The concept of a personal increasing coefficient

The Labor Code of the Russian Federation provides all civil servants with general working conditions and, as a consequence, the same conditions for receiving wages.

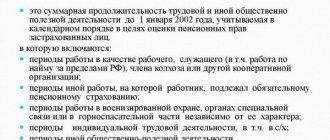

However, practice has demonstrated that such an approach in a certain sense demotivates workers, which ultimately affects the productivity of their work. Thus, the government of the Russian Federation has developed a program of financial incentives for employees, which involves increasing the salary of employees. Such an additional payment encourages subjects to work more efficiently and also increases the level of social security. Thus, a personal salary increase coefficient is an individual additional amount to an employee’s salary that can be provided to a subject for a certain limited period (month, quarter or year). The provision of such additional allowance can also be stipulated in a private employment agreement with the subject, or recorded in local regulations, for example, in the Regulations on remuneration, etc. Such standards must necessarily be developed taking into account the opinion of trade unions.

An increasing coefficient is often provided to employees of state-owned enterprises, since bonuses and other additional payments are almost universally paid in commercial structures. PPK is especially common in educational and medical institutions, as well as in federal and local military structures.

Moreover, in the vast majority of cases, the coefficient is applied to mid-level employees for additional professional activities or especially high-quality job assignments. For example, for extracurricular work, night duty, special army assignments, etc. It is understood that in certain circumstances, the coefficient can be applied not only to motivate employees to work, but also for increased work intensity.

Conditions for applying the personal coefficient to salary

The right of employers to apply PPC to subordinates is regulated by Order of the Ministry of Health and Social Development of the Russian Federation No. 463-n dated August 28, 2008. In addition, the specifics of using the coefficient are stipulated by labor legislation, in particular: Art. 57, art. 72 and Art. 135 Labor Code of the Russian Federation. It is also important to emphasize that the use of the coefficient does not contradict the provisions of Art. 22 Labor Code of the Russian Federation. The procedure for calculating the specific volume of PPC is determined on the basis of Art. 152 Labor Code of the Russian Federation.

In addition to the above, a specialized standard for the educational sector regarding the application of the coefficient is also relevant - Decree of the President of the Russian Federation No. 597 of May 4, 2015. "About events..."

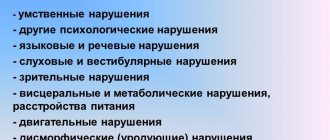

The CPD, in accordance with the position held by the subject, can be applied to all employees, including en masse, within a specific division of the company. Often, the assignment of a coefficient to the salary occurs in order to indicate the high professional level of the subject, his special skills and a high degree of independence in performing work.

Among other things, some institutions also assign PPC based on the citizen’s length of service. However, this is almost always typical only for state-owned enterprises.

In what cases is it used?

The increased rate on the bill for cold water is applied only if citizens do not have individual pension funds, but technically it is possible to install them in residential premises. If this is not possible, then residents pay utility bills at standard rates. You can learn about the criteria that qualify as technical impossibility of installing an IPU on Ministry Order No. 627 dated December 29, 2011.

The fact that it is not possible to install a meter must be confirmed at the regulatory level. To do this, an inspection report is drawn up for each living space. If there is no documentary evidence, then residents may be charged for utility services at an increased rate.

An increased tariff may be applied even if there is a meter on the premises. This happens in several cases:

- The device has failed.

- The readings were not taken from the meter within the prescribed period.

- Denial of registration access for a representative of the management company to check indicators.

If, during an inspection of the equipment, it was established that there was third-party interference in the work of the employee, the owner of the apartment undertakes to pay for utilities at an increased rate (coefficient 10).

The most common schemes for applying a personal increasing coefficient to salary

The legislation provides for the application of the PPC to a citizen’s salary up to an amount equal to its double amount. This allows each individual employee to be rewarded proportionately for their respective work. At the same time, the employer has the right to provide CPD in an amount less than the established maximum - this remains within the authority of the manager.

For employees of universities and research institutes, the coefficient can reach three times their standard salary. However, this is typical only for representatives of the senior teaching staff.

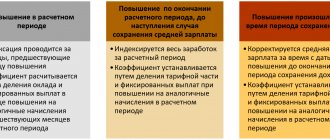

Practice demonstrates that managers of state-owned companies, which are directly dependent on budgetary allocations, often refuse to use fixed rates of increasing coefficients. This is due to the instability of such subsidies, which can not only be delayed, but cut and even rightfully cancelled. In turn, even if the additional financial support of the state structure is canceled, the head of the institution does not have the right to independently adjust the volume of the coefficient if these nuances were not recorded in the individual employment agreement with a specific entity or the general Regulations on remuneration in the company. In turn, in the fields of education and medicine, it is accepted that PPC is provided in a fixed amount from the salary.

