Concept

Additional conditions are clauses of the employment contract that do not have much influence on the main points of the document itself.

Such additional clauses may or may not be included in the text of the contract, in contrast to the essential terms. So, other terms of the agreement:

- can only be introduced and regulated by the manager;

- should not worsen the employee’s condition or limit his rights;

- should not interfere with the employee’s performance of the labor function established by the main clauses of the contract;

- allow you to make adjustments to the mandatory conditions if an error is made somewhere due to which the document may be considered invalid.

Despite the fact that the employer regulates amendments to the contract, additional conditions are introduced only by agreement of the parties. Some lawyers also call them optional.

Features of legislative regulation of additional terms of the employment contract

Mandatory terms of an employment contract are regulated in a standard manner. Legislative norms establish an official list of such conditions. This is the main criterion for subsequent regulation of this issue.

If we talk about additional conditions of modern labor agreements, it can be noted that regulation here is somewhat more difficult. That is why the main criterion here will be the following: whether the employee’s position worsens when one or another condition is included in the contract or not. Further, the scheme is quite simple: if the employee’s situation does not worsen or even improves, such a condition may well be included in the employment document. If there is a possibility that this condition may have a negative impact on the general position of the subordinate, then it is prohibited to include it in the relevant section of the employment contract.

Separately, we should mention situations in which the employee has some objections to the inclusion of a certain condition in the contract. In this case, the subordinate, even before signing the document, must tell the employer about such claims. The manager, in turn, will be obliged to review the contents of the employment agreement and exclude controversial clauses from it.

Kinds

Practice shows that there can be a great variety of optional conditions. Conventionally, they can be divided into 2 groups.

Correcting the main text

This group of additional conditions is included in the contract if inaccuracies were made when drawing up the main structure of the contract, and it is necessary to edit some fragments in the text of the main conditions.

Recording examples

In the form of a table, we present a list of items and an example of an entry that is indicated in the agreement.

| Optional condition | Example of an entry in a contract |

| Clarifications about the workplace (making adjustments about the structural unit if the name of the company has changed or the employee is transferred to another department of the company), about temporary transfer | "2.5. The employee was transferred to the company’s structural unit in Krasnoyarsk for 2 months.” |

| Appointment of a probationary period during employment to test the skills and qualifications of the employee. When introducing this clause into the contract, you should remember the maximum periods that are provided for testing certain categories of workers. They are regulated by Art. 70 Labor Code of the Russian Federation. This condition must be filled out especially carefully in a fixed-term contract. | "3.5. The employee is given a probationary period of 2 months.” |

| Non-disclosure clause of commercial or state secrets. If this condition is included in the contract, disclosure of official secrets may threaten not only dismissal, but also compensation for material damage caused to the employer by the employee’s misconduct. However, before introducing this clause into the contract, the manager creates a local act, which specifies all the data that relates to a trade secret. The employee must read the document before signing the contract. | “1.8 The employee undertakes, during the performance of his job duties and until the expiration of a year after termination of access to secret information or dismissal, not to disclose information called a trade secret of the company. The employee has been familiarized with the list of information and the non-disclosure act has been signed.” |

| Requirement to work after completion of training. In the process of work, advanced training, vocational training or retraining of an employee may be required. If an employer agrees to pay for an employee’s training, he has the right to add an optional condition to the contract that obliges the employee to work for a certain period of time. However, if there is no such note in the employment contract, the employee has the right to resign without working off and without reimbursement of the funds spent by the employer. | "15. Training at the expense of the employer. 15.1. The employee receives a higher education with a degree in industrial engineering. 15.2. After completing training, the employee undertakes to work in the acquired specialty for 3 years. 15.3. If the condition specified in clause 15.2 is not met, the employee undertakes to reimburse the employer for the costs incurred in the amount of 60% of the cost of training.” |

| Combining the main job function with an additional one. An employee replaces a colleague during his absence or simply performs other work without interrupting the performance of his main function under the employment contract. An additional clause establishes the performance during or after a work shift of work related or not related to the position for an additional fee (Article 60.1 of the Labor Code of the Russian Federation). may be drawn up as an additional agreement. | "19. An employee is hired as a manager with a combined position of cashier-operator. For the performance of official duties, the employee is given a salary of 10,000 rubles. Also, for combining professions, an allowance of 5,000 rubles is established.” |

Other. Social package

The second group includes all other adjustments that can be made to the employment agreement. For example:

- enhanced medical insurance for the employee (the manager can enter into an agreement with the insurance company to provide the employee with additional benefits during treatment);

- improving the living condition of the employee and his family members (in the case of remote work, the manager offers the employee and his relatives a place to live);

- compensation to an employee for the costs of mobile communications or travel on public transport, if the costs were related to the work process;

- provision of free vouchers for treatment in a sanatorium or partial payment for them for the employee and his relatives;

- providing free lunches;

- the ability to go on vacation before six months of permanent work expires;

- transfer of all rights to created materials (the worker transfers to the employer all rights to materials created at the direction of the employer).

