The concept of total work experience

The total length of service, which includes all periods of work, as well as socially useful activities of a citizen, plays a special role in taking into account the periods of work before 01/01/2002 in the calculation of pensions.

After this date, in connection with the entry into force of the Law “On Labor Pensions in the Russian Federation” dated December 17, 2001 No. 173-FZ, this concept is replaced by the definition of “insurance period”, information about which begins to accumulate directly in the Pension Fund. For information about how the Pension Fund receives information about the insurance experience and income of each person, read the article “From what year was personalized accounting introduced?”

Fundamentally, these 2 types of length of service are distinguished by the fact that in the general work experience the periods of labor and socially useful activities carried out by the citizen are taken into account, and in the insurance period the periods of payment of contributions from his income to the Pension Fund are taken into account. With the introduction of Law No. 173-FZ of December 17, 2001, the size of the pension began to depend on different values depending on the period of labor activity:

- for the period before 01/01/2002 - on the duration of the total length of service and the amount of average monthly earnings;

- for the period from 01/01/2002 - from the amount of contributions paid to the Pension Fund and the presence of a minimum insurance period.

The new and old algorithms for calculating pensions turned out to be incomparable. Pension rights earned by a citizen before 01/01/2002 could not be taken into account when applying the new rules without appropriate data linking. For this purpose, paragraph 1 of Art. 30 of Law No. 173-FZ of December 17, 2001 provided for the possibility of recalculating these rights into an amount comparable to the new rules: the estimated pension capital accumulated on the date of the change in legislation. The formula for calculating this capital includes the value of the estimated size of the labor pension, which can be determined by one of 2 algorithms given, respectively, in clause 3 or clause 4 of Art. 30 of the law of December 17, 2001 No. 173-FZ.

Requirements for proof of experience

To confirm experience in accordance with Art. 13, 14 Federal Law No. 400, as well as the rules for calculating the insurance period (Resolution of the Government of the Russian Federation No. 15 of 2014), information is collected that confirms the personalized accounting of the applicant’s employment. If the periods of work coincide, the one that will have a greater impact on the amount of the pension is selected.

Experience is calculated using:

- work book, a duplicate is also taken into account;

- labor agreement with the employer, including a civil law one. Employment under GPC agreements is taken into account from 01/01/1997;

- military identification cards;

- certificate from the employment center, accounting department;

- archival extracts;

- the testimony of witnesses is taken into account. Information from two or more people is taken if lost documents cannot be recovered.

Periods of work as a nanny or housekeeper are taken into account only when concluding a GPC agreement with the employer and a certificate of payment by the latter of insurance payments for the employee. This condition also applies to workers in creative professions under copyright or licensing agreements.

The activities of lawyers, notaries, private detectives and other persons who provide employment on their own are confirmed by a certificate from the local Pension Fund or the Federal Tax Service on the transfer of mandatory payments.

If, when calculating a pension, experience was not taken into account, for example, caring for a disabled person, a request is sent to the Pension Fund with a request to provide a reasoned answer as to why they refused. If the answer is provided, but the applicant is not satisfied with the decision of the Pension Fund, a statement of claim is filed with the judicial authority. A citizen has the right to appeal the decision of the Pension Fund within a three-year period from the date the decision was made. However, it should be taken into account that procedural proceedings with the Pension Fund of the Russian Federation are considered a complex category of cases, so it is better to involve a lawyer in the process.

Types of total length of service that affect the calculation of pensions

Differences in establishing the estimated size of a labor pension are not limited to the difference in the formulas for their calculation: the lists of periods that form the total length of service involved in them also differ.

For calculations according to clause 3 of Art. 30 of the law of December 17, 2001 No. 173-FZ, the total length of service consists of the periods:

- any types of work (including creative activities) in the Russian Federation or abroad;

- military service;

- illness that occurred during work, or disability of 1-2 groups related to work;

- unjustified excessive detention;

- registration with the employment service in connection with unemployment.

For calculations according to clause 4 of Art. 30 of Law No. 173-FZ of December 17, 2001, the total length of service, in addition to the above periods, additionally includes the time:

- vocational training;

- caring for a disabled person;

- maternity leave and child care up to 3 years (but not more than 9 years);

- lack of opportunity to work for the wives of military personnel staying with their husbands at the place of service, and the wives of persons sent to work abroad. In the latter case, this period should not exceed 10 years;

- being in the occupied territories, in concentration camps or in besieged Leningrad during the Second World War.

See also “Is military service included in seniority (nuances)?”

Insurance experience - what is it?

In the modern world, insurance experience is of great importance.

The insurance period is the total duration of work, which is used to assign a labor pension or pay sickness benefits..