In this case, the coefficient in question is also assigned in accordance with length of service, in particular:

- in conditions where the length of service of a particular subject is from 1 to 3 years, the increasing coefficient will be 0.05% of the monthly salary;

- if the length of service is between 3 and 5 years, then the PPC will be 0.2% of the monthly salary;

- for more than 5 years of service, the coefficient will be 0.3% of the salary.

For the period when the subject is on sick leave, on maternity leave or on regular leave, the PPC does not apply to his payments. The coefficient can be used again in relation to the allowance of a specific employee upon his return to work duties, after the re-publication of the corresponding order of the head of the enterprise.

Principles for calculating PPC to employees for night and overtime working hours

In situations where an employee performs work duties at night, he is also entitled to additional payment for each hour of additional work. The calculation of the increasing coefficient recommended by the Labor Code is 20% of the hourly salary during the daytime. To calculate the amount of an employee's hourly salary, the amount of his monthly salary must be divided by the number of hours worked.

Also, an employee of government agencies is entitled to payment for work on weekends and holidays in the amount of at least one daily rate in addition to the salary, if such additional payment does not exceed the fixed monthly number of working hours. And, if work on weekends is carried out in excess of the monthly working time norm, then it is paid in the amount of no less than 200% of the daily salary.

Conditions for canceling the personal salary increase coefficient

The main basis for the use of PPC is the corresponding order of the head of the company. Representatives of the trade union must be present at the meeting with an agenda regarding the issue of applying the coefficient to a specific employee. If the coefficient in question is applied en masse, then it will be necessary to conclude an additional agreement with each employee to his main employment contract. This agreement must also specify the validity period of the CPP.

It is important to emphasize that the coefficient cannot be canceled unilaterally at the initiative of the employer if the relevance of the relevant order is still in effect.

Due to the fact that such payments are urgent expenses of the enterprise, the manager can include a position on adjusting such payments in the Regulations on Remuneration, even in conditions where the Order is in force. However, there must be a compelling justifiable reason for such a decision, such as lack of government support. It is also appropriate to include in the said Regulations a clause on the abolition of the PPC if the subject does not comply with the PVTR or performs his official duties in bad faith.

Thus, a personal increasing coefficient to salary is a means of stimulating the workforce to be more productive. Managers of enterprises where this is relevant need to familiarize themselves in advance with the algorithm for introducing PPC.

An example of an order for calculating PPC

The manager also needs to issue an internal departmental order to accrue a personal increasing coefficient.

The order must be in the following form:

Name, address and details of the government agency

No. _______ on the calculation of a personal increasing coefficient to the official salary from (date of signing the order) in order to stimulate the employee’s work (or another reason: acquisition of an increased category, combining positions, etc.).

In accordance with Article 135 of the Labor Code of the Russian Federation, accrue ___________________, (full name of the employee) occupying the position _________________ (full name of the position) a personal increasing coefficient to the official salary for the period from "___" _________ ____ to " ___" _________ ____ in the amount of ______.

Director: ______________________ (Signature, initials)

Chief Accountant: _________________ (Signature, initials)

Personal coefficient

1. Is it necessary to notify the employee about the reduction in the personal increase coefficient? For what period?

1.1. The employer has the right to introduce changes to the wage system, which may lead to a reduction in the final wages of employees. But no financial difficulties, for example, a decrease in revenue, can be a basis for such actions. The employer has the right to exercise the above powers if, due to the deterioration of the financial situation, he has already begun to change the organizational or technological working conditions (improvement of workplaces based on their certification, structural reorganization of production (clause 21 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 N 2 “On the application by the courts of the Russian Federation of the Labor Code of the Russian Federation”). Thus, you can, having warned 2 months in advance, notify employees against signature (Article 74 of the Labor Code of the Russian Federation), reduce the PPC, but there must be a strict, clear argumentation for your actions, i.e. j. Judicial practice in these cases sides with the Employee.

2. Is it possible to get acquainted with the order of the chief physician on the appointment of a personal increase coefficient for other employees, since I was deprived of it without an order.

2.1. You can get an extract from the order. As an employee, you have the right to familiarize yourself with an extract from the order as a local regulatory act adopted by the organization (Article 8 of the Labor Code of the Russian Federation) and affecting your rights, but they will familiarize you with the extract from the order, because there is personal data of other employees (Article 3 of the Federal Law of July 27, 2006 N 152-FZ “On Personal Data”).