If, during the employment of an employee, optional conditions are agreed upon and approved by both parties, they become essential, that is, mandatory for fulfillment by one party or another.

Other terms of the contract related to the specifics of labor

The court noted that from K.’s explanations and her statement it follows that she wrote the job application addressed to the director of Network LLC, S.V. Kuznetsova. under the dictation of the manager of Network LLC Vali. She worked as a salesperson in the “Kuban Wines” section, every day the proceeds for the entire day of work were collected by Network LLC, her monthly salary was 3,000 rubles (K.

) kept for herself from the proceeds. In such circumstances, when no evidence is presented that K. began working as a seller with the knowledge and on behalf of the employer - Voronova S.N., and that Kuznetsova S.V. ─ the director of Set LLC was the representative of S.N. Voronova, the court came to the conclusion that K.

performed certain work under a contract and refused to satisfy her claims.

Working hours, rest time and social conditions

Important Based on the relevant provisions of the employment contract, the order (instruction) for hiring must indicate information about: the employee’s last name, first name, and patronymic; the name of the structural unit to which the employee was hired; name of profession (position), rank, class (category) of qualifications; start date of work; the amount of salary (tariff rate) and other conditions of remuneration; the presence and duration of a probationary period (if the employment contract contains this condition), as well as other necessary information. The order is the basis for including the employee on the payroll of the organization, as well as for charging him the salary stipulated by the employment contract. In accordance with Part 2 of Art. 68 of the Labor Code of the Russian Federation, the employer is obliged to familiarize the employee with the order (instruction) on hiring within three days from the date of actual start of work.

working hours, rest time and social conditions

Persons recruited through competition or to elective positions must be elected through competition or elections. Some persons, after concluding an employment contract, must be approved in this position (for example, loan managers)[5]. Federal Law No. 90 - Federal Law introduced amendments to Article 303 of the Labor Code of the Russian Federation concerning the procedure for concluding an employment contract with an individual employer.

working hours, rest time and social and living conditions

The Labor Code of the Russian Federation does not correspond to the essence of the concept of “essential terms of the contract”, chosen by legal science... Analysis of the terms of the employment contract referred to in Art. 57 of the Labor Code of the Russian Federation to mandatory (previously they were called essential), from the point of view of science only two can be recognized - on the place of work and labor function. As for all other conditions, they are aimed only at clarifying or specifying the rights and obligations of the parties to the employment contract”[2].

The lack of proper registration of labor relations cannot serve as a basis for depriving an employee of the rights established by law. For example, the right to social insurance against accidents at work and occupational diseases. In Part 2 of Art.

67 of the Labor Code of the Russian Federation states that an employment contract that is not properly drawn up is considered concluded if the employee began work with the knowledge or on behalf of the employer or his representative.

Condition for improving the social and living conditions of the employee and his family members

Salary, wage supplements and other monetary payments Salary (tariff rate), wage supplements and other monetary payments Amount percentage amount, rub. Salary Total 5.1.2. Awards 6. Responsibility of the parties 6.1. The employee is responsible in accordance with the law: 6.1.1.

Who contributes optional items?

Any non-essential requirement establishes the obligations of either the employee or the manager. It is included in the contract at the initiative of the employer or after the request of the employee.

If non-essential clauses were not specified when drawing up the contract, they can be drawn up later after the employee is hired.

At the initiative of one of the parties, the list of optional items may be expanded. The proposal is discussed and, if approved by the employee and employer, included in the contract. The main thing is that the new agreements do not in any way worsen the employee’s current situation.

| Page: 6 of 8 next —> | Go to page: | |

7. Upon termination of the Contract, the Employee is paid severance pay in cases provided for by law.

Remuneration 1. The employee is given a salary in the amount of rubles per month; 2. The employee is given: -a bonus in the amount of rubles per month; -bonus in the amount of rubles monthly: -bonus in the amount of rubles quarterly; -remuneration based on the results of work for the year in rubles (or in the amount of % of average monthly earnings). 3. Allowances, bonuses and remuneration are established in the following cases: 4. Amounts and forms of remuneration can be revised by agreement of the parties.

