Maternity benefit (Maternity benefit) - maternity benefits. This is the money that the expectant mother receives shortly before the birth of the child. She is paid leave according to BiR. It is also called maternity leave, and it is not the same as parental leave.

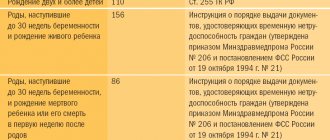

Maternity benefits are accrued 70 days before childbirth and 70 days after. For multiple pregnancies or births with complications, the leave period is longer. For example, when twins are born, they pay not for 140 days, as usual, but for 194: 84 before birth, and 110 after.

- Art. 255 TK;

- Art. 8 No. 81-FZ.

The amount of the benefit is calculated taking into account the woman’s status. For the calculation, they take average earnings, stipends, allowances or minimum wages.

If a woman officially worked before going on maternity leave, then they calculate it as follows: Income for 2 calendar years / Number of days in this period × Number of days of maternity leave

Expert opinion

Nikishina Anastasia Yurievna

General Director of the law firm Pravo Consult. More details

Please note: if the employee is a part-time worker and has worked for the same employers for the previous two years, then both employers pay her maternity benefits in 2021.

The benefit is calculated in the accounting department at the woman’s place of work, and then the accuracy of the calculation is checked by the FSS, since “maternity benefits” are paid from the Fund’s funds - on the basis of Federal Law No. 81 “On State Benefits for Citizens with Children.”

Monthly payments during maternity leave

You need to count 203.96 rubles. The maximum average daily earnings in 2021 is 2150.68 rubles. if 2021 and 2021 are used in calculations. If it turns out more, calculate the benefit at 1772.60.

Now multiply the resulting average daily earnings by the number of days of maternity leave:

- normal birth – 140 days;

- complicated – 156 days;

- multiple pregnancy – 194 days;

- DP – maternity benefit;

- DDO – days of maternity leave.

In addition to maternity benefits, there are other mandatory payments that have changed since February 1, 2021: One-time payment - for employees who registered before the 12th week of pregnancy from 02/01/2019. She receives the funds at her place of work or study.

If a woman does not work and receives unemployment benefits, she is not entitled to benefits.

Also, the mother can choose one of the types of transfers (for pregnancy or for care), which she will receive if she becomes pregnant again while on maternity leave.

The amount of payments is 40% of the average earnings for the previous two years before the maternity leave. It should be taken into account that the minimum amount is 4,512 rubles for caring for the 1st child, as well as 6,284.65 for the second and subsequent ones. The maximum payment amount in 2021 is 26,152.27 rubles.

Therefore, a working mother will receive 40% accrual at her place of work (service), and a non-working mother will receive minimum payments at her place of study or in the department of benefits and social payments in her district.

The calculation period is the same as when calculating maternity benefits - the total number of calendar days minus the periods not taken into account.

Maternity payments

In order to understand how repeated maternity leave without going to work is paid, you should understand the structure of maternity leave. In accordance with the legislation of the Russian Federation, maternity leave is divided into the following periods:

- for pregnancy and childbirth;

- child care up to 1.5 years old;

- for child care up to 3 years old.

Each period has a different duration and amount of benefits due. The separation is provided due to the impossibility of predicting in advance what the duration of the prenatal and postpartum period will be.

In fact, the structure is necessary for the convenience and accuracy of calculations, and the vacation period itself lasts continuously. The first part can range from 140 to 194 days . The period depends on the severity of childbirth and other circumstances specified in Art. 255 Labor Code of the Russian Federation.

The time frame of the second period is limited to the onset of 1.5 years of age for the baby, on the one hand, and the writing of an application by the mother about the end of leave under the BiR, on the other hand.

The source of financing for this period is the Social Insurance Fund, the amount of payment is regulated by the relevant legislation (Federal Law “On compulsory insurance in case of temporary disability and in connection with maternity” and is 40% of average earnings (Article 11.2 of the above-mentioned law).

The third period is limited by the age of the child (the onset of 3 years); in special cases described in Article 262 of the Labor Code of the Russian Federation, additional days off are provided after 3 years.

Providing financial support during pregnancy and childbirth, as well as during the period of caring for a baby up to 3 years old, is one of the types of insurance.