2.2. Labor Code of the Russian Federation Article 8. Local regulations containing labor law norms Issues of application of Art. 8 of the Labor Code of the Russian Federation Employers, with the exception of employers - individuals who are not individual entrepreneurs, adopt local regulations containing labor law norms (hereinafter referred to as local regulations), within their competence in accordance with labor legislation and other regulations containing labor law norms, collective agreements, agreements. In cases provided for by this Code, other federal laws and other regulatory legal acts of the Russian Federation, collective agreements, agreements, the employer, when adopting local regulations, takes into account the opinion of the representative body of employees (if there is such a representative body). A collective agreement or agreements may provide for the adoption of local regulations in agreement with the representative body of workers. Norms of local regulations that worsen the situation of workers in comparison with established labor legislation and other regulations containing labor law norms, collective agreements, agreements, as well as local regulations adopted without observing the procedure for taking into account the opinions of the representative body of workers established by Article 372 of this Code , are not applicable. No, you won't be able to read it. You can contact the labor inspectorate and the prosecutor's office to conduct an inspection; documents will be requested to verify good luck to you and all the best.

2.3. Of course it is possible. This order concerns you. Therefore, you have the right to know its contents (Article 8 of the Labor Code of the Russian Federation)

2.4. Hello Dmitry! You can, because Equality of rights and opportunities for workers is enshrined in Article 2 of the Labor Code of the Russian Federation.

2.5. YOU can familiarize yourself with documents that in one way or another affect your rights in accordance with Article 8 of the Labor Code of the Russian Federation. Therefore, if this order concerns you directly, you have the right to demand familiarization with it.

2.6. Hello, it is unlikely that they will provide you with information about other employees, at least they are not obliged to do so. A personal increasing coefficient is assigned taking into account professional training, the complexity of the work performed, and the degree of responsibility of the employee. It is determined in accordance with Order of the Ministry of Health and Social Development of the Russian Federation dated August 28, 2008 N 463 n (as amended on August 2, 2011) “On the introduction of a new system of remuneration for employees of federal budgetary scientific institutions that have clinical units subordinate to the Ministry of Health and Social Development of the Russian Federation” 2.2 . The following increasing coefficients can be established for the recommended minimum salary for the relevant PKG for a certain period of time during the relevant calendar year and taking into account the provision of financial resources: - increasing coefficient for the salary for the position held; — increasing coefficient to the salary of the institution (structural division of the institution); — personal increasing coefficient to salary. 2.3. The amount of payments based on the increasing coefficient to the salary is determined by multiplying the employee’s salary by the increasing coefficient. The application of all increasing factors to the salary does not form a new salary and is not taken into account when calculating compensation and incentive payments. 2.4. The recommended amounts of increasing coefficients for salary for the position held, established for all employees of the institution depending on the assignment of the position to the qualification level of the PKG, are given in Appendix No. 1 to these Regulations. 2.5. The recommended sizes of increasing coefficients for salaries for an institution (structural unit), established for all employees of an institution, are given in Appendix No. 2 to these Regulations. 2.6. A personal increasing coefficient for salary can be set for an employee taking into account the level of his professional training, the complexity or importance of the work performed, the degree of independence and responsibility in performing assigned tasks and other factors. The decision to establish a personal increasing coefficient for the salary and its amount is made by the head of the institution personally in relation to a specific employee.

3. I have the following problem: I had a salary supplement in the form of a personal coefficient; when I went on maternity leave, the girl working for me, naturally, was not paid this supplement. And after I returned from maternity leave, they stopped paying me too, which I found out a month later when I received my salary. I pointed out the fact of violation to the personnel officer, after which she brought me additional information. an agreement that stated that I would be paid this bonus within two months. But she didn’t give me any notification about the salary change. Is she right or wrong?

3.1. Rights - what? According to the text, they forgot to pay part of the salary on time, they offered to agree that the unpaid part would be returned within two months. What should I notify?

4. Legality of removing the allowance. For me and a number of employees, a personal coefficient (pc) was set from 1.01 for the year. In November the PC was accrued and paid. On 12/15 an order was issued to stop paying PCs from 11/01. The PC withheld the salary paid in November to the December salary. And for December the PC was not credited. Is this legal?

4.1. Judging by the above - quite. The procedure and conditions of remuneration, including its parts, are determined not by law, but by the employer or owner of the institution, unless otherwise agreed in the terms of the employment contract. And the employer is not limited in his powers by his order, which he, in the same order, can cancel or change at any time.