Optional terms of the employment agreement (contract)

Optional conditions include those conditions that do not affect the very fact of concluding an employment agreement (contract). They depend on the discretion of the parties, but cannot worsen the employee’s position in comparison with legislation and regulations. It is impossible in an employment agreement (contract), even by agreement of the parties, to establish the following conditions: grounds for dismissal (except for contracts with company managers); o disciplinary sanctions not provided for by law; introduction of full and increased financial liability in addition to cases provided for by law; o the procedure for considering individual labor disputes.

The optional conditions included in the employment contract are mandatory for the parties. Violation of optional conditions by the employer is sufficient grounds for early termination of the contract. Since optional conditions cannot introduce any restrictions or supplements, optional conditions included in an employment contract are mandatory for the parties. Violation of optional conditions by the employer is sufficient grounds for early termination of the contract. Since optional conditions cannot introduce any restrictions or additional responsibility for the employee, violation of them by the latter does not serve as a reason for termination of the employment agreement (contract). Optional conditions vary in nature and purpose.

Contract time

According to Art. 17 of the Labor Code, employment agreements (contracts) are concluded: for an indefinite period; for a specified period of not more than five years; for the duration of a specific job.

Most often, an employment contract is concluded without specifying a term, that is, for an indefinite period, which is more beneficial to the employee. The employer is more satisfied with a fixed-term employment contract. To establish appropriate guarantees for employees, the Supreme Council of Russia adopted the Recommendation of the International Labor Organization and included as a mandatory legal norm restrictions on the conclusion of employment contracts for a certain period. A fixed-term employment agreement (contract) is concluded in cases where the employment relationship cannot be established for an indefinite period, taking into account the nature of the work to be done, or the conditions for its implementation, or the interests of the employee, as well as in cases directly provided for by law. Fixed-term employment contracts are usually concluded with seasonal workers, workers replacing permanent ones, and workers waiting for vacancies at another enterprise. The law directly provides for the conclusion of a fixed-term contract with the head of the enterprise and teachers of educational institutions. If the parties enter into a fixed-term employment contract, they have the right to choose any duration of the contract within the maximum (five years) period, with the exception of contracts with temporary workers, which are concluded for a period of up to two months, under some conditions - up to four months. Temporary workers must be warned about the duration of their work, that is, this condition is fixed in the employment contract. If this has not been done, the hired employees are considered permanent. Here is an example of the corresponding article of an employment agreement (contract):

Duration of the Contract. 1. The validity period of this Contract is established by agreement of the parties and is equal to three years. 2. Upon expiration of the specified period, the Contract may be extended for a new period or terminated. 3. If, after the expiration of this Contract, the employment relationship actually continues, and neither party has demanded its termination, then the Contract is considered extended for an indefinite period. 4. The Employer is obliged to notify the Employee at least two months in advance that he is not going to extend the Contract.

Probation

A test to verify the compliance of the employee’s preparedness and knowledge with the assigned work is also an optional condition. It is provided for by law, but can be included in the contract only by mutual agreement of the parties. If the employee does not agree to the inclusion of this condition, the contract is either not concluded at all or is concluded without this condition. It is necessary to distinguish between the establishment of a probationary period in the contract and the size of its limit. The maximum probation period is established by law and cannot be increased. The maximum probation period is established by law and cannot be increased even by mutual agreement of the parties. According to Art. 22 of the Labor Code, the probationary period, unless otherwise established by law, cannot exceed three months, and in some cases, in agreement with the relevant elected body, six months. The probationary period does not count the period of temporary disability and other periods when the employee was absent from work for valid reasons. Here is an example of the corresponding article of an employment contract:

Probation. 1. The employee is given a probationary period of two months. 2. If, after the expiration of the probationary period, the Employee continues to work and the Employer does not announce the release of the Employee, he is considered hired, and subsequent termination of the contract is possible only on a general basis. 3. If the test result is unsatisfactory, the Employer releases the Employee from work without agreement with the trade union body. 4. Payment of severance pay in case of unsatisfactory test results is not made.