In accordance with existing standards, the expectant mother is entitled to:

- A one-time payment, subject to early registration, in the amount of 628.47 rubles. There is a bill according to which, if adopted, the payment will be indexed in 2019-2020 to 649.84 rubles)

- One-time assistance after childbirth, in the amount of 16,759.09 rubles. (planned to increase to 17,479.73 rubles) To receive it, you should contact your employer, and if you do not work, then the social security authorities at your place of residence.

- Monthly payment under BiR. The amount of this type of assistance is calculated individually, depending on the woman’s labor status. Working women receive the equivalent of the average salary for the last two years. The amount of payments to unemployed women is equal to the minimum wage (minimum wage). From January 1, 2021, it is equal to 11,280 rubles (Federal Law No. 481 of December 25, 2018).

At the same time, before the child turns 1.5 years old, the minimum benefit for 1 child for the unemployed in 2021 was 3142.33 (from February 1, 2019 it is expected to increase and amount to 3277.45), for the second child in 2021 - 6284.65 (presumably from February 1, 2019 – 6554.89)

The deadline for applying and submitting documents to the service is standardized - no later than 6 months before the end of the Birth and Reconciliation leave.

The amount of payments directly depends on the presence or absence of work and income received over the previous 2 years . The B&R benefit is paid to workers in the amount of their salary, and to full-time students – in the amount of a scholarship.

Women who lost their jobs during maternity leave (to care for a child) due to the liquidation of the company will continue to receive 40% of their salary, i.e. the same amount, only you will need to contact social services for it. service.

The amount paid to students of secondary and higher educational institutions corresponds to the amount of the scholarship, and for military personnel working under a contract - to the amount of monetary allowance.

One-time assistance at birth

In addition to paying money for maternity leave, the state provides a one-time payment at birth. Its size in 2021 is 16,870 rubles.

There is also a one-time fixed payment for expectant mothers who registered with the housing complex before 12 weeks in the amount of 643.67 rubles. (for 2021).

To receive the accrual, the employee must submit to the accounting department a certificate from the antenatal clinic indicating registration. The amount is transferred along with accruals for labor and employment if the employee submits the documents necessary to receive maternity pay.

If the above-mentioned certificate is submitted late, the employee will receive the money within 10 days from the date of submission to the place of work.

The funds are paid from the Social Insurance Fund, therefore, if a pregnant woman is an individual entrepreneur and pays insurance contributions for herself to the Social Insurance Fund, she can also receive a payment.

An employee returning to work early from maternity leave

Let’s assume that a woman already has a sick leave certificate in her hands, which allows her to write an application for maternity leave from today and leave work. However, if a pregnant employee does not go on maternity leave and does not want to do this, she simply does not submit an application and sick leave to the employer, but works as before. In this case, the workplace is reserved, the length of service is credited as work experience, and for the first 1.5 years of the baby’s life she receives 40% of her average earnings. For the second 1.5 years, mother can count on 50 rubles a month until she leaves maternity leave.

Vacation for labor and employment is actually standardized sick leave. There are four timing options depending on the conditions of pregnancy. Throughout this three-year period specified in the law, the employee who gave birth to a child retains her job. In addition, she is given the opportunity to receive maternity and child benefits, calculated depending on earnings for the 2 years preceding the maternity leave.

Who is entitled to maternity benefits

Expert opinion

Nikishina Anastasia Yurievna

General Director of the law firm Pravo Consult. More details

It is important to understand that, unlike child care benefits, only women can count on maternity benefits. All categories of recipients of maternity benefits in 2021 are listed in the Federal Law of the Russian Federation - No. 81-FZ “On state benefits for citizens with children.”

These include women:

- working;

- unemployed - dismissed due to the liquidation of organizations during the 12 months preceding the day they were recognized as unemployed;

- full-time students;

- undergoing military service under contract;

- who have adopted a child and belong to the above categories.

A non-working mother has no right to receive maternity benefits.

Girls working under employment contracts have the right to receive payments under employment contracts; as well as women individual entrepreneurs who voluntarily entered into a relationship with the Federal Social Insurance Fund of the Russian Federation for compulsory insurance in connection with maternity (clause 3 of article 2 of the Federal Law of December 29, 2006 No. 255-FZ).