5. The employee had a personal coefficient established by an additional agreement until June 30, 2017. On July 1, 2017, the employee went to work for a new company, which was formed by merging two. He was given a notice of transfer with the previous terms and conditions of remuneration retained. The employee received his salary in July with the accrual of a personal coefficient. In the month of August, the personal coefficient was not accrued. Question: Is the employer obliged to notify the employee and issue an order that from now on the employee will not receive a personal coefficient?

5.1. If the additional payment according to the coefficient was established precisely by an additional agreement to the employment contract, then when companies merge, the new company must fulfill the obligations undertaken by the first company; Federal Law dated 02/08/1998 N 14-FZ (as amended on 07/29/2017) “On Limited Liability Companies” (as amended and supplemented, entered into force on 09/01/2017) “” Article 52. Merger of companies 1 A merger of companies is the creation of a new company with the transfer to it of all rights and obligations of two or more companies and the termination of the latter.5. When companies merge, all rights and obligations of each of them are transferred to the company created as a result of the merger, in accordance with transfer acts.

5.2. Obliged, because this is a condition of the employment contract, and any change to it, as a general rule, is possible only by agreement of the parties.

6. Can pregnant women have their personal salary increase reduced? For what reasons?

6.1. Due to pregnancy, working conditions and wages cannot be worsened. If this happens, you must immediately file a complaint with the labor inspectorate or prosecutor's office.

7. Can an employer reduce the personal salary coefficient without the knowledge of the employee? I am a young specialist (27 years old), working for the first time after graduating from university, I was paid 200% for the first year, then reduced to 150%. And is it worth considering that PPC is an incentive, which can subsequently be reduced for a reprimand (being 40 minutes late for work). and if so, for how long? Do they charge?

7.1. It is necessary to look at your employment contract and the Regulations on remuneration. If this is really an incentive payment, then everything depends on the employer: if he wants, he will pay, if he doesn’t, he won’t (Article 135 of the Labor Code of the Russian Federation)

8. The organization undergoes certification of employees for the size of the personal salary increase coefficient. Can an employee refuse certification due to the fact that his salary is paid up to the minimum wage?

8.1. If the employer has established an obligation to undergo certification, then you have no choice but to pass it. The employer sets the frequency of certification independently, taking into account the regulations of the region, territory, district on certification issues for the relevant position in the relevant field. In this case, the temporary nature of the work does not matter. If you refuse certification, then you automatically refuse to perform the job function specified in the employment contract, which entails dismissal.

9. Is it legal to reduce wages in the form of deprivation of a personal increasing coefficient? to the boss (they were left with a bare salary) after notification of the layoff in order to reduce the amount of compensation payments, if no one canceled the workload after the notification. (The coefficient is not reflected in the employment contract; it is assigned by an additional order)

9.1. Hello! Reducing wages in this case is not legal, file a complaint with the labor inspectorate. All the best, I wish you good luck!

10. Is it legal to reduce wages in the form of deprivation of a personal increasing coefficient? to the boss (they were left with a bare salary) after notification of the layoff in order to reduce the amount of compensation payments, if no one canceled the workload after the notification.

10.1. Hello! Reducing wages is not legal, file a complaint with the labor inspectorate (LIT) All the best, I wish you good luck!

10.2. Good day! The reduction is illegal if these payments are specified in the employee’s employment contract and the organization’s collective agreement. File a complaint with the labor inspectorate.

11. Question on the payment of an increasing personal coefficient in the public sector.

11.1. Not here. The procedure and conditions of remuneration, including its parts, are determined not by law, but by the employer or owner of the institution.

12. Does the employer have the right, without changing working conditions, to lower the personal increase coefficient, citing financial difficulties?

12.1. No, he does not have such a right.

13. The employee was given a personal increase coefficient for additional work, and an additional agreement to the work was concluded. According to the agreement, now we need to reduce the pers. Increase Coef. from 5,000 to 3,000 rubles, do you need to notify the employee two months in advance, or? which is correct? Thank you!

13.1. You must always notify.

14. Please tell me, should orders for a long-service bonus or a personal increase coefficient be issued on the last day of the month or, for example, on the first day of the next month? Thank you.

14.1. Hello! This procedure must be established by a local act of the organization, for example, the Regulations on Remuneration. If we set a personal increasing coefficient based on the results of work for July, then it will be more convenient to issue an order at the end of the month and pay this amount in August in the salary for July. If we set it for a future time, for example, for a quarter (July, August, September), then it is more convenient to issue an order in early July. An order for a long service bonus is usually issued on the day the right to this bonus is obtained.

15. Please explain what a personal increasing coefficient is. What factors does it depend on and can it be different if the professional category, salary, and workload are absolutely the same for education employees. Thank you in advance!