Business trips

A business trip is a trip by an employee, by order of his manager, to another location for a certain period of time to perform a work assignment outside his place of permanent work. If the conditions of permanent work are traveling or mobile in nature, or the work constantly takes place on the road, then such business trips are not business trips. There is a special procedure for reimbursement of expenses in connection with business trips. According to Art. 116 of the Labor Code, employees sent on business trips are paid: travel expenses to the destination and back; expenses for renting residential premises; daily allowance for the time you are on a business trip. For the duration of the business trip, posted workers retain their place of work (position) and average earnings. Travel expenses to the place of business trip and back are reimbursed to the employee in the amount of the cost of travel by air, rail, water, and road public transport (except taxis), including insurance payments for state compulsory insurance of passengers in transport, payment for services for the pre-sale of travel documents and for use on trains with bedding. The Ministry of Finance of the Russian Federation, together with the Ministry of Labor of the Russian Federation, issued a letter “On changes in the norms for reimbursement of travel expenses, taking into account changes in price indexation.” According to the amendments made to it, from February 1, 1995, the following standards for reimbursement of travel expenses are introduced: Payment for the rental of residential premises is made according to actual expenses confirmed by relevant documents, but not more than 60 thousand rubles per day. In the absence of supporting documents, expenses for renting residential premises are reimbursed in the amount of 2 thousand rubles per day. Daily allowance is paid in the amount of 10 thousand rubles for each day of stay on a business trip. Payment of daily allowances to employees sent to the regions of the Far North and equivalent areas, as well as Khabarovsk, Primorsky Territories and the Amur Region, is made at increased rates. The amount and payment of daily allowances to employees sent to the regions of the Far North and equivalent areas, as well as the Khabarovsk, Primorsky Territories and the Amur Region, are made in increased amounts. The amount and procedure for paying daily allowances for short-term business trips abroad are also regulated by the state. These standards are established for state-owned enterprises. Of course, enterprises of other forms of ownership have the right to establish excess payments for their employees to reimburse expenses. But according to the standards established for state-owned enterprises, the costs of business trips for employees of non-state enterprises related to production activities are included in the cost of products (works, services). Additional payments related to the business trips of employees of these enterprises can be made from the profits remaining at their disposal after paying taxes and other obligatory payments to the budget. Below is an example of the corresponding article of an employment agreement (contract):

Business trips. 1. If it is necessary for the Employee to perform his duties outside his permanent place of work, he may be sent by the Employer for a period of no more than 30 days (not counting travel time) to another location. 2. Guarantees and compensation, as well as the necessary documentation related to business trips, are established by current legislation and the Regulations on business trips. 3. An employee may refuse a business trip for good reasons. 4. Secondment of an Employee for a period longer than specified above is possible only by agreement of the parties. If the Employee is not satisfied with the long duration of the business trip, he has the right to refuse it without giving additional arguments. 5. For the entire duration of the business trip, the Employee retains his place of work (position).

Training

For a far-sighted employer, it seems obvious that it is advisable to periodically send its employees to advanced training courses and use other opportunities in order to have at its disposal well-trained, experienced, highly qualified personnel. During the period of training in advanced training courses, they retain their place of work (position) and make payments as provided by law. The standards and procedure for reimbursement of such expenses are approved by the Resolutions of the Ministry of Labor of the Russian Federation. Employees of enterprises, regardless of their form of ownership, retain the average salary at their main place of work during their training (training, retraining, training in second professions, advanced training) outside of work. Nonresident students sent for training while away from work are paid daily allowances according to the standards established for business trips in the Russian Federation. Payment for students' travel to and from the place of study and daily allowances for the time spent on the road is carried out at the place of main work. During the training, students are provided with a hotel-type dormitory with expenses paid by the sending party. Heads of ministries, departments, and state enterprises may, as an exception, allow additional payments to be made in excess of the cost reimbursement standards: o in budgetary organizations - at the expense of ePayment for trainees' travel to and from the place of study, daily allowances for the time spent on the road are made at the place of main work. During the training, students are provided with a hotel-type dormitory with expenses paid by the sending party. Heads of ministries, departments, and state enterprises may, as an exception, allow additional payments to be made in excess of the cost reimbursement standards: o in budgetary organizations - due to savings in the estimate for their maintenance; o in organizations financed from special funds and other sources - within the limits of available funds; o in other organizations and enterprises - at the expense of the profits remaining at their disposal after paying taxes established by current legislation and other obligatory payments to the budget. Below is an example of a corresponding clause in an employment contract:

Training. 1. Continuous professional development is the right and responsibility of the Employee. The Employee does not have the right to refuse any offer from the Employer to improve his qualifications through training at the Employer’s expense. 2. The Employer’s responsibility is to provide the Employee with the necessary conditions to maintain and improve the level of professional qualifications. 3. If it is necessary to switch to new products, technology, new methods of organizing production and management, the Employer is obliged to provide the Employee with the opportunity for training and retraining. 4. Training and retraining of the Employee is carried out at the expense of the Employer. 5. If the training and retraining of the Employee involves acquiring special knowledge that requires expenses significantly higher than those usually accepted, the Employer and the Employee will agree on the conditions for attracting additional funds from the Employee.

Additional social guarantees

To make employees more interested in maintaining their jobs at this particular enterprise and attracting highly qualified personnel, employers are introducing additional social guarantees at the enterprise. They usually relate to protecting the health of workers, improving their living conditions, etc. Such measures are always attractive to employees. Of course, the provision of additional social guarantees cannot in any way cancel or reduce the amount of guarantees and compensations, the payment of which is entrusted to employers by law. Below is an example of a corresponding article in an employment agreement (contract):

Additional social guarantees. 1. The Employer provides the Employee with the following additional social guarantees while working at the enterprise: - additional leave due to temporary disability; -payment of additional amounts to the state social insurance benefit established by law; -medical care in the form of payment of compensation for the use of paid medical services in the following institutions: -sanatorium and resort services in the form of annual free or partially paid vouchers; - consumer services in the form of: - additional compensation for damage caused to the Employee’s health; -payments to the Employee’s family in the event of his death; - periodic medical examination and assessment of the Employee’s health and ability to work at the Employer’s expense; - maintaining health in the event of a deterioration in his condition both during work and for circumstances not related to the performance of work duties. 2. If the cause of the Employee’s deterioration in health was alcohol or drug abuse2. If the Employee’s deterioration in health is caused by alcohol or drug abuse, no additional payments for medical care are made, or, by agreement of the parties, the Employee may be provided with a loan for medical care. 3. Part of the listed guarantees applies to the Employee in the event of his retirement.

Profit sharing

Some enterprises that are particularly interested in attracting highly qualified specialists form a staff profit sharing fund. In this case, employees are interested in the success of the enterprise as a whole. An employer can develop a special document on staff participation in profits as a local regulatory act, and it is possible to include this condition in every employment contract. Most often, such a condition is included in employment contracts in joint-stock companies. An example of such an article in an employment contract for an employee of a joint stock company:

Profit sharing 1. An employee of the Joint Stock Company has the right to contribute his funds to the staff profit sharing fund. 2. A personal account is opened for the Employee, and the amount of the Employee’s contribution to the fund is proportional to his salary. 3. An employee does not have the right to withdraw funds from a personal account earlier than three years from the date of their accrual. 4. The employee gets the opportunity to take advantage of the income received from the use of the funds of the profit-sharing fund when paying them as dividends. 5. The amount of dividends paid to the Employee depends on the Employee’s personal labor participation in the activities of the Joint Stock Company. 6. Payment of dividends from the use of funds from the profit-sharing fund is made based on the results of the financial year. 7. The employee must be given the right to participate in the development of the profit sharing program. 8. Due to the fact that the Employee participates in the profits of the Joint Stock Company, he shares the risk of losses from unfavorable results of the production, economic and commercial activities of the Joint Stock Company and does not have the right to refuse appropriate compensation payments to the Joint Stock Company within the limits of the amounts in his personal account. 9. In the event of temporary financial difficulties, in order to prevent further significant losses, the administration and staff representatives agree on the size of the salary, limiting it to no lower than the minimum established by law, as well as limiting the amount of capital dividends paid from the profit-sharing fund. 10. In the event of significant losses, it is possible to reimburse part of them from dividends due for payment or amounts in the Employee’s personal account. 11. All issues related to the formation of the staff profit participation fund, including determining the amount of dividends, the procedure for their payment, and establishing the amount of Employee contributions, are resolved by the Board of Directors of the Joint Stock Company in agreement with the staff.