Expert opinion

Nikishina Anastasia Yurievna

General Director of the law firm Pravo Consult. More details

Please note: maternity benefits in 2021 are paid only for the period of maternity leave. This means that if a woman does not take advantage of the right to the specified leave and continues to work (and, accordingly, receive wages), then she is not entitled to benefits. In this situation, the employer does not have the right to provide the woman with two types of payments at once: both salary and benefits. Therefore, wages will be paid for days worked. As soon as a woman decides to exercise the right to maternity leave and it is issued, the payment of wages will stop and the employer will accrue benefits.

The benefit is paid for the entire period of maternity leave. It is appointed from the day the employee submits her application for maternity leave. If an employee was put on maternity leave, for example, in December 2021, and she submitted an application for leave on January 9, 2021, then the benefit will have to be calculated from this date, and the calculation period will be 2021 and 2021.

If a woman is simultaneously entitled to child care benefits and maternity benefits, she can choose only one of these benefits.

Women's rights while on maternity leave

Absolutely all maternity leavers retain the right to an existing workplace. The employer is prohibited from:

- dismiss an employee who has gone on maternity leave;

- shorten it;

- transfer to another position.

Even if the company undergoes a personnel reshuffle, staff reduction, if new employees are hired, this does not in any way affect the position of the maternity leaver.

In addition to the position, the salary amount is also maintained. However, if the organization increases the rate for all employees, then a recalculation will be made for the maternity worker. But the employer has no right to reduce the salary level of a woman who is expecting a baby.

Back to contents

Duration of maternity leave

- for normal childbirth – 70 calendar days before birth and 70 calendar days after;

- for complicated ones - 70 calendar days before birth and 86 calendar days after;

- for the birth of two or more children – 84 calendar days before birth and 110 calendar days after.

The benefit is also issued if an employee of the organization has adopted a child. In this case, the doctor issues a sick leave certificate, and the duration of leave is 70 calendar days from the date of birth.

If after the adoption more than 70 calendar days have passed since the birth, then no money is paid.

Please note: if a child under the age of three months was adopted by a man, then sick leave is not issued, but leave is provided in connection with the adoption and benefits are paid.

It is calculated in the manner and amount established for the payment of funds under the BiR. When adopting two children, leave is granted for 110 calendar days from the date of birth. When calculating the number of vacation days, holidays must be taken into account.

Documents for obtaining benefits

To apply for benefits, you will need to submit the following documents:

- A completed and certified sick leave certificate received at the clinic.

- Application in the form established by the employer.

- If the woman was previously employed elsewhere, then confirmation is required that the previous employer is not making payments.

- Certificate of income from previous jobs for two years.

Nuances

- A woman going on maternity leave retains her place of work. An employer does not have the right to fire an expectant mother without her consent during the period of child care.

- If a woman works but is not officially employed, she is not entitled to payments. However, she can count on receiving a one-time maternity benefit and monthly payments.

- If the employer refuses to pay maternity benefits or delays them, then the woman needs to complain to the State Labor Inspectorate. Benefits must be provided within the prescribed period (10 days). For delaying benefits, a woman can demand that the employer pay a penalty.

- The maternity benefit is paid once, in full. If an employer offers to “split” the amount into parts by making monthly payments, he is doing so illegally.

- If a woman was previously employed in other organizations, then benefits are paid based on average earnings over the past two years. To do this, the expectant mother will need to bring a certificate of income from all places of work for the specified period.

- Complaints about unlawful actions of employers should be sent to the prosecutor's office or labor inspectorate.

Knowing all aspects of receiving benefits due to expectant mothers, you can calmly plan your family budget by making preliminary calculations. The information also allows you to avoid unfair treatment on the part of the employer.

Previous article: Are maternity leave subject to income tax? Next article: Minimum wage

How is the amount of maternity benefits calculated?

Money is paid on the basis of a certificate of incapacity for work no later than 10 days from the date of presentation.

The sheet must be presented to the accounting department no later than six months from the date of the end of the leave under the Bank of Russia.

The amount of maternity leave is determined differently than when paying benefits for temporary disability. The difference is that the amount of the employee’s income for two calendar years for which contributions to the Social Insurance Fund are calculated must be divided not by 730, but by the number of days obtained by subtracting from 730 (731, 732 - if the billing period consists of leap years ) days falling within the time period excluded from the calculation.

These are periods of temporary disability, parental leave, etc. Leave without pay is not excluded from the calculation of days.