15.1. Familiarize yourself with the local regulations of your enterprise.

16. Is it possible to reduce an employee’s personal increasing coefficient to his official salary if it is specified in the employment contract and the employment contract is concluded for an indefinite period.

16.1. By agreement of the parties, it is possible under the Labor Code of the Russian Federation, Article 72. Changes in the terms of the employment contract determined by the parties (as amended by Federal Law No. 90-FZ of June 30, 2006) (see the text in the previous edition) Guide to personnel issues. Questions of application of Art. 72 of the Labor Code of the Russian Federation Changing the terms of an employment contract determined by the parties, including transfer to another job, is allowed only by agreement of the parties to the employment contract, except for cases provided for by this Code. An agreement to change the terms of an employment contract determined by the parties is concluded in writing.

16.2. If the employee unconditionally agrees with this, then yes, by making changes to the work. agreement! if not, then dismissal.

17. When revising the system of personal increasing coefficients for teachers, is it necessary to take them into account in such a way that the resulting salary is greater than the amount before the revision?

17.1. Not necessary. If the system is revised for the purpose of saving, then the salary may be reduced, but employees must be notified of this no later than two months before the introduction of these changes.

18. Can a teacher’s personal coefficient be lowered if he works in two classes, his own and a substitute (teacher in session). Last month in one class the increasing coefficient was 0.5, and this month in two classes it was 0.25

18.1. Hello! No, you cannot. Increasing coefficients for salary (official salary), wage rate are established for a certain period of time during the corresponding calendar year. Consequently, the legislation does not provide for a reduction in the personal increase coefficient for employees. This coefficient is set for a certain time and in a certain amount.

19. The manager reprimanded me and, based on it, reduced my personal coefficient by 1 point until the end of the year (from 04/01/16 to 12/31/16). on organization of p.k. established by order from 03/01/16 to 12/31/16 on the eve of the reprimand specifically, although before this p.c. was established by order for a month. (I’m a single mother, I lose 5,000 rubles monthly). Was this one punishment for disciplinary action? Should I contact the labor inspectorate?

19.1. no, a reduction in allowances is not a punishment, but you can still appeal it - Art. 392 TK allows

19.2. Deprivation of a coefficient is not considered a disciplinary punishment by the labor code. And you should look at the regulations on the coefficient for the organization

20. I work at a cultural information center as an artist. I have a personal coefficient for my salary. We are paid a monthly incentive in the form of bonuses. But when distributing bonuses, they refuse me, citing a personal coefficient. At first they paid me these bonuses, but then they forced me to return this amount, since I have a personal coefficient. Is accounting correct?

20.1. Such issues are regulated by the organization's VNA.

21. Is it possible to reduce the personal increasing coefficient for the presence of a disciplinary sanction (reprimand) for 9 months (from 04/01/16 to 04/31/16)?

21.1. No you can not. The same offense cannot be punished twice.

22. Is it possible for an employee to have a reprimand to reduce the personal increase coefficient by 1 point until the end of the year (from 04/01/16 to 12/31/2016)

22.1. Hello. These issues are regulated by the internal documents of the enterprise (institution). Contact your employer.

23. Should the manager justify the reduction of the personal coefficient?

23.1. Mandatory

24. If I have a salary, they charge a little more than the minimum wage, taking into account the regional coefficient, personal coefficient and increasing coefficient. Is this legal? Thank you.

24.1. Hello, if it’s more than the minimum wage, then it’s ok. According to the Labor Code of the Russian Federation, salary should not be lower than the minimum wage.

25. Is it legal for the employer to reduce the personal increase coefficient to the salary without warning the employee about it?

25.1. Is it legal for an employer to reduce a personal salary increase without notifying the employee about it? - appeal this action of his in court

26. A personal increasing coefficient is calculated on the salary. I took 3 days without pay. The salary amount decreased, and the amount of the personal increasing coefficient was calculated from it, and not from the full salary. This is right?

26.1. Of course, that’s correct. The calculation is proportional to the amount of the accrued salary.

26.2. Yes. this is right.

27. Can a manager not pay a personal coefficient to an employee at all?

27.1. Hello! NO, of course it can't GOOD LUCK TO YOU

27.2. What field of activity are we talking about?

Fresh materials

- Kosgu service fee for issuing air tickets O.Ya. Reshetova, author of the answer, Askon consultant on accounting and taxation in budgetary organizations QUESTION Budgetary institution...

- Act on the issuance of a work book, sample The maintenance and content of work books at an enterprise must be carried out in a certain order. In particular, there are...

- Article 76 2 of the Criminal Code 1. An act committed with direct or indirect intent is recognized as a crime committed intentionally.2. The crime is recognized as committed...