In addition to the time of official employment, the insurance period includes the following main cases:

- Period of military service

- Sick time

- Maternity leave period up to 1.5 years (but not more than 6 years)

- Period of receiving unemployment benefits

- Time to serve the sentence if the conviction was unfounded

The periods included in such length of service are regulated by Law No. 400-FZ of December 28, 2013 (as amended on March 6, 2020).

|

What is included in the length of service and how to calculate the periods?

The periods included in the total length of service are taken into account in this calculation according to their actual calendar duration by summation (clauses 3–4 of Article 30 of Law No. 173-FZ of December 17, 2001). However, there are a number of exceptions, according to which the corresponding intervals are taken into account in an increased amount. For example, for both options for determining the total length of service for a full year, the time worked during a full season in seasonal industries is taken.

In calculating the length of service under clause 4 of Art. 30 of the Law of December 17, 2001 No. 173-FZ additionally increases the time:

- work in the Far North, in areas equivalent to it, in the zone of the Chernobyl accident - 1.5 times;

- conscript service in the army, work in leper colonies, anti-plague institutions, work during the Second World War (except for areas of occupation), living in besieged Leningrad, being in a concentration camp - 2 times;

- participation in hostilities and service in the zone of the Chernobyl accident, treatment of war injuries, work in besieged Leningrad, unjustified detention in places of detention - 3 times.

Explanations from officials about the order in which periods of conscription service in the army and periods of study at universities are included in the general length of service and insurance experience are available in the ConsultantPlus system. Get trial access to K+ for free and proceed to conclusions.

The right to choose a calculation formula and, accordingly, to evaluate the total length of service is reserved by law to the insured person. However, in practice, such a calculation is made by the Pension Fund based on the documents it has, choosing from 2 options the most profitable for the pensioner.

The length of service is assessed in years, months and days. In this case, 30 calendar days are taken for a full month, and 12 months for a year (clause 47 of the Government of the Russian Federation Resolution No. 1015 of October 2, 2014 and clause 35 of the previous Government Resolution of the Russian Federation dated July 24, 2002 No. 555).

An example of the correct calculation of total length of service according to an employee’s work record book

Reading time: 4 minutes(s) Often people try to register at work without making entries in a special document - a work book. But this is a mistake, since the insurance period is calculated according to the work book. It is necessary for calculating pensions and other payments.

What is work experience and why should it be counted?

This concept means the total duration of all periods of a citizen’s working activity. Since 2002, according to the norms of Federal Law No. 400, Article 2, the second name is insurance experience.

According to Federal Law No. 166, Article 20, the pension is calculated from the length of service, which includes insurance and sometimes continuous. Therefore, this indicator is necessary for calculating pension payments. Also, the duration of the working period is the basis for the following rights:

- on vacation;

- sick leave;

- in some cases - receiving a salary.

After the reform, which was carried out in 2015, the minimum length of service of a citizen must be at least 15 full years.

The length of service recorded in the work book is considered the basis for calculating pension payments. The entries are located directly in the details.

Periods that are taken into account when calculating

Part 1 of Government Decree No. 1015 of the Russian Federation states that in order to correctly calculate the duration of a citizen’s working activity, it is necessary to take into account various periods of socially useful activity. These include not only officially registered positions in enterprises:

- periods of work and other public activities on the territory of the Russian Federation by citizens who are insured according to the norms of Federal Law No. 167, with a mandatory condition being insurance premiums by the citizen or his employer;

- a citizen’s work outside the Russian Federation under an international labor contract, but insurance contributions to the Pension Fund of the Russian Federation are also mandatory;

- all periods of socially useful activity when the citizen made insurance contributions;

- training at secondary educational institutions, universities;

- military service;

- decree;

- being in the civil service;

- parental leave for one and a half years;

- periods of incarceration spent in prison;

- the period of time when a citizen was considered officially unemployed and was registered with the Employment Center;

- the period when a person was engaged in social activities.

Federal Law No. 27 also states that the period of time when a person was not insured is also taken into account when calculating length of service. This must be confirmed by the employer.

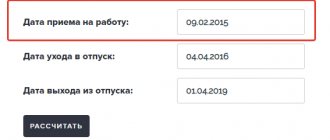

How to calculate work experience according to a work book?

The calculation procedure is regulated by Russian Government Decree No. 555, part 7. You can calculate your annual service manually yourself. It is important to remember that all periods of training and advanced training are also taken into account when calculating. The algorithm is simple:

- Write out in chronological order from the work book all periods of work: from entry to dismissal.

- Calculate the time worked at each enterprise: subtract the date of dismissal from the date of employment. First they count the days, then the months, then the years.

- Add up the resulting indicators.