To calculate the employee's actual average daily earnings, use the formula:

Earnings for the two years preceding the insured event, subject to contributions / Actual number of calendar days in the calculation period (730, 731 or 732) – Number of days excluded from the calculation period = Average daily earnings

Next, the amount of daily earnings must be compared with the maximum possible. This is the amount of average daily earnings that cannot exceed the maximum base for calculating contributions for the two years preceding the occurrence of the insured event, divided by 730.

When calculating maternity benefits, average daily earnings cannot exceed:

- in 2021: (755,000 + 815,000): 730 days. = 2150.68 rub.;

- in 2021: (718,000 + 755,000): 730 days. = 2021.81 rubles;

- in 2021: (670,000 + 718,000): 730 days. = 1901.37 rubles;

- in 2021: (624,000 + 670,000): 730 days. = 1772.60 rub.

Thus, the maximum benefit amount in 2021 will be:

- RUB 301,095.20 – during normal childbirth (2150.68 × 140 days);

- RUB 335,506.08 – for complicated ones (2150.68 × 156 days);

- RUR 417,231.92 – for complicated multiple births (2150.68 × 194 days).

Maternity benefits are not subject to personal income tax and insurance premiums.

The benefit is paid to the insured woman in the amount of 100%, regardless of the insurance period, but only if it exceeds six months.

If in the calculation period (one or two calendar years preceding the year of maternity leave) the employee was already on maternity leave or child care leave, the corresponding calendar years, upon application, can be replaced by the previous calendar years. There is one condition: if this leads to an increase in the amount of financial assistance (Part 1 of Article 14 of Law No. 255-FZ).

Documents to go from maternity leave to maternity leave.

A woman has the opportunity to apply for maternity leave after returning to her official duties.

She will need to prepare the necessary documents and complete the following steps:

- Write an application to your manager to terminate your vacation before the deadline.

- The procedure is fixed by an internal order of the organization.

- A paper is written in the name of the boss granting a new leave.

- A sick leave certificate issued by a medical organization is attached.

- After the end date, an application for parental leave is submitted until the child turns 18 months old.

The employer must calculate and accrue maternity benefits upon return to work within 10 days after receiving the application.

When an employee goes on a new vacation, the amount of the benefit changes, since a new period of work experience is taken for accruals.

A representative of the company's HR department will need to make a note in the employee's personal card stating that maternity leave was terminated early due to a new maternity leave. In addition, you will need to issue an order to end the previous vacation.

Download the application for switching from maternity leave to maternity leave and changing the estimated period for pregnancy benefits:

Changing the calculation period years for maternity benefits.

Maternity benefit based on the minimum wage

For women who have less than six months of insurance coverage, payments are calculated based on the minimum wage (minimum wage) for labor, taking into account the regional coefficient. Based on the minimum wage, benefits must be calculated even if the employee’s earnings are below the minimum or were not included in the calculation.

From January 1, 2021, the federal minimum wage is set at 11,280 rubles per month. From January 1 to April 30, 2021, the minimum wage was 9,489. From May 1 to December 31, 2021, the federal minimum wage was 11,163.

Maternity benefits based on the minimum wage are calculated by multiplying the minimum wage, which is in effect at the time of leave, by 24 and dividing by 730 (clause 15.3 of the Government of the Russian Federation of June 15, 2007 No. 375). In this case, no periods need to be subtracted.

While when calculating average daily earnings based on accrued payments, excluded periods, which are established by part 3.1 of Law No. 255-FZ, must be subtracted.

So, if maternity leave began on January 1, 2021 or later, then the minimum average daily earnings is 370.85 rubles. (RUB 11,280 x 24: 730). Depending on the length of maternity leave in 2021, there will be different minimum maternity payments:

- RUB 51,919 (370.85 × 140 days) – in the general case;

- RUB 57,852.60 (370.85 × 156 days) – for complicated childbirth;

- RUR 71,944.90 (370.85 × 194 days) – in case of multiple pregnancy.

Maternity payments with return to work

In order to increase the amount of maternity benefits, sometimes it is beneficial for a woman to go back to work after the first maternity leave for at least 1 day before going on the second. This is beneficial if, during the first maternity leave, the employee’s salary increased: it is on the basis of the cost of one working day that the subsidy for accounting will be calculated.

