, as well as those planning to end their working career in the coming years, began working before 2002, this is of great importance for them. This is due to the fact that until 2002, pension rights were formed exclusively on the basis of the TTS, which will be taken into account when calculating material payments.

In addition, the special working period affects the right to preferential (early) receipt of pension payments for certain categories of persons.

Reference! After 2002, all citizens were registered in the compulsory pension insurance system, and therefore all periods that were discussed in the article above are counted only in the insurance period.

The length of total work experience is not considered by modern Russian legislation as the main factor for calculating old-age benefits (with the exception of periods of work before the pension reform of 2002). The insurance model of pension provision presupposes other grounds for receiving financial support in old age, depending, in addition to the length of work, on the volume of transfers to the Pension Fund.

Is it possible to receive an honorary title without awards?

In this case, only the citizen who began working during the Second World War before reaching the age of eighteen receives the honorary title.

However, there is a condition : their work experience must be at least forty years for males, and at least thirty-five years for females.

In order to qualify as a labor veteran, it is necessary to collect documents that will confirm that the citizen did not work in the occupied territory of the Soviet Union.

In all other cases, citizens will need awards, orders and other above-mentioned awards.

Obtaining a title in Moscow and Moscow Region

At the moment, the following categories of citizens are recognized as Labor Veterans in the capital:

- having orders or medals of both the USSR and the Russian Federation;

- awarded significant titles of the USSR or the Russian Federation;

- those who received thanks or certificates from the head of state;

- marked with signs of merit in labor or long-term work;

- have worked for at least 15 years in one field, taking into account the total output of 20-25 years (for women or men, respectively);

- those who have reached retirement age with the required length of service;

- who began working at a young age during the Second World War.

In this case, the person must be registered in Moscow.

Other nuances when registering an honorary veteran

For people of retirement age, obtaining the title of labor veteran on their own is quite difficult. This is due to the fact that many simply do not know the rules and conditions for registering as a labor veteran.

Also, it is necessary to collect the necessary sufficiently voluminous package of documents, which is not always an easy task.

In addition, citizens do not know the legitimacy of their awards, since there are a great many departments, but the awards of not all of them are recognized by government bodies.

A communist drummer is equated to a veteran; this is precisely the opinion that exists among people of retirement age.

However, this is a misconception, although certain awards received in the Soviet Union give the right to apply for a veteran of labor award.

The Supreme Court of Russia published an explanation on this issue: “This award was envisaged in 1976 as a moral incentive for citizens to work, and is not awarded as an award for labor merit, which does not allow citizens who have the “Shock Worker of Communist Labor” to apply for the title of veteran labor.

Now regional departments are introducing their lists of awards, taking into account the local branches of the departments.

In Tatarstan, there is Order No. 481 of the Ministry of Labor, which describes the list of awards that are required from candidates to receive honorary status, as well as preferential benefits for veterans of this region.

The list of regional benefits varies.

In Moscow, preferential privileges will come into force immediately after receiving the title, and in St. Petersburg they come into force only when a citizen reaches retirement age (men can use benefits from the age of sixty, and women from fifty and not earlier).

New legislation

In 2005, the bill “On the monetization of benefits” was released, which provoked many protests in the country.

This law abolished the appointment of the title at the state level. Significant corrections were also made, as a result of which all benefit citizens were divided into two types: federal and regional. The first include:

- disabled people;

- heroes of the Soviet Union;

- WWII veterans;

- heroes of labor;

- survivors of the siege.

And for the regional ones:

- home front workers;

- victims of repression;

- labor veterans.

The listed categories of beneficiaries are now the responsibility of the regional authorities, which, based on their budget, independently determine the amount of financial compensation or benefits.

Accordingly, in each region the issue regarding the title of labor veterans was considered completely differently. For example, in some regions, the authorities decided that it was possible to completely deprive this category of citizens of all benefits, not counting those who were assigned to it before 2005. And in others (for example, in Moscow and St. Petersburg), the order remained practically the same. Today, it is also impossible to talk about any kind of unity on this issue, since each region organizes it in its own way. The only thing in common is that now there is no need for awards for good work to confer a title.

The federal law also includes mention of the title of Veteran of Labor. It states that such people are considered to be people who have such a certificate, Soviet medals and other distinctive signs in the working sphere, as well as those who began working in childhood, during the Second World War.

However, it sometimes happens that regional laws conflict with federal ones. In particular, pensioners often encounter the fact that departmental bodies do not take into account their Hero of Labor awards. And in a number of regions, on the contrary, the list of conditions, each of which allows a person to be assigned a title, has been expanded.

Obtaining a certificate

If the commission approves the pensioner’s application, he becomes a labor veteran and receives a document certifying this fact - a “Veteran of Labor” certificate. It is given out free of charge. To do this, the applicant, or his notarized representative, must appear in person. After receiving the certificate, the retiree will need to determine which benefits are most needed. Having chosen privileges, the honorary worker must write a corresponding statement, which will indicate the selected benefits.

Such assistance can make the life of a pensioner many times easier. But today the title is no longer so honorable and significant. Now the importance of status is rapidly declining in favor of pension reform, which state authorities are beginning to implement.

This is interesting! How to correctly write a resignation letter of your own free will

Things to consider

Citizenship issue

official citizenship of the Russian Federation can become an honorary veteran . A foreign citizen, even if he has achieved sufficient experience, can receive the title only after receiving Russian citizenship. When receiving work experience in another country, it can be counted in the total work experience when the state concludes an Agreement of the CIS countries.

When can you use benefits?

According to current legislation, a citizen has the right to obtain veteran status before retirement if there are sufficient grounds. However, a citizen can take advantage of the benefits provided to veterans only upon completion of his working career.

Since the issues of regulating the acquisition of the title fall within the powers of the constituent entities of the Russian Federation, the rules for obtaining veteran status in different constituent entities may differ slightly. At the same time, the regulations of a particular region should not conflict with the federal laws of the Russian Federation. The following differences exist:

- in a number of regions, the presence of non-departmental awards is not considered a basis for the possibility of conferring the title;

- in a number of regions, the list of grounds for assigning the status has been expanded and to assign the title it is enough to have only a certain number of years of total experience.

Conditions for obtaining status

A government agency can assign an honorary veteran title only if the person has met certain conditions throughout his working life:

- the worker has completed the length of service to become a veteran of labor;

- received an honorary title;

- received various awards from the department for success in his work.

The legislation of the country and regional government officials establish the conditions for obtaining and registering status. Amendments for the capital's pensioners are not included in the law, but local authorities frequently adjust the conditions. Typically, changes concern the timing and the presence of labor differences of regional significance.