It is impossible to analyze the entire set of optional conditions of an employment contract used in the practice of labor relations. The more specific the working conditions at the enterprise, the more details the drafting of an employment contract requires. The most important thing is not to include in the contract conditions that are contrary to the It is impossible to analyze the entire set of optional conditions of the employment contract used in the practice of labor relations. The more specific the working conditions at the enterprise, the more details the drafting of an employment contract requires. The most important thing is not to include in the contract conditions that contradict labor legislation and worsen the employee’s position in comparison with it. If similar conditions are included in the employment contract in the form of optional ones, then the contract nevertheless gives rise to the rights and obligations of the parties, with the exception of the rights and obligations under the above conditions, which are legally invalid.

3. Termination of an employment agreement (contract)

Grounds for termination of an employment agreement (contract)

In labor relations practice, several terms are used related to the termination of an employment relationship: termination, dissolution and dismissal. The concept of “termination” includes all other concepts. Termination means the termination of an employment relationship at the initiative of the parties to the employment contract or bodies with the right to demand this termination. The use of the term “dismissal” implies the termination of employment relations at the initiative of the administration. Dismissal and termination should not be confused with the removal of an employee from work. Suspension is possible only at the proposal of authorized bodies. Suspension is temporary and entails termination of salary payments. Art. 29 of the Labor Code defines the following grounds for termination of an employment agreement (contract): agreement of the parties; o expiration of the period (clauses 2 and 3 of Article 17), except in cases where the employment relationship actually continues and neither party has demanded its termination; o the employee’s conscription or entry into military service; o termination of an employment agreement (contract) at the initiative of the employee (Articles 31 and 32), at the initiative of the administration (Article 33) or at the request of the trade union body (Article 37); o transfer of an employee with his consent to another enterprise, institution, organization or transfer to an elective position; o the employee’s refusal to be transferred to work in another location together with an enterprise, institution, organization, as well as refusal to continue work due to a change in significant working conditions; o the entry into force of a court sentence by which an employee is sentenced (except for cases of suspended sentence and deferment of execution of a sentence) to imprisonment, correctional labor outside the place of work, or to another punishment that precludes the possibility of continuing this work; The transfer of an enterprise, institution, or organization from the subordination of one body to the subordination of another does not terminate the validity of the employment agreement (contract). When the owner of an enterprise changes, as well as its reorganization (merger, accession, division, transformation), labor relations continue with the consent of the employee; In these cases, termination of an employment agreement (contract) at the initiative of the administration is possible only if the number or staff of employees is reduced. Any employment contract can be terminated by agreement of the parties. This basis applies to early termination of employment contracts concluded for a specific period or for the duration of a specific job. In these cases, the employee does not have the right to stop working before the expiration of the period stipulated in the contract without the permission of the employer. An employment contract concluded under a non-pre-employment contract concluded for an indefinite period is also terminated by agreement of the parties, without requiring approval from any authorities.

4. Grounds for termination of an employment agreement (contract) at the initiative of the employee.

The most common basis for termination of an employment contract is the initiative of one of the parties. For various reasons, an employee may wish to terminate the employment contract. The procedure for dismissing an employee who wishes to terminate an employment contract depends on whether the term of work was determined in the contract. Art. 31 of the Labor Code establishes the rules for terminating an employment agreement (contract) concluded for an indefinite period. An employee has the right to terminate an employment contract concluded for an indefinite period by notifying the administration in writing two weeks in advance. In cases where the employee’s application for voluntary resignation is due to the impossibility of continuing his work (enrollment in an educational institution, transition to retirement and other cases), the administration terminates the employment agreement (contract) within the period requested by the employee. The written warning is due to the need for the administration to find a replacement for the employee, as well as to complete certain work. Upon expiration of the notice period for dismissal, the employee has the right to stop working, and the administration of the enterprise, institution, or organization is obliged to issue the employee a work book and make payments to him. By agreement between the employee and the administration, the employment agreement (contract) can be terminated even before the expiration of the notice period for dismissal, if this does not contradict the interests of production. Thus, the contract is terminated by agreement of the parties. However, the initial reason was the desire of the employee and the work book must contain a reference to Art. 31 Labor Code – the employee’s own desire. During the period of notice of dismissal, an employee may violate internal labor regulations or commit absenteeism. In such cases, the administration has the right to dismiss the employee on its own initiative (clause 4 of article 33 of the Labor Code) with all the ensuing consequences for the employee.