Let's look at this option using an example:

Anna Kotelnikova went on her first maternity leave, with a salary of 25,000 rubles. Now her salary is 31,000 rubles. She went on maternity leave in December 2021, and is going on her second maternity leave in 2021. In 2021, she went to work for 1 day.

We calculate the cost of one working day:

31,000 × 12 / 365 = 1019 rubles.

The benefit will be calculated as follows:

(0 rubles in 2021 + 1019 rubles in 2021) / (0 days in 2017 + 1 day in 2021) × 140 days = 142,660 rubles.

The amount is less than the 2021 maximum of 302,054.79, so the money will be paid in full.

If Anna had used the change of years and had not gone to work between vacations, then the calculation would have been as follows: for 2021 she received 300,000 rubles, for 2021 - 275,000 rubles.

The average daily salary is:

575,000 rubles/730 days = 787.6 rubles.

The benefit amounts will be:

787.6 rubles × 140 days = 110,274 rubles.

Read: Calculation of maternity benefits

Documents for payment of maternity benefits

Expert opinion

Nikishina Anastasia Yurievna

General Director of the law firm Pravo Consult. More details

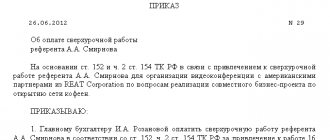

Maternity benefits are paid at the place of work, service or other activity. The company pays the entire amount due to the woman, and then can either apply to the Social Insurance Fund for reimbursement of expenses, or offset the amount against the insurance premiums due.

The company pays the entire amount due to the woman, and then can either apply to the Social Insurance Fund for reimbursement of expenses, or offset the amount against the insurance premiums due.

Therefore, inspectors from the fund will definitely check whether the benefit was calculated correctly. If errors are found, then the expenses incurred will not be accepted for offset (clause 3 of Article 11 of the Law of July 16, 1999 No. 165-FZ).

To prevent this from happening and to ensure that the package of documents for the BiR benefit is accepted by the Social Insurance Fund the first time, you need to make sure that you have the following documents for maternity payments:

- an employment contract with an employee who received financial assistance (Clause 1, Article 9 of Law No. 165-FZ);

- sick leave completed by a medical institution;

- staffing table, order for its approval, payroll and pay slips;

- personal statement of the employee for granting leave for employment and labor and payment of benefits;

- if the birth was complicated and the employee brought sick leave for an additional 16 days of maternity leave, the initial application must be rewritten taking these days into account;

- order for granting leave, assigning benefits and its calculation.

For women dismissed due to the liquidation of an organization, benefits are paid by social security authorities at their place of residence (place of actual stay or actual residence). The FSS will also pay maternity benefits to an insured woman if the company where she works is in bankruptcy (Order of the Russian Ministry of Labor dated May 6, 2014 No. 291n).

How to calculate the amount of vacation payments yourself

To get the data you need, you need to know your average daily earnings.

Average daily earnings for vacation pay and compensation for unused vacations are calculated for the last 12 calendar months by dividing the amount of accrued wages by 12 and by 29.3 (average monthly number of calendar days), according to the wording of Federal Laws dated June 30, 2006 No. 90-FZ and dated 04/02/2014 No. 55-FZ.

The maternity leaver had no official income for the last year, so the indicators of her salary for the 12 months before receiving the certificate of incapacity are taken. In addition to the salary itself, the calculations include:

- monthly bonuses;

- surcharges;

- indexing;

- regional odds;

- sick leave.

It is not difficult to calculate the average daily wage (ADW): annual income (AD) is divided by 12 months and by the average amount of calendar days (29.3): GD: 12: 29.3 = SDW.

Vacation pay calculator

| Vacation period: | = 0 |

| Billing period: |

| Months | Days for calculation | Accruals |

| Total | — |

| Vacation pay amount: | days × rub. = rub. |

| Personal income tax 13%: | rub. |

| To be paid without personal income tax: | rub. |

Example 1

Maria’s salary from 04/01/2015 to 04/30/2016 was 11,163 rubles.

(11163 * 12) : 12 : 29.3 = 380.99 rubles.

So, Maria’s average daily salary was 381 rubles. The next step is to calculate the required amount of vacation pay (SB). To do this, multiply the average daily earnings by the number of vacation days:

SDZ * 28 = CO

380.99 * 28 = 10667.72 rubles.