Single formula for calculation:

| Total work experience | = | The sum of the end dates of each work period | — | The sum of the start dates of each work period |

But first the total number of days is counted, then they are converted to full months, and then to years.

When working at the same company

You can come to work at the same enterprise twice, or you can become a veteran of labor for your length of service, working in the same organization throughout your life.

An example of calculating length of service using a work book at one enterprise.

Record: Alexey Nikolaevich Smirnov worked at Okean LLC from 12/25/2004 to 07/18/2008.

- First we count the number of days:

18-25 = -7 + 30 = 23. - Now the number of months:

7-12 = -5 + 12 = 7. - And here is the number of years:

2008-2004 = 4.

According to the resulting indicators, the total length of service at Okean LLC is 4 years 7 months 23 days.

But there is a nuance - the calculation is equal to full years, that is, the resulting figure must be rounded. If the partial term is less than six months, then it is rounded down and, conversely, if it is more than half, it is rounded up. It turns out that the total figure was 5 years.

When working at different enterprises or using two or more work books

The legislation of the Russian Federation does not prohibit part-time work and two work books. But it is not at all necessary to create a second copy of the document. According to the norms of the Legislation, the calculation of length of service according to work books is calculated by calendar days. Therefore, only one “general” entry is taken into account, which includes both periods.

An example of calculating annual service using two labor books or when working part-time at two enterprises.

- The citizen worked at Romashka LLC from 03/01/1997 to 03/01/2000.

- And at LLC "April" part-time from 06/03/1997 to 08/03/2000.

It turns out that the length of service in the calculation will be from 03/01/1997 to 08/03/2000 - 3 years 5 months 2 days.

We count:

- 3-1 = 2 days

- 8-3 = 5 months

- 2000 - 1997 - 3 years

3 years 5 months 2 days, when rounded according to standards, gives the total length of service for this period - 3 years.

Since only the full indicator is taken into account, in this case the figure is rounded down. The total experience for these records is 3 years.

The same applies to more than two records coinciding with the same period.

How to calculate length of service for sick leave?

The amount of sick leave pay also depends on the employee’s length of service.

- If a citizen’s length of service ranged from six months to five years, then the amount of sick leave payment will be 60% of the average monthly earnings.

- A work experience of five to eight years allows you to receive 80% of the average salary.

- And service of more than 8 years provides for sick leave payment of 100%.

Example.

Ivan Ivanovich Ivanov worked at the enterprise for 6 years and 5 months. His work experience is 6 years. The average monthly salary is 12 thousand rubles.

12000 rub. * 80% = 9600 rub.

An example of calculating northern experience

There is a type of length of service - special work experience. This is the work activity of a citizen in a special production, in a special industry, in certain climatic conditions. This includes activities in the Far North.

According to Article 33 of Federal Law No. 400, citizens working in such conditions have the right to retire early.

Accordingly, the northern experience is calculated somewhat differently.

- The period of joining the labor exchange is not taken into account when calculating.

- There is no period of child care.

- Part-time work is not taken into account.

The procedure for calculating the northern length of service is regulated by Part 6 of Order of the Ministry of Labor of the RSFSR No. 2. Such length of service is calculated according to the scheme of a year and a half.

Example.

Ivan Petrovich Petrov has been working in the Far North for 11 years at an oil producing enterprise, and before that he worked at a diamond mining enterprise for 14 years.

The total length of service of the employee was 14 + 11 = 25 years.

Since one year of northern experience is equal to 1.5 ordinary years, we get:

25 * 1.5 = 37.5 years. Round up to 38.

Work experience is a very important concept and indicator. It is necessary to carefully check all entries in the work book immediately after it appears, since later (before calculating payments for sick leave, vacation pay and before retirement) difficulties associated with calculating payments are likely.

Did this article help you? We would be grateful for your rating:

2 0

How to confirm the calculation of total work experience?

The work book is used as the main document confirming the total work experience. If it is lost, contains defective records or is missing, the length of service can be confirmed:

- certificates;

- extracts from the employer's accounting documents;

- employment contracts;

- archival documents;

- testimony of witnesses.

Read more about the rules for filling out entries in a work book in the material “Instructions for filling out work books.”

Results

Determining the total length of service is of particular importance for taking into account, when calculating the amount of a pension, the rights to it acquired before the entry into force of Law No. 173-FZ of December 17, 2001, which established a new procedure for its calculation. There are options for recording this length of service, in the choice of which the insured person himself has the right to participate. The experience must have documentary evidence.

Sources:

- Federal Law of December 17, 2001 N 173-FZ “On Labor Pensions in the Russian Federation”

- Decree of the Government of the Russian Federation dated October 2, 2014 N 1015

- Decree of the Government of the Russian Federation of July 24, 2002 N 555

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.