If the employee continues to actually perform work after the end of the notice period, then termination of the employment contract is possible only if the employee confirms such a desire. Also, dismissal is not allowed if the employee refuses to terminate the employment contract before the expiration of the notice period. Such a refusal will not be accepted if another employee is invited, since the withdrawal of a resignation letter cannot serve as a basis for the administration’s refusal to conclude an agreement with a new employee. The law provides for some other cases of non-acceptance of a refusal from an announced dismissal.

| Page: 6 of 8 next —> | Go to page: | |

| © 2007 ReferatBar.RU — Home | Sitemap | Reference |

Could this be an advantage?

Some agreements can be an advantage for one of the parties without worsening the present situation of the other party. Let's consider the most popular additional condition that can be included in the contract - the probationary period clause.

It is appointed to check the employee’s professional preparation for the proposed job, and can last several months. However, at any time during the probationary period, the employer can dismiss the employee, explaining that the new employee cannot cope with the responsibilities assigned to him.

Also, during the probationary period, employers sometimes seek to assign a lower salary to employees than during the working period.

It is assumed that a reduction in wages is accompanied by a lesser workload. However, wage payments must be made in full and on time, as for other workers for the entire period of employment. That is, such actions are not legal. In contact with

Employment contract with the chief accountant

“Personnel officer. Personnel records management", 2012, N 7

Approximate sample

Moscow city July 01, 2012

Limited Liability Company "Archive", hereinafter referred to as the "Employer", represented by director A.M. Grigoriev, acting on the basis of the Charter, on the one hand, and citizen Kogan Alla Sergeevna, hereinafter referred to as the "Employee", on the other hand, collectively referred to as the “Parties”, have entered into this employment agreement as follows:

Article 1. Subject of the agreement

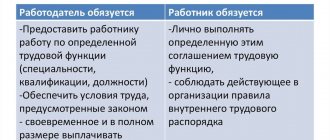

1.1. This employment contract (hereinafter referred to as the contract) governs the labor relations between the Employee and the Employer, in accordance with which:

1.2. Ms. Kogan Alla Sergeevna is hired to perform the job function of chief accountant.

1.3. The contract is:

- contract for main work;

- part-time contract (underline as appropriate) .

Article 2. Duration of the agreement

2.1. The agreement is concluded between the Employer and the Employee:

- for an indefinite period (perpetual) and is valid from “__” ________ 201_;

- for a certain period in accordance with Part 2 of Art. 59 of the Labor Code of the Russian Federation as chief accountant and is valid from July 1, 2012 to July 1, 2013.

(Indicate the reason for concluding a fixed-term contract.)

Article 3. Rights and obligations of the Parties

3.1. Basic rights and responsibilities of an employee:

3.1.1. General provisions:

3.1.1.1. The employee reports directly to the Director.

3.1.1.2. The Employee, together with the Director, resolves all issues related to the financial activities of the Employer.

3.1.1.3. The employee carries out his work activities taking into account the interests of the Employer and in close cooperation with other structural divisions.

3.1.1.4 The Employee is guided in his activities by the current legislation, the Employer’s Charter, local regulations, orders and instructions of the Employer’s management, and the terms of the contract.

3.1.1.5. All accounting employees are subordinate to the employee in accordance with job descriptions, internal labor regulations of the Employer and the terms of the contract.

3.1.2. The employee is obliged:

3.1.2.1. Strictly comply with the requirements of local regulations, orders and instructions issued by the director; agreement conditions; occupational safety and health regulations.

3.1.2.2. Maintain labor discipline and properly fulfill assigned job responsibilities as set out in the job description and contract.

3.1.2.3. Treat the Employer's property with care, maintain cleanliness and order in your workplace and office premises.

3.1.3. The employee has the right:

3.1.3.1. Receive complete and reliable information regarding all financial and other transactions related in one way or another to his activities as chief accountant.

3.1.3.2. Perform on behalf of the Employer actions within its competence by current legislation, the Employer’s Charter, job description and contract.

3.1.3.3. In agreement with the Director of the Employer, make decisions on the use of financial resources for the development of the material base of the Employer.

3.1.3.4. Make proposals to improve the organization of accounting at the Employer and improve working conditions.

3.1.3.5. Within the limits of his competence, give instructions to other employees regarding financial issues of the Employer’s activities and accounting rules.

3.1.3.6. Receive wages for carrying out labor activities within the terms and in the amounts stipulated by the terms of this agreement.