If a woman took not 28 days, but only 15, then she will receive 5,714.85 rubles.

381 * 15 = 5714.85 rubles.

Monthly allowance for child care up to 1.5 years

Despite the fact that care leave can be taken up to 3 years, these payments are made monthly until the baby is one and a half years old. As a rule, maternity leave is granted the day after the end of sick leave for pregnancy and childbirth.

Transfers can be received by any member of the parent’s family (father, grandmother, grandfather), if she herself goes to work.

Payments are made even if the mother works part-time or works from home. The money is paid from social insurance funds.

The calculation period is exactly the same as when calculating maternity benefits - the total number of calendar days minus the periods not taken into account.

Maternity benefit

During maternity leave, the expectant mother receives benefits. Calculation of the amount of cash benefits is based on three factors:

- pay period (2 calendar years worked by the employee before pregnancy);

- the level of average daily earnings (the amount of payments for the billing period divided by the number of days actually worked);

- duration of maternity leave (depends on the health of the expectant mother and the outcome of childbirth).

The employer does not pay wages, since the employee does not work during the period of such leave. Instead of a salary, she receives benefits or maternity benefits.

Back to contents

Compensation payments to women on maternity leave

A small financial reward for women who will be on vacation until the baby is 3 years old is 50 rubles per month and is paid monthly from their place of work.

This payment can be received by any relative of the mother who gave birth, who actually takes care of the child and has taken maternity leave.

Such financial resources are paid at the expense of the company’s own funds, to which an application will be submitted with a request to transfer the accruals.

Work on civil law agreements while on maternity leave

Ministry of Health and Social Development dated June 29, 2011 No. 624n). But if the limit of paid days in the current year has already been exhausted by the mother, then it will not be paid to other family members. That is, the benefit is calculated for a specific child, and not for the family members who care for him. Another option is not excluded. Wages are given to the employee in proportion to the quantity and quality of labor expended. Its size is established in accordance with regulatory acts of labor law.

According to the law, an employee who returns to work during maternity leave is deprived of her rights to child care benefits. However, Article 256 of the Labor Code of the Russian Federation stipulates the conditions under which payments will continue to be received. There are four options for maintaining benefits when you go back to work:

- Continuation of activities on a part-time basis . In order to switch to such a work scheme, you need to submit a corresponding application to the employer. Article 93 of the Labor Code of the Russian Federation specifies all the nuances of part-time work. The minimum length of a working week, according to Part 2 of Article 91 of the Labor Code of the Russian Federation, is 40 hours. Anything less than this limit will be considered part-time. Working hours can be reduced in different ways. For example, this is the provision of an additional day off, a reduction in the length of the working day. In this case, the salary will be calculated based on the time worked or the amount of work performed. This rule is established by part 2 of article 93 of the Labor Code of the Russian Federation.

- Continued work from home . If a woman works freelance, at home, she also does not lose her right to benefits. To change working conditions, you need to conclude a new employment contract or annex to it.

- Work under a civil contract . In this case, nothing will prevent you from receiving funds and being at work at the same time. The parties can enter into, for example, an agreement for the provision of services.

- Re-registration of benefits to another family member . This possibility is also stipulated by Article 256 of the Labor Code of the Russian Federation. In particular, any close relative of the child who cares for him can receive benefits. For example, it can be re-registered to the baby’s father or grandmother. It must be remembered that only an officially employed person can receive social benefits. You cannot apply for benefits for several people.

When adopting an infant and surrogacy options, a working woman is granted leave without the prenatal part. In this case, the time frame will be 70 days when taking one child and 110 days for two or more.

Return to work after the expiration of sick leave for pregnancy and childbirth. No special documentation of exit is required here, since maternity leave has not been initiated. The last weeks of pregnancy are considered the most dangerous, contributing to involuntary miscarriage under any stress on the body.

Working during maternity leave has its own legal characteristics. Let's look at the main five options that can happen when a woman who has the right to be on maternity leave or on leave granted to all mothers to care for a young child goes to work:

- a pregnant employee continues to go to work after 30 weeks of pregnancy, already having the appropriate sick leave in hand;

- a female employee returns to work early from maternity leave provided by the employer;

- a woman works under a civil agreement until the end of maternity leave;

- an employee, while on leave to care for a newborn baby, works part-time;

- a woman goes to work full time, interrupting her vacation intended to care for a young child.

After the birth of a child, a woman is given the right to maternity leave. During this period, the employee receives child care benefits. However, maternity leave is precisely a woman’s right, and not her responsibility. If necessary and desired, the employee can go to work ahead of schedule. Will her benefits remain in this case? Let's take a closer look in this article.

Legislation

As stated in Art. 255 of the Labor Code of the Russian Federation, the basis for registration of leave under the BiR is a certificate of incapacity for work. According to Section VIII of the Order of the Ministry of Health and Social Development dated June 29, 2011 No. 624n “On approval of the Procedure for issuing certificates of incapacity for work,” sick leave for pregnancy and childbirth is issued:

- at 30 weeks for pregnant women with normal pregnancy;

- at 28 weeks if several children are expected to be born;

- for a period of 22 to 30 weeks with premature birth (the minimum duration of sick leave in this case is 156 days);

- in case of termination of pregnancy up to 21 weeks (the minimum duration of sick leave in this case is 3 days, the maximum is the actual duration of disability);

- when adopting a baby under three months of age (only a woman can also count on such sick leave, clause 53 of Order No. 624n).

Receive compensation from the FSS

Compensation works like this: you pay the employee a benefit, and then reduce the monthly insurance contributions to the Social Insurance Fund. If the amount of the benefit exceeds the contributions, contact the fund with an application. You attach a statement of calculations and a breakdown of expenses to your application, and you receive an overpayment into your account.

When the FSS refuses compensation

The Social Insurance Fund has the right to refuse the employer and not reimburse benefits for employees. This happens for several reasons:

- Errors in documents: certificate of earnings, certificate of incapacity for work, application for maternity leave.

- Fictitious labor relations. When an employee is hired in the late stages of pregnancy and immediately goes on maternity leave, this looks suspicious to the Social Insurance Fund.

- Inflated salary. If a woman lawyer receives a salary of 100,000 rubles, and her fellow lawyers receive 20,000 rubles, this is also suspicious.

- The employee receives benefits and works at the same time. The working day is full or reduced only formally, by less than an hour a day.

If fund employees find a violation, they will request explanations and documents.

Experts answer

Currently, many mothers are wondering: will the period of child care be extended to 4.5 years, regardless of whether it is the first child in the family or the third? This proposal has been submitted for consideration and is under discussion. If such a law is adopted, then 4.5 years will be counted as length of service, and accordingly, the amount of the mother’s pension will also increase.

Another difficult question: does a mother need to go to work between two periods of maternity leave? No, you can do without it. Until 2015, there was a completely different system for calculating maternity payments. Now all the necessary mathematical operations are based on the average daily earnings two calendar years before the maternity leave.

There is a special offer on our website - you can quickly get advice from a professional lawyer completely free of charge by simply filling out the form below.

Refusal to pay maternity benefits: for what reason is it acceptable?

Only liquidation or bankruptcy of an enterprise makes refusals of benefits legal on the part of the employer himself. In this case, they collect the same documents, but contact representatives of the Social Insurance Fund. Be sure to take with you an agreement confirming the relevant relationship.

The social security fund is rarely denied; most often this is due to the following circumstances:

- If there are suspicions about illegal receipt of funds.

- If the citizen recently got a different job.

- If work at the old enterprise continues.

The work experience of the maternity leaver and her official status at the enterprise with which the official contract was concluded must be checked. If everything is in order, payments will come, even if you recently got a job.

An employment contract is also necessary for the director of an enterprise if a woman is involved in arranging the corresponding type of leave. Otherwise, there is a high probability of receiving a refusal to pay benefits.

How are maternity benefits calculated?

To accurately find out the due amount, it is enough to know three main indicators:

- Minimum earnings.

- Its maximum.

- Average earnings for the two years preceding the date of application.

The standard formula looks like this:

Minimum wage by the day the sick leave starts x 24 months. They divide everything by 730 calendar days and multiply it with the duration of maternity leave. The last steps are multiplications by the working rate and the regional coefficient, if any.

To calculate the minimum amounts, 730 days are always taken.

The experience must be more than 6 months; other more precise figures do not affect the results. The full salary is taken into account, including personal income tax. In addition, it includes other indicators:

- Travel allowance minus sick pay.

- Official awards.

- Vacation pay.

Maximum limits are set for income throughout each year.